During the production cycle, basic inventories can be partially consumed or even completely transformed. An inventory of goods and materials will help you understand what condition they are in. Therefore, we want to consider in detail what it is, how and why it is carried out.

Let us immediately note that the manager must provide full assistance in the matter of its implementation: it is much more convenient when the top officials of the organization immediately appoint responsible inspectors, provide all the necessary equipment, equipment, instruments, and also conduct control and immediately analyze the results. At the same time, it is important that auditors be especially accurate in their assessments and support them with relevant documentation, which can later be retrieved from the archive.

What is an inventory of inventories: briefly about the main thing

In general, this is a procedure for checking those company assets that can either be used to produce its own products, or sold, or leased. Considers raw materials, fuel, containers, special equipment, equipment, finished materials - from among those that, according to documents, are in the possession of the enterprise.

It is carried out both on a voluntary basis and in a mandatory form. In the first situation, it is carried out on the initiative of management, in the second - upon the occurrence of one of the cases described in Order No. 119 of the Ministry of Finance of the Russian Federation dated 12/28/01 (we will indicate them below).

It is always necessary to carry out planning, during which the peculiarities of the warehouse structure of the organization are taken into account. And after that - preparation: sealing the warehouses, making sure that there is a sufficient quantity of measuring containers, and that the scales are as accurate as possible, collecting reports on the movement of assets, looking at receipts for the delivery of the necessary papers for accounting, and the like. Representatives of the commission must do this.

Inventory of work in progress

This stage of the inventory process in production is the most difficult. WIP includes:

- semi-finished products of own production , products intended for assembly;

- fully finished products not accepted by the quality control department , or accepted but not transferred to the finished goods warehouse;

- products accepted by the quality control department , but not having ready-made accompanying documentation, appropriate packaging, or necessary accessories manufactured at this or another enterprise;

- products in the testing stage , which can be carried out both within and outside the enterprise;

- semi-finished products and products requiring correction and improvement .

The volume of work in progress largely depends on the complexity and duration of the finished product manufacturing cycle. The following are not related to work in progress:

- rolled metal that has already arrived at the production site, but the processing of which has not yet begun;

- purchased components and semi-finished products that have not yet been taken into the production process;

- semi-finished products and finished products recognized by the quality control department as completely unsuitable and not subject to correction or modification.

WIP balances are usually determined monthly, and the frequency of recording their actual availability is usually once a year.

Main purposes of inventory inventory

- reliable determination of the fact of the presence/absence of property - both owned by the company and temporarily in possession - for the prompt adoption of measures for its safety;

- calculation of the current amount of resources involved during a single production cycle;

- comparison of real information with those indicated in the reporting - to accurately identify shortages or surpluses;

- checking whether the conditions are sufficiently well maintained and whether the rules for storing the mineral oil are observed;

- finding out how completely and correctly the value of assets and liabilities in relation to them is reflected in the accounting documents; determining the possibility of revaluing resources based on changes in their physical condition and the current market situation.

Separately, we note that in the latter case you literally need to be guided by the provisions of Federal Law No. 129, which emphasizes that as a result it is necessary to establish reliable data, and not those that the head of the organization considers profitable or convenient.

What is Inventory Inventory

Inventory is an important point in the activities of every company.

For accounting, it is very important to know exactly what resources the company has and to monitor the safety of property. Inventory can be carried out not only in relation to the company’s property and inventories, but also in relation to liabilities.

Thus, it can be stated that inventory is a recalculation of material assets and liabilities of the company, its documentation to ensure correct accounting . Also, during the inventory process, the state in which the company’s property and its liabilities are located is revealed.

When conducting an inventory, the actual presence of valuables in the organization is revealed. This data is compared with data from accounting programs. After this, a conclusion is made about the identified surpluses or deficiencies, or about the compliance of the inventory results with the accounting data. Along the way, the conditions for storing valuables are clarified. It is not necessary that a complete check be carried out. The calculation can be carried out partially.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What features of inventory inventory are worth highlighting?

We have already mentioned that both voluntary and mandatory audits are possible, but here it is worth adding that, depending on the urgency of implementation, it can be both unscheduled and planned (on schedule). There is also a division into a random inspection, when a specific storage facility is considered, and a full inspection. In this case, assets can be stored at facilities that are considered separate structural divisions, assigned to a specific workshop (department, branch) or not classified.

One of the following commissions has the right to conduct such an audit:

- Permanent – must be an independent internal corporate body that has all the functions that allow it to quickly carry out any types of audits. Usually works at large enterprises for which regular review of reserves is relevant.

- A permanent worker is a kind of assistant to the previous one, obliged to assist her at a specific facility. Most often it is created on the basis of a branch or representative office of a large manufacturer, less often - to evaluate part of the assets (when their total volume is very significant).

- Temporary - established for each individual case, but with a specific frequency and is valid for a limited period. Typically relevant for medium and small companies.

Types of checks during inventory counting

We found that they can be voluntary or not, planned or not, but there is also another important classifier: the assessment method. And there are two revision options for it.

Natural

It includes those objects that can be observed directly: their number is counted, and their condition is determined by visual inspection, their geometric parameters are determined as a result of measurement and weighing, and so on.

Attention, the actual presence/absence of assets is determined only in the direct presence of persons bearing financial responsibility. This rule is stated in guidelines No. 49, clause 2.8.

If the valuables are goods by weight and are presented in large or even huge quantities, when auditing them, statements should be filled out, in two copies and independently: one by a member of the commission, the second by the employee who was entrusted with storage. Upon completion of the work, the data is collated and entered into an inventory, to which all related acts and reports are attached.

Documentary

Possible in cases where goods (raw materials, supplies) are contained in undamaged original packaging and only their quantity needs to be assessed. In such a situation, it is permissible to count on papers, although there is still a reservation.

It is imperative to materially check the sample - a small part of the MPZ - by making all the measurements. Based on the information received, technical calculations of dimensions, weight and volume must be made.

If any errors are identified in the inventories, you must immediately notify the chairman of the commission about the actual discrepancy of the data. As soon as the head is convinced of this, he is obliged to initiate a correction - in accordance with MU No. 49 (clause 2.13).

Carrying out an inventory of inventories in the organization

After the orders are issued, the commission is assembled, and the main stage of inventory begins.

Carrying out inventory activities should not interfere with the current activities of the company. However, during this period all stock movements will have to be suspended. This allows you to avoid errors when making calculations. If some critical case occurs when it is necessary to issue materials from the warehouse or accept them, then such a movement is recorded in a separate statement and then attached to the main documents. If inventory activities are carried out for more than one day, then after the workers go home, all premises are sealed.

It should be borne in mind that the inventory before the annual report is complete; this is a prerequisite.

Initially, the chairman of the commission fills out a document indicating the amount of material assets according to the accounting program.

During inventory, depending on what exactly is being checked, inventory is recalculated, weighed and measured. To reflect the results of the work, an inventory list is drawn up.

Usually, when taking inventory of goods or stocks, a continuous count is carried out. But there are also exceptions. If the valuables are packaged in the supplier’s container and it is not touched, then the calculation is made based on the information on such packaging or on the invoice.

If inventories are weighed, then if there is a large number of weighings, one of the commission members and the responsible employee involved in the inventory carry out the weighings independently of each other. Then the data is verified and entered into the general inventory.

The procedure for conducting an inventory of inventories

All its provisions and features are regulated by the above-mentioned guidelines approved on 13 07 95 by the Ministry of Finance of the Russian Federation. In accordance with them, the following stages are distinguished:

1. Preparation - sealing storage facilities and warehouses, collecting receipts and reports from financially responsible persons.

2. Checking the availability of commodity valuables using a continuous method, that is, by external inspection and recount (and without making a single exception).

3. Weighing and measuring to determine mass, volume, compliance with normal geometric characteristics - with mandatory recording of the result.

4. Determining the completeness of the package of accompanying business papers - it is established whether there are all the necessary instructions for installation and operation, whether the technical passports are in order, whether the declared package is complete.

5. Drawing up acts, inventories, matching statements - to confirm the results of a natural or other audit, as well as when discrepancies are detected (for their further correction).

Cases of mandatory inventory

- Transfer of property for rent, purchase, sale, transformation of a state or municipal unitary enterprise;

- Preparation of annual reports, except for property for which the inventory was carried out no earlier than October 1 of the reporting year;

- Change of financially responsible persons (day of acceptance - transfer of cases);

- If facts of theft or abuse, damage to valuables are established;

- Natural disasters, fire, accident, emergency situations;

- Liquidation, reorganization of an enterprise, before drawing up a liquidation balance sheet, in other cases provided for by the legislation of the Russian Federation.

Paperwork

They are filled out strictly according to the forms approved by Resolution No. 88 of the State Statistics Committee of the Russian Federation, issued on 08/18/98. Moreover:

- INV-3 reflects information about the actual availability of assets, as well as all their movements within one enterprise. In case of detection of damaged or unusable valuables, in addition to it, acts are also drawn up (about scrap, damage, write-off, destruction). Members of the commission fill out chapters No. 1-9.

- INV-4 transparently shows that goods have been shipped but not yet paid for (either on time or not). In this case, the transaction amount, release date, and current account number are entered into the act, drawn up in two copies at once: the first is sent to the accounting department, the second is transferred to the responsible person.

- INV-5 clearly reflects which assets are taken for storage. In this case, the audit of inventories also includes the compilation of inventories, each of which is duplicated - for transferring a copy to the audit specialists.

- INV-6 provides information about what materials are in transit at the time of the inspection.

- INV-8 contains data on precious metals and valuables made from them, and INV-8a contains data on those precious metals that are present in certain quantities in functional units, assembly units of instruments, equipment, and machinery. It is also worth mentioning INV-9, dedicated to natural diamonds, other stones and objects made from them.

- INV-19 sets the rules for drawing up matching statements, which are filled out when discrepancies are detected between actual results and the figures stated in accounting. They are drawn up in two copies, and each is considered separately, and the conclusions and decisions on it are recorded in detail.

- INV-26 succinctly reflects data on the results of inspections for the calendar year.

To minimize errors and generally simplify the inventory of inventories, documents are strictly standardized.

Inventory of tolling assets. Who conducts it and how

Having concluded a tolling agreement, one party (the toller) transfers the tolling raw materials for processing (processing), and the other (the processor) accepts it and makes products from it or simply refines it. The owner of both the raw materials and the final product is the providing organization. The processor only performs processing (refinement) work <*>. This is the peculiarity of the tolling scheme. And this feature leaves an imprint on the order of inventory of tolling assets on both sides of the transaction.

Who does the inventory?

To answer this question, let us turn to the general rules for conducting inventory. Thus, assets are subject to inventory regardless of their location. It is also necessary to take inventory of assets that do not belong to the organization, but are listed on its balance sheet <*>.

The purpose of inventory is to compare the balances of assets listed in accounting with their actual availability. It should also be carried out before drawing up the annual balance sheet so that the figures in it are reliable <*>.

Thus, to answer the question of who should inventory the toll assets, let us recall where and how the parties to the transaction take them into account.

As we have already said, the owner of the transferred raw materials remains the supplier. He takes into account these raw materials in subaccount 10-7 “Materials transferred for external processing.” And the processor who received the raw materials transfers them to off-balance sheet account 003 “Materials accepted for processing.”

Subsequently, having manufactured the final product and written off the used raw materials from account 003, the processor also shows such products on the balance sheet until they are returned to the seller. For example, on account 002 or an additionally opened account <*>.

The above means that the supplier is obliged to take inventory of the supplied raw materials, even though he does not physically have the raw materials. After all, the seller is responsible for taking inventory of the assets he owns, regardless of where they are actually located.

In addition, the processor must also conduct an inventory. Since both the raw materials supplied by the customer and the final products are listed on his balance sheet before being returned to the customer.

How does a recycler take inventory?

The processor's toll assets are subject to inventory on the same basis as their own. So, in order to ensure the presence and safety of the former, the processor should inventory:

- unused customer-supplied raw materials stored in his warehouse;

— customer-supplied raw materials in production (an assessment of the actual amount of raw materials transferred to production can be carried out on the basis of consumable documents);

- manufactured products that have not yet been transferred to the seller.

The processor draws up separate inventory records for assets that do not belong to it. And if deviations are detected - comparison sheets. It is recommended to send one copy of these documents to the seller <*>.

Thus, the processor checks the availability of assets in kind. This may raise a question. Since the processor is conducting an inventory of tolling assets, and they belong to the toller, then perhaps he needs to invite a representative of the toller to participate in the inventory? Indeed, in this case, the latter will sign all inventory documents, which will increase the confidence of the parties in the result of this procedure.

In this regard, we note the following. As a general rule, representatives of the dealer are not included in the inventory commissions <*>. Therefore, the processor, as a rule, does not do this. At the same time, we believe that the parties have the right to stipulate this point in the processing agreement <*>.

Features of inventory from the dealer

For the supplier, the inventory of customer-supplied raw materials transferred for processing consists of reconciling the amounts listed in subaccount 10-7 with the data of invoices, reports on the consumption of raw materials and other documents that are used to document customer-supplied operations. In other words, the dealer carries out only a documentary check and, based on its results, draws up a separate inventory list. In it, he indicates the name of the processor, the name of the transferred raw materials, the date of its transfer for processing, as well as the quantity and cost according to accounting data <*>.

The actual presence of assets can be confirmed by data received from the processor: copies of inventory lists, matching statements or other documents <*>.

Is it possible to re-evaluate and in what order?

Yes, but only in cases stipulated by law (namely paragraph 12 of PBU 5/01), that is, in case of real obsolescence of assets or a significant decrease in their actual cost. In each of these two situations, they can be discounted, but their reduction in price can be reflected in the balance sheet only at the end of the reporting period. In this case, the reserve provided specifically for this purpose in clause 25 of the same Accounting Regulations should be deducted.

Please note that current standards do not require revaluation, so the value of already stored objects does not increase to the current market level.

Accounting for shortages

It must be divided into two fundamentally different categories:

- arising due to the natural loss of raw materials or materials or due to a natural disaster;

- resulting from human activity: both the responsible person and someone else.

Write-off of shortages during the audit of inventories (postings)

Occurs as of the date the check was performed.

In cases where there are no culprits (or they cannot be found), the costs of issuing and circulating assets are taken as the cause. Then the procedure is carried out in accordance with:

| D 94 | K 10 (41, 43) | Nature of write-off |

| D 20 (25, 26, 44) | K 94 | taking into account natural loss |

If the shortage is higher than the norm, this results in a recovery from the responsible person, or (if it is proven or obvious that this person has nothing to do with it) an entry into other expenses. Then, depending on the situation, the following will be used:

| D 94 | K 10 (41, 43) | Nature of write-off |

| D 73 (76) | K 94 | the cost is assigned to the culprit |

| D 50 (51, 70) | K 73 (76) | the cash equivalent of the shortfall has been recovered |

| D 91 | K 94 | written off as other expenses |

Please note that when the culprit is identified, the difference in value is determined as of the day when the person admitted his offense; if he denies it, then upon the entry into force of the court decision. And natural decline must be documented - by compulsory preparation of a report signed by representatives of the competent authorities.

Accounting for materials transferred and accepted for processing

All topics in this section:

PBU 6/01 “Accounting for fixed assets”.

The procedure for recognizing fixed assets in accounting. Organization of analytical accounting of OS. Primary documentation for accounting and inventory of fixed assets 4. An asset is accepted by the organization for accounting as fixed assets if the following conditions are simultaneously met: a) the object is intended for use in production Criteria and features of recognition of fixed assets An item of fixed assets must be recognized as an asset when : - it is highly probable that the company will receive future economic benefits associated with the asset;

Initial valuation of an item of fixed assets Initial recognition of items of fixed assets is carried out at actual cost. Historical cost is the amount of cash or cash equivalents paid or fair

Requirements for conducting and reflecting revaluations of fixed assets It is not individual objects of fixed assets that are subject to revaluation, but the entire group to which the object belongs. Revaluations should be carried out on a regular basis so that the carrying amount of the item is

Depreciation methods and the procedure for accounting for depreciation charges on fixed assets In accounting, depreciation of fixed assets is understood as the process of gradually transferring the cost of fixed assets to manufactured products, work or

Accounting for depreciation of intangible assets. Termination of recognition of intangible assets in accounting Amortization of intangible assets. The cost of intangible assets (intangible assets) is repaid in installments throughout the entire time of their use in the organization through

Documentation and accounting of disposal of inventories. Accounting for the reserve for reducing the cost of material assets and procurement of materials Documentation and accounting for the disposal of inventories Inventories from the enterprise warehouse are released to the workshops for the manufacture of products and at one time

Features of accounting for material assets in safekeeping Account 002 Inventory assets accepted for safekeeping Inventory assets received by an enterprise are not always its property. For example, in my

Accounting for shortages and losses from damage to valuables Account 94 “Shortages and losses from damage to valuables” is intended to summarize information on the amounts of shortages and losses from damage to material and other valuables (including cash), identified

Inventory inventories are accepted for accounting at actual cost. Synthetic accounts 10 “Materials”, 43 “Finished products”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in

Inventory of inventories Inventory of inventories must be carried out at least once a year and no earlier than October 1. The timing of the inventory is determined directly by

Accounting and evaluation of shipped products As already noted, finished products and shipped goods can be reflected in the accounting and balance sheet at: full or partial actual production cost. Shipped or presented

Accounting for semi-finished products of own production Semi-finished products of own production are materials that have undergone certain processing at a completed technological stage, which can be used either for long-distance

IFRS 18 revenue IFRS 18 “Revenue” and PBU 9/99 “Income of the organization” According to IFRS 18 “Revenue”, revenue is understood as the gross receipt of economic benefits

Primary documentation, assessment and accounting of manufactured products, work performed, services provided. The movement of finished products is documented in the following standard forms of primary documentation: 1) Acceptance invoice - drawn up at the time of receipt of the goods from production

Valuation of finished products In the balance sheet, finished products are reflected: · at actual production cost (if account 40 “Output of products (works, services)” is not used);

Accounting and evaluation of work performed, services provided Work (services) performed (rendered) for the needs of the structural divisions of the enterprise are evaluated in the following order: Services of supplying auxiliary units are evaluated in fact

Without using account 40 In this case, the GP according to the actual s/s is taken into account in account 43 “Finished products”. The account is active. The debit balance reflects the value of the balance of the GP in the warehouse. Dt reflects the receipt of GP from production

Accounting for the sale of GPs During the sale of GPs, additional expenses arise, which are called commercial expenses. These include costs for packaging, transportation, advertising costs, intermediary fees,

By payment” and crediting revenue from buyers With this method, products are considered sold only when actual payment is made by buyers. Until this moment, shipped products are accounted for in account 45, and taxes are calculated

Features of accounting for import transactions The procedure for accounting for import transactions depends on the chosen form of settlements with foreign suppliers (collection, letter of credit, open account, etc.), delivery conditions, content of accounting pairs

Peculiarities of accounting for export transactions Export is a customs regime under which goods in free circulation on the customs territory of the Russian Federation are exported from this territory without an obligation to collect

Disposal of financial investments Disposal of financial investments is recognized in the accounting records of the organization on the date of one-time termination of the conditions for their acceptance for accounting given in paragraph

The concept of accounts receivable and accounts payable Under accounts receivable, we understand the debt of another organization, employees and individuals of this organization (borrowers, other debtors, buyers) Authority

Valuation of accounts receivable and payable For the accounting department of an enterprise, the evaluation of debt obligations in the balance sheet and other forms of financial statements is very important. Currently, accounts receivable are reflected in the balance sheet

Accounting for settlements with suppliers and contractors, including advances, prepayments and bills of exchange issued. Suppliers include organizations from which enterprises purchase material assets, as well as those providing various types of services (supply of electricity, steam, water, gas, etc.

Accounting for settlements with buyers and customers, including those received in advance and bills of exchange Settlements for commodity transactions associated with the movement of goods are settlements with suppliers and contractors, buyers, including scheduled payments, which are made through: payment

Accounting for payments for taxes and fees Accounting for the organization's settlements with the budget for taxes and fees paid by the organization itself, and taxes with the employees of this organization, is kept on account 68 “Calculations for taxes and fees”

Value added tax The following entries are made in VAT accounting. D90.91 - K68 - sale of goods, products, works and services D 62 - K68 - VAT is charged on the amount of advances received; D

Accounting of the management company of a closed joint-stock company, open joint-stock company. Procedure for registration and accounting of shareholders. Accounting for own shares purchased by the company The authorized capital of a joint-stock company is the sum of the par value of the shares of this company distributed among shareholders. When establishing a company in

Decrease in capital ¾ Upon departure of the founders and return of deposits D80 K75.1 ¾ upon reduction in the par value of shares D80 K50 (51, 70, 75.1) ¾ upon reduction in the number of shares in

The procedure for accounting for additional capital, its formation and accounting Additional capital is part of the organization’s capital that is not associated with contributions from participants and capital gains from profits accumulated over the entire period of the organization’s activities. DK with

Formation, use and accounting of reserve capital Reserve capital is a so-called reserve financial source for compensating for possible losses and writing off expenses incurred in the event of a lack of profit. Creation of the Republic of Kazakhstan

ACCOUNTING REGULATIONS “ACCOUNTING FOR ASSETS AND LIABILITIES, THE VALUE OF WHICH IS EXPRESSED IN FOREIGN CURRENCY” (PBU 3/2006)

Scope 3 This standard applies:[1] (a) to the accounting for transactions and balances of transactions denominated in foreign currencies, other than those transactions

C) when translating the entity's results of operations and financial position into the presentation currency 4 IAS 39 applies to many foreign currency derivatives and is therefore excluded from the scope of that standard. However, derivatives

Functional currency 9 The primary economic environment in which an entity operates is the economic environment in which it earns and uses most of its cash. When defining

Net investment in foreign operations 15 An entity may have a monetary asset receivable from a foreign operation or a monetary liability payable to a foreign operation. Monetary item, the redemption of which in a convoy

Monetary Articles 16 The essential characteristic of a monetary article is the right to receive (or the obligation to provide) a fixed or determinable number of currency units. Examples of monetary items are

Summary of the approach recommended by this Standard 17 In preparing financial statements, each entity is an independent entity, an entity with a foreign operation (for example, a parent entity) or a foreign subsidiary

Initial recognition 20 A foreign currency transaction is a transaction denominated in or to be settled in a foreign currency, including transactions that an entity enters into: (a)

Recognition of exchange differences 27 As set out in paragraph 3, IAS 39 applies to hedge accounting for foreign currency items. The application of hedge accounting requires an entity to account for certain exchange differences with

Translation into presentation currency 38 An entity may present its financial statements in any currency(ies). If the presentation currency is different from the entity's functional currency, it translates its work results

C) all exchange differences resulting from the translation are recognized as a separate component of equity 40 In practice, the translation of income and expense items often uses an exchange rate that approximates the actual rate at the transaction dates: for example, the average rate for the period. However, the EU

Discontinuation of OTHER documents 61 This standard replaces IAS 21 The Effects of Changes in Foreign Exchange Rates (as amended in 1993). 62 This Standard supersedes the following explanations: (a) PC

According to accounting “accounting for expenses FOR LOANS AND CREDITS” (PBU 15/2008) (as amended by Orders of the Ministry of Finance of Russia dated October 25, 2010 N 132n, dated November 8, 2010 N 144n, dated April 27, 2012 N 55n)

Accounting for settlements with personnel for wages The enterprise independently establishes payment systems for its employees (piecework, time-based, etc.). Remuneration systems are fixed in the collective

Basic definitions Employee benefits are all forms of remuneration and payments to a company in exchange for the services of employees. Includes brief

Short-term benefits are recognized on the balance sheet as a liability of the company immediately upon receipt of services, net of any previously paid advances. Debit balances of previously paid advances are included in the account

Accounting for defined contribution plans Defined contribution plans (including government ones) are accounted for in the same way as payroll accounting, usually simultaneously with it: accrued contributions are recognized in the balance sheet

Accounting for Defined Benefit Plans Unlike defined contribution plans, a defined benefit plan requires an estimate of future benefits and the possibility of actuarial gains or losses. Accounting procedure [19.50]:

Severance payments Liabilities and expenses are recognized when [19.133] There are formal grounds for the dismissal of an employee upon reaching retirement age.

Other long-term benefits Includes long-term leave, long-service benefits, long-term disability benefits, and any benefits paid 12 months or more after the period in which

Accounting for settlements with accountable persons Accountable persons are employees of the enterprise who have received advance cash amounts for future operating, administrative and travel expenses.

Debit Account 71 “Settlements with accountable persons” Credit Increase in debt of accountable persons Corresponding account Reduction of debt of accountable persons Corresponding account

Accounting for settlements with personnel for other operations To summarize information about settlements with personnel of the organization, in addition to settlements for wages, settlements with accountable persons and depositors, account 73 “Settlements with personnel for

Unconditional benefits are benefits for which entitlement under the terms of a pension plan is not conditional on continued employment. 9 Some pension plans have non-employer sponsors. This Standard also applies to the financial statements of such plans. 10 Most pension plans are based

Current and non-current assets Current assets are assets that serve or are repaid within 12 months, or during the normal operating cycle of the organization (if it exceeds 1 year). Many obor

Income of the organization PBU 9/99 Income of the organization is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in capital

Recognition of income 12. Revenue is recognized in accounting if the following conditions are met: a) the organization has the right to receive this revenue arising from a specific agreement or confirmed otherwise

Expenses of the organization PBU 10/99 Expenses of the organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in capital

Accounting for tax expenses (PBU 18/02 and IFRS 12) In accordance with clause 1 of PBU 18, reflection in accounting of information on income tax calculations is mandatory for organizations that, according to current legislation, are taxable

Accounting and recognition of income and expenses for ordinary activities in accounting Income. For the purposes of these Regulations, income other than income from ordinary activities is considered other income. Other income also includes

The essence and purpose of accounting reports in a market economy Accounting reports are a unified system of accounting data on property, liabilities, as well as results of business activities, compiled on the basis of oral accounting data

The importance of the balance sheet in a market economy The transition to market relations has given rise to various forms of ownership and types of business activities. Bill circulation is being recreated, shares and other prices have appeared

Accounting for surplus

In some cases, an inventory of inventories throughout the organization gives unexpected results, for example, it shows that there are actually more assets than according to documents. Then these inventory assets need to be capitalized as early as possible, reflecting this fact when reconciling the balance sheet. And you should separately find out why they appeared.

It is also important to enter them into account 91, which explains the totality of other income and expenses, or into account 99, which contains information about profits and losses. The posting is here: D10 - K 91. According to it, accounting must be carried out strictly at the market price of the object, which will subsequently affect tax indicators.

Results

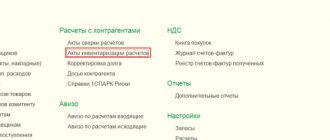

The inventory of inventories is carried out with the participation of a commission using standardized forms of inventories and statements. Inventory of inventories, as well as work-in-progress items, can be carried out using modern software tools such as 1C.

You can learn more about accounting for inventories in production from the articles:

- “The procedure for writing off materials in accounting (nuances)”;

- “Methodology for accounting for inventory items (nuances)”;

- "PBU 5/01 - accounting of inventories."

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Drawing up matching statements

- Filled out according to the INV-19 form if discrepancies are detected during the audit.

- The results of any of them at the end of the reporting period are summarized in an act corresponding to INV-26.

Each such document is accompanied by an extract from the accounting department, in which experts indicate possible options for writing off shortages: natural loss, damage during storage, natural disaster, theft, actions of criminals, and so on.

When preparing these papers, it is necessary to take into account the misgrading and the resulting difference in the cost of the goods. The amounts of shortages or surpluses should be indicated based on how they are valued in accounting.

If any objects do not belong to the company, but are temporarily on its balance sheet (rented, for processing, in storage), separate matching statements should be drawn up for them and confirmation certificates and copies of inventories should be provided to their owners.

Inventory Goals

The objectives of the inventory are:

- identification of the actual presence of property

- comparison of actual availability with accounting data.

The result of the comparison may be the identification of inventory differences. It could be a surplus or a shortage. The reasons for this may be various errors and miscalculations. Upon completion of the inventory, all materials are submitted to the accounting department. In accounting, there is a process of eliminating discrepancies between data, actual availability and accounting data.

Note 3

In all cases of identified inconsistencies, a comparison sheet is drawn up. This is a document that contains the full amount of information about the inventory results. All discrepancies are also reflected there.

The amounts of surpluses and shortages are indicated in the estimate given in the accounting records.

When an inventory of fixed assets and inventories is required

- Any transactions related to the purchase and sale of industrial equipment, as well as their rental.

- When reorganizing a previously state or municipal legal entity.

- When there is a change in the persons who, according to the documents, are responsible for the assets (in such a situation, an extraordinary audit is carried out - directly on the day of the transfer of cases).

- In case of actual damage to valuables, establishment of the presence of arrears or theft, abuse, misuse of inventories, breakdown.

- In case of an accident or catastrophe at an enterprise, flooding of storage facilities, fire, large-scale fire, natural disaster or other emergency.

- Filling out reports for a period of one year (not counting those objects that were inspected later than 01/10 of the current year).

- In case of liquidation or reorganization of the company, but strictly to the balance sheet.

As well as other situations regulated by current laws of the Russian Federation.

Exceptions to mandatory cases

- inspection of fixed assets is carried out every 3 years;

- audit of library collections - once every 5 years;

- revision is carried out when goods and materials run out (in the Far North).

Innovations in the field of inventory inventory

It has long been carried out using specialized programs, trying to choose ones that are constantly supported and regularly improved. For example, “1C: Accounting” has gained some popularity in this area (its most used version is 8th). It allows you to upload standard configuration documents as templates. This solution significantly saves time on filling out and allows you to avoid a number of common mistakes.

Nowadays, more and more software is appearing that helps to correctly calculate the price of objects, reflect direct costs, correctly distribute them between finished goods and unfinished products, and so on.