What is the limit on the cost of fixed assets in 2020 in accounting?

In accounting, write off through depreciation property that has signs of fixed assets and costs more than 40 thousand rubles.

An asset has the characteristics of an OS if it:

Intended for production, management activities or rental;

The company has no plans to resell;

Capable of generating future income.

The company must set the limit on the cost of fixed assets in accounting in 2020 in its accounting policies. 40 thousand is the maximum limit. The organization has the right to choose a smaller amount. But not big. Property more expensive than 40 thousand rubles. In accounting, it can only be written off through depreciation.

Top five questions that are asked most often

Question No. 1. The individual entrepreneur is engaged in leasing space in the administrative building. They are furnished with furniture purchased at the expense of the individual entrepreneur. Is it possible to write them down as expenses and reflect them in accounting?

Such costs can be included in expenses. They are completely economically justified, since renting out space along with the furniture installed on it is a source of income for this individual entrepreneur.

Question No. 2. The company (OSNO) purchases about a hundred items of office supplies every quarter. They are immediately distributed to employees to ensure their work. Is it necessary to reflect the cost of office supplies in which primary documents?

To avoid claims from auditors and tax authorities, you should do this.

- Goods are accounted for. 10 with this notation: Dt 10 → Kt 71

- The receipt order is filled out.

- When distributing stationery to employees, a demand invoice is issued. On its basis, the value of the low value is written off: Dt 26 → Kt 10

Question No. 3. How to determine the amount of low-value property?

The amount depends on the characteristics of the enterprise. IBP does not include OS whose cost is more than 40 thousand rubles. These two factors should be taken into account and fixed for accounting purposes (mandatory) in the order on accounting policies.

Question No. 4. Is it possible to write off low-value property on the day it is received if payment for it has not yet been reflected in the accounts?

Is it possible. In accounting, a low value can be written off at the same time it is received. Whether the payment has gone through or not at this point does not matter.

Question No. 5. An individual entrepreneur bought a microwave for his employees. Will its cost be included in the expenses of the simplified tax system?

No. Expenses can only include those that are fully justified and used in production. In every enterprise, IBP accounting should not be underestimated, although it is an inexpensive asset.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓Legal Consultation is freeMoscow, Moscow region call

Call in one click St. Petersburg, Leningrad region call

Call in one click From other regions of the Russian Federation, call: 8 (800) 550-34-98

One-click call

Any company has a fairly substantial stock of assets called low-value wear and tear items (LCA). The decoding of this group of assets in the accounting department in exactly this abbreviation is not used today and is not mentioned in the Chart of Accounts, however, the low value asset has not disappeared from the turnover of companies, and accountants still take it into account. Let's consider which groups of property belong to IBP, what they are used for, and how IBP is accounted for in an enterprise.

Is it possible. In accounting, a low value can be written off at the same time it is received. Whether the payment has been made or not is irrelevant.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓Free legal consultationMoscow, Moscow region call: 7 (499) 288-17-58

One-click call

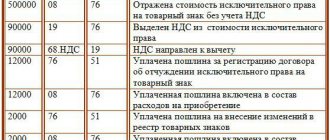

How to reflect the difference

So, the limit on the cost of fixed assets in 2020 in accounting is 40 thousand, and in tax accounting - 100 thousand rubles. Let's say a company buys an object worth from 40 thousand to 100 thousand rubles. In accounting, such an asset will be depreciated, but not in tax accounting. Therefore, those companies that use PBU 18/02 will have to take into account the differences.

Example. How to take into account property worth from 40 thousand to 100 thousand rubles.

In December 2020, the company bought a computer. And in January 2016 it was put into operation. The purchase price is 70,800 rubles, including VAT - 10,800 rubles.

Monthly depreciation on the computer is 2000 rubles.

In January, the accountant will write:

DEBIT 08 subaccount “Purchase of fixed assets” CREDIT 60

- 60,000 rubles (70,800 - 10,800) - purchased a computer;

DEBIT 19 CREDIT 60

— 10,800 rub. — input VAT is reflected;

DEBIT 01 CREDIT 08 subaccount “Purchase of fixed assets”

— 60,000 rub. — put the computer into operation;

DEBIT 68 subaccount “VAT” CREDIT 19

— 10,800 rub. — accepted for deduction of VAT;

DEBIT 68 subaccount “Income Tax” CREDIT 77

— 12,000 rub. (RUB 60,000 x 20%) - took into account the deferred tax liability.

In tax accounting, the company will write off the cost of the computer as an expense at the time of purchase. But in accounting it will be depreciated. A deferred tax liability (DTL) will arise.

From February and every month as the object depreciates, the difference and IT will be repaid by postings:

DEBIT 20 (25,26) CREDIT 02

— 2000 rub. — monthly depreciation is calculated;

DEBIT 77 CREDIT 68 subaccount “Income Tax”

— 400 rub. (RUB 2,000 x 20%) - part of the IT is repaid.

Any company has a fairly substantial stock of assets called low-value wear and tear items (LCA). The decoding of this group of assets in the accounting department in exactly this abbreviation is not used today and is not mentioned in the Chart of Accounts, however, the low-value asset has not disappeared from the turnover of companies, and accountants still take it into account. Let's consider which groups of property belong to IBP, what they are used for and how IBP is accounted for in an enterprise .

Accounting and write-off of low-value and wearable items

Bedding used by the medical service and in the company's dormitories. Low-value and wearable items are included in the working capital of the enterprise. From the point of view of the nature of use, IBP are similar to fixed assets, and from the point of view of the acquisition procedure, they are similar to materials, i.e.

occupy an intermediate position between fixed assets and materials, which determines the peculiarities of their accounting. So, accounting for low-value and wearable items, household equipment, tools and devices for general and special purposes has a number of features.

IBPs are accounted for on account 12 “Low-value and wear-and-tear items” at the actual cost of their acquisition (procurement) or planned accounting prices.

Mbp - what is it? accounting for low-value and wearable items

When the low-valuation will be used in production for more than 12 months, the accountant makes the following notes: Accounts Description Debit Credit 08 60 The low-valuation is capitalized upon the fact of its receipt 19 (1) 60 Reflection of VAT 01 08 The low-valuation is put into operation 68 19 (1) VAT is credited 20 or 23 02 Depreciation has been accrued (all 100% of the value of the low-priced value can be applied at once, or part of it for the first quarter or year) 02 01 The depreciation amount has been written off (but not before the object is completely written off) When using IBP for less than a year, the postings are as follows: Accounts Description Debit Credit 10 (10) 60 IBP are capitalized according to the facts of their receipt 19 (1) 60 VAT 20 or 23 10 (11) Low-valuation is transferred for use 68 19 VAT is credited 10 (11) 02 Depreciation is written off in 100% of the value of low-valuation Inventory and household supplies are capitalized according to account 10 (9). They will be listed until they go into service.

Features of accounting for low-value and wearable items

What applies to low-value and high-wear items? By their nature and purpose, low-value and wearable items are means of labor, but unlike fixed assets, their value is included in inventories.

According to P(S)BU 9, inventories include low-value and wearable items used for no more than one year or the normal operating cycle, if it is more than one year.

To determine the presentation of the operating cycle, it is necessary to be guided by Accounting Regulations (standard) 2 “Balance”, paragraph 4 of which defines that operating cycles are understood as the period of time between the acquisition of inventories for carrying out activities and the receipt of funds from the sale of products, works and services made from them.

Accounting for low-value and wearable items

Almost every company, regardless of its activity profile, has a certain amount of assets called low-value wear-and-tear items (IBP), which are characterized by repeated use in production while maintaining their own shape and a gradual increasing loss of inherent properties, that is, wear. The term IBP is not used in accounting (since 01/01/2002), but the objects implied by it have not disappeared from the turnover of enterprises and are counted as part of fixed assets or inventories. What is meant by low-value and wear-and-tear items? Previously, the main criteria for classifying an asset as an IBP were the period of its use, the initial cost upon acquisition, and the lack of possibility of subsequent resale.

Features of accounting and taxation of low-value and wearable items

VAT);

- Debit account 20, 23 / Credit account. 02 (accrual of depreciation);

- Debit account 02 / Credit account 01 (write-off of an item not earlier than its complete wear and tear).

The price of the IBP is written off to accounts 20, 25, 26, 44 depending on the place of its use (auxiliary or main production) using the following transactions:

- Debit account 10/9 / Credit account 60 (acceptance of IBP into account).

- Debit account 20 (25, 26, 44) / Credit account. 10/9 (writing off an item after it is completely worn out).

For your information! Immediately after capitalization, it is allowed to write off in full objects with a service life of up to 12 months, or in parts, objects for which use is planned for 2 years. Despite the possibility of complete or partial write-off, the assessment of IBP in accounting is reflected until it is completely worn out.

Disposal of low-value and high-wear items

Low-value non-current tangible assets.”

How is the initial cost of low-value and wear-and-tear items determined? According to paragraph 9 of P(S)BU 9, the initial cost of IBP purchased for a fee is the cost price, which consists of the following actual expenses: - amounts paid under the contract to the supplier (seller); - amounts paid for information, intermediary and other similar services in connection with the search and acquisition of reserves; — the amount of import duty; - the amount of indirect taxes in connection with the acquisition of inventories that are not reimbursed to the enterprise; — costs of procurement, loading and unloading, transportation of MBP to the place of their use; - other expenses directly related to the acquisition of MBP and bringing them to a state in which they are suitable for use for the intended purposes. It can be carried out at cost:

- each individual unit purchased;

- weighted average;

- first in time for purchasing materials (FIFO method).

Low valuation is a special component of material reserves. The initial cost of the IBP contains all the costs that the enterprise incurred during the purchase. This is reflected in the relevant primary documentation.

Based on this, it is necessary to write in the order on accounting policies that IBP is assessed based on the actual cost of each individual unit. At the same time, you should not forget to add the amount of expenses for its purchase. A list of primary documentation is also included here.

With its help, the movement of the IBP from capitalization to write-off will be traced. IBP does not include workwear, since according to the law it should be classified as a type of property that is taken into account especially.

Important Later they decided to cancel the IBP, but this did not eliminate the problem. But this is all yesterday. And today, low-value and wearable items still exist, and they are accounted for. How this happens will be discussed further.

So, MBP: what is it and what is it eaten with? Working with PBU 5/98 Accounting for low-value and wearable items is carried out in accordance with the accounting provisions of PBU 5/98 (“Accounting for inventories”).

The life cycle of low-value wearable items has three stages: receipt, operation, disposal. In accordance with this, the following stages of accounting are distinguished:

- admission;

- issuance of IBP;

- commissioning;

- wear;

- write-off of MBP.

The first and second options are made by analogy with the procedure for accounting for materials. On it you can keep records (in quantitative terms) of all inexpensive property, written-off items that are still used in business. This method of accounting allows you to:

- control the movement of low-value items after they have already been written off from the account. 10;

- know exactly which employees are responsible for operating the MBP;

- confirm, if necessary, the feasibility of additional costs at a low cost (for example, repairs, refilling a printer cartridge).

All data on the movement of low-value property must be recorded in a special journal. Its sheets indicate the name, date of receipt and decommissioning, inventory number, persons responsible for the safety of the property.

The items listed in this act, in the presence of the commission, were turned into scrap, which is subject to capitalization according to the invoice: soft equipment - rags, hard equipment and others - scrap metal and boards. Scrap that is not subject to accounting is destroyed. This act is certified by the chairman of the commission and all members of the commission.

Also, the enterprise can draw up a “Certificate of Disposal of Low-Value and Wearable Items”, which is used to document the breakdown and loss of tools (devices) and other low-value and wearable items. Drawed up in one copy by the foreman and the initial workshop (section) for one or more workers.

In case of breakdown, damage or loss of the IBP due to the fault of the employee, the report is drawn up in two copies. It should be taken into account that we consider as IBP part of the organization’s inventories, the service life of which is less than one year, while their cost does not play a role (they are wearable).

Another principle for classifying goods into this group is the upper limit on the cost of low-value wearable items. It is this that determines whether to classify them as fixed assets or specifically as IBP.

Thus, the cost of the MBP is a significant criterion. Using a similar definition, low-value wearable items include work clothes, shoes, office equipment, dishes, household items, etc. Regardless of their useful life and cost, the MBP group also includes specialized tools, devices for specific purposes necessary for production; replacement equipment parts; fishing gear; chainsaws.

Source: https://territoria-prava.ru/uchet-i-spisanie-malotsennyh-i-bystroiznashivayushhihsya-predmetov/

IBP in accounting

Until recently, small business enterprises were taken into account on the account. 12 “IBP”, but currently it is not used in accounting. IBP is a decoding in accounting that has been used for a long time and gives an accurate definition of these items. These include inventory, fixtures, tools and special equipment used in the production process.

Despite the fact that these resources correspond to the characteristics of fixed assets, it is impossible to take them into account as part of these assets due to their paltry cost, which is incomparable with the price of fixed assets. Therefore, IBE includes assets procured or purchased directly for production needs and contributing to an increase in income received. The criteria by which purchased materials are reflected in the IBP are as follows:

- Service life up to a year or two;

- The unit cost is no more than 40 thousand rubles. Companies have the right to establish in the UE such a concept as the maximum cost of an IBP;

- Not subject to subsequent resale.

Features of accounting for low-value and wear-and-tear items (IBP)

| Textbooks for universities |

| Accounting Section: Economics |

IBP includes items with a cost on the date of acquisition below the legal limit of value (100 times the minimum monthly wage) per unit (based on the cost stipulated in the contract) regardless of their useful life or employees less than one year, regardless of their value. The head of the organization has the right to set a lower limit on the value of items to be accepted for accounting as part of the IBP.

Regardless of the cost and useful life, MBP includes: special tools and special devices (tools and devices for special purposes, intended for serial and mass production of certain products or for the production of an individual order); replaceable equipment (repeatedly used in production devices for fixed assets and other devices caused by the specific conditions of manufacturing products - molds and accessories for them, rolling rolls, air tuyeres, shuttles, catalysts and sorbents of the solid state of aggregation, etc.).

Regardless of the useful life and cost, MBP also includes fishing gear, gas-powered saws, loppers, alloy cable, seasonal roads, mustaches and temporary branches of logging roads, temporary buildings in the forest, work clothes and safety shoes, and bedding.

IBP does not include agricultural machines and tools, mechanized construction tools, working and productive livestock. They are included in fixed assets regardless of cost and service life.

Accounting for IBP is regulated by the accounting regulations “Accounting for inventories” (PBU 5/98).

The life cycle of an IBP contains the following stages: receipt - operation - disposal. In accordance with the life cycle, the following groups of accounting operations are distinguished: accounting for the receipt of IBP; accounting for commissioning; accounting for MBP wear; accounting for write-off (liquidation) of small business enterprises.

Receipt and warehouse accounting of IBP is carried out similarly to materials accounting.

Accounting for IBP in operation may have features related to the choice of methods for accounting and writing off IBP into production and distribution costs.

Low-value items with a value within 1/20 of the established limit per unit are written off as production and distribution costs as they are put into operation.

For MBP costing more than 1/20 of the established limit, depreciation is charged. Depreciation of small business enterprises can be calculated in the following ways: linear, percentage, proportional to the volume of products (works, services).

When calculating depreciation using the straight-line method, depreciation rates are used based on the useful life of the IBP.

Depreciation is calculated using the percentage method according to one of two options: in the amount of 100% when the MBP is transferred into operation or in the amount of 50% of their cost when transferred from the warehouse to operation and the remaining 50% when they are removed from service.

Material assets remaining from the write-off of small business enterprises are accounted for at market value on the date of write-off with crediting to the financial result (D-t account 10, K-t account 80). An example of calculating wear using the second option of the percentage method is given in the table.

Calculation of MBP wear for ____________ month

| Division - holder of the IBP | MBP put into operation, rub. | MBP written off, rub. | Cost of scrap, waste, rub. | Amount of wear, rub. |

| Main production Management | 500300 | 200100 | 24 | 350200 |

| Total | 800 | 300 | 6 | 550 |

For each division, depreciation is determined as follows:

The cost of special tools, fixtures and replacement equipment is repaid only in proportion to production volumes.

Accounting for MBP is carried out on active account 12 “Low-value and wear-and-tear items”, which has sub-accounts: 12-1 “MBP in stock”; 12-2 “MBP in operation.”

D Account 12-1 “Low value and wearable K

items in stock"

| Receipt of IBP and expenses for their acquisition | Corresponding account | Release of MBP and their shortage | Corresponding account |

| Balance - balance of goods in stock at the beginning of the period | — | ||

| Capitalization of IBP: | IBP release: | ||

| • from suppliers at actual cost (purchase price) excluding VAT | • into operation | 12-2 | |

| • for production | 23, 25, | ||

| 60 | needs | 26, 44 | |

| • paid by accountable persons | 71 | A shortage of MBP has been identified | 84 |

| • from other creditors | 76 | ||

| Payment to transport organizations for delivery services (excluding VAT), customs duties, fees, interest on loans | |||

| 51 | |||

| Balance - balance of goods in stock at the end of the period | — |

D Account 12-2 “Low value and wearable items K

in operation"

| Corresponding account | Corresponding account | ||

| Receipt of IBP | Disposal of IBP | ||

| into operation | out of service | ||

| Balance - balance of IBP | — | ||

| in operation at the beginning | |||

| period MBP from the warehouse were transferred | 12-1 | MBP written off (liquidated) Shortage of MBP identified during inventory in production | 13 |

| into operation | |||

| 84 | |||

| Balance - balance of IBP | — | ||

| in use at the end | |||

| period |

Analytical accounting of IBP is carried out for homogeneous groups of IBP.

Depreciation of MBP is taken into account in passive account 13 “Wear and tear of low-value and high-wear items.”

D Account 13 “Wear and tear of low-value and high-wear items” K

| Reduced wear on the MBP | Corresponding account | Increased wear of the MBP | Corresponding account |

| Balance - the amount of depreciation of the IBP at the beginning of the period | — | ||

| Write-off of depreciation for liquidated small business enterprises | 12-2 | Accrual of depreciation for MBPs released into operation | 23, 25, 26, 29 |

| Accrual of depreciation for liquidated small business enterprises | 23, 25, 26,29 | ||

| Balance - the amount of depreciation of the IBP at the end of the period | — |

Small enterprises, in accordance with the recommendations of the Ministry of Finance of the Russian Federation on accounting and the use of accounting registers, can account for low-value and wearable items in account 10 as materials and write off their cost as production and distribution costs as they are put into operation. To ensure the safety of IBPs transferred into operation, organizations must maintain operational records and control over their movement.

To the contents of the book: Accounting

Source: https://www.bibliotekar.ru/buhgalterskiy-uchet-1/58.htm

What refers to IBP in accounting: list and criteria

IBP is a component of the company's working capital. In the balance sheet of the enterprise, the value of their balances as of the reporting date is indicated in line 1210 along with the cost of inventories. IBP is accounted for on account 10 “Materials” in separate subaccounts:

- 10/9 “Inventory and household supplies” to record the movement of inventory, tools, and other supplies circulating in the company;

- 10/10 “Special equipment and workwear in the warehouse” summarizes accounting information on the receipt and dynamics of special devices, tools, equipment and workwear in the company’s warehouses;

- 10/11 “Special equipment and clothing in operation” is intended to account for these assets in operation.

Please note that workwear/work footwear is not included in the IBP group, as it falls into the category of assets that are taken into account separately.

Criteria for classifying goods as infantry fighting vehicles

The name of this term already contains two principles: low price and service life - rapid wear. The main criteria were the cost limit and service life. The limit changed from time to time. But the service life has always been understood as one year. This means that, theoretically, there could be only four options for classifying acquired items into the category we are considering:

- The item costs less than the monetary limit, but is used for more than one year.

- The item costs less than the limit, but also lasts less than a year.

- The item costs more than the limit and lasts more than 12 months.

- The object costs less than the limit and lasts less than a year.

Previously, only the fourth group could be classified as interbank business and called working capital. Initially it was assumed that the first, second and third groups would be classified as fixed assets. But in practice, people remembered the price limit and forgot about the service time. So the IBP became an independent group. Entire departments of institutes were engaged in research on low-value and wearable items.

View gallery

Accounting for small business enterprises in 2020

The initial cost of the IBP includes the costs incurred by the company during the procurement or manufacturing process, i.e. the low value is estimated at the actual cost.

The receipt of IBP is reflected in the debit account. 10/9, 10.

MBPs with a service life of more than a year are reflected on the account. 01/02. Postings:

| Operation | Accounts | |

| Received MBP with a service life of more than a year | ||

| Transfer of MBP for use | ||

| VAT credited | ||

| Depreciation accrued (in full or in parts on a quarterly basis) | ||

| Write-off of IBP (necessarily not earlier than the object is completely worn out) | ||

In accounting, IBP can be written off immediately after capitalization:

- completely with a service life of up to 1 year;

- in parts for 2 years of use.

The cost of IBP is written off and transferred to d/t accounts 20, 26, 44, depending on where and in what production (main or auxiliary) the asset is used. Capitalization of inventory is carried out according to the account. 10/9. It remains on the account until it is used. At the same time, its cost is written off.

Write-off of IBP – postings:

| Operation | Account correspondence | |

| Inventory accepted for accounting | ||

| Write-off | ||

Accounts for accounting of small business enterprises

To account for the movement of IBPs and their wear and tear, different accounts are used: 13, 12, 15, 16, 48... All actions associated with the receipt of IBPs are the same as when accounting for materials, i.e. 15, 16 accounts are used. Then all operations are preliminarily reflected in DT15. Then they come and write it off to account 16 of the IBP.

Items that are out of order are processed through a disposal certificate.

Well, we have looked at such a concept as IBP: what it is, how items in this category are accounted for and written off. I would like to hope that the time spent reading the material was not wasted for you.

How to control the availability of IBP after writing off the cost

Despite the fact that the cost of the IBP is written off immediately or partially, it is reflected in accounting until it is completely worn out. In addition, the company must establish control over the movement of low-value items to ensure their safety: the number of units of IBP (without the amount) is registered on off-balance sheet account 012. It is often practiced to maintain accounting cards by the names of objects to track their availability.

Maintaining off-balance sheet quantitative accounting allows you to:

- Control the movement of the IBP after writing off the cost;

- Justify and confirm the feasibility of spending MBP;

- Have information about which employees are responsible for operating equipment.

How to work with MBP. Theorists vs practitioners

Practice has developed several options:

1. Items counted 12 “Low-value wear-and-tear items” were received and put into operation. They were carried out at the cost of acquisition in the asset. And at the end of each month, 1/12 of this price was written off as expenses. That is, the service life could be more than a year, but the cost of equipment or, say, inventory was written off exactly in 12 months.

2. Upon commissioning of the facility, depreciation of 50% was immediately accrued. And the remaining 50% – at the time of its write-off.

The second option was, of course, used more often. It was simpler for an accountant. Moreover, the first one had its drawbacks. In the month of purchase, the entire cost of the object was included in the balance sheet, and this illogically increased the profit of that month. Further, of course, the uniform charge of depreciation reduced the profit of subsequent reporting periods, but this was not entirely correct. From a scientific point of view, both options were imperfect.

Features of writing off MBP

To write off low-value items with a service life of up to a year, standard form No. MB-8 is used. Typically, this document is used to formalize the liquidation of property, the operation of which has become impossible due to complete wear and tear or damage. The decision on liquidation is made and recorded in the act by a commission created by order of the head. The document is certified by commission, approved by the head of the company and is confirmation of the write-off of the small business enterprise in accounting.

is of interest to any organization, especially for small firms where most of the property does not have significant value. This article will discuss in what cases such a document is drawn up, as well as how to draw it up correctly.

When should you draw up an act for writing off low-value items?

Any company has one or another property that it uses in its activities, but does not reflect in accounting as a fixed asset (FPE), since the cost of such property does not exceed 40,000 rubles. This could be, for example, computers, scanners, printers, some office furniture, etc.

Read more about the criteria for classification as fixed assets in the article

“Guidelines for accounting of fixed assets” .

Despite the fact that such objects are not considered fixed assets, they have a certain service life, after which the company can no longer operate them. In such a situation, it becomes necessary to write off these property items.

For these purposes, a special act is drawn up.

NOTE! Currently, there is no single form of the act in question that is mandatory for all companies. At the same time, until 2013, this was the MB-8 template, approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a.

Therefore, when writing off low-value property in 2020, a company can use the standard form of the MB-8 act or draw up a write-off act developed independently. The decision on which form will be used for this purpose is fixed in the accounting policy.

You can download the MB-8 standard form on our website.

Documentation of the fact of write-off must be preceded by a decision of a special commission that a specific low-value object is no longer advisable to use in work.

The document in question is drawn up in 1 copy. As soon as the act is drawn up and the written-off property is transferred to the storage room as scrap, such a document should be transferred to the company’s accounting department.

For information on the procedure used when writing off fixed assets, read the material

“Unified Form No. OS-4 - Act on the write-off of fixed assets” .

Mbp - what is it? accounting for low-value and wearable items

Finance December 5, 2015

Accounting for low-value wear-and-tear items (IBP) is an extremely important category in accounting. In its activities, no enterprise can do without the mentioned phenomenon. In this article we will try to give as complete and detailed an answer as possible to the question: “IBP – what is it?”

A little theory

Any enterprise buys and uses many products that cannot be classified as fixed assets. These are what are called low-value wearable items in accounting. To make it more clear, we’ll tell you what we’re actually talking about.

What can be classified as IBP

In fact, low-value and wearable items are means of labor, but their value is included in the enterprise’s inventories. The basic principle of classifying this or that equipment, tool, etc. as an MBP is to determine its service life, as well as the initial price.

It should be taken into account that we consider as IBP part of the organization’s inventories, the service life of which is less than one year, while their cost does not play a role (they are wearable).

Another principle for classifying goods into this group is the upper limit on the cost of low-value wearable items. It is this that determines whether to classify them as fixed assets or specifically as IBP. Thus, the cost of the MBP is a significant criterion.

Using a similar definition, low-value wearable items include work clothes, shoes, office equipment, dishes, household items, etc.

Regardless of the useful life and cost, the MBP group also includes specialized tools, devices for single-purpose purposes necessary for production; replacement equipment parts; fishing gear; chainsaws.

MB items cannot include agricultural machinery and labor tools, construction equipment and tools, and working livestock. All this is included in fixed assets, regardless of service life and cost.

A little history

Money spent by an organization on the purchase of certain items should not be included in the expense item. These things can be used for a long time, or they can have a one-time use. In the first case we are talking about fixed assets. But in the second - about negotiables. And the expense is recognized at the time of write-off. This is what accountants thought and still think.

But back in the last century, experts in this field came to an important decision: items that have been used for several years and which at the same time have a fairly low cost are difficult to classify as fixed assets. Therefore, our colleagues decided to remove a certain part of the objects from the mentioned category.

They were called low-value wear-and-tear items (WAP) and included in working capital.

Criteria for classifying goods as infantry fighting vehicles

The name of this term already contains two principles: low price and service life - rapid wear. The main criteria were the cost limit and service life. The limit changed from time to time. But the service life has always been understood as one year. This means that, theoretically, there could be only four options for classifying acquired items into the category we are considering:

- The item costs less than the monetary limit, but is used for more than one year.

- The item costs less than the limit, but also lasts less than a year.

- The item costs more than the limit and lasts more than 12 months.

- The object costs less than the limit and lasts less than a year.

Previously, only the fourth group could be classified as interbank business and called working capital. Initially it was assumed that the first, second and third groups would be classified as fixed assets.

But in practice, people remembered the price limit and forgot about the service time. So the IBP became an independent group.

Entire departments of institutes were engaged in research on low-value and wearable items.

How to work with MBP. Theorists vs practitioners

Practice has developed several options:

1. Items counted 12 “Low-value wear-and-tear items” were received and put into operation. They were carried out at the cost of acquisition in the asset. And at the end of each month, 1/12 of this price was written off as expenses. That is, the service life could be more than a year, but the cost of equipment or, say, inventory was written off exactly in 12 months.

2. Upon commissioning of the facility, depreciation of 50% was immediately accrued. And the remaining 50% – at the time of its write-off.

The second option was, of course, used more often. It was simpler for an accountant. Moreover, the first one had its drawbacks.

In the month of purchase, the entire cost of the object was included in the balance sheet, and this illogically increased the profit of that month.

Further, of course, the uniform charge of depreciation reduced the profit of subsequent reporting periods, but this was not entirely correct. From a scientific point of view, both options were imperfect.

There was another drawback in accounting for IBP. There are some things whose price is low. Practicing accountants insisted that these items were immediately written off as operating expenses. And there is no need for any depreciation or wear.

Quite convenient, isn't it? But theorists were very confused by this approach. However, their opinion did not have much influence on the outcome of the case.

Practice remains practice, because all this reduced the profit of the enterprise in the month of purchase, and therefore simplified the work of accountants.

Later they decided to cancel the IBP, but this did not eliminate the problem. But this is all yesterday. And today, low-value and wearable items still exist, and they are accounted for. How this happens will be discussed further. So, MBP: what is it and what is it eaten with?

Working with PBU 5/98

Accounting for low-value and wear-and-tear items is carried out in accordance with the accounting provisions of PBU 5/98 (“Accounting for inventories”). The life cycle of low-value wearable items has three stages: receipt, operation, disposal. In accordance with this, the following stages of accounting are distinguished:

- admission;

- issuance of IBP;

- commissioning;

- wear;

- write-off of MBP.

The first and second options are made by analogy with the procedure for accounting for materials. But the IBP in operation has its own characteristics, which are determined by the choice of the type of accounting and write-off.

Low-value items, the price of which is within 1/20 of the established limit per conventional unit, are written off as production expenses as they enter service. For infantry fighting vehicles costing more than 1/20 of the established minimum, it is customary to charge depreciation. It is usually calculated in the following ways: percentage, linear, proportional to the volume of production. Let's briefly explain what it is.

When using the linear depreciation method, standards are taken based on the useful life of the MBP.

When calculating depreciation using the percentage method, they use one of two options: in the amount of 100% upon transfer to operation or in the amount of 50% of their price when issued from the warehouse for use, and the remaining 50% upon disposal.

The remainder from the write-off of IBP (tangible assets) comes at the market price on the date of write-off and is recorded in the financial result (DT 10, CT 80).

More details about accounting: stages, features, nuances

Each enterprise keeps records of its IBP. How does this happen in practice? The algorithm is simple:

- The organization's accounting department receives goods.

- Monitors safety.

- Determines the cost of low-value wearable items.

- Controls service life.

- Writes off worn-out MBP.

Since 2014, when things are put into operation, wear and tear on infantry fighting vehicles is charged not at the entire cost, but at half minus the residual value. The balance of 50% is accrued upon write-off.

When transferring low-value, wearable goods for use, they are assigned to financially responsible people. They are then assigned inventory numbers, which simplifies the inventory process.

At the last stage, a write-off act is drawn up (see below for a sample filling) of the IBP.

You must remember to remove these items from the register (from the financially responsible person). Enterprises independently determine the cost limits for small business enterprises. What does this mean? Absolute benefit. Because the mentioned category essentially includes fixed assets.

IBPs undergo moral and physical wear and tear during operation, and the cost of fixed assets decreases. In the balance sheet they are carried at the residual value, which is the difference between the initial price and the amount of accrued depreciation for a certain reporting period.

The initial cost of IBPs also includes the costs of their acquisition.

Depreciation and write-off

Wear and tear of the MBP is part of the production costs. It is difficult to calculate depreciation for each individual item, as for fixed assets.

Therefore, they choose one of two methods of accounting for small business enterprises (we described in detail above what it is), according to the accounting policy of the enterprise. There is a special write-off act.

A sample of such a document, shown in the photo below, will help novice accountants navigate this issue.

It happens that MBP issued for use are immediately written off: debit accounts 20, 23, 26, 25, 31, 43. Or DT 29, 08, 88, 81, 96. Credit account 12, to subaccount 1.

Accounts for accounting of small business enterprises

To account for the movement of small items and their wear and tear, different accounts are used: 13, 12, 15, 16, 48... All actions associated with the receipt of small items are the same as when accounting for materials, i.e. 15, 16 accounts are used. Then all operations are preliminarily reflected in DT15. Then they come and write it off to account 16 of the IBP.

Items that are out of order are processed through a disposal certificate.

Well, we have looked at such a concept as IBP: what it is, how items in this category are accounted for and written off. I would like to hope that the time spent reading the material was not wasted for you.

Source: .ru

Source: https://monateka.com/article/229344/

What is important to remember to fill out the form correctly

Filling out the act in form MB-8 does not present any difficulties. In particular, it is required to indicate:

- name of the object being written off;

- its nomenclature and inventory numbers;

- unit of measurement;

- cost and number of objects being written off (if they are of the same type);

- passport number of the item being written off;

- the date when operation of the facility began;

- date and reason for write-off.

After the act is completed and executed, both the chairman of the commission and all its members put their signatures at the end of the document, indicating their initials and positions.

The procedure for drawing up the act is completed by the storekeeper, who marks the date of acceptance of the written-off low-value property into the warehouse.

The composition of the information reflected in the act developed independently should be similar.

You can download a completed sample based on the MB-8 form on our website.

IMPORTANT!

If it is simultaneously decided to write off several items at once, the MB-8 act must be issued separately for each such item, if they belong to different types. A general act can be for several items of the same type.

Results

An act for writing off low-value and wear-and-tear items is drawn up in cases where the company decided to write off items that were no longer suitable for use, necessary for the implementation of the work process, but due to their insignificant value were not accepted as part of the operating system. Such an act is drawn up either according to the standard form MB-8, or according to its own template, which also contains all the necessary information about the object being retired from use.

Low-value and high-wear items (IBP)

- a category of property not currently used in accounting. IBP included household equipment, tools and devices for general and special purposes and other means of labor, which were included in the funds in circulation.

Currently, a similar concept is used: - fixed assets with a cost less than the limit established by law, which can be taken into account in expenses at a time, and not through depreciation.

Working with PBU 5/98

Accounting for low-value and wear-and-tear items is carried out in accordance with the accounting provisions of PBU 5/98 (“Accounting for inventories”). The life cycle of low-value wearable items has three stages: receipt, operation, disposal. In accordance with this, the following stages of accounting are distinguished:

- admission;

- issuance of IBP;

- commissioning;

- wear;

- write-off of MBP.

The first and second options are made by analogy with the procedure for accounting for materials. But the IBP in operation has its own characteristics, which are determined by the choice of the type of accounting and write-off.

Low-value items, the price of which is within 1/20 of the established limit per conventional unit, are written off as production expenses as they enter service. For infantry fighting vehicles costing more than 1/20 of the established minimum, it is customary to charge depreciation. It is usually calculated in the following ways: percentage, linear, proportional to the volume of production. Let's briefly explain what it is.

When using the linear depreciation method, standards are taken based on the useful life of the MBP. When calculating depreciation using the percentage method, they use one of two options: in the amount of 100% upon transfer to operation or in the amount of 50% of their price when issued from the warehouse for use, and the remaining 50% upon disposal. The remainder from the write-off of IBP (tangible assets) comes at the market price on the date of write-off and is recorded in the financial result (DT 10, CT 80).

A comment

Low-value and wear-and-tear items (IBP) are a currently unused category of property in accounting. IBP included household equipment, tools and devices for general and special purposes and other means of labor, which were included in the funds in circulation.

Those assets that were previously classified as IBP are now recognized as either fixed assets or inventories.

Regulations on accounting and financial reporting in the Russian Federation, approved. Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n, as amended in 1998, determined (clause 50):

50. They do not relate to fixed assets and are taken into account in organizations as part of funds in circulation, and in budgetary organizations - as part of low-value items and other valuables:

a) items with a useful life of less than 12 months, regardless of their cost;

b) items with a value on the date of acquisition of no more than 100 times the amount (for budget organizations - 50 times) the minimum monthly wage per unit established by the legislation of the Russian Federation (based on their value stipulated in the contract), regardless of their useful life, with the exception of agricultural machinery and tools, construction mechanized tools, weapons, as well as working and productive livestock, which are classified as fixed assets regardless of their cost.

The head of the organization has the right to set a lower limit on the value of items to be accepted for accounting as part of funds in circulation;

c) the following items, regardless of their cost and useful life:

fishing gear (trawls, seines, nets, nets and others);

special tools and special devices (tools and devices for special purposes intended for serial and mass production of certain products or for the manufacture of individual orders); replaceable equipment (repeatedly used in production adaptations to fixed assets and other devices caused by the specific conditions of manufacturing products - molds and accessories, rolling rolls, air tuyeres, shuttles, catalysts and sorbents of the solid state of aggregation, etc.);

special clothing, special shoes, as well as bedding;

uniforms intended for issue to employees of the organization; clothing and footwear in healthcare, education and other organizations on a budget;

temporary (non-title) structures, fixtures and devices, the construction costs of which are included in the costs of construction work as part of overhead costs;

items intended for rental under a rental agreement;

young animals and fattening animals, poultry, rabbits, fur-bearing animals, bee families, as well as service dogs, experimental animals;

perennial plants grown in nurseries as planting material;

d) gas-powered saws, delimbers, floating cable, seasonal roads, mustaches and temporary branches of logging roads, temporary buildings in the forest with a useful life of up to 24 months (mobile heating houses, boiler stations, pilot workshops, gas stations, etc.).

To account for small business enterprises, a separate accounting account was used ACCOUNT 12 “LOW-VALUE AND FAST-WEAR ITEMS” (“Chart of accounts for accounting financial and economic activities of enterprises and Instructions for its application” (approved by Order of the USSR Ministry of Finance dated November 1, 1991 N 56)):

“Account 12 “Low-value and wear-and-tear items” is intended to summarize information on the presence and movement of low-value and wear-and-tear items belonging to the enterprise, household equipment, tools and devices for general and special purposes and other means of labor, which, in accordance with the established procedure, are included in the funds in turnover. Temporary (non-title) structures, fixtures and devices operated by the enterprise are also taken into account here. Ready-made uniforms intended for issue to employees of the enterprise are subject to accounting on account 12 “Low-value and wear-and-tear items”; materials for sewing the specified clothing are taken into account on account 10 “Materials.”

Fixed assets in 2020 -

their minimum value was increased by the legislator in tax accounting (TA). At the same time, for accounting (accounting) the limit on fixed assets in 2016 remained the same.

As shown by E. Slutsky [127], this influence is realized in two ways through the terms contained on the right side of expression (11.3.8).

Factor of the first term (q /x. j,j, j", r change in demand for the y-th product under the influence of a decrease in real income (subject to growth /)). As a result of a change in real income, the demand for expensive goods for which q(/x. > 0) decreases, and the demand for low-value goods for which q/x increases. [p.243] If good 1 is low-valued compared to good 2, then the Engel curve takes a special form (Fig. 3.2.2). In section d with a negative slope of the demand curve, the demand for low-value goods begins to fall. [p.205] Depending on income, goods are divided into four groups: low-value goods - I 0. [c .209]

| Rice. 3.2.2. Income-consumption curve for a low-value product |

The coefficients of elasticity of demand from income are different for different goods; they can also be negative when consumption decreases with income growth.

It is customary to distinguish four groups of goods depending on the coefficient of elasticity of demand for them from income: low-value goods (E 1). [p.556] To low-value goods, i.e. goods with a negative elasticity of demand from income include such as bread and low-grade goods. Judging by the survey results, elasticity coefficients for basic food products are in the range from 0.4 to 0.8, for clothing, fabrics, shoes - in the range from 1.1 to 1.3, etc. As income increases, demand moves from goods of the first and second groups to goods of the third and fourth groups, while the consumption of goods of the first group in absolute terms decreases. [p.556]

In practice, using this system, you can order one of many goods purchased from the same supplier, goods for which the level of demand is relatively constant, low-value goods, etc. [p.305]

All companies check (at least once a year) the actual level of inventory. An inventory count may be the only way to verify some low-value items, but for which no written record is kept. Physical inventories can be carried out periodically, continuously or randomly. [p.574]

Industrial inventories include material assets that have not yet entered the production process and are located in warehouses. They include the following groups of material assets: raw materials, basic materials, auxiliary materials, fuel, containers, spare parts, low-value and wearable items, industrial and food products. [p.200]

In planning and accounting, the following classification of working capital is used: 1) raw materials and basic materials, 2) purchased semi-finished products, 3) auxiliary materials, 4) fuel, 5) containers, 6) spare parts, 7) low-value and wear-and-tear items, work in progress, etc. including semi-finished products of own production, 9) deferred expenses, 10) finished products, 11) goods shipped, 12) cash, 13) debtors (debtors who have not paid the company’s bills). [p.323]

work in progress, etc. including semi-finished products of own production, 9) deferred expenses, 10) finished products, 11) goods shipped, 12) cash, 13) debtors (debtors who have not paid the company’s bills). [p.323]

Working capital of associations, enterprises and organizations is a combination of working capital (fixed and other materials, goods in warehouses, low-value and wearable material, spare parts, etc.) and circulation funds (goods shipped, cash in settlements, etc. .). In a socialist economy, the size of the required working capital is established by the plan (standardized and non-standardized working capital). Standardized working capital includes material assets located in the production sector and ensuring the uninterrupted operation of the enterprise (inventory, work in progress, self-made semi-finished products, finished products in the process of moving to the warehouse and completing documentation). Non-standardized working capital includes finished products in a warehouse and funds in circulation (cash in a current account, shipped but unpaid goods, etc.). [p.54]

Working capital of enterprises and organizations is a combination of working capital (fixed and other materials, goods in warehouses, low-value and wear-out materials, spare parts, etc.) and circulation funds (goods shipped, cash in settlements, etc.) . [p.38]

IT includes all inventories of raw materials, supplies, low-value and wear-and-tear items, work-in-process costs, finished products and shipped goods, deferred expenses and other inventories. This group includes value added tax and all accounts receivable, including advances issued. [p.41]

In multi-storey retail establishments, low-value and seasonal goods, as well as food products, are usually placed on the ground or underground floors. More valuable goods find their place above them. [p.372]

Material current assets include production inventories (purchased or extracted material resources intended for further processing in a given organization), finished products, low-value goods and wearable items. This also includes the organization’s costs for creating a backlog of work in progress as a necessary technological cycle condition for continuing production in future reporting periods. Work in progress is the most difficult part of working capital to sell. [p.184]

In table Table 3.1 shows the records documenting the movement of current non-financial assets in the accounting accounts at JSC Granat for the year 199., and in table. 3.2 - in the economic balance. Current non-financial assets include inventories of materials, low-value and wear-and-tear items, work in progress, semi-finished products of own production, inventories of finished products, and shipped goods. Goods shipped in the analysis of the financial condition of JSC Granat are considered as inventories, which corresponds to accounting for sales of products at the moment the proceeds from sales are credited to the current account (as opposed to accounting for sales at the time of shipment). [p.117]

The need for working capital (capital) is determined by the three main items of current assets: inventory, inevitable accounts receivable, necessary means of payment (cash) and, in addition, stocks of low-value and wearable items (containers, packaging materials, utensils), fuel and materials used in technological processes of trade and during the transportation of goods. [p.312]

The assets of the balance sheet are taken into account in section A - fixed assets and funds diverted from economic turnover (contributions to the budget, deductions from profits, etc.) in section B - working capital covered by the organization’s own sources (materials, structures, parts, low-value property, unfinished production, etc.), cash and settlements (cash office, customers on submitted invoices for work performed, etc.) in section B - funds in settlements (invoices not paid on time for work performed, long-term bank loans, goods in transit , services provided, etc.) in section D - costs of capital construction and acquisition of fixed assets provided for by the capital investment plan. [p.391]

Current assets (current assets) are the value advanced in monetary form, which in the process of circulation of funds takes the form of working capital and circulation funds. Production working capital includes raw materials, materials, fuel, costs of work in progress and semi-finished products of own manufacture, deferred expenses (costs incurred in the reporting period, but repaid in subsequent periods), as well as low-value and wear-and-tear items. Circulation funds consist of finished products and goods shipped, funds in settlements and funds in accounts. [p.261]

Buying organizations receive from suppliers raw materials, goods, fuel, construction materials, spare parts, low-value and wearable items [p.377]

In terms of imports, Russian organizations acquire fixed assets (07, 08 - 60), material assets (10 - 60), low-value and wearable items (12 - 60), goods (41 - 60). To purchase valuables, an agreement (contract) is concluded directly with a foreign supplier or an intermediary foreign trade organization. The content of the agreement (contract) must indicate the subject of the contract, the quantity and quality of the value, their cost, the place of execution of the contract (delivery basis), the timing of its execution, terms of payment, guarantees, packaging and labeling and other necessary details. [p.382]

To present inventories in financial statements in accordance with the requirements of IFRS 2, it is necessary to analyze the items recorded in the following accounts: 10 Materials, 12 Low-value and wear-and-tear items, 20 Main production, 21 Semi-finished products of own production, 23 Auxiliary production, 31 Deferred expenses, 37 Product output (works, services), 40 Finished products, 41 Goods, etc. [p.284]

Enterprises, which include territorially separate divisions that do not have a separate balance sheet and settlement (current) account, credit the property tax of enterprises in the prescribed manner to the income of the budgets of the constituent entities of the Russian Federation and local budgets at the location of these divisions in an amount determined as the product of the tax the rate in force in the territory of the constituent entity of the Russian Federation on which these divisions are located, on the cost of fixed assets, materials, low-value and wearable items and goods of these divisions. In this case, the difference between the amount of property tax calculated by the parent enterprise for the enterprise as a whole and the amounts of tax paid by the parent enterprise to local budgets is subject to payment to the budget at the location of the parent enterprise [p.400]

The most important component of an enterprise's financial resources is its current assets. They include inventories (raw materials, supplies, low-value and wear-and-tear items, finished products, shipped goods, work in progress, etc.), cash (funds in current and foreign currency accounts, in cash, etc.) short-term financial investments (securities provided for short-term loans, etc.) accounts receivable (debt of buyers and customers, subsidiaries and affiliates, founders for contributions to the authorized capital, bills on behalf, etc.). [p.428]

Fixed assets, including long-term leased assets, intangible assets, low-value and wear-and-tear items, are included in the balance sheet at their residual value, and goods at their purchase price. This makes it possible to more realistically assess the value of the property owned by the enterprise. In addition, the original cost and wear and tear of low-value and wearable items are reflected. The sales price and trade margin are reflected for goods. The presence of this information allows for a more in-depth analysis of balance sheet item data. [p.17]

The third section of the balance sheet asset contains the most mobile part of the funds - current assets, or working capital. They are reflected in two subsections. The first concentrates inventories and costs in physical form. Inventories - raw materials, materials, semi-finished products necessary for the production process, work in progress, low-value and wearable items, finished products, goods, shipped goods, purchased for resale, deferred expenses, distribution costs for the balance of goods. What these balance sheet items have in common is that they are valued at actual acquisition cost or actual costs. [p.17]

Material assets include raw materials and basic materials, auxiliary materials, fuel, low-value and wear-and-tear items, work in progress, finished products, goods, etc. The content of these objects is obvious and does not require special explanations, with the exception of low-value and wear-out items, which, according to their functional characteristics, are the same as fixed assets, but with a service life of less than t years and a cost of less than n rubles. [p.286]

Thus, the account Transport and procurement expenses, on the one hand, is a calculation account (group 1.1.1.1.2), as it shows the amount of expenses associated with a certain economic process, on the other hand, it is additional regulating (group 1.2.2.1), as it specifies evaluation of materials. However, if this account is not used, then such expenses are recorded in the Materials account, and, therefore, the Transportation and procurement expenses account can be considered as inventory (group 1.1.1.1). If materials are accounted for at certain predetermined prices, then the Materials account is treated as material (group 1.1.1.1.1), but if the debit of this account accrues all costs associated with their acquisition, then the account can be called a costing account (group 1.1.1.1. 2). Account Depreciation of low-value and high-wear items can be considered either as contractual (group 1.2.2.2.1) or as reserve (group 1.1.2.2). Accounts of expenses and income for future periods can be presented either as contrarian accounts (group 1.2.2.2) or as financial distribution accounts (group 1.1.1.2.3). Further, the Goods account is material (group 1.1.1.1.1), but with no less reason we can claim that this is also a settlement account (group 1.1.1.2.2), since the financially responsible person must account for the valuables in his possession . The Trade margin (discount) account according to the accepted classification is a counter contractual account (group 1.2.2.2.1). But it can be interpreted as a stock fund (group 1.1.2.1), as a source of own funds, as an account of potential profit, in addition, in practice it is often primarily a collection and distribution (within a month it concentrates the trade margin (discount) in a trading company, and then distributes it among stores, but if it redistributes, it becomes financial distribution - group 1.1.1.2.3). [p.313]

The tax amount is calculated and paid into the budget quarterly on an accrual basis, and recalculated at the end of the year. In accordance with the Federal Law of January 8, 1998, Vol. No. 1-FZ, enterprises, which include territorially separate divisions that do not have a separate balance sheet and settlement (current) account, credit the property tax of enterprises in the prescribed manner to the budget revenues of the constituent entities of the Russian Federation and local budgets at the location of these divisions in an amount determined as the product of the tax rate in force in the territory of the constituent entity of the Russian Federation in which these divisions are located by the cost of fixed assets, materials, low-value and wearable items and goods of these divisions. In this case, the difference between the amount of property tax calculated by the parent enterprise as a whole for the enterprise and the amounts of tax paid by the parent enterprise to the budgets at the location of territorially separate divisions that do not have a separate balance and settlement (current) is subject to payment to the budget at the location of the parent enterprise. ) accounts. [p.363]

Qualitative and quantitative parameters of taxation directly depend on the results of financial and economic activities, valuation of property, and allocation of capital. Fulfillment of tax obligations, therefore, is predetermined by the monetary value of fixed and working capital, labor, and resource potential (land, forest wealth, subsoil wealth, water resources). Depending on it, the amounts of depreciation funds, current assets, wages, and profits are calculated. This defines a wide area of application of control actions of tax, audit and other interested services. The theory and practice of control identifies seven main areas within which special norms and rules for conducting control checks are applied: the sale of goods, works and services, the sphere of circulation and the pricing system, settlement and payment discipline, compliance with reproductive proportions, use of property, depreciation of fixed assets, intangible assets, low-value and wearable items and the state of working capital; formation of wages and material incentives; determination of profit and non-operating financial results. [p.172]

Natural meters serve to characterize the objects taken into account in physical terms. Depending on the physical properties of objects, various meters are used (meter, liter, kilogram, kilowatt-hour, tonne-kilometer, etc.). Natural meters are used in economic practice mainly to obtain data on the condition, movement and use of property, fixed assets, intangible assets, materials, low-value and wearable items, semi-finished products, finished products, goods, etc. However, they have a significant drawback. The fact is that it is impossible to obtain generalized indicators for various objects using only one meter - ton, meter, liter, piece, etc. Therefore, natural meters are used only to characterize homogeneous objects. [p.6]

Paragraph 15 of PBU 5/98 stipulates that all four of the listed valuation methods are applicable when releasing into production and otherwise disposing of all inventories, with the exception of low-value and wearable items and goods accounted for at sales (retail) cost. [p.40]

Q Materials, goods, fixed assets, intangible assets, low-value and wear-and-tear items, production or external orders. [p.56]

The trade margin serves as a source of covering production and distribution costs in trade, intermediary supply, and sales enterprises. The valuation of production and distribution costs includes an assessment of the costs of transportation, wages and contributions for social needs, rent and maintenance of buildings, premises, equipment, depreciation of fixed assets and intangible assets, depreciation of low-value and wear-out items, storage, part-time work, sorting and packaging of goods , advertising, marketing research, loss of goods within established norms, payment of interest on loans, compulsory medical insurance and compulsory property insurance. [p.189]

Giffin goods are usually low-value goods, the demand for which, under certain conditions, increases when their price increases, and does not decrease, as one would expect. [p.111]

With an increase in income, the demand for a product, as a rule, increases dhk / dM >0. However, with regard to low-value goods, a drop in demand is also possible Dhk/dM the price of the product, demand for it usually decreases Dhk/drk 0. This is due to the fact that among low-income buyers, an increase in prices for certain goods can cause an increase in demand for them due to refusal more valuable purchases. Such goods are called "Giffin goods". [p.204]

The consumer demand model also uses Tornqvist functions, which model the relationship between the amount of income (Y) and the amount of consumer demand (x) for a) low-value goods [p.39]

According to the methods of planning and regulation, circulating media are divided into standardized and non-standardized. Standardized working capital, except for production working capital (raw materials, basic materials and purchased semi-finished products, auxiliary materials, fuel, packaging, spare parts for repairs, low-value and wearable items, unfinished industrial production and semi-finished products of own production, deferred expenses, balances of finished products for warehouse and goods shipped i-th, for which settlement documents have not been submitted to the bank for collection, as well as goods shipped and work handed over to documents not transferred to the bank for collection as security for loans and within the established period, and goods purchased by the enterprise for packaging, packaging, etc.). In addition, the structure of the enterprise's normalized working capital includes other noe-rated funds for the activities of subsidiary agriculture, young animals and fattening animals, and unfinished agricultural production. Non-standardized working capital includes cash in the cash register of the pre- [p.214]

In the petroleum product supply system for supply and sales activities, the structure of working capital is characterized by the dominant share of inventory (up to 90%), then the following groups of working capital are ranked (downward): auxiliary materials, containers, low-value and wearable items, spare parts for repairs, Future expenses. In general, in the petroleum product supply system, working capital in terms of inventory is characterized by the following structural distribution (in % on average for the year): goods in warehouses - 53, paid for but not removed from the supplier's warehouses - 10, in retail enterprises - 6, in transit - 7, shipped, for which payment documents were not submitted to the bank for collection - 20, packaging paid for by buyers - 4. [p.184]

Payment for production assets. Construction organizations that have been transferred to a new system of planning and economic incentives are prescribed a rate of payment for production fixed assets and standardized working capital in the amount of 2 to 6%. The amount of the actual payment for the corresponding period is determined by calculating the average cost of production fixed assets on the balance sheet of the construction organization and the average cost of excess reserves of uninstalled equipment not credited by the bank. The amount of the actual payment for standardized working capital is determined minus the amounts reflecting the depreciation of low-value and fast-wearing items, a loan for inventory items, debts to suppliers on accepted invoices for which payment has not come due, urgent debts to subcontractors for work performed, etc. [c .178]

Inventories include production inventories (raw materials, materials, fuel, spare parts, etc.), finished products, low-value and high-wear items, as well as goods (clause 3 of the Accounting Regulations Accounting for inventories ( PBU5/98) [p.93]

Limit of fixed assets in 2020 for accounting and accounting purposes

In NU, starting from 01/01/2016, objects worth up to 100,000 rubles. inclusively relate to materials and can be written off as expenses at the time of their acquisition (if the taxpayer uses OSNO) or at the time of payment and posting (if the company uses the simplified tax system). These innovations were approved by Law No. 150-FZ dated 06/08/2015, amending Art. 256, 257 Tax Code of the Russian Federation.

ATTENTION!

Ch. 25 of the Tax Code of the Russian Federation does not allow accounting policy to regulate the limit on the value of fixed assets . This norm is imperative.

According to the meaning of the BU, the limit for classifying objects as materials is left at 40,000 rubles. inclusive (clause 5 of PBU 6/01; letter of the Ministry of Finance of Russia dated February 17, 2016 No. 03-03-07/8700).

ATTENTION!

Unlike NU, the legislator allowed companies to regulate this standard with accounting policies, but within the limits established by law.

This norm is dispositive. Thus, even before 01/01/2016, taxable temporary differences (hereinafter referred to as TDT) and corresponding deferred tax liabilities (hereinafter referred to as IT) could arise in the organization’s accounting, provided that a limit for the recognition of fixed assets is fixed in the accounting policies, different from such a limit in NU (clauses 12, 15, 18 PBU 18/02).

Early disposal of an object

It is possible that the company will sell or liquidate the OS before the end of its useful life. In this case, both the taxable and temporary differences will remain partially outstanding. In such a situation, the deferred tax liability and the deferred tax asset must be written off to account 99.

In February 2020, a trading organization acquired a fixed asset with an initial cost of RUB 90,000. and a useful life of 2 years (which is 24 months). In February 2019, the facility was registered and put into operation.

In accounting, the object is reflected as a fixed asset. According to the accounting policy, the linear depreciation method is used for accounting purposes. The accountant has determined that the annual depreciation rate is 50% (100%: 2 years). Accordingly, the annual amount of depreciation is equal to 45,000 rubles. (90,000 rubles x 50%), and monthly - 3,750 rubles (45,000 rubles: 12 months). In June 2020, the property was sold.

In February 2020, the accountant made the following entry: DEBIT 01 CREDIT 08 – 90,000 rubles. — the fixed asset is accepted for accounting.

In tax accounting, the initial cost is completely written off as current expenses. As a result, a taxable temporary difference was created in the amount of RUB 90,000. The accountant made the posting: DEBIT 68 CREDIT 77 - 18,000 rubles. (90,000 x 20%) - IT is reflected.

Consequences of introducing a new cost limit

1. In NU, it is now possible to write off as expenses the vast majority of office furniture and equipment, tools and production equipment, etc. much faster, which will allow companies to obtain significant tax savings and enable the taxpayer to speed up the renewal of the fixed asset fleet, as envisaged by the legislator.

How to take into account production inventory, see the material.

2. The difference between the limits for recognizing fixed assets in NU and ACC, allowed by the legislator to regulate accounting policies, after 01/01/2016 arises for fixed assets worth more than 40,000 thousand rubles. Anyway.

Thus, companies will no longer be able to avoid the occurrence of NVR and the application of PBU 18/02 in relation to objects costing from 40,000 to 100,000 rubles, which will significantly complicate accounting.

How to solve the problem of bringing NU and BU closer together in new conditions, see the material.

3. For organizations with insignificant tax profits, increasing the limit on writing off the value of fixed assets for tax purposes will lead to the possible occurrence of tax losses, which is negatively perceived by local tax authorities. At the same time, the legislator did not provide organizations with the opportunity to regulate these tax expenses using accounting policies when forecasting future losses.

The procedure for applying the limit on the value of fixed assets for OSNO and simplified taxation system

The limit on the cost of fixed assets for companies using simplified taxation system and OSNO is the same for NU and accounting purposes (clause 1 of article 256, clause 1 of article 257, clause 4 of article 346.16 of the Tax Code of the Russian Federation, clause 5 of PBU 6/01) .

For organizations using OSNO, the question of applying the specified limit for taxation does not arise; The fixed asset recognition limit applies to facilities put into operation in 2020.

However, for organizations using the simplified tax system, the question of applying a new value limit is not so clear, since write-off:

- fixed assets in accordance with clause 3 of Art. 346.16 and paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation is made in equal shares;

- material costs - in accordance with subparagraph. 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation is made in full

only after payment.