What are the new measures to support doctors?

President V.V. Putin, in an address to citizens on May 11, 2020, identified additional incentive payments to health workers in 2020, introduced due to the coronavirus pandemic. During the period from April 15, 2020 to July 15, 2020, a special federal surcharge is in effect for doctors and other personnel serving in social institutions. Here are the amounts required:

- doctors - 40,000 rubles per two-week shift;

- doctors working directly with coronavirus patients - 60,000 rubles per two-week shift;

- social and pedagogical workers, paramedical and administrative personnel - 25,000 rubles, and when working with coronavirus patients - 35,000 rubles;

- junior staff - 15,000 rubles, and when working with coronavirus patients - 20,000 rubles;

- for technical employees - 10,000 rubles, and when interacting with coronavirus patients - 15,000 rubles.

Salaries and all required allowances must be transferred by May 15, 2020.

Regional authorities have the right to establish additional support measures. These are the benefits for medical and social workers adopted in the Leningrad region.

Types of incentive payments

Russian legislation does not provide complete and comprehensive legal regulation of the possible list of types of incentive payments. However, in general, these include the following ways to encourage workers by the employer:

Additional payments may include various types of payments related to the employee’s performance of additional and unscheduled duties. However, it should be noted that payment for overtime, night work and other legally regulated cases that require a mandatory increase in employees’ wages does not apply to incentive payments.

Additional payments.- Incentive bonuses. Some employers may establish in their wage system a mechanism for assigning employees certain bonuses to their salaries or tariff rates. Moreover, such allowances can be either permanent or temporary in nature, and even the possibility of their removal from the employee in the cases provided for by regulations.

- Awards. This type of incentive payment is the most common. In particular, bonuses can be paid for absolutely different achievements of employees.

- Incentives in kind. Although in fact these incentive payments from the employer are not exactly payments, since they are not financial, often even natural incentives in the form of products or services also qualify as incentive payments, since the employer bears certain costs for their provision. In this situation, the employer should remember that incentives in kind are also part of the salary and in any case, in accordance with the law, cannot exceed 20% of its total amount.

Employers have the right to independently develop other types and mechanisms of incentive payments for employees. The legislation does not contain direct prohibitions or restrictions on these actions.

How will doctors be paid for the month from March 30 to May 11?

The month from March 30 to May 11, 2020 is non-working (Presidential Decrees No. 206 of March 25, 2020, No. 239 of April 2, 2020 and No. 294 of April 28, 2020). Medical institutions and health workers continue to work as usual. Here are the basic rules for how doctors will be paid for the next week, taking into account quarantine:

- From March 30 to April 30 and May 6–8 are non-working days, not weekends or holidays. For those who work according to a schedule, payment is made at the usual rate.

- If a health worker’s work shift falls on a holiday or a scheduled day off, then he is entitled to increased pay.

- The amount of remuneration is determined by local regulations.

- If the employee is on vacation during this period, the days from March 30 to April 30 and May 6–8 are included in vacation time, and the vacation is not extended.

Concept and composition of salary

Remuneration is one of the main conditions of labor relations between the employee and the employer. This concept includes:

- calculation rules;

- size;

- payment terms;

- components.

Based on Art. 57 of the Labor Code of the Russian Federation, the most important information about payment (size, salary allowances) must be included in the employment contract, and additional information (for example, specific terms, calculation rules, etc.) should not change the position of the employee for the worse compared with the law.

You can find the correct employment contract in ConsultantPlus. Get free trial access to the system and proceed to the sample.

From the definition enshrined in Art. 129 of the Labor Code of the Russian Federation, it follows that salary means employee remuneration, taking into account:

- specific qualifications;

- complexity of conditions;

- workload.

This concept also includes:

- compensation payments;

- incentive payments (including various salary supplements and bonuses).

It is necessary to dwell on the composition of payments in more detail. For a simpler understanding, we will show the important components of the salary with examples in the table.

| What is included in the salary | ||

| Main part | Incentive payments | Compensation payments |

| Salary (tariff rate) | Prize | Additional payment for traveling nature of work |

| Bonus for experience | Allowance for work in special climatic conditions (heat, frost, high humidity, etc.) | |

| Additional pay for performing management functions | Additional payment for irregular working hours | |

| Financial incentives or rewarding with a valuable gift for a holiday (anniversary) | Premium for “harmfulness”, i.e. for the negative impact of production factors[u1] | |

How to get paid for work during self-isolation

While self-isolation has been declared for the entire country, doctors continue to work and actively fight the spread of coronavirus. To support medical staff who risk their lives and health every minute, Vladimir Putin introduced special surcharges.

Federal payments to medical workers are introduced for three months, from April to June 2020. But if the epidemic cannot be contained, the period of federal coronavirus payments will be extended. Whether doctors will receive the bonus promised by the president depends on what the specialist does. If a health worker directly interacts with COVID-19 patients, he will be paid state compensation.

The President outlined specific figures. The amount of the federal surcharge for medical workers depends on the position of the medical staff. The following values are set:

| Category of personnel directly working with coronavirus infected people | The amount of federal surcharge from Putin |

| Doctors of hospitals, clinics, etc. | 80,000 rubles per month |

| Emergency doctors | 50,000 rubles per month |

| Nursing staff | 50,000 rubles per month |

| Junior medical staff | 25,000 rubles per month |

| Paramedics, nurses and ambulance drivers | 25,000 rubles per month |

Additionally, medical personnel working with coronavirus infection are provided with increased insurance guarantees from the federal budget. The rules for provision are similar to insurance guarantees for personnel of the Russian Armed Forces.

The Government has already allocated almost 12 billion rubles for these purposes, of which:

- 10.2 billion was allocated to the Ministry of Health for the payment of special federal additional payments to medical personnel working with those infected with COVID-19;

- 1.6 billion rubles were allocated to Rospotrebnadzor to pay incentive payments to personnel directly working with a dangerous strain of coronavirus (laboratory workers, research participants, vaccine developers, etc.).

Regulations on incentive payments with performance criteria

The provision of incentive payments with performance criteria in most cases refers to bonuses that are paid depending on the specific professional achievements of the employee.

Awards are made based on performance criteria, which are described in detail in the regulations on incentive payments. A ready-made sample of this document and the rules for its preparation are described in detail in the article.

provisions on incentive payments (word)

Previously, we provided a sample salary clause; we recommend that you also read this document here.

Sample and rules for drawing up regulations on incentive payments

There is no single sample regulation on incentive payments, therefore each company has the right to draw up a Regulation in its own form. The document usually consists of 4-5 sections. When compiling, follow these instructions.

General provisions

In this section, indicate the place and date of drawing up the provision, and the name of the company. Here also describe the scope of regulation, types of incentive payments, the purpose of their accrual (increasing interest in achieving the set goals of work activity).

Bonus indicators

These are the performance criteria on the basis of which bonuses are calculated; its size depends on them. It is impossible to establish uniform indicators for different categories of employees, therefore the requirements are prescribed separately for each department, for different positions, for example:

- accounting;

- Human Resources Department;

- sales department, etc.

The description of the requirements in the regulation on incentive payments should be presented in the form of a table in which specific performance criteria are listed, as well as formulas for calculating bonuses.

Bonus procedure

In this section, indicate the frequency of bonus accrual: monthly, quarterly, annually. Here also describe the procedure for documenting the incentive payment: drawing up an order from the employer, timing of accrual by the accounting department, etc.

Conditions for non-payment of premiums

Separately, the provision on incentive payments specifies in which cases an employee is deprived of payment in full or in part; establish clear criteria and the amount of bonus deduction:

- Violation of deadlines for completing tasks.

- Failure to comply with manager’s orders (oral and written).

- Inaccuracies and errors when filling out documents.

- Failure to fulfill the sales plan and other quantitative indicators (indicating specific numbers: for example, 75% of the plan, 50% of the plan, etc.).

- Availability of complaints from clients and partners.

- The presence of administrative offenses identified by the tax inspector and other officials.

Final provisions

In this section, indicate whether bonuses are included in the salary and whether they are taken into account when calculating average earnings. Here, write down the procedure for changing the position (reason, adjustment procedure).

- The Regulations must be signed by:

- Chief Accountant;

- Head of HR Department;

- director of company.

Employees sign and decipher them (last name, initials). Also put a stamp if the company uses it in document flow.

Additionally, we recommend that you familiarize yourself with a sample order for bonuses for employees.

The legislative framework

In labor legislation, salary refers to the material remuneration of an employee for work activity, which consists of:

- salary (main part);

- additional payments of a compensatory nature;

- additional incentive payments.

The latter are also called incentive payments. A specific list of these payments is not provided, but in practice they include:

- one-time bonuses;

- regular bonuses based on the results of the month, quarter, year, etc.

- long service pay;

- payment for the intensity of work activity;

- incentives and rewards of a material nature.

It is important to understand that incentive payments may or may not be included in the salary. It all depends on the specific wording in individual, collective employment contracts and other documents:

- If the contract states that the salary of a particular employee consists of a salary, compensation (for example, a regional coefficient) and an incentive payment (for example, a quarterly bonus), the employer is obliged to pay bonuses when the corresponding performance indicators are achieved.

- If the bonus is not reflected in the contract, payment is a right and not an obligation of the company. For example, the text states: “A bonus can be awarded to an employee if the company has the financial capabilities and he fulfills the sales plan for 3 months in a row.” In this case, the bonus is not included in the salary and is calculated solely at the discretion of management.

The company may apply disciplinary sanctions to an unscrupulous employee, which include only a reprimand, reprimand or dismissal under the relevant article of the Labor Code.

Deprivation of bonuses as a penalty measure is not included in this list.

Therefore, deprivation of a bonus is possible only if the contract states that it is to be received only in the absence of disciplinary sanctions.

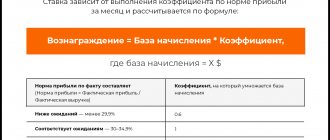

Performance criteria

The performance criteria in the provision on incentive payments refers to a system of indicators upon achievement of which the employee is entitled to receive a bonus or other incentive payment. Performance criteria allow you to evaluate:

- possibility/impossibility of calculating bonuses;

- its specific size for an employee.

Each company develops its own criteria, which may differ depending on:

- positions;

- departments;

- areas of activity of employees.

In practice, these indicators are developed in the form of a point system and other digital indicators, for example:

- sales plan;

- number of new clients;

- the number of retained clients who wanted to terminate the contract;

- customer reviews in points (for example, at least 8 out of 10).

Each employee can have their own system of performance criteria applied, which consists of points. They are made up of different quantitative indicators, and the size of the bonus is determined depending on the amount received, for example:

- 0-30 points – 25% of salary;

- 31-50 – 40% of salary;

- 51-75 – 60% of salary;

- 76-100 – 80% of salary;

- more than 100 – 100% of salary.

The Ministry of Education, Health and other sectoral departments develop their own labor quality indicators. For example, for teachers they are approved in the corresponding Letter.

The main criteria include:

- Implementation of additional educational projects.

- Implementation of activities to interact with parents of schoolchildren.

- Working with children from disadvantaged families.

- Creation of educational infrastructure and many others.

Thus, when developing criteria it is necessary to describe:

- Qualitative and quantitative indicators for assessing an employee’s labor achievements.

- Formula for calculating points.

- Converting points into incentive payment.

link:

(1 5,00 of 5) Loading...

Source: https://2ann.ru/polozhenie-o-stimuliruyushhix-vyplatax/

What are the allowances?

Doctors are entitled to payments for:

- intensive work activity and high performance;

- quality of work;

- continuous experience and length of service.

Bonuses based on the results of work activity are also considered incentives.

The amount of payments and the conditions for receiving them are established at the level of the medical institution by collective agreements and other documents. Incentives and additional funding for health workers in state-run children's rehabilitation institutions follow a general principle.

How an employer can introduce incentive payments

To introduce incentive payments into a company, several sequential actions are required. At the initial stage, the company's management makes adjustments to the rules applied within it. It is necessary to specify in detail what conditions the employee must fulfill in order to receive remuneration for his work. This does not apply to basic payments, but to additional ones. In this case, when hiring a person, it is necessary to familiarize everyone with such acts.

For example, a company may stipulate that, subject to the conscientious fulfillment of the obligations assigned to a person, a bonus is paid to him. In addition, the format of incentive payments can be different, for example, this is an announcement of gratitude to a person, payment of additional payments or bonuses. Also, employees are given valuable gifts or they are placed in reserve for subsequent rotation of personnel.

The enterprise has the right to prescribe that at the same time incentive measures of material and moral expression are applied to the person. In this case, we are talking, for example, about gratitude and bonuses. When assigning payments, you need to take into account the provisions reflecting the rules of remuneration. Certain regulations adopted by the enterprise contain an algorithm for citizens to receive incentives for their work.

Then each employee gets acquainted with the innovations introduced by management in remuneration. This happens by affixing a signature in the relevant documentation. This is necessary so that the employer can subsequently prove that all employees were familiar with the standards established by the company.

Who is entitled to incentive payments in 2020?

The medical institution employs:

- the main personnel who provide medical services to the population: doctors, nurses, etc.;

- support staff not engaged in medical activities: orderlies, secretaries, catering workers;

- administrative, managerial and service personnel: heads of the organization, their deputies, etc., and persons engaged in maintaining buildings, equipment and not providing medical services.

Bonuses and monthly allowances for medical workers from among the main and auxiliary personnel are established according to the criteria adopted in relation to these categories of employees. The activities of administrative, managerial and service personnel are assessed according to other, individual indicators.

If representatives of the management team combine management with seeing patients, they are entitled to incentive bonuses for doctors.

Incentive payments in educational and medical institutions

To determine the assessment of remuneration for teachers and medical workers, there are special requirements. Remuneration in such organizations is regulated by government agencies.

The Government of the Russian Federation, trade unions and employers form a special commission, which annually develops a single document approving the amount of funding for the maintenance of state unitary enterprises and municipal unitary enterprises.

All employees must be familiar with information about the payments due to them. For this purpose, meetings of the labor collective are held.

Are there any exceptions

Cash incentives do not apply to the following categories of health workers:

- participants of the “Health” program providing obstetrics and newborn care services: pediatricians, local therapists and nurses;

- doctors providing high-tech care.

Payments are canceled:

- if there is a disciplinary sanction during the reporting period;

- if the doctor received money from patients for medical care, which should be provided free of charge.

Special requirements are imposed on the heads of the institution: they are not entitled to incentives when fulfilling a government order below 90%, if violations of fire safety rules are detected, etc.

How much do they pay extra?

The amount of payments is determined by a special commission. The amount of compensation varies depending on the quality of services provided by the health worker. The procedure for calculating additional payments is established by local regulations. The document is valid for one year, then a new one is approved. Here are the basic rules for how incentive payments are calculated for health workers:

- If in a medical institution bonuses are calculated depending on the amount of salary, the accountant determines the base rate and applies the established amount of additional payments to it - multiplies it by a percentage.

- If an organization has a point system for evaluating performance, then the calculation is based on the cost of one point. The accountant needs to calculate the total number of points received by the employee during the reporting period and multiply them by the price of one point and the group coefficient.

The amount of final compensation is no less or more than recommended by the Ministry of Health or the Health Committee of a particular region.

The role of incentive provisions in salary calculation

The Regulations on Incentive Payments is a document, the presence of which is necessary to include in the employee’s salary that part of it that is defined as incentive in the Labor Code of the Russian Federation.

According to Art. 129 and 135 of the Labor Code of the Russian Federation, wages consist of:

- from the salary itself (salary or rate), determined by the qualifications of the employee and the characteristics of the work he performs;

- compensatory additional payments for special working conditions;

- incentive additional payments aimed at encouraging employees to work more efficiently;

- social benefits, in certain situations compensating for loss of income.

Stimulating in accordance with Art. 129 of the Labor Code of the Russian Federation can become:

- additional payments;

- allowances;

- bonuses;

- other payments.

They are divided into established ones:

- legislatively - for title, degree, category;

- independently - annual bonus, additional payments for length of service, quality, intensity of work or specific achievements.

For information about what payments form the composition of labor costs for the purposes of calculating income tax, read the article “Art. 255 of the Tax Code of the Russian Federation (2017): questions and answers.”

Each employer bases its incentive mechanisms on its own methodology, outlining both the main criteria for which the employee should be rewarded and formulas for determining the amount of remuneration depending on the quantitative or qualitative characteristics of this criterion. A document such as the regulation on incentives is devoted to defining these criteria and the methodology for their application.

How does the quality of a doctor’s work affect the amount?

The criteria for incentive payments are determined by each medical institution individually. The recommendations of federal authorities must be taken into account. They are enshrined in Orders of the Russian Ministry of Health No. 421 and No. 430n.

Incentive payments are distributed in different ways. A point system with an increasing coefficient is often used.

An example of criteria for assessing the work of a local general practitioner.

| Index | Criteria | Grade | Periodicity |

| Execution of government orders | 100% | + 3 | Monthly |

| From 95% to 100% | + 1 | ||

| 90% to 95% | 0 | ||

| Proportion of visits for preventive purposes from the total number of visits | 30% or more | + 2 | Monthly |

| From 25% to 30% | + 1 | ||

| Less than 25% | 0 | ||

| Hospitalization rate of the population in the area | Less than 18% | + 1 | Monthly |

| 18% or more | 0 | ||

| Justified complaints | Absence | + 1 | Monthly |

| 1 or more | 0 | ||

| Satisfaction with the quality of medical care provided | 50% or more | + 1 | Monthly |

| Less than 50% of respondents | 0 | ||

| Absence of advanced cases of cancer (in terms of manageable causes) | Absence | + 2 | Monthly |

| 1 or more | — 1 | ||

| Absence of complications and decompensated forms of diabetes (in terms of controllable causes) | Absence | + 1 | Monthly |

| 1 or more | 0 | ||

| Coverage of the adult population with dispensary observation (subjects) | More than 97% | + 1 | Monthly |

| Less than 97% | 0 |

The main criteria for incentive payments to health workers in 2020 (regardless of the epidemiological situation in the country):

- how well the work is done;

- whether the services were provided in full and how effective the work done was;

- how many awards received;

- continuity of service;

- part-time work.

Additional criteria:

- how many diseases were detected and at what stage;

- the percentage of late hospitalizations and incorrect diagnoses;

- percentage of complications during various medical procedures;

- How satisfied are patients with the quality of treatment (their complaints, positive reviews);

- work with documentation: reports filled out correctly or incorrectly.

At the institution level, the work activity of each employee is assessed by a special commission, taking into account the opinion of the trade union. She also distributes payments.

The commission is set at two levels:

- First level: structural unit. The commission includes three specialists: head. department, head nurse, chairman of the primary trade union organization. They evaluate the activities of the department’s employees, enter the decision into the protocol, and introduce it to the employees against their signature.

- Second level: the central commission of the institution. Consists of five or more specialists: a manager (or his deputy), an accountant, a personnel officer, the chairman of the trade union committee, an economist, etc.

What the commission does:

- distributes monetary remuneration among structural units and throughout the hospital staff;

- establishes the amount of bonuses for deputy chief physicians, heads of departments, and other employees outside departments;

- considers complaints from employees dissatisfied with the assessment of their work;

- develops a draft order on the distribution of additional payments.

Features of creating a situation in state unitary enterprises and municipal unitary enterprises

Most employers have a fairly large degree of freedom in determining the rules for stimulating employees. However, along with them, there are organizations in Russia in which wages are regulated at the state level. These are budgetary institutions (SUE and MUP).

In relation to them, the text of Art. 135 of the Labor Code of the Russian Federation contains a reference to unified recommendations for establishing wages. Such recommendations are developed annually by a tripartite (Government of the Russian Federation - trade unions - employers) commission and establish a unified approach to remuneration of employees of these legal entities at all levels of the budget system (from federal to local). Based on this document, the volumes of budget funding for the next year are established for the maintenance of state unitary enterprises and municipal unitary enterprises, including those working in the fields of education and healthcare. If the tripartite commission has not developed such a document, then it is approved by the Government of the Russian Federation, bringing the commission’s opinion to the constituent entities of the Russian Federation.

In addition, the number of regulations that define the system of remuneration for public sector employees includes Decree of the Government of the Russian Federation dated 05.08.2008 No. 583. According to paragraph 5 of this resolution, each budgetary organization develops and approves an individual regulation on incentive payments.

Types of payments of an incentive nature for budgetary institutions are established by order of the Ministry of Health and Social Development of the Russian Federation dated December 29, 2007 No. 818. Among them, additional payments are highlighted:

- for the intensity of work and achieving high results in work;

- high-quality performance of work;

- continuous experience and long service;

- based on the results of work activity.

To implement the mechanism of incentive additional payments in a state unitary enterprise or municipal unitary enterprise, a system of criteria must be created that will allow assessing the effectiveness and quality of the work of each employee individually and can become a factor encouraging the improvement of the quality level of functioning of the budgetary institution as a whole.

The general recommended approach to the criteria is as follows:

- The employee must have a clear understanding of his job responsibilities, the rules for assessing the effectiveness of their implementation and their impact on the final amount of remuneration.

- The amount of remuneration for a specific employee should be determined taking into account the impact of his activities on the final result of the institution as a whole.

- The conditions that serve as the basis for calculating the final amount of remuneration must be sufficiently transparent to be clearly understood by both the employer and the employee.

When developing regulations on incentives in a state unitary enterprise or municipal unitary enterprise, one should be guided by industry recommendations for its formation, if they are established. For example, there are similar documents:

- for the healthcare system - order of the Ministry of Health of the Russian Federation dated June 28, 2013 No. 421;

- education systems - letter of the Ministry of Education and Science of the Russian Federation dated June 20, 2013 No. AP-1073/02;

- preschool educational institutions - letter of the Ministry of Education and Science of the Russian Federation dated March 31, 2008 No. 03-599;

- cultural institutions - letter of the Ministry of Culture of Russia dated 08/05/2014 No. 166-01-39/04-nm.

But at the same time, the incentive system in each specific institution can be individual. When developing it for itself, each state unitary enterprise or municipal unitary enterprise must be guided not only by uniform recommendations, but also by regional documents devoted to this issue, which should not contradict the uniform recommendations, but can complement and specify them.

Unlike other employers, in state unitary enterprises and municipal unitary enterprises the contribution of managers to the results of the institution’s work is also assessed. This assessment is carried out by a higher authority based on the overall performance of enterprises.

Example of calculation as a percentage of salary

Doctor Ivanov’s salary is 50,000 rubles. In April, Ivanov was given an increase for continuous service in the amount of 20% of his salary. Thus, the increase for April will be 10,000 rubles.

Additional payment for the intensity and quality of work and bonuses are also established using a point system. The amount of payments depends on the number of points earned in the billing month, the cost of one point and the increasing coefficient.

For example, the increasing coefficient for the doctors of the institution is 3. We determine the number for doctors in the hospital, taking into account the increasing coefficient: 32 people × 3 = 96. The maximum number of points that an employee of the institution earns is 10. The maximum total number of points for doctors: 96 × 10 = 960 points.

We calculate how much one point is worth using the formula:

Point value = total amount paid for the entire institution / maximum total number of points for the organization.

For example, 200,000 rubles / 2460 points = 81.3 rubles.

What are incentive payments under the Labor Code of the Russian Federation - laws and regulations

The legal regulation of incentive payments is ensured primarily by the provisions of the Labor Code of the Russian Federation, as the main regulatory document regulating the relationship between employees and employers. Incentive payments under the Labor Code of the Russian Federation are discussed in the following articles of the said document:

- Article 57. This article regulates the basic legal principles of the content of employment contracts. This includes the need to indicate in this document the accepted payment system, as well as various incentive payments.

- Article 129. The standards set out in its provisions establish the general concept of wages as a whole, as well as its components. In particular, this article defines incentive payments as a component of employee salaries.

- Article 135. It regulates the procedure for establishing wages for workers in general, and also requires fixing the procedure for remuneration and payment of incentive payments in the local regulatory documents of the enterprise, for example, in a collective agreement, individual provisions and orders.

- Article 191. The text of this article directly deals with incentives for work that can be provided by employers to employees. These include bonuses or any other types of incentive payments.

It should be remembered that legislation may contain other regulations that may provide legal regulation of incentive payments in private situations. An example of such may be documents relating to the activities of budgetary institutions, which may provide for a separate procedure for assigning such bonuses to employees for effective work activities.

Incentives and compensation payments to employees should not be confused. The first includes direct remuneration of employees for certain labor successes, while compensation is paid either to certain categories of persons, or upon the occurrence of various negative circumstances. The difference between these types of payments is quite large, especially in terms of accounting for taxes and calculating the average earnings of workers. Also, bonuses and remunerations, the issuance of which is in no way directly related to the performance of employees, may not be recognized as incentive payments, for example, the 13th salary, if it is issued to all employees of the enterprise without exception.

Overall, incentive payments are an excellent way to increase employee motivation and increase management control. Current legislation directly prohibits issuing fines to employees or reducing their salaries and tariff rates, even when committing various offenses. However, the law does not prohibit the possibility of depriving workers of bonuses or other remuneration, for example, if workers commit certain disciplinary offenses.

What other additional payments are there besides incentives?

Types of surcharges:

- Bonuses according to the “May decrees” of the president - payment according to the “road map” of medical workers (annual increase in salaries). As part of this state program, a constant increase in wages for doctors, mid-level and junior staff is planned. As a result, the salary should be from 100 to 200% of the average income in the region.

- Payments under the Zemsky Doctor program. For doctors working in the village, compensation of 1 million rubles is provided. Conditions: age - not older than 50 years, higher education and completed internship in the field and readiness to work in one locality for five years.

- Regional payment for medical examinations for health workers in 2020: specialists receive an additional payment for additional medical examinations for public sector employees who work in schools, medical organizations, sports and research institutions. The rule does not apply to family doctors, local therapists and nurses working with them.

Regulations on incentive payments with performance criteria, sample

The provision on incentive payments is of fundamental importance for increasing staff pay. It provides grounds for including an incentive component in employee salaries. Thus, the Regulations are an effective tool in the hands of the administration, thanks to which staff motivation is developed and the payroll process is optimized.

What are the additional payments?

Staff salaries consist of many components. The principles of its formation are specified in Art. 129 and 135 TK. Accounting employees accrue well-deserved pay for working hours worked. It includes:

- Rate or salary. They are determined by the qualification category of the employee, as well as the quality indicators of the duties performed.

- Compensatory surcharges. They are accrued in the presence of difficult working conditions, as well as in the event that the labor functions of performing professional duties involve the use of toxic or explosive materials.

- Incentive surcharges. Their task is to encourage employees to grow professionally.

- Social payments. They are assigned as compensation for the loss of some part of a stable income.

According to Art. 129 of the Labor Code, the employer has the right to allocate incentive bonuses to a special category. These include bonuses, various additional payments or some additional payments.

The employer can set incentive bonuses independently. It is also possible to make a collegial decision on this issue.

Such payments include:

- annual bonus;

- "13 salary";

- additional payment for years of service (for length of service);

- incentives for high quality work performed;

- encouragement for personal professional achievements.

The employer has the right to decide on each specific payment independently. At the same time, the certification commission may recommend that the employer reward one of the employees for excellent results in professional certification.

This category of payments is established based on the company’s budget. They all pursue one goal: rewarding staff for the quality of their work.

There is another category of incentive payments: government. They are established by the legislator and involve the accrual of additional amounts for: qualification category, degree or title.

When you overcome each of the above steps, you are automatically entitled to a salary increase.

The methodology, calculation formulas and rules for calculating incentive payments are set out in a special Regulation on incentive payments with performance criteria.

When developing this document, the administration of an enterprise or company considers its own labor assessments. The employer decides on one form of remuneration or another.

Finally, management has the right to independently develop a formula by which the amount of remuneration is determined. As a rule, it includes a qualitative or quantitative characteristic of each individual criterion.

Incentive Regulations

During the development of the Regulations, the employer is guided by Art. 135 TK. In many ways, this is an autonomous decision of the manager.

However, experts recommend taking into account the following points:

- the opinion of a trade union or other social organization expressing the interests of the collective;

- preventing the deterioration of the conditions provided for by the collective agreement;

- preventing deterioration of the conditions provided for in the personal contract with the employee.

The specifics of the salary (its size; its components) of each employee must be fixed either in a collective agreement or in a separate local act for the enterprise. When calculating wages, accounting staff are required to take this circumstance into account. In most cases, employers fix the methods of paying employees in collective agreements.

As for incentive payments, it is convenient to fix them in additional Regulations. This will bring clarity to the work of accounting employees and make the calculation of wages for each individual employee logical and transparent.

The text of the Regulations on incentive bonuses must necessarily reflect:

- goals set for staff;

- reference to the regulatory documents that are the basis for its preparation;

- ways to document the assessment process;

- formation of reporting periods;

- formation of a point system for each individual position;

- determining the maximum number of points for positions;

- list of evaluation criteria;

- list of accounting algorithms in the formation of wages;

- rules for challenging assessment results by team members.

This is not an absolute scheme. It can change, be supplemented or reduced. In each production, the list of evaluation criteria is determined by the specifics of professional activity. However, the Regulations require each employer to use a digital assessment. The point system is as objective and convenient as possible.

The results of the assessment of each team member should be guided by the opinion of the trade union and the heads of the structural unit. It is also necessary to take into account the opinion of the employee himself. He may or may not agree with the number of points. For the convenience of calculations, the practice of evaluation sheets is recommended. They are issued for a specific period of time for each employee.

In order for the evaluation system (points or any other) to be effective, it is necessary to create such conditions in production so that each member of the team has a clear understanding of their own work responsibilities. In addition, the formed Regulations must be brought to the attention of each member of the work team.

It is recommended to provide preliminary instruction on the point system used in production. Employees must know the criteria for assessing the effectiveness of their work. Each of them has the right to know what specifically affects the final salary amount.

How the situation is formed in different professional fields

In different industries, the lists of indicators with criteria for their implementation vary.

For example, for health workers the most important indicators are:

- number of patient complaints;

- dynamics of recovery;

- taking advanced training courses;

- compliance or non-compliance with sanitary standards;

- knowledge and implementation of medical standards;

- participation or non-participation of specialists in preventive measures;

- the total amount of time worked during the accounting period.

Completely different evaluation criteria are practiced in the public education system.

Incentive payments to teachers depend on:

- qualification category;

- student performance;

- teacher participation in public school life;

- participation in methodological work;

- the level of mastery of educational standards by students;

- absence of conflict situations in the team;

- certification results;

- participation of students in city, regional and All-Russian Olympics.

The evaluation criteria for library workers are focused on the preservation and replenishment of the book collection, as well as on the level of visitor attendance at the institution. For cultural institutions, it is important to have author’s developments and personal participation in competitions and festivals.

For the production sector, indicators of the production of the daily norm, the presence of rationalization proposals, compliance with work regulations and the general level of mastery of the profession are important.

So, this Regulation is extremely important for the formation of a general system of remuneration for work in production in a state or municipal institution. Its task is to increase the interest of each team member in the results of their own work. ( 37 votes, 4.00 out of 5) Loading...

Source: https://sovetkadrovika.ru/organizaciya-biznesa/polozhenie-o-stimuliruyushhih-vyplatah-s-kriteriyami-effektivnosti.html