Preparing for the deal

We recommend considering a detailed inspection of the property for sale as point zero in preparing for a transaction. Inspect and photograph all pieces of furniture, communications, state of repair, equipment and meter readings. This will help you make an informed decision about the purchase, study the condition of the object in detail, and eliminate disputes when transferring the object regarding the condition and configuration.

Before completing a purchase and sale transaction, the parties must agree on a number of interim conditions. The result of the agreements between the parties is the conclusion of a preliminary agreement. In it, the parties agree not only on the cost and payment procedure. The completeness of the object is prescribed, the period for the release and discharge of persons is specified, the costs of paying for the services of a notary and registrar are distributed, and a deposit is transferred. Additional conditions are provided, for example, for the purchase of a counter option, and deposits are secured for release or discharge in certain cases.

Article on the topic

Why do you need a preliminary agreement when buying and selling real estate on the secondary market?

This is a preparatory stage that is not mandatory. However, we do not recommend skipping it. Here's one of the reasons why. The seller and buyer agreed that all furniture and appliances are included in the price of the house and remain with the buyer. No preliminary agreement was concluded. As a result, after the transaction, the seller removed all the furniture and equipment that he promised to leave. This infringes on the interests of the buyer and actually reduces the value of the transaction object. The buyer finds himself in a situation where he has to either come to terms with this injustice or go to court to protect his rights. There is no guarantee that the court will be on his side.

In some transactions, it is simply impossible to do without a preliminary agreement. For example, in the case of credit transactions. To approve the loan, the bank requires you to provide a copy of the preliminary agreement signed by the parties.

Real estate agencies always encourage clients to enter into a preliminary agreement to avoid conflicts and increased stress. The correctness of this approach has been proven over years of practice and thousands of transactions.

Where can I confirm the transaction?

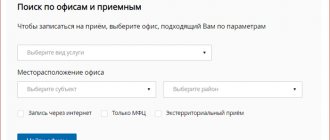

You can certify the transaction at the local agency for state registration and land cadastre (popularly known as BTI) or at a notary.

The transfer of ownership can only be registered with the BTI.

Address: Minsk, st. Maxim Bogdanovich, 153 Working hours: Monday – Friday from 8.00 to 19.00, Saturday from 8.00 to 16.20

The issuance of coupons begins 30 minutes before the start of accepting applications, ends 15 minutes before the end of reception for individuals, 20 minutes for legal entities and individual entrepreneurs.

In case of a large number of issued and not serviced coupons, the issuance of coupons may be completed earlier than the specified time.

Required documents

As a general rule, when registering through a registrar, you need the following documents:

- Personal passports of the owner and all participants in the transaction.

- A copy of the personal account. It is taken from the service organization (Settlement and reference centers, partnerships, housing and communal services). The telephone number and address of the service organization can be found by calling 190 (this is a paid certificate, a landline phone number). You can also find out the address and phone number of your RSC here.

- Certificate of state registration of property rights.

- A document that serves as the basis for the transfer of ownership (sale and purchase agreement, gift, exchange, privatization, certificate of inheritance, etc.).

- Technical passport (transferred to the buyer).

Other documents may be needed:

- Consent of the spouse or ex-spouse (if the apartment was purchased during marriage).

- Consent of adults registered at the place of residence (registered) in the apartment at the time of the transaction, if discharge is planned after the transaction.

- Money to pay government fees. duties and services (5 b.v. – state duty and registrar services).

- Personal passports of all participants in the transaction, including those giving consent.

- Consent of city district administrations.

- Certificates of accrual of housing quotas.

- Consent of the guardianship and trusteeship authorities to the alienation of residential premises in which minor members live, former members of the owner’s family, recognized as being in a socially dangerous situation, or in need of state protection.

- Certificate from the territorial tax authority on payment of income tax by a seller who is not a resident of the Republic of Belarus.

- Waiver of the pre-emptive right to purchase a co-owner of real estate when selling a share.

- Other.

When contacting a notary, you will need an extract from the Unified State Register of Real Estate, which is obtained from the agency for state registration and land cadastre. Issued using coupons from the registrar at the time of application.

Free legal advice

The dacha has not yet been privatized and is not registered in Rosreestr, but according to documents it belongs to the father and was purchased last year. He wants to transfer it to his daughter, as can be done at a notary. Which deal is better in this case: donation or sale? At his own discretion, the owner has the right to take any actions in relation to his property that do not contradict the law and other legal acts and do not violate the rights and interests protected by law of other persons, including alienating his property into the ownership of other persons. Since the information in the question asked is not enough to give a definite answer, based on the facts mentioned, I can only give some clarifications and suggest options for the development of events based on existing practice. According to Art.

USEFUL INFORMATION: Main pros and cons of a prenuptial agreement

Deal stages

Between the preliminary agreement and the purchase and sale agreement it can take from several days to several weeks. The deadline is necessary for the parties to fulfill their obligations, select a counter option for the transaction, prepare documents, collect the necessary certificates, and check the legal history of the property.

When the preparatory stage is completed, you can proceed directly to the purchase and sale transaction. The transaction procedure itself can be divided into 5 stages. Below we will tell you more about each of them.

How to re-register a private house

Ways to re-register apartments. What to do or not to do... Transferring an apartment from one owner to another is a rather troublesome procedure. You need to collect a bunch of certificates, pay taxes, notary fees and registration fees. It may suddenly turn out that due to a couple of inconsistencies in the documents that were not noticed in time, you cannot dispose of the apartment at all, or this may complicate and delay the entire re-registration process.

In the modern world, residential and commercial buildings, garages, and land plots become not only good material support, but, sometimes, also the main sources of income - they can always be sold or rented out. And this purpose of the property makes it even more valuable. Even the premises intended for a car have now acquired much greater value, although they have always been in short supply. Few modern people can imagine themselves without a car, and renting or buying a good garage remains a very pressing issue, and garage premises themselves are a sought-after product and a coveted piece of real estate.

USEFUL INFORMATION: Annulment of a marriage contract: what is needed for this

Re-registration of an apartment to another owner We take into account all the nuances of various methods Usually, when they talk about re-registration of an apartment, we are talking about transferring the property into the ownership of their loved ones. However, ownership rights should also be re-registered in the event of transfer of real estate to third parties. Sometimes, transactions that are standard for outsiders are also drawn up between close relatives, it all depends on the circumstances and the goals pursued. Let's talk about this in more detail. Options for re-registration of rights to real estate There are six main options for re-registration of real estate to other people. Some of them are used mainly by relatives, but other options can also be used to transfer property to loved ones.

VIDEO ON THE TOPIC: What documents are needed for the purchase and sale of land

Settlement between the parties

This is a rather delicate stage. Often it is he who causes a lot of fears and concerns for each of the parties.

With proper preparation and taking into account all legal subtleties, it is carried out calmly and safely. It is important to remember that payments between individuals, according to the legislation of the Republic of Belarus, are made in Belarusian rubles. It can be cash or non-cash, occur before or after the signing of the purchase and sale agreement.

We talk in detail about the settlement between the parties to the transaction in this article.

Transfer of ownership

The final stage of the transaction. After the price of the apartment has been paid, the transfer and acceptance certificate has been signed, the keys and necessary documents for the property have been handed over, the buyer remains to register the transfer of ownership.

The procedure is carried out at the BTI. The presence of the seller is not necessary. To do this, the purchase and sale agreement must provide for the right to submit documents for registration by the buyer alone, and not jointly with the seller.

The buyer is issued a certificate of state registration of the established form. From this moment on, he is the full owner of the property.

Who is a close relative

The transaction of purchase and sale of an apartment, gift or will is the subject of the receipt of real estate or its sale, which in both cases is considered income. According to the Tax Code, any type of income is taxed. The income tax rate is 13% and is calculated on the assessed amount of the property. The only exception is property transferred to close relatives. In this case, the transaction is exempt from taxation and income tax does not have to be paid.

Now it remains to identify a group of citizens who are classified as close relatives by law. Since many people confuse this concept and attribute all blood relatives here. So, according to Article 14 of the Family Code, a close relative is:

- children (including adopted children);

- parents (including adoptive parents);

- siblings;

- grandmothers, grandfathers.

According to the Housing Code and the Criminal Procedure Code, spouses are also included in the list of close relatives, however, the Tax Code, when distributing taxes, refers exclusively to the provisions of Article 14 of the RF IC. This means that spouses do not belong to this category.

The above list is complete. Under no circumstances include the following relatives here, otherwise taxation when re-registering an apartment cannot be avoided:

- uncles and aunts;

- nephews and nieces;

- cousins;

- great-grandparents.

Now familiarize yourself with the features of re-registration of an apartment by the above-mentioned relatives (close ones):

- If a spouse becomes the owner, then, depending on the type of transfer of real estate, the property may be considered joint or personal property, but tax will have to be paid, regardless of the method of transfer of the apartment.

- Despite the fact that adopted children, parents, brothers/sisters are not of the same blood, they still belong to the category of close relatives, which means they avoid paying tax.

- Half-siblings (only one parent each) also belong to the preferential group of citizens.

- Other persons who were listed in Article 14 of the RF IC can transfer ownership of an apartment to their relative without paying tax.

This is important to know: How to transfer an apartment to municipal ownership

However, it is worth making an amendment right away, even if close relatives are the participants in the transaction, the 13 percent tax charge can be avoided only with a certain method of transferring property - under a gift or inheritance agreement. Drawing up a standard procedure for a purchase and sale agreement will not allow you to evade the state contribution, since the terms of the agreement imply the transfer of money, which means receiving profit, which must be taxed.

Methods for re-registration of real estate

Actual transfer of the object

This stage occurs when the property is not vacated at the same time as the signing of the purchase agreement or settlement. In this case, it is necessary to meet at the site, check paid meter readings and outstanding utility bills, check the equipment, and inspect the condition. Based on the results of these actions, it is necessary to draw up and sign a reconciliation act, or an acceptance and transfer act, if the settlement is provided simultaneously with the transfer of real estate.

If you doubt that you can properly organize all stages of the transaction yourself, we recommend turning to professionals. Our realtors will help you competently draw up a preliminary agreement and carry out the transaction safely and on time.

Share the article on social networks, it may help your friends. And you can always find it when you need it.

Re-registration of an apartment to a relative without taxes in 2021

The transfer of real estate into the ownership of another person is often accompanied by the payment of taxes and state duties. But it is not always possible or desirable to incur additional expenses. Is it possible to re-register an apartment to a relative without taxes in 2021?

This is important to know: Risks for the buyer if the apartment has been owned for less than 3 years