Main purposes of calculations

The FFP is determined with the following objectives:

- If a reduction in revenue from product sales is planned, the company needs to find out to what extent sales can be reduced. The critical point is the state of the company in which it does not incur losses, but sells a minimum volume of products. That is, the organization in this case works “to zero”.

- Finding the financial stability of the company.

- Analysis of the risk of losses when reducing production.

Calculation of the ZPF provides the solution to the following tasks:

- Analysis of the financial stability indicator.

- Assessment of existing bankruptcy risks.

- Determining methods to increase financial strength.

- Establishing safe levels of sales reduction.

- Comparison of different forms of products sold.

- Ensuring a competent pricing policy.

It is recommended to determine the margin of financial strength when making serious financial decisions. The formula is relevant in various crisis situations.

Documents used in determining the margin of financial safety

When calculating stock, information is taken from company documents. The more accurate the initial values are, the more accurate the result will be. Let's consider the documents on the basis of which calculations are made:

- Balance sheet. It reflects retained earnings and uncovered losses. From the document you can understand the current state of the organization’s property, capital and liabilities. Based on the balance, a third-party user can analyze the company’s creditworthiness and make a decision on cooperation.

- Gains and losses report. The standard reporting period is one year. Based on the document, you can analyze the financial results of activities. The balance sheet allows you to analyze the dynamics of profit values and determine the degree of influence of third-party factors.

- Appendix to the balance sheet. Includes provisions that disclose asset and liability items.

If necessary, other documents may be used.

Formula for calculation

ZPF is determined by this formula:

Total revenue – critical revenue

The FP reserve indicator may change under the influence of the following factors:

- Production volumes and sales indicators are similar.

- Production volume values exceed sales volume values.

- Sales figures exceed production values.

If an enterprise produces too many goods, but cannot sell them, profits are low and the margin of financial strength decreases. Therefore, in order to maintain the optimal level of the indicator, you need to plan the scale of production well. Another unfavorable option is the excess of sales indicators over production indicators. In this case, the organization’s dependence on its counterparties increases.

In a business plan, the margin of financial strength is defined as

Drawing up a business plan involves a large list of activities to analyze the market and the competitiveness of the project/product, develop a production program, investment planning, and forecast future financial results. One of the components of such forecasting is determining the margin of financial strength.

The calculation of the financial strength coefficient must necessarily be preceded by the calculation of the break-even point. This once again confirms the need for a comprehensive assessment and integration of any coefficient into the overall structure of the business plan.

We also note that the margin of financial strength can be called a more objective parameter than the break-even point. For example, the break-even points of a small store and a large supermarket can differ thousands of times, and only the margin of financial strength will show which of the enterprises is more stable.

When choosing an option for implementing your business, pay attention to an option such as a private school business plan. This is an interesting business idea that you might like.

What is the financial strength ratio?

The FP ratio is the ratio of the FP stock indicator to total revenue, expressed as a percentage. The scale of revenue reduction at which the company will begin to incur losses is determined. The ratio reflects the portion of assets that are formed from stable sources. That is, sources of financing are determined through which the company can continue its activities for a long time.

The CFP is determined by this formula:

Total revenue – critical revenue: total revenue *100

Based on the obtained indicator, one can judge the financial condition of the company.

Analysis of the obtained coefficient

A ratio of more than 10% is evidence of the company’s high financial strength, as well as increased profitability. The higher this indicator, the greater the financial strength. The closer the value is to the break-even point, the faster the FP stock changes. The inverse relationship is also true. A high value of the FP stock indicates the following processes in the company:

- Small risks of losses.

- Financial stability.

- Small revenue at which the organization does not incur losses.

Let's take a closer look at the coefficient values:

- 0.5-0.8 – relative stability of the enterprise.

- 0.2-0.5 – the company’s unstable position.

- Less than 0.2 – crisis situation, close to bankruptcy.

The FP reserve is an indicator that is constantly changing. It is recommended to regularly monitor it and analyze changes.

What is included in financial strength?

In the process of operation of any commercial organization, its indicators are calculated to determine the degree of success of a particular business, many of which most entrepreneurs are not even aware of.

One of these indicators is financial strength, which demonstrates the efficiency of the company's production activities and its reliability as a business partner, but this indicator is a combination of a number of other factors.

That is why many are trying to understand what the financial strength of an enterprise includes and by what formula this indicator is calculated.

Concept Overview

Financial strength is the ratio of a company's financial strength margin to its total profit as a percentage. In other words, this indicator reflects the volume of the company’s revenue, if it is reduced, it will begin to operate at a loss.

This ratio demonstrates a certain part of the asset financed from stable sources, that is, which the company can use for a long period of time without interrupting its work.

Thus, financial strength shows which losses for the company are not critical and allow it to continue to conduct successful activities, providing its owners with profit.

What to pay attention to

In order to increase the indicator of financial stability of an enterprise, you need to pay attention to a fairly large number of factors, but at the same time, in principle, it is worth understanding why this indicator is needed and whether it is really so important in the work of the organization.

Important parameters

To determine the financial strength of a company, several key factors must be taken into account, such as the company's fixed and variable expenses, as well as the profit earned by the organization minus value added tax and excise taxes.

It is worth noting that in order to carry out the analysis, these groups must be distributed, because the determination of the margin of financial safety is carried out on the basis of a certain break-even point, and it directly depends on variable costs.

https://youtu.be/cr-BnMlr3B4

Fixed costs do not depend in any way on production volumes or the cost of products sold. In the same way, it does not matter in what quantity the commercial products were produced, since rental, credit, utility and many other costs will be constantly present in the company’s work.

Variable costs have a direct connection with the volume of manufactured products, that is, they include all the organization’s costs necessary for the acquisition of raw materials, materials and other necessary elements. This category of expenses appears during the production of goods or after making a profit, but in any case, such costs are under control.

Features of the procedure

In the presence of excess products, a reduction in the overall profitability of the company and, accordingly, a decrease in its financial strength, the sales volume is of greater importance compared to the production volume.

A direct indication that the company has a production surplus is the regular increase in the volume of finished products, while an important indirect parameter is the increase in raw materials and inventories, since the costs of their acquisition are already incurred at the time of purchase.

If there is a sharp increase in raw material reserves, it can be said that production volume will also increase in the future, but this phenomenon must have an economic justification.

In any case, when an increase in raw material reserves, this affects financial stability, and in this regard, in order to measure the value of financial strength, the revenue indicator must be adjusted by the total amount of increase in reserves over a certain reporting period.

If the sales volume is less than production volume, the amount of profit increases and, accordingly, the indicator of the company’s financial strength when comparing it with the standard structure, but at the same time, the sale of products that have not yet been manufactured involves the need to fulfill certain requirements in the future, and therefore the organization falls into a certain dependence from counterparties and some part of its reserve will be imaginary.

The actual financial strength of the company is reduced in the presence of the impact of hidden financial instability, one of the main signs of which is the presence of sharp changes in the volume of raw material reserves.

Formula nuances

The margin of financial strength can be indicated in the form of an absolute or relative value, and the latter parameter is more indicative, and therefore it is used to carry out all kinds of comparisons or forecast calculations, and therefore its definition is considered to be the calculation formula reserve of financial strength.

Using conventions, this formula looks like this: the break-even sales volume is subtracted from the actual sales volume, after which the resulting result is divided by the actual sales volume and multiplied by 100.

It is worth noting that to carry out these calculations, you first need to determine the volume of break-even sales, and this is done using the following formula: the volume of actual sales is multiplied by the actual fixed costs, after which the result is divided by the difference between the volume of actual sales and variable actual costs.

In addition, you can obtain the break-even sales volume in quantitative terms by dividing the actual fixed costs by the difference between the final cost of each unit of production and the variable average costs for it.

All of the above formulas remain relevant only if several conditions are met, such as:

- constancy of the product range;

- unchanged volume of fixed expenses;

- the presence of a linear relationship between production volumes and the amount of variable costs;

- commercial products do not remain in the warehouse and are immediately sent for sale.

What determines financial strength

This indicator is mainly calculated in the presence of mass production with a short period of the production cycle.

It is worth noting that the more insignificant the expenses (and this especially applies to constant ones), the more this indicator grows, but basically the determination of financial stability is carried out on the basis of three situations:

- sales and production volumes completely coincide;

- sales volume is greater than production volume;

- sales volume is less than production volume.

It is worth noting that in order to fully assess the financial strength of a company, it is necessary not only to carry out calculations in accordance with the specified formula, but also to analyze all possible aspects present in the economic activities of the company, and first of all, this concerns how much the difference between the sales and production volumes affects the work of the organization, as well as how the amount of inventory increases.

Calculation example

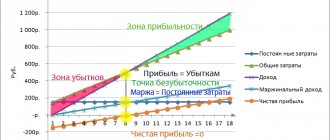

To correctly represent the nature of this change, you need to build a graph of how the safety margin depends on the sales volume in kind.

This parameter can be monitored if the company has a well-established management accounting system, which provides for a regular grouping of expenses allocated for the production and sale of commercial products depending on the sales volume.

The growth of this indicator will occur if the management of the organization takes measures to reduce the costs necessary for the manufacture and sale of commercial products, but it is also more important due to the reduction of fixed costs.

The calculation procedure itself may look like this:

| Parameter | In 2020 (in rubles) | In 2020 (in rubles) | Dynamics (calculated as a percentage) |

| Realization profit | 38 596 | 32 079 | 83 |

| Cost of commercial products, including: | 36 611 | 28 668 | 78 |

| Variable expenses | 20 952 | 17 055 | 81 |

| Fixed expenses | 15 659 | 11 613 | 74 |

| Gross profit margin | 17 644 | 15 024 | 85 |

| Sales income | 1 985 | 3 411 | 172 |

| Profitability limit | 34 253 | 24 795 | 62 |

| Financial strength | 4 342 | 7 283 | 168 |

| Financial strength (percentage) | 11.3 | 22.7 |

Data characteristics

To carry out calculations correctly, you need to obtain certain characteristics from which you can build on in this process, and also understand exactly how such calculations should be carried out.

detailed instructions

The standard version of calculating the margin of financial safety in price terms looks like the above formula, that is, the planned sales volume is multiplied by the cost of each product, after which the product of the break-even point and the cost of each product is subtracted from it.

There is also another option for how to determine an indicator of the company’s financial strength, according to which the excess between the profitability threshold and the actual production volume will be established. Thus, the stock will be established as the difference between the company's profit and the profitability threshold established for it.

The profitability threshold is a state in which the organization's financial reserves are only sufficient to cover fixed costs, while the company itself does not have any profit.

Graphical view of the FP and break-even point

Types and acceptable actions

Analysis of the financial condition of a company is carried out with varying degrees of detail, but there are only two types of this procedure - express or in-depth.

Express analysis only provides for obtaining a general idea of the organization’s work, and its main goal is to determine the state of financial well-being and the further dynamics of the organization’s development.

This procedure involves studying reports according to certain formal criteria, such as the correctness of the reports, the consistency of the final indicators, checking the control relationships between certain reporting items, as well as familiarizing with the conclusions made by the auditors.

In the process of conducting an in-depth analysis, specialists can get a rough idea of the following nuances of the company’s work:

- solvency and liquidity;

- financial strength;

- property status;

- income and profitability;

- work activity.

Thus, in order to determine the financial strength of an organization, an in-depth analysis must be carried out, since in the process of its implementation many indicators are established that are not established during an urgent audit.

Break even

The break-even point is the minimum sales volume required for the company to not operate at a loss. If this indicator is calculated in units of manufactured goods, then in this case fixed costs must be divided by the difference between the final price of each unit and the amount of variable costs required for its production.

If the calculation is carried out in monetary units, then the amount of fixed costs is divided by the difference between the unit and the share of variable costs in the base profit.

After determining this parameter, it can be used to calculate the indicator of financial strength, since this is what needs to be subtracted from the planned sales volume.

Source: https://buhuchetpro.ru/finansovaja-prochnost/

The main stages of determining the margin of financial safety

To determine the FFP, this algorithm is proposed:

- Calculation of FP reserve.

- Determining the impact of the difference in the number of sales and production indicators through the correlation of the FP indicator, taking into account the growth of inventories.

- Determination of the optimal increase in the scale of implementation and the limiter of the FFP.

The obtained result is used in predicting the production rate and ensuring a stable indicator.

How to increase your financial safety margin?

To change the FP stock, the following actions are taken:

- Increase in total revenue from product sales. This is done by increasing sales volume and increasing the cost of products. It is possible to take both of these measures simultaneously.

- Increasing the indicator to the break-even point. This is done by increasing the cost of products and investing in product promotion.

- Reduced costs. This can be done by reducing variable and fixed costs.

Another method of increasing the financial reserve is to replace fixed expenses with variable ones.

Summarizing

1. Increase total sales revenue.

- Increase the number of sales.

- Increase sales prices.

- Increase the quantity and sales prices at the same time.

2. Reduce the values at the break-even point.

- Increase sales prices.

- Improve the turnover structure through intensive promotion of products that have a large specific coverage amount as a percentage of the price.

3. Reduce costs.

- Reduce variable costs.

- Reduce fixed costs.

- Reduce both fixed and variable costs at the same time.

4. Replace fixed costs with variable ones, for example, when switching to procurement from outside your own production.

Summarizing the above, it is worth noting that both the start of a project and its subsequent development require special attention not only to direct production processes and marketing strategy, but also to accounting and analysis of financial and economic indicators. Moreover, such an analysis includes a wide range of areas - this includes determining the profitability of the enterprise, and analyzing the liquidity of its assets, and, of course, diagnosing its stability and sustainability. To determine the last of the named characteristics of the enterprise’s activity, the financial safety factor is used.

Management Recommendations

The company's goal is to increase the stock of pharmaceutical products. To achieve this, you need to regularly analyze the PPF indicators and formulate strategies to increase the stock. To increase the stock these methods are used:

- Attracting new customers and increasing sales volume by participating in tenders.

- Changes in product costs. It must be justified in order to increase the company's income.

- Increase in production capacity.

- Reducing variable costs, which include the cost of raw materials, fuel and other resources used in production.

- Reducing fixed costs, which include salaries for low-skilled employees, automation of personnel activities.

- Introduction of innovative technologies into the company's activities to reduce costs.

Which method should you choose? It all depends on the specifics of the enterprise’s activities. For example, some companies do not want to reduce the cost of products. The price of the product can be as low as possible. It would be wiser to use funds to promote the product.

FOR YOUR INFORMATION! There are no specific ways to increase the financial stability margin. The indicator can be increased by improving the quality of the enterprise. The company's goal is to increase sales figures and make products more attractive.

Safety margin: calculation formula, what it shows – Plan-Pro

Both the start of a business and its ongoing development require systematic economic analysis. Analysis of the economic activity of an enterprise involves maintaining accounting records and drawing up various reports based on it, but this rather refers to quantitative methods of analysis.

Speaking about qualitative methods for diagnosing the state of an enterprise, first of all, we should mention such a tool as the calculation of various coefficients. Today in the article we will talk about the financial safety margin .

We will try to explain the essence of this indicator, provide a formula for its calculation and determine the role of this coefficient in business planning.

What does the financial safety margin factor show?

The margin of financial strength is a value that demonstrates the difference between the actual volume of produced (sold) products and the volume of output that corresponds to the break-even point.

This indicator, in essence, shows the maximum permissible limit by the amount of which a reduction in the output of goods and services is possible, which in this case can lead to the break-even limit of production and, if the reduction continues, to the unprofitability of the enterprise. Thus, the margin of financial strength is an indicator of a certain “insurance” of the enterprise - that is, how far the enterprise is from the unprofitable level.

Like any other financial ratio, the financial safety margin will be more “indicative” and informative if it is calculated in conjunction with such parameters as:

- break even;

— profitability ratio;

— leverage of financial leverage;

— financial stability coefficient, etc.

Formula for calculating the margin of financial safety

The margin of financial strength can be calculated both in absolute (cost) and relative (percentage) terms. But the main thing is that, unlike other indicators, the formula for calculating the margin of financial safety is quite standardized and looks like this:

FFP (in absolute terms) = (Sales revenue - Sales volume at the break-even point);

FFP (in relative terms) = (Sales revenue - Sales volume at the break-even point) / Sales revenue.

The presented formulas can be calculated in monetary and physical terms. Monetary expression represents a calculation in rubles, thousands of rubles, etc., or in another currency. The natural expression involves calculation in pieces, kilograms, tons, liters, square meters, etc., that is, abstracting from the influence of the price factor.

Margin of financial strength - formula in percentage

ZFP = ((Sales revenue - Sales volume at the break-even point) / Sales revenue) * 100%.

Relative (percentage) values, as opposed to absolute ones (in pieces, kilograms, rubles, etc.) are more convenient for analysis, since they allow you to compare different coefficients with each other. But sometimes calculating relative values, in particular the margin of financial safety , may not be appropriate.

In order to correctly determine by what formula and in what expression to calculate the financial safety margin , we advise you to download a ready-made business plan for an enterprise similar to yours in terms of activity and sales market. Focusing on such a template will help you take into account all the necessary sections and paragraphs.

Example of calculating the financial safety margin

The scale of calculating the financial coefficient. strength and break-even point will depend on the specifics of each specific enterprise. Next, consider a conditional example of calculating this indicator.

Before performing any analysis, you need to determine the value:

- fixed costs per unit of production (FC);

- variable costs per unit of production (VC);

- the price at which a product is sold on the market (P).

Let's say that in the example under consideration the named units will be equal to:

FC= 90 rub.

VC = 60 rub.

P = 70 rub.

In order to calculate the break-even level (point), you need to calculate the total variable costs (TVC), then the total costs (TC), the total income (TR) and, finally, the net profit (I).

In our conditional example, let the above values be equal:

TVC = 80 rub.

TC = 140 rub.

TR = 240 rub.

I (TR - TC) = 100 rub.

Break-even point = FC * TR / (TR - TVC) = 90 * 240 / (240 - 80) = 135 rubles.

Margin of financial strength = TR - Break-even point = 240 - 135 = 105 rubles.

Thus, calculated in monetary terms, the example shows that:

- the break-even point will be reached at a production volume of 135 rubles,

- and the margin of financial strength is 105 rubles.

Methods for adjusting the financial safety margin

It is clear that it is not enough to simply calculate any indicator. We still need to find or come up with methods to control it. So, if as a result of calculations you received a low value of the financial safety margin , then the next step will be to develop measures to improve the situation.

Below we list some options for increasing the financial stability of an enterprise.

Firstly, the most obvious way to improve a company’s financial results is simply to increase sales. Even with a small margin per unit of production, you can get a good income due to high turnover (aggregate increase in income) and the emergence of economies of scale.

In general, economies of scale are one of the main indirect sources of increasing the efficiency of an enterprise and increasing its profitability. It is also connected with the break-even point, which determines the margin of financial strength.

As you know, with an increase in production volume, fixed costs in the cost of a unit of production tend to decrease, so to speak, “stretch”. This trend is called economies of scale.

At the same time, the break-even point shows what the minimum output should be in order to at least minimally cover all production costs. It is this break-even level that becomes, one might say, the starting point for achieving economies of scale in the future.

An additional source of financing may be participation in auctions for work, government procurement and tenders. Spending time on marketing can be a catalyst for much larger revenues.

Of course, you can’t do without cost management. Their optimization (if this is still possible) will reduce costs, which will increase the profit of the enterprise. This is especially true for variable expenses.

But “manipulation” with fixed costs is also a good tool for increasing the financial strength of an enterprise. For these purposes, it is possible to optimize wages, as well as review the production program.

Sometimes purchasing innovative equipment with high returns can also significantly improve not only production, but also financial performance.

In a business plan, the margin of financial strength is defined as

Drawing up a business plan involves a large list of activities to analyze the market and the competitiveness of the project/product, develop a production program, investment planning, and forecast future financial results. One of the components of such forecasting is determining the margin of financial strength .

The calculation of the financial strength coefficient must necessarily be preceded by the calculation of the break-even point. This once again confirms the need for a comprehensive assessment and integration of any coefficient into the overall structure of the business plan.

We also note that the margin of financial strength can be called a more objective parameter than the break-even point. For example, the break-even points of a small store and a large supermarket can differ thousands of times, and only the margin of financial strength will show which of the enterprises is more stable.

When choosing an option for implementing your business, pay attention to an option such as a private school business plan. This is an interesting business idea that you might like.

Summarizing

Summarizing the above, it is worth noting that both the start of a project and its subsequent development require special attention not only to direct production processes and marketing strategy, but also to accounting and analysis of financial and economic indicators.

Moreover, such an analysis includes a wide range of areas - this includes determining the profitability of the enterprise, and analyzing the liquidity of its assets, and, of course, diagnosing its stability and sustainability.

To determine the last of the named characteristics of the enterprise’s activity, the financial safety .

Moreover, the calculation of all these coefficients and indicators is important at the planning stage. In this case, we will be talking about the potential margin of financial strength , that is, the ability of the enterprise to be to a certain extent “protected” from unprofitable levels.

If you are determined to independently develop a business plan for a future project, then to facilitate this process, we recommend downloading a ready-made sample business plan on the Internet, which will help to correctly integrate the financial section into the overall structure of the business plan.

It is also possible to order the development of such a document by contacting specialists in the field of business planning, who will write down all the necessary sections taking into account the characteristics of your business.

Source: https://plan-pro.ru/entsiklopediya-biznes-planirovaniya/finansovoe-planirovanie/zapas-prochnosti-formula-rascheta-chto-pokazyvaet/