Order on the commission for writing off material assets

On our forum you can discuss any difficult moment for you that arose in the course of keeping inventory records. For example, you can learn how to properly write off unsalable goods.

The regulation must also provide for the following:

- other important aspects of the work of the CSC.

- the validity of decisions of the CSC with a certain quorum (for example, the presence of at least 2/3 of its members when making a decision on write-off);

- situations when it is necessary to invite experts or other specialists to determine the suitability (degree of possible use) of the property;

- deadlines for consideration by the CSC of documents submitted to it on property subject to write-off;

The regulation may also determine the period during which the CSC submits for consideration to the head of the company a document containing the commission’s conclusions on the further fate of certain material assets.

If such a provision has not been developed by the company, the necessary aspects of the work of the CSC are reflected in the order. Read about the role the commission plays in the procedure for writing off low-value property.

The write-off of material assets must be considered as one of the elements of the accounting and control system for ensuring the safety and efficient use of the company's property. Therefore, it makes more sense to organize the work of the CSC on an ongoing basis, and describe the regulations in a separate provision.

Taking into account this approach, there is no need to reflect a detailed description of the commission’s actions in the order on the CSC, and you can limit yourself to the following information, including:

- company name;

- details of the order (name, number and date);

- manager's signature.

- an indication of the purpose of creating the CSC, listing personalized information about its members;

You can see one of the options for a sample order on the commission for writing off material assets on our website. The frequency of issuing an order for the CSC is not established by law, so this can be done once, and then reviewed as necessary.

ON THE CREATION OF A PERMANENT COMMISSION FOR ACCEPTANCE AND TRANSFER, WRITTEN OFF FIXED ASSETS AND INVENTORIES (as amended as of August 26, 2014)

(edited)

Orders of the Ministry of Territorial Development of the Perm Territory dated July 7, 2014 N SED-53-03.15-62, dated August 26, 2014 N SED-53-03.15-77) In order to ensure the acceptance and transfer of fixed assets, as well as the timely write-off of those that have become unusable, obsolete, physically worn-out fixed assets and inventories, I order: 1. Create a permanent commission for acceptance and transfer, write-off of fixed assets and inventories.2. Approve the attached composition of the permanent commission for acceptance and transfer, write-off of fixed assets and inventories.3.

Recognize as invalid the Order of the Ministry of Territorial Development of the Perm Territory of April 4, 2013 N SED-53-03.20-37

“On the creation of a commission for acceptance and transfer, write-off of fixed assets and inventories”

.4. I reserve control over the execution of the order. First Deputy Chairman of the Government - Minister of Territorial Development of the Perm Territory A.Yu. MAKHOVIKOV APPROVED by Order of the Ministry of Territorial Development of the Perm Territory dated March 24, 2014 N SED-53-03.15-29 (as amended by Orders of the Ministry of Territorial Development of the Perm Territory dated July 7, 2014 N SED-53-03.15-62, dated 08.26.2014 N SED-53-03.15-77) Sapko Olga Vladimirovna - Deputy Minister, Head of the Department of Monitoring and Legal Work of the Ministry of Territorial Development of the Perm Territory, Chairman of the Commission Members of the Commission: Ksenia Viktorovna Korotkova - Head of the Information and Analytical Department of the Development and Support of Local Government of the Ministry of Territorial Development of the Perm Territory Lyadova Marina Sergeevna - Deputy Head of the Department of Finance and Consolidated Reporting of the Department of Financial Security of Municipal Entities of the Ministry of Territorial Development of the Perm Territory Natalia Anatolyevna Novikova - Head of the Department of Municipal Finance of the Department of Financial Security of Municipal Finance Ministry of Territorial Development of the Perm Territory

for free

.

Order on commissioning of a fixed asset facility. In this case, such official papers as construction permits, urban planning plans for land plots, and a package of project documentation must also be available.

We recommend reading: If you are insulted, can you go to court?

What is the purpose of the operational act? How is the selection of the inspection commission carried out? Letter of the Federal Tax Service of the Russian Federation dated July 25, 2020 No. ED-4-15/

“On the work of the commission on the legalization of the tax base and the base for insurance premiums”

activities to control the payment of “shadow” wages were regulated.

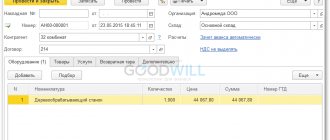

A municipal budgetary institution acquires fixed assets - computer equipment

.

At the same time, the Federal Tax Service departments in the constituent entities of the Russian Federation were instructed to bring this letter to lower tax authorities and ensure its application. From this article you will learn, in particular, how candidates are selected for invitation to a meeting of such a commission and what to do when you receive an information letter from the inspectorate and a notice of invitation to the taxpayer.

On the basis of what primary accounting documents can these fixed assets be accepted for accounting? Having considered the issue, we came to the following conclusion: According to clause 9 of the Instruction, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n (hereinafter referred to as Instruction N 157n), in order to ensure timely and reliable reflection in the accounting of business transactions (results of operations), the institution must form the primary accounting document at the time of a business transaction, and if this is not possible, immediately after the completion of the transaction.

In accordance with paragraph 34 of Instruction No. 157n, the acceptance of fixed assets for accounting, as well as their disposal, is carried out on the basis of a decision of the permanent commission for the receipt and disposal of assets, drawn up by a supporting document (primary (consolidated) accounting document) - an Act in the form established regulatory legal acts adopted in accordance with the legislation of the Russian Federation by the Ministry of Finance of the Russian Federation.

Order on the appointment of a commission for commissioning of the OS

He has the following responsibilities:

- Organization of collegial discussion.

- General leadership.

- Signing protocols.

- Distribution of responsibilities between committee members.

The secretary is responsible for documenting the activities of the commission.

FOR YOUR INFORMATION! It is not recommended to appoint the head of the organization as the chairman of the commission.

In addition, it is recommended to assign responsibility for drawing up the act to one employee, and to another for approval. All these measures will help avoid problems during verification.

The members of the commission are employees of the organization. In particular, these are:

- Representatives of the accounting department responsible for documenting and recording assets.

- Experts who can assess the suitability of equipment for use.

You can include experts in the commission who will be involved in work in certain cases.

For example, when commissioning a PC, a system administrator may be involved.

If the company does not have the necessary experts, it is permissible to attract third-party specialists. IMPORTANT! If the individual entrepreneur does not have hired personnel, there is no need to form a commission. ATTENTION! An employee responsible for the safety of valuables cannot become an expert. The purpose of the commission is to make a decision on registering the OS. This decision must be collective.

The members of the commission perform these functions:

- Checking the availability of permits.

- Consideration of the feasibility of changing the useful life.

- Assessment of technical condition.

- Checking the health of the OS.

- Establishing compliance with safety standards.

- Establishing the quality of installation.

- Conducting a test run.

- Analysis of the feasibility of changing the cost of the operating system.

The commission members are responsible for creating and signing all related papers. To create a commission, you need to issue an order. It is on this basis that the commission will function.

The order will have this form: JSC “Kvadrat” Order No. 09-01 “On the appointment of a commission for commissioning the OS” dated 10.20.2018.

Formation of an order to create a commission for write-off of fixed assets - rules for drawing up and sample

A fixed asset is an object from the operation of which the organization should receive economic benefits.

If there is none, then he may demand that the unusable OS be written off, and an order to create a commission is being prepared, a sample of which is presented in this article. The reason for the lack of benefit for the owner of the object may be due to breakdown, obsolescence, complete or partial wear and tear of the OS. The decision to write off is made by a special commission created, whose members inspect existing fixed assets, analyze them for their usefulness and the possibility of further use.

The composition is approved by order of the head; members may include an accounting employee, a chief accountant, persons responsible for fixed assets, technical specialists and other employees of the enterprise. The issuance of an order, which will determine the surname list of commission members, is a mandatory component of the procedure for writing off unsuitable objects. Responsible employees confirm their final decision on the need to deregister OS in the OS-4, OS-4a or OS-4b act.

The act is approved by the director of the enterprise, after which you can begin to directly dispose of the object and make special entries in accounting.

The approved report form serves as the basis for the accountant to make a corresponding entry in the OS-6 inventory card. .

Sample order for the creation of a commission for write-off of fixed assets -.

A commission should be created not only if it is necessary to deregister OS, but also other assets of the company.

For example, to write off material assets, an order is generated according to. Fixed assets are regularly inspected and tested. The commission can be created to inspect and write off specific equipment; members can also be instructed to inspect the entire fixed assets to identify unsuitable operating systems.

The starting point in this procedure is the preparation of the order and its subsequent approval.

We recommend reading: MTPL points and maintenance periods

The form states:

- place and date of creation of the document;

- name and title, briefly reflecting the essence of the order;

- the reason for issuing an administrative document - for example, the need to evaluate any fixed asset;

- an order to create a commission with a list of its members - the position of each, his full name;

- responsibilities assigned to the group, in particular, the obligation to inspect, evaluate, make a decision on the need for write-off, draw up an act and other documents, establish the possibility of using parts and assemblies remaining after dismantling the written-off fixed asset;

- deadline for execution of the manager’s order;

- information about the responsible person who must convey to the members of the commission the duties assigned to them related to the write-off of fixed assets, as well as monitor the correctness of their execution;

- signature of the manager approving the document;

- the signature of each member of the commission, which is affixed when reading the documents;

- signature is the responsibility of the person who must monitor the execution of the order.

The document is drawn up on the company’s letterhead or on a regular sheet indicating the full details of the company. The number is placed at the top of the form after registration in a special registration book or journal.

Sample order for the creation of a commission for write-off of fixed assets -.

Didn't find the answer to your question in the article? Get instructions on how to solve your specific problem. Call now:

+7 Moscow St. Petersburg ext.849 — Other regions — It's fast and free!

How to draw up a certificate of commissioning of fixed assets in 2020

As a rule, the commissioning procedure is handled by a special commission created by the receiving party.

For her appointment, the director issues an appropriate order. This group should include qualified specialists who are familiar with the new facility. The commission must consist of at least three employees. They are the ones who will evaluate the serviceability, performance, technical condition and other characteristics of the received property. All information can be entered either on a computer or by hand. To do this, you must use a ballpoint pen, and in no case a pencil. If the computer option for document preparation is chosen, there must still be “live” signatures of the responsible persons. As for stamps, their availability is determined by the regulations of the organization, since companies are allowed not to use stamp products when conducting their business.

How many copies should there be?

This document must be drawn up in at least two copies. However, if there is a need, their number can be increased. The act is stored in the organization along with other primary documents. When its validity period expires, the document is sent to the archive. As a rule, the period of such storage is established by the company’s internal rules.

Order of the commission for acceptance of fixed assets

The composition must include:

- Accounting employees who know the rules for documenting, evaluating and accounting for fixed assets;

- Experts are technical specialists (engineers, builders, power engineers, mechanics, adjusters, etc.), whose special knowledge and experience will help assess the physical and technical suitability of the object for further use.

The order allows for the inclusion of experts in the types of activities who will be present in special cases. For example, “When commissioning computer/computer equipment objects, involve programmer Markin A.

I.” If the enterprise does not have the required expert, in special cases it is possible to engage a third-party expert on the basis of a business agreement:

- Profile specialist (individual);

- Specialized organization (legal entity).

Thus, if an enterprise deals with high-precision, highly complex or experimental equipment, then for its marking it is possible to include a representative of a scientific association or a specialized government agency in the Commission. To change the composition, a separate decree of the head of the company with regulatory justification is required. If an individual entrepreneur does not have employees, then there is no point in creating a Commission. In other cases, it is recommended to create it, even if the members are not specialists of a narrow profile (for example, an accountant, a cleaner and a watchman). Please note: the person responsible for the safety of material assets cannot act as an expert. The purpose of this internal control body is to make a collegial decision on placing movable and immovable property on the balance sheet of the enterprise and transferring movable and immovable property for responsible protection to the financially responsible person. When new property arrives, the competence of the Commission includes making the following decisions:

- Can we conclude that the applicant

- Is specific property classified as fixed assets based on the enterprise's accounting policies?

Certificate of write-off of fixed assets

A prerequisite after all activities is the preparation of appropriate documentation. First of all, the act of writing off a fixed asset is considered, which indicates the reasons for the procedure and its consequences for the legal entity.

Leasing, as well as transfer on gratuitous terms, sale require the presence of an acceptance certificate. Wear and other reasons leading to the impossibility of operation require the existence of a liquidation act.

There is no standard form of completed documentation, but all details must be reflected without fail:

- name of the item;

- inventory number. You can learn more about the procedure for conducting an inventory of fixed assets;

- initial cost;

- the amount reached by wear;

- reasons for liquidation and lack of possibility for further exploitation;

- liquidation costs (costs of additional work for specialists, disassembly and dismantling);

- income (the cost of products that were sold or the price of materials that can be used in the future, despite the liquidation of the main facility);

- result of the procedure.

All documentation must be completed in accordance with current requirements.

Order for commission on fixed assets sample form

Accordingly, the value of such property decreases, and enterprises require constant monitoring of the condition of fixed assets. Such control is carried out by creating a special group that carries out the assessment. The general point is that the manager, by his strong-willed decision, appoints members of the working group, gives them the necessary powers and confirms the fact of the need to conduct an assessment audit.

Typically, such a commission includes employees of the enterprise administration and authorized employees responsible for the condition of fixed assets. But it is not uncommon for a situation to arise when the inspection of a company’s fixed assets is entrusted to an independent audit or expert service.

In this case, the internal management order regulates the work of third-party specialists on the company’s territory and establishes the rules for the interaction of the company’s divisions with members of the evaluation commission.

When involving third-party specialists, in addition to the order, it is necessary to draw up an agreement with the persons who have taken upon themselves the responsibility to conduct an inspection of fixed assets. Based on the results of the work of the CSC for the specified period, management assesses its effectiveness and formulates certain organizational conclusions (on the need to reduce or expand the number of CSC, change the structure, adjust the work regulations, etc.). Results The Commission for the write-off of material assets is necessary to carry out a set of measures to assess the suitability of the company’s material assets and resolve the issue of their write-off.

Its composition and powers are established by a special order. ImportantSend by mail The order on the commission for writing off material assets is issued in connection with the creation of the body on the results of whose work the validity of the disposal of property unsuitable for further use will depend. What

Legal basis for issuing an order

In the “Regulations on accounting and financial reporting in the Russian Federation”, approved by the Order of the Ministry of Finance, fixed assets are understood as assets that are used by the organization:

- as means of production;

- to manage the company.

The list of such funds is not precisely defined by the legislator and is open in nature. As an example of material assets, the Regulations indicate:

- perennial plantings;

- building;

- bosom;

- bodies of water;

- laboratory equipment;

- cars;

- draft animals;

- investments that were made in the OS.

An important condition for classifying property as basic assets for an enterprise is the service life of such assets, which must be more than 12 months.

When classifying material assets as fixed assets, it does not matter how they came to be owned by a legal entity.

Order on the creation of a commission for the acceptance and transfer of fixed assets sample

Create a permanent commission for acceptance and transfer, write-off of fixed assets and inventories. 2. Approve the attached composition of the permanent commission for acceptance and transfer, write-off of fixed assets and inventories.

3. Recognize as invalid the Order of the Ministry of Territorial Development of the Perm Territory of April 4, 2013 N SED-53-03.20-37

“On the creation of a commission for acceptance and transfer, write-off of fixed assets and inventories”

. 4. I reserve control over the execution of the order.

First Deputy Chairman of the Government - Minister of Territorial Development of the Perm Territory A.Yu. MAKHOVIKOV THE COMPOSITION OF THE PERMANENT COMMISSION FOR RECEPTION AND TRANSFER, WRITE-OFF OF FIXED ASSETS AND INVENTORIES APPROVED BY Order of the Ministry of Territorial Development of the Perm Territory dated March 24, 2014 N SED-53- 03.15-29 (as amended)

Orders of the Ministry of Territorial Development of the Perm Territory dated July 7, 2014 N SED-53-03.15-62, dated August 26, 2014 N SED-53-03.15-77) Acceptance and transfer certificate of fixed assets in the OS-1 form Drawing up an acceptance and transfer act of fixed assets occurs when property classified as fixed assets is transferred from the use of one company to another.

Fixed assets - what are they? Fixed assets of enterprises and organizations include any property with which the company carries out its activities: equipment, machinery, inventory, materials, transport, instruments, etc. Buildings and structures are also fixed assets, just like raised livestock and some types of plants. But those items or products that are in warehouses and are planned for further sale, as well as those that are in the transportation stage, are not considered fixed assets.

The purpose of the act in form OS-1 The act is drawn up when transferring an object of fixed assets (one or more) from an organization to another enterprise, in order to implement the terms of any agreement.

It does not matter who the parties to the transaction are: legal entities or individual entrepreneurs - the act must be drawn up regardless of this.

We recommend reading: Write an application for resignation of your own free will without working off

Today there is a promotion - consultation of lawyers and advocates 0 - rubles. hurry to get an answer for free→

“User of the site https://online-sovetnik.ru” (hereinafter referred to as the User) - a person who has access to the site https://online-sovetnik.ru via the Internet and uses information, materials and products of the site https://online -sovetnik.ru.1.1.7.

“Cookies” are a small piece of data sent by a web server and stored on the user’s computer, which a web client or web browser sends to the web server every time in an HTTP request when trying to open a page of the corresponding site.1.1.8.

“IP address” is a unique network address of a node on a computer network through which the User gains access to the Online Advisor.2. General provisions2.1. Use of the site https://online-sovetnik.ru by the User means agreement with this Privacy Policy and the terms of processing of the User’s personal data.2.2.

In case of disagreement with the terms of the Privacy Policy, the User must stop using the site https://online-sovetnik.ru .2.3. This Privacy Policy applies to the website https://online-sovetnik.ru. Online Advisor does not control and is not responsible for third party sites that the User can access via links available on the website https://online-sovetnik.ru.2.4.

The Administration does not verify the accuracy of the personal data provided by the User.3.

Subject of the privacy policy 3.1. This Privacy Policy establishes the Administration’s obligations to non-disclose and ensure a regime for protecting the confidentiality of personal data that the User provides at the Administration’s request when registering on the website https://online-sovetnik.ru or when subscribing to the e-mail newsletter. 3.2.

Personal data permitted for processing under this Privacy Policy is provided by the User by filling out forms on the website https://online-sovetnik.ru and includes the following information: 3.2.1.

last name, first name, patronymic of the User; 3.2.2. User's contact phone number; 3.2.3.

email address (e-mail)3.2.4.

Organization of accounting of fixed assets - Acceptance of fixed assets for accounting

Stage 1 - Recognition of acquired property as a fixed asset What property is recognized as a fixed asset for accounting purposes?

A fixed asset is an item of property: • with a useful life of more than 12 months (clause 4 of PBU 6/01; clause 2.1 of Appendix 9 to Regulation 385-P) • capable of generating economic benefits (income) in the future (clause 4 of PBU 6 /01; clause 11.2 of Appendix 9 to Regulation 385-P); - use as means of labor for use in production, for the provision of services, for management needs, - use in cases provided for by sanitary-hygienic, technical-operational and other special technical standards and requirements, - provision for a fee for temporary possession and use or for temporary use.

Commission on fixed assets (we issue an order for its creation)

Author of the article Olga Lazareva 1 minute read 2,266 views Contents The company's fixed assets have their own service life.

As time passes, machines and equipment become unusable, break down, become obsolete, and their service life ends. There comes a time when it is necessary to write off fixed assets. In order to decide what to write off and what can still serve for the benefit of the company, a special commission is created for fixed assets, which deals with their write-off.

To do this, you definitely need an order approved by the manager, a sample of which you can download for free at the end of this material. (understand how to keep accounting records in 72 hours) > 8,000 books purchased Worn-out objects of the enterprise's fixed assets require write-off, since their further use will be costly and impractical , not rational and unprofitable. If expensive repairs are required, it is better to purchase new equipment and write off the old one.

Note that fixed assets are also written off if their useful life has expired or they have completely depreciated their value. In order to determine the fixed assets that can be written off, it is necessary to create a special commission that will conduct an inventory and identify old, damaged objects , will prepare the necessary documents and draw up an act for writing off the operating system of the enterprise. The commission is formed by the heads of the company or enterprise. It consists of at least three people, of whom a chairman and a secretary are selected. From experience, we will say that most often the commission includes representatives of the accounting department and a company employee who is financially responsible for the integrity and safety of the operating system. The composition of the created commission is approved by order of the director. We also suggest you can download other sample orders:

- About the creation of an expert commission

- On the creation of a special commission to investigate accidents.

Such an order is issued on company letterhead. The name of the document is written at the top, below is the order, locality and table of contents.

It is necessary to indicate the reason for creating the order, as well as:

- Approve the composition of the special commission, list all its members, indicating their full name and position.

- List of fixed assets that are subject to write-off.

- The time frame within which the inspection of the objects subject to write-off will be carried out.

- Indicate the list of persons who must familiarize themselves with the order.

The document is signed by the manager. Signatures are placed below by interested parties and members of the commission. (Understand how to keep accounting records in 72 hours) > 8,000 books purchased Share the article

(votes: 1, average rating: 5.00 out of 5)

Loading.

We recommend similar articlesHot Sign up for the online school Accounting for Dummies29 original lessonsField is emptyGet it now! More than 45,000 subscribers Useful to know IP taxes on a patent in 2020: table with list, payment deadlines, reporting Calculation of the cost of a patent for an individual entrepreneur Does an individual entrepreneur submit reports to the Federal Tax Service on PSN Our books

How to issue an order for modernization if the timing is unknown

An order is the basis for the beginning of any process in production; in this case, by signing the order, the manager gives permission to carry out modernization, its documentary support and other processes related to it.

It is also required as a primary document on the basis of Art. 9 Federal Law No. 402 of 2011 for carrying out various operations during the modernization of fixed assets.

https://youtu.be/kGupP52HcOY

In addition, this form indicates all the nuances of the event - the composition of the commission that will determine the feasibility of updating fixed assets, determines the work schedule and other important points.

The order is drawn up by the person responsible for this; usually a personnel officer or legal consultant deals with this issue.

But if the production is small and these positions are not available, then the compilation is carried out by a person who combines the responsibilities of these specialists.

In the process of drawing up an order, you need to consider several points:

- filling out the document can be arbitrary, since there is no unified form. But if necessary, its sample is created by the enterprise individually and subsequently consolidated in regulatory documents;

- An order can be generated either printed or handwritten, and it is important to ensure that all persons concerned, as well as the manager, can sign it;

- it is not necessary to use a stamp; its use is available if there is a corresponding norm in the internal local acts of the enterprise;

- filling out is carried out in one copy with subsequent registration in the order journal;

- the order is valid in accordance with the requirements of legislative acts for a year, but you can also determine this position in the document by indicating the period of its activity;

- after drawing up the form and signing it by the manager, it is necessary to familiarize it with the signature of all interested parties and hand it over to the responsible person;

- As a result, after the expiration of the validity period, the order is transferred for storage to the archive.

Filling procedure

| Points required for use | Description |

| Document header |

|

| Document's name | Indicating the serial number and the rationale for its preparation “On the modernization of fixed assets” |

| Basis for compilation | Link to a legislative act or internal document - memorandum, etc. |

| Order regarding OS modernization | Its technical characteristics, registration number and other identifying data of the fixed asset are indicated. |

| Term | The manager must designate a period for carrying out the entire process |

| Object characteristics | It is important to indicate its condition at the time of modernization, indicate the service life, degree of wear and tear, residual value of the fixed asset |

| Indicate the composition of the commission | It should be taken into account that it should include a specialized specialist, an enterprise economist, and a lawyer. |

| Outline the tasks facing it | In list form |

| Designate those responsible for executing the order | Also indicated in a list indicating the position for each employee |

Important: the order must be signed by the manager and the employees indicated in it.

But in accounting, all costs for OS repairs are included in the department where the equipment is assigned. Cost accounting is regulated by PBU 6/01 “Accounting for fixed assets”.

According to this provision, account 08 “Investments in non-current assets” should be used for accounting, where it is best to open sub-accounts to account for costs spent on equipment modernization.

From this account, all costs will be debited to account “01” (Fixed Assets).

There are two write-off options: During the modernization of one OS object, costs will be written off to 01 when the original cost increases. Information about the amount of costs that led to an increase in price is entered into the inventory card.

If several or more objects are being modernized, then using the above method will be quite problematic. In this case, it is better to open an inventory card where all information about costs will be entered.

In this case, a complete disassembly of the object is carried out, worn parts are changed For main composite vehicles Engine, gearbox, etc. For buildings When worn parts are replaced with more durable ones. This applies to the foundation, walls, pipes, etc.

- Legal Resources

- Collections of materials

- Order for OS upgrade

A selection of the most important documents upon request Order for OS modernization (regulatory acts, forms, articles, expert consultations and much more).

Order for commission for acceptance of fixed assets

[p.41] Availability of orders (instructions) on the creation of a commission in the organization to write off fixed assets.

Grounds [p.57] Inventory is carried out either by a permanent or working inventory commission, approved by order of the head of the organization, which checks the availability and use of fixed assets, identifies unused property (equipment, machinery, etc.) and draws up an inventory of fixed assets. When making an inventory of real estate (buildings, structures, etc.), as well as land plots, the commission checks the availability of documents confirming the ownership of this property.

[p.159] Based on the order/instruction dated 200. The number of the order/instruction of the head of the organization on the appointment of a commission for the acceptance/transfer of fixed assets is indicated. The unnecessary name of the document must be crossed out [p.231] When choosing objects of actual control, and especially inventory, one has to face some difficulties.

The procedure for conducting inventories is regulated by the Basic Provisions for the Inventory of Fixed Assets, Inventory, Cash and Settlements.

However, they address the issues of conducting inventories by the enterprises themselves and do not address the conduct of inventories during audits. Therefore, some organizational issues of conducting an inventory during an audit have become objects of discussion in the literature. There is an opinion that in order to carry out an inventory it is necessary to issue an order or instruction.

Thus, A. M. Savitsky writes that the actual presence of inventory items is checked by a commission appointed by the director of the enterprise [p.71] To establish the technical condition and determine the unsuitability of fixed assets for further operation, as well as confirm the economic inexpediency of restoration and repair and modernization at enterprises, permanent commissions are appointed by order of the head. The composition of such a commission

The procedure for writing off fixed assets

The procedure can only be performed in certain situations.

Regardless of the reason, the procedure for writing off fixed assets must be followed.

It should be noted that the movement of any type of property between different structures of one organization does not constitute a disposal.

See this article about the procedure for calculating and calculating depreciation of fixed assets.

In addition, upon completion of the operation of the property due to reconstruction or installation of additional equipment, the fact that the item has been removed from the account does not occur.

If the value of the object is lost or the property cannot guarantee income for the enterprise, evidence of changes in a certain part of the accounting must occur.

The event that occurs must be reflected in the income and expenses of the enterprise.

Focusing on the debit of account 91, it is necessary to reflect that the residual value of the equipment has been disposed of, as well as all subsequent expenses due to the procedure.

In this case, the loan must take into account the amount of depreciation, possible income from the sale of property or renting it out.

In order for the necessary procedure to be carried out legally, you should open not only account 01, but also a sub-account that will perform a certain task immediately.

Account 99 “Profits and losses” should be a direct reflection of all expenses of the enterprise.

In this case, income, as well as expenses after the event regarding the written-off property has been completed, should be reflected in the reporting documentation.