Financial assistance, as a rule, is subject to contributions for compulsory pension, health insurance and VNIM.

However, some types of financial assistance, which are directly specified in the law, are exempt from insurance premiums, for example, financial assistance to an employee up to 4,000 rubles. per year or financial assistance at the birth of a child within 50,000 rubles.

There is also no need to impose contributions on financial assistance to individuals with whom you do not have labor relations or civil contracts.

How to properly prepare documents for payment of financial assistance?

In general, the procedure for providing financial assistance can be presented as follows (Fig. 1).

The employee writes a written application for financial assistance addressed to the manager, indicating the reason for seeking help.

↓

The application is considered by a permanent commission

↓

An order is issued to provide financial assistance (in case of a positive decision)

↓

The employee is paid financial assistance

Rice. 1. The procedure for providing financial assistance

An employee of the institution must write an application for financial assistance addressed to the head, indicating the reason for seeking help. The application must be accompanied by documents confirming the specified reason (birth certificate of the child, death certificate of a family member, etc.).

Example of an application for financial assistance

Chief physician of the Federal Budgetary Healthcare Institution

Mishin V.A.

epidemiologist

Lipina S.I.

Statement

I ask you to provide me with financial assistance in connection with the birth of Lipina Anastasia Sergeevna’s child on January 20, 2020.

Enclosure: copy of birth certificate.

01/28/2015 Lipina S.I. Lipina

After this, the application is reviewed by a permanent commission. If the decision is positive, the employer gives consent in writing. Based on this decision, an order to provide financial assistance is issued. The order specifies the amount of payment, timing of issuance, source and reason for payment. According to the Regulations on the procedure for paying financial assistance, a reference is provided to the point on the basis of which the amount of payment in this particular case and the reason for payment are determined.

Fragment of the order for payment of financial assistance

In connection with the birth of a child by epidemiologist S.I. Lipina, on the basis of clause “b” of the Regulations on the procedure for paying financial assistance to employees of the Federal Budgetary Healthcare Institution

I ORDER:

1. Accrue and pay Svetlana Ivanovna Lipina one-time financial assistance in the amount of 25,000 rubles. until 02/28/2015.

2. Assign chief accountant T.V. Kuznetsova to be responsible for calculating financial assistance.

Reason: 1. Personal statement by S.I. Lipina.

2. A copy of the birth certificate dated January 20, 2015 No. I-AV 3421576, issued by the Kirov Department of the Civil Registry Office in Yekaterinburg.

Chief Physician of the Federal Budgetary Healthcare Institution Mishin V. A. Mishin

The following have been familiarized with the order:

Chief Accountant Kuznetsova T.V. Kuznetsova 01/30/2015

Epidemiologist Lipina S.I. Lipina 01/30/2015

The source of payment is usually cash received from income-generating activities.

Important detail! Financial assistance is paid out of profit, so the decision on the use of net profit is made by the head together with the permanent tariff commission for the institution. After a decision is made on the possibility of paying financial assistance, an order is issued to provide assistance to the employee who applied.

Financial assistance 4000 rubles: taxes, contributions in 2020

Financial assistance is paid by the employer voluntarily at the request of the employee. Chapters 23 (NDFL) and 34 (Insurance contributions) of the Tax Code of the Russian Federation provide for some relaxations regarding the tax burden on the employee and employer associated with such financial support for an individual.

Subp. 11 clause 1 art. 422 of the Tax Code of the Russian Federation establishes a limit on the amount of financial assistance that is not subject to insurance contributions. It is similar - 4,000 rubles. per employee per calendar year. True, there is no longer any connection with the amount of financial assistance received by an individual from all employers. In the case of insurance contributions, even if the employee had previously received financial support from another employer, this fact does not affect the exemption of the new amount of financial assistance from insurance contributions from the current employer.

Amounts of financial assistance not subject to personal income tax in 2020

Personal income tax on financial assistance in 2020 is withheld taking into account the benefits provided for in paragraph 8 of Art. 217 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), in the following order (Fig. 2).

| Type of financial assistance | Maximum size; subject to / not subject to personal income tax | Features of provision | ||

| ↓ | ↓ | ↓ | ||

| Assistance paid to employees in connection with the birth or adoption of a child, issued during the first year of the child’s birth (adoption) | → | No more than 50,000 rubles. for one child. There is no need to pay personal income tax | → | Paid during the first year of birth (adoption) of the child. The employee must provide a copy of the child's birth certificate along with the written application. Exemption from personal income tax is provided to only one parent at his choice or to both, but based on the total payment amount of 50,000 rubles. for two. Therefore, when paying financial assistance to one of the parents, the institution, in order to be exempt from personal income tax, must make sure that the second parent did not receive financial assistance or received an amount that in total did not exceed the established limit. To confirm the fact that financial assistance was not (or was) provided to one of the parents, one of them must submit to the organization a certificate in form 2-NDFL or a statement from the organization (where the other parent works) stating that he did not receive financial assistance it turned out. Also, the employer himself can directly contact another organization where the second parent works and independently obtain information about the income received by the second parent. If financial assistance is paid to an employee on the basis of several orders, then it will be considered a one-time payment provided that its amount does not exceed 50,000 rubles. |

| Assistance paid to an employee, as well as to a retired former employee, in connection with the death of a member of his family | → | Size is not limited; Personal income tax is not assessed | → | When applying this norm, it is necessary that the deceased relative meets the concept of “family member” established by the provisions of the Family Code of the Russian Federation. Family members in accordance with Art. 2 of the Family Code of the Russian Federation recognizes spouses, parents, children, adoptive parents and adopted children. In this case, one-time financial assistance will not be subject to personal income tax. |

| Assistance paid in connection with a natural disaster or other emergency circumstances (fire, flood) to compensate for material damage and harm to health | → | Personal income tax is not imposed on amounts paid both to the employees themselves and to members of their families in the event of the death of the employee as a result of these circumstances. The amount of financial assistance in this case is not limited. | → | To confirm that assistance was provided in connection with a natural disaster, the injured employee will need a written statement, an order from the manager to provide financial assistance, and necessarily a document confirming the fact of a natural disaster (for example, a certificate from the fire service in the event of a fire in the employee’s apartment). Theft or robbery, according to the Russian Ministry of Finance, does not apply to emergency circumstances. If the organization stipulates in the collective agreement the issue of providing assistance in this situation, then upon application of the employee and on the basis of the order of the manager, payment of financial assistance can be made. If an employee is paid financial assistance in connection with a robbery , it is not subject to personal income tax only up to 4,000 rubles. If the payment is made in large amounts, then the amount of financial assistance is over 4,000 rubles. subject to personal income tax (letter of the Ministry of Finance of Russia dated August 30, 2007 No. 03-04-05-01/282) |

| Assistance paid to employees who suffered from terrorist attacks on the territory of the Russian Federation | → | Personal income tax is not imposed on amounts paid to employees, as well as to members of their families in the event of the death of an employee as a result of a terrorist attack. The amount of such financial assistance is not limited | ||

| Assistance paid to an employee or former employee in connection with retirement due to disability or age | → | The maximum amount of financial assistance not subject to personal income tax is no more than 4,000 rubles. in year |

Rice. 2. Features of providing financial assistance

Important to remember! In other cases, personal income tax on material assistance in 2020 is not withheld if its total amount for a calendar year does not exceed 4,000 rubles. for each employee (clause 28 of article 217 of the Tax Code of the Russian Federation). That is, the base for calculating tax includes material assistance in an amount in excess of 4,000 rubles.

Therefore, when paying financial assistance above the established amounts, it is necessary to calculate and withhold personal income tax.

The procedure for assessing personal income tax on material assistance depends on the reason for the assignment, the nature (social assistance) and the correct execution of documents.

The institution has the right to provide financial assistance to large families, non-working pensioners and disabled people (former FBUZ employees) in the amount of no more than 3,000 rubles, in accordance with the regulations and instructions on this in the collective agreement on the basis of an application and order.

Financial assistance can also be provided in other special cases at the request of the employee if funds are available, based on the decision of the permanent commission. In this case, a payment order is also issued. The employee must submit documents confirming his need to receive financial assistance.

Insurance premiums

Is financial assistance subject to insurance contributions or not? The answer to this question is contained in paragraphs. 3 and 11 clause 1 art. 422 of the Tax Code of the Russian Federation.

Financial assistance is not subject to insurance premiums if a lump sum payment is made:

- in connection with a natural disaster or other emergency in order to compensate for damage or injury to health;

- victims of terrorist attacks on the territory of the Russian Federation;

- in connection with the death of a member (members) of his family;

- upon the birth (adoption) of a child, the establishment of guardianship of a child - in the amount of no more than 50,000 rubles for each child in the first year after birth or adoption;

- others, not exceeding 4,000 rubles during a calendar year.

How to reflect the accrual of financial assistance in accounting?

Expenses for the payment of material assistance to full-time employees of a budgetary institution according to the budget classification of the Russian Federation are included in the “Wages” subitem of KOSGU 211.

Important! Amounts of financial assistance cannot be attributed to the cost of work and services, that is, account 2.109.61.211 “Wage costs in the cost of finished products, work, services” cannot be used to calculate material assistance - this will be considered an error. Amounts of financial assistance should be charged to account 2.401.20.211 “Wage expenses” in the “Financial result” section.

Let's consider the procedure for reflecting the accrual of financial assistance in accounting.

Situation 1. On the occasion of his retirement, an employee of the institution, Vasiliev, was awarded financial assistance in the amount of 10,000 rubles.

The following entries will be reflected in the accounting records:

- financial assistance accrued:

Debit account 2.401.20.211 Credit account 2.302.11.730 - 10,000 rubles;

from the amount of financial assistance exceeding 4,000 rubles, personal income tax is withheld ((10,000 rubles - 4,000 rubles) × 13%):

Debit account 2.302.11.830 Credit account 2.303.01.730 - 780 rub.;

- insurance premiums were charged for the amount of financial assistance exceeding 4,000 rubles, according to Art. 9 of Federal Law No. 212:

a) to the Social Insurance Fund (FSS; (10,000 rubles - 4,000 rubles) × 2.9%):

Debit account 2.401.20.213 Credit account 2.303.02.730 - 174 rubles;

b) to the Pension Insurance Fund (PFR), insurance part ((10,000 rubles - 4,000 rubles) × 22%):

Debit account 2.401.20.213 Credit account 2.303.10.730 - 1320 rubles;

c) to the Federal Compulsory Medical Insurance Fund (FFOMS; (10,000 rubles - 4,000 rubles) × 5.1%):

Debit account 2.401.20.213 Credit account 2.303.07.730 - 306 rubles;

d) insurance contributions for compulsory social insurance against industrial accidents and occupational diseases ((10,000 rubles - 4,000 rubles) × 0.2%):

Debit account 2.401.20.213 Credit account 2.303.06.730 - 12 rubles;

financial assistance was issued from the cash register to employee Vasiliev (10,000 rubles - 780 rubles (personal income tax)):

Debit account 2.302.11.830 Credit account 2.201.34.610 - 9220 rub.

Situation 2. Epidemiologist S.I. Lipina received one-time financial assistance in the amount of 25,000 rubles in connection with the birth of a child.

This will be reflected in accounting as follows:

Financial assistance accrued in connection with the birth of a child:

Debit account 2.401.20.211 Credit account 2.302.11.730 - 25,000 rub.

In accordance with current legislation, such material assistance is not subject to personal income tax and insurance premiums do not need to be charged on it;

- financial assistance was issued from the cash register to employee Lipina S.I.:

Debit account 2.302.11.830 Credit account 2.201.34.610 - 25,000 rub.

Situation 3. Former FFBUZ employee V.I. Volkova, who is retired, applied for financial assistance. Based on the order, she was awarded financial assistance in the amount of 3,000 rubles.

The institution's accrual of remunerations, benefits and other social payments to former employees is reflected in the Credit of account 302.63.730. Expenses for the payment of material assistance to pensioners of a budgetary institution, according to the budget classification of the Russian Federation, are included in subarticle 263 “Social benefits”.

The following entries are made in accounting:

financial assistance accrued:

Debit account 2.401.20.263 Credit account 2.302.63.730 - 3000 rub.

The amount of financial assistance during the year does not exceed 4,000 rubles, so the accrued amount will not be subject to personal income tax and insurance contributions;

financial assistance was issued from the institution's cash desk to a former employee:

Debit account 2.302.63.830 Credit account 2.201.34.610 - 3000 rub.

___________________

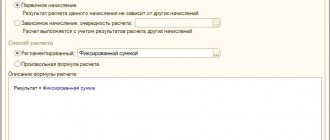

We recommend. To reflect financial assistance in the salary summary (see figure), you can use several types of calculation of financial assistance and configure the necessary algorithm for each type in the program to correctly reflect financial assistance in accounting. Then, for different types of accrual, the summary will reflect the amounts of one-time social assistance, the amount of financial assistance to pensioners - former employees of the institution, the amount of financial assistance accrued to key employees for other reasons (based on the Regulations on the procedure for paying financial assistance). In addition, the settings of the program for withholding personal income tax and levying insurance premiums on financial assistance depend on the type of accrual.

| Type of charges/deductions | Sum | Doctors | Assistants | Others |

| 152. Financial assistance | 10 000,00 | 10 000,00 | ||

| 168. Financial assistance to pensioners | 3000,00 | 3000,00 | ||

| 204. One-time financial assistance | 25 000,00 | 25 000,00 | ||

| TOTAL ACCRUED | 38 000,00 | 35 000,00 | 3000,00 | |

| 302. Cash desk | 37 220,00 | |||

| 328. UBRIR | 0,00 | |||

| 505. Personal income tax | 780,00 | |||

| 508. Social insurance | 174,00 | |||

| 509. Honey insurance | 306,00 | |||

| 511. Pension insurance | 1320,00 | |||

| 554. Injury | 12,00 | |||

| TOTAL HELD | 38 000,00 |

Rice. 3. Summary of accruals of financial assistance due to entrepreneurial activity, rub.

It follows from the code that according to type 204, one-time assistance (at the birth of a child) is not subject to personal income tax and insurance contributions.

Accrual type 168 is financial assistance to pensioners. Payments to former employees are taken into account here, and in the application for receiving cash to the FFBUZ cash desk from a personal account with the federal treasury, we indicate KOSGU 263 “Social Security”.

Accrual type 152 is configured in such a way that only amounts of financial assistance not exceeding 4,000 rubles are not subject to taxation. This type of payment is used to accrue financial assistance to key employees. In the application for receiving cash at the cash desk and in the checkbook, the budget economic classification code 211 KOSGU is indicated.

2 questions per topic

Should financial assistance be taken into account when calculating benefits and vacation pay?

When calculating vacation pay, all types of payments that are provided for in the wage system are taken into account. Financial assistance does not fall within the definition of the employee remuneration system, so it is not necessary to take it into account when calculating vacation pay. All other payments that do not relate to wages do not participate in the calculation of average earnings. Will not be included in the calculation:

- benefits and other social payments;

- financial assistance, gifts and other payments not related to wages.

According to the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (as amended on October 15, 2014), to calculate average wages , all types of payments provided for by the wage system and applied by the relevant employer are taken into account sources of these payments, and social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account Therefore, when calculating vacation pay, financial assistance will not be taken into account in full.

At the discretion of management, some organizations provide financial assistance to employees in addition to vacation.

If, for example, the management of an organization paid monthly health benefits to employees, let’s say in the amount of 1000 rubles. and this would be stipulated in the Regulations on remuneration, then this thousand would be taken into account when calculating average earnings.

But if this is a certain amount that is given to the best employee as an incentive measure, we are talking about a payment that is in no way related to the calculation of the average salary for calculating vacation pay.

______________________

When calculating temporary disability benefits, is it necessary to include financial assistance in the amount of average earnings?

Let’s assume that the employee was on sick leave from 02/02/2015 to 02/10/2015.

In 2013, she was paid financial assistance in the amount of 30,000 rubles. at the birth of a child, and in 2014 - in the amount of 10,000 rubles. for hospital treatment. When calculating temporary disability benefits based on the employee’s average earnings for 2013–2014. Payments for which insurance premiums are not charged are excluded:

- for 2013 - financial assistance in the amount of 30,000 rubles;

- for 2014 - financial assistance in the amount of 4,000 rubles.

Based on paragraph 1 of Art. 14 of the Federal Law of December 29, 2006 No. 255-FZ (as amended on December 31, 2014) “On compulsory social insurance in case of temporary disability and in connection with maternity,” the temporary disability benefit is calculated based on the average earnings of the insured person, calculated for two calendar years preceding the year of the onset of temporary disability. The average earnings for calculating sick leave benefits include all types of payments made by the insured person for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation are calculated in accordance with Art. 9 Federal Law No. 212-FZ.

It follows from this that, based on the average earnings of an employee for 2013–2014. payments for which insurance premiums were not charged are excluded (material assistance 30,000 rubles in 2013, 4,000 rubles in 2014).

________________________

For profit tax purposes, the taxpayer reduces the income received by the amount of expenses incurred on the basis of clause 1 of Art. 252 of the Tax Code of the Russian Federation. It must be taken into account that in accordance with paragraph 23 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base, expenses in the form of amounts of financial assistance to employees are not taken into account. Thus, amounts of financial assistance are not taken into account for profit tax purposes, regardless of whether they are provided for in the employment contract or not.

Financial assistance 4000 rubles taxation 2020 insurance premiums

One-time nature of assistance provided for social reasons When issuing an order and making payments for the reasons specified in paragraphs. 3. clause 1 art. 422 of the Tax Code of the Russian Federation, attention must be paid to the one-time nature of the provision of assistance. A one-time payment refers to settlement transactions performed under one order.

Forgiveness of an interest-free loan: we charge personal income tax According to the rules in force from 01/01/2020, when issuing an interest-free loan to an employee, personal income tax must be charged on the individual’s benefit from saving on interest on a monthly basis. The question arises: what to do with the already accrued tax amounts in the case when the lender forgives the borrower the entire amount of the loan issued.

conclusions

- The collective agreement must provide for all the grounds for providing financial assistance, and the regulations on remuneration stipulate the cases of payment of financial assistance, its amount and payment terms.

- The accounting department has the right to require documents that are the basis for the payment of financial assistance.

- The institution must create a permanent commission, which, together with the manager, decides on the payment of financial assistance when employees apply for it in a difficult life situation.

- Financial assistance to employees of the institution is paid subject to the availability of funds remaining at the disposal of the institution after taxes are paid, at the expense of net profit.

- Taxation of material assistance with personal income tax in 2020 should be carried out in accordance with Art. 217 Tax Code of the Russian Federation. Amounts of financial assistance that are not subject to insurance premiums are specified in Art. 9 of Federal Law No. 212-FZ.

- Financial assistance and taxation must be correctly reflected in accounting and tax records.

Insurance contributions from financial assistance for quitting employees

If the company has decided to pay financial assistance to former employees (for example, in difficult life situations), it does not need to be subject to insurance contributions. According to paragraph 1 of Art. 420 of the Tax Code of the Russian Federation and paragraph 1 of Art. 20.1 of Law No. 125-FZ, contributions are calculated from those payments that are intended for individuals included in the insurance system, that is, with whom employment or civil employment contracts have been concluded.

Such agreements are not concluded between the employer and the former employee, and therefore there are no grounds for calculating insurance premiums.

The video material provides information about financial assistance:

Documenting

An employee who needs to receive financial assistance submits an application in any form. Copies of supporting documents (for example, a birth or adoption certificate of a child, a death certificate of a family member, etc.) are attached to it.

Based on the application, an order is drawn up and signed by the head of the organization.

Financial assistance of 4,000 rubles is allocated by the employer or the state to provide financial support to citizens in particularly difficult life situations. These include payment for treatment, the birth of a child, the death of a close relative, etc. When issuing funds as assistance, accountants are concerned about the need to withhold taxes and contributions to the Social Insurance Fund from the accrued amount. Let's look at this in more detail.

Financial assistance to low-income families in 2019

Financial assistance to low-income citizens of the Russian Federation is currently provided in several forms. The most common option is cash payments that the state makes monthly. In addition, there is one-time monetary assistance in the form of a grant for training, a scholarship, assistance for the purchase of basic necessities, assistance in kind (food, medicine, etc.). A low-income family may be exempt from paying all taxes and fees when calculating material assistance in the form of benefits and subsidies.

Children who are raised in a family with low-income status have the right to receive education in higher and secondary educational institutions, taking part in a general competition for applicants. They can also count on help from the state, but for this at least one of the following conditions must be met:

- if the child is raised by only one parent who is recognized as a disabled person of the second or first group;

- if a child from a low-income family has scored the minimum number of points based on the exam results, which allows him to take part in the competition, since the exams are considered to have been passed successfully;

- the age of the child who wishes to enter a higher education institution does not exceed 20 years.

There are a number of innovations specifically for children raised in low-income families:

- out of turn children must be admitted to educational preschool institutions;

- in schools, children must have two meals a day, which are paid for by the state;

- Children should receive both a uniform for school and clothing for sports free of charge;

- Children under 6 years of age can receive the necessary medications for free, but only with a doctor’s prescription.

Parents who are part of a low-income family can count on the following benefits:

- preferential employment;

- lowering the retirement age;

- exemption from paying registration fees;

- obtaining a garden or summer cottage plot out of turn;

- obtaining a mortgage loan on preferential terms.

Is financial assistance for treatment from the profit of the enterprise subject to insurance premiums 2020

When a subordinate becomes a parent, he can be paid up to 50 thousand rubles without calculating insurance premiums. Financial assistance in connection with the death of a family member, compensation for damage due to injury, terrorist attack, emergency or accident are not included in the base for calculating insurance premiums and personal income tax. Deadline for provision of funds In most cases, the law does not provide for a specific period for payment of funds.

Payment of amounts is carried out by bank transfer or in cash through the cash register. Cases of providing assistance in kind are less common. Purpose of the operation Account debit Account credit Accrual of financial aid to a full-time employee 91/2 73 Presentation of financial aid to a dismissed employee or a family member of a person 91/2 76 Calculation of contributions 91/2 69 Payment of financial aid 73, 76 50, 51 Question No. 1.