Who uses

The key purpose of the paper is to confirm the expenses of an employee who, in order to fulfill his job duties, is forced to pay travel expenses. Route sheet 2020 can be used by the following categories of workers:

- Drivers operating official or personal vehicles.

- Couriers, logisticians and other delivery workers (transport companies).

- Specialists whose positions, according to job descriptions, have a traveling nature of work.

- Employees who travel on business due to the specific nature of their position. For example, an accountant submits reports to regulatory authorities.

It is worth noting that this list is not closed. Other categories of hired specialists can also use this type of primary employment.

Do not confuse the waybill and the route. These are completely different types of primary documentation. Even though, in fact, the sheets have one purpose - confirmation of expenses incurred. Only with a voucher does the organization write off fuel and lubricants, that is, it confirms the costs of paying for gasoline, gas or diesel fuel.

Invoice for the export of material assets

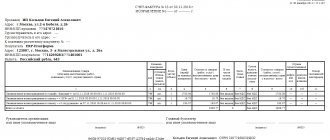

The unified form of primary accounting documentation No. 1-T “Consignment note” (OKUD 0345009) was approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78. Designed to record the movement of inventory items and payments for their transportation by road. The consignment note consists of two sections:

- Commodity, which determines the relationship between shippers and consignees and serves to write off inventory items from shippers and post them to consignees.

- Transport, which determines the relationship of shippers of motor transport customers with organizations - owners of motor vehicles that carried out the transportation of goods, and serves to record transport work and settlements of shippers or consignees with organizations - owners of motor vehicles for the services provided to them for the transportation of goods.

Rules of the Ministry of Transport and Communications from N 409-1 - RULES FOR ISSUING PASSES ON THE TERRITORY OF INTERNATIONAL AIRPORTS OF THE REPUBLIC OF KAZAKHSTAN

44.

The removal (removal) of material assets from the territory (facility) of the airport is carried out only with material passes of the established form, with the permission of authorized persons, regardless of whether these values are temporarily or permanently exported or removed.

45. Material passes for the export (removal) of material assets are issued (issued) only by the service that releases (issues) material assets. Material passes are one-time and valid during the day of issue.

How to create your own form

It is permissible to develop your own individual document format that will fully meet the specifics of the institution’s activities and the specifics of the work of a particular employee. However, please ensure that the paper contains the following mandatory details:

- The name of the document, for example, “route sheet, sample for the driver.”

- Full name of the organization that issued the ML.

- Place and date of issue of the form, if prepared outside the company.

- Validity. ML can be prescribed for a period of one day or for a week or a month.

- FULL NAME. the employee who received the route sheet, his position and structural unit.

Next, a special table is filled in. The following must be indicated in the tabular section:

- Destination, that is, where the employee is sent.

- Purpose of the trip - indicates the specific purpose for which the employee went to the destination, for example, delivering a report.

- Arrival or departure notes. Such marks are made by a representative of the organization (government agency) to which the employee was sent.

- A type of transport that was used as a means of transportation, such as a bus, taxi or personal car.

Additional information is provided in no particular order. For example, you can provide notes on the time spent on the road - this is relevant, for example, if you are preparing a sample route sheet for a courier. Information on the amounts of costs incurred can also be reflected in the tabular section.

About work

At first glance, it may seem that working as a courier is easy - you take the parcel and bring it where you need it. However, everything is not so simple here, since the courier service employee is entrusted with great responsibility, including financial responsibility. After all, he must deliver the order on time and do everything necessary for its safety. Therefore, in modern companies engaged in the delivery of goods, parcels or correspondence, there are certain courier documents that specialists in this field of activity deal with.

Design features

The developed form should be approved in the accounting policy of the institution or enshrined in a separate local order. The procedure and rules for filling out should also be fixed in the order. We recommend that responsible persons be familiarized with these local regulations against signature. This procedure will eliminate errors and problems in filling out the primary documentation.

If an error was made in the route sheet, it must be corrected accordingly. An incorrect entry (error) is crossed out (with one line), a corrective entry is made next to it, and a date, signature and full name are added. the employee who made the correction. The use of grouts and corrective agents is prohibited.

It is not necessary to put a stamp, since the form is considered an internal document. However, this is at the individual discretion of the institution.

The completed document must be submitted to the head of the department or directly to the accounting department. It is acceptable to attach checks, receipts and other documents confirming the employee’s expenses. For example, a taxi ticket or a bus ticket.

Documents required for sending cargo

Recently, the rules for the provision of transport and forwarding services have undergone some changes. For example, since July 2020, amendments have come into force that require private citizens and legal entities to provide certain documents when sending.

Individuals

If goods are sent by an individual, he/she must present:

- your passport;

- dispatch inventory, the form of which is issued by the transport itself class=”aligncenter” width=”658″ height=”558″[/img]

- a notarized power of attorney (if the citizen’s representative acts instead of him).

Legal entities

For any companies (commercial firms, charities, public organizations, religious societies), a set of the following documents is expected:

- Passport.

- A power of attorney for the actions of a company representative, which is certified by the manager or other authorized person. If the manager himself sends the goods, it is enough to provide a document confirming his appointment to the position.

- Document for the cargo: as a rule, this is a packing list, designed according to a random sample.

In some special cases, along with these papers, additional ones will be needed: characteristics of the cargo, permission to transport, etc. This is usually due to the special nature of the material assets - hazardous chemicals, biological samples, etc.

Exceptional moments

Some organizations undertake to pay their employees travel to their holiday destination. Such provisions must be enshrined in the local regulations of the institution, and must also have an economic justification (in terms of volume and feasibility).

Payment for this type of expense can only be made with supporting documents. For example, tickets, checks. Or the employee has the right to provide a route sheet for vacation by car if he went on vacation by personal transport.

Arrival or departure must be marked by the relevant party. For example, the administration of a sanatorium or hotel. Next, we offer an itinerary for a vacation by car.

Invoice for the export of material assets

The waybill (BW) is intended to record the movement of inventory items and payments for their transportation by road. The waybill consists of two sections: 2.

Transport, which determines the relationship of shippers of motor transport customers with organizations - owners of motor vehicles that carried out the transportation of goods, and serves to record transport work and settlements of shippers or consignees with organizations - owners of motor vehicles for the services provided to them for the transportation of goods.

A consignment note for the transportation of goods by road is drawn up by the consignor for each consignee separately for each vehicle trip with the obligatory completion of all details.

Documentation of transportation of inventory items (Polukhina M

Almost any company in its economic activity is faced with the operation of acquiring and delivering inventory items (materials and materials).

When centralized export of goods from railway stations, ports, marinas, airports, transportation is documented by waybills drawn up jointly with employees of organizations that own vehicles, railway stations, marinas, ports, airports.

Despite the apparent simplicity of preparing documents confirming this operation, difficulties often arise.

After all, the company can deliver goods and materials both on its own and by the buyer, as well as hire a special transport company to transport the goods. Let's figure out what documents are needed to confirm the expenses incurred. Arbitrage practice. The Resolution of the Federal Antimonopoly Service of the East Siberian District dated April 30, 2009 in case No. A19-10710/08-11-F02-1646/09 noted that organizations transporting goods for the needs of their production using their own and rented vehicles are also required to register a commodity transport invoices.

TTN is the only document used for writing off inventory items from shippers and capitalizing them from consignees, as well as for warehouse, operational and accounting. Arbitrage practice.

Who fills it out and the sample

Sample of filling out a railway invoice (form GU-27)

After representatives of Russian Railways issue sheets with invoice forms, they will need to be filled out in accordance with the basic requirements:

- The issued consignment note form is always filled out by the shipper ;

- It is allowed to fill out the document in printed or written form (only with ballpoint pens);

- The entered data must fully correspond to the real data;

- Corrections and blots are not allowed; if any changes occur before the cargo is sent, the invoice must be filled out again on a blank form;

- Changes that occur en route are entered into the form by railway employees and certified by the signature and seal of the station;

- The road manifest must be multiplied by the number of organizations participating in the transportation;

- If the column for entering information is not enough, then additional sheets are printed, and o is placed on the main page;

- All sheets of the consignment note are securely fastened together so that none of them disappears until the end of the cargo journey.

Cargo sent by separate wagon and smaller in size is issued with a consignment note in the form GU-27 or GU-29. The complete set of accompanying forms corresponds to the GU-29-O form and includes:

- Invoice;

- Receipt for acceptance of cargo;

- Road manifest;

- Travel slip stub.

Railway consignment note form GU-27

According to the existing rules, the columns of the railway invoice are filled in by the shipper according to the sample:

- "Sender". Information about the sender is indicated here: address, name of organization or full name, signature;

- "Departure station" The name of the railway station and/or the name of the station is written down;

- "Sender Statements." The route, type of transportation (according to the characteristics of the cargo transportation object), number of document sheets, etc. are indicated;

- "Recipient". The recipient's data is entered: address, name of organization or full name, contact information (telephone), assigned identifier to the cargo;

- "Destination station" Name of the station where you need to receive the cargo;

- "Border crossings." The names of border stations are indicated;

- "Railway carriage". The carriage number is indicated;

- “The carriage was provided.” Put “O” - the car belongs to the sender or recipient, “P” - the carrier’s car;

- "Carrying capacity". Registered in tons;

- "Axis". The number of axes is entered;

- "Tare weight". Information is written off from the carriage;

- "Tank type". The caliber of the tank is written off from the car (under the number);

Points No. 13 and No. 14 are not filled out by the shipper. And then the object of transportation is described in detail. And fill in the fields:

- "Shipping Name";

- “Type of packaging”;

- "Number of places";

- "Weight";

- "Seals";

- "Loaded";

- “Method for determining mass”;

- "Carriers";

- “Payment of freight charges”;

- “Documents attached by the sender”;

- “Information not intended for the carrier.”

The sender does not fill in the remaining items.

After filling out the document, a railway employee checks the correctness of the entered data and, if everything is correct, a visa is issued. This number is permission for further acceptance of the cargo/

Railway consignment note in form GU-29 (all sheets)

Invoice for the export of material assets

Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n (as amended on October 24, 2016)

“On approval of the Guidelines for accounting of inventories”

(Registered with the Ministry of Justice of Russia on February 13, 2002 N 3245) Federal Law dated November 21, 1996 N 129-FZ lost force on January 1, 2013 due to the adoption of Federal Law dated December 6, 2011 N 402-FZ.

For the procedure for drawing up primary accounting documents, see Article 9 of Federal Law No. 402-FZ.

On the application from January 1, 2013 of the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation, see Information of the Ministry of Finance of Russia No. PZ-10/2012.

The basis for issuing an invoice for the release of finished products at the warehouse, in some cases directly in the divisions of the organization (when shipping large-sized cargo, as well as cargo requiring special transportation conditions, for other reasons), is an order from the head of the organization or a person authorized by him, as well as an agreement with buyer (customer). 209.

Sample invoice for export of material assets

In the case of the supply of material assets to the farms of one’s organization located outside its territory, or to third-party organizations, on the basis of contracts and other documents, an invoice is issued for the supply of materials to the third party.

More often the document is used in the first case. A sample of filling out an invoice for the release of goods and materials to the third party. Invoice form for materials release to the Excel side.

Popular documents Characteristics from a place of work Characteristics of a student How to write a leave application Characteristics of a school student Autobiography.

Draft agreement

Mobile electrified feed dispenser: diagram and process of operation of the device Transverse profiles of embankments and coastal strips: In urban areas, bank protection is designed taking into account technical and economic requirements, but special importance is attached to aesthetic ones. Procedure for executing commands.

Responsibilities for receiving, storing, and accounting for inventory items are assigned to the relevant officials, for example, the warehouse manager, storekeeper, etc. To ensure the safety of inventory items, the head of the company must provide the necessary conditions. What are considered necessary conditions?

One of the important factors in the functioning of an industrial zone is the established Rules for the import and export of material assets. The import and export of inventory and materials by enterprises on the territory of the industrial zone is carried out according to established uniform invoice templates.

Average headcount Download tax return. About the changes. Amendments have been made to the form of the consignment note and the procedure for filling it out. The changes affected sections 13 and 15 of the consignment note and the procedure for filling them out. The new amendments establish that when transporting dangerous goods, as well as when transporting goods by heavy or large vehicles, the carrier indicates in paragraph 13 of the waybill information about the number, date and validity period of the special permit, as well as the route of such transportation.