Why do you need an extract from the balance sheet?

What kind of explanations and extracts accountants have to compile in the course of their work!

Some of them must be designed according to strictly established standards, others - in any form. One of these “arbitrary” documents is an extract from the balance sheet. There is no specific form for it - each statement is unique and depends on what information and in what volume the user requires.

Let us dwell on the most common situation when an extract from the balance sheet is needed in connection with the company’s decision to exercise the right not to pay VAT (Article 145 of the Tax Code of the Russian Federation).

NOTE! This right is granted by paragraph 1 of Art. 145 of the Tax Code of the Russian Federation for those whose revenue excluding VAT for the previous 3 months in a row did not exceed 2,000,000 rubles.

About how to obtain exemption under Art. 145 of the Tax Code of the Russian Federation, read this material .

https://youtu.be/aH6gWoiRYF0

Preparing data for extract

In order not to pay VAT legally, the company needs to collect a package of documents and submit it to the tax authorities (clause 6 of Article 145 of the Tax Code of the Russian Federation). This package also includes an extract from the balance sheet. But in fact, the information that should be given in it cannot be taken from the balance sheet. To do this, you need to collect data on revenue, and you can get it from accounting registers.

For more information about how revenue is related to the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

To fill out the statement, you will need data on the volume of goods (work, services) sold. This should also include revenue from transactions taxed at a 0% rate.

NOTE! Officials insist on the mandatory inclusion in revenue of proceeds from transactions not subject to VAT, transactions that are not subject to VAT, as well as from the sale of goods (work, services), the place of sale of which is not the Russian Federation (letter of the Ministry of Finance dated January 29, 2013 No. 03- 07-11/1592, dated 10/15/2012 No. 03-07-07/107, Federal Tax Service of Russia for Moscow dated 04/23/2010 No. 16-15/43541), although the judges do not agree with them (clause 4 of the resolution of the Plenum of the Supreme Arbitration Court RF dated May 30, 2014 No. 33, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 27, 2012 No. 10252/12, etc.).

There is no need to take into account the prepayment received (letter of the Federal Tax Service of the Russian Federation for Moscow dated April 23, 2010 No. 16-15/43541), revenue from activities on UTII (letter of the Federal Tax Service dated May 12, 2014 No. GD-4-3 / [email protected] ) or goods transferred free of charge (letter of the Ministry of Finance of the Russian Federation dated September 30, 2013 No. 03-07-15/40261).

When the information for the statement is prepared, you can begin filling it out.

Sample balance sheet statement for equipment

For your information! An organization (individual entrepreneur) can send a notification along with the above documents to the tax office by registered mail. In this case, the day of their submission to the tax authority is considered the sixth day from the date of sending the registered letter (clause 7 of Article 145 of the Tax Code of the Russian Federation). If the organization (individual entrepreneur) has not notified the tax authority in writing about the use of the right to exemption from the duties of a taxpayer and (or) has not submitted supporting documents (including the full set of documents listed in paragraph 6 of Article 145 Tax Code of the Russian Federation), then he/she has no grounds for using the right to exemption, and therefore calculates and pays VAT in the generally established manner. In this case, Mir LLC must submit to the tax authority at its location: a notification in the form approved by the Ministry of Taxes of Russia, extracts from the balance sheet and from the sales book, a copy of the journal of received and issued invoices no later than April 20, 2004 .

This is interesting: What should happen if a father has a third child in the Irkutsk region

Among the fixed assets are buildings and structures, machinery, equipment, instruments, equipment, transport, tools and other objects for carrying out the activities of the enterprise. They also include capital investments in improving land resources and renting premises and equipment.

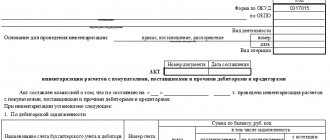

Extract from the balance sheet: fill out the form

Let's give an example. The management of Salut LLC decided to exercise its right under Art. 145 Tax Code of the Russian Federation. The accountant collected information about revenue and prepared an extract.

In Federal Tax Service No. 19 for the city of Moscow

INN 7702678342 Checkpoint 770201001

Extract from the balance sheet

The revenue of Salut LLC for 3 months, from 10/01/2018 to 12/31/2018 (excluding VAT), amounted to 1,540,000 rubles.

Revenue breakdown by month:

Revenue from sales of goods (works, services) excluding VAT, rubles

Extract from the balance sheet on the availability of fixed assets sample

A sample certificate of the book value of assets reflects the current price value of the institution’s property assets on the balance sheet. It reflects information on the valuation of the organization's current and non-current assets.

- revenue received from the sale of goods (work, services) when carrying out activities subject to taxation by a single tax on imputed income for certain types of activities;

- amounts of funds listed in Article 162 of the Tax Code of the Russian Federation, including funds received in the form of sanctions for non-fulfillment or improper execution of agreements (contracts) providing for the transfer of ownership of goods (work, services);

- revenue received from the sale of goods (work, services) free of charge;

- operations listed in clauses 2 - 4 clauses 1 and clause 2 of Article 146 of the Tax Code of the Russian Federation;

- operations carried out by tax agents in accordance with Article 161 of the Tax Code of the Russian Federation.

Entertainment expenses: general information

Representation expenses include:

- expenses for holding an official reception for negotiators;

- transportation costs for delivering company representatives to the venue of official events and back;

- costs of catering during official meetings and negotiations;

- costs for the services of translators who take an active part in the negotiations and are not full-time employees of the simplified company.

For general-regime organizations, entertainment costs are included in expenses in the amount of no more than 4% of labor costs in a given period. Representative expenses under the simplified tax system do not include income minus expenses in the list of expenses for simplifiers, since this list is closed. This means that these expenses are not taken into account and it is impossible to reduce the size of the tax base by them. However, despite this, representative costs must have an economic justification and be supported by documents.

You can verify your hospitality expenses through receipts, event programmes, expense reports and expense estimates. If entertainment expenses were paid non-cash, invoices and acts will serve as confirmation.

If entertainment expenses are incorrectly documented and do not have confirmation, the tax office may recognize them as personal and charge not only taxes, but also fines.

Balance sheet and off-balance sheet accounts

Compensation for unused vacation: ten and a half months count for a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169) . But sometimes these 11 months are not so spent.

< …

Important

Income tax: the list of expenses has been expanded. A law has been signed that has amended the list of expenses related to wages. Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children).

<... Check employee salaries with the new minimum wage From 05/01/2018, the federal minimum wage will be 11,163 rubles, which is 1,674 rubles more than now.

Accounting for entertainment expenses

Representation expenses of a simplified company must be taken into account in accounting. In this case, a posting is generated: Debit 20, 44 and so on – Credit 71. For tax accounting purposes, in the “expenses” column, a note is made that expenses are not accepted.

A document such as advance reporting is used to confirm entertainment expenses. It can be found in the tab called “bank and cash desk”.

In the “advances” tab, the document on which the funds were issued must be indicated, and entertainment expenses themselves must be reflected in the “other” tab.

Control of settlements for short-term loans and borrowings (account 66)

Almost any organization uses borrowed funds to carry out its current activities and expand its business. In accounting they are divided into the following categories:

Only then will you receive your tax number. Completing this questionnaire is not witchcraft. However, you should be careful about this so that you don't experience an unpleasant surprise later. Finally, the state understands little pleasure when it comes to money.

What is the purpose of a tax survey?

In the following sections, we will give you tips on how to properly enter your tax assessment questionnaire. and avoid negative consequences. Even his name shows: The main purpose of a tax survey is to classify you as a founder or your company. It is advisable to estimate sales and profits as realistically as possible and complete the questionnaire. Otherwise you will have to reckon with the consequences, e.g.

- Long-term loans and borrowings (account 67 for liabilities over a year).

- Short-term loans and borrowings (66 account for liabilities up to a year).

The balance sheet for account 66 allows you to see the flow of funds to pay off debts: payment of debt is reflected in the debit of account 66. All transactions are carried out in correspondence with 51 or 50 accounts. All loans issued during the period of analysis of the statement are taken into account in the turnover of 66 loan accounts. The final balance allows, along with cash statements, to make a decision on attracting additional borrowed funds or switching to own collateral.

Delayed issuance of tax number Requests by tax authorities Sensitive additional payments due to insufficient prepayment. The questionnaire itself is automatically sent to you after registration. The exception applies to freelancers. They must contact the tax office.

Where can I download a blank balance sheet form for free?

The first paragraph of the tax questionnaire covers general information about your person and your proposed activity. This also includes your account information. For "Personal Reimbursement", please report your private bank account and "Business Reimbursement" to your business account.

Other expenses not included

In addition to entertainment expenses, the tax base cannot be reduced by the following expenses:

- for marketing services;

- for disinfection;

- to connect water and electricity supplies;

- for various promotions for clients;

- for drinking water for company personnel;

- for various printed publications subscribed by the organization;

- to attract workers from other companies (engaged in other activities);

- for the arrangement of the company's office;

- for advertising;

- for staff pensions;

- VAT amounts;

- for certification of workplaces;

- to purchase property rights;

- customs duties when importing goods from abroad;

- penalty for violation of contract terms;

- registration costs.

Every accountant should be able to do at least three things:

- draw up a balance sheet;

- find the error;

- draw up an accounting statement.

It is the last point that will be discussed in this material. First, let’s find out what kind of paper this is. And where can I find a sample accounting certificate?

What kind of document is this

At its core, an accounting certificate is a primary accounting document, but at the same time it also serves as a register. In it, an authorized specialist records operations for which there is no full-fledged primary record:

- bug fix;

- debt write-off;

- determining the amount of reserve for doubtful debts;

- formation of the initial cost of a fixed asset, which consists of several operations;

- maintaining separate VAT accounting;

- and so on.

In some cases, a regular accounting certificate is required, and in some cases only a calculation certificate, in which the accountant, in addition to the entry itself, makes calculations. For example, an example of how to draw up an accounting statement to form the initial cost of a fixed asset looks like this:

In addition, there are other varieties of this important paper that are not primary. In particular, if it is necessary to compile information at the request of a government agency or court, in which to describe accounting data already reflected in the system by an accountant, for example, on debt, an accounting certificate is also drawn up. In court, for example, it can be used to confirm expenses incurred by a company or the amount of damage from someone else’s actions, as well as the validity of the stated adjustments. A sample accounting certificate of debt for the court can be downloaded at the end of the article.

It is important to remember only one thing: you cannot draw up this paper for transactions involving the capitalization or sale of material assets if third-party contractors were involved in the process. In this case, a different primary is used.

Off-balance sheet statement of fixed assets 2020

Material assets received (accepted) by the institution are accounted for in an off-balance sheet account on the basis of a primary document confirming receipt (acceptance for storage (for processing) of material assets by the institution, at the cost specified in the document by the transferring party (at the cost stipulated by the agreement), and in in the case of unilateral execution of an act by an institution, in a conditional valuation: one object, one ruble.

Internal movements of material assets in an institution are reflected in an off-balance sheet account on the basis of supporting primary documents, by changing the financially responsible person and (or) storage location.

The disposal of material assets from off-balance sheet accounting is reflected on the basis of supporting documents at the cost at which they were accepted for off-balance sheet accounting.

336.

Analytical accounting of the account is maintained in the Card of quantitative and total accounting of material assets in the context of financially responsible persons, storage locations by type of material assets (indicating production numbers, if any), their quantity and value.

Account 14 “Settlement documents awaiting execution”

359. The account is intended to record received and unpaid documents by the financial authority.

360.

Analytical accounting of the account is maintained in the Account Card for settlement documents awaiting execution in the context of budget accounts for each document.

Account 15 “Settlement documents not paid on time due to lack of funds in the account of a state (municipal) institution”

361.

Info

If the inspection reveals that an organization acquired fixed assets and unreasonably capitalized them into an off-balance sheet account, then the taxpayer will have to pay a fine and additional tax. Ownership rights are critical in such transactions.

If an enterprise received an OS for rent, free use and capitalized it as 01 instead of 001, negative consequences in the form of inspections and fines will not be long in coming.

Form and required details

Since this is a primary document, two important conditions must be met:

- The form and procedure for compilation must be prescribed in the accounting policies of the organization.

- Availability of the mandatory details provided for in Article 9 of the Federal Law of December 6, 2011 No. 402 on accounting.

If an organization can develop the form on its own or use a sample for filling out an accounting certificate (0504833), which was developed and approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n for government institutions, then the requirements for the details are quite strict. The form must include:

- name of the organization;

- document number and date of its preparation;

- title of the document;

- the content of the reflected fact of economic life;

- units of measurement and method of reflection (monetary or natural);

- data from other primary documents (if necessary);

- position and full name the person who performed the operation;

- signature of the compiler.

Only if these requirements are met will the completed form be considered valid.

Balance Sheet

Attention

This should be achieved by stable software, simultaneous reflection in the computer, as mentioned above, of transactions in interconnected accounting registers. The error is corrected the moment it is discovered.

Reprinting of analytical and synthetic accounting materials is not permitted. The basis for building accounting in banks is a unified system of accounts of synthetic accounting, i.e. “Chart of accounts in credit institutions of the Russian Federation.” The chart of accounts is used to reflect the state of the bank's own and borrowed funds and their placement in credit and other active operations. The chart of accounts was developed on the basis of the Civil Code of the Russian Federation, federal laws dated July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia”, dated December 2, 1990).

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

Why do you need to prepare a certificate of the book value of fixed assets?

A certificate of the book value of fixed assets shows their value according to accounting data as of a particular date. It does not apply to mandatory forms of accounting reporting, but may be of interest to a certain circle of users.

Fixed assets belong to the category of capital investments of the organization. They have a lower degree of liquidity than, for example, working capital, and show the property and financial situation of the company.

For information on how to audit investments in non-current assets, read the article “Audit of investments in non-current assets (account 08)”.

A certificate of the book value of fixed assets can be used for internal analysis of the solvency of an enterprise, for management accounting purposes, and can also be provided for consideration by third-party users - investors, credit institutions, insurance companies and others. Fixed assets can act as collateral in commercial transactions.

For more information on what constitutes fixed assets, read our article “Non-current assets on the balance sheet”.

Why do you need an accounting certificate of fixed assets?

The original price cannot be changed. This can only be done during retrofitting, reconstruction, or completion. Also, objects may be overvalued up or down. All data refers to the additional capital of the organization.

This is interesting: What is land squatting, definition

Fixed assets are reflected in accounting taking into account depreciation. In this case, the balance on credit account 02 is subtracted from the debit balance on account 01. The difference is reflected in line 1150 of the first asset section of the balance sheet.

Where can I find a form for a certificate of book value?

The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document. Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities. Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Fixed assets in the certificate can be listed by name (if there are a small number of them) or divided into groups: non-residential buildings, machinery, inventory and equipment for production needs, and so on.

You can see an example of preparing such a certificate on our website. We offer 2 options for formatting this document.

A certificate of the book value of fixed assets is an optional document when submitting financial statements. It contains information about the cost of fixed assets that are listed on the organization’s balance sheet. Therefore, the certificate may be of interest to potential investors, banking and insurance organizations. A certificate of the book value of an enterprise's assets is filled out in any form due to the lack of a legally established form.

Sample balance sheet

FORMS FOR CALCULATING BUDGET ESTIMATE INDICATORS OF THE CENTRAL EQUIPMENT OF THE FEDERAL SERVICE FOR HYDROMETEOROLOGY AND ENVIRONMENTAL MONITORING, ITS TERRITORIAL BODIES AND INSTITUTIONS - RECIPIENTS OF BUDGET INVESTMENTS

approval and maintenance of budget estimates of the central office of the Federal Service for Hydrometeorology and Environmental Monitoring, its territorial bodies and institutions - recipients of budget investments, approved by the Order of Roshydromet dated _________ N ______

When necessary

In most cases, an accounting certificate about the availability of fixed assets also shows their residual value according to the balance sheet. She:

- helps business owners and its participants analyze the composition and condition of the company’s non-current assets;

- confirms the calculation of income tax;

- promotes insurance, as well as obtaining investments and loans.

Here we remind you about paragraph 49 Where required

Certificate of book value of property

It is hereby confirmed that, according to accounting data, the book value of property owned by LLC “_______________” on the right of ownership, as of “____” ______________ 20___ is __________________ (in words) rubles ___ kopecks.

Listing of property and its value (can be in tabular form):

A more specific example of an accounting certificate about the value of a fixed asset may look like this:

Limited Liability Company "Guru"

ACCOUNTING CERTIFICATE No. 18-OS

Moscow 03/31/2017

As of April 1, 2020, the residual (book) value of the building located at the address: Moscow, st. Ryabinovaya, 17, building 3, with a total area of 75.3 sq. m. m according to those. BTI passport No. 07-09-04444 dated September 10, 2005, accounted for as part of fixed assets (excluding revaluation), amounts to RUB 8,045,458.

Performed by: accountant____________Shirokova____________/E.A. Shirokova/

Chief accountant____________Pirogov____________/N.Yu. Pirogova/

If you find an error, please select a piece of text and press Ctrl+Enter.

In what form?

According to Art.

314 of the Tax Code of the Russian Federation, an enterprise can develop its own accounting form; this is not an imperative form. However, in accordance with the order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, recommendations are given for reflecting relevant information for each section.

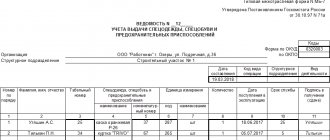

The most popular form of statement is the OKUD form No. B-1, which is designed for small businesses, but can be used in larger-volume industries.

This form is advisory in nature; the enterprise has the right to develop its own regulatory document.

The form is filled out monthly. The total for the previous month is carried over to the next month until the reporting form for the year is completed.

Maintaining a special form allows you to streamline the accounting of fixed assets and reflect objective data about fixed assets.

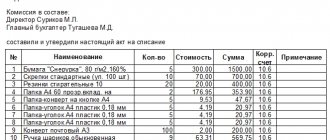

How to fill in when calculating depreciation charges for fixed assets?

Filling out the statement on a monthly basis allows the management of the enterprise and its financial departments to receive up-to-date information about the state of fixed assets, the degree of wear and tear of equipment and the cost taking into account depreciation.

For correct registration you need to remember:

- The depreciation sheet is divided into two main sections - account 01, in which fixed assets are recorded, and account 02, in which depreciation charges are reflected.

- Groups of fixed assets are reflected separately in each line without general mixing. Otherwise, it may provide misleading information about accrued depreciation.

In account 01 the following is reflected:

- Name, inventory number of the object. Each OS in the enterprise is given an individual number when such funds arrive at the enterprise.

- Price. The cost of an object is based on the method of its receipt - acquisition or production on site and must be reflected in the invoice.

- Status of the object and its location. The OS can be moved, which is fixed by regulatory documents - this information is also subject to mandatory reflection. A movement or change can also include the calculation of depreciation on an object.

At the same time, assets that the enterprise intends to give for use to other industries must be calculated in a separate statement and separate depreciation records are kept in relation to them.

Account 02 indicates the facts about the calculation and calculation of depreciation of the object and the grounds for this procedure:

- The amount of depreciation per unit of time. Since the form is filled out monthly as deductions are calculated, the unit of time is usually considered to be 1 month.

- The category to which the fixed asset belongs. The value of this category determines the rate at which depreciation (wear and tear) of equipment is calculated.

- The amount in total monetary terms of depreciation accrued on a separate fixed asset item.

- Volume and amount of depreciation per unit of time (month). It should be understood that subsequent accruals will directly affect the residual value of the asset.

- The value of a fixed asset after depreciation has been calculated at the end of the month (including the deduction of deductions).

After calculating all the values under each item, a separate total is summed up for each group of fixed assets, which ultimately provides objective information about the state of fixed assets.

Upon completion of filling out the form, data on fixed assets, their cost and condition are transferred to the organization’s cost accounting sheet.

The inclusion of such a list of data can be applied to both small and medium-sized businesses. New equipment is entered into the list in the month following its acquisition (manufacturing).

and sample filling

Download a standard form for the calculation and calculation of depreciation of fixed assets form according to OKUD V-1 – excel.

in free form – word.

filling out the statement of fixed assets – word.