About the legislative framework

The maximum salary for employees is almost unlimited by current legislation. According to Article 132 of the Labor Code of the Russian Federation, the final figures are determined by several indicators:

- qualification;

- complexity of the tasks performed;

- quality of work;

- the amount of time spent on implementing functions.

The only restrictions in force relate to the maximum ratio between the remuneration of management and ordinary subordinates.

Article 145 of the same Code applies to the following categories:

- Members of the supervisory board of state corporations.

- Chief accountants.

- Chairmen of foundations.

- Deputies of the latter.

- Directors of institutions.

The rules about the marginal ratio cease to apply if we are talking about the difference between the general director and his subordinates.

The adopted Federal Law No. 247 of 2020 slightly changed these requirements. This law also applies to citizens of certain categories:

- Related to the territorial bodies of the compulsory medical insurance.

- Representatives of state extra-budgetary funds of the Russian Federation.

- Employees of unitary enterprises.

- Representatives of state and municipal institutions.

Determination of wages for managers, deputies, chief accountants

Part 2 of Article 145 of the Labor Code of the Russian Federation states that the amount of wages of managers, deputy managers and chief accountants is established by labor contracts, but is regulated by the laws of the Russian Federation, i.e. cannot be less than the size prescribed in Decree of the Government of the Russian Federation No. 210 of March 21, 1994.

Resolution No. 210 states that the heads of state. enterprises receive wages equal to the tariff rate of an employee of the main specialty of the enterprise of the 1st category, multiplied by a coefficient corresponding to the size of the enterprise.

The headcount ratio of an enterprise is calculated based on the number of employees in the main specialty of the enterprise:

- the number of employees is less than 200 people – coefficient 10;

- 200-1500 – coefficient 12;

- 1500 – 10,000 – coefficient 14;

- from 10,000 – coefficient 16.

Thus, if an enterprise employs 5,000 employees of the main specialty, then the head of the enterprise receives a salary equal to 14 wage rates for an employee of the main specialty. The salary of the manager is fixed and changes in parallel with the change in the rate of the employee of the main specialty. Changes in wages are fixed in the employment contract.

The salary of the management team is determined in accordance with the number of employees on the 1st day of the month in which the contract is concluded. When the number changes, the salary may remain unchanged or change in accordance with the change in number.

At enterprises in which wages are calculated in accordance with the monthly salary, and tariff categories are not taken into account, the wages of management personnel are calculated based on the minimum wage for employees of the main specialty.

At such enterprises, the minimum rate is calculated based on the actual performance of low-skilled employees for the last quarter. The calculations take into account the time worked according to the timesheet. The resulting figure is considered one, i.e. rate.

Salary of government management personnel. enterprise is established by executive authorities responsible for coordinating and regulating activities in certain industries, and fulfilling the obligations of the property owner.

Also, the amount of wages can be set by an authorized body, which has the right to conclude labor contracts with government management. enterprises.

Main aspects of drawing up an employment contract

The agreement is drawn up between the manager and the economic entity.

When appointing a position, the initiative usually comes from one of the following stakeholders:

- sole founder;

- general meeting of founders;

- another collegial body managing a business entity.

The decision must be accompanied by appropriate written form.

The legislation establishes the information that must be contained in such a document under any circumstances:

- A probationary period lasting up to six months.

- Work schedule. Most often, a non-standardized model is chosen.

- Salary size. It is usually fixed, with additional rates and bonuses depending on performance.

It is permissible to specify powers and job responsibilities in the main employment contract. The same applies to the situation related to full financial responsibility.

The ongoing changes in the organization of remuneration for employees are aimed at increasing official salaries for managers, specialists and employees by an average of 30-35%, ensuring uniformity in the remuneration of employees in manufacturing industries and introducing a general salary scheme for them, establishing more differentiated remuneration for managers, specialists and employees, depending on the quality, efficiency of labor and the final results of their work, bring the job titles of these employees in accordance with the work performed and salary schedules.

[p.126] Based on official salary schemes, which are a type of time-based payment, payments are made to managers, specialists and employees. [p.126] The volume of work, complexity and responsibility of managers of oil and gas transport and storage enterprises in general and its divisions separately are largely determined by the volume of the transported or stored product and the complexity of organizing the production process. To take into account this important circumstance, all oil and gas transport and storage enterprises are divided into groups (categories). Indicators for classifying enterprises and divisions into categories are established centrally. For example, management of main oil pipelines for the remuneration of managers are divided into four groups, depending on the planned volumes of oil transportation, oil shipment by rail and water transport, and water pumping through water pipelines (Table 11.2). [p.245]

Managers of Russian enterprises need to pay the closest attention to reforming the system of motivation and remuneration, because all other services merely adjust our enterprises to international standards, but only targeted work with management personnel can create [p.54]

Remuneration of managers, specialists and employees [p.197]

The main element of remuneration for managers, specialists and employees is official salaries. The size of official salaries is determined depending on the national economic importance of the industry, the volume and complexity of the work performed, working conditions, the place and role of a particular position in the production process. [p.197]

Based on the results of the certification, the possibilities for promoting employees, establishing an increase to the official salary, and transferring to another job are determined. They make recommendations for improving business qualifications, and in some cases, for dismissal from their positions. This ensures a closer connection between the remuneration of managers, specialists and employees with personal contribution to accelerating scientific and technological progress and increasing production efficiency. [p.199]

To remunerate managers, specialists and employees, as a rule, official salaries are used, which are established by the administration of the organization in accordance with the position and qualifications of the employee. For these employees, other types of remuneration may be established as a percentage of revenue, as a share of the profit received, and a system of variable salaries, which has recently become increasingly used. [p.254]

Remuneration for heads of government organizations has its own characteristics. According to the Regulations on the conditions of remuneration for heads of state organizations, their remuneration consists of an official salary and remuneration for the results of the financial and economic activities of the organization. The official salary is established depending on the value of the tariff rate for the category of worker in the main profession, determined by the collective agreement in a given organization, according to the following indicators [p.255]

The costs of carrying out administrative and management functions at the enterprise level include wages for managers and specialists, depreciation of office equipment, office expenses, rent, etc. [p.147]

Remuneration of top-level managers. In the Anglo-American model of corporate governance, executive compensation consists of three parts [p.389]

The floating salary system is based on the monthly determination of the amount of the employee’s official salary (subject to the fulfillment of a production task) depending on the results of work in the serviced area (increase or decrease in labor productivity, increase or decrease in the quality of products (works, services), fulfillment or non-fulfillment of work standards and etc.). This system is used to remunerate managers and specialists. [p.221]

Remuneration for managers, specialists and employees is made, as a rule, on the basis of official salaries. Conditions on the amount of official salary or other type of remuneration are among the essential working conditions and are established individually by agreement of the parties when concluding an employment agreement (contract). At the same time, salaries for specialists and employees of the organization are set without observing the average salaries according to the staffing table and without taking into account the ratio of the number of employees of various categories. [p.222]

The specifics of remuneration for managers of state-owned enterprises are regulated by the Regulations on the conditions of remuneration for managers of state-owned enterprises, approved by Decree of the Government of the Russian Federation of March 21, 1994 No. 210 On the conditions of remuneration for managers of state-owned enterprises when concluding employment agreements (contracts) with them. [p.223]

Remuneration of the head of the research department 1000 1000 [p.106]

Development of an effective system for stimulating the implementation of management decisions in the field of investment activities. In the process of implementing this function, a system of incentives and sanctions is formed in the context of heads and managers of individual structural divisions of the enterprise for fulfilling or failing to fulfill established targets, investment standards and plans. Individualization of the incentive system is ensured by introducing a contract form of remuneration for executives and investment managers at the enterprise. [p.62]

A clear system of remuneration for executives largely determines the efficiency of the company, the socio-psychological climate in its team, therefore, when developing a remuneration system for executives, they take into account the general situation with the business, the company’s development plans, the prevailing idea of fairness of payment, and the ratio with the amount of remuneration of other employees. Companies constantly monitor the level of pay at other enterprises. Often, to justify the management remuneration system, a special group of developers is created, and experts on legal, financial, investment and personnel policies are brought in. The system must meet the interests of the company, take into account its financial capabilities and provide managers with a sufficiently high level of labor motivation. [p.365]

The wage fund for factory workers for the volume of the order plan is determined on the basis of the state-recommended tariff schedule for remuneration of factory workers. Remuneration for plant managers is carried out on a contract basis. Forms of remuneration, rates (salaries), the ratio of their sizes between individual categories of plant employees, the bonus system, the procedure and conditions for the payment of remunerations based on the results of work for the year and other forms of material incentives are determined by the director of the plant in accordance with the regulations on the Procedure for remuneration of plant employees , approved by the Government of the Russian Federation. [p.117]

When determining the rules for constructing a remuneration system, managers must [p.246]

To remunerate managers and specialists, it can be used [p.43]

Remuneration for managers, specialists and employees is made, as a rule, on the basis of [p.310]

Total forecast sales volume Most probable production costs Intermediate profit Marketing costs Advertising Organization of sales Other costs of product promotion Bringing the product to consumers and their service Packaging Maintenance Remuneration of managers and employees of marketing services Loans provided to consumers Cost of information Total marketing costs Profit [c .220]

Remuneration for directors of enterprises, their deputies, as well as heads of relatively independent divisions can be made as a percentage of profits [p.220]

Remuneration of managers and employees of marketing services 20 [p.508]

Managers are remunerated at the salary established by them according to the staffing schedule and in accordance with the current bonus system. By its nature, it is closer to the time-bonus system with the only difference that instead of the tariff rate (daily or hourly) there is a monthly one [p.131]

The independence of the Central Federal District consists of searching for third-party orders and determining prices for them, organizing labor, establishing the form of payment and remuneration system (except for the remuneration of division managers), using income, and subleasing funds. [p.94]

Planning of the wage fund for employees of an enterprise should be carried out on the basis of the state-recommended tariff schedule for remuneration of employees of enterprises, and remuneration of enterprise managers is carried out on a contract basis. The organization of remuneration for employees of the enterprise, their material incentives are carried out by the director of the enterprise in accordance with [p.44]

When concluding a contract with the head of a non-state sector enterprise (joint stock company, partnership, collective enterprise, etc.), the terms of payment for his work are determined by the owner or his representative body (board of shareholders, board of directors, staff meeting). However, in contrast to the remuneration of the heads of a state-owned enterprise, the remuneration of the heads of collective, private enterprises is, as a rule, more autonomous in nature and is more dependent on the production and financial results of the enterprise. [p.359]

Most often, assessing the merits of a manager and regulating his remuneration are associated with the level and dynamics of such indicators as the volume of work (services) performed, the volume of products sold (or the rate of its growth), and the profit of the enterprise. Other external factors, such as changes in wages in other sectors of the economy, an increase in the minimum wage, etc., may also influence the level of pay for the manager, etc. [p.359]

Remuneration for managers of non-state sector enterprises, in particular directors of small enterprises, commercial and distribution enterprises [p.359]

The regulation on the conditions of remuneration for the heads of state-owned enterprises when concluding employment agreements (contracts) with them was approved by Decree of the Government of the Russian Federation of March 21, 1994 No. 210. It provides that when concluding employment agreements (contracts) with the heads of enterprises of joint-stock companies, the shares of which enshrined in state ownership, as well as with the heads of municipal enterprises, the terms of payment for their labor are also determined in relation to this Regulation. [p.360]

The wage fund for managers and specialists of the workshop is determined on the basis of the number of this category of personnel, official salaries and the amount of bonuses, allowances, and additional payments. [p.153]

An executive's compensation is usually set out in his contract and is confidential information. In addition to the salary or instead of the salary, the manager may receive a share of the profit received in the amount of a set percentage or depending on the results achieved according to the indicator [p.273]

Peculiarities of remuneration for managers [p.222]

Remuneration for managers and other categories of employees is based on the same general principles as remuneration for workers. However, it takes into account the peculiarities of the content and organization of their work, as well as the role they perform in the production process. [p.222]

With this goal, it is envisaged to establish more differentiated wages for managers, specialists and employees, depending on the quality, efficiency of labor and the final results of their work; (engineer, engineers of categories I and 11, leading engineer) and the corresponding categories for other specialists, increase the range between the minimum and maximum salaries for each position and qualification category. [p.173]

Remuneration for managers and other categories of employees depends on the amount of time actually worked and the achievement of the final results of the enterprise. [p.389]

The Ministry of Labor of the Russian Federation, in its letter dated April 28, 1994 No. N727-RB, provided clarifications on the application of the Government Resolution. The regulation on the conditions of remuneration for executives is mandatory for application at state-owned enterprises in the manufacturing and non-production sectors, as well as in joint-stock companies in which the state-owned block of shares provides more than 50% of the votes at the shareholders’ meeting. In joint stock companies where the state owns a block of shares that provides less than 50% of the votes at a meeting of shareholders, the terms of remuneration provided for by the Regulations can be established for the general (executive) director by a decision of the board of directors or a meeting of shareholders at the proposal of a representative of the executive authority in a joint stock company. The provision does not apply to heads of state enterprises, institutions, organizations financed from the budget, and workers whose wages are paid according to a single tariff schedule. [p.360]

Payroll

In the case of managers, time-based systems for remuneration are most often chosen. That is, the exact result and numbers depend on how many hours actually worked. Overtime is compensated through the provision of time off.

Compensation may be paid to executives when the financial year ends and all tax returns are completed and submitted. Most often, the source of payments is net profit. That is, the money is transferred when all obligations to conventional loans are fulfilled.

The days when such an employee was sent on a business trip are paid according to average earnings.

What documents to rely on?

The obligation of managers, deputy managers and chief accountants of state (municipal) institutions to maintain the salary ratio is established by Art. 145 Labor Code of the Russian Federation. According to its norms, the maximum boundaries are approved by legal acts of the Government of the Russian Federation, a constituent entity of the Russian Federation, a local government body, operating in relation to institutions of the corresponding level, and individual values that fit into this range and apply to a specific institution are determined by the founding body.

This design applies at the federal level. Regulation No. 583[1] established the maximum salary ratio - a range of multiples from 1 to 8, and the founding bodies approve individual thresholds within this framework. In particular, the Ministry of Sports and the Ministry of Education retained the multiplicity of 8 for their subordinate institutions (orders No. 591 dated June 25, 2018 and No. 380 dated July 17, 2019, respectively).

A similar scheme is used for regional and municipal institutions. For example, in the Kaluga region, the maximum wage ratio (in a multiple of 6) is set by Decree of the Government of the Kaluga Region dated March 23, 2017 No. 159, and the founding bodies in their areas of regulation have established a similar range (see, for example, orders of the Ministry of Culture and Tourism of the Kaluga Region dated 04/20/2017 No. 151, Ministry of Labor and Social Protection of the Kaluga Region dated 02/07/2018 No. 132-P). It is the maximum ratios set by the founding body that should be used when comparing the average salaries of the management staff of an autonomous institution and the rest of the staff. Note that some founders reduce the maximum salary ratio for subordinate institutions compared to the maximum range approved at the level of public legal education. And someone else differentiates the values by positions of management personnel, groups of managers, or even individual institutions. Thus, the heads of healthcare institutions in the Moscow region[2] are divided into five groups, for which different salary ratios are established (from 5 to 7), while for deputy managers and chief accountants of these institutions there is one general value - 4.5. Here are some more examples.

* A separate value is set for each institution.

How to calculate salary ratio?

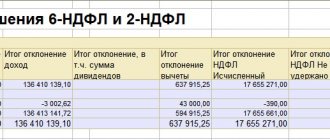

According to Art. 145 of the Labor Code of the Russian Federation, the average monthly salary is calculated for the calendar year, taking into account payments from all sources of financial support. Calculations are carried out separately for the positions of the manager, his deputy and chief accountant. The calculation procedure is established by clause 20 of Regulation No. 922[3]. We present an algorithm common to all institutions.

1. Determine the payments taken into account in the calculation. The following rule applies here: if the accrual is related to wages, it is included in the calculations, and if it is of a social nature, it is not taken into account. What exactly applies to this or that type of payment is indicated in clauses 2 and 3 of Regulation No. 922. Thus, salary, payment for work at piece rates, royalties and royalties, allowances for professional skill, length of service, expansion of service areas, vacation pay , incentives and compensation payments are included in the calculation, but payment for the cost of food, travel, training, and utilities are not.

It is somewhat more difficult to combine professions (positions) and part-time work. If the manager, his deputy or chief accountant combines positions or performs the duties of a temporarily absent employee without being released from the main job, this earnings are taken into account in the actual accrued salary for the managerial position. But if the manager works part-time (for example, as a scientific and pedagogical worker), his part-time salary is taken into account in the wage fund of the institution’s employees, and not the management staff (Letter of the Ministry of Education and Science of the Russian Federation dated October 31, 2017 No. 12-1066).

2. Determine the average number of employees of the institution. This indicator does not include the manager, his deputies and the chief accountant. Internal part-time workers are fully taken into account.

3. Calculate the average monthly salary of employees (excluding the management of the institution). The amount of actually accrued payments related to wages is divided by the average number of employees for the corresponding calendar year, and then by 12 (the number of months in a year).

4. Calculate the average monthly salary separately for each managerial position. The amount of payments actually accrued for each position for the calendar year is divided by 12. If the manager, his deputy or chief accountant worked for an incomplete calendar year, the actual number of full calendar months worked is taken instead of 12 months.

5. Determine the salary ratio for each position of the management team. To do this, the average monthly salary of the manager (deputy, chief accountant) is divided by the average monthly salary of the rest of the staff.

Let us show with an example how the ratio of a manager’s salary is calculated.

Example.

The staff of the autonomous institution is 70 people, four of them are the head, two of his deputies and the chief accountant. The actual accrued salary for 2020 for main employees is 28.5 million rubles, for managers - 1.5 million rubles. (of which 100 thousand rubles are fees for part-time work as a teacher). Let's calculate the ratio of the salary of the manager and the main personnel.

First, let's determine what part of the manager's salary is taken into account for the managerial position: 1,500,000 - 100,000 = 1,400,000 (rub.). Accordingly, the salary fund for key personnel will include the manager’s salary for part-time work: 28,500,000 + 100,000 = 28,600,000 (rub.).

The number of employees will be 67 people. (66 main staff + 1 part-time worker).

Let's calculate the average salary of key employees: 28,600,000 rubles. / 67 people / 12 months = 35,572 (rub.).

Then we determine the average salary of the head of the institution: 1,400,000 rubles. / 12 months = 116,667 (rub.).

Let's calculate the salary ratio: 116,667 rubles. / RUB 35,572 = 3.28.

If the founding body has approved a threshold threshold of a multiple of 5, 4 or even 3.5, the autonomous institution has fulfilled the requirement for the salary ratio, but if it is necessary to comply with a multiple of 3, the salary of the head of the administrative institution does not fit within the established limits.

Who is obliged to establish the ratio of salaries of heads of budgetary institutions and their employees

Federal Law No. 347 of 2020 does not indicate specific values indicating what should be the difference between the average monthly earnings of managers and employees of budgetary organizations.

But here it is said that such a relationship must be affirmed:

- For federal level organizations – by the Government of the Russian Federation.

- For organizations of Russian regions and municipalities - regulatory legal acts of constituent entities of the Russian Federation and local governments.