Return back to The simplified form of the balance sheet, approved by Appendix No. 5 to Order No. 66n of the Ministry of Finance, can only be used by small businesses and contains columns in which aggregated indicators are given for each item.

The balance sheet consists of assets and liabilities. Section totals are calculated in lines with codes 1600 and 1700 and must be equal. The codes for the remaining lines, entered in independently added column 2, indicate the indicator that has the largest share in the aggregated indicator (clause 5 of order No. 66n).

Technological changes, namely the growth of new information and communication technologies, have also contributed to the wider, faster and cheaper dissemination of information. As a result, institutional investors also benefit from the expertise of professional managers. Allen and Santomero's cost of participation concept reflects the idea that non-financial agents do not have the time or expertise for modern portfolio management.

The level of intermediation in household finances remained stable or increased in all countries, and the share of bank savings fell significantly in continental Europe, where banks have traditionally collected most of their wealth. household savings. It is in these countries that the contribution of non-monetary financial institutions to the level of intermediation of household financial provision is greatest.

The asset reflects the amount of non-current and current assets, the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

Assets

Tangible non-current assets. This line reflects, in particular, fixed assets and unfinished capital investments in fixed assets.

The share of equities in institutional investors' financial assets is slightly higher than 40% in the United States, the Netherlands and France, but covers very different realities. The dominance of bonds in Japan and Italy is due to the waxing and waning importance of public debt financing in these two countries.

Expansion of the intermediary chain

The share of institutional investors' investments with other financial institutions is becoming increasingly important: on the one hand, banks issue more and more securities to finance themselves and compensate for the decline in bank savings; mainly acquired by institutional investors. This leads to an increasing lengthening of the mediation chain.

Intangible, financial and other non-current assets. The very title of the article suggests that it should reflect intangible assets and long-term financial investments. The line also includes the results of research and development, unfinished investments in intangible assets, research and development.

Inventories. This line should not raise any special questions. Since the article of the same name is also in the usual form of the balance sheet.

Diversification of investments

Thus, financial innovation enabled by deregulation and initiated by financial intermediaries has significantly increased the diversification of savings.

The development of financial innovation and, as a consequence, the increasing complexity of the intermediation process are aimed at meeting the demand for investment diversification of non-financial agents, but also increasingly on the financial intermediaries themselves. works by Gourley and Shaw. The rise of institutional investors does not mean the death or fall of banks. Deregulation allowed them to significantly diversify their activities beyond the traditional business of providing loans and collecting deposits. The main banks today are financial conglomerates that combine banking and insurance activities. and asset management. The bancassurance model is particularly widespread in continental Europe. They show that the general trend towards the institutionalization of savings was mainly driven by banks in continental Europe, while in the United Kingdom banks and insurance companies contributed equally.

Cash and cash equivalents. Here, too, the line of the same name appears in the usual form of the balance sheet.

Financial and other current assets. The line is intended to reflect short-term financial investments, accounts receivable and other assets.

Passive

Capital and reserves. This should include the authorized capital, additional and reserve capital (if any), retained earnings (uncovered loss), revaluation of fixed assets (intangible assets), if such is carried out in the organization. This line also reflects own shares purchased from shareholders for cancellation (founders' shares).

Their development in Europe remains much more limited. The importance of mortgage securitization in the United States stems from a specific institutional mechanism: the presence of financial intermediaries enjoying an explicit or explicit guarantee from the federal government. Nearly half of the mortgages originated are refinanced in the United States and thus transferred from banks' balance sheets to institutional investors. The credit risk that is thus transferred by banks to institutional investors, especially insurance companies, will ultimately be transferred to households, who are the ultimate owners of the institutional investors' assets.

Long-term borrowed funds. This shows borrowed funds received from long-term loans and borrowings.

Short-term borrowed funds. This line is intended to reflect borrowed funds received under short-term loans and borrowings.

Accounts payable. The amount of short-term debt of the organization to its creditors is indicated on this line.

This relates to the unitary approach of Gourley and Shaw, whose recent developments in financial intermediation theory incorporate some of the ideas. However, if they adopt mimetic behavior, they can increase price volatility. A particular category of institutional investors, hedge funds, is a potential source of systemic risk, however hedge funds are quite small in terms of assets under management compared to other institutional investors, although they are difficult to value due to their nature. offshores.

While not subject to mandatory regulation, they have massive exposure to debt, particularly with banks, but also with derivative products, which allows them to generate the very important leverage effect. In addition, the evolution of risk management by banks through the growth of credit derivatives and receivables securitization results in a partial transfer of credit risk to institutional investors who are not typically exposed to any credit risk. in this area, including insurance companies and increasingly hedge funds.

For indicators that remain unrecorded, the lines “Other long-term liabilities” and “Other short-term liabilities” are provided.

Financial and other current assets

are one of the lines of the simplified form of the balance sheet. In our article we will tell you what is included in this line, and will also pay special attention to the reflection of financial assets.

What is included in current assets

To understand what is included in current assets, let's look at the balance sheet. So, current assets include:

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- other assets that meet the criteria of current assets.

Based on the composition of current assets, we can conclude that these are the most liquid assets of the organization, i.e. those that can be quickly sold and receive cash.

Now let’s figure out which accounts need to be taken from in order to fill in information about current assets in each line of the balance sheet.

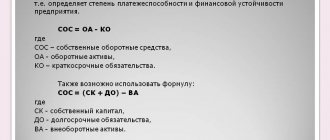

Gross, net and own current assets

Current assets, depending on the source of financing, are divided into:

Own current assets are part of the assets that are formed from the organization’s own capital.

Net - the amount of working capital that was formed at the expense of own funds and long-term loans with a term of attraction of more than 12 months.

Gross - total volume (equity and borrowed capital).

Non-current assets include: fixed assets; profitable investments in material assets; intangible assets; Equipment for installation; investments in non-current assets.

Current assets include: inventories and costs; taxes on purchased goods, works, services; accounts receivable; settlements with founders; cash; financial investments.

Let's take a closer look at the property of organizations.

Fixed assets are means of labor. They create the necessary conditions for the normal production process of the organization. The main feature of fixed assets is that they function for a long time in the production process (more than a year), wear out gradually, which allows the organization to include their cost in the cost of services in parts, by calculating depreciation according to established standards.

The main assets include:

- buildings and constructions;

-cars and equipment;

-vehicles;

-tools, equipment and accessories;

- other fixed assets.

The limit on the value of property related to fixed assets is over 30 basic units per unit (except for carpets and rugs, the limit for which is set within 10 basic units) and a service life of over 12 months.

Fixed assets are accepted for accounting under account 01 “Fixed assets” at their original cost.

Profitable investments in material assets are material assets that are leased, purchased for leasing, as well as rental items.

These tangible assets are accounted for in account 03 “Income-generating investments in tangible assets” at their original cost.

Intangible assets are long-term objects that do not have a physical basis, but have a valuation and generate income for the organization.

These include rights (exclusive and non-exclusive to the use of intellectual property).

For example, cultural organizations use property rights to works of literature and art, to objects of intellectual property arising from licensing and copyright agreements:

— rights to literary, dramatic and musical-dramatic works;

- works of choreography and pantomime, musical works;

— audiovisual works, filmstrips and other film and television works;

- works of sculpture, painting, graphics, lithographs and other works of fine art;

- works of applied art.

also belong to intangible assets .

A license is a permit issued by competent government bodies to carry out various types of activities by legal entities and individual entrepreneurs.

Intangible assets are accepted for accounting in account 04 “Intangible assets” at their original cost.

Intangible assets do not transfer their value to the created product immediately, but gradually, in parts, as depreciation is calculated.

Equipment for installation is technological, energy and production equipment that requires installation and is intended for installation in facilities under construction (reconstruction).

Equipment for installation is accepted for accounting on account 07 “Equipment for installation” at the actual cost of acquisition, which consists of the cost at acquisition prices and expenses for acquisition and delivery to the organization’s warehouse.

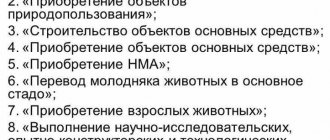

Investments in non-current assets are the costs of creating durable facilities through new construction, reconstruction and expansion of existing facilities.

The actual costs of the organization included in the initial cost of fixed assets, intangible assets and other relevant assets are taken into account in account 08 “Investments in non-current assets”.

Current assets complete their turnover during one production cycle and are reimbursed from the proceeds from the sale of services provided by the organization.

These include:

Inventories and costs, including:

materials are materials, fuel, spare parts, inventory, household supplies and other material assets of the organization, which are accounted for in accounting on account 10 “Materials” at the actual cost of their acquisition (procurement) or at accounting prices.

Work in progress (WIP) costs are the expenses of an organization associated with the main activities of the organization. Accounting for the total cost of producing services should be carried out according to economic elements, and calculating the cost of individual types of services - according to cost items.

Accounts are used to record costs:

— 20 “Main production”;

— 23 “Auxiliary production”;

— 26 “General business expenses”, etc.

Sales costs are costs associated with the sale of services:

— commission fees (deductions) paid to intermediary organizations;

— advertising (ads in print and on television, catalogues, booklets);

— entertainment and other expenses.

Accounting for sales expenses is kept on account 44 “Sales expenses”.

Finished products (services) are services provided during the reporting period.

The amounts of the actual cost of services provided can be reflected in accounting in accounts 20 “Main production” or 40 “Output of products, works, services.”

Deferred expenses are expenses incurred in a given reporting period, but related to future reporting periods:

— expenses associated with the development of new types of services when they are not financed from special sources;

—expenses for uneven repairs of fixed assets;

— amounts of rent paid for the subsequent period;

— subscription amounts for special literature and other expenses.

Expenses are a decrease in assets or an increase in liabilities leading to a decrease in capital.

To account for deferred expenses in accounting, account 97 “Deferred expenses” is used.

Taxes on purchased goods, works, services are value added tax, which is accounted for in account 18 “Value added tax on purchased goods, works, services”, payable and paid by the organization.

Accounts receivable are debts of other organizations or persons of this organization. Debtors are called debtors. Accounts receivable contains:

— debt of customers for services received (purchased) from this organization;

— debt of accountable persons for sums of money issued to them on account for travel or business expenses;

— other receivables.

Accounts receivable are taken into account in various accounts:

account 62 “Settlements with buyers and customers”,

account 71 “Settlements with accountable persons”,

account 76 “Settlements with various debtors and creditors”,

account 73 “Settlements with personnel for other operations”, etc.

Settlements with founders are the debt of the founders (participants) of the organization for contributions to the authorized capital. In accounting when creating an organization, account 75 “Settlements with founders” reflects the amount of debt of the founders.

Cash is working capital in the sphere of circulation, serving the sales process: cash in the official monetary unit of the Republic of Belarus and foreign currencies located:

— at the organization’s cash desk;

— on settlement, currency and other accounts opened with credit institutions on the territory of the Republic of Belarus and abroad;

- securities;

— payment and monetary documents.

To record the availability and movement of funds in accounting, the following accounts are used:

— 50 "Cashier";

— 51 “Current account”;

— 52 “Currency account”;

— 55 “Special bank accounts”;

— 57 “Translations on the way.”

Financial investments are investments of an organization:

— in securities (stocks, bonds);

— to the authorized funds of other organizations;

— loans provided to other organizations.

Financial investments made by the organization are reflected in the accounting records on account 58 “Financial investments”.

More articles on the topic:

Primary accounting documents Turnover statements Accounting methods

Current assets in the balance sheet

Balance sheet form approved. by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

The balance sheet consists of 2 parts - assets and liabilities. The section “Current assets” is included in the composition of assets and contains 7 lines.

We have compiled a convenient table in which we indicate where to get the information to fill out each line of the “current assets” section of the balance sheet.

Table. Filling in data on current assets in the balance sheet

Asset type (line) | What information to display |

| stocks (1210) | The amount of the debit balance on accounts 10, 11, 15, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 (expenses for less than 12 months) minus the amount of the credit balance on accounts 14.42 plus ( minus) total account balance 16 |

| VAT on purchased assets (1220) | Debit account balance 19 |

| accounts receivable (1230) | The amount of the debit balance on accounts 46, 62, 60, 68, 69, 70, 71, 73, 75, 76 minus the credit balance on account 63. Look at the details of filling out this line below after the table. |

| financial investments (excluding cash equivalents) (1240) | The amount of the debit balance on accounts 58, 55-3, 73-1 minus the credit balance on account 59 |

| cash and cash equivalents (1250) | The amount of the debit balance for accounts 50, 51, 52, 55 (except 55-3), 57, 58, 76 (in terms of accounting for cash equivalents) |

| other assets that meet the criteria of current assets (1260) | The amount of the debit balance on accounts 94, 76-VAT and 45-VAT (in terms of accrued VAT amounts, the shipment revenue from which cannot be accepted for some time), 19 and 68 (in terms of excise taxes that will be accepted for deduction), 46 |

How to fill out line 1230 “Accounts receivable”

When filling out this line, consider a number of nuances:

- for account 60 - data is taken into account minus the amounts of advances to suppliers and contractors for the supply of fixed assets;

- for account 60, 76 - reflected advances issued are taken into account without VAT;

- according to account 73-1 - if the reflected loans issued to employees fall under the concept of financial investments according to PBU 19/02, then they are reflected in non-current assets.

See an example of filling out the “Current assets” section of the balance sheet.

Accounting and formation of non-current assets

It is not enough to know which resources are classified as non-current assets: to correctly reflect work operations, you must properly organize and keep records of such objects. In this case, it is necessary to rely on the norms of Order No. 94n dated October 31, 2000, which describes the procedure for using accounting accounts at Russian enterprises. In particular, what accounts are used to account for SAI?

The account is intended to reflect intangible assets. 04 with the same name. The basic rules for accounting for intangible assets are contained in PBU 14/2007. It is determined here that such assets are accepted for accounting based on the actual costs of acquiring and manufacturing the object, including associated costs (clauses 6, 7). It is mandatory to approve the period of use of the asset, and 3 methods are available for calculating depreciation of objects with approved SPI (clause 28).

If non-current assets include fixed assets, their accounting is organized on an account. 01 according to the requirements of PBU 6/01. The conditions for accepting an object as fixed assets are listed in clause 4, the amount of the initial cost is calculated from all actual costs of acquiring the asset (clause 8), and depreciation can be calculated in one of 4 ways (clauses 18-25).

Note! Investments in MC are reflected in the account. 03, and financial investments - to the account. 58. The main regulatory document for financial investments is PBU 19/02.

Current assets in a simplified balance sheet

Small businesses, non-profit organizations and Skolkovo residents have the right to draw up a simplified balance sheet.

To be able to use simplified forms in the organization’s accounting policies for accounting purposes, you can specify the following phrase “The organization prepares and presents simplified financial statements as part of the balance sheet and income statement.”

In a simplified balance sheet, current assets are reflected in three lines:

- Stocks;

- Cash and cash equivalents;

- Financial and other current assets.

See the table below for how to fill out current assets on a simplified balance sheet.

Asset type (line) | What information to display |

| Inventories (1210) | The amount of the debit balance on accounts 10, 11, 15, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 (expenses for less than 12 months) minus the amount of the credit balance on accounts 14.42 plus ( minus) total account balance 16 |

| Cash and cash equivalents (1250) | The amount of the debit balance for accounts 50, 51, 52, 55 (except 55-3), 57, 58, 76 (in terms of accounting for cash equivalents) |

| Financial and other current assets | The amount of the debit balance for accounts 58, 55-3, 73-1, 62, 60, 68, 69, 70, 71, 73 (except 73-1), 75, 76, 19, 45-VAT, 46 - minus the credit balance by count 59, 63 |

Balance sheet: example of filling out a simplified form

| Account number | Debit balance | Credit balance | Note |

| 01 | 5 274 | — | Fixed assets |

| 02 | — | 1 017 | Depreciation of fixed assets |

| 04 | 305 | — | Intangible assets |

| 05 | — | 57 | Depreciation of intangible assets |

| 08 | 924 | — | Capital investments |

| 09 | 102 | — | Deferred tax assets |

| 10 | 1 014 | — | Material reserves |

| 14 | — | 101 | Provision for impairment of inventories |

| 19 | 219 | — | VAT on purchased assets |

| 20 | 1 714 | — | Unfinished production |

| 41 | 2 011 | — | Goods |

| 44 | 415 | — | Selling expenses |

| 51 | 543 | — | Cash in current accounts |

| 55 | 100 | — | Special accounts. 100 – long-term deposit |

| 58 | 314 | — | Financial investments. Of these, 107 are long-term, 207 are short-term |

| 59 | — | 62 | Provisions for impairment of financial investments. Of these, 20 are long-term, 42 are short-term |

| 60 | 907 | 10 103 | By credit - debt to suppliers, by debit - advances transferred to them |

| 62 | 9 125 | 642 | By debit - debt of customers, by credit - advances received from them |

| 63 | — | 1 115 | Provision for doubtful accounts receivable |

| 66 | 18 | 2 019 | Short-term loans with interest on them. For debit 18 – overpayment of interest |

| 67 | — | 3 004 | Long-term loans with interest on them. Of these, 2,342 are with a remaining maturity of more than 12 months, 505 are with a remaining maturity of less than 12 months, 157 are interest on all long-term loans |

| 68 | 516 | 1 327 | Calculations with the budget. By debit - overpayment of taxes and the amount of VAT to be reimbursed, by credit - debt to the budget |

| 69 | 54 | 219 | Calculations for insurance premiums. On debit – overpayment on them and the amount of compensation from the Social Insurance Fund, on credit – arrears in contributions |

| 70 | — | 1 095 | Payments to personnel regarding wages. Debt to employees |

| 71 | 98 | 355 | Calculations with accountable persons. By debit - amounts issued on account, by credit - debt to accountable persons according to advance reports |

| 73 | 150 | — | Settlements with personnel for other operations. 150 – short-term loan issued to an employee |

| 76 | 129 | 1 438 | Settlements with other debtors and creditors. On debit – interest on loans issued and VAT on advances received, on credit – debt on customer claims and deposited wages |

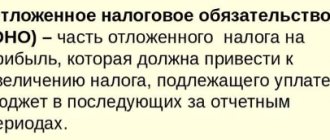

| 77 | — | 96 | Deferred tax liabilities |

| 80 | — | 100 | Authorized capital |

| 82 | — | 2 | Reserve capital |

| 84 | — | 239 | retained earnings |

| 96 | — | 972 | Reserves for future expenses. 972 – reserve for payment of vacations with a period of use of less than 12 months |

| 97 | 31 | — | Future expenses |

| Total: | 23 963 | 23 963 |

The balance sheet of an enterprise, filled out as an example of the 2020 sample, will look like this.

| Balance sheet sections | Amount at the reporting date | Formula for calculating the amount based on the accounting account numbers from which the balance values are taken |

| ASSETS | ||

| I. NON-CURRENT ASSETS | ||

| Intangible assets | 248 | 04 – 05 |

| Fixed assets | 5 181 | 01 – 02 08 |

| Financial investments | 187 | 55 58 (long-term) – 59 (long-term) |

| Deferred tax assets | 102 | 09 |

| Total for Section I | 5 718 | |

| II. CURRENT ASSETS | ||

| Reserves | 5 084 | 10 – 14 20 41 44 97 |

| Value added tax | 219 | 19 |

| Accounts receivable | 9 732 | 60 62 – 63 66 68 69 71 76 |

| Financial investments | 315 | 58 (short-term) – 59 (short-term) 73 |

| Cash and cash equivalents | 543 | 51 |

| Total for Section II | 15 893 | |

| BALANCE | 21 611 | |

| PASSIVE | ||

| III. CAPITAL AND RESERVES | ||

| Authorized capital | 100 | 80 |

| Reserve capital | 2 | 82 |

| retained earnings | 239 | 84 |

| Total for Section III | 341 | |

| IV. LONG TERM DUTIES | ||

| Borrowed funds | 2 342 | 67 (loans with a remaining maturity of more than 12 months) |

| Deferred tax liabilities | 96 | 77 |

| Total for Section IV | 2 438 | |

| V. SHORT-TERM LIABILITIES | ||

| Borrowed funds | 2 681 | 66 67 (loans with remaining maturity less than 12 months) 67 (interest on all long-term loans) |

| Accounts payable | 15 179 | 60 62 68 69 70 71 76 |

| Estimated liabilities | 972 | 96 |

| Total for Section V | 18 832 | |

| BALANCE | 21 611 |

We invite you to familiarize yourself with Another country, new citizenship, what documents do Belarusians need to obtain Russian citizenship?

The correctness of filling out the balance sheet form 1 on the 2019 form can be checked arithmetically. This can be done in two ways: from the total of debit balances and from the total of credit balances.

When checking in the first way, from the total amount of debit balances on accounting accounts, it is necessary to subtract the values related to regulatory items (depreciation, provisions for impairment), i.e. credit balances on accounts 02, 05, 14, 59, 63. The result should be equal to the balance sheet asset total.

Let's check: 23,963 – 1,017 – 57 – 101 – 62 – 1,115 = 21,611.

A similar formula is used when checking in the second way: the values of regulatory items are subtracted from the total amount of credit balances on the accounting accounts (credit balances on the same accounts 02, 05, 14, 59, 63). The result should be equal to the total liabilities of the balance sheet.

If the above accounting data related to interim reporting, then their only difference would be the presence of data on account 99 (due to the absence of balance sheet reformation performed only at the close of the year). In our example of the balance sheet before the reformation, account 99 had a loss of 70,000 rubles. (i.e.

debit balance), and account 84 showed the profit of previous years in the amount of 309,000 rubles, which had not yet been reduced by the loss of the reporting year. In this case, the amount in the balance sheet would remain arithmetically the same, but the data on the line “Retained earnings” would be taken as the difference between the figures reflected in accounts 84 and 99.

The balance sheet form 1 on the 2020 sample form, filled out automatically in the accounting program, must be checked. To do this, its figures are verified with data obtained from the consolidated balance sheet for the accounting accounts generated as of the reporting date. To select data on the analytics of property, financial investments, loans, additional capital, reserves, balance sheets for the corresponding accounting accounts are used.

| Balance Sheet Lines | Amount at the reporting date | Formula for calculating the amount based on the accounting account numbers from which the balance values are taken |

| ASSETS | ||

| Tangible non-current assets | 5 181 | 01 – 02 08 |

| Intangible, financial and other non-current assets | 537 | 04 – 05 09 55 58 (long-term) – 59 (long-term) |

| Reserves | 5 084 | 10 – 14 20 41 44 97 |

| Cash and cash equivalents | 543 | 51 |

| Financial and other current assets | 10 266 | 19 58 (short-term) – 59 (short-term) 60 62 – 63 66 68 69 71 73 76 |

| BALANCE | 21 611 | |

| PASSIVE | ||

| Capital and reserves | 341 | 80 82 84 |

| Long-term borrowed funds | 2 342 | 67 (loans with a remaining maturity of more than 12 months) |

| Other long-term liabilities | 96 | 77 |

| Short-term borrowed funds | 2 681 | 66 67 (loans with remaining maturity less than 12 months) 67 (interest on all long-term loans) |

| Accounts payable | 15 179 | 60 62 68 69 70 71 76 |

| Other current liabilities | 972 | 96 |

| BALANCE | 21 611 |

To be submitted to state statistics authorities, balance sheet lines must be encoded in a separate column of the report. The codes used in full form are given in Appendix 4 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

Line 1210 “Inventories”

Line 1210 should reflect information about materials, goods, finished products and work in progress. Inventories also include household equipment, inexpensive office furniture, stationery and other property of the organization that has not been written off at the end of the reporting period.

The data on line 1210 primarily includes the debit balance on account 10 “Materials”. Here the cost of materials, purchased semi-finished products, components, fuel, packaging and spare parts that are not written off for production is indicated.

An organization can keep records of raw materials and supplies on account 10 at accounting prices. Then actual costs are reflected in the debit of account 15 “Procurement and acquisition of material assets”, and the deviation of actual costs from accounting ones is reflected in account 16 “Deviation in the cost of material assets”.

With this accounting procedure, when filling out line 1210, to the balance of account 10, you must either add the debit balance on account 16 (if the actual cost of materials exceeds the accounting one), or subtract the credit balance on this account (if the actual cost of materials is lower than the accounting one).

If an organization creates a reserve for the depreciation of inventories, then when filling out line 1210 from the debit balance of account 10, the credit balance of account 14 “Provisions for the reduction of the value of material assets” is subtracted.

Line 1210 reflects the cost of products that have not gone through all stages of processing, as well as work that was not accepted by customers. To fill out this line, manufacturing firms summarize their account balances:

— 20 “Main production”; — 21 “Semi-finished products of own production”; — 23 “Auxiliary production”; — 29 “Service industries and farms”; — 44 “Sales expenses”; — 46 “Completed stages of unfinished work.”

Trading companies show on line 1210 transportation costs that relate to the balance of unsold goods. If the accounting policy provides that transportation costs are included directly in the cost of purchased goods, then such expenses are reflected in account 41 “Goods” and are also included in these lines 1210 of the balance sheet, but as part of the cost of goods.

To reflect balances of finished products and goods in the balance sheet, the debit balance of accounts 41 “Goods” and 43 “Finished Products” is transferred to line 1210. If an organization accounts for goods at sales prices, then from the debit balance in account 41 the credit balance in account 42 “Trade margin” is subtracted. That is, in line 1210 of the balance sheet, goods are reflected at actual cost.

Manufacturing enterprises indicate in line 1210 the actual or standard cost of finished products.

In addition, line 1210 reflects the cost of products or goods transferred to customers, the proceeds from the sale of which cannot be recognized in accounting. For example, if the transfer of ownership of goods occurs not at the time of shipment, but after payment. On the same line, the cost of valuables that are transferred to other organizations for sale under a commission agreement is recorded. Thus, the debit balance of account 45 “Shipped Goods” is entered in line 1210.

Types of non-current assets

First, let's look at the financial type of assets. This type of internal funds includes long-term investments, which are divided into several main groups. The first group includes certificates of deposit and bonds with a long maturity. This type of investment is used to distribute available funds into various projects to generate income as a percentage of the investment amount.

Securities purchased from LLCs, OJSCs, CJSCs and other organizations. One of the purposes of this acquisition is to gain control over third-party companies. The purchased securities generate profit through dividend payments. Often, entrepreneurs take such a step in order to gain control over the process of supplying industrial raw materials. In addition, the acquisition of LLC shares allows you to establish your own sales system for finished products.

Non-current assets are fixed assets that serve the company for more than a year and are capable of generating income for it.

This article also includes various loans and credits issued by third-party companies. Financial obligations allow you to receive not only income, but also increase the financial well-being of the company by increasing production capacity.

Other non-current assets include the entrepreneur's costs associated with organizing a business. One example of this expense item is the cost of preparing documents submitted to the Federal Tax Service for company registration. As a rule, this type of expense is contributed to the company’s authorized capital. It is important to note that some funds in this category are not reflected on the balance sheet. Such funds include copyrights and business reputation of the company.

Other non-current assets on the balance sheet are production costs, which are shown in line number 1190. It is important to note that these costs must meet a number of strict criteria. First of all, their circulation period must be more than one year. Secondly, these costs should not be classified under other classifications.

Tangible and non-current assets form the company's fixed assets. This group includes real estate owned by the company, as well as land plots. This article includes production equipment, vehicles, furniture, equipment and other material assets that are used for more than one year. Also included in the category of the company's fixed assets are the company's property assets transferred for long-term lease. It is important to pay attention to the fact that only those objects that have a certain value belong to this category . In addition, their cost must be at least ten thousand rubles.

Items with a value of less than 10,000 rubles are included in the category of “low-value” property. Such assets are accounted for in the balance sheet line as a working capital, which has the form of a material reserve. It should also be separately mentioned that when calculating the cost of land plots, the price according to the cadastre or the concluded agreement for their purchase is taken into account. Calculation of the cost of buildings and construction structures is based on the cost of construction work or the purchase price of these objects.

Intangible non-current assets are assets whose value is difficult to determine. This section of the balance sheet should be discussed in more detail due to the width of this group. This line includes:

- The right to use the land.

- A license to produce a certain type of product or provide services.

- Software (If the software is developed by a third party, the cost of purchasing the software should be taken into account).

- Trademarks and other patents.

It should also be said that the costs associated with conducting scientific research, training and creating production samples do not fall into this category. These expenses must be included in the reporting for the time period during which the company incurred the expenses. It is important to pay attention to the fact that the process of registering such expenses has many subtleties and nuances . Quite often, regulatory authorities ask questions regarding the price of purchased trademarks and patents.

Assets classified as non-current include assets that are used for a long time in the activities of an economic entity

Patents have a clearly defined validity period during which they are protected. As a rule, this period is equal to twenty years. The cost of a patent is directly proportional to its age. This means that patents registered more than ten years ago have low value compared to new ones. The value of a patent is also affected by its level of fame. Most often, this circumstance is observed in the pharmaceutical sector.

Separately, it is necessary to highlight the protected objects of intellectual property - know-how. Know-how or a production secret has an unlimited validity period and often becomes the object of industrial espionage. As practice shows, know-how is much more reliable than a patent, due to the difficult process of reproducing such products. As an example, let’s look at a situation in which a company has developed its own method for producing polyethylene.

This technology must be patented. However, the product itself, manufactured using the new method, is no different from those products that are manufactured using the generally accepted method. This allows competing manufacturers to use the description of the method for their own purposes. It is important to note that this process cannot be controlled.

The presence of know-how in a patent allows you to remove some important information from the public domain; thanks to this step, competing manufacturers will not be able to reproduce the product, which will increase the price of the patent itself several times.

Line 1240 “Financial investments (except ...)”

In line 1240, reflect data on short-term financial investments. Here we are talking about assets with a circulation or maturity period of no more than 12 months. For example, these are loans issued for a period of less than a year, bills or bonds with a maturity of no more than 12 months. Data on long-term investments are indicated in line 1170 of the first section of the balance sheet.

In line 1240 enter the debit balance of account 58 “Financial investments” (in terms of short-term investments). If a company creates a reserve for reducing the cost of financial investments, then the indicator in line 1240 of the balance sheet is reflected minus contributions to this reserve. That is, when filling out line 1240, the credit balance of account 59 “Provisions for impairment of financial investments” is subtracted from the debit balance of account 58.

Information about interest-free loans is not indicated in line 1240. Such loans are not financial investments. Therefore, their amount is taken into account as part of accounts receivable on line 1230 of the balance sheet.

And further. Line 1240 does not reflect information about cash equivalents. Their amount is given in line 1250 of the balance sheet.

Accounting for financial investments

This section of accounting is regulated by PBU 19/02 “Accounting for Financial Investments”, approved by Order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n. Financial investments include:

- various securities,

- bonds,

- bills,

- contributions to authorized capital,

- loans issued,

- deposits, etc.

The capitalization of financial assets occurs at the original cost, which includes the sum of all purchase costs: payments directly to the seller under the contract, costs of consulting specialists, fees to intermediaries, etc. In addition to the purchase, financial assets can be received in other ways. The diagram shows other options for estimating the initial cost of the investment fund.

In the future, the PV should be considered for the possibility of revaluation. PBU 19/02 divides PV into two types; depending on the type, the subsequent assessment of PV occurs. Options for subsequent assessment are presented in the diagram.

Let's look at the example of the initial and subsequent reflection of debt securities.

Example

On March 1, Vector LLC purchased 100 bonds at a price of 7,000 rubles. a piece. The nominal value of 1 bond is 10,000 rubles. The maturity of these bonds is 1 year. Interest accrues every month at a rate of 15% per annum. Vector LLC exercises the right to increase the value of bonds to par during the circulation period, which is enshrined in the accounting policy. The accountant made the following entries.

March 1

Dt 58.2 Kt 76 - 700,000 rub. — bonds were capitalized as part of financial investments.

Dt 76 Kt 51 - 700,000 rub. - payment of bonds has been made.

March 31

Dt 76 Kt 91.1 - 12,740 rub. (10,000 × 100 / 365 × 31 × 15%) - interest accrued on bonds for March.

Dt 58.2 Kt 91.1 — 25,479 rub. (10,000 – 7,000) × 100 / 365 × 31) - partially reflects the difference between the original and nominal value relating to March.

The last two entries are made similarly every month. At the end of the circulation period, bonds are listed on the balance sheet at par value. At the maturity date, the accountant made the following entries:

Dt 76 Kt 91.1 - 1,000,000 rub. — shows the income on redeemed bonds.

Dt 91.2 Kt 58.2 — 1,000,000 rub. — repaid bonds are written off.

Dt 51 Kt 76 — 1,000,000 rub. — money received on bonds.

As for those using simplified accounting, clause 19 of PBU 19/02 allows you to take into account any financial assets as those for which the current market value is not determined, that is, not to overestimate them.

Let us also pay some attention to the depreciation of financial assets. The impairment test is performed for financial assets for which the current market value is not calculated. The organization itself develops a methodology for calculating the amount of reduction in the cost of a financial investment. A reserve must be created for this amount, which is accounted for in account 59 and attributed to other expenses. Then the financial assets will be shown in the balance sheet in an amount equal to the book value minus the reserve.

Line 1250 “Cash and cash equivalents”

Line 1250 indicates information about the company’s money - both in rubles and in foreign currency. So, on line 1250 of the balance sheet they reflect:

- money in the company's cash desk, as well as the cost of monetary documents (for example, postage stamps, paid travel tickets, vouchers, etc.);

- money in bank accounts

- money in foreign currency held in foreign currency accounts in banks;

- other funds, for example money held in special bank accounts, transfers in transit, etc.

Funds in deposit accounts opened for the purpose of generating income are not shown in line 1250. Depending on the term of the deposit, they are reflected either on line 1170 (long-term) or on line 1250 (short-term) of the balance sheet.

The cost of funds in foreign currency is converted into rubles at the official exchange rate of the Bank of Russia as of the reporting date. To fill out this line, use data on the organization’s cash balances reflected in bank statements and the cash book.

The organization's cash equivalents are also entered in line 1250 of the balance sheet. These are short-term (for a period of no more than 3 months) and highly liquid investments that are not subject to the risk of changes in value, which can be converted into a predetermined amount of money. For example, this is a cash equivalent - this is a bank deposit on demand.

Thus, in line 1250 the debit balance is entered for accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts”, etc.

Financial assets in budget accounting are...

The Unified Chart of Accounts for budgetary structures, approved by Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n, contains a section devoted to financial assets, which includes:

- cash,

- financial investments,

- various types of receivables and advances issued,

- issued loans.

The balance sheet for government agencies is compiled according to the principle of the arrangement of items in the chart of accounts. The composition of financial assets in the balance sheet is similar to this section in the chart of accounts. Let's focus on accounting for FV.

FV is accepted for accounting at its original cost, which is equal to the amount of actual investments. Revaluation of financial assets is carried out on the reporting date or on the date of transactions with them. The value of the investment fund is formed on account 021500000 “Investments in financial assets”. The chart of accounts for budgetary institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n, provides for the following procedure for reflecting financial assets.

What do they include

For detailed information on the state of other current assets, it is assumed that there is a specially designated line 12605 “Deferred expenses”.

This line reflects income from the sale of property, the right to ownership of which has not yet been registered in the name of the buyer. To clarify the situation, an accompanying note or a note in the form of an additional line with a transcript is allowed as an attachment.

Also, line 12605 takes into account the value added tax, which was accrued on the amount of revenue received, but cannot be temporarily taken into account due to the following circumstances regulated in PBU 9/99. Conditions for revenue recognition that must be met simultaneously:

- The right to receive revenue for an organization is legally secured and has a legal basis, i.e. it arose when concluding the relevant agreement or in another way.

- The amount of money received is determinable.

- When there is a guarantee that from specific actions, the enterprise will receive an increase in economic benefits. For example, when a firm has received payment for an asset or its receipt is certain.

- Ownership of certain products has been transferred from the organization to the buyer, customer, and also if the service has been provided in full and accepted.

- The expenses that the company has made or plans to make have a cost determination.

If at least one condition is not met, then the cash and other assets that were transferred to the company will not be taken into account in the revenue column, but will be taken into account in the balance sheet in the accounts receivable group.

However, there are exceptions:

- Lease or provision for temporary operation of any asset owned by the company.

- Providing intellectual property products – registered patents – for remuneration for temporary use. They can be for inventions, samples of industrial equipment and other types.

- Taking part in the authorized capital of other enterprises.

To recognize the revenue of such organizations, it is necessary to simultaneously fulfill only the first three items from the list.

- The amount of damage caused due to property damage or shortages, the culprit of which has not yet been identified or a decision has not been made to write them off as expenses for the production process or sales expenses.

- VAT and excise taxes refundable in the near future.

- The price determined by the contract, which has been calculated but not yet issued.

- The amount of shares that were purchased from other companies for further resale.

What does the abbreviation TZR (decoding) and others mean?

https://youtu.be/Bm_Cqj-2NtU

Further in the article, abbreviations that are often used in accounting will be frequently mentioned. But beginners may have difficulty deciphering them, so we will give the full name of such abbreviations:

- TZR - transportation and procurement costs.

- OS - fixed assets.

- R&D - research and development work.

- Intangible assets - intangible assets.

- WIP - work in progress.

- FBP - deferred expenses.

- Commodities and materials - inventory items.

- FSS - social insurance fund.

Line 1260 and count

On line 1260, transactions are carried out on those current assets that cannot be attributed to any item in the main section 2 in the balance sheet.

Example:

- Debit balance on account 45 “Shipped goods”, including here the amounts of VAT accrued upon shipment of products.

- Debit balance for account 46 “Stages completed for work in progress.”

- Debit balance with entry to account 62. Settlements with clients and customers are indicated here. The display finds VAT accrued on the product and advance payment or partial payment of the amount.

- The debit balance of account 69 is payment of taxes and fees. The amounts of excise taxes deducted, but overpaid and not offset, but for which a decision was not made to return them to the company’s budget, are noted. This also includes excessive payments of social insurance and security contributions, which have not been taken into account, but have not yet been entered into the budget balance.

- The debit balance of account 76 is payment of debt to debtors and creditors. In particular, the amounts of VAT, accrued advance payments and preliminary calculations of a full or partial nature.

- Debit balance on account 81 – shares and interests in other organizations, purchased and owned by the enterprise for the purpose of their further sale on more favorable terms.

- The debit balance of account 94 is losses from property damage, defects and shortages.

Line 1260 may take into account the value of assets, the size of which is not significant for assessing the financial and economic condition of the enterprise.

Thus, when compiling line 1260 in the balance sheet, the debit balance of the following accounts can be used:

- 45 – Goods that have been shipped;

- 46 – Stages that have been completed for unfinished work;

- 62 – Settlement operations with customers, buyers and clients;

- 68 – Payment of tax assessments and fees;

- 81 – Shares and equity participation in other companies owned by the enterprise;

- 94 – Losses incurred due to identified shortages, defective goods and damage to property.

FAQ

Question No. 1. What are the main characteristics of other current assets?

Answer. Main characteristics:

- collection of information on all means that are used in different periods of time: year, business cycle;

- the cost is written off on finished products within one year;

- are present in the balance sheet in line 1260.

Question No. 2. There was a sharp increase in the value of other current assets on the balance sheet. They accounted for 0.5% of the total balance at the beginning of the year and grew to 85% in the structure of current assets. Is this good or bad and what might be the reason?

Answer. Since line 1260 reflects information about assets that are not reflected in other lines of the second section of the balance sheet. This is usually the debit balance of accounts 45,46, 62,68,69,76,81,94.

The following values can be taken into account here:

- material assets that are missing or have been damaged. Inventory and materials for which no decision has been made to write them off as production costs;

- the amount of VAT accrued on advances and prepayments. Which is separately indicated on account 62 or 76;

- the amount of excise taxes that will be subject to deductions in the future;

- amounts of taxes that were excessively collected or paid;

- the amount of VAT on shipment of products for which revenue is not recognized in accounting;

- shares (own) or shares that were purchased from shareholders for subsequent resale;

- other assets with very little value.

A sharp increase trend is good in a situation where the company’s liquidity after all the changes remains at the same level or improves. Otherwise, the trend is unfavorable.

Accounting

On account 1260, only current assets that are not recognized as significant can be taken into account. The information is generated based on the following data:

- The cost of expenses for already completed stages of construction of an unfinished facility, which has independent significance and is calculated on the basis of the contract.

- Data on unreported revenue that was generated as a result of a construction contract agreement whose duration is more than one year, or when the start and end dates of work are set for different reporting years. It is calculated based on the cost specified under the contract or information on costs incurred during the specified period during the execution of work, if the possibility of their reimbursement was recognized.

- The cost of losses due to shortage or damage to valuables, which was not included either in production costs or accrued as a debt to the account of the guilty party.

- The amount of VAT that was accrued on advance payments and prepayments is displayed in accounts 62 and 76 in a separate form.

- Total estimate of excise taxes that will be deducted.

- The cost of VAT calculated on shipped goods is from revenue that cannot be taken into account in a given period and is accounted for separately on account 76 and 45.

- VAT and excise taxes calculated for exports, which are not confirmed and will be covered from budget funds in the future.

Therefore, the size of the cost indicator in line 1260 directly depends on:

- Estimates of the debit balance for accounts 46 and 94.

- Balances recorded in debit for analytical type accounts 62 – VAT, 68, 76 and 45 as of the date of the report.

Example: during accounting, a shortage of 32,000 rubles was identified at the Snezhinka weaving enterprise. On January 21, an advance payment for products was received in the amount of 324,000 rubles, including accrued VAT.

On January 27, products worth 462,000 rubles were shipped. with VAT in accordance with the concluded agreement. The cost of the finished goods was 212,000 rubles.

How to display in accounting:

- Write-off of the cost of shortage or missing goods - 32000. Posting: Dt. 94 K. 41.

- Prepayment received on account of future shipment - 324000. Posting: Dt. 51 K. 62 Av.

- Value added tax accrual – 49423.43. Wiring: Dt. 76 K. 68.

- Accounting for shipped goods – 212000. Posting: Dt. 45 K. 41.

- VAT accounting - 70474.58. Wiring: Dt. 76 K. 68.

Line 1260 will display:

32000 + 49423,43 + 70474,58 = 151898,01.

In cases where, after an accounting audit, an increase in the values in line 1260 “Other working capital” was revealed, we can say that the company is using the available cash resources and funds efficiently and stably.

It is recommended to conduct a specialized analysis of current assets regularly. This allows you to see the efficiency of use and monitor the dynamics of growth of the company’s funds.

Deferred expenses in current assets are presented below.

https://youtu.be/7AFmM9a9lJg

Components of assets on the balance sheet

The balance sheet contains important information about the value of the property assets of a particular company. This information is generated on the basis of financial statements, valuation activities and other documents. In simple terms, a balance sheet asset is a kind of list listing the company’s material assets that are at its own disposal.

Current assets

The working capital item of each enterprise includes six components. The first component is accounts receivable, which are urgent. The next part of this group is the financial investments made by the company itself. The validity period of these investments should not exceed one year. In addition to accounts receivable and financial investments, “input” VAT is included in the working capital item, which has not yet been accepted by regulatory authorities.

One of the important parts of current assets are financial resources. This part of this group includes several items:

- Cash kept in the cash register of a particular institution.

- Money placed in the current account of a banking organization.

- Funds credited to the company's foreign currency account.

The fifth component of working capital is the company's reserves. This category includes raw materials and inventory, products being prepared for sale, unfinished goods, semi-finished products and those valuables that will be used for resale. The last part of working capital is other assets that can be converted into cash.

Current assets - refers to material assets directly used to carry out the production process

Other current assets

Other current assets include a debit balance, that is, the amount of VAT accrued during the shipment of marketable products. This article also includes value added tax received when making an advance payment. This group of funds also includes manufacturing defects, shortages and financial losses. The complete list of resources related to this group is as follows:

- Damaged property that has not been written off from the company’s accounts.

- Costs associated with fulfilling unfinished orders.

- VAT on shipped products, advance payments, as well as excise taxes, which will be reimbursed in the next reporting period.

In addition to the resources listed above, this group may include securities and funds invested in the authorized capital of third-party companies. The main criterion for selecting resources in this group is their implementation period. According to the established rules, other working capital is recorded in the second section of the balance sheet, in line number 1260.

Low liquid current assets

Before examining the question of what falls into the category of assets with low liquidity, it is necessary to consider the meaning of the term “liquidity”. This economic analysis tool displays the rate of transformation of property values into financial resources. In simple words, this indicator demonstrates the speed of asset sales. According to experts, asset liquidity is of paramount importance in generating revenue. In order to gain full control over the financial condition of the company, you need to develop a strategy that allows you to quickly identify the most liquid assets that can be used to overcome the crisis.

Experts also note that the risk level of an entrepreneur is inversely proportional to the liquidity of the asset. Thus, financial resources and liabilities of a short-term nature have the highest level of liquidity and the minimum degree of risk for the entrepreneur. Inventories and finished goods also have high liquidity. The only caveat associated with these funds is the need for a quick sale. The risk level of these assets is low.

Semi-finished and unfinished products have average liquidity and average risk. Low liquidity assets include unused capacity, overdue accounts receivable and unfinished goods (assuming high volume). It is important to note that this group has the maximum level of risk.

As a rule, the category under consideration includes those assets where the turnover rate in cash equivalent is more than twelve months. A striking example of such assets is commercial products stored in a company's warehouse for a long time. This category also includes loans issued with a repayment period of more than one year. Based on the foregoing, we can conclude that working capital with a high degree of risk is included in the group of low-liquidity resources.

Analysis of current assets displayed in the balance sheet allows us to identify the provision of the production cycle with the necessary resources

The composition of the organization’s non-current assets and their difference from current assets

Non-current assets are the property resources of an enterprise with a long period of circulation, used in the process of production or commercial activity.

Unlike current assets, non-current assets have a long service life (more than 1 year), participate in multiple production cycles and transfer their financial value to the results of operations gradually. At the same time, depreciation charges are made on some of them.

In accordance with PBU 4/99, non-current assets include:

- intangible assets (hereinafter - intangible assets),

- fixed assets (hereinafter referred to as fixed assets),

- profitable investments in material assets (hereinafter - MT),

- financial investments.

In Form 1, non-current assets are presented in a slightly different structure - in what and why, find out from the material “Non-current assets on the balance sheet (nuances)”.