Receiving materials from the supplier

Accounting at actual price (excluding VAT) + transportation and procurement costs (for example, delivery).

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| When paying after receiving materials: | ||||

| 10.01 | 60.01 | Received materials from supplier | Cost of materials (excluding VAT) | Receipt order, Consignment note |

| 19.03 | 60.01 | VAT on materials received | VAT amount | Consignment note, Invoice |

| 68.02 | 19.03 | VAT is transferred to reimbursement from the budget | VAT amount | Purchase book, Invoice, Delivery note |

| 60.01 | Payment to the supplier for materials | Cost of purchasing materials (including VAT) | Bank statement Payment order | |

| Receiving prepaid materials: | ||||

| 60.02 | Prepayment for materials to the supplier | Prepayment amount | Bank statement Payment order | |

| 60.01 | 60.02 | Repayment of accounts payable to the supplier (offset of prepayment) | Cost of purchasing materials (including VAT) | Accounting certificate-calculation |

https://youtu.be/UHB5b3xMtOs

Features of equipment accounting for installation

Fixed assets subject to pre-operational assembly, configuration and installation are accounted for by the enterprise in a synthetic account separate from other non-current assets. For these objects, separate accounting is carried out on a special account until the equipment acquires the properties of a working asset. After the entire complex of installation and commissioning work, the main asset is launched. At this moment, documentation for commissioning of the installed equipment is drawn up, and an entry for the transfer of the asset to the operating system is recorded in accounting.

Equipment is reflected in accounting data based on the total amount of costs incurred for its purchase and pre-operational preparation:

- cost of equipment paid to the supplier;

- costs incurred at the stage of delivery of the asset and its shipment to the buyer’s site;

- costs associated with commissioning and installation activities;

- the amount of resources spent by the new owner of the equipment to ensure the necessary storage conditions for the equipment before its launch;

- construction of supports for equipment, platforms, foundations.

When several units of assets requiring assembly and subsequent installation are simultaneously purchased, the total costs accumulated for their preparation are subject to distribution among the facilities involved. Installation can be done on your own or with the involvement of specialists from third-party organizations. The installation process involves carrying out such work as:

- installation on a site designated for the operation of this type of equipment;

- assembly of components;

- connection of measuring and control instruments, utility networks;

- checking the correct setup;

- assessment of the performance of the asset, the serviceability of all its parts;

- wiring insulation.

REMEMBER! Equipment requiring installation, which was not put into operation at the reporting date, must be reflected in the financial statements.

In the Balance Sheet form, line 1190 is provided for it, in which the value of such assets is summed up with the monetary valuation of other non-current assets.

Registration of equipment to be assembled and installed by an enterprise is carried out on the basis of documentation confirming the fact of acceptance and transfer of the asset (for example, a signed OS-14 act). The direction of equipment for installation is reflected in the OS-15 act. This event is accompanied by a transfer of the value of the installed fixed asset to the account for investments in non-current assets.

The amount of expenses incurred in connection with installation activities is credited to the value of the asset based on one of two documents:

- certificate of work performed by the contractor;

- accounting information.

The last form is used in cases where pre-operation work was carried out by employees of the equipment owner, and third parties were not involved in installation. After the preparatory stage is completed, the functionality of the equipment, the correctness of its connection, and the safety of the new workplace for personnel are checked. The next step is commissioning. From this moment on, the equipment is classified as fixed assets.

Receipt of materials to the warehouse under an exchange agreement

The cost of the exchanged materials is determined by agreement of the parties to the transaction. The price must be market price.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 10.01 | 60.1 | Receipt of materials from the counterparty | Cost of materials (excluding VAT) | Receipt order, Consignment note |

| 19.03 | 60.01 | VAT on materials received | VAT | Consignment note, Invoice |

| 68.02 | 19.03 | VAT is transferred to reimbursement from the budget | VAT | Purchase book, Invoice |

| 62.01 | 91.01 | Transfer of materials to the counterparty under an exchange agreement | Market price of materials | Invoice, invoice |

| 91.02 | 10.01 | Transferred materials are written off from the balance sheet | Cost of materials written off (FIFO, piece, weighted average) | Invoice, invoice |

| 91.02 | 68.02 | VAT on transferred materials | VAT of transferred materials | Invoice, Invoice, Sales Book |

| 60.01 | 62.01 | Settlement of exchange debts | Cost of materials | Accounting certificate-calculation |

ACCOUNTING FOR MATERIALS AT ACCOUNTING PRICES USING ACCOUNTS 15, 16 (ENTRY, EXAMPLE)

If to account for materials, not the actual cost price is used, but the accounting price, then the accounting department uses additional accounts 15 and 16. Inventory and materials are entered into the debit of account 15 at the actual cost, and into the debit of account 10 at the accounting price. The difference between the actual and accounting price is called a deviation and is reflected in account 16. The excess of the accounting price over the actual price is reflected in the credit of account 16, the excess of the actual price over the accounting price is reflected in the debit of account 16. The wiring is shown in the table below.

ACCOUNTING FOR MATERIALS AT ACCOUNTING PRICES

The table below shows the main entries for accounting for receipt of materials (materials and materials).

| Debit | Credit | Operation name |

| 60 | 51 | The cost of the supplier's goods and materials has been paid |

| 15 | 60 | The cost of inventory items is taken into account according to supplier documents excluding VAT |

| 19 | 60 | VAT allocated |

| 10 | 15 | Inventories are capitalized at the accounting price |

| 15 | 16 | |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Let's consider this option for accounting for materials using a specific example.

EXAMPLE OF ACCOUNTING RECEIPT OF MATERIALS

| The organization Alpha LLC purchased materials in the amount of 1,000 pieces with a total cost of 240,000, including VAT of 40,000 rubles. Materials are purchased at a discount price of 250 rubles. for 1 piece. 400 pieces were sent into production. It is necessary to reflect these transactions. |

Postings for accounting for the purchase of materials for production

| Sum | Debit | Credit | Operation name |

| 240000 | 60 | 51 | Payment transferred to the supplier |

| 200000 | 15 | 60 | Inventory and materials are accounted for at actual cost excluding VAT |

| 40000 | 19 | 60 | VAT allocated |

| 250000 | 10 | 15 | Materials were capitalized at the accounting price |

| 50000 | 15 | 16 | The excess of the book price over the actual cost is written off |

| 100000 | 20 | 10 | 400 pieces written off for production |

If the purchase price exceeds the accounting price, a debit balance is formed on account 16, this balance at the end of the month is written off to those accounts where the materials were written off proportionally according to the formula:

(debit balance at the beginning of the month for account 16 + debit turnover for account 16) x credit turnover for account 10 / (debit balance at the beginning of the month for account 10 + debit turnover for account 10).

If the purchase price is less than the discount price, then account 16 has a credit balance, which at the end of the month is written off according to the formula:

(credit balance at the beginning of the month of account 16 + credit turnover of account 16) x credit turnover of account 10 / (debit balance at the beginning of the month of account 10 + debit turnover of account 10)

In our example, the purchase price is less than the accounting price, account 16 has a credit balance, we determine the above ratio:

At the end of the month, using posting D20 K16, we write off the amount of 20,000.

In addition to purchase, materials can be supplied to the enterprise in other ways:

- Production of materials in-house: posting D10 K20 (23) - materials manufactured were capitalized.

- Receipt of materials in the form of a contribution to: posting D10 K75.

- Donation (gratuitous transfer of materials): gratuitous receipt of materials is formalized by posting D10 K98, then account 98 is closed on 91 with posting D98 K91.

Inventory assets (TMV) are the tangible property of an organization related to working capital. Let's take a closer look at how inventories, transactions and documents are kept in accounting.

In accounting, inventory items are material assets that will be used in the manufacture of finished products. To account for inventory items in accounting, the active account 10 “Materials” is primarily intended. At enterprises, for more convenient accounting, sub-accounts are opened for account 10 by type of materials:

Methods for acquiring inventory items in an organization can be different, for example:

- Purchase of goods and materials from a counterparty for non-cash payments ( discussed in example 1

); - The organization issues cash to the employee for the purchase of goods and materials ( studied in example 2 and example 3

).

Subsequently, purchased and capitalized goods are transferred to production. When transferring materials into production, an enterprise can write off the cost for accounting purposes by indicating in its accounting policy one of the following methods:

For tax accounting purposes, the cost of written-off materials is determined in accordance with clauses 2 and 4 of Art. 254 Tax Code of the Russian Federation.

Materials can be written off:

- For main production (account 20) ( example 4

); - For auxiliary production (account 23);

- For general production expenses (account 25);

- For general business expenses (account 26) ( example 5

).

Postings for posting materials under constituent agreements

The founders unanimously approve the cost of materials contributed to the authorized capital of their organization.

Postings for the 10th account:

| Account Debit | Account Credit | Description | Sum | A document base |

| 10.01 | 75.01 | Receipt of materials from the founders | Assessed value | Receipt order |

| 19.03 | 83 | VAT recovery (if required by the founder) | VAT restored | Certificate of acceptance of transfer of materials, Invoice |

SECTION 8. ACCOUNTING OF INVENTORIES

Raw materials: concept, classification

Materials are items whose useful life is less than 1 year, which are classified as objects of labor and are necessary for the production of products, works, services, and for the economic needs of the organization.

Materials are current assets, consumed in the production process, and transfer their value to the finished product.

Material classification:

| Group | Characteristic |

| Raw materials and basic materials | They form the material basis of the finished product. Raw materials - previously unprocessed product of the mining industry and agriculture Basic materials - products of the manufacturing industry |

| Semi-finished products of our own production | They are not inventories, they belong to work in progress |

| Purchased semi-finished products | Materials that have already been processed in other plants |

| Auxiliary materials | Additives, lubricants, returnable waste |

| Tara | Auxiliary material intended for transportation and storage of materials and finished products |

| Fuel | By state of aggregation: solid, liquid, gaseous By purpose of use: energy, technological, for economic needs |

| Spare parts | Purpose - maintaining mechanisms in working order, carrying out repairs |

| Construction Materials | Purpose: construction, repair of buildings and structures |

| Household equipment and supplies | Tools that cannot be classified as fixed assets: office supplies and consumables, etc. |

Materials typically come to the organization from suppliers through purchase for a fee. It is also possible to receive funds from your own production, from the founders, during dismantling of equipment, through barter transactions, etc.

For materials received from suppliers, on the basis of accompanying documents (waybill, invoice), a Receipt Order (Form No. M-4) is issued at the warehouse. Storekeepers enter information from the receipt order into the Materials Accounting Card (Form No. M-17).

If, during the acceptance of materials, a discrepancy between the actual data and those indicated in the documents (quantity, quality, etc.) is revealed or there are no accompanying documents (uninvoiced deliveries), then a Materials Acceptance Certificate is drawn up (form No. M-7), the materials are received by the accounting commission prices, while a receipt order is not issued. The amount of excess materials is attributed to the increase in debt to the supplier or accepted for safekeeping; if a shortage is identified due to the fault of the supplier, a claim is sent to him.

If the organization receives materials at the supplier’s warehouse, then the forwarder (driver) needs to issue a Power of Attorney (in form No. M-2 or No. M-2a)

The receipt of materials to the warehouse from in-house production is documented using a Request-invoice (Form No. M-11). When materials are received during dismantling, a Certificate is drawn up in form No. M-35.

After receiving the materials, all documents are transferred to the accounting department.

In accordance with the Instructions for using the Chart of Accounts, there are two options for accounting for the receipt of material assets:

- at the actual cost of acquisition (procurement)

- at discounted prices.

The option for accounting for receipt of materials must be fixed in the accounting policy.

Accounting prices are prices that an organization conditionally sets independently to simplify the accounting of production costs.

Actual prices - amounts paid in accordance with contracts to suppliers (contractors) minus refundable taxes, amounts paid for information and consulting services related to the acquisition of inventory, customs duties, non-refundable taxes.

The first option is usually used by organizations working with a small range of materials. In this case, all costs for the purchase of materials are reflected in the same account 10 “Materials”

Example: Aktiv LLC buys office supplies for accounting employees in the amount of 118,000 rubles, incl. VAT.

Postings: D 60 K 51 in the amount of 118,000 - the supplier's invoice was paid D 10 K 60 in the amount of 100,000 - office supplies were received by the organization D 19 K 60 in the amount of 18,000 - "input" VAT was taken into account D 26 K 10 in the amount 100,000 - stationery issued to employees

In the second method, it is necessary to use account 15 “Procurement and acquisition of material assets”, the debit of which reflects the actual costs of the acquisition (procurement) of material assets, and the credit - the accounting value of the inventories received by the organization and capitalized.

The difference between the accounting and actual values is written off from account 15 to account 16 “Deviation in the cost of material assets.” Differences accumulated on account 16 are written off (reversed if the difference is negative) to the debit of production cost accounts (sales expenses) or other relevant accounts. When selling materials, differences on account 16 are written off to debit 91-2. "Other expenses".

Example: Aktiv LLC buys paper for accounting employees (100 packs). The registration price of a pack is 90 rubles. The supplier issued an invoice for paper in the amount of 11,800 (including VAT 1,800) rubles.

Transactions: D 60 K 51 in the amount of 11,800 - the supplier's invoice was paid D 10 K 15 in the amount of 9,000 - paper was accepted for accounting at the discount price D 15 K 60 in the amount of 10,000 - paper was accepted for accounting at the actual price D 19 K 60 in the amount of 1,800 - “input” VAT is taken into account

The book value of the paper is 9,000 rubles, the actual value is 10,000 rubles, therefore:

D 16 K 15 in the amount of 1,000 - overexpenditure was written off (the excess of the actual cost over the book price) D 26 K 10 in the amount of 9,000 - paper was issued to employees

Then, at the end of the month, deviations recorded on account 16 are written off:

D 26 K 16 for the amount of 1000 rubles - deviations written off

Material assets accepted for safekeeping and customer-supplied raw materials are stored and accounted for separately on off-balance sheet accounts 002 “Inventory assets accepted for safekeeping” and 003 “Materials accepted for processing”

Free supply of materials

The cost of materials is determined by the market value of similar materials on the date of their registration.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 10.01 | 91.01 | Receipt of materials | Market price | Receipt order, Certificate of acceptance of transfer of materials |

Income tax calculation

To calculate income tax, an organization must know the amount of material expenses incurred when performing work (subclause 1, clause 1, article 254 of the Tax Code of the Russian Federation). This amount is determined based on the cost of material assets, which consists of the price of materials and the cost of their acquisition. How to determine the price of materials if settlement documents have not yet been received? In addition, according to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses that reduce taxable income must be confirmed by documents drawn up in accordance with the legislation of the Russian Federation. Consequently, these material expenses can be recognized for profit tax purposes only in the period when the supplier provides settlement documents. If this happened in the next tax period, then the organization can recognize these expenses as losses of previous tax periods identified in the current reporting (tax) period (subclause 1, clause 2, article 265 of the Tax Code of the Russian Federation).

Thus, during the period of receipt of materials when they are used in production, expenses form accounting profit (loss), but are not taken into account for tax purposes.

In this case, the organization recognizes a deductible temporary difference in accounting and reflects the deferred tax asset with an entry in the debit of account 09 “Deferred tax assets” and the credit of account 68 subaccount “Calculations with the budget for income tax” (clauses 11, 14 of PBU 18/02 “ Accounting for income tax calculations").

Upon receipt of settlement documents, the organization recognizes the expense in tax accounting. Accordingly, the deferred tax asset is reduced or completely repaid by this amount, which is reflected by an entry in the debit of account 68 of the subaccount “Calculations with the budget for income tax” and the credit of account 09 (clause 17 of PBU 18/02).

If, in accordance with the supplier’s documents, the accounting reflects the difference (markdown) in the cost of materials written off as expenses, then the taxable profit of the reporting period and subsequent reporting periods will never be reduced by the remaining amount of the deductible temporary difference. It is necessary to write off the remaining amount of the deferred tax asset from account 09 to account 99 “Profits and losses” (clause 17 of PBU 18/02).

In this case, accounting records reflect other income that is not taken into account for profit tax purposes. The organization recognizes a permanent difference and reflects a permanent tax asset in the debit of account 68 subaccount “Calculations with the budget for income tax” and the credit of account 99 subaccount “Permanent tax liabilities (assets)” (clauses 4, 7 PBU 18/02).

Example

The organization has entered into a contract for the supply of materials, which defines the total volume of materials supplied and the total cost of the contract and states that the price of materials is determined separately for each supplied batch. When conducting an inventory, the organization discovered that for one of the batches of materials capitalized in November 2007 at a price calculated based on the average contract price (35,400 rubles, including VAT 5,400 rubles), the supplier did not submit settlement documents. The materials were used in contract work, the results of which were handed over to customers in December 2007. At the same time, the revenue amounted to 118,000 rubles. (including VAT - 18,000 rubles), cost of work - 70,000 rubles. (including the cost of materials - 30,000 rubles). The documents were submitted by the supplier only in April 2008. The cost of materials, according to calculation documents, is 34,220 rubles. (including VAT RUB 5,220).

The following will be recorded in the accounting records.

- In November:

- DEBIT 10 CREDIT 60 – 30,000 rub. (35,400 - 5,400) – materials were received at the estimated price;

- DEBIT 20 CREDIT 10 – 30,000 rub. – materials used for the work have been written off.

- DEBIT 62 CREDIT 90 – 118,000 rub. – the customer’s debt for the work is reflected;

- DEBIT 90 subaccount “Value added tax” CREDIT 68 subaccount “Calculations with the budget for VAT” – 18,000 rubles. – VAT is charged on the work performed;

- DEBIT 90 subaccount “Cost of sales” CREDIT 20 – 70,000 rub. – the cost of work accepted by the customer is written off;

- DEBIT 09 CREDIT 68 subaccount “Calculations with the budget for income tax” –

- 7,200 rub. (RUB 30,000 5 24%) – a deferred tax asset is reflected.

December:

Upon receipt of payment documents from the supplier.

In April:

- DEBIT 68 subaccount Calculations with the budget for income tax" CREDIT 09 - 6,960 rub. (34,220 rubles - 5,220 rubles 5 24%) – the deferred tax asset was reduced;

- DEBIT 99 CREDIT 09 – 240 rub. (7,200 – 6,960) – deferred tax asset is written off;

- DEBIT 60 CREDIT 91 subaccount “Other income” – 1,000 rubles. (30,000 - (34,220 - 5,220)) - the obligation to the supplier in terms of reducing the cost of materials was adjusted;

- DEBIT 68 subaccount “Calculations with the budget for income tax” CREDIT 99 – 240 rubles. (RUB 1,000 5 24%) – a permanent tax asset is reflected;

- DEBIT 19 CREDIT 60 – 5,220 rub. – the amount of VAT on materials is reflected according to the supplier’s invoice;

- DEBIT 68 subaccount “Calculations with the budget for VAT” CREDIT 19 – 5,220 rub. – the amount of VAT on materials has been accepted for deduction;

- DEBIT 60 CREDIT 51 – 220 – payment has been made to the supplier.

Receipt of materials produced in-house

In this case, the cost of materials will be their actual cost of production.

Typical wiring:

| Account Debit | Account Credit | Description | Sum | A document base |

| 10.01 | 20.01 | Production of materials | Actual manufacturing cost | Receipt order |

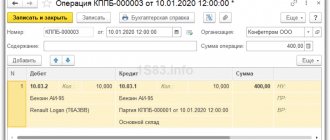

In the 1C program, the receipt of materials to the warehouse is documented with the document “Receipt of goods and services” for account 10:

Accounting for materials upon receipt

During the reporting period, an enterprise writes off O&R in different ways: in D 90, in D 20. This error is especially common in enterprises that did not have sales in the current reporting period.

Next, an employee of the purchasing company (the financially responsible person) checks the composition of the delivered material with the delivery note and invoice and, if everything is in order, signs the documents (each in 2 copies) and keeps one of the copies for himself.

If both goods and materials are delivered by one vehicle, the proposed method cannot be used.

Often, legally competent drafting of documents upon acceptance of goods and materials helps resolve disputes between the supplier and the buyer if such arise, for example, due to inadequate quality of received materials.

If, upon receipt of materials, it is possible to unambiguously associate transportation costs with a specific batch of materials, then delivery can be included in the cost of materials.

The acquisition of OS is possible not only at the expense of the company’s free funds. They can be:

- produce (construct) independently (or by contract);

- receive for free;

- purchased using targeted budget funding;

- receive as a contribution to the authorized capital of the company.

To record in accounting the moment when materials were received from the supplier, the posting is generated by posting a debit turnover on the 10th account.

If they reflect the internal movement of valuables, for example, when materials are released into production, the posting is made using analytical subaccounts.

Any enterprise needs means of labor - fixed assets that provide and support the production process. Proper accounting plays an important role in their acquisition. Let us recall the main records accompanying the receipt of OS from various sources.

The document flow system operating in the company is based on a set of unified forms. Their templates must be developed in accordance with the regulatory requirements of the Law of December 6, 2011 No. 402-FZ.

MFPU "Synergy" is one of the flagships of distance education in Russia. A wide range of disciplines, ease of managing your personal account on the Megacampus 2.0 portal, individual access to your personal account - this is not a complete list of the benefits a student receives when enrolling here.