Features of drawing up a statement of claim

People leave behind an inheritance not only of material assets, but also of monetary debts. Some of them are passed on to heirs. And in most cases, the transfer of rights has not yet been formalized and there is no one to claim in a lawsuit. The only way to sort out this situation is to file a claim for inherited property. But it's not just lenders who do this. Depending on the circumstances and essence of the case, the text of the claim differs.

It also happens that you have to demand if the inheritance has already been re-registered. Let's consider who to ask for the claim in this case. The claim against the heirs is not entirely correct, since they did not borrow anything and did not have the opportunity to influence the decisions of the testator during his lifetime. But part of the property transferred by inheritance may be claimed as compensation in a claim.

If we consider claims against inherited property, the samples show that they are filed by:

- banks and credit organizations, if the deceased did not manage to pay;

- individuals who have borrowed sums of money and have an issued receipt;

- organization, if the deceased was an entrepreneur, took an advance payment, but did not work.

The question arises of who is the defendant in the claim if the debtor no longer exists. Even if the inheritance is accepted, it is unfair to complain about the heirs. And even more so, a problem arises in the case when all the relatives knew that this would happen and refused the inheritance. But judicial practice allows you to claim what is due through the court.

Who is the defendant?

The essence of this case is to collect debts, despite the absence of defendants. When no one has entered into the inheritance, there are no claimants or they have refused, you can pay off the debt with the help of property. To do this, a claim is filed without specifying the responding party. Contents of the statement of claim

A claim to judges for the debts of the testator does not have clear rules regarding text and form. However, there are a number of mandatory requirements that must be taken into account. This applies to:

- brevity of presentation of information;

- the validity of each requirement;

- documentary evidence of arguments;

- design and arrangement of text blocks.

A claim filed for an inheritance (property left to the heirs by a deceased debtor) requires the payment of a state fee. But this is not enough for the application to be accepted. Errors made during writing and the absence of required attributes are the reason that the claim remains without consideration.

Contents of the statement of claim

Schematically, the text is divided into three main parts, each of which has features in terms of legal correctness. For a claim to be considered, the following three sections must be present:

- Explanatory . It describes the period of formation of debt obligations, and also indicates what kind of property is an inheritance. Documents, date of opening of the inheritance case, amounts and other data are indicated.

- Evidence-based . Be sure to refer to specific articles of the regulations confirming the legality of the requirements. It also contains the testimony of witnesses and lists the list of attached documentary evidence of the case.

- Requirements . The main thing is to clearly state which articles of the law allow you to demand repayment of debts. The claim will not give the expected result if this section does not indicate what the plaintiff is starting from when filing.

A laconic presentation without lyrical digressions is necessary. No manifestations of personal grievances or indications of mental suffering. Only facts, arguments, evidence, justification. To do everything right, claim. The inheritance is described specifically. Property is identified and valued based on official documents.

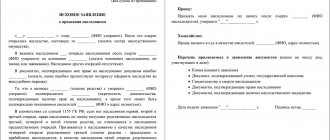

Application form

Legislative acts indicate a free form, but this does not mean that there are no mandatory requirements. There is a header at the beginning of the A4 page in the upper right corner. The addressee is written - the name of the court. Then the applicant is indicated - the person who wrote the claim. There is no defendant, and this column is omitted if the creditor wishes to claim the property of the deceased for money when no one accepted the inheritance.

The upper left sector of the sheet remains blank. This is the place to enter registration notes and other data. The title is written under the header, and then there is text. But there are mandatory attributes, without which an inheritance claim will not be accepted, these are:

- date and city;

- identification of the testator;

- original signature;

- stamp, if the claim is filed by a legal entity;

- amount of debt in rubles;

- attached documents for the property;

- receipt of payment of state duty.

If one of the listed attributes is missing, the claim against the property will remain without consideration. Material benefits will become inaccessible, because inheritance cases are initiated within a limited time - 3 years (statutory limitation period according to the Civil Code).

Sample

There are many examples of claims in the public domain when the claim is made against property that cannot be called an inheritance due to the lack of legal successors. There are also lawsuits in which there are heirs. Finding the right case is easy. But it is better if an experienced lawyer is involved in the process. This is a guarantee that the claim will be accepted, considered, and part of the property will be allocated from the inheritance to pay off debts.

Sample statement of claim for inherited property

Size: 14 KB

Sample statement of claim for inherited property

There is no specific template for drawing up the document. However, a sample statement of claim for inherited property must contain:

- Information part, including:

- name and address of the justice authority;

- details of the plaintiff indicating the full name for an individual, the name of the institution for a legal entity;

- information about the defendant and inherited property values;

- claim price.

- The main part containing a thesis statement of facts in chronological order:

- provision of funds in pursuance of a credit agreement or loan agreement, reflecting the date of conclusion, the fact of financing and gradual repayment in accordance with contractual terms;

- the amount of the outstanding debt at the time of the death of the debtor;

- opening an inheritance case and announcing a successor.

- The summary part expressing the essence of the requirements against the defendant for the recovery of funds in the specified amount, taking into account the outstanding loan, interest accrued for the use of funds and calculated financial sanctions in case of late payments.

- Date, signature of the plaintiff and list of attached documents:

- credit agreement or loan agreement;

- settlement and payment documents for repayment;

- calculation of the amount of debt and the balance of debt obligations at the time of death of the debtor;

- receipt of payment of state duty;

- information about inherited property.

: Sample claim for inherited property (20.7 KiB, 62 hits)

The list of documents and the number of copies of the claim are determined by the total number of participants in the process. A statement of claim against the heirs for the debts of the testator is drawn up based on the number of applicants.

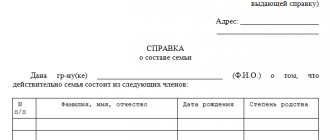

Required documents

The list may vary. It is necessary to prepare and submit documentation for a claim on property, following the principle of ownership, which includes:

- Justification of debt . Agreements, receipts, receipts and bank statements are provided here.

- Definition of property . It is expected to present papers issued by a notary at the place where the inheritance was disclosed, a copy of the will, etc.

- Identity cards . For individuals - passport. Legal entities act through a representative with sufficient grounds.

- Death certificate . Proves that the inheritance is indeed such, because the owner has passed away, which is officially confirmed.

After collecting the papers, it’s time to file a claim to defend the property in the form of a share of the inheritance to return the funds previously spent. It is important to determine jurisdiction, that is, to send the claim to the right authority.

Nuances of the procedure

All cases of claims from the inheritance, property, and monetary savings of the deceased in judicial practice are different, although the general essence of the plaintiffs’ claims is similar. The reason is the lack of legal knowledge, which leads to fatal mistakes. If the name of the representative is not indicated, but the statement of claim is filed in the wrong instance, there will be no movement in the case of collecting property from the inheritance in favor of paying off debts. With regard to the plaintiff himself, the sample statements of claim show that this may be a creditor personally, a company representative, or a lawyer who acts on the basis of a notarized power of attorney.

Application deadlines

If there are no heirs, or there is no information about applicants for the inheritance, this is not a reason to write off the debt. The remaining property is a guarantee of money back, but only if you file a claim for inheritance within three. The starting point is the date of opening of the inheritance case. And this is automatically the day of death of the debtor. The six months allotted for the adoption of inheritance rights are included in this period, and are not added to it, which is important not to forget.

It is necessary to understand that the remaining funds are what lies on the accounts, or property left by inheritance and available in kind:

- apartment;

- car;

- garage;

- country house;

- land plot;

- valuables, furniture;

- personal belongings;

- securities, etc.

To restore the statute of limitations for claims against property (inheritance), it is necessary to file a corresponding claim. The text indicates the objective reasons that caused the delay. If the judge decides that they are satisfactory, the case will be reopened and considered. This also applies to cases where there are persons who have accepted the inheritance.

What problems might arise?

Any mistake made when drawing up a claim can hinder the achievement of justice. If the procedure for repaying the debt is violated during your lifetime, it is important that the creditor tries to resolve the problem with debts, property and inheritance in a pre-trial manner.

For example, a collection claim case falls apart if there is no documentary evidence of the existence of a debt. It also happens that the repayment deadline has not arrived and the creditor is not able to submit a claim in a timely manner. Then a claim is filed to restore the statute of limitations.

Other reasons for refusal to implement claims include cases when a claim is filed with the wrong authority. Let us remind you that you need to contact the district court at the location of the property included in the inheritance. I mean most of it. Regarding the time count, this may not be the only reason. The state fee is paid before filing. If you do not attach a receipt, there will be no progress in the case. And decisions that have already been made are final if the essence of the dispute is the same.

Procedure

The right to file a claim against property transferred after the death of the testator is prescribed in Article 1175 of the Civil Code of the Russian Federation. It also states that the creditor can do this until the inheritance is accepted.

The procedure includes several steps:

- Collection of necessary papers.

- Drawing up a statement of claim.

- Determination of jurisdiction to select the body that will consider the case.

- Payment of state duty.

- Consideration of the case in court and making a decision.

One of the important issues is the determination of jurisdiction. You need to go to court at the place where the inheritance was opened (Parts 1, 2, Article 30 of the Code of Civil Procedure of the Russian Federation). This is the last address of residence of the deceased.

Reference! If the place of residence of the testator is unknown, then the opening of the inheritance is made at the address where the property is located. If there are several objects, the location of the most valuable part is selected.

Who can file a claim

All interested parties can file this type of claim. There is no specific list, but it can be logically assumed that all kinds of creditors are primarily interested in filing such an application.

Where to apply

To begin the trial, the applicant must send documents to the court. Correctly identifying the judicial authority will save time.

Violation of the jurisdiction of cases may lead to an increase in the period for consideration of the claim. Because the court will leave the claim without consideration. At the same time, the applicant will be explained his right to reapply to the appropriate court.

If a violation of the rules of jurisdiction is revealed during the trial, the court will have to transfer the case to the appropriate judicial authority (Article 33 of the Code of Civil Procedure of the Russian Federation).

Possible options for filing a claim:

- The statement of claim is filed in the general manner at the place of residence of the defendant (Article 28 of the Code of Civil Procedure of the Russian Federation). There are no problems when concluding credit agreements. The residential address is indicated in the contract.

- If the defendant’s residential address is unknown, then the application is submitted at the location of his property .

- Claims against a property are filed at its location . The rule of exclusive jurisdiction applies here.

- If the claim is filed before the acceptance of the inheritance by the legal successors, then the territorial reference goes to the place of opening of the inheritance (Article 30 of the Code of Civil Procedure of the Russian Federation).

List of documents

In order to start the process, you need to collect a package of documents.

It includes:

- plaintiff's civil passport;

- a power of attorney drawn up in the name of a citizen if the claim is filed by a legal entity;

- a receipt confirming payment of the state fee;

- a loan agreement, receipt or other grounds giving the right to claim the debt;

- a copy of the request sent to the notary;

- the answer given by the notary;

- information about the availability of inherited property.

It is worth paying attention to the collection of documents. Judicial authorities often refuse to consider a claim unless the existence of inherited property is proven.

Filing a claim

The statement of claim must be made in writing. The document must comply with the rules of civil procedure.

Key points:

- name of the court;

- details of the applicant (full name of the plaintiff - an individual and place of registration, name of the legal entity and legal address);

- cost of claim;

- name of the statement of claim;

- data on the conclusion of a loan agreement or other document confirming the existence of an obligation;

- information about the death of the debtor;

- reference to law;

- a request to collect debt from inherited property;

- list of documents for the claim;

- date and signature.

Features of drawing up a statement of claim

People leave behind an inheritance not only of material assets, but also of monetary debts. Some of them are passed on to heirs. And in most cases, the transfer of rights has not yet been formalized and there is no one to claim in a lawsuit. The only way to sort out this situation is to file a claim for inherited property. But it's not just lenders who do this. Depending on the circumstances and essence of the case, the text of the claim differs.

It also happens that you have to demand if the inheritance has already been re-registered. Let's consider who to ask for the claim in this case. The claim against the heirs is not entirely correct, since they did not borrow anything and did not have the opportunity to influence the decisions of the testator during his lifetime. But part of the property transferred by inheritance may be claimed as compensation in a claim.

If we consider claims against inherited property, the samples show that they are filed by:

- banks and credit organizations, if the deceased did not manage to pay;

- individuals who have borrowed sums of money and have an issued receipt;

- organization, if the deceased was an entrepreneur, took an advance payment, but did not work.

The question arises of who is the defendant in the claim if the debtor no longer exists. Even if the inheritance is accepted, it is unfair to complain about the heirs. And even more so, a problem arises in the case when all the relatives knew that this would happen and refused the inheritance. But judicial practice allows you to claim what is due through the court.

Price

The creditor cannot independently find out who will claim the inherited property.

Therefore, he files a claim not against a specific person, but against the transferred objects as a whole. In this case, you will definitely need to pay a state fee. The cost is calculated in accordance with the rules developed for any property claims. It depends on the price of the object.

| Cost of the claim | State duty amount |

| Less than 20 thousand rubles | 4% of the price, but minimum – 400 rubles |

| From 20 to 100 thousand rubles | 800 rubles + 3% of the amount that exceeds 20 thousand rubles |

| From 100 to 200 thousand rubles | 3200 rubles + 2% of the amount that exceeds 100 thousand rubles |

| From 200 thousand to 1 million rubles | 5200 rubles + 1% of the amount that exceeds 200 thousand rubles |

| More than 1 million rubles | 13,200 rubles + 0.5% of the amount that exceeds 1 million rubles; maximum – 60 thousand rubles |

Deadlines

The claim is filed within the time limits established by law. The creditor can go to court to collect the debt from the inherited property within 6 months. It does not matter whether the deceased made a will or not.

It is worth distinguishing between the time limits allocated for filing a claim against property and the statute of limitations. Next, the creditor will be able to apply for debt collection directly from the heirs.

State duty

Such claims relate to property claims. When calculating the state duty, you must be guided by Article 333.19 of the Tax Code of the Russian Federation (clause 1, subclause 1). The basis of calculation is the cost of the claim. It, in turn, is based on the estimated value of the inherited property, determined by licensed appraisal companies.

The report must be prepared as of the date of death of the testator-borrower.

All calculations are divided into 5 categories, depending on the cost:

- If the inheritance, based on the appraisal report, is worth less than 20 thousand rubles, then the plaintiff will have to pay 4% of this amount, but not less than 400 rubles.

Example : If the cost of the claim is 15,000, the state duty will be 600 rubles. And if the cost were 2,000 rubles, then 4% of this amount would be only 80 rubles. In the latter case, the rule “not less than 400 rubles” is used and you would have to pay exactly 400 rubles, and not 80 rubles.

- If the price of the claim is more than 20,000, but does not exceed 100,000 rubles, you will have to pay 3% of the amount exceeding 20 thousand and an additional 800 rubles of a fixed amount.

Example : The price of the claim is 50 thousand rubles. 3% of this amount will be 1500 rubles. A fixed 800 rubles are also added here. In this case, the state duty will be 1500+800=2300 rubles.

- If the value of the claim is within the range of 100-200 thousand rubles, a state duty is paid in the amount of 2 percent of the amount over 100 thousand rubles and a fixed amount of 3,200 rubles is added to it.

- If the cost is above 200 thousand, but not more than one million rubles, the state duty will be equal to 1% + 5200 rubles of a fixed amount.

- And if the price is more than one million rubles, the state duty will be equal to 13,200 rubles and 0.5% of the amount. In this case, the maximum limit applies: no more than 60 thousand. As a result, even when applying for a very expensive inheritance item, its value will not exceed 60 thousand under any circumstances.

Trial

Popular issues in litigation are:

- The judge's request to identify the defendant. Since the estate is considered a fictitious defendant. But the plaintiff must substantiate his claim, since inherited property, like the property of a legal entity, does not have a real owner. It is simply separate property. Therefore, the applicant must justify his claim.

- The next problem is the ability of the heirs to sell the inherited property in advance and before taking ownership. As a result, the lender cannot get their money back. To avoid this, the plaintiff must apply to the court to impose a ban on the sale of objects.

- Another difficulty is the lack of information from the creditor about the composition of the deceased’s property. The secrecy of the will does not allow the notary, the executor of the will and other citizens to notify the creditor about the composition of the property.

In addition, in 2021 there is no uniform approach to identifying the property of the deceased. The notary requests information from Rosreestr, the State Traffic Safety Inspectorate, and Sberbank. But the property may include accounts in other banks, special equipment and other things that the notary may not know about. Therefore, the creditor must himself find and prove the existence of property of the deceased.

Is a claim filed in case of hereditary transmission?

This term refers to the transfer of the owner's rights to persons who are not direct successors (holders of the inheritance). Creditor organizations can demand funds, but not from legal successors, but from property transferred by inheritance. In this case, fines and penalties are negotiated in court, and interest until the date of death of the testator is defended without problems. This does not depend on the period of acceptance.

Is there a statute of limitations?

This concept is used for cases when it is necessary to file a claim and direct it against property (part of the inheritance or property in full). The right remains for a period of three years from the date of delay in debt payments. According to the Code of Civil Procedure of the Russian Federation in Art. 38 states that there are two parties involved in the case, called plaintiffs and defendants. Even in the absence of the latter, the limitation period expires on a general basis. The courts of the Russian Federation do not conduct trials concerning events that occurred 3 years ago or more.

Filing a claim against inherited property

Debts can be divided into 2 categories:

- Personal debts.

They are not collected from heirs. From the moment of death of the debtor, they are considered automatically repaid. These are obligations for alimony and fines. Important! Personal debts include only the general alimony obligation. If a citizen has already accumulated debt, it must be repaid from the inherited property. - Property debts. These are loans, credits and other obligations. They pass to the heirs in proportion to their shares in the inherited property.

If a citizen dies without paying the loan or utility debts, the creditor can collect the debt from the heirs. Until they enter into legal rights, a claim may be made against the inherited property.

Since any property cannot be ownerless, the inheritance that was not formalized by the relatives of the deceased passes to the municipality or the state. This is called escheat inheritance (Article 1151 of the Civil Code of the Russian Federation).

Therefore, a claim against the inherited property can only be brought within 6 months from the date of death of the debtor.

Arbitrage practice

The application form has been completed and there are no complaints regarding deadlines. But the applicant did not have time to pay the state fee, and therefore the claim is sent to the archives without consideration. There are also frequent cases when there are heirs, but they ignore the agenda and do not appear in the courtroom on the appointed day and time.

The claim is considered without them if the inheritance does not raise questions that only they can answer. A decision is made that is final. And the applicant-creditor cannot apply to the court again with the same demand. The property is sold and the debts are repaid. Even if the current owners of property have acquired rights by inheritance, it is better to negotiate with them in court, since it will be impossible to appeal the decision made.

There are cases when a change of defendant is a decision made during the hearing of a claim against the heirs. If it is recognized that they have no relation to the debts and are not personally liable, the matter takes a different turn. Now claims are directed directly to the property (part of the property or the entire inheritance). The turn of events is reflected in the corresponding resolution.

The result of the proceedings is the satisfaction of the plaintiff’s demands (full or partial) or refusal. A copy of the verdict is given to each participant in the procedure.