Decision not to pay dividends

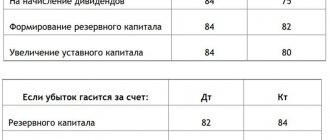

In accordance with the norms of Law No. 402-FZ. The documents regulating accounting are, in particular, federal standards, which include the Chart of Accounts and the procedure for its application (clause 1, subclause 5, clause 3, article 21 of Law No. 402-FZ). In accordance with these documents, the final financial result of the company’s economic activity in the reporting year is formed and summarized in account 99 “Profits and losses”. At the end of the year, when reporting, this account is closed, the amount of net profit is written off from it to the credit of account 84 “Retained earnings”. The allocation of part of the profit to the payment of income to the founders of the organization based on the results of approval of the annual reporting is reflected in account 84

in correspondence with

account 75 “Settlements with founders”

.

In a situation where shareholders (participants) simply do not withdraw the dividends accrued to them, accountants of JSC, OJSC, LLC, etc. may find themselves. And “undisciplined” shareholders (participants) may be, for example, individuals who are not in Ukraine at the time of payment of dividends , do not know about their payment, etc. In addition, there may be many such shareholders (participants), and therefore the total amount of unclaimed dividends can also be quite large.

Accounting for dividends unclaimed by one of the shareholders

How to reflect in the accounting of an organization (JSC) the restoration of profit distributed in favor of a participant (an individual who is not an employee of the organization) and not claimed by it within the established time frame? According to the decision of the general meeting of shareholders adopted in March 2008, the amount of income (dividends for 2007) due to this participant amounted to 50,000 rubles. Dividends due to individuals are paid from the organization's cash desk on specified days in April 2008. All shareholders were notified of the payment date. One of the shareholders did not appear on time. In this regard, the unpaid dividend amount was deposited and handed over to the bank. The shareholder also did not make a claim for payment of unpaid dividends in the next three years. The organization is not a founder (shareholder) of other legal entities and does not receive dividends from other legal entities.

Civil relations

Based on the results of the financial year, the general meeting of shareholders has the right to make a decision (announce) on the payment of dividends on outstanding shares (clauses 1, 3, Article 42 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies”). According to paragraph 2 of Art. 42 of Federal Law No. 208-FZ, the source of payment of dividends is the company’s profit after taxation (net profit of the company). The company's net profit is determined according to the financial statements of the joint-stock company.

The timing and procedure for paying dividends are determined by the charter of the joint-stock company or the decision of the general meeting of shareholders on the payment of dividends. The period for paying dividends must not exceed 60 days from the date of the decision to pay them. If the deadline for the payment of dividends is not determined by the charter or by the decision of the general meeting of shareholders on their payment, it is considered equal to 60 days from the date of the decision to pay dividends (clause 4 of Article 42 of Federal Law No. 208-FZ).

In this case, the organization did not pay dividends due to the fault of the shareholder.

According to Art. 196 of the Civil Code of the Russian Federation, the general limitation period is three years. Consequently, for accounts payable to a shareholder who did not receive dividends, in the situation under consideration, the statute of limitations expires in April 2011. On this issue, see Letter of the Federal Tax Service of Russia for Moscow dated June 15, 2010 N 16-15/ [email protected]

From 01/01/2011 Art. 42 of Federal Law N 208-FZ, clause 5 has been added, according to which, if within the period established by the company’s charter, dividends are not paid to the shareholder and he has not applied for their payment within the next three years (unless a longer period is established by the charter company), the part of the profit distributed and not claimed by the shareholder is restored as part of the company’s retained earnings (clause “b”, part 2, article 1 of the Federal Law of December 28, 2010 N 409-FZ “On Amendments to Certain Legislative Acts of the Russian Federation in Part regulation of dividend payment (profit distribution)”).

Note that the provisions of paragraph 5 of Art. 42 of Federal Law No. 208-FZ as amended by Federal Law No. 409-FZ apply to claims the deadline for submission of which has not expired before the date of entry into force of Federal Law No. 409-FZ - December 31, 2010 (Part 3 of Article 4 of Federal Law No. 409-FZ). In this case, as of the specified date, the statute of limitations for the payment of dividends had not expired, therefore, the organization applies the norms of clause 5 of Art. 42 of Federal Law N 208-FZ.

Accounting

The announcement of annual dividends based on the results of the JSC's activities for the reporting year is recognized as an event after the reporting date (clause 3 of the Accounting Regulations “Events after the reporting date” PBU 7/98, approved by Order of the Ministry of Finance of Russia dated November 25, 1998 N 56n). Annual dividends declared in the prescribed manner based on the results of the JSC’s work for the reporting year are reflected in the financial statements in the manner prescribed for events after the reporting date, indicating the economic conditions in which the organization conducts its activities that arose after the reporting date (clause 5, paragraph 2 clause 10 PBU 7/98). According to para. 1 clause 10 of PBU 7/98, such an event is disclosed in the explanations to the balance sheet and profit and loss statement. At the same time, no entries are made in accounting (synthetic and analytical) accounting during the reporting period. In accounting, entries reflecting the accrual of dividends are made during the period of their announcement (in this case - in March 2008) (paragraph 4, clause 10 of PBU 7/98).

The accrual of dividends to an individual who is not an employee of the organization is reflected in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of account 75 “Settlements with founders”, subaccount 75-2 “Calculations for the payment of income” (Instructions for using the Chart of Accounts accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Depositing the unpaid amount of dividends due to the recipient’s failure to appear may be reflected in the credit of account 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements on deposited amounts”, in correspondence with the debit of account 75, subaccount 75-2. In this case, the restoration of profit distributed in favor of the shareholder and not claimed by him within the established time frame, in our opinion, can be reflected by an entry in the debit of account 76, subaccount 76-4, and credit of account 84.

Personal income tax (NDFL)

An organization that pays income in the form of dividends is recognized as a tax agent for personal income tax when paying dividends to shareholders - individuals (clause 2 of Article 214 of the Tax Code of the Russian Federation). The procedure for determining the tax base in this case is regulated by Art. 275 Tax Code of the Russian Federation. In this case, the organization does not receive dividends from other legal entities, therefore personal income tax is withheld from the entire amount of dividends accrued to shareholders (clause 2 of Article 275 of the Tax Code of the Russian Federation). For the purposes of calculating personal income tax, the date of receipt of income in cash is the day the income is paid (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Tax agents are required to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon actual payment. The tax agent withholds the accrued amount of tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer upon actual payment of these funds to the taxpayer or on his behalf to third parties (clause 4 of Article 226 of the Tax Code of the Russian Federation). Moreover, in accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks . Thus, in April 2008, on the day of receipt of cash from the bank for the payment of dividends to individual shareholders, the amount of calculated personal income tax is withheld from the shareholders’ income and transferred by the organization to the budget. Personal income tax on the amount of dividends is withheld at a rate of 9% (clause 4 of article 224 of the Tax Code of the Russian Federation). In accounting, an entry is made for the amount of withheld personal income tax in the debit of account 75, subaccount 75-2, in correspondence with the credit of account 68 “Calculations for taxes and fees.”

In this case, one of the shareholders did not show up to collect the dividends due to him. In this regard, the amount of dividends was deposited.

According to the explanations of the Ministry of Finance of Russia, given in Letter No. 03-05-01-04/1 dated January 11, 2006, withholding personal income tax until the date the taxpayer actually receives income does not comply with the law.

Thus, in the event of non-payment of dividends to a shareholder, the amount of calculated personal income tax transferred by the organization to the budget when receiving funds from the bank for the payment of dividends is excessively withheld. For the amount of excessively withheld personal income tax in accounting, a reversal entry is made on the debit of account 75, subaccount 75-2, in correspondence with the credit of account 68.

Corporate income tax

The amounts of dividends accrued by the organization are not taken into account as expenses when calculating income tax (Clause 1, Article 270 of the Tax Code of the Russian Federation).

The amount of profit restored as part of undistributed profit is not taken into account as income (clause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation).

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Entries from 2008 | ||||

| The debt to the shareholder is reflected in the amount of dividends due to him | 84 | 75-2 | 50 000 | Extract from the minutes of the general meeting of shareholders of the JSC, Accounting certificate |

| On the date of receipt of funds from the bank for the payment of dividends, personal income tax was withheld from the amount due to the shareholder (50,000 x 9%) | 75-2 | 68-NDFL | 4 500 | Tax card |

| Cash received from the current account to pay dividends (excluding the amount of dividends to other shareholders) (50,000 - 4,500) | 50 | 51 | 45 500 | Receipt cash order, Bank statement on current account |

| Transferred to the personal income tax budget from the amount of dividends due to the shareholder | 68-NDFL | 51 | 4 500 | Bank account statement |

| STORNO Adjusted the amount of personal income tax withheld from the amount of unpaid dividends | 75-2 | 68-NDFL | 4 500 | Tax card |

| Unreceived dividend amount deposited | 75-2 | 76-4 | 50 000 | Dividend payment statement |

| The amount of deposited dividends (without personal income tax) was handed over to the bank (50,000 - 4,500) | 51 | 50 | 45 500 | Expenditure cash order, Announcement for cash payment, Bank statement on current account |

| Restoration of earnings as part of retained earnings (April 2011) | ||||

| The restoration of part of the profit not claimed by the shareholder is reflected | 76-4 | 84 | 50 000 | Accounting information |

N.V. Chaplygina, consulting and analytical center for accounting and taxation

Sample decision on non-payment of dividends

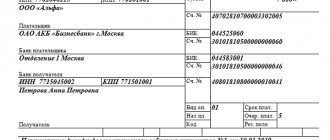

Paying dividends is a procedure consisting of a number of sequential actions, each of which is important in its own way. One of them is drawing up a payment order. But they are not employees of the company, and the technical work of calculating and transferring dividends must be performed by the company’s employees. Therefore, an order is needed to force them to carry out the necessary procedures. It is written in a free, arbitrary form, but with the obligatory mention of points specifying the mechanism for executing the decision of the founders:

The first is to distribute profits and pay dividends among the owners of the organization in accordance with their shares in the authorized capital. The second point is how to do this and by what date. Dividends to a non-resident founder must be subject to the following tax:. So, the decision of the founders to distribute the profit received from the business activities of the company is documented in a protocol.

Making a decision on non-payment of dividends in the presence of net profit

The courts proceed from the fact that, in accordance with Art. 11 of the Law on Joint Stock Companies, the requirements of the charter are mandatory for fulfillment by all bodies of the company and its shareholders, and the adoption by the board of directors of a decision to approve the amount of dividends in a larger amount than established by the charter is a violation of the Law and the provisions of the company’s charter.

". The court of first instance found that on June 26, 2009, the annual general meeting of shareholders of OJSC GUM-3 took place. By decision of the general meeting, the company's annual report was approved, including the profit and loss statement, according to which the company's net profit for 2008 amounted to RUB 1,437,000. The meeting approved the distribution of the company's net profit by sending 71,850 rubles. to the reserve fund and 1,365,150 rubles. - to the accumulation fund. Shareholders with 72.6% of the votes voted for this decision. The meeting decided not to pay dividends at the end of the year on the company’s ordinary shares, with the profit received being used for the development of the company. Shareholders with 73.11% of votes voted for this decision. The meeting approved the quantitative composition of the board of directors of five people (99.91% of the votes were given for this decision) and elected the personal composition of the board of directors (in cumulative voting, shareholders with 99.94% of the votes voted against all candidates - 0.01% of the votes) .

Transfer of goods to pay dividends

The organization (ODO) accrued dividends to its participants. One of them is a Belarusian organization (LLC). She agrees to receive partial dividends in goods that can be used in her business activities. Let us consider, using an example, whether there are any peculiarities in the accrual of dividends in kind, how to withhold income tax from dividends of an organization that transfers goods to a participating organization to pay dividends in kind, and what other tax consequences it has.

Situation

The Belarusian organization ODO "B" (organization "B") in May 2020, when distributing profits based on the results of work for 2020, accrued dividends in the amount of 60 thousand to a participant - a legal entity (Belarusian organization LLC "A" (organization "A")) . rub.

ALC "B" and LLC "A" apply a common taxation system.

In July 2020, in order to pay dividends, organization “B” transfers goods to organization “A” at an agreed upon cost of 52.8 thousand rubles. (including VAT 8.8 thousand rubles). The accounting value of goods is 30 thousand rubles, transfer costs amounted to 100 rubles.

The distribution of profits for the payment of dividends to other participants is not considered in the article.

Dividends in kind: studying the legal basis

Tax legislation understands the term “dividends” as any income accrued by a unitary enterprise to the owner of its property, by another organization (except for a simple partnership) to a participant (shareholder) on the shares (units, shares) belonging to this participant (shareholder) in the order of distribution of profits remaining after taxation . Dividends also include income received under agreements (debt obligations) providing for participation in profits <*>.

An organization that pays dividends to its participants based on the distribution of net profits has a liability showing the amount to be paid to participants as declared dividends.

The accounting assessment of the organization's obligations (including the payment of dividends) is made in the official monetary unit of the Republic of Belarus <*>.

Consequently, profit distributed as dividends has a monetary value and involves its payment in cash, i.e. in Belarusian rubles.

The issue of the legality of paying profit to a participant in a business entity (LLC, ALC) in kind is debatable, since the Law of December 9, 1992 N 2020-XII “On Business Companies” (hereinafter referred to as the Law on Business Companies), which regulates, among other things, the procedure for distribution of profits, neither the possibility nor the prohibition of paying the company’s profits to its participants in non-monetary form is indicated.

While lawyers argue about this, in practice they use various ways to solve this issue. It is necessary to take into account that the distribution of profit of a business company falls within the exclusive competence of the general meeting of participants. This issue cannot be referred to other management bodies of this company for decision. The results of profit distribution are reflected in the minutes of the general meeting of participants <*>. The participants of the company have the right to take part in the distribution of the profit of the business company <*>.

Based on the above, the following can be noted:

- profits are distributed by the highest management body of the company - the general meeting of its participants, and not by the company itself, which for one reason or another intends to pay dividends to the participants in property <*>;

— the general meeting of participants must take into account the interests of the participants, including if they are offered to receive dividends in property. The offered property may be unnecessary for them and difficult to sell. Participants have the right to refuse non-cash payment of dividends;

— taking into account the balance of property interests of the parties, it is advisable to reflect dividends paid by property at its market value on the date of announcement of dividends. At the same time, the market is characterized by a range of prices, which are formed taking into account conditions, supply volumes, settlement procedures between the parties and other factors. Consequently, in the case of payment of dividends in kind, there is a need to agree on the type and value of property between the transferring and receiving parties (in our case, between the Belarusian organizations ODO “B” and LLC “A”, respectively).

It is also necessary to take into account tax consequences , namely:

— on the amount of accrued dividends, depending on who the participant is, the appropriate tax (profit tax, tax on income of foreign organizations or income tax) should be calculated, withheld from the participant’s income and paid to the budget. It is problematic to withhold tax on “in-kind” dividends, therefore, when determining the form of payment of dividends, part of them (at least in the amount of withheld taxes) is advisable to provide for in cash;

- VAT should be calculated from the value of the transferred property and presented to the participant - the VAT payer, as well as determine the taxable profit from the property transfer operation. This is due to the fact that for tax accounting purposes this operation is an operation for the alienation of property for compensation and is recognized as a sale <*>.

Taking into account the above, the safest way to solve the problem is a mixed option of paying dividends (part in cash and part in non-monetary form) with the conclusion of an agreement between the company and its participant on the transfer of property (in our case, goods) at a value agreed upon by them to pay off the company's debt for the payment of dividends to this participant. This agreement can be formalized, for example, by a purchase and sale agreement, which stipulates the terms, procedure for transfer, the specific name of the property, its quantity and value (including VAT), the possibility of terminating the obligation to pay for the transferred property by offsetting a counter-similar claim <*>.

How are “in-kind” dividends calculated?

If a participant in an organization with whom settlements are made for the payment of dividends and other income from participation in the authorized capital of the organization is not its employee , in accounting the obligation to pay dividends is reflected in the credit of subaccount 75-2 “Settlements for the payment of dividends and other income” account 75 “Settlements with founders.” At the same time, the debit of account 84 “Retained earnings (uncovered loss)” reflects the use of net profit for the payment of dividends <*>. The accrual is made on the date of the decision to distribute profits for the payment of dividends in the amount of declared dividends, i.e. in the amount before taxes are withheld from them <*>.

Thus, for the purpose of calculating dividends, it does not matter when and in what form the dividends will be paid.

How are taxes on “in-kind” dividends calculated and withheld?

The peculiarity of the situation is that it is impossible to withhold any tax on dividends in kind. In this regard, when declaring dividends, it will be necessary to provide for the payment of part of the dividends in cash. In this case taxes calculated on the declared amount of dividends can be withheld from “cash” dividends.

In the situation under consideration, dividends are accrued to a participant who is a Belarusian organization. The organization that accrues dividends to such a participant must calculate, withhold and pay to the budget the income tax on dividends <*>, as well as submit a tax return (calculation) for the income tax by filling out Part III “Calculation of the amount of income tax on dividends”. The tax must be reported and paid accordingly no later than the 20th and no later than the 22nd day of the month following the month in which the dividends were accrued <*>.

The form of dividends (cash or in kind) does not affect the procedure for calculating tax (determining the tax base, applying the rate).

In general, income tax rate 12% <*>.

The tax base for income tax on dividends is determined by the following formula <*>:

In accounting, the withholding of income tax at the source of payment of income (i.e. in the accounting of ALC “B”) is reflected in the debit of subaccount 75-2 in correspondence with the credit of account 68 “Calculations for taxes and fees” <*>.

Note! In practice, to reflect this operation, subaccount 68-3 “Calculations for taxes and fees calculated from profit (income)” is used. However, the standard chart of accounts stipulates that this subaccount is used for calculations of taxes on profits and income and other taxes and fees calculated from the profit (income) of the organization <*>. In this case, the organization paying dividends (OOO “B”) is a tax agent and calculates income tax not on its own income, but on the income of the participant (OOO “A”), so use standard subaccount 68-3 to calculate income tax on dividends it would be incorrect. To solve this problem, an organization can clarify the purpose of subaccount 68-3 in its working chart of accounts or introduce an additional subaccount to account 68 <*>.

Let’s say, in the situation under consideration, the Belarusian organization “B”:

- does not belong to the category of persons applying a preferential rate of income tax on dividends <*>;

— did not receive dividends from organizations founded by her;

— clarified the purpose of subaccount 68-3 and uses it, among other things, in settlements with the budget for income tax on dividends.

Then the following entries will be made in the accounting of organization “B”:

| Contents of operation | Debit | Credit | Amount, rub. |

| In May 2020, on the date of the decision on the distribution of profits for the payment of dividends | |||

| Dividends accrued to Belarusian organization “A” | 84 | 75-2 | 60000 |

| Profit tax withheld from dividends of Belarusian organization “A” (RUB 60,000 x 12%) | 75-2 | 68-3 | 7200 |

| In June 2020 (no later than the 22nd) | |||

| Payment of income tax on dividends of organization “A” | 68-3 | 51 | 7200 |

After withholding income tax, the debt on account 75-2 (i.e., the amount of dividends payable) will be 52,800 rubles. (60000 - 7200). According to the situation, organization “B” transfers goods to organization “A” for this amount.

Tax consequences when issuing dividends in goods

As noted above, the transfer of property to a participant for the payment of dividends in tax accounting is recognized as a sale <*>.

In the situation under consideration, both Belarusian organizations (“A” and “B”) are VAT payers. Organization “B” , when transferring goods to its participant as dividends, has a sales turnover , therefore it must calculate VAT, present it in the invoice (for each type of goods) to organization “A” and no later than the 10th day of the month following the month day of shipment of goods, issue it an ESCHF indicating the calculated and presented amount of VAT <*>.

The VAT tax base for the sale of goods is determined in the usual manner - as the cost of these goods, calculated on the basis of the prices of goods without including VAT (taking into account excise taxes for excisable goods) <*>.

Organization “A” (participant), in fact, purchases goods, therefore it has the right to deduct the amount of VAT presented to it in the cost of goods in the generally established manner <*>.

The funds and property received by the participant for the payment of dividends are not included in the VAT tax base <*>.

For profit tax , the transfer of goods for the payment of dividends in the accounting of organization “B” is also a sale, since they are alienated at a cost determined by the parties. Revenue from sales is reflected on the date of its recognition in accounting (regardless of the date of settlements on them in compliance with the accrual principle) in the amount of the cost of the transferred goods, including VAT. Simultaneously with the recognition of revenue, the accounting value of goods is included in the costs taken into account when taxing profits <*>.

Accounting legislation does not contain rules for reflecting a business transaction involving the transfer of property for the payment of dividends. In this matter, it is advisable to build on the documentation of this transfer.

If the parties have formalized the agreement reached on the payment of dividends in kind in a purchase and sale agreement, then no difficulties will arise in accounting, since in this case the standard sale of goods is reflected <*>. In this case, there will be no discrepancies with tax accounting, which also reflects the sale. As for settlements under such an agreement, in this case it is possible to offset debts, in which the obligation of organization “B” to pay dividends is extinguished by the obligation of organization “A” to pay for the goods transferred to it. In other words, in the accounting of organization “B”, accounts payable on account 75-2 are closed by accounts receivable on account 62 <*>.

With this method of registering transactions, the following entries will be made in the accounting of organization “B”:

| Contents of operation | Debit | Credit | Amount, rub. |

| In July 2020, on the date of shipment of goods for payment of dividends | |||

| The sale of goods by the Belarusian organization “A” is reflected | 62 | 90-1 <*> | 52800 |

| VAT charged on shipped goods (RUB 52,800 x 20/120) | 90-2 <**> | 68-2 | 8800 |

| The accounting cost of goods sold is written off to the financial result | 90-4 <***> | 41 | 30000 |

| The costs of selling goods are reflected | 90-5 <***> | 44 | 100 |

| An offset has been carried out (the debt of “A” for goods is repaid by the debt of “B” for the payment of dividends) | 75-2 | 62 | 52800 |

| ——————————— <*> Included in revenue for tax purposes and in sales turnover for VAT purposes <*>. <**> Participates in determining taxable profit <*>. <***> Included in costs taken into account when taxing profits <*>. | |||

If the payment of dividends in kind is formalized in some other way, we recommend enshrining the procedure used by the organization for reflecting this business transaction in the accounting records in the accounting policy <*>.

Grounds for non-payment of dividends: analysis of judicial practice

In addition, in judicial practice it can be considered an established position that the sale by a shareholder of his shares after the company makes a decision to pay dividends does not relieve the company from the obligation to pay them to such shareholder. In other words, the monetary obligation to the shareholder that arose for the company at the time the decision was made to pay dividends does not cease with the alienation of the shares by the shareholder and is not transferred to the buyer. This approach is based on the moment of determining the list of persons entitled to receive dividends[7].

We recommend reading: How much is the State Duty for Divorce?

Regarding the last group of grounds, the Supreme Arbitration Court of the Russian Federation, in paragraph 17 of the Resolution of the Plenum of November 18, 2003 No. 19, indicated that the suspension of the payment of dividends does not deprive shareholders of the right to receive declared dividends after the termination of the circumstances preventing their payment. After the termination (elimination) of such circumstances, the company is obliged to pay declared dividends to shareholders within a reasonable time. If they are not paid within such a period, the shareholder has the right to go to court with a claim for the recovery of dividends with the accrual of interest on the amount due to him for the delay in fulfilling the monetary obligation (Article 395 of the Civil Code of the Russian Federation). Interest is accrued for the period from the date of termination (elimination) of obstacles to payment until the date of repayment of the debt.

Dividend tax for individuals in 2020

The taxation of dividends from individual participants depends on their status: whether they are recognized as residents of the Russian Federation at the time of payment of income. The tax rate on dividends in 2020 is:

- 13% for resident individuals;

- 15% for non-resident individuals.

The status of a Russian resident depends on how many calendar days over the last 12 months the participant was actually in Russia. If there are at least 183 such days (not necessarily in a row), then the citizen is recognized as a resident. For him, the tax paid on dividends for individuals in 2020 will be levied at a rate of 13%. Periods spent abroad for valid reasons, such as treatment and training, are not taken into account (Article 207 of the Tax Code of the Russian Federation).

Citizenship does not affect the status of a resident of the Russian Federation, so it can also be a foreign founder if he has actually been in Russia for most of the last 12 months.

The company itself is obliged to withhold personal income tax from dividends in 2020 for transfer to the budget. For individuals receiving income from business, the company is a tax agent. The founder is paid dividends after taxation, so he does not have to independently calculate and transfer personal income tax.

However, if dividends are not transferred in cash (fixed assets, goods, other property), then the situation changes. The tax agent cannot withhold the tax amount for transfer, because funds, as such, are not paid to the participant. In this case, the LLC is obliged to inform the inspectorate about the impossibility of withholding personal income tax.

Now all responsibilities for paying personal income tax are transferred to the participant himself who received dividends in property. To do this, at the end of the year, you need to submit a declaration in form 3-NDFL to the Federal Tax Service and pay the tax yourself.

Additional difficulties when paying the founder non-monetary income are associated with the fact that such a transfer of property is a sale, because in this case there is a change of owner. And when selling property, its value must be taxed, depending on the taxation system on which the company operates:

- VAT and income tax (for OSNO);

- single tax (for simplified tax system).

If a legal entity works for UTII, then the transaction for the transfer of property to the founder should be taxed under the general or simplified regime (if the company combines the UTII and STS regimes).

This results in a truly absurd situation when property transferred as dividends is taxed twice:

- Personal income tax paid by the founder;

- tax on “sales” in accordance with the regime that the Federal Tax Service obliges the company itself to pay.

In some cases, the courts take the side of the LLC, recognizing that there are no signs of the sale of property, but there are also opposing court decisions. If you are not ready to argue with tax authorities in court, then we do not recommend using this method. Perhaps someday appropriate changes will be made to the Tax Code of the Russian Federation, but for now the payment of dividends with property threatens additional taxation.

We suggest you read: How to correctly write a petition to the court about health status

A participant in a limited liability company can be not only an individual, but also a legal entity (Russian or foreign company). Taxation of dividends paid by legal entities in 2020 is carried out according to the standards established by Article 284 of the Tax Code of the Russian Federation.

| Tax rate on dividends in 2020 for organizations | |

| Russian organization | 13 percent |

| A Russian organization, if for at least 365 calendar days before the decision to pay dividends is made, it owns a share of at least 50% in the authorized capital of the organization that is the source of the payment. | zero |

| Foreign organization | 15 percent or other rate if provided for by an international agreement for the avoidance of double taxation |

As we can see, if a Russian organization has at least 50% in the authorized capital of another Russian company, then no income tax is levied on dividends received (zero rate). To confirm this benefit, the participant-legal entity must submit to the inspection documents confirming the right to a share in the capital of the organization paying the income.

Such documents may be:

- contract of sale or exchange;

- decisions to divide, spin off or convert;

- court decisions;

- agreement on establishment;

- deeds of transfer, etc.

Income tax on dividends in 2020 is also established for legal entities that operate under special regimes (USN, Unified Agricultural Tax, UTII). In relation to the income they receive from their activities, such legal entities do not pay income tax. However, exceptions are made for income received from participation in other organizations:

- for companies using the simplified tax system, the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation apply;

- For companies on the Unified Agricultural Tax, the norms of paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation apply.

These articles explicitly state that the special tax regime does not apply to profits received from participation in other enterprises. As for companies on UTII, although there is no such direct clause, the exemption from income tax applies only to income received from the types of activities specified in Article 346.26 of the Tax Code of the Russian Federation.

Thus, the tax on dividends of a legal entity in 2020 is paid in the form of income tax (at the rates indicated in the table), even if, in general, a company under a special regime is exempt from paying this tax.

As in the case of an individual participant, the tax agent obligated to withhold and remit income tax is the organization that paid the dividends. The tax payment deadline is no later than the day following the day of payment (Article 287 of the Tax Code of the Russian Federation).

When creating an LLC, the founders make contributions to the authorized capital and receive the right to receive a portion of the Company’s income according to their share. In the process of carrying out activities in the LLC, new participants may appear, who also have the right to a portion of the profits. Payment of income to the Company's participants in proportion to their shares in the authorized capital is made in the form of dividends (Clause 1, Article 43 of the Tax Code of the Russian Federation).

According to the Tax Code, the profit remaining after taxation is used to pay dividends. Profits can be distributed quarterly, once every six months or once a year (Article 28 of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ). The timing and procedure for paying dividends are prescribed in the charter of the LLC. In practice, it is more common to pay dividends at the end of the year.

There are a number of cases when an organization does not have the right to pay income to the founders. All exceptions are specified in Art. 29 of the Federal Law of 02/08/1998 No. 14-FZ.

The founders of an LLC can include both legal entities and individuals. Next we will talk about settlements with individual participants.

Organizations that pay dividends are recognized as tax agents. The responsibilities of tax agents include complete and timely calculation, withholding and transfer of taxes (Clause 3, Article 24 of the Tax Code of the Russian Federation).

If an organization pays dividends to a legal entity, income tax must be calculated and the appropriate declaration must be submitted. When dividends are paid to individuals, there is no obligation to pay income tax. In this case, the Company must charge and withhold personal income tax from the participant’s income.

For resident individuals, the personal income tax rate on dividends is 13%; before 2020, the rate was 9% (Article 224 of the Tax Code of the Russian Federation). Income in the form of dividends paid to individuals - non-residents of the Russian Federation, is taxed at a rate of 15%.

We invite you to familiarize yourself with: Deadlines for returning tax deductions after filing a declaration

All income generated in favor of individuals is reflected in the 2-NDFL certificate. Starting from 2020, the tax withheld from dividends is also reflected in the calculation of 6-NDFL.

The Company should not show the amount of dividends paid to individuals as part of the income tax return (letter of the Ministry of Finance of the Russian Federation dated October 19, 2015 No. 03-03-06/1/59890).

Personal income tax on dividends must be transferred no later than the day of their actual payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The Tax Code does not indicate that personal income tax must be transferred separately for each founder. Therefore, personal income tax withheld from dividends of all participants can be sent to the Federal Tax Service account in one payment (letter of the Ministry of Finance of the Russian Federation dated November 19, 2014 No. 03-04-07/58597).

We will calculate the tax based on the above data.

Dividends are not subject to insurance contributions to the Pension Fund, Federal Compulsory Medical Insurance Fund and Social Insurance Fund. This is explained by the fact that dividends are not paid within the framework of labor relations and are not remuneration for the performance of duties under employment and civil law contracts (clause 1, article 7 of the Federal Law of July 24, 2009 No. 212-FZ, clause 1, article 20 .

Prohibition of non-payment of dividends in the presence of profit

The arbitration courts made a reasonable conclusion that neither the norms of the Federal Law “On Joint-Stock Companies” nor the charter of OJSC MGTS established a ban on making a decision on non-payment of dividends on the company’s preferred shares in the presence of net profit based on the results of the last financial year.

The operative part of the resolution was announced on February 26, 2008. The full text of the resolution was made on March 4, 2008. Federal Arbitration Court of the Moscow District, composed of: presiding judge Bragina E.A. judges Solovyov S.V., Petrova V.V. with participation in the meeting: from the plaintiff - O.V., Dov. dated March 28, 2007 from the defendant - G., dov. N 12-11/10654 dated July 23, 2007, having considered the cassation appeal of O.O. on February 26, 2008 at the court hearing. to the resolution of November 29, 2007 N 09AP-15541/2007-GK of the Ninth Arbitration Court of Appeal adopted by judges Krylova A.N., Lyashchevsky I.S., Smirnov O.V. in case No. A40-51773/06-81-286 according to the claim (application) of O.O. on the invalidation of decisions of the board of directors, the general meeting of shareholders of OJSC "Moscow City Telephone Network"

Opinion of fiscal authorities

For several years, tax authorities have taken the position that in this case there is a transfer of ownership of the property, which means there is a sale and, as a consequence, the obligation to charge VAT and income tax (tax according to the simplified tax system) (letter from the Ministry of Finance dated December 17. 2009 No. 03-11-09/405, letter of the Federal Tax Service of the Russian Federation dated May 15, 2014 No. GD-4-3 / [email protected] ).

Recent letters from the Ministry of Finance of the Russian Federation dated August 25, 2017 No. 03-03-06/1/54596 and dated February 7, 2018 No. 03-05-05-01/7294 confirm this position.

In giving such explanations, the Ministry of Finance of the Russian Federation is probably guided by the following logic: if an organization, if it had unnecessary property, wanted to pay dividends in cash, it would first have to sell this property, pay taxes and only then distribute profits to its participants.

But we dare to reassure you: judicial practice on this issue has developed contrary to the position of the Ministry of Finance and the Federal Tax Service of the Russian Federation.

Decision on non-payment of dividends on shares

Good afternoon At the EGM it is planned to make a decision on non-payment of dividends on shares for the first half of 2020. How to properly justify such a decision? What reason should be indicated in the minutes of a meeting of the board of directors at which it is recommended that the meeting not declare dividends? Provided that the company has a profit and there are no conditions established by law under which the company cannot decide to pay dividends.

At the EGM it is planned to make a decision on non-payment of dividends on shares for the first half of 2020. How to properly justify such a decision? What reason should be indicated in the minutes of a meeting of the board of directors at which it is recommended that the meeting not declare dividends? Anna Egorova

KS: purchasing preferred shares does not guarantee dividends

The Constitutional Court, in its new refusal, explained why owners of preferred shares may be left without dividends despite the company making a profit.

Background of the issue

At the annual general meeting of shareholders of Gazprom Gas Distribution Rostov-on-Don, it was decided to refuse to approve the amount of dividends on preferred shares for 2013. The St. Petersburg management company Arsagera did not agree with this: it appealed to the Arbitration Court of the Rostov Region to have it invalidate the decision. The attempt was unsuccessful, but the investment company did not give up and first went to appeal, then to cassation. Case No. A53-19292/2014 even reached the Supreme Court, but the Economic College did not consider Arsagery’s complaint.

All courts confirmed that the charter of the joint-stock company secures the right for the owners of preferred shares of type “A” to receive an annual fixed dividend in the amount of 2% of the company’s net profit. At the same time, this right directly depends on the decision of the shareholders, as stated in Art. 32 and art. 42 of the Law “On Joint Stock Companies”. In addition, dividends are not a guaranteed source of income for shareholders. All this is explained in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003 No. 19 “On some issues of application of the Federal Law “On Joint Stock Companies”: in the absence of a decision to declare dividends, the company does not have the right to pay them, and shareholders do not have the right to demand their payment.

But Arsagera considered that the provisions of the Federal Law regulating the rights of shareholders contradict the Basic Law to the extent that, according to the meaning given by law enforcement practice, they allow for the possibility of non-payment of dividends on preferred shares by decision of the general meeting of the joint-stock company.

Going into business - remember the risks

The Constitutional Court declared Arsagera's complaint inadmissible, pointing out that, when implementing the legal regulation of corporate relations, the legislator takes into account the constitutional principle of freedom of economic activity: it assumes that the general meeting of shareholders has the right to independently make strategic decisions, which include the decision regarding the payment of dividends on the shares of each type. Having entered into an obligatory legal relationship with the “granddaughter” of Gazprom, the management company did not object to the substance of these provisions of the Federal Law.

Owners of preferred shares of a company, according to a single rule, do not have the right to vote at the general meeting of shareholders, that is, they are usually removed from managing the affairs of the joint-stock company, and their main interest is related to receiving dividends. In the Criminal Code case, it was established that they were not distributed based on the results of 2012, and therefore the shares of Arsagera were voting, and it had the legal opportunity to take part in the annual general meeting of shareholders of Gazprom Gas Distribution Rostov-on-Don, thereby realizing rights granted to her.

The economic activity of the applicant involves a certain financial risk, since it constitutes a business activity. Accordingly, there is no reason to believe that Arsagera was deprived of the opportunity to foresee the consequences of its acquisition of preferred shares of the joint-stock company as a failure to receive the expected profit in a given period - even if this joint-stock company had a positive financial result, the Constitutional Court concluded (definition No. 1-O) .

Delcredere lawyer Sergei Savosko agrees with this position: the Constitutional Court correctly indicated that the risks of non-receipt of dividends are common for investors purchasing preferred shares. “Such shares are fundamentally different, for example, from bonds, which guarantee a certain income,” explains the lawyer. “The Law “On Joint Stock Companies” allows for non-payment of dividends on them, but provides that in this case their owners acquire the right to participate in the general meeting of shareholders with the right to vote on all issues within its competence.” Lawyer Sergei Morozov also agrees with him . According to him, such a mechanism encourages “ordinary” shareholders to take into account the interests of privileged shareholders when voting, because if they vote against the distribution of profits, their share in the management of the company will decrease. “Therefore, “ordinary” shareholders will vote for such a decision only if there are strong arguments,” adds Morozov. “This is precisely what the Constitutional Court drew attention to, considering that the described mechanism sufficiently guarantees the maintenance of a balance of interests between the company and its shareholders.”

- Judgment, Shareholder disputes, Legal community, Courts and judges

- Gazprom

- Arbitration Court of the Rostov Region, Constitutional Court of the Russian Federation

- Federal Law “On Joint Stock Companies”

- Challenging non-normative acts

Encyclopedia of solutions

The competence of the court in disputes on appealing a decision made by a general meeting of shareholders includes only checking compliance with the procedure for holding meetings and making decisions at them (see, for example, resolution of the Federal Antimonopoly Service of the North Caucasus District dated July 17, 2014 N F08-5016/14). When appealing decisions on the payment (non-payment) of dividends, the court does not assess the economic feasibility of such a decision, but only establishes whether there were violations of the law when making it.

— making a decision on the payment of dividends when the board of directors of the joint-stock company recommended not to pay dividends (Resolution of the Federal Antimonopoly Service of the Ural District dated March 20, 2013 N F09-1855/13). However, in judicial practice one can also find a different approach, when the decision of the general meeting of shareholders to pay dividends is recognized as competent, despite the fact that the board of directors recommended not to pay them (Resolution of the Federal Antimonopoly Service of the North-Western District dated November 2, 2012 N F07-5291/12) ;

Position of the courts

Back in 2011, landmark judicial acts were adopted in the case of Farmland CJSC. Three courts, including the Federal Antimonopoly Service of the Ural District (Resolution No. F09-1246/11-S2 dated May 23, 2011), supported the taxpayer in a dispute with the tax authority on the issue of calculating VAT and income tax when paying dividends with real estate. The courts have indicated that the payment of dividends in real estate is not the sale of this property, but forms an object of taxation under the personal income tax.

The courts have indicated the following as necessary conditions for the payment of dividends with property:

Indication in the company's charter on the possibility of paying dividends with property.

Availability of retained earnings after tax.

In the Resolution dated 02.25.2015 in case No. A58-341/2014, the Arbitration Court of the East Siberian District spoke in a similar way: “Since the legislation allows the payment of dividends to a shareholder with real estate, the transfer of this property does not form an object of taxation other than income, therefore, it is not sale of real estate subject to VAT.”

The same position was indirectly confirmed by the Supreme Court of the Russian Federation in Ruling No. 302-KG15-6042 dated July 31, 2015, refusing to transfer the case for review and indicating that the transfer of real estate for the payment of dividends is not included in the VAT tax base.

Since the tax authorities continue to insist on their position, the use of this method of transferring property to a company participant is associated with the risk of tax claims, which will have to be resolved at the level of the arbitration court. Although, as our experience shows, territorial tax authorities reluctantly listen to the taxpayer’s arguments and judicial practice within the framework of a constructive dialogue, without regarding such a transfer as an implementation.

Let's compare the payment of dividends in cash and by transfer of property using the example of a conditional calculation, using the following fixed indicators as a basis:

the amount of expenses for core activities,

the amount of expenses for the acquisition of property (in this case, for the purpose of calculation, we take into account the costs incurred at a time),

net profit amount

the amount of dividends paid.

Initial data

Conditional revenue with VAT 18%

expenses incurred for core activities (including VAT 18%)

property purchased (VAT deductible, all expenses will be taken into account immediately)

Profit before tax

Income tax

Profit after tax

Let's compare the tax burden when paying dividends in the amount of 50,000 rubles.

Method of payment of dividends (in the amount of 50,000 rubles)

Justification and choice of dividend policy of the joint-stock company

Accounting for the form of dividend payment (cash or non-cash form) is carried out by the securities registrar by collecting personal account questionnaires provided by persons registered in the register when contacting the registrar - JSC Doroga.

At the meeting of shareholders of Doroga JSC following the results of 2005, held on June 8, 2006, it was decided to pay dividends on ordinary and preferred shares at the rate of 4.48 rubles. per share with a par value of 1 rub. The dividend history of the enterprise is shown in tables 1 and 2.

Decision not to pay dividends

By decision dated May 17, 2001, the claim was satisfied. The decision of the board of directors regarding the recommendation to the annual general meeting of shareholders on the distribution of profits and non-payment of dividends for 1999, as well as the approval of the form and text of ballot No. 3 for voting on the third issue of the agenda (judges O.A. Shvetsova, L.H. Rib) was declared invalid ., Sitnikova N.A.).

We recommend reading: Industrial Practice 2020 Year Economist

Federal Arbitration Court of the Ural District for verification in the cassation instance of the legality of decisions and rulings of arbitration courts of the constituent entities of the Russian Federation, adopted by them in the first and appellate instances, composed of presiding G.Ya. Stoyakin, judges T.L. Verbenko, A.G. Kuznetsov. Considered at the court hearing the cassation appeal of OJSC Uralkali against the decision of May 17, 2001 and the decision of the appellate instance of June 27, 2001 of the Arbitration Court of the Perm Region in case No. A50-3750/2001 on the claim of Investment OJSC to invalidate the decision of the board of directors.

Non-payment of dividends to the participant (shareholders) of the Company

The main right of a shareholder of a JSC and a participant of an LLC is the right to receive dividends - a certain monetary portion of the total profit of the Company. Accordingly, the amount of dividends is established depending on the number of shares owned by the shareholder of a JSC, and in an LLC - on the size of the participant’s share in the authorized capital of the Company. There are often situations when a shareholder or participant, after familiarizing himself with the results of the financial year and the profit distribution plan of the Company, identifies a violation of his rights. Below are violations of the rights of a shareholder/participant related to the right to timely receipt of dividends (part of net profit):

- payments to members of the Company;

- payment of bonuses to the Company's employees;

- direction of profit (part of profit) for the development of the Company.

- increase in the Company's charter;

- development of the Company's activities;

- allocation of profits to the development of new directions of the Company.

Dividend distribution

The profit received by the organization at the end of the calendar year is subject to distribution in accordance with the decision of the founders. Profits can be invested in expanding the company, purchasing equipment, or used to pay dividends to shareholders.

The basis for the payment of dividends is the minutes of the board, which reflects:

- the total amount of profit received by the organization at the end of the year;

- the amount (in hard form or as a percentage of profits) that is used to pay dividends.

The amount of dividends paid to each shareholder is calculated based on the share of each participant in the authorized capital. If we are talking about the distribution of profits of a joint-stock company, then the payment is calculated based on the number of shares held by the shareholders.

Let's look at an example . Grand Invest JSC issued 1000 shares.

The shareholders of JSC Grand Invest are:

- Shchekin (250 shares);

- Gubarev (350 shares);

- Nosov (400 shares).

At the end of 2020, Grand Invest received a net profit of 641,500 rubles, which it was decided to distribute among shareholders as dividends.

Let's calculate the amount of dividends for each shareholder:

| Shareholders | Shchekin | Gubarev | Nosov |

| Number of shares | 250 | 350 | 400 |

| Dividend calculation | 641,500 rub. / 1000 * 250 = 160.375 rub. | 641,500 rub. / 1000 * 350 = 224.525 rub. | 641,500 rub. / 1000 * 400 = 256,600 rub. |

Conditions for paying dividends

In accordance with laws No. 208-FZ “On Joint-Stock Companies” and No. 14-FZ “On Limited Liability Companies”, an organization has the right to pay dividends while simultaneously meeting the following conditions:

- Full payment of the authorized capital . If one or more shareholders have not fully repaid their share in the authorized capital, then the payment of dividends is prohibited for all participants.

- The organization has no signs of bankruptcy . A legal entity has the right to distribute profits in the form of payment of dividends in the absence of signs of bankruptcy established by Art. 3 of Law No. 127-FZ of October 26, 2002, also provided that the payment of dividends will not lead to bankruptcy.

- The authorized capital does not exceed the size of net assets . In order to determine the amount of net assets, it is necessary to sum up assets (line 300) and deferred income (line 640), and then subtract liabilities (sum on lines 590 and 690).

Restrictions on dividend payments for LLCs

Dividends are profits received from the activities of a company in the form of an LLC, distributed among members of the company. The procedure for making payments is defined in the law adopted in February 1998 (No. 14-FZ). By virtue of this legislative act, dividends to members of the company can be paid at various periods of time:

Lawyers on our portal are often asked the question of how much money an LLC should pay dividends from. The law indicates that only net profit (i.e. assets, after payment of all relevant taxes) can be taken into account as income distributed among members of an LLC.

Sample decision and order on payment of dividends to LLC

The object of distribution can be amounts received for a quarter or a year, both for the current and the previous one. In this case, the share of payments to each participant in the company is determined in accordance with his share in the capital or on other grounds specified in the charter. The protocol may contain already recalculated amounts to be paid. Although it is most likely to transfer income in cash, other forms of receiving it are also possible.

When studying the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, you need to pay attention to the fact that on the basis of clause 1 of Art. 28 members of the company can use its profits in whole or in part to pay dividends. Carrying out such an action is possible only by decision of the general meeting of founders. The law stipulates that before it is carried out a number of mandatory actions must be completed:

Supreme Court to decide fate of unpaid dividends in bankruptcy case

On May 21, 2020, the SKES of the Supreme Court of the Russian Federation will consider the case of unpaid dividends to the shareholder. We will talk about qualifying the debt of the Design Bureau, a bankrupt subsidiary of Gazprom (Definition dated April 15, 2020 No. 305-ES20-16).

In the case under consideration, decisions on the payment (declaration) of dividends were made by the shareholders of the Design Bureau based on the results of 2003 - 2014. But in fact, no dividends were paid. In 2020, the Design Bureau and Gazprom entered into an agreement on the phased repayment of the accumulated debt by the end of 2020. And in March 2017, the Moscow City Administration filed an insolvency case for the bureau.

How to qualify dividends unpaid under a debt settlement agreement?

- The position followed by the lower courts: the claims are current, since the period for their repayment, determined in the agreement of the parties, occurred after the date of acceptance of the application for declaring the debtor bankrupt (clause 1 of Article 5 of the Federal Law on Insolvency (Bankruptcy) dated October 26, 2002 No. 127-FZ, hereinafter also referred to as the Insolvency Law).

- The bankruptcy trustee's position: the obligation to pay dividends arose before the bankruptcy case was initiated, so the shareholder's claims are not current.

We believe that the judicial acts adopted in the case were adopted in violation of the provisions of the Insolvency Law.

The obligation to pay dividends arises in the manner established by the Federal Law on Joint Stock Companies dated December 26, 1995 No. 208-FZ (hereinafter also referred to as the JSC Law). Dividends, the decision on payment (declaration) of which was made by the general meeting of shareholders, are subject to payment within the period determined by the company's charter or resolution.

The right of the company to pay, and the shareholders to demand the payment of dividends, is conditioned solely by the adoption by the general meeting of shareholders of the corresponding decision (clause 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003 No. 19 “On some issues of application of the federal law “On joint stock companies”). The subsequent conclusion between the shareholder and the company of a civil agreement to change the deadline for fulfilling the obligation that arose on the basis of a decision of the general meeting of shareholders should not affect the qualification of the creditor’s claim in the bankruptcy case as current.

The establishment of a special favorable regime for current payments is due to the need to ensure financing of the costs of the bankruptcy procedure. And the basis of the disputed claim is the legal relationship for the payment of income from participation in the debtor’s authorized capital, the obligation to pay which is provided for by law, and the procedure for fulfilling the obligation is changed by agreement of the parties.

Gazprom's claims arose before the initiation of bankruptcy proceedings on the basis of a decision of the general meeting of shareholders, and not a debt settlement agreement. Moreover, they are not related to ensuring the financing of the procedure, therefore, in any case, they cannot acquire the status of a current claim (clause 13 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 63 “On current payments for monetary obligations in a bankruptcy case”).

Moreover, since the requirements arise from the fact of Gazprom’s participation in the debtor’s authorized capital, the issue of attributing the risk of providing compensatory financing to it must be resolved. By virtue of Art. 2 of the Bankruptcy Law, participants in the debtor cannot be recognized as bankruptcy creditors for obligations arising from such participation. The demand of such a person is satisfied on the basis of paragraph 1 of Art. 9 of the Insolvency Law, paragraph 1 of Art. 2 of the Civil Code of the Russian Federation in the order preceding the distribution of the liquidation quota (clause 3.1 of the Review of judicial practice in resolving disputes related to the establishment in bankruptcy procedures of the claims of the controlling debtor and persons affiliated with him, approved by the Presidium of the Supreme Court of the Russian Federation on January 29, 2020).

It is also noteworthy that the lower courts actually avoided qualifying the disputed payments, since there is a ruling of the same court that has entered into legal force on the inclusion of one of the tranches under the debt settlement agreement in the third priority. Referring to prejudice (part 1 of article 16 of the Arbitration Procedure Code of the Russian Federation, paragraph 10 of article 16 of the Insolvency Law), the courts similarly resolved the dispute about the fate of the remaining payments provided for in the schedule, including them in the current ones.

Decision on payment of dividends to LLC - sample and order

Payment is made no later than 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). If a period within this period is not established by the charter, the meeting has the right to set it by its decision for each specific payment. The period is considered equal to 60 days if it is not included in the decision and charter.

The total amount is distributed among the participants in proportion to the share of each, unless the charter provides for a different procedure (Clause 2, Article 28 of Law No. 14-FZ), therefore it is enough to establish its value. Although the protocol can also record specific amounts intended for distribution to each participant in accordance with the distribution rules.

Nuances

Firstly, the company’s charter must indicate the types of property (movable, immovable, including securities) that can be transferred for the payment of dividends (clause 1, article 42 of the Law “On JSC”, clause 3, article 28 of the Law “ About LLC").

Secondly, when paying dividends with property to an individual participant, a situation may arise in which the organization will not be able to withhold personal income tax - this will happen if the participant does not receive any income from the organization other than dividends. In this case, the company must submit a notification to the Federal Tax Service about the impossibility of such deduction, and the individual will be required to independently pay personal income tax by July 15 of the next year.

https://www.youtube.com/watch{q}v=FbbJloDULJM

Thirdly, if we are talking about the payment of dividends with property, then one should take into account the position of the Ministry of Finance and tax authorities that in this case there is a sale and, accordingly, the obligation to pay VAT and income tax (single tax under the simplified tax system).

Great Encyclopedia of Oil and Gas

Information about non-payment of dividends gives a negative signal, while paying dividends in shares allows you to preserve the reputation of the enterprise and not reduce the share price. The consequence of paying dividends in shares can also be an increase in the liquidity of shares through a decrease in the market price. [4]

Refusal to pay dividends will increase the total amount of possible investments to 1050 million rubles. [ (500: 0 5) 150 ], of which 750 million rubles. (500 100 150) will be own funds, 300 million rubles. — new debt, the target capital structure will not change. But failure to pay dividends can reduce the company's image. [9]