How an advance is paid - new rules and payment procedures

> > October 01, 2020 How is an advance paid taking into account the latest changes in legislation? Our article will discuss how to calculate the amount of the advance, how and when to pay it to employees, what sanctions await the employer for failure to pay the advance. The concept of “advance” is not enshrined in labor legislation.

Since the employer is obliged to pay his employees wages every half month, payment for the first half of the month is called an advance. How are advances paid under the Labor Code of the Russian Federation? Specific terms for payment of wages and advances are not established in the Labor Code of the Russian Federation.

The rules for advance payment currently applied (since October 3, 2016) limit the period for issuing money to 15 calendar days from the end of the period for which the salary was accrued.

At the same time, the Labor Code does not prohibit making advance payments more often than every half month, for example, 3 times a month (every decade) or 1 time a week. The employer independently establishes the exact dates for payment of income calculated to employees in internal local regulations:

- .

- ;

- ;

Thus, according to the current rules for advance payment, the deadline for payment of wages for the first half of the month can be set on one of the days from the 16th to the 30th (31st) day, and for the final payment - from the 1st to the 15th e day of the month (letter from the Ministry of Labor, dated September 21, 2016 No. 14-1/B-911).

At the same time, establishing a variable period for transferring income calculated to an employee, for example with the wording “salaries are paid from the 1st to the 10th” or “... no later than the 10th”, is considered a violation of the requirements of the Labor Code, since the employer is obliged to set a specific date of issue (Clause 3 of the letter of the Ministry of Labor dated November 28, 2013 No. 14-2-242).

IMPORTANT! Setting deadlines for paying salaries on the 15th day and advance payments on the 30th is considered inappropriate due to the need to calculate and withhold personal income tax from the advance payment if there are 30 days in a month (i.e.

if its payment falls on the last day of the month).

How to calculate the amount of a fixed advance?

The Labor Code of the Russian Federation, which provides for the payment of wages to the employee at least every half month, Rostechnadzor decided to submit timesheets to the Financial Department twice a month: - for the 1st half of the month (indicators in the timesheet are entered from the 1st to the 15th); — for the past month (indicators in the report card are entered from the 1st day to the last day of the month). Maintaining actually two timesheets per month makes the job much more complicated.

The employer has the right to keep timesheets electronically, but only with the mandatory use of an appropriate electronic signature.

Also inconvenient will be the date of payment of the advance for the 1st half of the month, set on the 15th day of the month, since the employer will be obliged to pay the 2nd part of the salary on the 30th day of the current month. But the time sheets for the time worked by employees will reach the accounting department no earlier than the 1st day of the next month. Consequently, the accountant simply physically will not be able to calculate wages and pay them to employees on the 30th.

Such requirements are established for the payment of wages accrued to the employee for the time he worked in a specific period.

Salary advance: is it more convenient to pay by settlement or fixed?

→ The article from the magazine “MAIN BOOK” is current as of September 22, 2017.

M.A.

Kokurina, senior lawyer The legislation does not directly stipulate how much of the salary should be paid to employees for the first half of the month (advance payment). Therefore, employers in their regulations establish the option of advance payment that suits them.

By the way, a more labor-intensive option at first glance may turn out to be safer and more convenient in the event of emergency situations. As a survey on our website showed, employers use different options for calculating advances. The advance may be determined as a percentage of the salary (for example, 40% or 50% of the monthly salary), as an amount calculated depending on the time worked by the employee in the first half of the month.

Or the advance is paid in a fixed amount. Most often, an advance is paid as a percentage of the salary (48% of respondents). When calculating based on, for example, 40% of the salary, the employee is paid approximately the same amounts every 2 weeks, as the Ministry of Labor recommends.

Let’s say, with a salary of 25,000 rubles. the employee is entitled to: •advance in the amount of 40% - 10,000 rubles.

(RUB 25,000 x 40%); •salary for the second half of the month - 11,750 rubles.

(25,000 rub. – 25,000 rub. x 13% – 10,000 rub.).

At first glance everything is just perfect. There is no need to process timesheets, and the employee knows exactly how much he will receive for the first half of the month.

But keep in mind that there may be difficulties when paying an advance in percentage or in a fixed amount. Salary, including part of it for the first half of the month, is paid for labor. Therefore, if an employee did not work in any month, say, was ill or took a vacation at his own expense, then the unworked part of the advance will have to be withheld from subsequent payments.

For example, with a salary of 25,000 rubles. The employee was paid an advance of 10,000 rubles on the 22nd.

(40% of salary).

Free legal assistance

/ / Sample report card for the 1st half of the month Law N 402-FZ) directly follows that the primary accounting document can be drawn up both on paper and in the form of an electronic document * (1), signed with an electronic signature * (2), or at the same time in paper and electronic form. In addition, p.

7 Instructions for the application of a unified chart of accounts for state authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 N 157n, defined that primary and summary accounting documents are compiled on paper or, if the subject of accounting has the technical capabilities, on machine media - in the form of an electronic document using an electronic signature (hereinafter referred to as the electronic document).

From the above, we can conclude that, regardless of the number of working days in a month, the timesheet for the first half of the month is filled out from the 1st to the 15th.

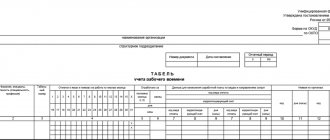

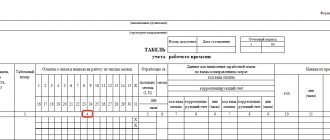

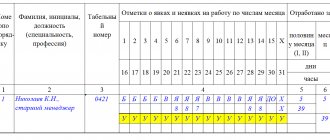

Sample timesheet for half a month: Timesheet (fragment).

The employee is an internal part-time worker. The time sheet for the second half of the month is filled out in the same way, but in the half of the month column, II must be indicated and the total time worked by the employee for the month is entered for the month. In accordance with paragraph 3 of Article 226 of the Tax Code of the Russian Federation, you pay income tax when paying wages for the month.

Details in the materials of the Personnel System:

- Situation: Is it necessary to draw up a separate timesheet for calculating the advance payment?

... The employer is obliged to keep records of the time actually worked by each employee (Part.

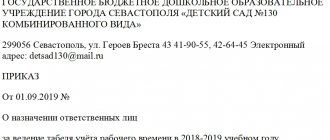

4 tbsp. 91 Labor Code of the Russian Federation). Attention The following points will need to be reflected in it: Appointment of the person (or persons responsible) for maintaining the time sheet.

The need to maintain separate time sheets by department.

Approval of additional codes for exits or absences from work.

When calculating wages for the first half of the month (advance), is it necessary to submit time sheets to the accounting department 2 times a month?

Answer to the question: Yes, we believe that the timesheet should be prepared for both the first and second half of the month. The timesheet reflects the time actually worked by the employee in the corresponding period.

Accordingly, overtime hours must be reflected in the timesheet for the period in which they actually occurred. But these hours are subject to payment either at the end of the month or another accounting period (see Letter of the Ministry of Labor of Russia dated August 10, 2017 No. 14-1/B-725 On the timing of salary payments).

On October 3, 2020, a new version of Article 136 of the Labor Code of the Russian Federation came into force.

Article 136 of the Labor Code of the Russian Federation still provides that salaries must be paid “at least every half month.” However, a clarification will appear: “Wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.”

Those. and the new version of Art. 136 of the Labor Code of the Russian Federation does not provide for prepayment of wages.

Within the framework of Art. 136 of the Labor Code of the Russian Federation, it is more correct to talk specifically about settlements with employees for the first and second half of the month. The part of the salary that must be paid based on the results of the first half of the month cannot be less than the salary, taking into account compensation payments, for the time actually worked or work performed (Letter of the Ministry of Labor of Russia dated 02/03/2016 No. 14-1/10/B-660 O terms of payment of wages, on the amount of wage payment for half a month, Letter of the Ministry of Labor of Russia dated 08/10/2017 No. 14-1/B-725 On the terms of payment of wages). That is, salaries need to be calculated for every half month in approximately equal amounts, excluding bonus payments, provided that the full standard of time is worked.

We recommend reading: Print out Novice Driver Sign

And to record and confirm the time worked for the first half of the month, a time sheet is used. Thus, in accordance with Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee for each half of the month.

A time sheet should also be drawn up for the same periods.

Answer

As we understand from your question, the employee is assigned part-time working hours.

At the same time, we note that if part-time working hours are established for an employee upon hiring, then this condition must be reflected in the employment contract, as well as in the hiring order.

about a sample of filling out a time sheet by following the link.

In the employment contract, in the “Working hours” section, indicate part-time work, and also specify the working conditions (for example, “ The employee is assigned

a part-time work week. The working day is Monday

.

The start and end times of classroom classes are determined by the class schedule. The duration of work is ... hours per week

").

Indicate the employee’s salary in the employment contract in full (for a full rate), and it is necessary to indicate that the salary is calculated for the time actually worked (for example, “ The employee has a monthly salary of 17,000 rubles

.

Wages are calculated depending on the amount of time actually worked

."

Fill out the order using the unified form No. T-1, in the line “Conditions of employment, nature of work” indicate that the employee is hired on a part-time basis.

Thus, it turns out that in the time sheet, you must mark the actual time worked by the employee, taking into account the working hours established for the employee.

As a rule, only cases of deviations from the normal use of working time established by the internal labor regulations are recorded in the Timesheet (f. 0504421). In the upper half of the line, for each employee who had deviations from the normal use of working time, hours of deviations are recorded, and in the lower half - symbols of deviations.

If you keep a complete registration of appearances/no-appearances, then for days off from work such an employee must be marked with the letter designation of the day off “B”.

If we proceed from a 36-hour week, we find that at 0.6 rates an employee must work 0.6 * 36/5 = 4.32 hours a day with a five-day work week.

Features of the working time and rest time regime for teaching and other employees of educational institutions are prescribed in Order of the Ministry of Education and Science of the Russian Federation dated March 27, 2006 N 69 “On the peculiarities of the working time and rest time regime for teaching and other employees of educational institutions”

https://budget.1kadry.ru/#/document/99/901975022/?step=34.

Details in the materials of the Personnel System:

1.Answer: How to set the work schedule for a teaching worker

Legislative regulation of working hours

What documents regulate the working hours of teaching staff?

The working hours of teaching staff of educational organizations are regulated by:

Reduced working hours

How to establish reduced working hours for teaching staff

Teaching staff are provided with a reduced working time, which should not exceed 36 hours per week (Article 333 of the Labor Code of the Russian Federation, Article 47 of the Law of December 29, 2012 No. 273-FZ). Depending on the position and (or) specialty, taking into account the characteristics of their work, teaching staff may be assigned a different (less than 36 hours) duration of the shortened working week (Order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601).

You will have no questions about the additional payment for the title of honored teacher after reading the article at the link.

Thus, a 20-hour work week is established for speech pathologists and speech therapists. The norm equal to 18 hours per week is determined for teachers of educational organizations implementing basic general education programs, including adapted ones (clause 2 of Appendix 1 to the order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601). The specified hours norm is determined in astronomical hours and short breaks (changes) between them, as well as a dynamic pause (clause 2 of the note to Appendix 1 to the order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601).

During working hours, teaching staff, depending on their position, include:

- educational (teaching) and educational work;

- individual work with students;

- scientific, creative and research activities;

- other types of teaching work provided for by job responsibilities and (or) individual plan;

- methodological, preparatory, organizational, diagnostic, monitoring work;

- work provided for by plans for educational, physical education, sports, creative and other events carried out with students.

Time sheet for the first half of the month

Timesheet - sample completion Management has the right to assign anyone to perform this task.

To do this, an order is issued indicating the position and name of the responsible person.

If an order to appoint such an employee is not issued, then the obligation to keep records must be specified in the employment contract. Otherwise, it is unlawful to require an employee to keep records.

In large organizations, such an employee is appointed in each department. He fills out the form within a month, gives it to the head of the department for signature, who, in turn, after checking the data, passes the form to the personnel officer. The HR department employee verifies the information, fills out the documents necessary for his work based on it, signs the time sheet and passes it to the accountant.

In small companies, such a long chain is not followed - the accounting sheet is kept by a personnel employee, and then immediately transferred to the accounting department. However, a clarification will appear: “Wages are paid at least every half month.

The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.” Those. and the new version of Art. 136 of the Labor Code of the Russian Federation does not provide for prepayment of wages.

The concept of “advance” is mainly used in accounting literature and some explanations of Rostrud. The establishment of advance payments is not prohibited by current legislation.

But in this case, the employer bears certain risks associated with the return of amounts overpaid to employees.

Within the framework of Art. 136 of the Labor Code of the Russian Federation, it is more correct to talk specifically about settlements with employees for the first and second half of the month. Before marking vacation on your time sheet, it is important to know the following points:

- vacation period - from what date to what date the employee rests;

- what type of leave to indicate;

- what method is used to fill out the timesheet - continuous or only deviations are recorded?

Different types of leave are indicated in the report card by the following abbreviations: FROM regular paid leave OD additional paid TO administrative (without retaining salary) U educational with retention of salary HC training without interruption from work (reduced day) UD educational without retaining salary R for pregnancy and childbirth OZ for caring for a child under 3 years of age without retaining a salary in cases provided for by law DB additional without retaining a salary When using both methods of filling out a time sheet, the vacation symbol is affixed for each day of the employee’s absence.

Salary for the first half of the month: how to calculate the advance and what amounts to withhold from it

August 27 August 27, 2020 One of the hottest topics that accountants discuss is the calculation of advance wages, or wages for the first half of the month. Experts cannot agree on a number of issues. Is it permissible to determine the amount of the advance as a percentage of the salary?

Is it possible to make deductions when issuing an advance?

Do I need to calculate the advance taking into account vacation pay, additional payments and bonuses?

We studied all the arguments for and against, formed our own position and presented it in this article. An article of the Labor Code obliges the employer to pay wages at least every half month.

The same article establishes the timing of salary payment: no later than 15 calendar days from the end date of the period for which it was accrued. The payment for the first half of the month is usually called an advance, and the payment made at the end of the month is the salary itself.

Today, neither the Labor Code of the Russian Federation nor other legal acts provide clear instructions on how much an advance payment should be charged. It is also not completely clear what deductions to make from the advance payment and what payments to include in it. The employer has no choice but to form his own opinion and consolidate it in local regulations.

There is a lot of controversy about the question of whether it is possible to issue an advance in a fixed amount that does not depend on the actual time worked.

Simply put, does the employer have the right to determine the amount of the advance as a percentage of the employee’s monthly salary.

Proponents of this method give the following arguments. Firstly, it allows you to calculate the time worked, calculate all additional payments due and make all the necessary deductions only once a month, which significantly saves the accountant’s effort and time. Secondly, this method corresponds to business customs, because most employers traditionally determine the amount of the advance as a percentage of the salary.

Thirdly, there are official explanations from officials that confirm the legitimacy of this approach.

Filling out the working time sheet correctly

Didukh Yulia Author PPT.RU February 15, 2020 Labor legislation obliges employers to keep records of the time worked by employees.

Organizations, regardless of legal status, and individual entrepreneurs must take into account hours worked. Especially for this purpose, the State Statistics Committee has developed and approved forms of the Time Sheet N T-12 and N T-13.

ConsultantPlus TRY FOR FREE We will provide instructions for filling out, which will help you correctly reflect the data and use the timesheet rationally. The working time sheet, approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1, helps the personnel service and accounting department of the enterprise:

- take into account the time worked or not worked by the employee;

- have official information about the time worked by each employee for calculating wages or preparing statistical reports.

- monitor compliance with the work schedule (attendance, absence, lateness);

It will help the accountant confirm the legality of accrual or non-accrual of wages and compensation amounts for each employee.

The HR officer must track attendance and, if necessary, justify the penalty imposed on the employee. A time sheet refers to the forms of documents that are issued to an employee upon dismissal along with a work book upon his request (). It is worth noting that the unified forms of report cards N T-12 and N T-13 from January 1, 2013

are not required for use.

However, employers are required to keep records (Part.

4 ). Organizations and individual entrepreneurs can use other ways to control the time employees spend at work.

But in fact, the form format developed by Gostkomstat is quite convenient and continues to be used everywhere.

According to the Instructions for the use and completion of forms of primary accounting documents:

- the work time sheet for 2020 is compiled and maintained by an authorized person;

- the document is signed by the head of the department and the HR employee;

How to calculate a salary advance - new calculation rules

> > September 23, 2020 How to calculate a salary advance?

It is not at all easy to answer this question unambiguously, because not only the procedure for calculating the advance payment, but also this concept itself is not explicitly defined by labor legislation.

And for incorrect calculation of the advance payment, the employer may face fines.

How to be? Let's figure it out. Anyone who has worked for hire understands what an advance is on a practical level. In the second half of the month, employees receive a certain amount. As a rule, it is some percentage of the salary. This part of the salary that employees receive during the pay month is traditionally called an advance.

If we turn to labor legislation, the basis of which is the Labor Code of the Russian Federation, then this concept is explicitly absent there.

But the Labor Code of the Russian Federation regulates the procedure for paying wages. Law dated July 3, 2016 No. 272-FZ introduced corresponding amendments to Art.

136 code. The current version of this article determines that employees must receive wages at least once every 2 weeks and no later than 15 calendar days from the end of the pay period. It is clear that fully calculating your monthly salary is more difficult than calculating an advance.

Therefore, in practice, the organization first determines the salary payment date. In accordance with Art. 136 of the Labor Code of the Russian Federation, it must be installed in the period from the 1st to the 15th of the next month. Which specific number to choose in this range depends on the organization of accounting at the enterprise.

The better the exchange of information between services is organized and the higher the degree of automation of accounting, the sooner wages can be calculated and paid. After setting the salary payment date, half a month (15 days) must be added to it. This is how the advance payment date is determined in accordance with the requirements of the Labor Code of the Russian Federation.

Calculation for the first half of the month, two formulas for the non-advance method

The non-advance method involves calculating wages for the first half of the month according to the time sheet.

For example, if the deadline for salary payment is set on the 4th, then the advance must be issued no later than the 19th, if it is 8th, then no later than the 23rd, etc. What if the advance is issued earlier than 15 days? For example, on the 12th when the salary payment date is 5.

The Ministry of Labor provided two formulas. The first formula from the Ministry of Labor The first formula from the Ministry of Labor takes into account two indicators: the basis for calculating the advance payment and the time worked (letters from the Ministry of Labor dated 02/05/2020 No. 14-1/OOG-549 and dated 04/04/2020 No. 14-1/OOG-2146).

Basis for calculating the advance payment. Officials ordered that the advance be calculated from the salary and mandatory payments, which can be calculated for the first half of the month: additional payments and allowances for working conditions, performing additional work, overlapping, etc. Working hours. The Ministry of Labor believes that the employee has the right to receive for the first half of the month the amount actually earned in proportion to the time worked. To find out the time worked, you need to close the timesheet.

In this case, the first half of the month is understood as the period of time from the 1st to the 15th. “The Labor Code does not clarify what is considered the first half of the month. From Article 192 of the Civil Code it follows that the first half of the month is a period of 15 days.

In the unified form of the timesheet, half of the month is defined as follows: 15 days from the 1st to the 15th and from the 16th to the end of the month. In this document you enter the number of days worked, including for the first half of the month.

At the same time, it will not contradict the requirements of the Labor Code if for February you take the period from the 1st to the 14th.” The first formula for calculating the advance, according to the Ministry of Labor, can be presented as follows: The second formula from the Ministry of Labor The second method implies that the advance is also reduced by the amount of personal income tax - using a coefficient of 0.87 (see.

comment below). However, do not be confused: you do not withhold personal income tax, but simply take it into account when calculating. After all, the entire amount of wages is taxed, including for the first half of the month (letter of the Ministry of Finance dated 02/07/2020 No. 03-04-05/7113). You will withhold personal income tax and pay only at the end of the month.

“The Labor Code does not establish how to determine the amount of the salary advance. In practice they use

How to fill out a timesheet for the first half of the month?

Answer to the question: Today Art.

136 of the Labor Code of the Russian Federation does not contain such a concept as “advance payment”. An advance is an advance payment, i.e. payment “in advance” for a period of time not yet worked. From October 3, 2020, a new version of Article 136 of the Labor Code of the Russian Federation will come into force.

In this regard, there will be a change in the timing of salary payments in 2016. Article 136 of the Labor Code of the Russian Federation will continue to provide that salaries must be paid “at least every half month.”

However, a clarification will appear: “Wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.” Those. and the new version of Art. 136 of the Labor Code of the Russian Federation does not provide for prepayment of wages.

The concept of “advance” is mainly used in accounting literature and some explanations of Rostrud. The establishment of advance payments is not prohibited by current legislation. But in this case, the employer bears certain risks associated with the return of amounts overpaid to employees.

Within the framework of Art. 136 of the Labor Code of the Russian Federation, it is more correct to talk specifically about settlements with employees for the first and second half of the month. The part of the salary that must be paid based on the results of the first half of the month cannot be less than the tariff rate or salary for the time actually worked or work performed (letters,).

That is, salaries need to be calculated for every half month in approximately equal amounts, excluding bonus payments, provided that the full standard of time is worked.

And to record and confirm the time worked for the first half of the month, a time sheet is used.

Thus, in accordance with Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee for each half of the month.

The time sheet is filled out for the period for which wages are paid. This conclusion follows from (this condition is included in the instructions for filling out the report card) Also, the form of the report card itself is T-13 and

Advance sheet: is it necessary or not?

The concept of “advance” is not enshrined in labor legislation. Since the employer is obliged to pay his employees wages every half month, payment for the first half of the month is called an advance. We have not encountered any legal disputes with labor inspectors who fined us for paying an advance in a fixed amount or as a percentage of the salary. But, taking into account the opinions of the Ministry of Labor and Rostrud specialists, and also taking into account the inconveniences associated with fixed advances, we will consider in more detail the safest option. By the way, according to a survey on our website, 33% of accountants calculate an advance based on time worked.

It should be noted that the Labor Code does not contain such a thing as an “advance” at all: according to its wording, this is wages for the first half of the month. And the widely used concept of “advance” came from a Soviet-era document, Resolution of the USSR Council of Ministers dated May 23, 1957 No. 566 “On the procedure for paying wages to workers for the first half of the month,” which is still in effect to the extent that does not contradict the Labor Code of the Russian Federation. Therefore, to make it easier to understand, in this article, advance means wages for the first half of the month. From October 3, 2020, a new version of Article 136 of the Labor Code of the Russian Federation will come into force. In this regard, there will be a change in the timing of salary payments in 2020.

The same order determines the procedure for its completion and application. We suggest you choose the appropriate one and download the time sheet (simple form). Form T-12 Download Form T-13 Download Form OKUD 0504421 Download How to record time worked For any length of the working day, regardless of the established modes, working time can be reflected in the accounting table in two ways:

- method of continuous registration of attendance and absence from work;

- by recording only deviations (no-shows, overtime, etc.).

The timesheet contains notes on the actual time worked, hours worked per month, incl. overtime, evening, night work hours, etc., as well as other deviations from normal working conditions.

They must be entered in the main part of the timesheet in order to briefly and clearly reflect the amount of time actually spent by one or another employee at the workplace, as well as the reasons for his absence from work. If HR department specialists need to enter some additional codes into this timesheet form, they can be developed independently and entered into this table. Recording working time in T-12 This section in the timesheet is the main one - it is in it that working time is recorded.

So, for wages, the frequency of payment is established at least every half month. At the same time, other payments to employees have their own deadlines:

- vacation pay must be paid no later than 3 days before the start of the vacation;

- Severance pay must be paid on the day the employee leaves.