In which legal acts are the BCC approved?

KBK is a code for the budget classification of income or expenses of the budget of the Russian Federation.

In practice, business owners use only the “income version” of the KBK in their legal relations - indicating them in payment orders and thus identifying the payment that is transferred to the budget. This could be a tax, fee, contribution, duty, penalty or fine. Budget classification codes are approved in the regulations of the main federal department that is responsible for taxes and fees - the Ministry of Finance of the Russian Federation. The main source of law, which records all current BCCs in 2020, is the order of the Ministry of Finance of the Russian Federation “On the procedure for the formation and application of budget classification codes...” dated 06/08/2018 No. 132n.

Instructions in force in 2020, approved. by order of the Ministry of Finance dated 07/01/2013 No. 65n, from 01/01/2019, lose force (see letter of the Ministry of Finance dated 08/10/2018 No. 02-05-11/56735). That is, if you need to find out which tax KBK 18210301000012100110 (or any other) corresponds to in 2020, then order No. 132n dated 06/08/2018 will be the primary source.

Let's look at the main BCCs used by businessmen in 2019.

In what cases does a company pay fines and penalties?

When transferring the current income tax, organizations must prepare two payments: one for the tax to the federal budget (3%), the other for crediting to the regional budget (17%). In this case, the payment order indicates separate BCCs provided for each payment.

Different BCCs (taking into account the budget to which they are sent) are also used when transferring penalties for income tax. The 2018 BCC provides for the following combinations for penalties on “profit”:

- 18210101011012100110 – penalties transferred by tax payers to the federal budget,

- 18210101012022100110 – penalties sent to regional budgets.

The 12th and 13th characters in the KBK structure indicate that they belong to a specific budget: “01” means the federal budget, and “02” means the budget of a constituent entity of the Russian Federation.

Depending on the type of taxable income or taxpayer, the 2020 BCC for paying penalties on income tax may differ from the above. Let's consider in what cases this is possible.

If penalties are transferred for tax on interest income on Russian bonds, you should indicate - 18210101090012100110.

For penalties on the profit tax of a controlled foreign company, KBK 18210101080012100110 is applied.

For tax on interest income received on securities (state and municipal), penalties are paid by indicating code 18210101070012100110.

Penalties for the tax on dividends received from foreign companies are transferred to KBK 18210101060012100110. If taxable dividends are received by foreign companies from Russian companies, tax penalties are paid by indicating KBK 18210101050012100110. For the tax on dividends of Russian companies received from compatriot firms, penalties are listed using the code 18210101040012100110.

Payment of penalties for tax on income of a foreign company not related to activities through a permanent establishment in the Russian Federation is made to KBK 18210101030012100110.

Taking into account the ownership of the budget, the consolidated groups of taxpayers list penalties on “profit”:

- 18210101013012100110 – federal budget,

- 18210101014022100110 – budget of a constituent entity of the Russian Federation.

Corporate income tax is paid to two budgets - federal and regional. In the first case, payment orders in 2020 indicate BCC 18210101011011000110, in the second - 18210101012021000110. The same BCC are used when transferring arrears to the budget and making recalculations for the tax in question.

Penalties for income tax to the federal budget in 2020 must be transferred using KBK 18210101011012100110, fines - using code 18210101011013000110. When transferring fines and penalties for tax to the regional budget, it is necessary to indicate in the payment document, respectively, KBK 1821010101202300011 0 and 18210101012022100110.

Individual entrepreneurs and legal entities that have employees under an employment contract must pay contributions to the Social Insurance Fund for them:

- for compulsory insurance in case of temporary disability and in connection with maternity.

Since 2020, these contributions have also come under the jurisdiction of the tax authorities, and they, like contributions intended for the Pension Fund and the Compulsory Medical Insurance Fund, will have to be paid using new codes and choosing from them the one related to the corresponding period. In payments for periods before 01/01/2017, you must indicate KBK 18210202090071000160, and when paying for periods after 01/01/2017, you need to use KBK 18210202090071010160.

The codes indicated for penalties and fines will also be divided by period. If their payment is made for the period before 01/01/2017, then for penalties the code 18210202090072100160 is used, and for a fine - code 18310202090073000160. If penalties or fines relate to periods after 01/01/2017, then the code 182102020900721 is used, respectively 10160 and 18310202090073010160.

1. Pay penalties - amounts calculated daily on the amount of a tax or contribution upon exceeding the deadlines established by law for transferring the corresponding tax or contribution to the budget.

Penalties are accrued from the first day of late payment of the contribution. When determining their value, the following is taken into account:

- amount of debt;

- refinancing rate of the Central Bank of the Russian Federation.

It can be noted that penalties are characterized by unconditional accrual (unless it is proven that the company nevertheless paid the tax or fee, but with an error, as a result of which the payment was not received by the addressee). The company will be required to pay penalties even if there is one day of delay.

You can calculate the exact amount of penalties using our penalty calculator.

2. Pay fines - fixed payments calculated on the amount of tax or fee. A fine may be imposed if:

- the payment of a tax or fee is overdue, despite the fact that the taxpayer is a tax agent or a subject of controlled transactions;

- another tax offense has been committed, for example, the tax base has been underestimated, a tax or fee has been calculated incorrectly.

Penalties can vary greatly depending on the specific tax violation. For example, if a company has not paid a tax or fee, it will have to pay a fine of 20% of the amount of debt to the budget or 40% if the body administering payments proves that the company deliberately failed to fulfill its obligations to the budget.

Since 2020, liability for tax offenses in the form of penalties and fines, provided for by the Tax Code of the Russian Federation, fully applies to insurance premiums that have come under the control of the tax authorities.

If a legal entity fails to pay the fee on time or commits another illegal act under tax law, then according to Art. 122 of the Tax Code of the Russian Federation, the company pays fines. Tax authorities also have the right to charge penalties or interest on debt. There are corresponding codes for paying sanctions.

But depending on which treasury - the federal or regional budget - the funds are deposited into, the coding also changes. To pay penalties to the federal treasury, KBK 182 1 01 01011 01 2100 110 is used, to replenish the regional budget - 182 1 01 01012 02 2100 110. And the combination 182 1 0100 110 KBK, the decoding of which is the payment of funds for the accrued fine to enterprises, to the federal treasury . Legal entities contribute fines to the regional budget using the code 182 1 0100 110.

| Payment name | KBK |

| Penalties on the income tax of organizations (except for consolidated categories of payers) credited to the budget of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Monetary penalties or fines for corporate income tax (except for consolidated categories of payers) credited to the budget of the constituent entities of the Russian Federation | 182 1 0100 110 |

Since the budget classification code number depends on several factors, enterprises pay tax funds depending on the location, name of the payment, type of treasury, and also on what category of payers the organization belongs to.

Useful posts:

- Income tax KBK

Income tax payers Entities whose responsibilities include the calculation and payment of tax on the resulting… - Tax 51 Murmansk Federal Tax Service of Russia for the Murmansk Region Name Department of the Federal Tax Service of Russia for the Murmansk Region Region…

- Tax on childlessness USSR Tax on childlessness Tax on childlessness existed in the USSR as “Tax on bachelors, singles and small families...

- KBK how to find out A little history The budget classification code was established in 1999. Of course, since that time the code reference book...

KBK for VAT for tax agents

In order to be considered a tax agent when paying taxes, an organization must meet a number of criteria. The institution must:

- Rent property from government agencies and local governments.

- Purchase GWS from foreign companies that sell products on the Russian market, but are not taxpayers to the budget system of the Russian Federation.

- Purchase government-owned property within the territory of the Russian Federation. An exception is objects leased from the Northern Sea Route starting from 04/01/2011.

- Realize Russian property assets in accordance with a court decision. The owner of such property must be the taxpayer. The exception is the property assets of the bankrupt.

- Intermediate in trade with foreign companies that are not tax residents of the Russian Federation.

Value added tax is withheld by the tax agent from the counterparty. After this, the tax is sent to the budget.

The tax rate is determined depending on the types of industrial and industrial goods acquired or sold on the territory of the Russian Federation. The tax can be included directly in the price of the product or calculated by the tax agent independently and then added to the price of the goods.

Accrual is made on the day of payment for purchased goods, works or services. The tax is transferred at the end of the quarter - equal shares of the calculated amount are paid monthly until the 25th day inclusive.

If the counterparty is a foreign company not registered in the Russian Federation, then the tax agent must pay the calculated tax to the budget immediately at the time of transfer of funds. The organization must draw up two payment orders at once and send them to the bank.

When drawing up a payment order to pay VAT to the budget, the tax agent must indicate the special status in field 101 - “02”. The BCC will be similar to the BCC for payment by a legal entity - 182 1 0300 110.

Main BCCs for taxes and contributions in 2019: list, explanation

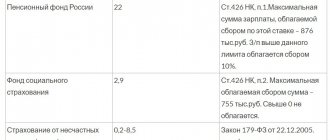

In addition to income tax, taxpayers must pay insurance premiums and contributions for hired employees. What codes do entrepreneurs and organizations often use?

- Income tax to the regional budget—18210101012021000110.

- Federal fund tax—18210101011011000110.

- Value added tax—18210301000012100110.

- To pay a fine for income tax, indicate - 18210301000013000110.

- Contributions to the Pension Fund for those whose income is more than 300,000—39210202140061200160, less than 300,000—39210202140061100160.

- Contributions to the Pension Fund for employees—39210202010061000160.

- Medical insurance for yourself—39210202103081011160.

- Honey. fear for the employee—39210202101081011160.

- Voluntary contribution to social services fear—39311706020076000180.

These are the main codes where all companies and organizations most often transfer funds. Once again, it is worth remembering that when entering a twenty-digit number into a payment order, you need to be extremely careful. Check that the KBK instructions are correct, otherwise either the operator will not accept the payment, or the money will go to the wrong recipient.

The most used in 2020 are KBK, necessary for modern Russian individual entrepreneurs and business entities dealing with payment:

- Personal income tax for hired employees (KBK 18210102010011000110);

- income tax (regional KBK - 18210101012021000110, federal - 18210101011011000110);

For details, see the material “KBK when paying income tax in 2018-2019.”

See also “KBK for insurance premiums for 2018-2019 - table”.

Simplified in 2019 (decoding KBK 18210501011011000110, 18210501021011000110)

Legal entities and individual entrepreneurs can accrue the simplified tax system according to two schemes: from the tax base “income” or from the base defined as “income minus expenses”. In the first case, to pay tax in 2020, KBK 18210501011011000110 is used, in the second - 18210501021011000110. Just as for income tax, the specified KBK are used when paying arrears and making recalculations.

Penalties when simplified according to the “income” scheme in 2020 are paid using BCC 18210501011012100110, fines - when using code 18210501011013000110. Regarding the simplified tax system under the “income minus expenses” scheme, for penalties and fines, codes 1821050102101210011 are applied, respectively. 0 and 18210501021013000110.

Until 2020, the BCC had its own minimum tax that must be paid when applying the simplified tax system “income minus expenses” if the total amount of tax calculated in the usual manner for the tax period (year) turned out to be less than 1% of the tax base. Since 2020, for the minimum tax, the BCC has been set the same as for the regular tax of the simplified tax system “income minus expenses,” i.e.

Find out about the form for drawing up a simplified tax system declaration from the material “Declaration form for the simplified tax system for 2018-2019”.

Insurance contributions for compulsory social insurance

For each category there is an internal division into tax liabilities, penalties and fines.

As a general rule, a company must pay the annual “simplified” tax no later than March 31st. But in 2020 It's Saturday, so the payment deadline for 2020 is due. for companies has been postponed to the coming Monday – April 2, 2020.

It turns out that KBK 18210501021010000110 is indicated in the payment slip when transferring the tax payment from the total income credited to the federal budget to the federal tax service. This may be the tax itself or a penalty or penalty for this tax. In this case we are talking about:

- the tax paid by firms and entrepreneurs working on the “income-expenditure” simplified tax system;

- minimum tax under the “income-expenditure” simplified tax system.

Penalties are imposed on a company or entrepreneur on a simplified basis if the payment is not received on time for its intended purpose. The deadlines for transferring taxes and advances under the simplified tax system are set out in the Tax Code:

- annual tax for companies – by March 31 of the next year;

- annual tax for entrepreneurs - by April 30 of the next year;

- tax advances for companies and individual entrepreneurs - by the 25th day of the first month after the reporting period.

In accordance with the scheme, if you divide the twenty-digit code into separate elements, you can decipher which payment it refers to.

Penalties for “simplified taxation” are accrued if the simplified tax system advance or annual tax is overdue. The general terms of payments under the simplified tax system are as follows:

- based on the results of reporting periods - by the 25th day of the next month;

- at the end of the year - by March 31 of the next year (for firms), by April 30 - for entrepreneurs.

Contributions of individual entrepreneurs to the FFOMS in 2020 (decoding KBK 18210202103081011160, 18210202103081013160)

When transferring fixed contributions to themselves intended for the FFOMS in 2020, entrepreneurs also need to use 2 BCC values depending on the period for which the payment is made. If the payment relates to periods before 01/01/2017, you need to use KBK 18210202103081011160, and if for periods after 01/01/2017, then KBK 18210202103081013160.

Penalties and fines will also be paid accordingly. For periods before 2020, you need to use for them, respectively, KBK 18210202103082011160 and 18210202103083011160. And when paying for periods from 01/01/2017, KBK 18210202103082013160 and 18210202103083 will be used 013160.

Contributions to the Social Insurance Fund for occupational injuries in 2020 (decoding KBK 39310202050071000160)

Contributions for insurance against accidents and occupational diseases were not affected by the 2020 innovations regarding payments to funds. Therefore, in 2020, they are still transferred to Social Security using the previously valid BCC 39310202050071000160.

The codes for transferring penalties and fines for these payments have not changed either. Penalties are paid with code 39310202050072100160, and fines are paid with code 39310202050073000160.

Debts for these payments from previous years are repaid using the same BCCs.

KBK personal income tax for 2020

There have also been changes in accounting for personal income taxes. New tax code for 2020:

- — 18210102010011000110 – personal income tax on income the source of which was a tax agent (exception – income under Articles 227, 227.1, 228 of the Tax Code of the Russian Federation);

- — 18210102010012000110 – penalties and interest on personal income tax on income the source of which was the tax agent;

- — 18210102010013000110 – personal income tax fines on income the source of which was a tax agent;

- — 18210102020011000110 – personal income tax on income received in the process of individual entrepreneurial activity, notarial practice, legal practice (in accordance with Article 227 of the Tax Code of the Russian Federation);

- — 18210102020012000110 – penalties and interest with personal income tax on income received from business, notary and lawyer activities;

- — 18210102020013000110 – personal income tax fines on income when carrying out business, notary and lawyer activities;

- — 18210102030011000110 – personal income tax on income received by individuals (according to Article 228 of the Tax Code of the Russian Federation);

- — 18210102030012000110 – penalties and interest on personal income tax on the income of individuals;

- — 18210102030013000110 – personal income tax fines on the income of individuals;

- — 18210102040011000110 – personal income tax in the form of advance fixed payments on the income of individuals of foreign citizens carrying out labor activities under a contract of employment with individuals (according to Article 227.1 of the Tax Code of the Russian Federation);

- — 18210102040012000110 – penalties and interest on personal income tax in the form of advance fixed payments on the income of individuals of foreign citizens carrying out labor activities under a contract of employment with individuals;

- — 18210102040013000110 – personal income tax fines in the form of advance fixed payments on the income of individuals of foreign citizens carrying out labor activities under a contract of employment with individuals.