This article talks about cash balances in the cash register. The basic rules and the procedure for dealing with them were fixed even before the implementation of the new cash register system. The changes that followed the reform of 54-FZ cannot be called significant, however, details and nuances always turn out to be important in each specific case. And analyzing them is not superfluous.

The material given in the article reveals all the details - from what a cash limit is and how it is set, to what to do if a cash limit is not set. It is established on the basis of an order and calculated in accordance with certain (although not strict rules). Some conditions are optional, but not all. To know all the details about the correct calculation, read the material presented here. It provides a general calculation algorithm and tells how to work with the cash limit in the modern version of the 1C accounting program. It also talks about the consequences of improper handling of the cash balance.

Experts have calculated that in 2018-2019, from 1.5 to 2.5 million entrepreneurs should switch to online cash registers.

After the introduction of Law No. 54-FZ in 2014 on the use of cash register systems, there were no global changes in the rules for conducting cash transactions.

Let us remind you what nuances may arise when working with the balance of cash in the cash register.

Who must comply with the cash limit?

Organizations (with the exception of small businesses) must comply with the cash balance limit. In this case, the organizational and legal form and the applied taxation system do not matter. This procedure is established by paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014, paragraph 4 of Article 346.11 and paragraph 5 of Article 346.26 of the Tax Code of the Russian Federation.

A simplified procedure for conducting cash transactions has been established for small businesses and entrepreneurs. They may not set a cash balance limit. This benefit is provided for in paragraph 10 of clause 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014. The decision not to set a limit can be formalized by an appropriate order.

If an organization acquires the status of a small enterprise within a year, then from that moment it has the right to stop determining the cash balance limit (letter of the Bank of Russia dated September 3, 2020 No. 29-1-1-6/6103). It is safer to cancel a previously established limit with a separate order.

Situation: can the HOA not set a cash balance limit? Cash comes to the cash desk from homeowners.

No, he can not.

Only small enterprises have the right not to set a cash balance limit (paragraph 10, clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014). And these include:

- consumer cooperatives;

- commercial organizations;

- entrepreneurs.

As for homeowners' associations, these are non-profit organizations. That is, they do not belong to small businesses. This means that the HOA must establish and observe a limit on the cash balance at the cash desk.

This follows from paragraph 1 of Article 4 of the Law of July 24, 2007 No. 209-FZ, paragraph 2 of Article 291 of the Civil Code of the Russian Federation, paragraph 1 of Article 135 of the Housing Code of the Russian Federation.

https://youtu.be/se9kmgeAHAo

Cash limit: comply or refuse

From the article you will learn:

1. Who has the right not to comply with the cash register limit and how to properly exercise this right.

2. In what order is the cash balance limit calculated?

3. How to document the establishment of a cash limit. The cash register limit, or the limit on the cash balance in the cash register, makes life difficult for many accountants, especially if there is no cashier on staff. After all, you need to be “on alert” all the time: if a surplus suddenly appears, put aside your business and take it to the bank. Therefore, the abolition from June 1, 2014 of mandatory compliance with the cash limit for certain categories of economic entities was perceived by them as a breath of fresh air. And many organizations and almost all individual entrepreneurs hastened to take advantage of this right to unlimited storage of cash at the cash register. However, as the results of checks of cash discipline by tax authorities show, you need to exercise your right to waive the cash limit competently: simply “saying” about it, citing the corresponding point in the procedure for conducting cash transactions, is not enough. We will look into who must comply with the cash register limit and who has the right to do without it, as well as how to correctly set the maximum cash balance in the cash register and how to refuse to set it.

Why do you need a cash limit?

The procedure for establishing a cash balance limit is currently regulated by Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.” This document came into force on June 1, 2014; until that moment, a different procedure for conducting cash transactions was in force - established by the Regulation of the Bank of Russia dated October 12, 2011 No. 373-P “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation "

In accordance with Bank of Russia Directive No. 3210-U, the cash balance limit is the maximum allowable amount of cash that can be kept in the cash register after the amount of cash balance at the end of the working day is displayed in the cash book. The amount of money exceeding the established limit must be kept in bank accounts. Storing “extra-limit” amounts of money at the cash desk is allowed only on certain days (paragraph 8, clause 2 of Bank of Russia Directive No. 3210-U):

- intended for payment of wages, payments included in the wage fund, scholarships, social payments - no more than five working days, including the day of receipt of cash from a bank account for these payments (paragraph 1, clause 6.5, clause 6 of the Bank of Russia Instructions No. 3210-U);

- weekends – in case of conducting cash transactions on these days;

- non-working holidays - in case of conducting cash transactions on these days.

In other cases, the accumulation of cash in the cash register in excess of the established limit entails administrative liability in the form of a fine (Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- from 4 thousand rubles to 5 thousand rubles - for officials and individual entrepreneurs;

- from 40 thousand rubles to 50 thousand rubles - for legal entities.

The current procedure for conducting cash transactions in the Russian Federation provides for the right to refuse to establish a cash balance limit for the following categories of economic entities (paragraph 10, clause 2 of Bank of Russia Directive No. 3210-U):

- legal entities related to small businesses;

- individual entrepreneurs, regardless of the taxation system applied.

! Please note: In order to exercise the right not to set a cash limit, organizations do not need to register in special registers of small businesses (in regions where such registers are maintained) - there is no such requirement in Bank of Russia Directive No. 3210-U. It is enough only to actually comply with the criteria established for small businesses (clause 1, article 4 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”):

- the average number of employees for the previous calendar year is no more than 100 people;

- revenue from the sale of goods, works, services excluding VAT for the previous calendar year – no more than 800 million rubles. (Resolution of the Government of the Russian Federation dated July 13, 2015 No. 702). The specified value applies from July 25, 2020; before this day, the revenue limit was 400 million rubles.

- the share of participation in the authorized capital of other legal entities that are not small or medium-sized businesses is no more than 25%;

- the total share of participation of the Russian Federation, its constituent entities, municipalities, foreign legal entities, public and religious organizations or associations, charitable and other foundations in the authorized capital of a legal entity does not exceed 25%.

Individual entrepreneurs and small businesses can refuse to set a cash balance limit and keep an unlimited amount of cash proceeds in the cash register from June 1, 2020. Organizations that acquired the status of a small business entity after June 1, 2020, receive the right to waive the cash limit starting from the day they acquired such status. For example, the organization’s revenue for 2014 amounted to 500 million rubles, all other criteria for classification as an SMP were met. Thus, from July 25, 2020 (when the revenue limit for SMP was increased from 400 million rubles to 800 million rubles), the organization acquired the status of SMP and, accordingly, the right to waive the cash register limit.

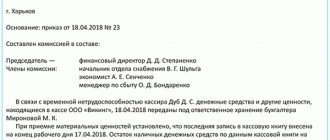

In order to exercise your right to refuse to set a cash balance limit, you must:

- cancel the previously valid order establishing a cash balance limit;

- issue an order according to which, from a certain date, a limit on the cash balance is not established.

Download a sample order to cancel the cash limit

! Please note : If the above order is missing, then when checking cash discipline, inspectors can either accept the limit approved by the order before 06/01/2014 as the established cash balance limit, or, even worse, consider that the limit has not been established. In the latter case, the cash balance limit is assumed to be zero, that is, any amount of cash in the cash register will be considered “over the limit”.

Establishing and calculating the cash balance limit

Organizations that are not small businesses are required to set a limit on the cash balance in the cash register. If such a limit is not set, it is assumed to be zero. In addition, small businesses and individual entrepreneurs can set a cash limit on their own initiative (for example, in order to ensure internal control and safety of cash). In this case, you need to keep in mind that if a cash balance limit is established (there is a corresponding order), then the organization (IP) is obliged to comply with it, that is, to hand over excess cash to the bank. Otherwise, she faces administrative liability.

The cash balance limit in the cash register is set by order of the manager (IP); it does not need to be agreed with the bank or the tax office. At the same time, as mentioned earlier, it is safer to cancel the limit established before June 1, 2014 and approve a new limit, referring to the current procedure for conducting cash transactions in the Russian Federation. The order must specify the amount of the limit and the date from which it comes into force. In addition, the order or annex to it must disclose the procedure for calculating the limit amount.

Download a sample order to establish a cash limit

The current procedure for conducting cash transactions provides for two options for calculating the cash balance limit (Appendix to Bank of Russia Directive No. 3210-U dated March 11, 2014):

- by the volume of cash receipts;

- by volume of cash disbursement.

- Calculation of the limit on the volume of cash receipts (for organizations (IP) that have cash revenue)

| Limit | = | Receipts | / | RP x Dn |

- Receipts – the amount of cash receipts for goods sold, work performed, services rendered during the billing period, expressed in rubles. Newly created organizations calculate the limit based on expected revenue;

- RP is the billing period in working days for which the volume of receipts is taken into account (from 1 to 92 days inclusive). The calculation period can be the period of peak cash receipts, or any other period relating to both the current and one of the previous years;

- Day - the number of working days between the days of delivery of cash proceeds, which should not exceed 7 days (14 days if there is no bank in the locality). The number of days can be determined based on the agreement with the bank, the period between collections or the dates of depositing cash into the account. The fewer the number of days, the lower the cash balance limit.

- Calculation of the limit on the volume of cash withdrawals (for organizations (IPs) that do not have cash revenue)

| Limit | = | Issue volume | / | RP x Dn |

- The volume of disbursements is the amount of money issued from the cash desk during the billing period, with the exception of amounts intended for payment of salaries, scholarships and other payments to employees, expressed in rubles. Newly created organizations calculate the limit based on the expected volume of cash disbursements.

The cash balance limit at the cash register is set in rubles. That is. If the calculation results in an amount in rubles and kopecks, it is rounded to the nearest whole ruble. As the Central Bank and the Federal Tax Service explained, for this purpose you can use the rules of mathematical rounding: amounts less than 50 kopecks are discarded, and more than 50 kopecks are added to the ruble (Letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876, Letter of the Federal Tax Service of Russia dated March 6, 2014 No. ED-4-2/4116). In this case, rounding to whole tens, hundreds, etc. not allowed. For example, if according to calculation the limit is equal to 18,542 rubles. 56 kopecks, then the rounded limit amount will be 18,543 rubles. Rounding up to 18550, 18600, or 19000 is not allowed, and during verification will be considered as an overstatement of the limit, which is fraught with the presence of excess balances.

***

Example of cash limit calculation

LLC "Trade" receives cash revenue from retail trade, the organization's work schedule: Mon-Sat, Sun - day off. Cash proceeds are collected once every six days. To calculate the cash limit, peak periods were determined (for which the maximum amount of cash revenue was received):

- 1 option

10/22/2015 – the amount of cash proceeds amounted to RUB 150,215.30. (maximum daily cash receipts).

Cash limit: RUB 901,292. (150,215.30 / 1 x 6 = 901,291.80)

- Option 2

from 12/08/2014 to 12/24/2014 – the amount of cash proceeds amounted to RUB 1,345,600.85.

Cash register limit: RUB 538,240. (1,345,600.85 / 15 x 6 = 538,240.34)

The organization has the right to independently determine which of the options for calculating the cash balance limit it should choose.

***

! Please note: The period during which an organization adheres to the established cash balance limit is determined at its discretion. As a rule, the order indicates only the date from which the limit applies. The established limit can be applied for several years, and can change every month if there is such a need. For example, it is advisable to review the limit if there is a change in the volume of cash receipts for goods (work, services) sold or the volume of cash disbursement (Letter of the Bank of Russia dated 02/15/2012 No. 36-3/25).

Organizations with separate divisions set a cash balance limit taking into account the following:

- If a separate division deposits cash into a bank account opened by an organization in a bank, the cash balance limit for such a division is established in the manner prescribed for the organization (paragraph 4, clause 2 of Bank of Russia Directive No. 3210-U)

- If a separate division deposits cash at the organization’s cash desk, then the organization determines the cash balance limit taking into account the cash balance limits established for this separate division (divisions) (paragraph 5 of clause 2 of Bank of Russia Directive No. 3210-U).

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any questions, ask them in the comments to the article!

Normative base

- Directive of the Bank of Russia dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”

- Code of Administrative Offenses of the Russian Federation

- Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”

- Letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876

- Letter of the Bank of Russia dated February 15, 2012 No. 36-3/25

- Letter of the Federal Tax Service of Russia dated 03/06/14 No. ED-4-2/4116

Find out how to read the official texts of these documents in the Useful sites section

When can you legally keep cash in excess of the limit?

There are two cases when you can exceed your cash limit. The first is on the days of payment of salaries, benefits, scholarships, social benefits and other payments that relate to the salary fund. Funds for these purposes can be kept in the cash register for five working days. After this period, hand over the excess cash to the bank.

And the second case is on weekends and holidays, if cash transactions are carried out on these days. Collect excess proceeds for such days no later than the first business day established for depositing excess proceeds to the bank.

This procedure is provided for in paragraph 8 of paragraph 2, paragraph 6.5 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

Situation: is it possible to leave cash proceeds received on the day of salary payment in the cash register? Did you receive cash from the bank to pay salaries? At the end of the day, the amount of revenue and unpaid wages exceeds the cash balance limit.

No you can not.

An organization cannot accumulate cash proceeds at the cash desk even for issuing salaries (clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014). And storing excess proceeds in the cash register can be qualified as accumulating cash. For such actions, the tax inspectorate may fine the organization under Article 15.1 of the Code of the Russian Federation on Administrative Offenses.

Thus, the funds received from the bank for the payment of salaries are targeted. Their amount is predetermined, and it can exceed the established cash balance limit only within five working days, including the day of receipt of cash for these payments from a bank account (clause 6.5 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

An example of calculating above-limit cash earnings on payday

Alpha LLC has set a cash balance limit of 30,000 rubles. The organization issues salaries for March on April 5, 6 and 7. According to the payroll for March, the amount of salary to be paid is 100,000 rubles. Alpha received this amount in cash from the bank on April 5. Daily cash revenue is 50,000 rubles. The organization delivers excess cash to the bank every day.

The accountant calculates the amount of excess cash as follows:

| Extra-limit cash at the till | = | Cash balance at the end of the day | – | Cash balance limit | – | Remaining unpaid salary |

At the beginning of April 6, the cash desk should have an amount not exceeding the limit (30,000 rubles) and the balance of unpaid wages. At the beginning of the day on April 5, there was no cash in the cash register. Data on the issuance of salaries and cash flows at the cash desk are shown in the table:

| date | Credited to the cash register, rub. | Issued as salary, rub. | Cash balance at the end of the day (before depositing excess cash at the bank), rub. | Over-limit cash to be deposited at the bank, rub. | Cash balance at the beginning of the next day, rub. |

| 5th of April | 150 000 (50 000 + 100 000) | 60 000 | 90 000 (150 000 – 60 000) | 20 000 (90 000 – 30 000 – (100 000 – 60 000)) | 70 000 (90 000 – 20 000) |

| April 6 | 50 000 | 30 000 | 90 000 (70 000 + 50 000 – 30 000) | 50 000 (90 000 – 30 000 – (40 000 – 30 000)) | 40 000 (90 000 – 50 000) |

| April 7 | 50 000 | 10 000 | 80 000 (40 000 + 50 000 – 10 000) | 50 000 (80 000 – 30 000 – (10 000 – 10 000)) | 30 000 (80 000 – 50 000) |

Situation: is it possible to leave cash proceeds received on the day of salary payment in the cash register? The organization did not receive cash from the bank to pay salaries. At the end of the day, the amount of revenue exceeds the cash balance limit.

Yes, you can.

An organization can spend cash proceeds on paying salaries (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013). If the organization did not receive money for the payment of salaries from the bank, it has the right to leave in the cash register the proceeds received on the days the salaries were paid (paragraph 8, paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014). In this case, the tax inspectorate cannot hold her accountable for accumulating funds in the cash register in excess of established limits. The FAS Volga-Vyatka District came to a similar conclusion in its resolution dated June 22, 2006 No. A28-2031/2004-61/27.

What it is?

Cash limit is the maximum established amount of cash to be kept at the cash desk of a business entity .

Excess funds must be transferred to the organization's current account opened with a bank. The fixed balance may be exceeded only during the period of payment of scholarships, wages, benefits and other payments, as well as on holidays and non-working days (subject to transactions being carried out on these days). Setting a limit allows you to reduce the amount of cash in circulation, which greatly simplifies the implementation of monetary transactions.

Directive of the Central Bank of the Russian Federation No. 3210-U determines that the maximum permissible amount of cash at the end of the day is calculated by organizations independently , but using approved formulas. This measure, on the one hand, regulates the procedure for calculating the carry-over balance, and on the other, allows it to be brought closer to a “convenient” value for a particular entity.

If an organization does not have an approved limit, then it is considered zero. This means that you cannot store money in the cash register. For any violation of the procedure for handling cash and conducting financial transactions, the entity may be held administratively liable and fined.

What are the risks of exceeding the limit?

If you exceed the cash balance limit and do not deposit the difference in a timely manner to the bank, then administrative liability will follow. The fine in this case ranges from 40,000 to 50,000 rubles. for organizations. An official, for example the head of an organization or an entrepreneur, will pay from 4,000 to 5,000 rubles for such a violation. This procedure is established by Articles 2.4 and 15.1 of the Code of the Russian Federation on Administrative Offences.

Important detail. Cases related to violation of the cash balance limit are considered by tax inspectorates (Article 23.5 of the Code of Administrative Offenses of the Russian Federation). Since such a violation is not ongoing, inspectors have the right to hold the organization accountable only within two months from the date of its commission (and not from the date of discovery). This conclusion follows from the provisions of Part 1 of Article 4.5 and Subparagraph 6 of Part 1 of Article 24.5 of the Code of the Russian Federation on Administrative Offenses and is confirmed by arbitration practice (see, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated June 20, 2006 No. A56-49021/2005, North Caucasus District dated December 13, 2005 No. F08-5915/2005-2341A).

Situation: can an organization be fined for exceeding the cash balance limit? The limit was exceeded due to late arrival of collectors. The collection schedule is established by agreement with the bank.

No you can not.

As a general rule, a guilty action (inaction) of an organization or official is recognized as an offense (Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Consequently, liability for violating the cash balance limit occurs only if the guilt of the organization and (or) its leader is proven (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Guilt may be expressed in the fact that the organization and (or) its leader:

- sought to accumulate an excess balance (Clause 1, Article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- foresaw the accumulation of an excess balance, but did not prevent it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- did not expect the accumulation of an excess balance, although they should have and could have foreseen it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation).

Advice: to prove that the organization is not at fault for violating the cash balance limit, record the fact of late arrival of collectors in the act.

In the situation under consideration, the excess balance arose due to the fault of the bank, which did not fulfill the terms of the collection agreement. If the organization documents this fact (indicating the date and time of the violation), it will not be possible to hold it accountable. This conclusion is confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated August 17, 2007 No. A56-50165/2006).

Calculation of the limit based on the volume of revenue

Determine the cash balance limit for the billing period based on the volume of cash receipts for goods sold, work performed, services rendered using the formula:

| Cash balance limit in the cash register | = | Volume of cash proceeds for the billing period | : | Billing period (but not more than 92 working days) | × | The period of time between the days of delivery of proceeds to the bank (no more than seven (14) working days) |

The billing period for which the cash balance limit is determined can be taken arbitrarily. This could be the period:

- which precedes the calculation (for example, calculate the limit for the third quarter based on data for the second quarter of the current year);

- in which the receipt of cash was maximum (for example, make the calculation based on the data of the fourth quarter of the previous year, in which there were maximum receipts of revenue);

- similar for previous years (for example, calculate the limit for the third quarter of 2020 based on the indicators of the third quarter of 2015).

In the billing period, include all days of work, but not more than 92 working days. If, for example, the store is open on weekends and non-working holidays, then to calculate the limit, also include these days in the calculation period.

This procedure follows from paragraph 1 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

The resulting limit value can be converted to full rubles - both according to the rules of mathematical rounding, and downward (letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876, Federal Tax Service of Russia dated March 6, 2014 No. ED-4- 2/4116).

An example of calculating the cash balance limit at the cash register. Cash proceeds are received daily

LLC "Torgovaya" calculates the cash balance limit based on accounting data, based on the volume of cash receipts for January, February and March of the previous year. Hermes has no separate divisions. The proceeds are deposited in the bank every fifth day.

Hermes is open seven days a week from 10 a.m. to 10 p.m. Therefore, the billing period is 90 working days (31 days + 28 days + 31 days).

The turnover in the debit of account 50 “Cash” in correspondence with the credit of account 90 “Sales”, as well as the credit of account 62 “Settlements with buyers and customers” in terms of cash advances received in the billing period, which were offset in the same period, amounted to 2 RUB 699,998:

- in January – 887,388 rubles;

- in February – 802,015 rubles;

- in March – 1,010,595 rubles.

The Hermes accountant calculated the permissible limit for the cash balance in the cash register: RUB 149,999.89. (2,699,998: 90 days × 5 days).

Based on these data, the head of the organization, by his order, set a limit on the cash balance in the amount of 150,000 rubles.

How to calculate cash limit

This is the question that most interests novice accountants. There is no need to rack your brains over it - calculation options are provided for by law:

- Based on the volume of cash receipts using the formula:

Limit = Revenue / Billing period x Days - By the volume of cash issuance (if there is no cash proceeds) using the formula:

Limit = Issues / Billing period x Days

Explanations:

Revenue is the amount of funds from the sale of services and the sale of goods. If the enterprise has just been created, then here you need to indicate the expected amount of revenue;

The billing period is from 1 to 91 days inclusive. It can be chosen absolutely arbitrarily;

Days – from 7-14 working days between cash deposits. It should be remembered that the fewer the number of days, the less money should remain in the cash register.

Thus, if an enterprise, due to circumstances established by law, is obliged to strictly observe cash discipline, carry out nightly calculations of daily revenue and deposit balances with the bank, then this must be done in accordance with all the rules and regulations established by the legislator. Otherwise, it is unlikely to be able to avoid administrative sanctions from regulatory authorities.

Bookmarked: 0

Today it is quite easy to receive a serious punishment or a simple fine for violating cash discipline. An individual entrepreneur must always follow the main rule - to record the amounts of cash deposited into the cash register and taken from there. To assess the importance of such accounting, let’s try to figure out what fine an entrepreneur will face for violating cash discipline and how to comply with it correctly.

Limit when there is no cash proceeds

If there is no cash proceeds (for example, there were only non-cash payments), then calculate the balance limit based on the volume of cash issued. The exception is amounts intended to pay salaries, scholarships and other payments to employees - do not take them into account when calculating the limit.

To calculate the limit if there is no cash proceeds, use the formula:

| Cash balance limit in the absence of cash proceeds | = | Volume of issues for the billing period | : | Billing period (but not more than 92 working days) | × | Time period between days of receiving money from the bank (no more than seven (14) working days) |

The billing period for which the cash balance limit is determined can be taken arbitrarily. This could be the period:

- which precedes the calculation (for example, calculate the limit for the third quarter based on data for the second quarter of the current year);

- in which the receipt of cash was maximum (for example, make the calculation based on the data of the fourth quarter of the previous year, in which there were maximum receipts of revenue);

- similar for previous years (for example, calculate the limit for the third quarter of 2020 based on the indicators of the third quarter of 2015).

In the billing period, include all days of work, but not more than 92 working days. If an entrepreneur or organization works on weekends and non-working holidays, then also include these days in the calculation period to calculate the limit.

This procedure follows from paragraph 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

The resulting limit value can be rounded to full rubles (letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876, Federal Tax Service of Russia dated March 6, 2014 No. ED-4-2/4116).

An example of calculating the cash balance limit at the cash register. There is no cash proceeds, money is withdrawn from the organization’s account

Torgovaya LLC purchases recyclable materials from the population. Hermes has no separate divisions. Cash is withdrawn from the bank account every three days. The cash balance limit is calculated based on accounting data for January, February, March of the previous year.

Hermes has a five-day work week. Therefore, the billing period is 56 working days (15 days + 19 days + 22 days).

The turnover on the credit of account 50 “Cashier”, excluding payments to employees, amounted to 2,800,000 rubles:

- in January – 960,000 rubles;

- in February – 800,000 rubles;

- in March – 1,040,000 rubles.

The Hermes accountant calculated the permissible limit for the cash balance in the cash register: 150,000 rubles. (RUB 2,800,000: 56 days × 3 days).

Based on these data, the head of the organization set by his order a limit on the cash balance in the amount of 150,000 rubles.

Situation: how to determine the cash limit? Does the organization pay only dividends, there are no other cash transactions?

Determine the limit based on the amount of cash issued.

When calculating the limit, payments to employees are not taken into account: salaries, scholarships, benefits, etc. But dividends do not apply to such payments. Therefore, if the organization does not have cash revenue, calculate the limit based on the volume of previously paid dividends. This conclusion can be drawn based on the provisions of paragraph 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U and Article 43 of the Tax Code of the Russian Federation.

In order for the limit to be sufficient, it is not necessary to take all dividend payment days. After all, for the billing period only a limit is set - 92 working days. Include in the calculation the days when the payment amount was maximum. It could be one day.

For example, in the previous year dividends totaled 100,000 rubles. paid within three days:

- first day – 2000 rub.;

- second – 60,000 rubles;

- third – 38,000 rub.

When calculating the cash balance limit, it is optimal to include in the calculation only the second day, when the payment amount was the largest.

The company receives money from the bank only to pay dividends, so the frequency of receiving money from the bank for the calculation was taken as the maximum - 7 days. As a result, the limit will be 420,000 rubles. (RUB 60,000: 1 day × 7 days).

Who sets the cash balance limit and how?

To answer all these questions, let us turn to Appendix 2 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U (as amended on June 16, 2017 No. 4416-U) “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses."

Is it necessary to set a cash balance limit?

The cash balance limit at the end of the working day is established by all enterprises working with cash, except for those classified as small enterprises. Individual enterprises also may not set a cash balance limit.

Who sets the balance limit

A legal entity sets its own cash balance limit based on its operating conditions. For a separate division that deposits funds into the current account of a legal entity, it is established by the head office.

How is the balance limit set?

The limit on the cash balance in the cash register is established by an administrative document, for example, an order from the manager. This is usually done immediately after the start of accounting. accounting or at the end of the calendar year.

For how long is the limit set?

This issue has not been resolved by law. The enterprise itself determines the frequency of setting the limit on the cash balance in the cash register.

Do I need to agree on a limit?

The cash balance limit is an internal document of the enterprise. There is no need to coordinate it with anyone.

How to calculate your cash balance limit

The calculation can be done in two ways. Based on data on the enterprise’s revenue received at the cash desk for a certain period (this is usually done by enterprises that receive revenue primarily at the cash desk).

Based on data on the expenditure of cash, except for expenses for paying salaries, scholarships, benefits, etc. (this is usually done by enterprises that receive money from a current account).

How to choose periods

The company chooses the period for which the data is taken completely arbitrarily. But, in any case, the cash balance limit is set based on data taken for no more than 92 business days. The period between the days of depositing cash into a bank account and the period between the days of receiving cash by check should not exceed 7 working days, and in the absence of a bank in a given locality - 14.

If you find an error, please select a piece of text and press Ctrl+Enter.

Separate units

If the organization has separate divisions, set a cash balance limit for each of them. At the same time, the procedure for calculating the cash balance limit for the structural divisions of the organization (branches, representative offices, geographically distant retail outlets, etc.) depends on where they deposit cash.

If a separate division credits proceeds to the current account, bypassing the cash desk of the parent organization, set a limit for it without taking into account the limits of other divisions and the limit of the parent organization. That is, in this case, the cash balance limit will need to be set separately for:

- parent organization;

- separate division of the organization. Provided that the money is not handed over to the cash desk of the parent organization.

But what if a separate division was created recently and there is no movement of money in its cash register yet? Then, to determine the limit, use the calculation formula based on the expected cash proceeds, and in its absence, the expected volume of cash disbursement. This procedure follows from paragraphs 1 and 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

An example of determining the cash limit for a new division of an organization. Cash is deposited at the bank

In January, Torgovaya LLC opened a separate division. The division will credit the proceeds to the current account. The cash balance limit is calculated based on the expected volume of receipts for goods.

The department has a five-day work week. Therefore, the billing period is 57 working days (17 days + 20 days + 20 days).

According to the plan, sales volume by month:

- in January – 600,000 rubles;

- in February – 800,000 rubles;

- in March – 800,000 rubles.

Total permissible limit of cash balance in the cash register: – RUB 115,789. (RUB 2,200,000: 57 days × 3 days).

Based on these data, the head of the organization established by his order the cash balance limit for the division in the amount of 115,789 rubles.

If separate divisions hand over revenue only to the head cash register, then the total amount of the cash balance limit for the organization as a whole should include:

- limit on the balance in the cash register of the parent organization;

- balance limits for all separate divisions.

For example, in this case, you can calculate the total limit for the organization as a whole, taking into account the revenue of all separate divisions. And then distribute it between the main (central) cash desk and divisions based on the share of revenue of each division. The distribution is formalized by an order from the head of the organization, drawn up in any form.

This procedure follows from paragraph 5 of paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

An example of determining the cash limit for a new division of an organization. Cash is deposited at the central cash desk

In January, Torgovaya LLC opened a separate division. The division will credit the proceeds to the central cash register.

LLC "Torgovaya" calculates the cash balance limit based on accounting data based on the volume of cash receipts for January, February and March of the previous year. And then it will distribute the limit between the head office and the division. The proceeds are deposited in the bank every fifth day.

Hermes is open seven days a week from 10 a.m. to 10 p.m. Therefore, the billing period is 90 working days (31 days + 28 days + 31 days).

The turnover in the debit of account 50 “Cash” in correspondence with the credit of account 90 “Sales”, as well as the credit of account 62 “Settlements with buyers and customers” in terms of cash advances received in the billing period, which were offset in the same period, amounted to 2 RUB 699,998:

- in January – 887,388 rubles;

- in February – 802,015 rubles;

- in March – 1,010,595 rubles.

The Hermes accountant calculated the permissible limit for the cash balance in the cash register, taking into account rounding: 150,000 rubles. (RUB 2,699,998: 90 days × 5 days).

The volume of goods in the department's warehouse is equal to 1/4 of the total volume of goods. Thus, according to the plan, the division's revenue will account for a quarter of the revenue of the entire organization.

The accountant distributed the limit as follows:

- RUB 37,500 (RUB 150,000 × 1/4) – cash limit for the division;

- RUB 112,500 (RUB 150,000 × 3/4) – cash register limit for the head office.

Based on these data, the head of the organization established in one order a limit on the cash balance for the organization in the amount of 150,000 rubles, where limits were separately allocated for the head office and divisions of the organization.