What is meant by audit

An audit is a verification of the reliability of the financial statements provided by the audited entity. Such accounting is carried out by an independent organization or individual representative. During the audit, a number of indicators that are not included in accounting may be assessed.

According to the law, tax audits are not included in a separate category of audits. It is considered one of the related services.

In the case when the customer organization plans to audit tax reporting as part of a general audit, the tax audit becomes part of the general audit.

However, as a point in the overall audit plan, this procedure is not enough to assess all components of the tax system. To get a complete picture, a separate tax audit is required.

Although the audit algorithm is different, they consist of three stages:

- assessment of the taxation system;

- checking and determining the correctness of the transfer of amounts to the tax service and funds;

- drawing up a report on the inspection carried out.

Important: organizing an audit does not replace additional checks carried out by representatives of the tax service.

back to menu ↑

LLC ACC "Accounting and Audit Center"

[email protected]Tax audit is the most popular type of audit services. Due to developments in the economy, clients are trying to avoid unnecessary expenses and fines, so it is especially important to avoid errors and omissions when calculating taxes.

A tax audit is a type of audit on a special assignment , during which the correctness of the accrual and payment of one or more taxes is verified. For example: audit of income tax, audit of value added tax, audit of land tax, audit of property tax, audit of the correctness of settlements with extra-budgetary funds. During a tax audit, the optimality of the tax policy chosen by your company is assessed. As a rule, the need for a tax audit may arise after consultations, as a result of which it becomes clear that there are problems associated with taxation and the organization of tax accounting at the enterprise. A tax audit can also be ordered after a mandatory and initiative audit. Tax audit is checked only by the continuous verification method

The purpose of a tax audit is to optimize identified errors in accounting and tax accounting systems and develop measures to eliminate them.

Tax audit for your organization is:

- Dress rehearsal for on-site tax audit

- reducing the risk of tax violations

- reducing the likelihood of conflict situations with tax authorities, law enforcement agencies, and specialists from extra-budgetary funds

- increasing the business reputation of your company

Tax audit quality guarantees:

- compliance with auditing standards

- accompanying the client during an on-site tax audit

- representing the client’s interests in cases of claims from tax authorities

Based on the results of the tax audit, you will be presented with:

- Audit report based on the results of a tax audit for the audited period in accordance with the requirements of Russian legislation.

- A detailed report containing information about significant errors in accounting and tax accounting, which entail an understatement of the tax base for taxes and fees. Detailed recommendations for eliminating identified issues. An assessment of the taxation system at your enterprise will be given.

meta name=”viewport” content=”width=device-width, initial-scale=1″

What work is carried out during the verification process

At the first stage, the auditor studies the components of the company's tax system. The factors influencing the accounting and formation of the contribution are assessed. The methods used to calculate the amount of payments are checked.

The auditor examines the obligations and activities of the departments in charge of calculating and making deductions. A preliminary calculation of financial indicators is also carried out.

Based on the data received? a general picture of business transactions is created and taxable objects are determined.

This information shows the appropriateness of the current tax system and helps identify and prevent potential violations.

Important: accounting assessment is carried out in accordance with international and Russian standards.

The first stage of the audit identifies weaknesses in the tax system, which require more in-depth research at the second stage.

If an accounting audit of a company supplying goods abroad is carried out, special attention is paid to the calculation and deduction of export VAT.

It may turn out that the accounting of cash flow is not organized enough. This, in turn, complicates income tax reporting.

On the other hand, calculating advertising tax is unlikely to cause difficulties. Therefore, an in-depth examination in this area is not carried out.

In most cases, it is irrational to study all areas of accounting. However, the tax system of companies with multiple liabilities requires a full audit at the second stage. For example, these could be:

- companies with subsidiaries operating under different tax regimes;

- enterprises with separate branches.

At the second stage, tax reporting is examined, which the audited entity provides according to approved forms. The accuracy of tax assessments and compliance with payment deadlines are assessed.

Each tax has a specific verification algorithm. An audit organization or individual auditor may provide the company with information about its assessment techniques.

back to menu ↑

Basic concepts and features

Tax audit is a popular service provided by audit companies. The procedure involves analyzing and verifying the calculation of accruals and payment of all taxes and fees of the company provided for by law. As a result of a tax audit, the expert develops a conclusion that expresses an objective opinion about the literacy and reliability of tax accounting. The auditor is guided by the provisions of the Tax Code and legislative acts.

Accounting and tax audits can be carried out in one, several areas or throughout the enterprise.

Free consultation

How reporting is prepared

At the third stage, a report on the assessment is prepared. All information received is included in the audit report. It includes conclusions about:

- completeness of data in the provided reports;

- correctness of calculations of tax payments, their display and payment;

- the feasibility of applying tax benefits to the activities of the enterprise.

The audit report is only part of the result of the work performed. The customer company also receives an inspection report. It is there that information about detected errors is indicated and instructions are contained on how to correct them.

The organization providing tax audit services is responsible for the accuracy of the collected data and its presentation in the report and conclusion.

The report contains the following information.

- What is the state of the tax accounting of the enterprise?

- Correct application of the tax regime.

- Possible risks.

- Ways to effectively distribute the tax burden.

back to menu ↑

Tax audit results

The end result of an audit is an audit report and an audit opinion. In what form the final result will be provided by the auditors will depend on what exactly is specified in the audit agreement. The report is confidential and contains the following:

- methods used in testing;

- recommendations regarding changes in accounting policies, which may ultimately affect the company’s tax reporting;

- proposals for adjusting tax reporting;

- other information that, in the expert’s opinion, should be paid attention to by management (for example, internal control errors, etc.).

If the auditor identifies violations during the audit, then the report offers different options for solving them . The report can be presented in the form of a pivot table.

Important! The report is accompanied by the auditor's opinion, as well as copies of the company's financial statements for the current year.

What is the purpose of audits?

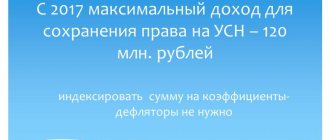

Tax legislation is periodically amended and clarified. Understanding all the intricacies of the system can be difficult. Failure to understand these nuances leads to errors in calculating tax contributions.

Authorized bodies strictly monitor compliance with the law. If established norms are violated, taxpayers are held accountable.

To avoid such unpleasant consequences, you need to ensure compliance of tax reporting with current legislation. An accounting audit will help to identify inaccuracies in advance and correct them.

This event achieves two goals:

- Identify and correct inconsistencies with tax legislation.

- As part of your tax accounting policy, select a suitable taxation system that will avoid unnecessary expenses.

Organizing an audit will provide the company with significant assistance in maintaining financial statements.

It is recommended to carry it out for newly opened companies as well. Here, consultation on payment issues will help plan the financial policy of the company.

back to menu ↑

What types of audit exist

Audits are classified according to different parameters. Depending on who carries out the audit, the audit is divided into:

- external;

- interior.

Third-party persons or organizations are involved for external audit. Internal is carried out by the company's employees.

There are other types of classification.

- Financial. During such an audit, the reliability and accuracy of financial transactions is assessed. Considers how accurately accounting records are maintained.

- Investment. Designed to evaluate the use of investments and predict their future performance. Investment risk assessment is not carried out.

- Industrial. A complex type of audit that requires an assessment of both the financial and technological components of the activity. As part of the financial part, they check the justification of prices for the goods or services provided. At the second stage, the progress of the production process and the work of quality control services are checked.

Important: financial and investment audits are combined into one category.

back to menu ↑

Interaction between the audit organization and company management

The main purpose of audits is to identify and promptly correct errors in accounting. If due to any circumstances it is impossible to eliminate inaccuracies, they are indicated in the report along with instructions on how to prevent such violations in the future.

To correct as many errors as possible in a timely manner, the audit organization should work closely with:

- company management;

- accounting department;

- legal service.

During the assessment, specialists need to clearly understand what the organization’s activities are and how they are carried out.

The purpose of compiling a report on how an accounting audit was carried out is not to enter as much data as possible about the errors identified, but to correct and prevent them in the future.

After verification, the company is provided with an assessment of the following parameters:

- accuracy of determining the tax base;

- correct choice of tax regime;

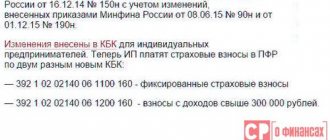

- correct calculation of contributions to the budget and funds (insurance, pension - do not mean non-state pension funds).

The company is provided with information about the amount of fines for non-compliance with tax laws. Experts give recommendations on the development of an optimal system for calculating contributions and the correct application of preferential regimes.

back to menu ↑

Audit for accounting purposes

During the audit, the auditor must carefully study and analyze the accounting policies of the audited entity. The purpose of the audit is not only to confirm the existence of an approved accounting policy and reflect in it the organization’s accounting methods, but also to assess the correctness and rationality of the chosen methods and forms that regulate the methodological and organizational basis of accounting and taxation procedures.