Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem — contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

An integral part of commodity-money relations that develop between subjects of law are monetary loans.

A loan involves the transfer of money; accordingly, there is always a risk of delay in repayment of the debt or a complete refusal of the debtor to fulfill his obligations under the contract.

To prevent and eliminate such situations, you need to know all the legal features of the loan.

What it is

The relationship that arises between the lender and the borrower, in terms of the transfer to the latter of funds or other valuables that have generic characteristics, into ownership, is characterized as a loan. According to the rules, the person taking out the loan must repay the debt within the time agreed upon by the parties when concluding the agreement.

Based on the norms of civil legislation of the Russian Federation, this type of agreement can be concluded in two types:

| In writing | is always concluded in this form if the amount of the contract exceeds ten times the amount of remuneration or a legal entity acts as a lender |

| Orally | if the subjects of the contract are citizens and the amount of transferred funds does not exceed ten times the minimum wage established by law |

Contractual relations will be considered to have arisen from the moment of transfer of funds or valuables for the use of the borrower.

A receipt, cash receipt, delivery note or payment order may serve as confirmation of the transfer of funds or material assets.

A cash loan implies the accrual of interest for the use of funds, unless otherwise agreed by agreement of the parties. If the subject of the contract is a thing, then we are not talking about interest.

The essence of a property loan is that the borrower takes ownership of certain things that have individual characteristics, while it is not the thing itself that is returned, but some property values that have similar characteristics or a similar quantity.

At the legislative level, legal relations in the field of loans are regulated by Federal Law No. 353 “On consumer credit (loan)” and Chapter 4, paragraph 1 of the Civil Code of the Russian Federation.

In terms of violation of the deadlines for repayment of the loan and the interest accrued on it, the borrower will be held liable based on the norms specified in the regulations, namely, Article 14 of the Federal Law and Article 811 of the Civil Code of the Russian Federation.

Not only the amount of the principal debt will be subject to payment, but also:

- The percentage specified in the Civil Code of the Russian Federation, Article 809

- Penalties in the amount provided for by agreement of the parties, and in its absence, part 1 of Article 395 of the Civil Code of the Russian Federation.

In what cases is it performed?

Delinquency on a loan occurs when the borrower does not repay the debt within the period agreed upon by the parties. If the parties have not provided for such a clause, then the borrower is obliged to repay the entire amount of the debt within thirty days from the date of receipt of notice from the creditor.

Debt can arise due to various circumstances, ranging from the deterioration of the borrower’s financial situation to his deliberate attempt to avoid repaying the debt. In any case, the lender should know the specifics of the procedure and the collection procedure.

Video: debt collection under a loan agreement and receipt

Features of the procedure

To have guarantees for debt repayment, the lender must take seriously the drafting of the loan agreement, taking into account all the reservations and nuances.

You can increase your chances of loan repayment by:

- presenting requirements to the applicant regarding the provision of bail or surety;

- a clear indication in the terms of the contract of the interest rate, penalties, fines, etc.;

- requesting from the borrower complete and reliable information about him.

In case of delay in repaying the loan, the lender has all legal grounds to apply to the court to collect the debt.

Regardless of what reasons there are for delays in debt repayment, the conflict between the parties must be regulated strictly within the law, without violating each other’s interests.

Collection of debt under a loan agreement from an individual

You can collect a debt under a loan agreement from an individual using three steps:

| Extrajudicial | The first stage involves debt collection by sending a claim to the borrower, indicating requirements for the timing of loan repayment, conditions and the amount of the debt itself. If the borrower ignored the claim or again delayed the deadlines specified in it, the lender has the right to go to court |

| Judicial | at the judicial stage, debt collection occurs by filing a statement of claim in court. The creditor must attach documents confirming the borrower’s failure to fulfill its obligations to the main claim. |

| Post-trial | After the trial is completed, the debt is collected. The lender receives a writ of execution, which is handed over to the bailiffs. Debt collection becomes their responsibility |

At the out-of-court stage

At this stage, the issue of debt repayment is resolved through negotiations. The law does not prohibit contacting third parties, such as collection agencies or mediators.

The stage itself goes something like this:

| The lender uses all available methods to communicate with the borrower | telephone calls, sending notifications by mail |

| If the client does not contact | the creditor engages collectors and expects a response within a certain period |

Thus, all actions are aimed at resolving the issue in order to avoid recourse to the judicial authorities. Going to court is an effective method for debt recovery, but it entails certain difficulties for both parties.

It is possible that the borrower will make contact and repay the debt voluntarily. A compromise solution to the issue is beneficial, since the lender can give additional installments or write off part of the penalties.

Judicially

Judicial procedure is the most reliable way to collect debt, despite all its complexity and cost.

The preparatory stage for applying to the court includes the collection and preparation of the necessary documents:

| Statement | containing information about the parties to the future process, the essence of the requirements, links to laws |

| Agreement | from which the borrower’s obligations to repay the debt arise |

| Document | confirming settlement of a dispute out of court |

| Receipt | on payment of state duty and other documents related to the process |

If the amount of debt is less than 50,000 rubles, then documents should be submitted to the magistrate’s court. If the amount of debt is higher than the specified amount, the appeal takes place to a district court. The amount of the claim will be determined based on the size of the total debt.

Read about the taxation of interest-free loans between individuals in the article: interest-free loans between individuals in 2021. How to draw up a gratuitous loan agreement between individuals, read here.

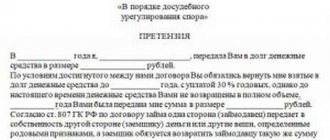

Sample of a claim

The claim is an essential condition, without which further actions to collect the debt through the claim proceedings are impossible.

The document is drawn up in two copies, one of which is given to the borrower, the second, with a note about the transfer, remains with the lender. The legislator has not established a unified form of claim; accordingly, it is drawn up in free written form.

The established judicial practice allows us to determine the general form of the claim, consisting of several sections:

| First part | includes the general essence of the appeal, the circumstances that caused the document to be drawn up, it is important to indicate the clauses of the loan agreement violated by the borrower, the amount of debt |

| Second part | contains information about how the obligations of the parties under the agreement to each other were fulfilled, a reference is made to the fact that the lender fully fulfilled its obligations, and the borrower did not take the required actions to repay the debt |

| The third part | is dedicated to the requirements, in addition to the principal amount of the debt, information on the payment of penalties and fines is indicated |

| Fourth | contains a reference to the time frame within which the debt must be repaid, taking into account all penalties |

In the complaint we provide the following information:

| Borrower and lender information | Full name, addresses, telephone numbers, as well as the grounds for the requirements |

| Circumstances | in which the funds were not returned within the period agreed upon by the parties to the agreement |

| Competent justification of requirements | taking into account references to laws and regulations of the Russian Federation |

| Actions the lender will be forced to take | if the borrower refuses to repay the debt after receiving the claim |

Copies of documents related to the stated requirements are attached to the completed claim. The document is sent to the person who, by agreement, acts as the borrower of funds.

If the client is a legal entity, then the claim is sent to the legal address of the organization or institution. Documents are sent to an individual at his place of residence.

Statement of claim for debt collection under a loan agreement - sample 2021

If you decide to file a claim regarding debt under a loan agreement, you need to be prepared. To recover a debt that the borrower does not want to repay, fill out an application to the court. A sample can be found on the Internet, but if you don’t want to spend time on this, check out the list of information that you will need to write on an A4 sheet of paper to file a claim for recovery of money:

- judicial district and court (address) where the loan claim is filed;

- Full name, address and contact telephone number of the plaintiff;

- Full name, address and contact number of the defendant against whom you are suing for debt collection;

- amount of claim (the amount you have the right to recover under the loan agreement). A little clarification is necessary here: the plaintiff has the right to demand compensation and moral damages, as well as interest in the claim;

- the statement of claim itself (the plaintiff must retell the history of the financial relationship with the defendant, using as many facts as possible regarding the loan agreement, a sample of which, by the way, must also be attached to the documents. You can attach your copy or the defendant’s receipts to the claim);

- Next in the statement of claim there is a clause with demands, which are often called “I ask” (without a sample).

In the last paragraph of the claim, it is necessary to clarify that you are filing a claim for collection and demanding the return of the debt, the fact of which proves the existence of a loan agreement. This sample is fully relevant for those wishing to file a claim.

Read the link: Statement of claim for debt collection under a supply agreement.

Under an interest-free loan agreement

If you file a claim for debt collection under an interest-free loan agreement (sample in the text), then you do not have the right to demand a penalty, regardless of the fact that the terms and conditions of repayment were violated in one way or another. In this case, the amount in the claim will correspond to the amount of debt in the receipt (in rubles). You can receive additional compensation by demanding that the court collect moral compensation in connection with the defendant’s improper fulfillment of his financial obligations. Such cases are never dealt with according to any specific pattern. In some cases, defendants advance refunds; in others, the amount of compensation increases because the plaintiff is able to prove the negative consequences of non-payment of the debt. Debt collection under an interest-free loan agreement occurs only with a receipt.

According to the loan agreement with interest, 2021

Such a claim and the application for it differ in that it is necessary to indicate in a separate line the claims for interest that have not been paid. Here you also need to understand that interest is often not documented, and if it was transferred from hand to hand, and not to a card or bank account, then it will be difficult for the court to find out exactly when the defendant stopped paying interest (especially if the testimony of the parties differs ).

Try to find as many documents as possible for the claim that will help you convey the truth to the court. For example, you go to court in Nizhny Novgorod with a claim to collect debt from an individual. Write the statement of claim for debt collection under a loan agreement with interest for 2021 as carefully as possible (a sample can be found online). Attach the main documents, a receipt describing the percentage and terms.

Under a loan agreement between legal entities

How to properly file a claim using the sample if the LLC does not want to return the debt to you; What to do with a dispute between legal entities? The statement of claim for debt collection between legal entities is not very different from the samples we have already considered. But the price of the issue in such disputes is usually much higher. In the contact information block in the application, you must indicate the following information about the plaintiff and defendant (sample):

- The name of the company being sued.

- Legal and physical address.

- IIN, KPP, OGRN and current account.

- Full name of the General Director

The claim for debt collection under a loan agreement between legal entities is otherwise no different from the previous examples. Next, you have to tell the story, put forward demands and attach documents.

Existing state fees

The court will accept the claim for proceedings only if the state fee is paid in advance. The amount of the fee is calculated based on the total amount of claims.

The duty should be calculated according to the norms of tax legislation, taking into account the norms of Article 333.19. According to this norm, the minimum duty is 400 rubles, the maximum amount if the debt exceeds 1 million rubles.

To apply to the courts of arbitration jurisdiction, one should rely on the provisions of Article 333.21 of the Tax Code of the Russian Federation.

Statement of claim for debt collection under a loan agreement with interest

In the event that all pre-trial measures have been taken, but the borrower has not repaid the debt, the lender has the right to go to court. To apply, you will need to draw up a statement of claim and prepare documents confirming the requirements.

The claim is written taking into account the general requirements imposed by law for this type of document and must contain the following information:

| Information about the court | to which the claim is filed, as well as information about the parties to the process (full name, addresses, telephone numbers, etc.) and the price of the claim |

| Description of the circumstances | in which legal relations arose between the parties, what amount was transferred as a loan, when the terms of the agreement were violated by the defendant |

| What actions were taken by the plaintiff | to settle a dispute out of court (claim work) |

| Requirements | presented to the defendant, indicating references to articles of law and a petition to the court |

| Date and signature of the applicant | list of attachments to the claim |

The attachments will include a loan agreement, a receipt for the transfer of funds, a receipt for payment of a fee, a copy of the applicant’s passport, a debt calculation, a claim (if the claim procedure was followed).

Between individuals

Debt collection under a loan agreement between individuals occurs in the general manner established by law.

To do this, a standard statement of claim is drawn up, consisting of three parts:

| Preamble | containing information about the court, the parties to the trial |

| Contents, subject of the claim | including the basis for the claims, what the problem is that was not resolved pre-trial |

| Base | requirements, reference is made to the clauses of the loan agreement, laws and regulations |

Each requirement must be based only on the norms of the current legislation of the Russian Federation. It is important that all attached documents are drawn up properly, otherwise the court may refuse to satisfy the claims.

Statement of claim for debt collection under a loan agreement

To court

Plaintiff:

Respondent:

The cost of the claim is 1,130,000 rubles

STATEMENT OF CLAIM

This lawsuit was filed in ………. court on the basis of Art. 32 of the Code of Civil Procedure of the Russian Federation, since clause 3 of the loan agreement dated ………. contractual jurisdiction has been established for disputes related to the loan agreement.

…. April 20... a loan agreement was concluded between me and G., in accordance with the terms of which I lent the Defendant 1,000,000 rubles, and the latter undertook to give me this amount.... November 20... In addition, the terms of the agreement stipulated that G. also undertakes to pay me a fee for using the loan amount, based on the calculation of 1% for each month. The defendant did not fulfill his obligation to repay the loan.

Part 1 art. 809 of the Civil Code of the Russian Federation provides the following: “Unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner determined by the agreement.” Clause 1 of the loan agreement provides for the borrower’s obligation to pay a fee in the form of 1% of the loan amount for each month. As of... January 20..., the loan term was 9 full months, i.e. the amount of interest determined in accordance with clause 1 of the loan agreement is equal to 90,000 rubles (9% of the loan amount).

In addition, for late repayment of the loan amount, a penalty in the amount of 0.05% of the debt amount is required for each day of delay. As of February 1, 20..... the period of delay was 80 days. (18 days - November; 31 days - December; 31 days - January = 80 days). The amount of the penalty as of 02/01/20... is equal to 40,000 rubles (1,000,000 X 0.05% = 500 rubles; 500 rubles X 80 days = 40,000 rubles).

To ensure proper execution of the above-mentioned loan agreement, G. was provided with a BMW X5 car as collateral, year of manufacture ….., identification number …………., state license plate ……….., valued by the parties at ……… .. rubles. Due to the defendant’s failure to fulfill the obligation to repay the loan amount, interest on the loan and penalties, and on the basis of Art. 348, 349 of the Civil Code of the Russian Federation, foreclosure must be applied to the mortgaged property.

In connection with the above and on the basis of Articles 348, 349, 809, 811 of the Civil Code of the Russian Federation

ASK:

To recover from G. in my favor 1,130,000 rubles, including 1,000,000 rubles of debt under the loan agreement, 90,000 rubles of interest for using the loan and 40,000 rubles of penalties for late fulfillment of the obligation to repay the loan amount.

To foreclose on the collateral: BMW X5 car (BMW X5), year of manufacture ……, identification number …….., state license plate …….., setting the initial sale price at 1,000,000 rubles.

To collect from G. in my favor 14,050 rubles for the cost of paying the state duty.

Application:

- State duty receipt

- Copies of the statement of claim

- Copies of the loan agreement

- Copy of power of attorney

"___" ___________ 20…. G. ________________ ____________