What types of accountants are there? part 1

This article appeared as a reaction to messages from accounting forums. There you can often find novice accountants looking for answers to the questions: “I want to work as an accountant. What I need to know”, “What a novice accountant should know”, “Where to start studying accounting”. Judging by how many people ask them and how many are trying to help them by giving advice, it is clear that the question is relevant.

I am writing this article because I noticed a pattern in these messages and I cannot remain silent about it. I consider it very important because, in my opinion, it creates confusion in the councils. I'll try to explain now what I mean.

Let's start with the fact that when giving advice, people describe the knowledge and skills that an accountant should have. For example:

“...Laws change at the speed of light, and so does the chart of accounts. Accounting at a confectionery factory is completely different than at a car factory or, in general, at a state-owned enterprise..."

“...she must have a thorough knowledge of accounting and all reporting...”

“...At this stage, the accountant is engaged not only in accounting, but also in financial, management, and tax accounting...”

“...To work as a normal accountant, you must have a specialist. education. And constant self-education - everything changes every day..."

“...To become a good accountant or chief accountant you need to study a lot and constantly learn...”

Accountant profession - description and history

Accountants are employees of government organizations, industries and commercial enterprises. They act strictly in accordance with the regulations of the Ministry of Finance, guided by legal acts and job descriptions.

The main work of an accountant in Russia is to record the company's income and expenses, prepare the relevant documentation, prepare and submit reports to the competent authorities.

Here's what else an accountant does:

- determining the cost of goods and services of the organization;

- accrual of payments to the state budget and their implementation;

- calculation of mandatory contributions to extra-budgetary funds and their implementation;

- calculating advances, salaries, bonuses to employees;

- The main thing that an accountant must be able to do is to minimize the mandatory expenses of the enterprise.

Today, in order to acquire professional accountant skills, it is not necessary to obtain a higher education. Often, ambitious and careful people, having completed specialized courses, get the desired position without any problems. After this, it is enough to monitor changes in the field and try to improve your skills. Professionals in the field, answering the question of how to become a good accountant, argue that one must constantly learn and expand the boundaries of skills and abilities.

The first representatives of financial specialties appeared in Ancient times. More than 2 thousand years ago in India there were workers who were engaged in various types of accounting in agriculture. In the 14th and 15th centuries, printed books on accounting began to appear. In Russia, the accounting position officially appeared under Peter I. Despite the fact that since then the country's universities have been continuously teaching those interested in this field, it began to gain popularity only at the end of the last century.

What might a novice accountant think about?

Personally, I perceive it this way: AN ACCOUNTANT seems to me to be an unattainable ideal, possessing maximum knowledge and virtuoso skills. I imagine such an accountant as a Chief Accountant, having a variety of experience from all areas of activity.

But do these tips help a beginner? Personally, they wouldn't help me. Of course, they would have given me some guidelines, but not specific actions in specific situations.

I want to say - let's use the right words: not ACCOUNTANT, as a collective image. This doesn't help beginners. Let's be specific.

And the specifics are that:

— There are “different” accountants at an enterprise. — the amount of knowledge and requirements for an “accountant” depends on the size of the enterprise and its accounting staff

Advantages and disadvantages of the direction

When considering the pros and cons of the profession, it is necessary to take into account the specialist’s focus on results and his desire to perform his duties in a high-quality manner. Neglecting a job description not only affects how much an employee earns, but can also cause serious problems with the law.

Advantages of the professional field:

- stability of work and demand for specialists, including young and without experience;

- prestige of the field, career prospects against the backdrop of opportunities to constantly improve your professional level;

- there is no need to constantly sit at work, modern technologies allow you to perform all the necessary functions remotely;

- there are no restrictions on age and gender, having many years of experience is considered a significant plus;

- the opportunity to change your field of activity to a more promising and profitable one by taking courses;

- how much an accountant receives depends on him - the figure can increase significantly as the employee acquires additional knowledge and skills;

- It is possible to run several businesses at the same time.

- The disadvantages of the job include the high level of professional responsibility.

- Errors in calculations can cause financial problems for an enterprise.

- Violation of reporting rules may result in administrative fines and criminal prosecution.

- Another disadvantage is the uneven distribution of the load - in certain periods it reaches such levels that it negatively affects the condition and health of the employee.

There are “different” accountants

Based on my practice, I will list the main ones:

- Accountant material desk

- Accountant cashier

- Accountant bank

- Accountant for mutual settlements

- Payroll Clerk

- Accountant for fixed assets

- Accountant on checkout

- VAT accountant

- Accountant for purchasing goods

- Chief accountant, putting together all accounting

Do all these options for “accountants” require the same amount of knowledge? Does each of them need to know everything related to accounting, for example:

- tax systems,

- filling out reports,

- ability to calculate salaries,

- name and rules for filling out all primary documents,

- knowledge of all accounting accounts and transactions,

- formation of balance,

- formation of a declaration,

- regulatory documents and laws on accounting/tax accounting?

- and etc.

Isn’t this all the knowledge implied in many pieces of advice? Is it possible for someone who has just embarked on the accounting path to do all this at once? Before I even started working!

Of course, not knowing anything at all is not an option either. It will be extremely difficult for such a specialist to both get a job and keep it, even in the role of an accountant in the simplest area of accounting. You will still have to know and be able to, either before employment or during work, you will urgently have to “obtain” knowledge and skills.

In addition to the names of accounting positions, the company itself can help us understand what a novice accountant needs to know. Read more

I recommend paying attention to these articles:

In the life of novice accountants, there are situations when, being without experience, they easily get a job. Was it by pure chance or was the stars aligned? A….

Today we can rightfully say that the accounting profession has become widespread. This is clear from the fact that almost any college, technical school or higher education institution teaches...

When choosing a future profession as an accountant, you should know what to prepare for in order to work as an accountant. I would like to find in advance the answer to the question “What types of accountants are there?”….

Material department Payment department for wages Cash center Department of settlements with suppliers and customers [p.563] The calculation department calculates wages due to workers and employees, maintains their personal accounts, accruals, as well as all calculations for deductions and deductions, etc.

In some organizations, this department keeps records of the use of working hours. [p.16] Each department deals with current accounting from beginning to end for a group of accounts based on their economic homogeneity. For example, the accounting department keeps records of settlements with personnel for wages and equivalent payments; the material department - for a group of inventory accounts, etc. The department may include several employees headed by a senior accountant. [p.428]

Order No. 1 to the accountant of the settlement department 1 I31 [p.297]

ORDER No. 1 TO THE ACCOUNTANT OF THE ACCOUNTING DEPARTMENT [p.298]

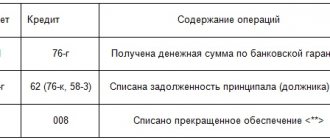

The chief accountant and the accountant of the settlement department must not only accurately and timely keep records of settlements with all legal entities and individuals, but also document settlement transactions correctly, prevent the presence of large receivables and payables, take measures to prevent missing the statute of limitations, and periodically carry out reconciliation of calculations. [p.253]

Time records cover all employees of the organization. The timesheet is drawn up in one copy by the timekeeper or foreman, or a person authorized to do so and is submitted to the accounting department twice a month to adjust the amount of payment for the first half of the month (advance) and to calculate wages for the month. [p.179]

The executive documents received by enterprises, institutions and organizations of all types of property are registered and no later than the next day after their receipt are transferred to the accounting department (settlements department) against signature to the responsible person appointed by order of the manager. [p.379]

The introduction of non-cash payments through the settlement departments of the State Bank contributed to limiting the need for gold coins. [p.422]

DEPARTMENT - a structural subdivision of an enterprise, organization, company, bank, stock exchange, for example, order department, sales department, purchasing department, design department, settlement department, design department, marketing department. [p.342]

The HR manager familiarizes the relevant departments with the above order against signature, makes the necessary entries in all reporting documents and transmits the order to the accounting department. [p.300]

At the end of the month, the work producer (foreman) or the site manager, all work orders and other primary documents for recording time worked, production and payroll are transferred to the planning and production department or the labor and wages department of the construction organization for substantive verification, as well as for comparison volumes of work on orders with monthly plans and tasks, applied prices with current labor rates. Verified documents according to a special register are transferred against receipt to the settlement department of the accounting department of the construction organization for calculating wages of workers and employees, as well as for reflecting transactions in accounting. [p.63]

Primary documents (work orders, waybills, shift reports for drivers, sheets for additional payment, time sheets, etc.) after an accounting check and a substantive check (the correctness of filling in all the established details, the presence of signatures of the workers preparing the documents, etc.) are registered in special register. Based on verified primary documents, the accounting department of the accounting department distributes the wages indicated in the orders and pay sheets among the members of the team (link). Distribution is made in proportion to the number of days or hours worked by each [p.63]

All calculations for wages at the university are carried out by the calculation department of the Accounting Department. He also calculates and withholds income tax from individuals at the end of each month from the amount of the total income of employees from the beginning of the year, reduced by the standard tax deductions established by the Tax Code of the Russian Federation (Article 218.1) from 01.01.01 [p.118]

The settlement department of the accounting department carries out settlements with workers and employees for wages and social insurance, carries out settlements with financial authorities, banks and depositors, and prepares reports on labor and wages. [p.199]

SETTLEMENT DEPARTMENTS are special departments that existed in Tsarist Russia and for some time in the USSR at the issuing bank, the functions of which included the implementation of mutual settlements between credit institutions. R. o., created under the Board and provincial offices of the State Bank of Russia, carried out mutual offset of debt claims between banks participating in the settlements. In 1916, there were 54 R. o. [p.269]

Foreman . . . Heads of sections 1895 3600 Accountant of the accounting department. …. 3635 [p.50]

The first division, often called the settlement department, carries out the entire cycle of work on accounting for labor and wages, compiles appropriate reporting and exercises control. [p.38]

Accountant of the accounting department 0 Who performs [p.57]

The form (FO 12-1) is ready for signature in the workshop and transfer to the settlement department [p.122]

B. and. items are divided into departments or groups headed by senior accountants. These departments carry out the following functions: material department - accounting for materials in warehouses and reporting on the availability and use of materials settlement department - calculating wages of workers and employees, accounting for settlements with them and with the trade union but social insurance, reporting on labor and wages production department - accounting for production costs, calculating the cost of products, identifying the results of in-plant cost accounting, drawing up costing reports; finished product accounting department - accounting for finished products in warehouses, their shipment to customers and sales; financial accounting department - documentation and accounting of money. and settlement and credit operations about the b-sch and and department - accounting for other operations of the main activity, maintaining generalized registers of synthetic accounting, drawing up and submitting reports on the main activity, economic. analysis of the work of the enterprise, instructing other departments of the accounting department, organizing an accounting archive, the capital investment accounting department - accounting and reporting on capital investments. In addition, counting cells are created in the workshops and warehouses of large enterprises for the primary processing and summary of documents. [p.93]

If the specified amounts are accrued after the dismissal of the debtor and the return of the writ of execution to the court, the accounting department (settlement department) pays the withheld amounts to the claimant without a writ of execution, which is notified to the court to which the writ of execution was sent. [p.318]

In accordance with Art. 109 of the Family Code of the Russian Federation, amounts withheld for alimony payments by the accounting department (settlement department) must be issued to the claimant in person or transferred by mail no later than three days from the date of payment of wages (pensions, benefits, scholarships, etc.). In this case, payment for postal services for the transfer of alimony is made at the expense of the alimony payer. [p.318]

The opening of the official stock exchange was delayed by the Ministry of Finance pending a resolution of fundamental issues of government policy regarding private issues and stabilization of the stock market. In January 1917, the St. Petersburg Stock Exchange was reopened. The Provisional Government prohibited forward transactions, the object of transactions could only be securities, the circle of participants in stock exchange meetings was limited (guests were not allowed, foreign nationals - only with the permission of the Ministry of Finance). To simplify mutual settlements between joint-stock banks for purchases and sales of securities, a stock settlement department was approved at the St. Petersburg office of the State Bank. It was understood that all exchange transactions, without exception, would be subject to registration and control by representatives of the Ministry of Finance. The unstable political situation meant that the exchange only existed for a month. [p.153]

The department of labor and wages, the economic planning department, and the bureau of normative management provide the accounting department (payment department) with tariff conditions, production standards, prices, estimates, and time standards. [p.78]

The addition to the protocol, signed by all members of the commission, must be drawn up in 2 copies, one of which is transferred to the accounting department of the accounting department to determine the amount of a one-time remuneration for length of service, and the second copy - to the personnel department of the enterprise, [p.168]

Primary documents on wages are transferred by the heads of workshops (departments), departments, and foremen to the accounting department of the accounting department, to the machine counting station or machine counting bureau according to the established schedule. [p.292]

ONE-CITY BRANCHES OF THE STATE BANK—institutions of the State Bank of the USSR located on the territory of one city. Mutual settlements between them are carried out using consolidated advice notes (for several settlement transactions at once) and are reflected in a special account opened for their accounting. Mutual settlements between O. f. G. can also be carried out through the settlement department of the city administration of the State Bank office, while the advice note is drawn up based on the results of mutual settlements for the day. Settlements between organizations served by O. f. G., are local (see Local calculations). [p.151]

The creation of clearing houses dates back to the middle of the 18th century. The first clearing house was established in London in 1775. With the development of credit and banking and the widespread use of checks in non-cash payments, conditions were created for the use of clearing settlements and the functioning of clearing houses and other capitalist sectors. countries. Such chambers were created in New York in 1852, in Paris and Vienna in 1872, in Berlin in 1883. In pre-revolutionary Russia, settlements between banks in the form of cash were carried out by the State Bank. Settlement departments created in a number of large cities at the institutions of the State Bank carried out clearing operations between commercial, mortgage and other banks. [p.528]

The role of the State Bank as a settlement center increased. The turnover of the settlement department under the Board of the State Bank grew, through which offsets and balancing of mutual payment claims of credit institutions were carried out. In 1926-1929 check circulation was expanded. The resolution of the Central Executive Committee and the Council of People's Commissars of the USSR dated November 6, 1929 approved the provision on checks. Intra-syndicate settlements began to develop, which were carried out by transfers through the bank, as well as by offsetting counterclaims, and planned settlements with industry. In 1928-1929 settlements by offsetting mutual claims became widespread. [p.76]

They are necessary not only for recording the use of working time of all categories of workers, but also for monitoring compliance by staff with the established working hours, settling wages with them and obtaining data on time worked. The timesheet is drawn up in one copy by the timekeeper or foreman, or a person authorized to do so, and is submitted to the accounting department twice a month to adjust the amount of payment for the first half of the month (advance) and to calculate wages for the month. Accounting for attendance at work and the use of working time is carried out in the timesheet using the continuous registration method, i.e., noting all those who showed up, no-shows, lateness, etc., or by registering only deviations (no-shows, lateness, etc.). The title page of the report card contains symbols of time worked and time not worked. The number of days and hours is indicated with one decimal place. When processing credentials manually, an alphabetic or numeric code is used, and when processed mechanically, a digital code is used. [p.96]

Accountant job description

The job description of an accountant is a document that defines the list of duties, rights and responsibilities of specialists in accounting departments.

APPROVED by: General Director of Supply Wholesale LLC Shirokov /I.A. Shirokov/ August 12, 2014

Accountant job description

I. General provisions

1.1. This document regulates the following parameters relating to the activities of an accountant: job functions and tasks, working conditions, rights, powers, responsibilities.

1.2. The hiring and dismissal of an accountant occurs through the issuance by the management of the organization of a corresponding order or instruction and is regulated by the legislation of the Russian Federation in the field of labor.

1.3. The accountant's immediate superior is the chief accountant of the organization.

1.4. During the absence of an accountant from the workplace, his functions are transferred to a person who has the necessary knowledge, skills and competence and is appointed in accordance with the procedure established by internal rules.

1.5. Requirements for an accountant: education of at least secondary specialized education, with work experience of at least two years, or higher professional education with work experience of at least six months.

1.6. The accountant must be familiar with:

- basics of civil and labor legislation of the Russian Federation;

- basics of economics and management;

- internal regulations, labor protection rules; fire safety and other types of security at the enterprise;

- internal regulations, instructions, orders and other documentation directly related to the activities of the accountant;

- organizing the company's accounting workflow;

- templates, samples and forms of various forms and documents accepted in the organization, as well as rules for their preparation, systematization and storage;

- ways and methods of accounting and tax accounting and reporting.

1.7. An accountant must have:

- skills in maintaining and preparing accounting and tax accounting and reporting;

- methods of economic analysis of the organization's work;

- plans and correspondence of accounting accounts.

- skills in working with computers and computing equipment, the Microsoft Office software package, specialized accounting services, as well as all office equipment.

II. Job responsibilities of an accountant

2.1. The duties and responsibilities of an accountant include:

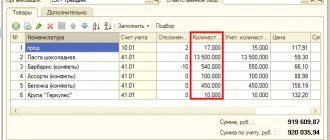

- conducting financial and economic transactions, accounting for liabilities and property, including registration of the acquisition and sale of products, items, inventory, etc.;

- accounting for cash flows, as well as reflecting processes and operations related to the finances of the enterprise on the organization’s accounting accounts;

- working with cash;

- registration, acceptance and issuance, as well as control over the movement of primary accounting documentation (invoices, acts, invoices, etc.);

- working with banks in which the company's current accounts are opened, including submitting payment orders to the bank, requests and receipt of statements, etc.;

- development of forms of accounting documents for registration of various financial and economic transactions, in the absence of their officially approved, mandatory samples;

- working with the tax base, calculating taxes and transferring them to budgets of various levels;

- calculation and transfer of insurance contributions to extra-budgetary funds (PFR, Social Insurance Fund, Compulsory Medical Insurance Fund);

- calculation of salaries and other payments to employees of the organization, incl. social in nature (financial assistance, bonuses, sick leave, vacation pay, business trips, etc.);

- preparation of accounting and tax reporting;

- regularly informing the immediate supervisor about current processes in accounting, as well as timely reports of all non-standard, complex, controversial situations;

- participation in activities to inventory the property and financial condition of the enterprise;

- participation in audits, tax and other inspections initiated by both the management of the enterprise and supervisory authorities;

- timely familiarization with amendments made by law to the rules of accounting and tax accounting and reporting at enterprises, as well as their application in practice;

III. Rights

3.1. The organization's accountant has the following powers and rights:

- make to management reasoned and substantiated written proposals for improving and optimizing the work of both yourself and the enterprise as a whole;

- participate in meetings, planning meetings, meetings, discussions and other events directly related to his activities;

- improve your professional level, including attending courses, seminars, webinars, conferences, trainings, etc.;

- request documents (including archival ones), teaching aids and other materials needed to solve current issues and problems;

- make constructive proposals to eliminate violations, errors, and shortcomings identified during the work;

- sign documents within his competence;

- refuse to perform work functions if there is a threat to life or health.

IV. Responsibility

Disciplinary liability threatens the accountant for the following actions:

4.1. Neglect of performing labor duties, including complete evasion of them.

4.2. Malicious, regular violation of the internal rules established at the enterprise, work and rest regime, discipline, as well as violation of any types of safety and other regulatory regulations.

4.3. Failure to comply with orders and instructions issued by the organization’s management or immediate supervisor.

4.4. Causing (intentional or unintentional) material damage to the company.

4.5. Disclosure of confidential information about the organization.

4.6. All the above points strictly comply with the current legislation of the Russian Federation.

V. Working conditions

5.1. An accountant must obey the company’s internal rules, which detail the conditions of his work.

5.2. If necessary, the accountant may be sent on business trips.

AGREED Deputy Director for Economic Affairs LLC “Supplies Wholesale” Sterkhov /Sterkhov R.A./ August 12, 2014

Tasks and functions of the accounting service

The tasks assigned to the accounting department are regulated by federal legislation. In particular, these include :

structuring truthful and complete information about the company’s activities, as well as timely reflection of the facts of economic life in the relevant documentation. At the same time, reporting should be generated for both external and internal users;

- provision of preventive measures regarding negative performance indicators;

- making payments on the company's obligations;

- appropriate use of company resources to achieve the goals of the developed strategy;

- organizing internal interactions between accounting departments and all other departments of the company.

The given list of tasks determines the existence of such functions performed by the accounting department:

- Accounting. This implies permanent accounting, reflection of transactions carried out by the enterprise. The accounting function is the main one, as it provides the required information to both external and internal users.

- Test. It is assumed that there will be constant monitoring and control over the safety of the company’s property, regular inventory taking, as well as competent and appropriate settlements with contractors, etc.

- Organizational. Accountants must establish a document flow system at the enterprise, as well as a system for the movement of information between departments of the company.

- Analytical. This involves regularly analyzing summary accounting data in order to maintain the financial stability of the company.

Why do you need a job description?

This document is of great importance both for the management of the enterprise and for the accountants themselves. It allows the first to competently coordinate and manage the work of subordinates, and the second to clearly understand work functionality and responsibility. In addition, in the event of controversial situations that require resolution in court, the job description can serve as evidence of the presence or absence of guilt on the part of the employee or employer. The more carefully and accurately the requirements for the employee are spelled out, as well as his rights, responsibilities and other points of the job description, the better.

Basic rules for an accountant's job description

There is no unified form for this document, so enterprises can develop an accountant’s job description on their own. Due to the lack of an approved template, at different enterprises employees employed in the same positions may perform slightly different duties, although the main functions are still standard and similar.

The document is divided into four main parts:

- "General Provisions"

- "Job Responsibilities"

- "Rights",

- "Responsibility",

but, if desired, the management of the enterprise can add other sections.

The job description is drawn up in one copy, and if there are several accountants in the organization, then its copies are printed in an amount equal to the number of accountants. Each accountant whose functions correspond to the job responsibilities specified in the document must sign it. In the same way, each document must be certified by an employee who is responsible for compliance with the rules and functionality prescribed in the job description and the head of the organization.

Drawing up a job description for an accountant

The upper right part of the document is reserved for approval by the head of the enterprise. Here you should enter his position, name of the organization, last name, first name, patronymic, and also leave a line for signature with mandatory decoding. Then the title of the document is written in the center of the line.

Main part of the instructions

In the first section entitled “General Provisions” you must enter which category of employees the storekeeper belongs to (specialist, worker, technical staff, etc.), then indicate on the basis of what order the accountant is appointed, to whom he reports and who replaces him, in if necessary (there is no need to write specific names here, it is enough to indicate the positions of authorized employees). The next step is to enter into the document the qualification requirements that the accountant must meet (specialization, education, additional professional training), as well as length of service and work experience, with which the employee can be allowed to perform work functions.

Further in the same section you need to list all the regulations, rules, orders with which the accountant must be familiar: standards and forms of documents accepted in the organization, rules for maintaining accounts and correspondence, organization of accounting document flow, rules on safety, labor protection and internal schedule, etc.

Second section

The second section, “Job responsibilities of an accountant,” relates directly to the functions that are assigned to an accountant. They may be different at different enterprises, but they should always be described in as much detail as possible. If there are several accountants in an enterprise and they have different functions, you must carefully ensure that there is no duplication in job responsibilities.

Third section

“Rights” section includes the powers that an accountant is given to effectively perform his work. Here you can separately indicate his right to interact with the organization’s management and other employees, as well as representatives of other structures if such a need arises. Rights must be spelled out in the same way as responsibilities - accurately and clearly.

Fourth section

“Responsibility” section establishes specific violations by the accountant, for which internal sanctions and penalties are provided. In one of the paragraphs, it is necessary to indicate that the applied measures comply with the framework of the law and the Labor Code of the Russian Federation.

Fifth section

The last section of the job description includes “Working conditions” - in particular, how they are determined (for example, internal labor regulations), as well as any features, if any.

Finally, the document must be agreed upon with the employee who is responsible for compliance with the rules and regulations prescribed in the accountant’s job description (this may be the immediate supervisor, the head of the human resources department, etc.). Here you need to enter his position, name of the organization, last name, first name, patronymic, as well as put a signature and be sure to decipher it.

Below you must provide information about the accountant :

- his last name, first name, patronymic (in full),

- Name of the organization,

- passport details,

- signature,

- date of familiarization with the document.

There is no need to put a stamp on the job description.

What positions in accounting do you know?

3 tbsp. 7 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”):

- or entrust accounting to the chief accountant;

- or entrust accounting to another official of the organization;

- or enter into an agreement for the provision of accounting services.

The head of the organization can also take charge of accounting (Clause 3, Article 7 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

The position of a deputy is a derivative position from the main position contained in the organization’s staffing table.

Considering that in the situation you describe, the staffing table does not provide for the position of “chief accountant,” then, in our opinion, it is not correct to provide for the position of “deputy chief accountant.”

We recommend:

- or provide for the position of “deputy accountant” in the staffing table, taking into account that the position of “accountant” is contained in the staffing table;

- or instead of the position “accountant”, provide in the staffing table the position “deputy general director for finance” (Resolution of the Ministry of Labor and Social Development of the Russian Federation dated 08/21/1998 N 37 “On approval of the Qualification Directory of Positions of Managers, Specialists and Other Employees”, Order of the Ministry of Labor of Russia dated 12.22.2014 N 1061n “On approval of the professional standard “Accountant”).

Mayorova Kristina Alekseevna

Customer Support Expert

This article appeared as a reaction to messages from accounting forums. There you can often find novice accountants looking for answers to the questions: “I want to work as an accountant. What I need to know”, “What a novice accountant should know”, “Where to start studying accounting”. Judging by how many people ask them and how many are trying to help them by giving advice, it is clear that the question is relevant.

I am writing this article because I noticed a pattern in these messages and I cannot remain silent about it. I consider it very important because, in my opinion, it creates confusion in the councils. I'll try to explain now what I mean.

Let's start with the fact that when giving advice, people describe the knowledge and skills that an accountant should have. For example:

“...Laws change at the speed of light, and so does the chart of accounts. Accounting at a confectionery factory is completely different than at a car factory or, in general, at a state-owned enterprise..."

“...she must have a thorough knowledge of accounting and all reporting...”

“...At this stage, the accountant is engaged not only in accounting, but also in financial, management, and tax accounting...”

“...To work as a normal accountant, you must have a specialist. education. And constant self-education - everything changes every day..."

“...To become a good accountant or chief accountant you need to study a lot and constantly learn...”

What might a novice accountant think about?

Personally, I perceive it this way: AN ACCOUNTANT seems to me to be an unattainable ideal, possessing maximum knowledge and virtuoso skills. I imagine such an accountant as a Chief Accountant, having a variety of experience from all areas of activity.

But do these tips help a beginner? Personally, they wouldn't help me. Of course, they would have given me some guidelines, but not specific actions in specific situations.

I want to say - let's use the right words: not ACCOUNTANT, as a collective image. This doesn't help beginners. Let's be specific.

And the specifics are that:

— There are “different” accountants at an enterprise. — the amount of knowledge and requirements for an “accountant” depends on the size of the enterprise and its accounting staff

Who and where can an accountant work?

Employees of this financial profile occupy responsible positions in small, medium and large businesses. They are in demand in banks and investment funds. Without such employees, the activities of economic sectors, including government ones, are impossible. Accounting workers are needed both in industrial enterprises and construction organizations, as well as in the service or entertainment sector. They are part of the staff of tax inspectorates, pension and other social funds, insurance agencies, and charitable organizations.

There are “different” accountants

Based on my practice, I will list the main ones:

- Accountant material desk

- Accountant cashier

- Accountant bank

- Accountant for mutual settlements

- Payroll Clerk

- Accountant for fixed assets

- Accountant on checkout

- VAT accountant

- Accountant for purchasing goods

- Chief accountant, putting together all accounting

Do all these options for “accountants” require the same amount of knowledge? Does each of them need to know everything related to accounting, for example:

- tax systems,

- filling out reports,

- ability to calculate salaries,

- name and rules for filling out all primary documents,

- knowledge of all accounting accounts and transactions,

- formation of balance,

- formation of a declaration,

- regulatory documents and laws on accounting/tax accounting?

- and etc.

Isn’t this all the knowledge implied in many pieces of advice? Is it possible for someone who has just embarked on the accounting path to do all this at once? Before I even started working!

Of course, not knowing anything at all is not an option either.

What should accountants do?

The contents of the job description affect the accountant’s salary, the level of his responsibility to the employer and law enforcement agencies. If 10 years ago an employee in this field could be assigned an impressive list of responsibilities, today this process is approached more selectively. Only in small enterprises is it not clearly stated what an accountant does. Such a specialist is forced to navigate all areas of the organization’s activities related to numbers and reporting.

Types of specialists and their functions

Before becoming an accountant, it is recommended to decide on the direction of work. The list of job responsibilities, salary, and career prospects depend on this. Career guidance will help you cope with these tasks. By performing simple tests, it will allow you to find out the areas in which the applicant will find it most interesting and easiest.

Types of accountants and descriptions of professions:

- accountant or junior employee - must be familiar with the basics of market relations, accounting systems, tax and commercial legislation. Maintain reporting for small enterprises or certain areas of the company’s work;

- technician or ordinary employee - engaged in reporting, accounting or analysis of the company’s activities. The minimum you need to know is the basics of auditing, financial and management accounting;

- economist - these are chief accountants or their deputies with good prospects. They can analyze the company's work, internal audit, and economic accounting. The basic skills of an accountant must be supported by knowledge in the field of banking, the basics of marketing, finance and organizational management;

- auditor - senior employees who are engaged in external audit and analysis of economic indicators.

Everything that an accountant of a particular group should know can be studied at specialized universities, specialized secondary educational institutions, and courses. According to statistics, only half of the workers in this field have a higher education. Increasingly, young people are trying to learn the basics of their specialty and further improve their qualifications with the help of courses depending on the chosen direction.

Characteristics of a representative of the profession

What an accounting employee should be like depends on the scope of the company’s activities, the goals of the organization and its taxation system, and the specifics of the area of work. In any case, he needs to know the basics of statistics, financial management and credit relations. Knowledge in the field of economic activity, reporting rules, technology and economics of a specific economic sphere, planning and organization of its work is required.

Professional requirements for an accountant:

- knowledge in the field of accounting and tax legislation;

- Confident PC skills, in particular Excel and professional programs (1C and others);

- The average salary of an accountant at an international company is much higher, but this requires proficiency in English (or another foreign) language, knowledge of the basics of IFRS and a permitting certificate.

The desired personal qualities of an accountant are perseverance, patience and endurance, the ability to efficiently perform monotonous and similar work.

Representatives of the professional sphere must be calm, attentive and resistant to stress. You should not even consider a referral if you have diseases of the nervous system, emotional instability, vision problems and chronic headaches.