Home » Inheritance » Power of attorney for inheritance matters

19

Registration of an inheritance is a long and labor-intensive process of preparing documents, visiting government agencies, and collecting the necessary signatures. All these procedures must be carried out within a limited time frame, contacting a notary no later than six months after the death of the testator. Otherwise, problems may arise with obtaining inherited property, which will have to be resolved in court.

In order not to waste time on proceedings in all the legal intricacies of this aspect, the heir can use the services of a special trustee who will act on his behalf. Acceptance of inheritance by power of attorney is provided for in Article 1153 of the Civil Code of the Russian Federation.

Power of attorney for registration of inheritance

- Who is it issued to?

The trustee can be any adult and capable person of the choice of the trustor. This does not have to be a lawyer; a relative or loved one can be given the right to represent a representative.

— Received rights and powers

A notarized power of attorney to conduct an inheritance matter allows an authorized person to perform all the necessary procedures for this process, acting on behalf of the heir in his interests. The list of powers of an attorney may include:

- Submitting an application for inheritance.

- Obtaining a certificate of inheritance.

- Registration of property rights.

- Payment of state duty and other payments.

- Signing documents instead of the principal.

According to Art. 1153 of the Civil Code, an inheritance can be accepted by a third party only if there is an act certified by a notary to exercise such powers. If this document only stipulates the possibility of registering an inheritance, it is also necessary to indicate the right of the attorney to apply for entry into it.

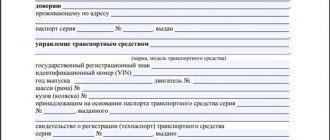

How to correctly draw up a power of attorney for inheritance

The power of attorney is drawn up exclusively in writing.

The document must contain:

- name and address of the notary office;

- name – power of attorney;

- city and date of compilation;

- information about the principal/testator (full name, passport details, registration address);

- similar information about the attorney;

- the essence of the order (the authority of the representative);

- validity period of the document;

- reassignment clause;

- certification inscription to a notary;

- registration number of the form;

- the amount of the withheld state duty;

- signature of the principal.

The content of the document depends on the scope of actions that the principal instructs the representative to perform.

Here you can specify the following:

- registration of inheritance;

- preparation/receipt of necessary papers;

- submitting an application for acceptance of property/receipt of a certificate;

- carrying out property assessment;

- registration of property rights;

- challenging notarial actions;

- contacting any government agency (list);

- filing a claim;

- full/partial refusal of the claim;

- appealing a court decision;

- receiving and submitting a writ of execution to the FSSP.

Types of power of attorney

Depending on the amount of powers vested, there are three types of powers of attorney:

- One-time – applies to performing a one-time action (visiting a notary’s office, filing an application for inheritance, etc.).

- Special – provides the opportunity to perform several similar actions in a certain time (represent the interests of the heir in court, file petitions, participate in meetings, etc.).

- General – provides the attorney with a wide range of powers for the period of time specified in the document (interaction with government agencies, courts, notary counters, preparation of necessary documents, payment of bills, etc.).

The last type is the most common, as it provides for the most productive and mutually beneficial cooperation of both parties.

Types of power of attorney for registration of inheritance

There are three types of power of attorney:

- One-time . Gives the representative the right to perform a specific action. Let's say this could be obtaining a certificate of inheritance rights.

- Special . According to it, the representative has the right to perform a number of actions during a specific period of time. For example, representing legitimate interests in court.

- General . Gives the representative a wide range of powers.

As a rule, a general power of attorney is provided to register an inheritance. It is this document that makes it possible to fully act in the interests of the heir.

Required elements

In order to correctly formalize the act of granting a third party the opportunity to act on your behalf, you must include in the document the following mandatory components:

- List of powers vested in the attorney.

- A list of rights of a trustee directly related to his powers.

- Complete information about both parties to the contract (principal and attorney).

- Personal information about the testator (full name, death certificate data, place of residence).

- Date and signature of both parties.

Registration of inheritance by power of attorney

Often, the purpose of issuing a power of attorney for registration of inheritance is not only the impossibility of being physically present at the scene of events, but also to avoid difficulties associated with the preparation of documents.

Procedure

To issue a power of attorney you will need:

- Visit a notary.

- Submit documents.

- Wait for the documents to be verified by a notary and the power of attorney is completed.

Procedure for issuing a power of attorney

The heir will need to visit a notary office, where:

- The notary will tell you how to draw up an agreement, indicating the rights and powers of the parties. It is possible to issue a power of attorney only for the preparation of a package of necessary certificates or for the full conduct of the case of inheritance of property.

- The application is drawn up with the help of a notary, who always has a prepared sample on hand. It is enough for the client to clarify the list of powers of the representative and the passport details of all parties to the agreement.

- After completing the entrusted documentation, it is certified by a notary’s seal and registered in a special register.

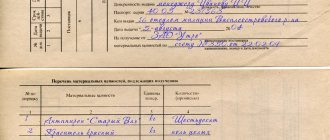

Documentation

The main application is also accompanied by a list of required documents:

- Passports of both parties.

- Death certificate of the testator.

- A will or, in the absence of one, documentary evidence of family ties with the deceased.

- Registration and title documents for property.

Further, the procedure for registering an inheritance by power of attorney does not differ from the standard one - the attorney submits an application for entry into the inheritance, collects the necessary certificates and documents, signs applications with government authorities and receives a certificate of the right to inheritance.

Procedure for entering into inheritance by power of attorney

The process of registering rights to the property of a deceased citizen by power of attorney is carried out without any deviations from the standard procedure. The only clarification will affect the list of required documents.

In order to exercise the right to inherited property, it is necessary to contact an authorized notary within six months from the opening of the inheritance case with a statement of intention to take part in the procedure. Next, you need to provide documents to open an inheritance case with a notary - you can check the full list with an office employee. The general list of information contains the following items:

- death certificate of the testator. To obtain it, you must contact the civil registry office;

- will – if available;

- confirmation of the existence of a family relationship between the principal and the deceased citizen;

- certificate of the last place of registration of the deceased. Issued by the registration departments of the Ministry of Internal Affairs;

- confirmation of the deceased’s ownership rights to objects from the inheritance mass: certificates of ownership, extracts from the Unified State Register of Real Estate, cadastral extracts, etc.;

- an independent expert’s opinion reflecting the assessment of the deceased’s property;

- power of attorney to represent the interests of the heir, notarized;

- civil passport of the authorized person.

After receiving the above information, the notary conducts a full verification of the accuracy of the information, relying on government databases. If errors are identified in the written expression of will of a deceased citizen or if errors are found in supporting documents, the applicant is notified of this. After this, his further actions are explained to him: either bring additional evidence, or go to court to prove the disputed fact.

The authorized person will have to pay a notary fee for registration. First of all, this is a state duty. Its size is determined taking into account the value of the property that the heir is entitled to receive:

- 0.3% of the cost if the heir is from the first or second stage. The maximum is 100 thousand rubles. This size is relevant for spouses, parents and other close relatives;

- in all other cases the rate is increased to 0.6%. Threshold limit – 1 million rubles;

- under a number of circumstances, the applicant is exempt from state duty. This is relevant for persons under the age of majority and heirs who receive residential real estate on the basis of living in an apartment on the date of death of the testator.

In addition to the state duty, you will also have to pay for technical services, be it:

- sending requests to government departments;

- drafting letters to heirs and interested parties;

- checking the contents of documents;

- and so on.

The amount of the tariff is determined taking into account regional characteristics and the qualifications of the notary. For clarity, before paying, you must clarify the amount with an office employee.

All actions are carried out within six months. If deadlines have been missed, they can be restored by obtaining the consent of all heirs or by going to court.

Transfer of rights to third parties

Article 187 of the Civil Code of the Russian Federation provides for the possibility of transferring the rights and powers of a trustee to a third party. This procedure is called transfer of trust and requires the drawing up of an appropriate agreement. To do this, you need to provide the notary's office with a basic power of attorney and documentation that confirms the existence of valid reasons that prevent the authorized person from fulfilling his rights and obligations. However, the original attorney will still be liable for any actions of the third party in the case.

Is transfer of rights allowed?

Transfer of rights when executing a power of attorney to receive an inheritance is permitted if there is no such prohibition in the primary document. Article 187 of the Civil Code of the Russian Federation provides for the possibility of transferring the duties and rights of the representative specified in the agreement to third parties. To do this, an additional agreement on sub-assignment is drawn up with mandatory notification of a change in the principal’s decision.

The legal representative is provided with a package of documents indicating good reasons that do not allow the primary trustee to fulfill his powers.

The new document retains the previous responsibilities, unless a similar situation was previously described with a reduction in the rights of a third party. The validity period of the new power of attorney is limited to the first option.

Responsibility for the activities of the new representative remains with the former trusted citizen.

Duration of the power of attorney

A power of attorney to receive an inheritance is issued for a period of up to three years, which is necessarily specified in the document. According to Article 188 of the Civil Code of the Russian Federation, the following reasons may serve as grounds for termination of the contract:

- Revocation of a power of attorney at the initiative of the principal.

- Refusal of the representative to perform his duties.

- Death or incapacity of any of the parties to the contract.

Registration of a power of attorney to obtain inheritance rights is a complex legal procedure that requires deep knowledge of the law. The help of specialists allows you to avoid inaccuracies in the preparation of documentation and significantly speed up this process.

To correctly issue a notarized power of attorney to conduct an inheritance case, you can use the services of lawyers on our portal. On the website ros-nasledstvo.ru you have the opportunity to get a free consultation by filling out the electronic form provided below.

[/jurist-block-first

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

12

Statement of claim to establish the fact of family relations in 2021

According to Articles 262 and 264 of the Civil Procedure Code of the Russian Federation, an application for...

97

How to enter into an inheritance after death without a will according to law

A will is an act of unilateral expression of the will of the testator, allowing one to determine the future fate...

9

How to enter into an inheritance after the death of a husband

The rules and procedure for entering into inheritance are regulated by the third part of the Civil...

21

Inheritance of a privatized apartment after the death of the owner by law and will

After privatization, the apartment used on the basis of a social tenancy agreement passes...

92

How much does it cost to enter into an inheritance from a notary in 2021?

The amount of expenses for entering into an inheritance after death depends on...

10

What to do if the deadline for accepting an inheritance is missed

Six months after the death of the testator is the period allotted for the adoption...

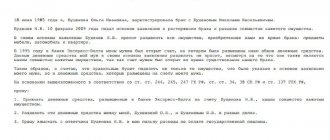

How to issue a power of attorney to register an inheritance? Pitfalls and sample

Despite the fact that we are talking about inheritance law, a power of attorney can also be divided into two types. We are talking about limited and unlimited power of attorney. This means that in some cases a person is endowed either with all the rights and powers that an heir has, or is endowed with limited rights that apply only to entering into inheritance rights.

Only the heir, on whose behalf the person will act, has the right to choose which power of attorney is best to draw up. When choosing the type of power of attorney, you need to focus on what you expect from an outsider. For example, if you want a person not only to receive an inheritance by power of attorney, but also to somehow dispose of it by registering ownership, then it is better for you to make the power of attorney unlimited. If we are talking about actions that are directly related only to the acceptance of an inheritance, you can register these powers and no more.

A power of attorney is a document that must be drawn up only by special, designated persons.

Unfortunately, you cannot draw up this document on your own, even if you really want to.

The thing is that the creation of a trust deed is the responsibility of a notary. It is this person who checks the legality of writing such an agreement.

But in addition to the notary, the head of the organization carrying out the expedition, the head of the colony, and so on have the authority to draw up a power of attorney.

People heading a particular territorial unit can certify your power of attorney, and it will also be executed legally and have appropriate force.

But this is only possible if for some objective reason you cannot contact a notary. For example, you are too far from the nearest notary office, you do not have the opportunity to leave, and so on.

Only in this case can a person who is the head of a department take steps to create a trust deed.

The power of attorney is issued to a third party whom we have designated as the attorney. However, the notary is authorized to transfer the rights to him if you are present at this action. Any adult capable person who has the rights established by law and bears responsibilities can act as a trustee.

When registering an inheritance, including with a notary, there are many nuances, for example, how to draw up an application for acceptance of an inheritance. Sometimes you need to draw up a statement of claim to establish the fact of acceptance of an inheritance, but for this you need to know how to draw up a claim and how to file an application in court. Sometimes heirs refuse inheritance in favor of another heir. You can read about all this on our website.

According to the norms of civil law, three types of power of attorney can be distinguished:

- one-time As a rule, it is compiled to perform a one-time procedure;

- special. It is issued for the implementation of the same type of actions for the entire period while the power of attorney is valid;

- general Allows you to transfer to the trustee the full range of powers to dispose of the trustor’s property and to carry out transactions on his behalf.

Important! A power of attorney to accept an inheritance implies an expanded list of powers. It can be issued to a lawyer, relative, lawyer or any other individual or legal entity.

A power of attorney to receive an inheritance with its subsequent sale does not differ in significant features. And yet, it is important to clarify a number of subtleties inherent in this type of document:

- the power of attorney must reflect the nuances that allow the representative, without prior agreement with the direct owner, to establish the value of the property being sold and the procedure for disposing of funds received from transactions involving the alienation of property;

- the execution of a trust deed with the right to sell property takes into account the same requirements that are established for other types of similar documents;

- The principal can draw up either one general power of attorney or two separate ones - one defines the authority to enter into an inheritance, and the second establishes provisions for its implementation by a representative.

Before drawing up this act, it is recommended to carefully listen to the notary’s explanations in order to avoid complications with the delegated powers.

In 2021, legal successors can enter into inheritance by proxy.

This is possible if a citizen cannot personally contact a notary office for the following reasons:

- living in another region;

- due to health status;

- due to lack of time.

To do this you need:

- Select a suitable candidate for the role of representative.

- Contact the notary's office with an application.

- Pay the fee.

The document differs depending on the purposes for which it is intended:

- One-time. Issued for one specific action. Its effect ends immediately after its execution.

- To perform certain actions. Such documents include a power of attorney to enter into an inheritance and conduct an inheritance case. But it is valid only for those actions that are directly indicated in it. For example, a representative will not be able to register ownership of inherited property.

- General. Provides for the transfer of all rights and obligations of the principal. In practice, a notary will refuse to accept a general power of attorney when registering an inheritance if all powers are not indicated in the text.

The law imposes a number of requirements for the candidacy of a representative. Only an adult and capable citizen can act in this capacity.

The heir is free to choose a candidate. A relative, acquaintance, spouse or stranger can become a proxy.

It is advisable to choose a professional lawyer as a representative. Many law firms provide this service.

You don't even need to visit the agency in person. You can also conclude an agreement remotely. The specialist will draw up all the documents, register ownership of the property and send the documentation to you.

In order for the principal to enter into inheritance rights, the representative must:

- find a will (if any);

- go to court to establish the place of opening of the inheritance (if necessary);

- submit an application for inheritance to a notary;

- check whether the testator has debts;

- evaluate property;

- check whether the testator has accounts with credit institutions;

- file a claim in court to restore the missed deadline;

- obtain a certificate of inheritance rights;

- register ownership of inherited property.

The representative must also be granted the rights to:

- for payment of state duty;

- to represent the interests of the principal in government and judicial authorities;

- to collect debts intended for the deceased.

This is an approximate list of the rights and obligations of a trustee. The principal has the right to include any powers at his discretion not prohibited by law.