Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 05/22/2020

Reading time: 6 min

0

104

When members of a company decide to close a company, they must appoint persons who will be responsible for the progress of the liquidation process and its compliance with civil law. This group of persons is called the “liquidation commission”. The list of powers of the commission and its composition are prescribed in the order on the creation of the liquidation commission.

- What is the liquidation commission and what are its powers?

- Procedure for appointing a commission

- Making an order

- What information should the document contain?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Procedure for appointing a liquidation commission

As mentioned earlier, the commission is appointed by the body that made the decision to liquidate the organization. The initiator of liquidation may be the founder or participant of the organization, as well as its director or other body authorized to do so by the constituent documents. Such a decision can also be made by the court if a claim was filed on one of the grounds listed in paragraph 3 of Art. 61 Civil Code of the Russian Federation.

In any case, the authorized person must make a decision on the appointment of a liquidation commission. A sample of such a document will be given later in the article.

This decision can be made by the management body together with the decision on liquidation or issued subsequently in the form of an order (instruction), which indicates:

- information about the organization - name, address, registration data, other details;

- date and number of the act;

- the basis for issuing the order is “in connection with the decision to liquidate the organization”, indicating the details of the relevant decision;

- composition of the liquidation commission;

- terms and procedure of the commission;

- persons who are entrusted with the execution and control over the execution of the order;

- position and signature of the person who issued the order.

The above powers and duties are assigned to the commission from the moment specified in the order, or from the moment this act comes into force.

As a rule, members of the liquidation commission are:

- Head of the organization;

- founders or participants or their representatives;

- representatives of the organization's employees.

If a member of the organization is a municipality, a subject of the Russian Federation or the Russian Federation, the commission must also include representatives of the relevant authorities.

Download the order to create a liquidation commission (sample)

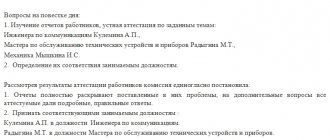

Order on the creation of a liquidation commission (recommended sample filling)

No. 3 on the liquidation of the branch in Kingisepp

I order:

1. Head of the regional management department A.D. Rozhkin by December 15, 2009, organize the liquidation of the company’s branch in Kingisepp, while providing for the following:

1) registration of changes to the charter;

2) timely warning of termination and early termination of lease agreements for premises and land plots;

3) distribution of the branch’s property to be moved to the head office (branch in Slantsy) and to be sold, as well as the subsequent sale of property (office equipment, furniture, cars, etc.);

4) compensation payments in connection with the dismissal of employees;

5) return of intangible assets transferred by the company to the branch;

6) elimination of jobs in full compliance with the legislation of the Russian Federation;

7) repayment of debts;

payment of fines, penalties, etc.;

payment of fines, penalties, etc.;

9) deregistration with the tax authority, extra-budgetary funds.

2. To the head of the legal department of the company, Kolyvanov M.M.:

1) provide legal and consulting support for the process of liquidation of the branch;

2) prepare and send letters to the addressees before “__” ____ on the revocation of the power of attorney of the head of the branch.

3. Chief accountant Nantsevashkina Yu.L. make changes to the accounting and tax reporting in connection with the liquidation of the branch in Kingisepp. Ensure that a voluntary audit is carried out.

4. Branch Director Zavyalov Kh.K. close the ruble and foreign currency accounts of the branch in the Sberbank branch and deregister the branch with the tax authority and extra-budgetary funds.

5. To the head of the office E.N. Prokofieva:

1) organize information support: timely collection, synthesis and presentation of materials on the liquidation of the branch prepared on the basis of clauses 1 - 4 of this order;

2) before August 25, 2009, familiarize the deputy heads of the company, heads of production, services and departments of the company with this order against signature.

6. I reserve control over the execution of this order.

General Director ____________________________ /A.V. Belkin/ M.P. Performer: Kadochnikov 3.O. Tel.

Comments:

Procedure for appointing a liquidation commission

As mentioned earlier, the commission is appointed by the body that made the decision to liquidate the organization. The initiator of liquidation may be the founder or participant of the organization, as well as its director or other body authorized to do so by the constituent documents. Such a decision can also be made by the court if a claim was filed on one of the grounds listed in paragraph 3 of Art. 61 Civil Code of the Russian Federation.

In any case, the authorized person must make a decision on the appointment of a liquidation commission. A sample of such a document will be given later in the article.

This decision can be made by the management body together with the decision on liquidation or issued subsequently in the form of an order (instruction), which indicates:

- information about the organization - name, address, registration data, other details;

- date and number of the act;

- the basis for issuing the order is “in connection with the decision to liquidate the organization”, indicating the details of the relevant decision;

- composition of the liquidation commission;

- terms and procedure of the commission;

- persons who are entrusted with the execution and control over the execution of the order;

- position and signature of the person who issued the order.

The above powers and duties are assigned to the commission from the moment specified in the order, or from the moment this act comes into force.

As a rule, members of the liquidation commission are:

- Head of the organization;

- founders or participants or their representatives;

- representatives of the organization's employees.

If a member of the organization is a municipality, a subject of the Russian Federation or the Russian Federation, the commission must also include representatives of the relevant authorities.

Download the order to create a liquidation commission (sample)

Order on liquidation of an enterprise: procedure and features of issuing the document

Liquidation procedures of an enterprise begin with the adoption of an appropriate decision by its founders. Issues of stopping work are resolved by issuing an order. This order is also grounds for dismissal of employees.

There are no regulatory frameworks regulating the form and content of the order. Meanwhile, in practice, the basic requirements for the content and form of writing an order have developed. The content should reflect the reasons for the decision to liquidate, as well as the procedure for dismissing employees, indicating the timing of this procedure, indicating the officials responsible for it.

Voluntary liquidation

If the participants (shareholders) of an organization voluntarily decide to terminate the company’s activities, they undertake the obligation to take the necessary actions at the expense of the organization’s property. If this property is not enough, then the participants (shareholders) will have to jointly participate in all costs associated with the liquidation.

The procedure is carried out in 3 stages:

- Decision-making.

- Notification of creditors.

- End of liquidation.

Let's look at what documents are needed to liquidate an LLC at the first stage:

- minutes of the general meeting of the company's participants, if, according to the charter, the decision to close the LLC is made by the highest management body - the general meeting;

- order to create a liquidation commission;

- application in form P15001 to the Unified State Register of Legal Entities (sent by an authorized person within 3 working days after the decision on liquidation is made).

IMPORTANT! After making an entry in the Unified State Register of Legal Entities about the start of the closure procedure, it is necessary to replace bank cards in the banks servicing the company, since the liquidator or an authorized member of the liquidation commission will have the right to sign on bank documents.

Documents for closing an LLC with one founder are drawn up according to the same algorithm, but an important difference is that instead of a protocol, a decision of a single participant is drawn up.

Liquidation of a legal entity

An enterprise or organization can be closed either voluntarily or forcibly. The decision on this is issued in the same place where the decision to open this enterprise was made at one time.

According to the law, the closure of a company is the complete cessation of all activities by it. At the same time, it is unacceptable to transfer the rights to the organization to other persons.

The organization is considered closed, and the process is completed only after the corresponding entry appears in the Unified Register of Enterprises.

That is, the liquidation of a company is a certain form of completion of the activities of a legal entity. In this case, any activity of this enterprise is completely stopped:

- Production.

- Scientific and technical.

- Trade or public and others.

After a decree on liquidation of a legal entity is issued, all loans the company has must be returned to creditors. And also carried out:

- Sale of company property.

- Return of share contributions to the founders of the organization.

Number of members of the liquidation commission: how many people should be part of this body

Approval of the decision to liquidate a limited liability company (hereinafter referred to as LLC) is within the scope of powers of the general meeting of participants of such a legal entity, if the liquidation is carried out on a voluntary basis (see paragraph 2 of Article 57 of the Law “On LLC” dated 02/08/1998 No. 14-FZ, clause 3 of article 62 of the Civil Code of the Russian Federation). Also, this LLC body appoints a liquidation commission (or liquidator) and determines its composition.

It is not regulated at the legislative level exactly how many people should be included in such a commission and what are the selection criteria for its membership. Typically, the number and personal composition of the commission are determined in the charter of the LLC. However, if this is not done, these issues are resolved at a general meeting of participants (subclause 12, clause 2, article 33 of Law No. 14-FZ). Most often, the head of the LLC, one of its participants, or the chief accountant are appointed to this role, although other persons may also be selected. The law also does not contain restrictions in this part.

Even when the LLC includes only 1 participant, the liquidation of the named legal entity still requires the appointment of a liquidation commission or liquidator. Most often, the sole participant of the LLC acts as such a liquidator, although the law does not require this to be done only in this way. This function may also be performed by another person(s).

These appointments are made by decision of the sole participant of the LLC (Article 39 of Law No. 14-FZ). The link below contains an example of such a document, which can later be used as a template to fill out:

Who and how makes the decision to terminate the activities of an OP?

Russian regulations do not precisely define which body of the economic entity is responsible for approving decisions to close an OP. So who then is authorized to make a decision on the liquidation of the OP?

There are 3 possible options:

- By analogy with that specified in paragraph 1 of Art. 5 of Law No. 14-FZ, the procedure for creating an OP, its liquidation is also carried out on the basis of a decision of at least 2/3 of the votes of the entire number of participants in the LLC, unless the charter specifies a higher threshold for making such a decision.

- In LLCs in which there is only one participant, the decision to terminate the activities of the OP, in accordance with Art. 39 of Law No. 14-FZ, adopted by him alone.

- The charter of an LLC may delegate the competence to make a decision on terminating the activities of an OP to the board of directors (subclause 11, clause 2.1, article 32 of Law No. 14-FZ).

Decision making procedure

- Consideration of the decision to terminate the activities of the OP must be included in the list of issues to be considered at the next meeting, which meets within the time period established by the charter (Article 34 of Law No. 14-FZ). If the issue of closing the OP requires an early resolution, then the general meeting of the partners of the business entity, in accordance with Art. 35, is convened by the director or authorized executive body within a period not exceeding 5 days after receiving the request of the supervisory board, auditor or auditor.

- In the event that the charter does not say anything about the OP, at the general meetings of the participants of the business entity, a decision is made to close it with the designation of a responsible person who will be entrusted with carrying out all the necessary actions to notify the regulatory authorities. According to para. 3 clause 8 art. 37 of Law No. 14-FZ, such a decision is made by a simple majority of votes.

- If the charter contains an entry about the OP, then at the general meetings of participants an additional decision is made to amend the charter or adopt it in a new edition. According to para. 1 clause 8 art. 37 of Law No. 14-FZ, to approve this decision, at least 2/3 of the votes of the participants of the economic society are required.

- The results of the decision to liquidate the OP, adopted at the general meetings of the participants of the business entity, are documented in the form of a protocol (Clause 6, Article 37 of Law No. 14-FZ). The sample decision to close an OP, which we offer below, will help the participants and the director of the parent company develop their own protocol.

Payments to the liquidation commission

The liquidation commission does not work for free. Its members receive remuneration for their work, but its amount is not fixed by law. Typically, the amount of due payments is determined at a meeting of owners, taking into account the financial situation of the company and is announced at the time of formation of the commission. It is from the funds of the liquidated company that payments are made to the members of the liquidation commission.

Full-time employees on the commission usually continue to work under existing employment contracts and receive payments at the same level in the form of salaries. This is not prohibited by law. The salaries of commission members are subject to all taxes and fees.

On the last day of work, commission members must receive a salary, compensation for unused vacation and severance pay.

But at their request, employment contracts can be terminated and civil contracts can be drawn up instead. They may include a new mechanism for calculating remuneration. This option is undesirable: regulatory authorities may consider that the termination of the employment contract was intended to evade payment of the required compensation during liquidation.

Dismissal of employees

The most important issue is related to the employees of the closing unit. It is recommended to approach this problem with special attention and caution. Employees must receive two months' worth of benefits. The payment amount is equivalent to average earnings. It is possible to pay the average salary until the person finds a new job. A procedure for informing the employee and the central control center must be developed.

People work in the department on the basis of labor agreements, under the terms of which notification of the closure of a branch must be made by a legal entity in writing. Each employee must receive such notice individually, no later than two months in advance, and a signature.

notification to the employee about the closure of the branch

Simultaneously with notifying workers about planned actions, the employment service must also be informed, which has the opportunity to prepare for the influx of new “clients”.

The procedure for closing a branch in relation to personnel is slightly different if the unit is geographically located in another city. In this case, the legal entity must take into account some nuances. Thus, the algorithm discussed above is suitable for cases where the branch and the main office are located in the same locality. According to the law, if the branch is located within the boundaries of transport accessibility, the dismissal is qualified from the position of reduction.

If a division is located in another city, the company can offer employees work in other branches, taking into account qualifications and existing skills. If there are no vacancies or conditions are unacceptable to employees, the employment agreement is terminated. In this case, the dismissal procedure takes into account the requirements of the Labor Code.

After being notified of a future branch closure, the employee must sign the notice. If he refuses to do this, the liquidation commission draws up a corresponding act. The procedure for distributing payments among employees deserves special attention. This process is organized at the request of the head office.

As soon as the considered actions have been carried out, the financial service draws up a liquidation balance sheet. The document reflects the balances for each type of material assets. This information is collected in one document, after which it is submitted for consideration to the main office of the legal entity. It is there that a decision is made on the remainder and the further course of action. Information about the balance sheet of the branch is noted in the balance sheet of the enterprise.

As can be seen from the above, the procedure for closing a branch is simpler and takes less time than liquidating the entire organization. This can be seen in many nuances. Thus, a legal entity may not notify creditors in respect of whom the branch has debts. This is due to the fact that responsibility for fulfilling debt obligations lies with the main company. But the simplicity of liquidation does not mean that it must be approached “carelessly.” The closing procedure must be followed to avoid problems with the Federal Tax Service and Pension Fund. In addition, the time spent on closing a branch largely depends on the correct organization of the process.

Who draws up the order

Drawing up an order to close a separate division can be entrusted to any employee of the organization who has an accurate idea of how exactly to write such orders and is familiar with the norms of the legislation of the Russian Federation in terms of labor and civil law. Most often, this function is directly performed by a legal adviser, secretary or personnel officer.

Regardless of who exactly will fulfill this duty, after the final formation of the order, the document must be submitted to the director for certification, because without his signature it will not become legitimate.

Contents and sample document

The law does not establish requirements and criteria for the content of such documents; for this reason, one should focus on already established practice. As a basis, you can take the rules for drawing up such a document from any manuals on record keeping and business correspondence, or look at a sample order on our website. According to these rules, the order must have continuous numbering, name, place and date of issue. So, the document header should look like this:

- The name of the order is “Order on liquidation (name of organization);

- The order number is placed above the date under the name in the upper right part;

- On the left side, under the name, the place of compilation is indicated: locality;

- The date of the order is placed on the right side of the sheet under its number.

This design option can be taken as a sample or basis for drawing up your own order. If there is an approved letterhead of the organization, it is printed on it. The original document is compiled in a single copy.

Typical document blocks

- The main block of this administrative document reveals the essence of the reasons and grounds for which the liquidation occurs. You can start it with the wording “Based on the decision on liquidation made by the founders of (name of organization), in connection with (specify the reason), I order (this word is placed in the center of the sheet and written in capital letters);

- Next, item by item (items are designated in format 1.1,1.2), a list of measures to implement the termination of activities and closure procedures is distributed, indicating the timing and persons responsible for their implementation;

- An additional block of the order may contain clarification of functions and responsibilities during the termination of the organization’s activities;

- The final paragraphs indicate the final deadlines for the closing process and the functions of higher control.

The document must contain the date of its publication and the signature of the manager with a transcript.

Features of the form design

If you are entrusted with the task of drawing up an order to close a separate division, we advise you to first read our recommendations and pay attention to the sample document.

First of all, general information. This order, like all other administrative acts, does not have a single standard, which means that it can be formed in any form or, if the company has its own approved document form, according to its type. The text can be either handwritten or printed, and the order can be drawn up on a simple sheet of any convenient format (generally accepted - A4), or on the company’s letterhead.

When drawing up an order, only one important condition must be met - it must be signed by the director of the company (since all orders are written on his behalf) or by an employee who, in accordance with the established procedure, acts on behalf of the director, as well as all the employees mentioned in it and those whom it concerns directly.

In addition, you must carefully ensure that the order is drawn up without errors, typos, blots and corrections.

There is no special need to certify the order form with a seal - this should be done only when the norm for certifying the organization’s local documents using various types of cliches is laid down in its accounting policy.

NOTE! The order is always written in one copy.

Upon completion, do not forget to include information about the document in the journal of administrative papers.

After the order to close a separate unit has been created, signed, issued and recorded, and all employees mentioned in it have read it, the form must be placed in a separate folder with other administrative documentation. It must contain the entire period of validity, which is established either in the document itself, or is automatically equal to one year from the date of signing the order.

Making an order

The order must be issued in written format. A unified form for its preparation has not been developed, so the company composes it arbitrarily.

It is better to issue the order on the organization’s letterhead, but this requirement is advisory in nature. It is also permissible to draw up an order on a regular A4 sheet and write down a mandatory list of information there. The order must not contain corrections, errors or inaccuracies.

The order is drawn up in a number of copies equal to the number of members of the liquidation commission. Each member of the commission is given one copy of the order for review. One copy of the order is kept in the organization and after its closure it is transferred for storage to the state archive along with the rest of the company’s documentation.

Notice of LLC liquidation

If a decision is made to liquidate, this must be reported to the tax authority. The notice period is 3 working days (Clause 1, Article 62 of the Civil Code of the Russian Federation).

It is also necessary to publish information about the liquidation in the media and notify creditors, and this responsibility also rests with the liquidation commission. This may be indicated in the order for liquidation of the enterprise, and a sample notice to creditors may be attached.

The publication in the journal "Bulletin of State Registration" also contains certain requirements - creditors must be given at least two months to present claims. In addition, identified creditors must be notified personally. Subsequently, creditors who did not receive information about the liquidation may challenge the liquidation on the grounds that the liquidation balance sheet contained inaccurate information; if there was debt, it was not reflected.

At the first stage, you must submit to the tax authority:

- Notification in form N P15001 (approved by Order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/).

- The decision of the sole participant or the Minutes of the general meeting of participants at which the decision to liquidate the company was made.

It is necessary to fill out the notification in form P15001 in full compliance with the established requirements; lack of data may result in refusal of registration. For example, failure to provide an email address when submitting a notice electronically became grounds for refusal. And the court supported the correctness of the position of the tax authority, indicating that this is one of the mandatory details of the applicant when sending through electronic communication channels, and its absence is a violation of the registration procedure (Resolution of the Arbitration Court of the Far Eastern District dated 02/07/2017 N F03-6510/2016 in case N A73-9918/2016).

Failure to notify the tax authority in a timely manner may result in a fine (Part 3, Article 14.25 of the Administrative Code).

> Order on the creation of a liquidation commission sample

Liquidation of an LLC by decision of a court or tax authority

An LLC can be liquidated either on a voluntary basis (see our article “Step-by-step instructions for liquidating an LLC in 2020”), or forcibly, by decision of a judicial authority in situations regulated by paragraph 3 of Art. 61 Civil Code of the Russian Federation, including:

- At the request of a government agency or local self-government body.

- Claim by the founder (participant) of the LLC. The reason for applying to a judicial authority in this case is the impossibility of implementing the tasks assigned to the LLC upon its creation.

Presented in paragraph 3 of Art. 61 of the Civil Code of the Russian Federation, the list of grounds is not exhaustive.

Among the government agencies vested by law with the authority to appeal to a judicial authority with a demand for the forced liquidation of legal entities are the bodies of the Federal Tax Service of Russia (Clause 11, Article 7 of the Law of the Russian Federation “On Tax Authorities of the Russian Federation” dated March 21, 1991 No. 943-I).

At the same time, the Federal Tax Service itself is not authorized to issue an order to an LLC regarding the need to carry out forced liquidation. It is necessary to wait for the appropriate judicial act, since the procedure can only be carried out by a court decision.

So, the number and personnel of the liquidation commission are not regulated by the legislator. It is also not defined who exactly should act as liquidator. The legal entity independently determines the procedure for their appointment. For this purpose, relevant provisions are included in the charter of the LLC. Another option for resolving the problem is to determine the composition of the commission and appoint a liquidator at a general meeting of LLC participants or through a decision of its sole participant.

More on the topic:

- Sample of filling out an application for a personal income tax refund when buying an apartment Application for a personal income tax refund when buying an apartment Current as of: February 14, 2020 Sample application for a personal income tax refund We talked in a separate consultation about the list of documents submitted to the tax office when using a property tax deduction. About the application for [...]

- Fines for crossing the road incorrectly Is it possible not to pay a fine for crossing the road in the wrong place in 2017-2018 In recent years, a real war has been unfolding across the vastness of the country between motorists and pedestrians. Tens of thousands of people become victims of this war every year, which is comparable, for example, with the losses […]

- Fine for entry into a passport Fine in the Russian Federation for a damaged passport in 2018 The main regulatory act that regulates any actions relating to the main document for identification of a citizen of the Russian Federation is the Decree of the Government of the Russian Federation “On approval of the regulations on the passport of a citizen of the Russian […]

- Child benefit in 2020 up to the age of 14 Child benefits after three years in 2020 Child benefits from the state are good financial support for families with an unfavorable financial situation. The amount of the benefit is determined by the age of the children, as well as their state of health. In addition, additional […]

- Signs of a crime in the Republic of Kazakhstan Concept and signs of a crime. Categories of crimes. Difference between crimes and other offenses A crime is a socially dangerous act committed guilty of guilt, prohibited by the Criminal Code of the Russian Federation under threat of punishment (Part 1 of Article 14 of the Criminal Code of the Russian Federation). Signs of a crime: Public danger – [...]

- I will issue a temporary residence permit in Novosibirsk Temporary residence permit in Novosibirsk In accordance with the legislation of the Russian Federation, a foreign citizen can be issued a temporary residence permit (TRP) only if there is an appropriate quota in a particular subject of the Russian Federation. Quota size […]

- If holidays fall on vacation, how to issue an order Work and vacation on New Year's holidays The conversation was conducted by Ekaterina Stepina, an expert in financial legislation New Year's holidays are a busy time for personnel officers and accountants. It is during this period that many employees seek to go on vacation in order to extend it by […]

- Order of the Ministry of Internal Affairs on payment for housing Forum of employees of the Ministry of Internal Affairs of Russia junior sergeant Profile Group: Users Messages: 14 User No.: 5704 Registration: 04/04/2012 Rating: (0%) Another question about renting housing: All the documents seem to have been collectedHousing is available but very far away (dacha in the village), there is no one in the city. Tobish [...]

Resolving issues regarding employees and property

One of the key points when suspending activities is the personnel issue, which requires proper registration of downtime and payment of workers for this period of time. In practice, employees are offered to take vacations at their own expense, resign at their own request, etc. However, from the point of view of labor legislation, this is illegal. Moreover, the suspension of the activities of an LLC in the form of downtime does not imply the dismissal of employees and therefore requires resolving the issue of paying them wages for the period of downtime.

This issue is resolved according to the following rules (Article 157 of the Labor Code of the Russian Federation):

- If downtime is initiated by the management of the enterprise, employees receive 2/3 of their salary during the entire downtime.

- A salary in the amount of 2/3 of the salary (not the full salary, but only the salary) is paid to employees if the suspension of work is caused by circumstances that were not the result of the will of the parties to the employment contract.

- The presence of the employee's fault in the occurrence of downtime deprives him of the right to receive wages for this period.

- At least 2/3 of the salary must be paid to an employee who was unable to perform his job function due to a strike by other workers and notified the employer in writing.

The property of the organization must be preserved during the period of temporary cessation of activities. Specific actions regarding the means of production and other things of the company depend, among other things, on the reasons for the downtime. Thus, if the equipment malfunctions, it must be sealed and access to it must be terminated.

As a general rule, a demurrage order also provides for basic means of preserving property, be it a guard post, locking devices, sealing, etc.

Powers and responsibilities of the head of the liquidation commission

The liquidator is assigned special functions and powers on the basis of which he will carry out activities and carry out the procedures necessary to terminate the activities of the enterprise in accordance with the current law.

Therefore, the head of the liquidator bears enormous responsibility for the work of the liquidation commission; his duties include signing documents issued by this body.

Paperwork

The final stage is the issuance of an order, registration of entries in personnel work books and their issuance to employees, as well as carrying out financial settlements with employees. No additional statements are required from people working at the enterprise.

According to the law, the order is issued two (in special cases - three) months after the notifications are served on the staff. It is not allowed to fire people before this period - this would be a direct violation of Russian labor legislation. The document form is standard. A sample dismissal order during liquidation of an enterprise contains the following information:

- Full name of the organization.

- Document Number.

- Date of completion.

- Title of the document (order).

- Information about termination of the employment contract: agreement number, expiration date.

- Information about the employee: Full name, personnel number (if any), name of the structural unit where the person worked, his position.

- Grounds for termination of the contract - here there should be a reference to Article 81 of the Labor Code of the Russian Federation (clause 1 of part 1).

- Signature of the head of the enterprise.

- Employee signature.

- Date of.

After the employee reads the order and puts his signature on it, the HR department employee makes the required entry in the work book, the manager signs it, and then the document is given to the dismissed person.

Who is a liquidator, and how does this concept relate to the concept of “liquidation commission”

A liquidator is a person dealing with issues arising during the implementation of the procedure for terminating the activities of an organization. The liquidation commission is a collegial body that resolves similar issues.

p, blockquote 2,0,0,0,0 —>

The procedure for appointing a liquidator or liquidation commission is prescribed in Art. 62 Civil Code of the Russian Federation, Art. 57 Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14. However, the provisions of the law are extremely stingy and do not fully regulate the activities of the liquidator or liquidation commission. Moreover, Federal Law No. 14 does not even contain a hint that a liquidator can participate in the termination of an organization’s activities, using the concept of a “liquidation commission.”

p, blockquote 3,0,0,0,0 —>

In practice, it is possible to appoint both a liquidator and a liquidation commission, and this issue is resolved by the general meeting of the LLC. To organize the termination of a small company, they most often use the services of one person. If the company is large, a commission is appointed (including at least two participants, one of whom is the chairman).

What is the liquidation commission and what are its powers?

The legislation does not contain a clear definition of the liquidation commission. The liquidation commission is a group of persons who are responsible for the liquidation of the organization and the implementation of all required actions during this procedure. This is a temporary executive body in the company to solve specialized problems.

For the purposes of liquidation, a commission is not necessarily appointed; one person can be selected - the liquidator. But regardless of who will carry out the liquidation (liquidator or liquidation commission), the powers of these bodies will be the same.

The powers of the liquidation commission (or liquidator) will be as follows:

- She takes over management of the organization : powers are transferred to her by the current management of the company.

- She acts on behalf of a company in court when filing lawsuits against such a company.

- It publishes mandatory information messages in the State Registration Bulletin and the media about the liquidation of the company , the timing and procedure for transferring claims from creditors.

- The commission notifies creditors that the company is planned to be liquidated in the near future.

- The Commission notifies the Federal Tax Service of the start of the liquidation procedure.

- The company prepares an interim liquidation balance sheet after the deadline for submitting creditor claims has expired . It displays the financial condition of the organization, accounts receivable and payable, as well as assets.

- The commission carries out settlements with creditors at the expense of its assets and takes measures to collect receivables.

- If necessary, the sale of company property is ensured to pay off debt.

- Upon completion of settlements, the commission prepares a final liquidation balance sheet.

- If after settlements the company has property left, then it is distributed among the company's participants . If it has been revealed that the company’s assets are not enough to fully satisfy the claims of creditors, then it must initiate bankruptcy proceedings and submit an appropriate application to the arbitration court.

- The commission transmits information to the Federal Tax Service and an application for registration of information about the exclusion of the company from the register.

These powers are not exhaustive and can be expanded based on a decision made by the founders. The liquidation commission must carry out its work conscientiously, act reasonably and in good faith, while respecting the interests of the liquidated company and its creditors.

It is worth considering that if a company had to initiate bankruptcy proceedings, then the procedure is carried out in accordance with 127-FZ “On Insolvency”. In this case, all powers of the liquidation commission are terminated and transferred to the bankruptcy trustee appointed by the arbitration court.

Liquidation of an enterprise: possible grounds

Liquidation of an enterprise and dismissal of employees in accordance with current legislation is a rather complex procedure that must be performed in accordance with all requirements. Otherwise, the registration authority may refuse to confirm the fact of liquidation, which will entail the need for the head of the organization to repeat some procedures: create a liquidation balance sheet, sign orders for the liquidation of the enterprise and the dismissal of employees. This, in turn, will require additional time and financial resources.

That is why some company managers, faced with the need to register the fact that a given enterprise has ceased its activities and dismiss employees, turn to specialized agencies for this purpose, which take upon themselves the registration of all the necessary stages of this legal procedure. At the same time, a careful study of the current legislation and samples of all necessary documents can allow the head of such a company or his authorized persons to independently organize all the necessary actions for this, saving significant financial resources.

The procedure for liquidation of legal entities, during which employees are dismissed, in the Russian Federation is regulated by the Civil Code and other legal acts. In particular, Article 61 of the Civil Code of the Russian Federation indicates that as a result of the liquidation of a company, its rights and obligations cease simultaneously with it, without passing to any other legal entity or individual. The same article provides two key grounds for the liquidation of an organization: its work can be terminated by a court decision if the judicial authority has grounds for issuing such a verdict, or by decision of its founder or founders.

What order appointed the head of the liquidation commission 3918

But it is advisable not to impose obligations by an additional agreement to the employment contract, since in this case dismissal in connection with the liquidation of the organization will be difficult, because all calculations must be carried out before liquidation, and the liquidation commission works until liquidation.

Rationale for the conclusion: Liquidation of a limited liability company (hereinafter referred to as the company, LLC) is carried out in the manner prescribed by Art.

61-64.1 Civil Code of the Russian Federation, Art. 57-58 Federal Law of 02.08. 1998 N 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law). The general meeting of participants, which decided to liquidate the company, appoints a liquidation commission (liquidator) (clause 3 of article 62 of the Civil Code of the Russian Federation, clause 12 of clause 2 of article 33, paragraph two of clause 2 of article 57 of the LLC Law). At the same time, the current legislation does not provide for prohibitions and restrictions for the appointment of a person performing the functions of the sole executive body of the LLC as chairman of the liquidation commission * (1).

How to draw up an order for the liquidation of an enterprise using the sample

The process of liquidating an organization, regardless of the basis for such termination, is formalized by an order for the enterprise. The correctness of drawing up such a document is the key to the implementation of all necessary measures required to complete the activities of a business entity.

The order is issued and signed by the manager, the information contained in it is brought to the attention of the workforce.

The procedure in which a liquidation order must be issued is in accordance with the method in which the termination of the activities of a business entity is carried out.

In order to liquidate an enterprise voluntarily, a decision made by the founders will be sufficient. The volitional decision of the participants will not have any significance in the event of a forced termination of economic activity. The main and only basis for carrying out the liquidation process, in this case, will be the decision of the court.

The decision made by the founders to terminate the existence of a business entity is made collectively, during the meeting. It is recorded by recording it in the minutes of the meeting. The presence of a protocol containing the relevant decision is the basis for issuing an order determining the start date and timing of liquidation procedures.

In the event that the founder and director of the company are represented by a single person, the decision on liquidation is stated in the order, without the need to draw up a protocol.

The presence of a procedural act of justice on forced liquidation is the basis for the mandatory creation of an order for the enterprise.

Enterprises that show signs of insolvency can be liquidated through arbitration proceedings, with the obligatory completion of bankruptcy proceedings

Details of filling out a sample order for liquidation of an enterprise

Content design

A sample order for the liquidation of an enterprise does not have an exclusive form. Such a document must contain several blocks of mandatory information regarding the basis and process of termination of business.

An order of this type must include:

- an indication of the reason for liquidation and the further procedure in which the dismissal of the workforce will be carried out;

- time restrictions regarding the date of completion of the procedure;

- information about the working commission created to comply with legal norms during the liquidation process;

- a list of tasks and goals that are set for the chairman;

- documentary details.

For enterprises with branches, it is mandatory to prepare separate orders for each of the representative offices.

The first priority order created during voluntary liquidation is the order to terminate the separate units. The registration authority must be notified of the upcoming termination of activities.

The dismissal of a director during the liquidation of an LLC is regulated, like the dismissal of other employees, by the Labor Code.

Step-by-step instructions for liquidating a charitable foundation are provided here.

The order, which is the basis for the liquidation of a separate unit, belongs to the category of administrative documents regulating the termination of the work of the main business entity.

A sample order for the liquidation of an enterprise contains the following parts:

- table of contents;

- descriptive block;

- information materials regarding the liquidation commission;

- a description of the functions and powers assigned to such a commission.

To place an order, use the company's form. Its header indicates the name of the document; for example, it can be called an order “on the liquidation of the organization.”

Here you must indicate the name of the business entity being liquidated. In cases where a separate structural unit is liquidated, the order must contain the name of the parent enterprise.

Registration of an order is carried out by assigning it an internal individual number.

The main information block includes an indication of the reason for the termination of the legal entity, as well as the method of dismissal of persons who are in an employment relationship with the liquidated company. The same block defines the procedure and timing of the liquidation procedure.

The information block about the liquidation commission determines its composition, indicating the name and position of each of its members. Its head is also appointed by order.

The commission may include employees of an enterprise that is in the process of liquidation, who, together with the legal fact of termination of its activities, will be subject to dismissal in the general manner.

The second descriptive section provides information about the functions and limits of authority of the head of the company liquidation commission. Such a person is responsible for the formation and submission to the founders of special acts created upon completion of the liquidation procedure, for the purpose of their approval.

Standard blocks are mandatory components of the order on the basis of which the liquidation procedure will be carried out. The content of these blocks is not regulated by the legislator, but it is well-established in terms of practice.

The meaning of the name of the order must reflect the very fact of the beginning of the liquidation process and contain the name of the organization being liquidated. This name must completely coincide with the name of the enterprise indicated on the company letterhead. After completing the internal registration procedure, a serial number is affixed to the document.

The main part of the document indicates the reason on which the company is liquidated and employees are dismissed. The same block indicates the main activities that will accompany the process of terminating the activities of a business entity.

The liquidation order is a source of informing government bodies and company employees about the upcoming liquidation of a legal entity

The order determines the time frame during which the enterprise will be liquidated. They may appear as a specific date or be presented as an indication of the number of days in the liquidation procedure.

The second block of the order is devoted to the creation of a liquidation commission and the definition of its terms of reference. Members of the liquidation commission are indicated by name, with the obligatory recording of their position. The person who will be entrusted with the functions of the chairman of the commission is also determined here.

The liquidation commission may include employees representing the accounting department, the economic sector, lawyers, management and production workers.

The final block determines the functional direction of the activities of the chairman of the liquidation commission.

The order is signed by the manager, and his signature is subject to decoding. A mandatory detail of the document is the date of its preparation. It is important when calculating deadlines if the order of the head of the enterprise determines the period of the liquidation procedure by the number of days, the countdown of which begins from the date of issue of the order.

Urgent liquidation of an LLC in practice takes about 3-4 months.

The nuances of liquidating a branch of a budgetary institution are discussed here.

The legal aspects of liquidating an LLC through sale are given at the link.

calculator-ipoteki.ru

Popular:

- When are pensions for January 2013 WHAT IS IMPORTANT TO KNOW ABOUT THE NEW DRAFT LAW ON PENSIONS Subscribe to news A letter to confirm your subscription has been sent to the e-mail you specified. December 27, 2013 Schedule of payment of pensions, monthly social benefits and other social payments for January 2014 […]

- Russian Post rules of delivery Russian Post rules of delivery In accordance with Article 2 of the Law on Postal Services, postal services include actions or activities for the reception, processing, transportation, delivery (delivery) of postal items, as well as […]

- Law 323 of 21112014 “Contents FOUNDERS: Federal Service IGOR VASILIEV: YEAR OF QUALITY. state registration, WHAT EXPECTS ROSREESTR IN THE NEW YEAR? FSUE “Rostekhinventarizatsiya” – Congratulations. » FOUNDER: IGOR VASILIEV: A YEAR OF QUALITY. […]

- Number of the law on accounting New Federal Law “On Accounting” Articles on the topic: Registration of transactions in accounting in 2014 Correct registration of business transactions is one of the cornerstone problems of both accounting practice and […]

- Order of the Ministry of Health Documents of the Ministry of Health of the Russian Federation (Enter the number and/or part of the name or date of the document. IMPORTANT: the date of the document is entered in the format “dd.mm.yyyy”) “On the admission of specialists to carry out medical or […]

- Taxes for individuals in Crimea What personal income tax is in Crimea The Republic of Crimea officially returned to the Russian state in mid-March 2014. Thus, 2 new regions have appeared in our country - the Republic of Crimea itself and Sevastopol as a city […]

- Law Federal Law 143 Federal Law of November 15, 1997 N 143-FZ “On Acts of Civil Status” (with amendments and additions) Federal Law of November 15, 1997 N 143-FZ “On Acts of Civil Status” With amendments and additions [ …]

- Plastic cards with cash back Plastic cards with cash back One of the disadvantages of credit cards until now was that if funds were stolen from your card account, you could not protect your rights and return the money. Everything, that […]