Entitled payments

Upon termination of an employment relationship with an employee, a full settlement must be made; he must be given a work book, a certificate of income and the required amount of money, which includes:

- severance pay;

- vacation compensation;

- wages.

Payments to the employee must be made on the last working day. The due amount can be received by a person personally at the company’s cash desk or transferred to a personal account. In the second case, the transfer of funds must be made the next day after the employee’s request.

It is important to know! If an employee resigns while on vacation or immediately after taking it, the date of termination of the employment relationship will be considered the last day of vacation.

In some cases, an employee may receive all payments due to him on payday. This request must be fully discussed with the supervisor in advance.

If for some reason a person refuses to collect money on his last day at work, then it must be provided to him on another day upon request.

If disputes arise regarding the amount of payments, the manager is obliged to pay the former subordinate the amount that is not subject to dispute. The remaining portion is transferred to the employee after a complete check and recalculation.

Sample of filling out a pay slip - front side Sample of filling out a pay slip - back side

When and how does a temporary employment contract end?

According to the provisions of Article 77 of the Labor Code, paragraph 2 determines that the legal basis for terminating the employment relationship between an employer and an employee is the expiration of the employment contract. That is, this wording refers to the general reasons why an employee can be fired without the employer initiating such dismissal. In addition, refusal to continue the employment relationship also cannot be attributed to the employer’s initiative to terminate the employment contract. Thus, the expiration of the contract, in its essence, does not relate to the reasons for dismissal at the request of the employee, or at the request of the employer.

The only important condition for the legality of dismissing an employee due to the expiration of the employment contract is the legality of concluding a temporary employment contract with this employee. If at the time of concluding the employment contract there were no legal grounds provided for in Article 58.59 of the Labor Code, the court regards dismissal at the end of the contract as illegal and unlawful. In this case, the court may recognize the specified employment contract as being concluded for an indefinite period. And, accordingly, it is impossible to dismiss such an employee due to the expiration of the employment contract.

Another important detail: if the fixed-term employment contract is not terminated on time, and the dismissal is delayed, the fixed-term employment contract will be transformed into an open-ended one, this is the requirement of Article 58 of the Labor Code. This will lead to the fact that it will be impossible to dismiss an employee using this wording, and the issuance of a dismissal order will be unlawful. To prevent this from happening, you need to warn the employee in time that the employment contract with him will not continue.

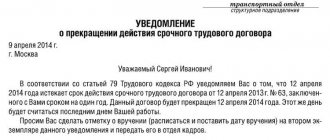

Notice of dismissal upon expiration of a fixed-term employment contract

There are situations when an employee must be notified of an upcoming dismissal. Termination of an employment contract due to its expiration refers to just such a case. Therefore, before issuing a dismissal order, you need to go through the procedure of notifying the employee of the termination of the employment relationship and the date of dismissal. In this case, the “two weeks” rule does not apply. The employee must be notified three calendar days before the expiration of the employment contract. The form of notification must, of course, be in writing. Moreover, the employer must have confirmation (written) that the employee received this notification and is familiar with the situation. This requirement of Article 79 of the Labor Code does not apply to those employees who work temporarily in place of an absent employee. When such an employee returns to work, the temporary employment contract with the temporary employee terminates. On the day of his dismissal, the employee must be given all pay slips, as well as a work book.

This is important to know: Agreement of the parties on termination of the employment contract: sample 2020

You should also not forget about the peculiarities of dismissal of pregnant women at the end of the contract. While such an employee is pregnant, the employer must extend the employment relationship with her until the moment of childbirth. After this, he can terminate the employment relationship with her by issuing an order for her dismissal. If a pregnant employee performs the functions of a temporarily absent employee, upon his departure, the pregnant employee must be offered all current vacancies at the enterprise that suit her according to her position, level of education and qualifications.

Compensation upon dismissal due to expiration of the employment contract

Since employees who have entered into a temporary employment contract with the company are entitled to paid vacations, then, accordingly, they are also entitled to compensation for unused vacations. Even if an employee is entitled to only two days of vacation and he did not use them, he is still entitled to compensation for these two days. When calculating this amount, you should be guided by the norms of the Labor Code, since it establishes the number of vacation days for temporary employees. At the rate of two days for each month worked, the employee is paid compensation if:

- an employment contract of up to two months has been concluded with the employee;

- the employment contract was concluded for a specific season or period.

If, however, an employment contract with an employee is concluded for a period of one year or more, after six months of work, such an employee already acquires the right to leave. In the event that he does not exercise this right, upon dismissal he must be calculated compensation for the allotted vacation time, based on the days established by the contract and the law.

Compensation in the form of severance pay is not established by law for employees whose employment contract is terminated due to the termination of the employment contract. However, the employer is not deprived of the right to independently establish in the labor and/or collective labor agreement additional material compensation for dismissed employees. So, for example, an employee can receive certain bonuses and allowances during his work, or he can receive them during the period of termination of the employment contract, after a certain amount of work, if this condition is specified in the employment contract with the employee.

If an employment contract is concluded with the head of an enterprise (and temporary fixed-term employment contracts are always concluded with the management team), as a rule, upon termination of employment relations with him, the enterprise pays “compensation” or severance compensation in connection with dismissal.

Vacation

Compensation for unused vacation can be received by anyone, regardless of the type of contract, who has worked for at least 1 month in the company. In Art. 291 of the Labor Code of the Russian Federation states that all employees have the right to receive two paid days of rest every month. Depending on the period, compensation calculations are required.

1 month

In case of an employment contract concluded for a period of 1 month or less, the calculation is carried out on a general basis, in accordance with Art. 291 and art. 139 Labor Code of the Russian Federation:

- If a citizen has worked for a company for a full month, then he is entitled to payment for 2 days of vacation that he did not use.

- If a person worked less than 15 days, no compensation is paid.

It is worth considering that if the contract is concluded for 14 days, then you will also need to pay various allowances, for example, according to the conditions in the RKS.

2 months

Payments under a contract concluded for a period of up to two months are calculated taking into account the time the person worked:

- If there is half a month left before the end of the contract, then in the calculation this period is taken into account as one month and payment is made for 2 days of vacation.

- If it is less than half a month, then no compensation is paid.

3 months

If the employee’s work activity lasted up to three months, then by common agreement he can be transferred to the status of an indefinite term. This requires the conclusion of a new employment contract or additional agreement. In such a situation, compensation for vacation is calculated according to the calculation algorithm for an open-ended contract:

- with a full month, the citizen receives cash payments for 2 days in accordance with the average monthly earnings;

- Payment for an incomplete month is carried out only in case of working more than 15 days.

From 2 to 6 months

When concluding a fixed-term contract for a long period, compensation for vacation is calculated taking into account only fully worked months. So, one month worked is equal to 2 days of paid vacation. The final amount is calculated by multiplying the average daily salary by the number of vacation days that the citizen did not use.

Read on topic: Procedure for terminating a fixed-term employment contract at the initiative of the employee

Answers to frequently asked questions

Is a personal income tax deduction available for a child in the case of compensation and wages?

Answer: Yes, a deduction for a child is provided without fail, for the first one in the amount of 1,400 rubles once a month, that is, if in one month you receive both compensation and wages, then there is only one benefit

- Question #2:

What is the difference between calculating compensation upon dismissal under a fixed-term employment contract and an open-ended one?

A regular employment contract differs from a fixed-term one in that it is concluded on a permanent basis and without a deadline, there is no difference in accrual, there are some peculiarities, such as vacation is not accrued for less than a month of work, and if you have worked more than 15 days, then as expected

What penalties are imposed on an employer for non-payment of compensation?

According to the Labor Code, in any case, the employer will have to pay the amount due, as well as interest in the amount of one hundred and five tenths of the Key Rate of the Central Bank for each day of delay in payment, starting from the next day.

Wage

Salary refers to mandatory payments that an employee must receive. Its size is determined taking into account the actual time worked before dismissal in accordance with Art. 139 Labor Code of the Russian Federation.

For example, in March, sales manager Ekaterina received 15,000 rubles as a salary, having worked for 20 days. To calculate payment for 1 day, 15,000 / 20 = 750 rubles are required. Before being fired, Ekaterina managed to work 10 days. To calculate the final amount that will need to be paid to Ekaterina upon dismissal as wages, 750 * 10 = 7,500 rubles are required.

Severance pay

Severance pay implies payment provided for by the Labor Code or a fixed-term employment contract. This amount of money is given to the employee for the period of searching for a new job. The amount of the benefit largely depends on the reasons for which the employment contract was terminated. Payment of benefits in an amount equivalent to the employee’s earnings for 2 weeks is provided if a person quits due to:

- failure to pass certification and inadequacy of the position held;

- medical indications that do not allow you to continue working;

- the return to work of another employee, in whose place a person was temporarily hired;

- mandatory service in the Russian Armed Forces;

- relocation of the organization and refusal of the employee to move.

Read on the topic: Peculiarities of dismissal of employees during liquidation of an enterprise

In the event of termination of a fixed-term contract for reasons beyond the employee’s control, for example, due to the liquidation of an enterprise or staff reduction, the compensation is equal to the amount of the average salary. Its payment is made within two months after dismissal. Payment of benefits can be extended after a two-month period, provided that the citizen is registered with the Labor Exchange and, during the allotted period of time, was unable to find a job.

It is important to know! Payment of benefits is carried out only if the employment contract was terminated prematurely for a valid reason. If the dismissal is made at one’s own request or by agreement of the parties, then the benefit is not paid (unless otherwise stated in the text of the contract).

Possible reasons for dismissal

Article 79 of the Labor Code considers the conditions for termination of a fixed-term employment contract between an enterprise and an employee.

- Upon expiration of the period, with a warning to the employee from the management of the enterprise about the upcoming dismissal three days in advance, except in cases where the contract was concluded during the absence of a permanent employee.

- After completing the scope of work specified in the contract, when it is impossible to predict in advance the completion date.

- Upon the departure of the employee during whose absence this employment agreement was concluded.

- In case of seasonal nature of work, respectively, at the end of the designated period.

Like any working person, an employee under a contract concluded for a certain period can quit before the established date at his own request (Article 80 of the Labor Code of the Russian Federation).

Termination of a fixed-term contract is also possible by agreement between the manager and the employee hired under a limited-term contract (by agreement of the parties, Article 78 of the Labor Code of the Russian Federation).

Also, in cases of violation of labor discipline or the organization’s charter, the manager has the right to terminate the employment relationship: dismiss the employee, regardless of whether he works on his own initiative on a permanent or temporary basis (Article 81 of the Labor Code of the Russian Federation).

In addition, like all employees, a person who has entered into a fixed-term contract is not insured against dismissal in the event of a need for staff reduction or liquidation (closing) of the enterprise in the absence of suitable vacancies for transfer to another workplace (position) or refusal of possible job replacement options .

Additional payments

Additional payments are considered to be any payments that are due to a person in addition to the mandatory ones. They can be specified both in the Labor Code and in a fixed-term employment contract and other agreements between the employee and the employer. A citizen may lose additional funds if he violates the company’s rules during the period of employment. However, Art. 84 of the Labor Code of the Russian Federation retains the right to additional payments if violations did not occur through the direct fault of a person.

Sample of filling out 2nd personal income tax

Rules in this matter

The legislation of the Russian Federation provides for the signing of employment contracts, which can have both an unlimited duration and an exact indication of the date of its completion, which is prescribed in Article 58 of the Labor Code of the Russian Federation. Article 59 addresses issues relating to when and under what conditions a fixed-term contract can be concluded with a particular employee.

This is important to know: Work contract with a foreign citizen: sample 2020

According to Article 127, if the agreement is concluded for a period exceeding 2 months, then compensation is calculated in the same way as for an open-ended contract. In fact, this means that payments will be made in proportion to the time worked with the required rest days. According to Article 291, 2 legal days of rest per month are assumed. After a year of work, a full-fledged vacation “flows” accordingly.

Payments upon termination of STD

Refusal of the organization to pay

If the employer refuses to pay compensation to employees, you must contact the labor inspectorate with a complaint. After the inspection, the inspectorate obliges the employer to make a payment of funds.

If the manager does not comply with the inspection order, the citizen can go to court. If the employer’s guilt is proven, he may be held administratively liable and a fine imposed. In court, a citizen can demand from the employer payment of compensation for moral damage if it is proven that the delay in payments had a negative impact on him.

If the employment relationship with an employee is terminated, both before the expiration of the contract and after, the employer is obliged to pay the funds provided for by law. In case of failure to fulfill obligations on the part of the manager, the employee may go to court to recover the entire amount of money.