What is internal audit

Internal audit is a review of the company's activities, which is carried out in the interests of the owner. The procedure is carried out on the basis of regulations drawn up by the company itself. During the process, documents are checked and employees are interviewed.

Main goals

Let's consider the tasks of the internal audit of a company:

- Organization of effective financial and economic activities.

- Establishing productive interaction with counterparties.

- Prevention of significant violations.

- Reducing the number of losses.

- Ensuring that activities comply with the law.

- Checking the accuracy of the information contained in the documents.

Internal audit is needed, first of all, by the head of the company. The test results will help optimize production.

The legislative framework

The work of specialists carrying out internal audit must comply with international (ISA) and domestic standards. It is regulated by Federal Law No. 307 “On the activities of the auditor”. In addition, the verification should not contradict these standards:

- Federal Law No. 115 “On combating money laundering” dated August 7, 2001.

- Federal Law No. 273 “On Combating Corruption” dated December 25, 2008.

Internal audit standards should also be contained in the company's internal documents.

Does a subsidiary need to hire the same auditor that its parent company hires?

The simple answer is NO unless your shareholder or group policy requires it.

But!

This may be more practical and cost effective from the group's point of view.

It is understandable why the local branch of an international group would want to choose a local accounting firm rather than an affiliate of the Big Four. Of course, the services of a Big Four company can cost much more than the services of a local auditor.

However, think about it from the parent company's perspective.

The auditor of the parent company needs to audit the consolidated financial statements. Therefore, he will also need to audit the financial statements of the subsidiaries.

In practice, auditors often rely on the work of experts, including other auditors.

If a subsidiary's financial statements are audited by the same auditor (for example, a local office of a Big Four firm), the parent company's auditor can rely on the results of the audit because it is performed by the same company, using the same procedures, auditing standards, etc. .

However, if the subsidiary's financial statements are audited by a local firm, the parent's auditor needs to decide whether he can rely on that audit or not.

In some cases, the parent company's auditor may decide to conduct its own audit of the subsidiary, which may ultimately be more expensive.

Why? Because:

- The subsidiary pays for the services of a local auditor;

- In addition, the parent company pays a fee to the group auditor for re-audit of the subsidiary.

What can be done in this situation?

If you work for a group company and need to decide whether to choose an expensive group auditor or a cheaper local auditor, consider the materiality of that company within the group.

Is the local entity large enough to cause a material error in the consolidated financial statements?

If so, you may want to hire a group auditor.

But if your local company has a minor share of the group's financial statements, then leave it to the local auditor.

What is checked during the internal audit process

Conducting an internal audit requires an integrated approach. That is, all aspects of the enterprise’s activities are checked. In particular, these are:

- Maintaining records of fixed assets, intangible assets, cash transactions, financial results, capital and other things.

- Transactions on foreign currency, settlement and other accounts, settlements with counterparties, insurance companies.

- Condition of the operating system, documentation of funds, correctness of depreciation calculations, execution of the repair work plan.

The auditor must also ensure information security. The processing of information in the company, the current information system, and the presence of trade secrets are checked. A specialist conducts an audit of the information security system.

“Handbook on internal audit. Risks and business processes" Oleg Kryshkin, 2014

One of the most requested books on the Internet on internal auditing. What's so special about it? The book contains practical developments not only from the field of internal and external audit, but also the nuances of risk assessment. The manual explains in simple language how to conduct an internal audit of various business processes in a company in order to identify risks and avoid financial losses.

The handbook on internal audit is called this for a reason. It contains many visual diagrams, tables, and templates that will help simplify audits and avoid many problems associated with them. One of the features is that the book is aimed at auditors working in the non-banking sector.

A fragment of the book “Handbook on Internal Audit” by Oleg Kryshkin can be found for free. Here you can read by subscription or buy the full version.

Types of internal audit

There are different types of internal audit. The audit is divided into types depending on the tasks assigned to the auditor. There are the following varieties:

- Checking the control system.

- Organizational and technical control.

- Control audit of the main activities.

- Checking the work for compliance with internal and legislative standards.

- Establishing the expediency of the activities of officials.

All types of audit considered are not mandatory. They are carried out on the initiative of the leader.

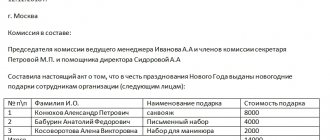

Documentary support of the audit

As part of the audit, it is necessary to draw up a number of documents. Otherwise, the audit will not be legal.

Issuance of an audit order

The inspection is carried out on the basis of the order of the manager. This document establishes the following aspects of the work:

- Dates of inspection.

- Employees who will be involved in the audit.

- Conditions for conducting internal audit.

- Control over the work of the auditor.

The order must contain clear instructions regarding the commencement of the audit.

Check list

As part of the audit, many areas are monitored. There are many operations performed, the sequence of which must be followed. To comply with the algorithm, it is recommended to create a checklist. It includes a checklist. There are no laws regulating the preparation of this document. The checklist is filled out in accordance with the wishes of the manager. It allows you to solve these problems:

- Proper planning of control activities in accordance with the law.

- Execution of intermediate and selective control of the auditor's activities.

- Carrying out all the main stages of the procedure.

- Facilitating the auditor's work.

- Possibility of carrying out a complex and holistic procedure.

You can create a checklist based on the provisions of Federal Law No. 307 “On Auditing Activities” dated December 30, 2008.

Team of authors - Audit. Short course

1

Short Course on Auditing: Study Guide

1. Audit: history, concept and essence

1. The development of audit began with the appearance in the 19th century. joint-stock companies in Europe as a consequence of the conflicting interests of the management personnel of enterprises and investors (owners, shareholders, investors). To avoid bankruptcy of enterprises, deception on the part of the administration and the risk of financial investments, in order to obtain reliable information about the state of affairs at the enterprise, to check the financial statements, shareholders invited auditors who could be trusted.

The criteria for selecting an auditor were primarily integrity and independence. At the same time, the increasing complexity of accounting required the necessary level of professionalism from the auditor.

Since 1844, laws on companies began to be adopted in Great Britain, which established the obligation of the board of joint-stock companies to invite an auditor at least once a year to check the accounts and report to shareholders.

In 1929–1933 There was a global economic crisis. In this regard, the need for the services of accountants and auditors has increased, and the requirements for the quality of audits have increased. Auditing has become mandatory. There was a need to verify during the audit the amount of information contained in annual reports, publish these reports and auditors' opinions.

In Russia, the introduction of the position of auditor was carried out by Peter I. At the same time, the auditor, in addition to his main duties, was also charged with some duties of a clerk, secretary, and prosecutor. The status of auditors was quite high: they were called “chartered accountants.”

¡ Auditing activities (audit services) – activities related to conducting an audit and providing services related to the audit, carried out by audit organizations and individual auditors.

¡ Audit is an independent verification of the accounting (financial) statements of the audited entity in order to express an opinion on the reliability of such statements.

2. The need for the services of an auditor arises due to the following circumstances:

☝the possibility of presenting biased information on the part of its compilers (administration) in the event of a conflict between them and the users of this information (owners, investors, creditors);

☝dependence of the consequences of decisions made on the quality of information;

☝the need for special knowledge to verify information;

☝lack of information users having access to it to assess its quality.

3. Auditing activities do not replace control of the reliability of accounting (financial) statements, carried out in accordance with the legislation of the Russian Federation by authorized state bodies and local government bodies.

Auditing organizations and individual auditors, along with audit services, can provide other services related to auditing activities, in particular:

☝establishment, restoration and maintenance of accounting records, preparation of accounting (financial) statements, accounting consulting;

☝tax consulting, establishment, restoration and maintenance of tax records, preparation of tax calculations and declarations;

☝analysis of the financial and economic activities of organizations and individual entrepreneurs, economic and financial consulting;

☝management consulting, including those related to the reorganization of organizations or their privatization;

☝legal assistance in areas related to auditing activities, including consultations on legal issues, representation of the interests of the principal in civil and administrative proceedings, in tax and customs legal relations, in state authorities and local governments;

☝automation of accounting and implementation of information technologies;

☝evaluation activities;

☝development and analysis of investment projects, drawing up business plans;

☝carrying out research and experimental work in areas related to auditing activities and disseminating their results, including on paper and electronic media;

☝training in areas related to auditing activities.

An audit of the accounting (financial) statements of the audited entity, whose accounting and financial documentation contains information constituting a state secret, is carried out in accordance with the legislation of the Russian Federation.

2. Types of audit

¡ Statutory audit – an annual mandatory audit of the accounting and financial (accounting) statements of an organization or individual entrepreneur.

1. A mandatory audit is carried out if:

☝the organization has the organizational and legal form of an open joint stock company;

☝the organization’s securities are admitted to circulation at organized trading;

☝audited entity - an insurance organization or mutual insurance company, a credit organization, a commodity or stock exchange, an investment fund, a state extra-budgetary fund, the source of funds of which are mandatory contributions made by individuals and legal entities, a fund whose sources of funds are voluntary contributions of individuals and legal entities;

☝the organization is a credit organization, a credit history bureau, an organization that is a professional participant in the securities market, an insurance organization, a clearing organization, a mutual insurance company, a trade organizer, a non-state pension or other fund, a joint-stock investment fund, a management company of a joint-stock investment fund, a mutual investment fund fund or non-state pension fund (except for state extra-budgetary funds);

☝the volume of revenue from the sale of products (sale of goods, performance of work, provision of services) of an organization (except for state authorities, local governments, state and municipal institutions, state and municipal unitary enterprises, agricultural cooperatives, unions of these cooperatives) for the previous reporting year exceeds 400 million rubles. or the amount of assets on the balance sheet as of the end of the previous reporting year exceeds 60 million rubles;

☝an organization (with the exception of a state authority, a local government body, a state extra-budgetary fund, as well as a state and municipal institution) presents and (or) publishes consolidated accounting (financial) statements.

2. An initiative audit is carried out by decision of the economic entity itself. In this case, an agreement is concluded with the auditing firm (individual auditor), which stipulates the nature and scope of the audit.

From the point of view of economic entities, the following types of audit are distinguished:

✓ general;

✓ banking;

✓ insurance organizations;

✓ exchanges;

✓ off-budget funds;

✓ investment institutions.

3. According to the Auditing Rule “Study and use of the work of internal audit” (approved by the Commission on Auditing under the President of the Russian Federation on April 27, 1999, protocol No. 3), internal audit is an organized system of control over compliance with the accounting procedure and the reliability of the functioning of the internal audit system control. Acts in the interests of the management of the enterprise and its owners. Management determines how the internal audit service will be organized, what its functions will be, depending on the specifics of the enterprise’s activities, financial and economic performance indicators, and how the organization’s management system is organized.

An external audit is carried out on a contractual basis by a third-party auditing firm for the purpose of objectively assessing the reliability of accounting and reporting, preparing recommendations for improving the efficiency of its activities, and tax optimization.

Management audit – checking the organization and management of an enterprise, assessing the efficiency of production and financial investments, productivity.

An audit of financial statements and a special audit consist of checking the reporting of an entity in order to express an opinion on the correctness of its preparation in accordance with established criteria and generally accepted accounting rules.

3. Goals and objectives of the audit

1. The purpose of the audit is to express the auditor’s opinion on the reliability of the financial (accounting) statements of the audited entities and the compliance of the accounting procedure with the legislation of the Russian Federation. The auditor expresses his opinion on the reliability of the financial (accounting) statements in all material respects.

1

End of introductory passage DID YOU LIKE THE BOOK?

This book costs less than a cup of coffee! FIND OUT PRICE

Stages of internal audit

Internal audit can be divided into three stages:

- Preparation. Includes issuing an order and drawing up a checklist.

- Worker. As part of it, documentation is checked for compliance with the law, and surveys of employees and management are carried out.

- Final. A conclusion is drawn up detailing the results of the procedure.

Each of these stages has its own significance. For example, if adequate preparation is not carried out, the procedure will not be as effective in the future.

The procedure for conducting an audit of an organization

- The initiator of the audit selects the contractor, draws up an application outlining all the requirements, and, if necessary, holds a tender.

- The preparatory stage, which determines the scope of the upcoming inspection, the required deadlines, methods of implementation, requirements for the specialists involved, etc.

- A plan for upcoming events is being drawn up.

- Collection and analysis of the provided data necessary to evaluate activities and existing financial statements. The audit is carried out according to existing standards.

- Drawing up a report indicating identified errors and recommendations for eliminating them.

It is necessary to prepare for an audit. Responsible employees must provide the audit firm's specialists with organizational and primary documents (invoices, invoices, payment orders, certificates of work performed, cash books with cashier reports, etc.), accounting and tax registers, previous audit reports, if available.

Internal audit tools

The components of an internal audit depend on the needs of the company. For example, these could be the following tools:

- Checking the correctness of estimates, projects and plans.

- Analysis of existing orders for the supply of raw materials.

- Checking the execution of supply contracts.

- Establishing the actual write-off of materials into production.

- Establishing the correctness of calculations, checking the reflection of their results in accounting for the cost of goods.

- Checking invoices.

- Checking the legality of depreciation calculation.

- Execution of control over the movement of funds.

- Timely reflection of all business transactions in accounting.

- Establishing the correctness of settlements with counterparties.

This list may be supplemented. The nature of the additions is determined by the specifics of the companies' activities.

Auditors use a variety of tools in the course of their work. For example, if invoices are checked, the following control procedure is relevant:

- Establishing the correctness of the book of sales and purchases.

- Analysis of invoices for missing numbers.

- Control over the entry of all entries into the General Ledger.

- Verifying the accuracy of customer accounts.

- Reconciliation of analytical and synthetic accounting information.

- Reconciling the dates of transactions performed with the dates indicated on invoices.

Checking the movement of material assets is carried out through an inventory. You need to prepare for this procedure. Preparation includes these steps:

- Compiling a list of materials that are subject to inventory.

- Formation of an inventory commission.

- Obtaining a receipt stating that all documents relating to the inventory are in the accounting department.

Analysis of the accuracy of depreciation calculation is carried out on the basis of documents. The list of papers subject to audit includes inventory cards. The auditor may also perform recalculation.

How to audit your life

What are you worth? How would you rate your life? When was the last time you stopped to take stock? Of course, a simple way to calculate your worth is to subtract your liabilities from your assets to determine your net worth.

When you do this for financial reasons, your assets are something like the economic value you have, including real estate, stocks, money you owe, and so on. However, this is only one area and does not give the overall picture of life. At the end of the day, there is more to a person than the amount of money they earn.

In financial terms, your good habits are assets and your bad habits are liabilities. The assets include the following:

- Meditation.

- Keeping a diary.

- Hobby.

Liabilities (obligations) can be:

- Procrastination.

- Smoking.

- The desire to criticize everyone and everything.

You can also think about your character traits. Positive features will be:

- Honesty.

- Sense of humor.

- Optimism.

Negative character traits include:

- Impatience.

- Indecisiveness.

- Over-emotional.

Conducting a life audit will help you determine whether you are in control of your life and whether it is going in the right direction. Below you will find out how to do this.

Areas of your life to audit

There are many areas in which you can conduct a life audit. These include the following:

- Time distribution

- Productivity

- Efficiency

- Skills

- Education

- Health

- Finance

- Habits

- Character

- Relationship

- Creative thinking

- Energy level

- Spiritual life

- Career

- Leisure

- Entertainment and pleasure

Audit Process

This process consists of seven stages.

1

Select area

You can use the areas we suggested above or create it yourself.

2

Select metric system

For example, in the fitness field, you might use measurements such as weight, waist circumference, and your body fat percentage. To measure your level of happiness, you can set an alarm on your smartphone to ring every hour: each time the alarm goes off, rate how happy you are at that moment in time on a scale of 1 to 10.

Another way is to ask questions about the area. To illustrate, if you are examining your relationships with friends, you might ask yourself the following questions:

- Do I remember my friends' birthdays or significant dates?

- How often do I talk to friends on the phone?

- How often do I see my friends?

- Do my friends support me and my goals?

- Do I support them?

- Do my friends enrich my life?

3

Select visualization form

This can be a simple table, graph or text information. Or maybe all together.

4

Conduct an audit

If you feel like you can't be completely honest with yourself (after all, it can be incredibly difficult to evaluate your life on your own), ask a close friend or family member to help you.

5

Decide where you want to be

For example, if your audit shows that you are overweight, determine how much you want to weigh.

6

Create an Action Plan

What steps do you need to take to move from where you are now to where you want to be? By way of illustration, your fitness action plan might include the following:

- Change your diet

- Buy a treadmill or join a gym

- Ask a friend who is in great physical shape for advice

- Drink more water

7

Make progress

Follow your action plan and track your progress. Make the necessary changes.

We wish you good luck!

We also recommend reading:

- Documents that everyone should have

- Metric of life

- Strategies for Overcoming Limiting Beliefs

- Ways to reboot your life

- Achieving Inner Balance

- What you can do with a notepad

- How to calculate your happiness level

- Life strategy

- How to convert your abilities into money

- How to create your own system for any activity

Key words:1Self-knowledge

Internal audit results

The audit results are recorded in the report. It contains this information:

- List of verified documents and areas of activity.

- Identified deficiencies.

- Recommendations for correcting defects.

- The person who conducted the audit.

Audit reports must be retained. They can be compared with each other in order to analyze the dynamics of the company. Based on the reports, work is carried out to correct the detected deficiencies.

FOR YOUR INFORMATION! Not every employee can participate in the audit. It is advisable that the specialist has the appropriate education. You can get all the necessary knowledge in specialized courses.

Types of audit

- a tax audit is necessary to maintain the correctness of tax accounting, identify existing shortcomings, assess possible risks and create reserves;

- financial audit determines the correctness and completeness of accounting, proper document flow, and the reliability of the preparation of annual financial statements;

- personnel audit verifies the correctness of personnel records, helps to solve identified problems that exist in the company’s personnel policy (for example, the suitability of employees for their positions or labor productivity);

- audit of accounting policies and development of recommendations taking into account the specialization of the organization’s activities;

- management audit examines all business processes, the efficiency of consumption of material and monetary resources;

- an operational audit evaluates the methodology for organizing various processes in departments to determine the effectiveness of activities (for example, the degree of implementation of plans, etc.).

- technological audit offers options for modernization and efficient use of existing production equipment;

- price audit checks the justification of the price of the product or service provided;

- other types of audit.