What to follow

- Art. 223 of the Tax Code of the Russian Federation - the day of receipt of income (in fact);

- Art. 226 of the Tax Code of the Russian Federation - deadlines for tax deductions to the budget;

- Art. 6.1 Tax Code of the Russian Federation – postponement of the payment deadline;

- letter from the tax service No. BS-4-11/8568.

What positions should you pay attention to? There are three significant dates in the calculation:

- actual receipt of funds subject to income tax;

- withholding income tax on income received from a person;

- deduction of tax amounts to the budget.

In what documents can you find information about citizenship?

The answer to the question of how to find out the date of acquisition of Russian citizenship can be found in some documents. For example, it can be viewed in the Order on acquisition of Russian citizenship. It is issued at the Main Directorate for Migration and Migration along with a Russian passport. If the paper is lost, you can request it again.

Finding out the day of obtaining Russian citizenship is easiest for those who were born in Russia and immediately received documents. If a child, together with his parents, becomes a citizen of the Russian Federation, at the request of the mother or father, a stamp may be placed on his birth certificate indicating that the minor has become a citizen of Russia. The stamp will also indicate the date of this event.

Stamp on acquisition of Russian citizenship in the birth certificate

Return to contents

Russian citizenship for minors

According to the law, the date of receipt of Russian citizenship by minors is:

- birthday;

- day of adoption;

- the day on which the authorized body made such a decision.

The above is reflected in the Law “On Citizenship of the Russian Federation” Art. 37

For citizens who are just about to become subjects of Russia, it makes sense to take note of the fact that information about the significant day when they will become Russians may be useful to them more than once.

It is worth remembering or writing it down so as not to waste time contacting the Main Department of Migration.

Return to contents

How to fill out dates in 6-NDFL

The date is reflected in line 100 of the second section. According to the law, it differs depending on the type of income:

- Salary. Indicate the last day of the month in which it was accrued. For example, the calculation for the first quarter should show wages for January-March. True, if the funds were partially accrued in March, but were actually paid in full later (in April), the tax calculation is done already in 6-NDFL for the second quarter. Also see “Filling out the lines in the 6-NDFL calculation.”

- Natural form. It is necessary to enter the number as of which the direct transfer of any values or benefits was made.

- Extracting material benefits. The date of receipt is the last day of each month throughout the entire savings period.

What dates should be indicated in form 6-NDFL for the payment deadline?

In line 120 of the second section of the calculation, the day is indicated - usually the last day for tax deduction. Inspectors are sure to pay attention to it, because the date set determines whether a violation has occurred. Also see “Filling out Section 2 in 6-NDFL”.

Please note: the deadline has changed in 2020! When receiving standard income, the last day is considered to be the day following their receipt.

EXAMPLE If salaries for September 2020 were issued to employees on October 10, the tax must be paid no later than October 11.

An exception is provided for the payment of sick leave and vacation money: in such cases, the deadline goes to the last day of the month in which they were paid. Moreover, only weekdays are taken into account.

When money is issued before a holiday or weekend, settlement with the budget is possible upon the first working day.

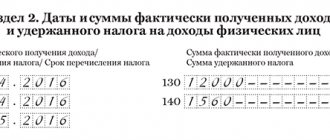

EXAMPLE Solaris LLC issued an advance payment to employees on December 29, 2020 in the amount of 287,000 rubles, and a final payment in the amount of 390,000 rubles. was taken on January 10, 2020. [What dates should I indicate] in the declaration for the first quarter in terms of income receipts and tax withholding?

Solution

- In the first section of the reporting, it is necessary to indicate the date on page 100 - December 29, 2016 (for RUB 287,000).

- On page 110 they write the date - 01/10/2017 for withheld funds in the amount of 88,010 rubles. ((RUB 287,000 + RUB 390,000) × 13%).

- On page 120, informing about the deadline for personal income tax payment, they put 01/11/2017.

Date of receipt of actual income for personal income tax purposes

Vitaly Semenikhin,

Head of the Semenikhin Expert Bureau The date of receipt of income is the date on which the income is recognized as actually received for the purpose of including it in the tax base for personal income tax.

We will talk about the features of determining the date of actual receipt of income for the purpose of calculating personal income tax in the material below. The date of receipt of income is determined according to the norms of Art. 223 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) and depends on what type of income the taxpayer receives.

In addition, mixed reorganization of a legal entity is also allowed, that is, a simultaneous combination of the forms listed above, for example, reorganization in the form of transformation with simultaneous merger with another organization.

At the same time, reorganization with the participation of two or more legal entities, including those created in different organizational and legal forms, is not prohibited, if the possibility of such a transformation is provided for by the Civil Code of the Russian Federation itself or another law.

The date of actual receipt of income is:

- Pupon receipt of income in cash

— the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).The Letter of the Ministry of Finance of Russia dated January 26, 2015 No. 03-04-06/2187 on determining the date of receipt of income in the form of vacation pay for personal income tax purposes states that the date of actual receipt of income in the form of vacation pay is determined in accordance with paragraphs. 1 clause 1 art. 223 of the Tax Code of the Russian Federation as the day of payment of income, including the transfer of income to taxpayer accounts in banks. This conclusion is confirmed by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11 in case No. A68-14429/2009;

- when receiving income in kind

— the day of transfer of income in kind (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

The Letter of the Ministry of Finance of Russia dated January 15, 2015 No. 03-04-06/306 explains that when receiving income in kind, for example in the form of payment by a bank of insurance premiums for individuals under an agreement concluded between an individual and an insurance organization, the day of transfer of income the date of transfer by the bank of insurance premiums to the insurance company is considered;

- when receiving income in the form of material benefits

— the day of acquisition of goods (work, services), acquisition of securities (clause 3, clause 1, article 223 of the Tax Code of the Russian Federation).Please note that if payment for purchased securities is made after the transfer of ownership of these securities to the taxpayer, the date of actual receipt of income is determined as the day the corresponding payment is made to pay for the cost of the purchased securities;

- when receiving income in the form of material benefits,

obtained from savings on interest when receiving borrowed (credit) funds

, - the last day of each month during the period for which borrowed (credit) funds were provided (clause 7, clause 1, article 223 of the Tax Code of the Russian Federation).The Federal Tax Service of Russia in Letter dated March 29, 2016 No. BS-4-11/ [email protected] “On the taxation of income of individuals” explains that income in the form of material benefits received from savings on interest for the use of borrowed (credit) funds, from 2020 year is determined on the last day of each month in which the loan (credit) agreement was valid, regardless of the date of receipt of such a loan (credit), and also regardless of which day of the month the debt obligation was terminated;

- when receiving income as a result of offset of counter-similar claims

- the day of offset of counter-similar claims (clause 4, clause 1, article 223 of the Tax Code of the Russian Federation); - upon receipt of income as a result of writing off, in accordance with the established procedure, a bad debt from the balance sheet of an organization that is an interdependent party in relation to the taxpayer,

— the day such a debt is written off (clause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

Please note that the provisions of paragraphs. 5 p. 1 art. 223 of the Tax Code of the Russian Federation applies to income received in tax periods starting from 01/01/2017, as indicated by clause 10 of Art. 9 of the Federal Law of November 27, 2017 No. 335-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation.”

Keep in mind that a special procedure for determining the date of actual receipt of income when writing off a bad debt from an organization’s balance sheet in accordance with the established procedure applies only if the taxpayer and the relevant organization are interdependent persons.

If the write-off in the prescribed manner of a bad debt from the balance sheet of an organization that is not an interdependent party in relation to the taxpayer (including if the impossibility or inexpediency of debt collection is confirmed by the stop of the bailiff on the completion of enforcement proceedings, issued in the prescribed manner), is not associated with a complete or partial termination of the taxpayer’s obligation in accordance with the legislation of the Russian Federation, then the specified date for such a taxpayer is not the date of actual receipt of income for the purpose of taxation on personal income.

Such explanations are contained in letters of the Ministry of Finance of Russia dated May 29, 2018 No. 03-04-06/36301, dated May 4, 2018 No. 03-04-06/30308;

- upon receipt of income arising in connection with reimbursement of travel expenses to the employee,

- the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

As the Ministry of Finance of Russia explains in Letter No. 03-04-06/6531 dated 02/09/2016, the determination of income subject to taxation, taking into account the provisions of clause 3 of Art. 217 of the Tax Code of the Russian Federation is carried out by the tax agent organization on the last day of the month in which the advance report is approved after the employee returns from a business trip, and the tax amounts are calculated by tax agents in accordance with clause 3 of Art. 226 of the Tax Code of the Russian Federation as of the date of actual receipt of income;

- for income in the form of amounts of profit of a controlled foreign company

- the last date of the tax period for the tax following the calendar year in which the end date of the period for which financial statements for the financial year are prepared in accordance with the personal law of a foreign organization (foreign structure without forming a legal entity) falls.

If, in accordance with the personal law of a controlled foreign company, there is no obligation to prepare and submit financial statements, the date of actual receipt of income in the form of profit amounts of such a company is recognized as the last day of the calendar year following the calendar year for which its profit is determined (clause 1.1 of Art. 223 Tax Code of the Russian Federation);

- when receiving income in the form of wages

- the last day of the month for which the taxpayer was accrued income for work duties performed in accordance with the employment agreement (contract) (paragraph 1, clause 2, article 223 of the Tax Code of the Russian Federation).

Here I would like to draw attention to the Letter of the Ministry of Finance of Russia dated 02/01/2016 No. 03-04-06/4321, which addressed the issue of personal income tax when the bank pays wages to employees on the 20th day of the current month and the 5th day of the month following the billing month. It says that on the last day of the month for which the taxpayer was accrued income in the form of wages, the tax agent calculates the tax amounts.

Before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Accordingly, the tax cannot be calculated until the end of the month.

The tax agent withholds the tax amount calculated at the end of the month from the taxpayer only when it is actually paid after the end of the month for which this tax amount was calculated.

Taking this into account, when paying wages on the 5th day of the month following the billing month, it is necessary to withhold the tax calculated for the previous month and transfer the tax amount to the budget no later than the day following the day the income is paid to the taxpayer.

Since payment of tax at the expense of tax agents in accordance with clause 9 of Art. 226 of the Tax Code of the Russian Federation is not allowed; the transfer of funds to pay personal income tax by a tax agent in advance, i.e. before the date of actual receipt of income by the taxpayer, is not provided for in Chapter 23 “Income Tax on Individuals” of the Tax Code of the Russian Federation. A similar conclusion is contained in the Letter of the Ministry of Finance of Russia dated December 15, 2017 No. 03-04-06/84250;

- when receiving income in the form of wages in the event of termination of the employment relationship before the end of the calendar month

- the last day of work for which the taxpayer was accrued income (paragraph 2 of clause 2 of Article 223 of the Tax Code of the Russian Federation).

As the Ministry of Finance of Russia explains in Letter dated September 24, 2009 No. 03-03-06/1/610, from paragraph. 2 p. 2 art. 223 of the Tax Code of the Russian Federation it follows that the date of receipt by a former employee of an organization of income in the form of an advance payment of wages is recognized as the last working day of his work in the organization.

Income in the form of payments received to promote self-employment of unemployed citizens and stimulate the creation by unemployed citizens who have opened their own businesses of additional jobs for the employment of unemployed citizens at the expense of the budgets of the budgetary system of the Russian Federation in accordance with programs approved by the relevant government authorities are taken into account as part of income for three tax periods with the simultaneous reflection of the corresponding amounts as expenses within the limits of actually incurred expenses of each tax period, provided for by the conditions for receiving the specified amounts of payments (clause 3 of Article 223 of the Tax Code of the Russian Federation).

In case of violation of the conditions for receiving payments, the amounts of payments received are reflected in full as part of the income of the tax period in which the violation was committed.

If at the end of the third tax period the amount of payments received exceeds the amount of expenses, the remaining unaccounted amounts are reflected in full as part of the income of this tax period.

Income (financial support funds) in the form of subsidies received in accordance with Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation” are reflected as income in proportion to the expenses actually incurred from this source, but no more than two tax periods from the date of receipt.

If, at the end of the second tax period, the amount of financial support received exceeds the amount of recognized expenses actually incurred from this source, the difference between the indicated amounts is reflected in full as part of the income of this tax period.

This procedure for accounting for financial support does not apply to cases of acquisition of depreciable property at the expense of the specified source (clause 4 of Article 223 of the Tax Code of the Russian Federation).

In the case of the acquisition of depreciable property using financial support funds, these financial support funds are reflected in income as expenses for the acquisition of depreciable property are recognized in the manner established by Chapter 25 of the Tax Code of the Russian Federation.

Income (funds of financial support) received by individual entrepreneurs from the budgets of the budgetary Russian Federation under a certificate for attracting labor resources to the constituent entities of the Russian Federation included in the list of constituent entities of the Russian Federation, the attraction of labor resources to which is a priority, in accordance with the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation”, are taken into account as income during three tax periods with the simultaneous reflection of the corresponding amounts as expenses within the limits of actually incurred expenses of each tax period, provided for by the conditions for receiving the specified financial support funds (clause 5 of Art. 223 Tax Code of the Russian Federation).

In case of violation of the conditions for receiving financial support, the amount of financial support received is reflected in full as part of the income of the tax period in which the violation was committed. If at the end of the third tax period the amount of financial support received exceeds the amount of expenses, then the remaining unaccounted amounts are fully reflected in the income of this tax period.

Date of actual receipt of income

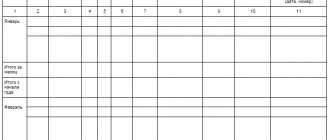

To decide which dates to put on line 100, you need to refer to Art. 223 “Date of actual receipt of income” of the Tax Code of the Russian Federation. We present the main dates of actual receipt of income in the table:

| Type of income | Date of actual receipt of income |

| Income in the form of wages | The last day of the month for which income was accrued |

| Income in cash (except income in the form of wages) | Day of payment of income (transfer to a bank account or withdrawal from a cash register) |

| Income in kind | Date of transfer of income in kind |

| Income in the form of material benefits received from savings on interest when receiving borrowed funds | The last day of each month during the period for which the borrowed funds were provided |

When do you need information about the day of acquisition of Russian citizenship?

Information about when a citizen became a Russian subject is rarely required. However, they can be requested. You will need to name this day in the following cases:

- joining a government agency;

- conscription into the army;

- extract-registration;

- privatization;

- when filling out various forms on the State Services website, etc.

You can learn about the methods of obtaining citizenship from the video below.

The question about the day of acquisition of citizenship can be found in many documents. It often leads people into a dead end, since they have never before thought about the need to remember or record such information in their notes.

What documents are required to obtain Russian citizenship can be found on our website.

Return to contents

Tax withholding date

The date of personal income tax withholding is the date of actual payment of income. After all, tax agents are required to withhold the calculated amount of personal income tax directly from the taxpayer’s income upon actual payment (paragraph 1, paragraph 4, article 226 of the Tax Code of the Russian Federation).

If income is issued in kind, as well as when receiving income in the form of material benefits, the tax agent must withhold personal income tax at the expense of any income paid in cash (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

In the case of an advance payment of wages, the date of tax withholding on it will be the date of the final payment of wages.