How to calculate penalties for osms contributions

To avoid late payments with the subsequent creation of a posting for penalties on insurance premiums, it is better to pay the insurance premium in advance. To avoid sanctions, we recommend reading articles about when to pay and to whom to transfer insurance premiums.

Fines and penalties for policyholders in 2020 Previously, penalties for non-payment of insurance premiums to the Pension Fund were regulated by Art. 47 FZ-212. Now this law is invalid, and the calculation and payment of these contributions, including all penalties, are regulated by the Tax Code of the Russian Federation, in particular Article 34.

The policyholder bears administrative responsibility and pays a fine; late insurance premiums 2020 are subject to financial penalties in the following cases.

Violation Fine Violation of deadlines for payment of contributions Penalty 5% of the amount of unpaid contributions for each overdue month within the following limits: no less than 1000 rubles and no more than 30% of the total amount of contributions (Art.

How to pay penalties on insurance premiums

Changes came into force in 2020. The functions of accepting payments for insurance of citizens, accepting reports and administering the payment process were transferred to the tax office. In connection with the changes, the two hundred and twelfth Federal Law lost its force, and the Tax Code was supplemented with the eleventh section, which explains in detail all the new rules for the payment of obligations to insurance funds.

Rules from the scrapped law adopted in 2009 are sometimes still applied to debts and reports for periods that were completed before innovations in the legislative framework. Accounting Insurance premiums in accounting must be displayed based on the period for which they are paid.

To carry out the operation of paying penalties for late payment of the insurance premium, debit accounts are used - 08. 20, 23, 25-26, 29, 44, 91, credit account - 69.

Arrears on insurance contributions to the Pension Fund, FSS, FFOMS: calculation of penalties

Entries for accrual of penalties for insurance premiums in accounting Entries for penalties for insurance premiums, the accountant reflects:

- on the date of calculation (it is reflected in the calculation certificate), if the company calculates them independently;

- on the date of entry into force of the decision of the inspection body, if the amounts are accrued based on the results of the inspection.

Penalties on insurance premiums, postings, are reflected in the debit and credit of the following accounts: Reflection of the transaction in accounting Debit Credit Penalties on insurance premiums accrued, posting 99 69 Penalties paid on insurance premiums, posting 69 51 Instructions for using the chart of accounts, which is approved Order of the Ministry of Finance of the Russian Federation dated No. 94n states that to reflect accrual transactions, it is permissible to use account 99 in correspondence with 69, and when paying - accounts 69 and 51.

Penalties on insurance premiums: example, postings, calculation

In order to quickly calculate penalties for insurance premiums, download a convenient calculator for calculating penalties for taxes and contributions. Accounting for insurance premiums Insurance premiums are calculated monthly.

Postings are created in the period to which the calculated amounts relate. Accruals are displayed on account 69.

Organizations must ensure analytical accounting of funds; for this purpose, appropriate sub-accounts are opened.

Entries for accounting for penalties on insurance premiums Typical accounting entries are provided in the table below. Name of transaction Debit Credit Insurance premiums accrued to the Pension Fund 20 (25, 26, 29, 44) 69.2 Accrued for payment to the Social Insurance Fund 20 (25, 26, 29, 44) 69.1 Accrued to the Compulsory Medical Insurance Fund 20 (25, 26, 29, 44) 69.3 Late interest accrued 91 69 Set amounts transferred to funds 69 51 Example #1.

How does the Internal Revenue Service calculate penalties on insurance premiums?

Moreover, for each type of compulsory insurance, an independent payment order should be generated with the transfer of funds in favor of the fund.

A monthly mandatory insurance payment is provided for persons paying remuneration to employees and deducting contributions from these amounts for various types of insurance (for employers, which may be foreign or Russian legal entities, individual entrepreneurs, private practitioners).

For those payers who do not have employees, mandatory medical and pension payments are provided, paid to the accounts of the Federal Compulsory Medical Insurance Fund and the Pension Fund of the Russian Federation until the end of the current year. These payments are made for oneself and are mandatory; they are calculated by payers independently, taking into account the current minimum wage and the level of income insofar as it exceeds 300,000 rubles.

in year.

How to calculate penalties on contributions in 2020 postings

If there is not enough money in the debtor’s accounts to cover the debt, the bank will write it off to the fund upon receipt. If the debtor does not have the required amount of money, the arrears can also be seized in the form of other property; the procedure for this procedure is determined by paragraph 20 of Law No. 212-FZ.

Important If the two-month deadline for making a decision is missed, then the issue of collecting the arrears can be transferred to the judicial authorities. The application may be sent to the court within six months from the date of expiration of the allotted period for repaying the debt. Attention: If the six-month period is missed, and the reason is valid, then the period can be restored through the court. How to pay arrears on insurance premiums? When receiving a request from the fund, the policyholder should look at the period specified in it for payment of the debt. If the period is not specified, then it is considered equal to 10 days from the date of receipt.

Kbk penalties for insurance premiums in 2017-2019

Let's list some of them. Clause 1 of this article stipulates that a penalty is an amount of money that a taxpayer must pay in the event of paying the due amounts of taxes later than the deadlines established by the legislation on taxes and fees.

Simply put, if you are late in paying your taxes, penalties will be charged on the debt. The tax penalty is calculated based on the refinancing rate (key rate) of the Central Bank of the Russian Federation according to the following formula (clauses 3, 4 of Art.

75 of the Tax Code of the Russian Federation): The number of days overdue for penalties on taxes is determined from the day following the due date for payment of the tax, and to the day preceding the day of its payment (clauses 3, 4 of Art.

How to calculate penalties for insurance premiums

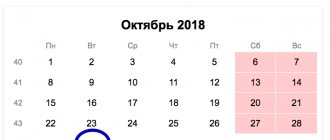

It is also clarified that if the last day of payment (15th) falls on a weekend or holiday, the transfer obligation can be fulfilled on the first weekday, after the red day of the calendar.

Amount The amount of the penalty accrued for late payment can be calculated independently. The Tax Code determined that penalties are assigned in the amount of one three hundredth of the refinancing rate of the Central Bank of the Russian Federation for each day of delay.

This sanction amount is applied the first month after non-payment of the main contribution.

If the defaulter delays payment of contributions even after the expiration of one month, then another penalty begins to accrue on the amount of the debt. Its size doubles compared to its original size.

Tax service. Extra-budgetary funds no longer administer them. We will tell you what the fines for late and non-payment are, how to calculate and where to pay penalties on insurance premiums.

Fines and penalties for insurance premiums, as well as the insurance amounts themselves, must be transferred to the account of the territorial Federal Tax Service.

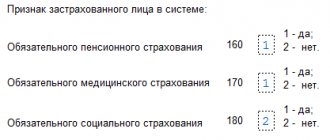

Explanations on the procedure for transfer and payment are provided by the Ministry of Finance and the Federal Tax Service - these bodies are entrusted with the responsibility to inform payers about issues of application of legislation. According to Chapter 34 of the Tax Code of the Russian Federation, the Tax Service controls the payment of contributions for:

- OPS (compulsory pension insurance);

- Compulsory medical insurance (compulsory health insurance);

- social insurance in connection with maternity.

Source:

Legislation

Until 2020, the procedure for paying insurance premiums was controlled by Federal Law No. 212 of July 24, 2009 “on insurance premiums.”

Changes came into force in 2020. The functions of accepting payments for insurance of citizens, accepting reports and administering the payment process were transferred to the tax office. In connection with the changes, the two hundred and twelfth Federal Law lost its force, and the Tax Code was supplemented with the eleventh section, which explains in detail all the new rules for the payment of obligations to insurance funds.

Rules from the scrapped law adopted in 2009 are sometimes still applied to debts and reports for periods that were completed before innovations in the legislative framework.

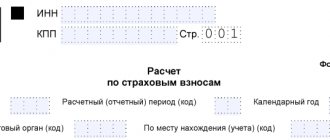

Filling out a payment order to pay penalties on insurance premiums in 2020

When transferring penalties, most fields of the payment order are filled out in the same way as when transferring the contribution itself. But you cannot transfer the fee and penalties in one payment. Payments for contributions and penalties must be separate.

Therefore, the easiest way is to take a payment slip to pay the corresponding contribution and change several details in it for transferring the penalty:

- Budget classification code,

- Basis of payment,

- Taxable period,

- Date and document number.

You can fill out a payment order from a blank form. Next, we will tell you how to fill out each payment details.

"Head" of payment

At the top of the payment order we indicate its number and date. Here we indicate the type of payment. If the payment order is generated in a remote banking program, for example, a client bank, leave this field blank.

Nearby is the “payer status” detail. We fill it out in the same way as in a payment order for the payment of a contribution, the penalty for which we are going to transfer. Let us recall the possible payer statuses:

The Ministry of Labor changes the deadline for paying vacation pay

Then write the payment amount twice:

- First, write the amount of rubles in capital letters, the amount of kopecks in numbers. We write the words “rubles” and “kopecks” in full without abbreviations,

- Then rubles and kopecks in numbers.

We pay penalties in rubles and kopecks. If the amount is in whole rubles, then it can be indicated as follows: “199=”, that is, without kopecks.

Payer details

Then fill in the payer details:

- Company name,

- If the payer is an individual, then indicate his status, for example, “Individual entrepreneur Aleksey Ivanovich Sergeev”,

- payer's TIN,

- checkpoint of the organization. In payments on behalf of individuals, we leave the checkpoint field empty,

- Bank details: Current account,

- BIC,

- Correspondent account,

- Name of the bank.

If a payment order is issued in a banking or accounting program, all details will be entered into the payment order automatically.

Payment recipient details

The recipient of the payment may be your Federal Tax Service or the territorial body of the Social Insurance Fund. If you do not know your payment details, then:

- Payment details of your Federal Tax Service can be found on the official website of the Federal Tax Service of Russia,

- FSS payment details are available on the official websites of regional branches of the fund, but not all. Therefore, it is better to clarify the details for transferring money at your FSS branch.

Fill in the recipient's name as follows:

- First we write “UFK for...”, enter the name of the region, for example, “UFK for Moscow”,

- Then in parentheses we write the name of our tax inspectorate or FSS branch, for example, “UFK for Moscow (IFTS of Russia No. 43 for Moscow)”, or “UFK for Moscow (GU - Moscow regional branch of the FSS of the Russian Federation l / s 40100770142)".

Next, we indicate the TIN and KPP of the payment recipient, as well as bank details: bank name, BIC and account. We do not indicate a correspondent account in budget payments.

Fill in the group of details located nearby:

Budget payment fields

The first difference between a payment order for the payment of a fine and the payment of the fee itself is another BCC:

Full KBK table for transferring contributions >>>

Next, enter OKTMO - the code of your municipality. You can find out your OKTMO on the official website of the Federal Tax Service of Russia.

Then there is the “Base of payment” detail; it is also filled out differently than in the payment slip for payment of the contribution. Here we indicate one of the letter combinations:

- ZD – if we voluntarily transfer the debt for penalties,

- TR - if you received a requirement from the Federal Tax Service or the Social Insurance Fund,

- AP – if the payment of the penalty is made according to the inspection report.

The next field is the tax period for which the payment is made. If you transfer penalties on demand or an inspection report, then these documents indicate the period for which the penalties must be paid. If the payment is made voluntarily, that is, the code “ZD” is indicated in the previous field, then in the “tax period” field we put zero.

We also indicate zero if the tax period cannot be determined. For example, when several penalties accrued for different tax periods are transferred in one amount.

Then we indicate the number and date of the request or inspection report for which we make payment. If the penalty is transferred voluntarily, and there is no demand or act, then we put zeros in these fields.

Finally, fill out the payment purpose. We write that we are transferring penalties, indicate for which insurance premium we are paying penalties, and the details of the basis document, if any.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia from No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

Calculation of penalties for insurance premiums in 2020 - 2020

Since 2020, the rules for determining the amount of penalties are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, containing 2 calculation formulas, in which the amount of debt is multiplied by the number of days of delay and by a rate equal to:

- 1/300 of the refinancing rate - applies to individuals and individual entrepreneurs (regardless of the number of days of delay in payment) and for legal entities that are late in payment by no more than 30 calendar days;

- 1/150 of the refinancing rate - valid only for legal entities and only for a period of delayed payment exceeding 30 calendar days, while for 30 days of delay a rate of 1/300 will be applied.

“Unfortunate” contributions, which continue to be supervised by the FSS, are subject to the procedure described in Art. Law “On Social Insurance against Accidents and Occupational Injuries” dated No. 125-FZ, and are calculated using a formula similar to those described above using a rate of 1/300 of the refinancing rate.

The refinancing rate in each of the above calculations is taken in its actual values during the period of delay. That is, if it changed during the calculation period, then such a calculation will be divided into several formulas using their own refinancing rates.

penalty calculator will help you correctly calculate the amount of penalties .

Fines and penalties for policyholders in 2020

Previously, penalties for non-payment of insurance contributions to the Pension Fund were regulated by Art. 47 FZ-212. Now this law is invalid, and the calculation and payment of these contributions, including all penalties, are regulated by the Tax Code of the Russian Federation, in particular Article 34.

The policyholder bears administrative responsibility and pays a fine; late insurance premiums 2020 are subject to financial penalties in the following cases.

With Law 250-FZ, amendments were made to the Criminal Code of the Russian Federation, and now tax violators for non-payment of contributions in especially large amounts (from 5 million rubles), which arose after, are brought to criminal liability on the basis of Part 1 of Art. 10 of the Criminal Code of the Russian Federation.

If an organization deliberately does not pay, then the investigative committee opens a criminal case under Art. 199 of the Criminal Code of the Russian Federation for failure to provide reporting or indicating false information in it.

The maximum fine for the above crime is 500,000 rubles, the maximum prescribed criminal term is 6 years. When paying the total amount of SV together with penalties after the calculation of penalties for insurance contributions to the Pension Fund and other authorities, criminal liability from the offender will be removed, but only on the condition that this was the first violation of this nature.

In May 2020 (letter No. 03-02-07/1/31912 dated) the Ministry of Finance of the Russian Federation published additional clarifications on the question of how to calculate penalties on insurance premiums. Inspectors do not have the right to fine an organization for violating deadlines, provided that the established payment forms are submitted on time. Inspectors can only charge penalties on insurance premiums.

Payment of penalties by payment order in 2019-2020

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

You can calculate penalties using our calculator .

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Since 2020, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated No. 132n. Order No. 65n has lost force. But this will not affect the general procedure for assigning penalties to BCC.

Filling out a payment form when paying a fine

The differences between paying the tax amount and the penalty amount lie in filling out several fields of the payment order:

- Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the supervisory authority or “AP” - when accruing penalties according to the inspection report.

- Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement.

- Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

As for the BCC (field 104), for penalties on contributions paid to the Federal Tax Service in 2019-2020, they are as follows:

And for contributions for injuries, which remain under the jurisdiction of the FSS, the KBC for penalties is 393 1 0200 160.

How to meet the payment deadline for social contributions, read in this material .

Indicators for calculating penalties

Several types of insurance are provided.

Including:

- pension;

- medical;

- associated with disability and motherhood.

The periods taken into account are from 2010 to 2020, as well as from 2020 to 2020.

| Basis of contributions | from 2010 to 2020 | from 2020 to 2020 |

| Pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Health insurance | 182 1 0211 160 | 182 1 0213 160 |

| The citizen's inability to work or pregnancy, childbirth | 182 1 0200 160 | 182 1 0210 160 |

| If contributions are related to work-related injuries | 393 1 0200 160 | 393 1 0200 160 |

The KBK indicator for contributions based on an injury at work remained unchanged.

KBC for paying penalties at additional rates

Order No. 35 of the Ministry of Finance of 2020 contains updated BCC indicators. This applies to penalties and fines used for additional tariffs. They are contributed to pension authorities for citizens working in hazardous industries.

Additional tariffs are established for taxpayers engaged in harmful and dangerous work. Employees in these positions have the right to early retirement.

The amount of additional tariffs varies depending on the inherent hazard class. It is established when assessing the activities of the enterprise.

Order of the Ministry of Finance No. 35 of 2020 came into force on April 23, 2019.

This means that from this day on, the size of the penalty depends on the assessment of production. It should be noted that the division into periods, which was used previously, has been canceled.

Payment of penalties to the Pension Fund

As a result of the resulting delay in paying contributions to the policyholder, starting from the first day of non-payment and until the day of actual payment of the amount of contributions, penalties are calculated by the Pension Fund of the Russian Federation (excluding non-working days - from the 16th day of the month following the reporting period). Penalties for late payment of contributions to the Pension Fund are calculated in accordance with Art. 25 Federal Law No. 212 of the city (in 2020 it becomes invalid with the entry into force of the Federal Law No. 250 of the city).

How to calculate penalties for insurance premiums?

Penalties for late contributions to the Pension Fund are calculated based on 1/300 of the refinancing rate officially adopted by the Central Bank for a given period of time. From the beginning of 2020 to the current moment, by a separate resolution of the Bank of Russia, the refinancing rate is equal to the key rate and it is equal to 10% (at the end of 2019).

In order for the employer to determine the exact amount of the Pension Fund penalty, which was formed as a result of the delay in payment of contributions due to the fault of the policyholder himself, it is necessary to perform the following actions:

P = SV x D x SR / 300

The amount of penalties for late contributions to the Pension Fund (P) is calculated by multiplying the amount of insurance premiums accrued for payment for the reporting period (SV) by the number of overdue days (D) and by the ratio of the refinancing rate of 1 to 300 (SR/300).

Example of penalty calculation

The debt to the Pension Fund is 23,000 rubles. The overdue payment period is 25 days. We calculate the penalties:

23,000 x 25 x 10% / 300 = 191.67 rubles.

After the policyholder has received the final amount of the penalty, he must pay it to the Pension Fund. This can be done together with the payment of insurance premiums, as well as separately from their payment, but only after they are sent to the Pension Fund. When paying penalties on insurance premiums, a special BCC must be indicated in the payment slip; it differs from what is used to pay the insurance premiums themselves.

If the policyholder does not transfer the fines voluntarily, they will be forcibly claimed from funds from his account. To do this, the Pension Fund of the Russian Federation, no later than two months from the date of discovery of the delay, must send an order to the bank to write off the required amount from the policyholder’s account. If there is no account, no funds in the account, or insufficient funds to cover the amount of the penalty, the funds will be collected by the Pension Fund from the organization’s property.

Penalties cannot be charged to the policyholder in the following cases:

- if the policyholder made an incorrect calculation of the amount of insurance premiums or the procedure for their payment, based on the information provided to him by the authorized bodies (persons of these bodies);

- due to the blocking of the organization’s accounts by a court decision (no penalties can be charged throughout the entire time the accounts are frozen).

Payment of penalties for insurance premiums: KBK, payment order for 2020 - sample

Late payment of taxes or contributions is followed by tax penalties in the form of penalties. It is important to fill out the payment form correctly, because in case of an error the amount will be considered not transferred. In this article, we will tell you how to fill out a payment order to pay penalties for insurance premiums in 2020, and show a sample of filling out a payment order to pay penalties for each premium.

Accountants have the right to work an hour less>>>

Calculate your salary in the Simplified 24/7 program for free, online

Payment of penalties on insurance premiums: payment order for 2018

To transfer penalties, use a unified payment order form approved by Bank of Russia Regulation No. 383-P dated.

Blank payment order form>>>

Filling out a payment order to pay penalties on insurance premiums in 2020

When transferring penalties, most fields of the payment order are filled out in the same way as when transferring the contribution itself. But you cannot transfer the fee and penalties in one payment. Payments for contributions and penalties must be separate.

Our colleagues from the Simplified magazine have created a very convenient electronic reporting service. First of all, it is focused on salary reporting - 6-NDFL, RSV, 4-FSS, SZV-M, SZV-STAZH. Service “Simplified 24/7.

Reporting" is used via a web browser; there is no need to install the program on your computer. Upload any report and click the “Submit” button. Next you will receive confirmation that the report has been accepted. The price for a year is only 2938 rubles. - You won't find a lower price.

We’ll connect you to the system within 24 hours, you don’t have to go anywhere, everything is done remotely.

Sample

Therefore, the easiest way is to take a payment slip to pay the corresponding contribution and change several details in it for transferring the penalty:

- Budget classification code,

- Basis of payment,

- Taxable period,

- Date and document number.

You can fill out a payment order from a blank form. Next, we will tell you how to fill out each payment details.

"Head" of payment

At the top of the payment order we indicate its number and date. Here we indicate the type of payment. If the payment order is generated in a remote banking program, for example, a client bank, leave this field blank.

Nearby is the “payer status” detail. We fill it out in the same way as in a payment order for the payment of a contribution, the penalty for which we are going to transfer. Let us recall the possible payer statuses:

3 important September salary changes:

We have opened VIP access to the magazine “Salary” especially for site visitors. Activate access to read articles.

Activate access

Then write the payment amount twice:

- First, write the amount of rubles in capital letters, the amount of kopecks in numbers. We write the words “rubles” and “kopecks” in full without abbreviations,

- Then rubles and kopecks in numbers.

We pay penalties in rubles and kopecks. If the amount is in whole rubles, then it can be indicated as follows: “199=”, that is, without kopecks.

Payer details

Then fill in the payer details:

- Company name,

- If the payer is an individual, then indicate his status, for example, “Individual entrepreneur Aleksey Ivanovich Sergeev”,

- payer's TIN,

- checkpoint of the organization. In payments on behalf of individuals, we leave the checkpoint field empty,

- Bank details: Current account,

- BIC,

- Correspondent account,

- Name of the bank.

If a payment order is issued in a banking or accounting program, all details will be entered into the payment order automatically.

Payment recipient details

The recipient of the payment may be your Federal Tax Service or the territorial body of the Social Insurance Fund. If you do not know your payment details, then:

- Payment details of your Federal Tax Service can be found on the official website of the Federal Tax Service of Russia,

- FSS payment details are available on the official websites of regional branches of the fund, but not all. Therefore, it is better to clarify the details for transferring money at your FSS branch.

Fill in the recipient's name as follows:

- First we write “UFK for...”, enter the name of the region, for example, “UFK for Moscow”,

- Then in parentheses we write the name of our tax inspectorate or FSS branch, for example, “UFK for Moscow (IFTS of Russia No. 43 for Moscow)”, or “UFK for Moscow (GU - Moscow regional branch of the FSS of the Russian Federation l / s 40100770142)".

Next, we indicate the TIN and KPP of the payment recipient, as well as bank details: bank name, BIC and account. We do not indicate a correspondent account in budget payments.

Fill in the group of details located nearby:

Budget payment fields

The first difference between a payment order for the payment of a fine and the payment of the fee itself is another BCC:

Full KBK table for transferring contributions >>>

Next, enter OKTMO - the code of your municipality. You can find out your OKTMO on the official website of the Federal Tax Service of Russia.

Then there is the “Base of payment” detail; it is also filled out differently than in the payment slip for payment of the contribution. Here we indicate one of the letter combinations:

- ZD – if we voluntarily transfer the debt for penalties,

- TR - if you received a requirement from the Federal Tax Service or the Social Insurance Fund,

- AP – if the payment of the penalty is made according to the inspection report.

The next field is the tax period for which the payment is made. If you transfer penalties on demand or an inspection report, then these documents indicate the period for which the penalties must be paid. If the payment is made voluntarily, that is, the code “ZD” is indicated in the previous field, then in the “tax period” field we put zero.

We also indicate zero if the tax period cannot be determined. For example, when several penalties accrued for different tax periods are transferred in one amount.

Then we indicate the number and date of the request or inspection report for which we make payment. If the penalty is transferred voluntarily, and there is no demand or act, then we put zeros in these fields.

Finally, fill out the payment purpose. We write that we are transferring penalties, indicate for which insurance premium we are paying penalties, and the details of the basis document, if any.

Attention!

The Salary Expert School has updated the “Employee Payments” course. Take a training course, watch video lectures and receive a state diploma.

Payment order for penalties on insurance premiums: payer – third party

Penalties on premiums can be paid not only by the policyholder himself, but also by a third party. This opportunity appeared in 2020. Taxes, contributions or penalties can be paid, for example, by the founder, director of the company or any other individual.

Fill out the payment order taking into account the following features:

- In the payer details group, indicate the INN and KPP of the organization for which the payment is being made,

- In the “Payer” field, enter the full name of the person who will go to the bank, for example, a director,

- In the “Payer status” field, indicate the status of the organization for which you are transferring money,

- Complete the purpose of payment as follows: enter the TIN of the individual who is actually transferring the money. Then put the “//” sign and indicate the name of the company for which you are transferring money.

The remaining details are filled out in the same way as in a regular payment.

Errors in payment orders for penalties on insurance premiums

Errors may occur when generating a payment order. Three of them are critical, since with them the penalty will be considered unpaid:

- Invalid recipient account,

- Incorrect Federal Treasury account,

- Invalid recipient tank details.

The remaining errors are non-critical and can be corrected by writing a letter to clarify the payment.

Samples of payment orders for penalties on insurance premiums in 2019

We told you how to fill out all the details of a payment order for the transfer of penalties for insurance premiums. Now let's give examples of filling. You will be able to download all samples.

Payment order for payment of penalties on insurance premiums to the Pension Fund of the Russian Federation: sample

We transfer penalties on contributions to the Pension Fund to the payment details of our tax office:

Payment order for penalties on insurance contributions to the Pension Fund >>>

Payment order for payment of penalties on insurance premiums to the Federal Compulsory Medical Insurance Fund: sample

Since 2020, contributions to the FFOMS are administered by the Federal Tax Service, so we also transfer penalties for medical contributions to the account of our Federal Tax Service:

Payment order for penalties on insurance premiums to the FFOMS >>>

Payment order for payment of penalties on insurance premiums to the Social Insurance Fund: sample

We transfer to the Federal Tax Service only contributions to the Social Insurance Fund in case of temporary disability and maternity:

Payment order for penalties on insurance contributions to the Social Insurance Fund >>>

Payment order for payment of penalties on insurance premiums for injuries: sample

Contributions for injuries are still administered by the Social Insurance Fund, so we pay penalties on these contributions to the territorial department of social insurance:

Payment order for penalties on insurance premiums for injuries >>>

Subscribe to the magazine “Salary” for only 13,900 rubles.

Hurry! The offer is valid for 3 days only.

Call

Subscribe

Source:

Kbk for insurance premiums for 2020: pension, medical, social insurance

BCC for insurance premiums for 2020 are budget classification codes, the purpose of which is the grouping and distribution of payments received by the budget and extra-budgetary funds.

ConsultantPlus TRY FREE

Get access

Insurance contributions to extra-budgetary funds must be paid by all organizations and entrepreneurs, although there are differences in individual insurance contributions for companies with and without employees. There is one detail on which the correct transfer of insurance premiums in 2020 depends - KBC. We will find out what it is, why it is needed and how it changes.

The legislative framework

Before considering the BCC for contributions for 2020, let us remember what these payments are. There are three known types:

- To the Pension Fund. Since January 1, 2017, they have been collected by the Federal Tax Service, and not by the Pension Fund itself. Chapter 34 of the Tax Code regulates payment rules.

- To the Federal Compulsory Medical Insurance Fund. Until 2017, the recipient was the Pension Fund. Now payments are also collected by the tax office in accordance with Chapter 34 of the Tax Code of the Russian Federation.

- To the Social Insurance Fund. Until 2020, he himself accepted both types of contributions. Now insurance premiums in case of sick leave or the birth of a child must be paid to the Federal Tax Service. But the FSS still receives funds for insurance against accidents at work, in accordance with Federal Law No. 125-FZ of July 24, 1998.

Everyone makes contributions to pension and health insurance, regardless of whether individuals work for them or not. Unless organizations calculate their amount from salaries, and individual entrepreneurs pay fixed amounts for themselves.

Only those employers who have concluded at least one employment contract are required to contribute funds to social insurance. Individual entrepreneurs without employees can enter into a relationship with the Social Insurance Fund solely at will.

Purpose of the budget classification code

The Federal Tax Service collects various payments to extra-budgetary funds. They come from different categories of payers and for different purposes. Accordingly, they need to be distributed correctly.

For this purpose, different BCCs have been developed: insurance contributions to the Pension Fund in 2019, paid by an organization, can be separated from:

- payments to the FFOMS and the Social Insurance Fund;

- insurance payments, but from individual entrepreneurs;

- amounts paid for previous years.

The codes also allow you to directly differentiate between deductions, penalties and fines for late payment.

Since in all cases, except for deductions for injuries, payments are accepted by the Federal Tax Service, the codes begin with the numbers 182. The FSS is designated by the numbers 393. The following numbers 102 indicate a subgroup of budget revenues, that is, insurance premiums.

Features of filling out a payment order

If you look at the KBK for 2020, the changes did not affect insurance premiums. So this year there will be fewer mistakes. However, they may occur in the process of filling out other fields in the payment order. Let's look at the most important points:

- Regardless of the type of insurance (pension, medical or social), we indicate as the recipient not the corresponding fund, but the tax office. The exception is deductions for injuries.

- The recipient is not the service itself, but the Federal Treasury Department of the subject of the Federation. The territorial tax authority is given in brackets. For example, the Federal Tax Service for the Leningrad Region (Inspectorate of the Federal Tax Service of Russia for the city of Luga, Leningrad Region).

- We enter the budget classification code in field 104 - immediately below the recipient. We fill it out carefully, since an error leads to non-crediting of money and the accrual of penalties.

Although new BCCs for insurance premiums have not been introduced since 2020, changes should be closely monitored in the future.

Even if the codes are slightly mixed up (for example, pension contributions went to health insurance), no one will redistribute them. The payer must find out this himself and inform the authority. It is advisable to do this before the expiration of the payment deadline, otherwise you will have to pay penalties and fines.

Kbk insurance premiums in 2020: table

Table 1. Basic tariffs.

| Purpose | Code by payment type | ||

| NE | Penalty | Fine | |

| OPS | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OSS VNiM | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

Table 2. Additional tariffs (codes of penalties and fines - in accordance with Order of the Ministry of Finance No. 36n dated 03/06/2019).

| Purpose | Special assessment | Main code | Penalty | Fines |

| Harmful working conditions | Affects | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

| Does not affect | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 | |

| Difficult working conditions | Affects | 182 1 0220 160 | 182 1 0200 160 | 182 1 0200 160 |

| Does not affect | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

Table 3. Injuries.

| Payment type | Code |

| NE | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fine | 393 1 0200 160 |

Table 4. Transfers of individual entrepreneurs for themselves.

| Purpose | Code by payment type | ||

| NE | Penalty | Fine | |

| OPS | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| OPS 1% of profit > 300,000 rubles | 182 1 0210 160 | – | – |

Sample of filling out a payment form

Source: https://ppt.ru/art/kbk/strahovie-novie

Payment order for penalties on insurance premiums: payer – third party

Penalties on premiums can be paid not only by the policyholder himself, but also by a third party. This opportunity appeared in 2020. Taxes, contributions or penalties can be paid, for example, by the founder, director of the company or any other individual.

Fill out the payment order taking into account the following features:

- In the payer details group, indicate the INN and KPP of the organization for which the payment is being made,

- In the “Payer” field, enter the full name of the person who will go to the bank, for example, a director,

- In the “Payer status” field, indicate the status of the organization for which you are transferring money,

- Complete the purpose of payment as follows: enter the TIN of the individual who is actually transferring the money. Then put the “//” sign and indicate the name of the company for which you are transferring money.

The remaining details are filled out in the same way as in a regular payment.

KBK adjustments in 2020

From the beginning of 2020, the provisions of Order No. 132 of the Ministry of Finance dated 06/08/2019 began to be used. After the entry into force of this act, changes occurred in the BCC regarding penalties for insurance premiums.

From January 1 to April 13, 2020, no separate tariff was applied, which depends on the assessment of working conditions. During this time, 2 codes can be used.

These include:

- for professions included in list 1 – 182 1 0210 160;

- for list 2 - 182 1 0210 160.

From April 14, the same calculation procedure as in 2020 began to apply.

Where to pay

Insurance premiums, including penalties, are paid to the territorial tax office according to the established details before the 15th day (inclusive) of the month following the reporting month. The exception is those months when the 15th of the calendar falls on a weekend, then the deadline will be the next working day. To avoid late payments with the subsequent creation of a posting for penalties on insurance premiums, it is better to pay the insurance premium in advance.

To avoid sanctions, we recommend reading articles about when to pay and to whom to transfer insurance premiums.