Estimate

| Reviews: | 4 | Views: | 11344 |

| Votes: | 0 | Updated: | n/a |

File type Text document

Document type: Contract

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

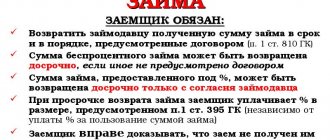

Loan AGREEMENT (interest-free) _________________ "___"_________ 20__ Citizen ________________________________, hereinafter referred to as (last name, first name, patronymic) “Lender”, on the one hand, and citizen _________________________, (last name, first name, patronymic) hereinafter referred to “Borrower”, on the other hand, have entered into this agreement as follows: 1. SUBJECT OF THE AGREEMENT 1.1. Under this agreement, the Lender transfers to the Borrower an interest-free loan in the amount of _____________ (__________________________) (amount in words) rubles in cash, and the Borrower undertakes to repay the amount received within the time frame and in the manner specified in this Agreement. 2. RIGHTS AND OBLIGATIONS OF THE PARTIES 2.1. The Lender is obliged to transfer to the Borrower the amount specified in clause 1.1 by ___________________. 2.2. The fact of transfer by the Lender of the specified amount is certified by a receipt from the Borrower. 2.3. The amounts received are repaid by the Borrower in equal installments - ____________ (________________________) rubles monthly - within ________________________, starting from ____________________ according to the following schedule: Payments: no later than: amount: +——————————————— —-+ ¦ 1 ¦ ¦ ¦ +———-+——————-+——————¦ ¦ 2 ¦ ¦ ¦ +———-+——————-+—— ————¦ ¦ 3 ¦ ¦ ¦ +———-+——————-+——————¦ ¦ 4 ¦ ¦ ¦ +———-+——————-+ ——————¦ ¦ … ¦ ¦ ¦ +————————————————-+ 3. RESPONSIBILITY OF THE PARTIES 3.1. In the event of non-fulfillment or improper fulfillment of obligations by one of the parties under this agreement, the dishonest party is obliged to compensate the other party for losses caused by such non-fulfillment. 3.2. In addition to compensation for damages, the dishonest party is obliged to pay the other party a fine in the amount of direct actual damage caused. 3.3. If the Borrower violates the schedule for repaying the amounts received specified in clause 2.3 of this Agreement, the Borrower will be obliged to pay the Lender a penalty at the rate of ___% of the loan amounts not repaid on time for each day of delay. 3.4. Failure of one of the parties to fulfill the terms of this agreement resulting in material losses to the other party entails the application of penalties to the guilty party in the amount of damage caused and may serve as grounds for early termination of the agreement. 4. FORCE MAJEURE 4.1. The parties are released from liability for partial or complete failure to fulfill obligations under this agreement if this failure was a consequence of force majeure circumstances that arose after the conclusion of this agreement as a result of extraordinary circumstances that the parties could not foresee or prevent. 4.2. The classification of certain circumstances as force majeure is carried out on the basis of business customs. 5. CONFIDENTIALITY 5.1. The terms of this agreement and additional agreements (protocols, etc.) to it are confidential and are not subject to disclosure. 6. DISPUTE RESOLUTION 6.1. All disputes and disagreements that may arise between the parties on issues that are not resolved in the text of this agreement will be resolved through negotiations on the basis of current legislation and business customs. 6.2. If controversial issues are not resolved during negotiations, disputes are resolved in court in the manner prescribed by current legislation. 7. TERM AND TERMINATION OF THE AGREEMENT 7.1. The term of this agreement begins from the moment the Lender transfers the loan amount to the Borrower and ends after the parties have fulfilled their obligations in accordance with the terms of the agreement. 7.2. This agreement is terminated: - by agreement of the parties; — early repayment by the Borrower of the loan amount; - if the Borrower violates the schedule for repaying the next part of the loan amount. In this case, the Lender has the right to demand early repayment of the entire unreturned loan amount; - on other grounds provided for by current legislation. 8. FINAL PROVISIONS 8.1. Any changes and additions to this agreement are valid, provided that they are made in writing and signed by duly authorized representatives of the parties. 8.2. All notices and communications must be given in writing. 8.3. The loan amount is considered repaid at the moment the cash is transferred to the Lender or the corresponding funds are credited to his bank account. 8.4. This agreement is drawn up in two copies having equal legal force, one copy for each of the parties. 8.5. Place of residence and passport details of the Lender:___________ _____________________________________________________________________ _____________________________________________________________________. 8.6. Place of residence and passport details of the Borrower: ____________ _____________________________________________________________________ _____________________________________________________________________. SIGNATURES OF THE PARTIES: Lender _________________________ (signature) Borrower _________________________ (signature) “__”____________ 20___ this agreement is certified by me, ____________________________________ by a notary in the city __________________ _____________________________________________________________________. (name of the notary office, No., date of issue of the license) The agreement was signed in my presence, the identity of the parties was established, their legal capacity was verified. The text of the loan agreement was read aloud. Registered in the register under No. ____________ Charged at the rate: ______________________ rub. m.p. Notary: __________________ (signature) COMMENTS: ———— Under the loan agreement, one party (Lender) transfers into ownership the other party (Borrower) money or other things determined by generic characteristics, and the Borrower undertakes to return to the Lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality. A loan agreement between citizens must be concluded in writing if its amount exceeds at least ten times the minimum wage established by law. In confirmation of the loan agreement and its terms, a receipt from the borrower or another document certifying the transfer to him by the Lender of a certain amount of money may be presented. A loan agreement is assumed to be interest-free, unless it expressly provides otherwise, in cases where: the agreement is concluded between citizens for an amount not exceeding fifty times the minimum wage established by law, and is not related to the entrepreneurial activity of at least one of the parties; under the agreement, the borrower is not given money, but other things determined by generic characteristics.

Download the document “Sample. Loan agreement (interest-free) with payment of the loan amount in installments »

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Loan agreement (interest-free) with payment of the loan amount in installments,” and ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

What it is

A loan agreement in tranches involves the transfer of funds not as a whole amount at once, but in separate parts (or tranches). Interest rates under such an agreement may be accrued unevenly (if this condition is provided for in the agreement).

The loan agreement in tranches may indicate different terms and dates for the provision of money, as well as additional conditions drawn up on an individual basis.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Each subsequent tranche can be issued if the conditions of the previous tranche are fully met (the borrower repays the tranche within the period established by the lender).

The parties to the tranche loan agreement can be both legal entities and individuals. For example, one party may be an organization and the other a citizen (or both parties – an individual or a legal entity).

Many people are concerned about the question: for what amount will the loan agreement be concluded in tranches if the funds are issued in installments according to the disbursement schedule? Each new tranche is a new debt obligation, therefore, the loan agreement is considered concluded for a specific transferred amount.

It should be noted that loan agreements in tranches are recognized by the courts as valid, provided that the fact that the borrower has received funds is confirmed by the terms of the agreement and letters (or applications) in which the borrower asks to transfer funds towards the loan to the current account, as well as payment orders from the lender.

For clarification, you can refer to the Civil Code of the Russian Federation, namely to paragraph one of Article 807: the loan agreement is considered concluded from the moment of issuance of funds or other objects.

It follows from this rule that the loan agreement is a real agreement and is considered concluded for the amount actually issued (and not for the amount specified in the document) from the moment of transfer of money (in particular, a specific tranche).

If a loan is provided in several tranches, all disbursements should be regarded as an increase in the size of the loan provided (but not more than the amount agreed upon in the agreement), and it does not matter whether such relationships are secured by one agreement or several.

In this case, the agreement will be considered concluded only for the amount of tranches already transferred. Specific loan amounts, terms and payment procedures may also be established by additional agreements to the loan agreement.

The possibility of providing a loan in parts (several tranches) is confirmed by Letter of the Ministry of Finance of Russia dated April 15, 2013 N 03-03-06/1/12502.

The document states that each new tranche in which funds are transferred to the borrower must be considered as a new debt obligation, but this is permitted by designation within the same loan agreement.

Thus, transferring the loan amount in installments cannot serve as a basis for declaring the agreement not concluded or invalid.

The wording in the contract may look like this:

“The funds are transferred by the lender to the borrower’s current account in installments from the moment of signing this agreement until __.__.____.”

Article 311 of the Civil Code of the Russian Federation also states that the lender has the right not to accept partial fulfillment of obligations, unless otherwise provided by law, other legal acts, terms of the obligation and does not follow from business customs or the essence of the obligation.

Thus, if the loan agreement did not indicate the lender’s right to issue the loan in parts (or tranches), then the borrower may refuse such fulfillment of obligations by returning the corresponding amount to the lender.

In such a case, the agreement will be considered not concluded. However, the lender still has the opportunity to prove that the transfer of the loan in tranches follows from the customs of business in relation to these transactions.

If the borrower has received funds, the loan agreement is considered concluded for the amount of money actually received. This follows from paragraph three of Article 812 of the Civil Code of the Russian Federation.

It states that if the borrower actually received from the lender an amount less than that specified in the agreement, the agreement is considered to be concluded for that amount of money. Accordingly, upon receipt of the next tranche, the loan size will increase by its amount.

If the loan agreement does not define the procedure for fulfilling obligations in installments, difficulties may arise with calculating interest for the use of funds.

This is because the amount of the loan that accrues interest will continually vary as the next installment of money is received.

Therefore, in order to avoid possible difficulties associated with providing the loan amount in installments, it is recommended to draw up an additional agreement to the loan agreement.

The agreement must specify the conditions for partial transfer of money to the borrower. Namely, indicate the size of the loan, the timing of the transfer of money, as well as the procedure for calculating interest.

A sample loan agreement with an employee is presented in the article: loan agreement with an employee. What is the state duty on debt collection under a loan agreement, and how it is paid, read here.

Comments on the document “Sample. Loan agreement (interest-free) with payment of the loan amount in installments »

Reply 0

| Andrey | 02/11/2015 at 10:28:50 Perhaps the agreement should reflect the articles of paragraph 1 of Art. 811, clause 1, art. 395 Civil Code of the Russian Federation |

Reply 0

| Paul | 03/14/2018 at 11:09:47 Thank you! Everything is short and competent |

Reply 0

| Alexander | 09/06/2019 at 17:31:22 Nice template, thanks a lot to the creator!!! |

Reply 0

| Lilya | 04/28/2020 at 17:58:00 Thank you, everything you need! |

Written form of loan agreement

Written form is strictly necessary if the contract amount is more than 50 times the minimum wage. In this case, an agreement or a receipt confirming the terms is concluded between individuals. And between legal entities or a legal entity and an individual, a full-fledged agreement must be drawn up. It may include up to several dozen sections describing in detail:

- liability of the parties;

- purpose of the loan;

- loan repayment procedure;

- deadlines;

- force majeure (force majeure) and other conditions.

Also, the written form of the agreement indicates the percentage for the use of funds or its absence (free use).

An important nuance: if the agreement between a legal entity and an individual (borrower) specifies a percentage that is less than 2/3 of the refinancing rate, then in this case personal income tax is paid.

Documents found on the topic “salary loan repayment agreement”

- Agreement on the provision of an interest-free loan Agreement of debt, credit → Agreement on the provision of an interest-free loan

agreement No. (on the provision of a loan ) » » 20 , hereinafter referred to as the “ lender ”, represented by... - Sample. Statement of claim for early termination agreement loan and collection of issued loans

Statements of claim, complaints, petitions, claims → Sample. Statement of claim for early termination of the loan agreement and collection of the issued loan... defendant: (last name, first name, patronymic) address: price of claim - rubles statement of claim for early termination of the contract and recovery of the issued loan "" 20 on the basis of a decision (management body) dated "" 20 (name of enterprise...

- Statement of accrual and issue salaries

Documents of the enterprise's office work → Statement of accrual and payment of wagesstatement of calculation and payment of salaries No. organization ( division ): No. full name position, degree (title)…

- Sample. Guarantee for loanissued to the borrower

Surety agreement → Sample. Guarantee for a loan issued to the borrowerguarantee for a loan issued to the borrower guarantee (place and date of issue of the guarantee in words) I, gr. , (full name, date of birth...

- Sample court order for collection salaries

Court orders, decisions → Sample court order to collect wagesCOURT ORDER "" 20, district (city) people's court of the region (region, republic) Judge (full name)

- Sample. Power of attorney to receive salaries

Powers of attorney: sample completion → Sample. Power of attorney to receive salary...Oskva, st. central, 1 apt. 1, passport series 1123 number 234555, issued by the Department of the Federal Migration Service of Russia for Moscow on May 13, 2001, department 231 - 790, I trust gr. Ivan Ivanovich Ivanov, born January 30, 1981, living at the address: m...

- Sample. Order on granting leave without saving salaries for passing university entrance exams

Employment agreement, contract → Sample. Order on granting leave without pay to take entrance exams to a university...amenov to the university from July 15 to July 29, 1997 2. in agreement with n. A. Morozovaya establish that the leave is not subject to . 3. to the chief accountant when calculating salaries n. A. frosty in July of this year, be guided by this order...

- Application from an individual borrower for issuance loans

Debt, loan agreement → Application of an individual borrower for a loanapplication from an individual borrower for a loan on April 30, 1991, Gennady Alekseevich Prokhanov from (last name, first name, patronymic of the borrower), Ryazan, ave. its...

- Sample. Certificate of movement of the actually created reserve for possible losses loans

Accounting statements, accounting → Sample. Certificate of movement of the actually created reserve for possible loan losses…O. 17 reg. no. (name of bank) certificate of movement of the actually created reserve for possible loan for 20 (reporting date) (thousand rubles) +-+ 1. opening balance +-+- 2. additionally accrued (total): +-+- 2.1. ...

- Certificate of actual debt loans and balances of funds on settlement, deposit and other accounts of legal entities and individuals

Accounting statements, accounting → Certificate of actual debt on loans and balances on settlement, deposit and other accounts of legal entities and individualscertificate of actual debt on loans and balances on settlement, deposit and other accounts of legal entities and individuals accepted for servicing...

- Statement of claim for payment of double the price of a damaged item, payment of a penalty and collection of a fine

Statements of claim, complaints, petitions, claims → Statement of claim for payment of twice the price of a damaged item, payment of a penalty and collection of a fine - Claim for payment sum insured for agreement personal insurance

Statements of claim, complaints, petitions, claims → Claim for payment of the insured amount under a personal insurance contract...address) from , (full name of the applicant) residing at the address: claim for payment of the insured amount under the contract contract was concluded ...

- Sample. Agreement for renting premises under office

Lease agreement for non-residential premises, buildings and structures → Sample. Lease agreement for office spacecontract no. for renting premises for an office in the city "" 20, hereinafter referred to as (name of enterprise, organization) "f...

- Sample. Claim about payment sum insured for agreement loan non-repayment risk insurance

Statements of claim, complaints, petitions, claims → Sample. Claim for payment of the insured amount under a loan non-repayment risk insurance agreement(position, full name) (name of organization) address: claim for payment of the insured amount under agreement for the risk of loan default "" 20 year between (name of organization) and an agreement for the…

- Agreement sublease of land under car parking

Lease agreement for land, land share, plot → Sublease agreement for a land plot for parkingagreement for a land plot for parking in the city (specify the place where the agreement ) ...

Drawing up and signing an agreement

The loan agreement in tranches, as well as the standard agreement, is recognized as valid from the moment the borrower receives the money. This norm is prescribed in Article 812 of the Civil Code of the Russian Federation. Tranche agreements have several such transfers, and each of them will be considered the basis for recognizing the transaction as valid.

Confirmation of the conclusion of the agreement can be not only the text of the agreement itself, but also written negotiations between the parties, where the borrower asks to provide him with borrowed funds in a series of tranches, as well as statements and other papers confirming that he has received these funds.

If, when signing the text of the agreement, a larger amount was indicated than that actually received by transferring several tranches, then the amount of the loan is considered to be the amount of money actually received by the borrower.

If the subject of the loan is an object of property rights, such an agreement will have legal force only if all of them were valued in monetary terms at the time of signing the agreement.

How to draw up a contract correctly

In accordance with civil law, the contract is drawn up in writing. Since the agreement involves the transfer of borrowed funds in several tranches, it is extremely important to describe as accurately as possible the conditions and timing of the transfer of each of them, and the procedure for repaying the debt. The text also specifies the total amount of the loan and the rules for calculating the interest rate.

With regard to the loan agreement in tranches, all the rules applicable to other loan agreements concluded between organizations apply.

The main distinguishing feature is the payment schedule, as well as individual debt repayment terms and other conditions for each tranche, which can be either the same or different from each other.

If the text of the agreement does not contain information about interest for the use of funds, then they will be calculated at the refinancing rate in force in the region where the borrowing company is registered.

The text of the contract must include the following information:

- loan amount, number of tranches, obligations to issue and repay;

- how the loan will be transferred: by bank transfer, cash, services or goods;

- the period of validity of the contract and the terms of debt repayment;

- procedure for debt repayment, the possibility of early repayment of the entire loan amount;

- procedure for action in force majeure situations;

- information on methods for resolving conflict situations and contract disputes;

- names of companies party to the agreement, details of founders, payment and other details;

- expiration of the agreement and the possibility of its extension.

If the text does not contain information about how long it takes to repay the borrowed funds, then repayment of the debt must be made within 30 days from the date of receipt of the relevant notification from the creditor.

Required package of documents

To draw up a loan agreement in tranches, the following package of papers is required:

- Certificates of state registration and tax registration for each of the counterparties.

- Charters of organizations and constituent documentation.

- If the agreement is signed by an authorized person, then a power of attorney and an order for the appropriate appointment will be required.

- Documents for property that will be transferred or provided as collateral.

- Papers confirming the presence of a current account with each organization.

Such an agreement can be concluded either between two organizations or between several companies. The document is signed in a number of copies that matches the number of parties involved in the transaction.

The size of the tranches and the procedure for their payment are prescribed in the appendix to the main text of the agreement.

Related documents

- Sample. Loan agreement with collateral

- Sample. A loan agreement concluded to pay for the repair and restoration of a car owned by the borrower

- Sample. Regulations on the conditions and procedure for providing loans to employees and shareholders of a closed joint stock company

- Sample. The borrower's receipt of the amount of money under the loan agreement

- Sample. Receipt from the lender for receipt of the entire amount of money under the loan agreement

- Sample. Receipt from the lender for receiving part of the amount of money under the loan agreement

- Sample. A fixed-term obligation of an individual borrower under a loan agreement concluded between an employee (shareholder) of a closed joint-stock company and the company

- Sample. Agreement on borrowing money with a penalty

- Sample. Agreement on the termination of an obligation by agreement of the parties to replace one obligation with another, as well as its fulfillment

- Sample. Money loan agreement

- Urgent obligation

- Form (sample) of receipt (for loan repayment)

- Form (sample) of receipt (for receiving a loan)

- Money loan agreement (free of charge)

- Cash loan agreement for the Borrower to purchase fixed assets

- Targeted loan agreement

- Receipt for receipt of funds under an agreement, under a transaction

- Borrower's receipt

- Loan agreement with interest

- Interest-free loan agreement from the founder of the company participant

Application for a loan under a loan agreement in tranches

As noted, a loan agreement in tranches may provide for the provision of the next tranche based on the borrower’s application.

A sample application for a tranche under a loan agreement can be downloaded from the link: Application for a tranche under a loan agreement - sample.

It is recommended that this application be submitted in the form of an annex to the DD in tranches, a sample of which was presented in the previous section of the article.

The legislation does not contain requirements for the execution of such applications. In the application, it is recommended to indicate the requested loan amount and the details to which the lender should transfer it.

At the same time, there are legal requirements for filing applications under other types of remote control. Thus, when applying for a loan in foreign currency, a citizen must be informed by the borrowing organization about the risks associated with a foreign currency loan (Article 2 of the Law “On Amendments...” dated December 5, 2017 No. 378-FZ).

In judicial practice, an application for the provision of a tranche under a loan agreement is regarded as one of the documents confirming the fact of the provision of a loan (resolution of the 3rd AAS dated October 10, 2018 in case No. A33-5778/2015k20).

Other documents, in addition to the application, that may be required when fulfilling the obligation under the contract are described in our articles:

- “When is early repayment of a loan possible and how to arrange it?”;

- “Early termination of a loan agreement - sample agreement.”

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample.

The loan agreement (interest-free) with payment of the loan amount in installments" was useful for you, we ask you to leave a review about it. Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Concept and form of loan agreement

The concept of a loan implies that one person trusts another to dispose of monetary or other valuables (things) at his own discretion - both for interest on use and on a free basis. The loan is possible both in Russian rubles and in foreign currency (in the contract it is indicated as an analogue of a certain amount in terms of the current ruble exchange rate).

At the same time, the form of the loan agreement is interpreted quite broadly. In a general sense, this also includes the oral form (the concluded agreement is not recorded; to establish the fact of such a relationship, for example, in court, two witnesses are enough). Written is used when the loan amount is over 50 minimum wages or if one of the parties is a legal entity or individual entrepreneur.