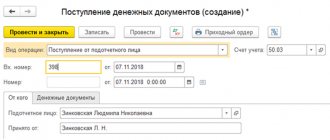

On the cash receipt there is only the amount: about the documents for the advance report

Receiving a receipt after making a purchase has long become an accepted norm.

Moreover, it is so familiar that sometimes we don’t even think about what document we receive from the seller, and whether the received receipt confirms the fact of purchase or sale of the goods. In today’s article we will analyze the concepts of fiscal and non-fiscal check, talk about the distinctive features of a non-fiscal check and find out whether a non-fiscal check can be accepted for accounting as a document confirming a purchase and sale transaction.

Fiscal and non-fiscal checks differ not only visually, but also in documentary status.

A fiscal check is a payment group document containing the details established by regulations.

Such a check has a number of details that can only be issued by a cash register that has been registered in the Federal Tax Service system - a fiscal sign, sequential numbering assigned by the cash register, registration and serial numbers of the cash register, tax identification number and name of the business entity, etc.

A non-fiscal check is a payment receipt printed on paper, which, however, may contain the details inherent in a fiscal check. But this type of check is not a document confirming the fact of payment for a product or service, since a non-fiscal check is printed on devices that have not been properly registered with the tax authority.

Perhaps the most common example of a non-fiscal document is a ticket for travel on public transport.

In fact, it confirms the payment, but does not contain information in its content, the presence of which is a mandatory attribute of a fiscal receipt, and information about its issuance (i.e.

– the fact of payment for the service) is not entered into the memory of the cash register, the operation of which is authorized by the Federal Tax Service. Thus:

- The main difference between fiscal and non-fiscal checks is that a fiscal check is a document confirming the fact of purchasing goods (or receiving services), while a non-fiscal cash receipt is not such a document (without providing additional payment documents).

- Fiscal receipts are printed using registered cash registers, and to issue a non-fiscal receipt, printing can be done on a POS printer or any other adapted device.

The type of payment receipt we are considering is a non-fiscal deposit check. Let's understand the concept of what a non-fiscal deposit check means.

We have to deal with this document much more often than we suspect: for example, every time we use the services of gas stations and pay for the purchased fuel before it is poured into the tank of the car being refueled.

To confirm payment, the gas station operator issues a non-fiscal report confirming that the client has paid a deposit for a service (sale) that has not yet been provided. Such a non-fiscal deposit receipt is usually printed on an unregistered printing device.

It is an internal document and serves as an administrative document for the supply of fuel for personnel servicing the refueling machine.

After completion of fuel dispensing, the gas station operator is obliged to issue the buyer, instead of a non-fiscal deposit receipt, an authentic fiscal receipt printed on a registered cash register.

Non-fiscal checks, even if they are issued by those who are exempt from the use of cash registers under Law No. 54-FZ, are not a self-sufficient payment document that would fully confirm the eligibility of expenses in the advance report.

This is important to remember: it is impossible to take into account in the financial statements, and in particular in the advance report, expenses that are certified only by a non-fiscal check. This will be a gross violation of cash, accounting and tax discipline.

A non-fiscal check can be accepted for accounting and entered into the advance report only in one case - if the seller (or service provider) provides other supporting documents of the established form with this check, confirming the expenses incurred by the accountable person when making a purchase in conditions of non-use by the seller (service provider) KKM – sales receipts, BSO, which must have fiscal characteristics and comply with the established form.

Business lawyer {amp}gt; Accounting{amp}gt; Primary documents {amp}gt; What to do with a non-fiscal check in an advance report: formation procedure

It is quite difficult to distinguish a fiscal check from a non-fiscal one by appearance.

For the most part, questions regarding the procedure for reporting on a purchase or performing a work assignment on a business trip arise from the employees themselves.

According to current practice, you can report for payment for a service without a cash receipt if you provide other documents that business entities use in their activities.

So, for example, the Central Bank's instruction 3210-U indicates the need to set up a procedure for an employee to report on an expense report, only that it must be submitted to the manager's accountant. However, the standard does not describe specific types of documents that must confirm expenses incurred. The legality of the expenses incurred can always be confirmed upon request.

Continuing to clarify the regulatory burden regarding the procedure for submitting reports on business trips and procurement, attention should also be paid to Government Resolution 749 of 2008.

The document clearly states that after returning from the place of performance of an official assignment, the employee is obliged to submit a written report on the work done. It should include details of costs such as travel and accommodation.

Expenses must be confirmed only with original documents that were issued at the point of travel. After submission, checks and strict reporting forms will be checked by the accounting department, approved by the manager and filed.

Business trip

In the main acts regulating the preparation of reporting forms, there is no clear requirement that cash receipts must be attached to the advance report. The absence of such clarification is quite fair, if only because the structure of Russian enterprises is diverse, as are the existing procedures.

As for what is common in the practice of business entities, this is the use of a single industry-wide form of advance report AO-1. We also recognize the form for budgetary institutions, which has minor differences from the basic form, its code is 0504505. Both types of reports have a tabular part where it is necessary to provide a transcript of supporting fiscal and non-fiscal documents.

What to attach to AO-1:

- Business contracts. For example, if a business traveler lived with an individual entrepreneur in a remote area.

- Strict reporting forms, for example, tickets for travel on public transport or an airplane. Today, this requirement can be considered somewhat abolished due to the fact that a large number of tickets are issued and paid for remotely. For the most part, employees provide electronic copies of tickets. If there are any doubts, the accounting department can always generate a request for the place where the funds were spent.

- Receipts and cash receipts are classic documents that are used by most enterprises. Here, too, it is necessary to take into account the fact that many enterprises have taken a course towards a new trend. Not all enterprises today have cash registers and a full-time cashier position. The issuance of strict reporting forms can be carried out by the operator, for example, from the “online cash register” application according to the Resolution.

- Sales receipts.

Let's imagine a situation where an employee, when preparing an expense report, did not provide cash receipts for one or more services. In this case, it is best for the accounting department to play it safe and accept the maximum number of documents that were issued to the employee after payment at the place of business trip or purchase.

An alternative behavior for the administration is to go to the enterprise before a planned business trip and pay bills by means of a payment order.

In this case, there is no need to issue accountable funds, say, for accommodation or even travel (for example, you can pay for tickets with a corporate card online).

If, nevertheless, the employee went on a business trip with corporate funds and did not bring fiscal documents, you can request additional completed forms from him, for example, strict reporting.

Package of documents

- They must indicate the name, for example, an invoice for a hotel or for additional services, if their payment is provided for in corporate title documents.

- Series and number of the form are strictly reporting.

- Registration number, name of the organization and other details by which you can identify the organization providing services to posted workers.

- Full name of the service, its cost and time of provision (calculation).

- Information about the employee who prepared the document.

Additional requirements for the form include the need to issue it on specialized equipment (printing). The form must include two sections: for the organization dispensing the services, and for delivery to the client.

Form KO-1 was approved back in 1998. The form is still used by a number of business entities. Before receiving such a document to confirm his expenses, the employee should make sure that the requirements for filling it out are met.

The standard form consists of two parts. The upper fields are filled in by the company with its details, the payment itself is detailed (amount, date, for what, by whom the money was paid).

- serial number for the shift;

- date, time and place (address) of settlement;

- name of the organization or surname, name, patronymic of an individual entrepreneur;

- taxpayer identification number;

- the taxation system used in the calculation;

- sign of calculation (receipt of funds from the buyer - receipt, return to the buyer of funds received from him - return of receipt, issuance of funds to the buyer - expense, receipt of funds from the buyer issued to him - return of expense;

- name of goods, works, services, payment, disbursement, their quantity, price per unit taking into account discounts and markups, cost taking into account discounts and markups, indicating the value added tax rate;

- the calculation amount with a separate indication of the rates and amounts of value added tax at these rates;

- form of payment (cash and (or) electronic means of payment), as well as the amount of payment in cash and (or) electronic means of payment;

- position and surname of the person who made the settlement with the buyer (client), issued a cash receipt or strict reporting form and issued (transferred) it to the buyer (client);

- registration number of cash register equipment;

- serial number of the fiscal drive model;

- fiscal sign of the document;

- the address of the website of the authorized body on the Internet, where the fact of recording this calculation and the authenticity of the fiscal indicator can be verified;

- subscriber number or email address of the buyer (client) in case of transfer of a cash receipt or strict reporting form in electronic form;

- the email address of the sender of the cash receipt or strict reporting form in electronic form in the event of transfer of a cash receipt or strict reporting form in electronic form to the buyer (client);

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message.

- Codes for filling out personalized accounting document forms are contained in the Parameter Classifier (Appendix 1 to the Instructions, approved by Resolution of the Pension Fund Board of July 31, 2006 No. 192p). This classifier contained a number of references to the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation.”

- However, from January 1, 2020, issues of assigning insurance pensions are regulated by Federal Law dated December 28, 2013 N 400-FZ “On Insurance Pensions”. In this regard, in the Classifier of Parameters (Appendix 1 to the Instructions approved by the Resolution of the Pension Fund of the Russian Federation Board of June 1, 2016 No. 473p) there are now references to this federal law.

- Also, Resolution of the Board of the Pension Fund of June 1, 2016 No. 473p provides for a number of technical amendments.

Consequences of forging checks and receipts

In this case, the employer has the right to sue and recover damages caused and fire the employee. When an employee provides accounting documents to an accountant, he may not notice that the document is falsified. But when the organization receives an audit from the tax office, identifying the fake will not be difficult.

You have to pay for deception

What to do if an employee brings a fake check

If fraud is detected, the amount of a false check or an incorrectly filled out strict reporting form is recognized as the employee’s income, since these funds were reimbursed to him.

As a result, inspectors will charge personal income tax on this check or form, and the company will be obliged to pay it by deducting this amount from the accountant’s salary. However, if the employee managed to quit his job before the inspection arrived at the organization, the employer must inform the inspectorate and the former employee that the organization cannot withhold personal income tax. In this case, the obligation to pay additional tax falls on the former employee. In case of non-payment, the fine will be 20% of the amount, as well as debt to the budget, which prevents the debtor from traveling abroad of the Russian Federation.

All these consequences are not pleasant, both for the employer, the accountant and the employee himself. Therefore, to avoid such situations, you need to conscientiously check accountable checks and receipts, paying attention to the required check details:

- Company name;

- TIN of the organization;

- Check number;

- Serial number of the cash register;

- Date and time of purchase;

- Purchase cost;

- Sign of the fiscal regime;

- EKLZ number.

For information: Since August 2020, the details of receipts for alcohol have changed.

Mandatory receipt details

- Document name, number and series;

- Company name (full name of the entrepreneur);

- Location and tax identification number of the company;

- Type and cost of service;

- Date and amount of payment;

- Position, full name responsible employee, his personal signature and seal of the organization (IP).

Fines for violations of handling online cash registers

- Issuing a fictitious cash receipt, that is, a document for which no sale or settlement was actually made, will be punishable by an administrative fine in the amount of 20,000 to 40,000 rubles.

- For the sale of goods without receipts in the amount of 1 million rubles or more, the fine will also be 1 million rubles.

- Lack of information about broken checks in the fiscal storage and failure to transfer it to the Federal Tax Service will threaten violating organizations with a fine of up to 100,000 rubles, and individual entrepreneurs - up to 50,000 rubles.

What checks can be accepted for the 2020 expense report?

The sale of goods for cash is usually confirmed by issuing a cash receipt to the buyer. When using online cash registers, the required details of the cash register receipt contain all the necessary information about the seller and the goods sold (name, price, value). Therefore, drawing up a sales receipt at the same time as the cash register receipt is not required. What if the cash receipt is not issued or is lost? Is a sales receipt valid without a cash receipt?

A sales receipt is a non-state document, which is generated by the seller for a cash register receipt. The current legislation of the Russian Federation provides for exceptions when a non-fiscal document is issued instead of a fiscal check.

Accountable money can be used to pay an individual who is not registered as an entrepreneur. Let's give examples: purchase of agricultural products from the population, road transportation, accommodation in the private sector during a business trip. In such cases, the expenses of the accountable person will be certified by the citizen’s receipt of the money. A legal entity is mentioned in it, if only the “accountable” acts on the basis of a power of attorney.

In cash. If your drivers purchase fuel at a gas station in cash, the documents on the basis of which the advance report will be drawn up will be the same as when purchasing goods at retail. At the gas station, the driver will receive a cash receipt, which will indicate the type of fuel, number of liters, price and amount. There will be no invoice. Include the entire cost of gasoline in costs without allocating VAT.

Thus, in order to recognize an organization’s expenses as documented, primary documents must be drawn up in accordance with the provisions of clause 2 of Art. 9 of Law No. 129-FZ. This conclusion is confirmed by the decision of the Federal Antimonopoly Service of the Moscow District dated April 22, 2010 N KA-A40/2561-10 in case N A40-25205/09-75-93 (the decision of the Supreme Arbitration Court of the Russian Federation dated August 31, 2010 N VAS-7524/10 refused to transfer this case for supervisory review).

- Related Posts

- How long does it take to register in a house purchased with maternity capital?

- From what year do contributions to the pension fund begin?

- Is it worth renting an apartment through an agency?

- Can an LLC not contribute to the pension fund for an employee with whom an agreement has been concluded?

"Pros and cons"

According to the provisions of the law, since 2014 there are no uniform requirements for the registration of “primary registration”. There is no unified form for such documentation; the requirements for it are determined by the employee of the organization who is entrusted with accounting.

Regulatory legal acts do not stipulate the format of primary documentation, but indicate what details should be contained in it. Requirements for the information reflected in the cash receipt are determined by Government regulations. If you follow the logic of the legislation, it turns out that the check does not provide all the data that should be available in the “primary” document. It is important that it does not contain the title of the position and the signatures of the responsible persons confirming the fact of the transaction.

According to explanations from the tax authorities, a check issued by KKM on paper confirms that an individual made a purchase from a commercial structure that sells goods or services to the public. It is not stated anywhere in the paper that a person works for a particular company. Thus, the buyer’s affiliation with a specific organization is revealed only indirectly.

Regulatory legal acts require that the company's expenses be confirmed by papers confirming the fact of receipt of the goods and the transfer of funds to the seller. A cash receipt belongs to the second category of documents. It is a necessary component of the “primary”, but it alone is not enough. Other forms must also be provided: sales receipt, receipt, expense report, etc. Otherwise, the expense will not be recognized, and it will not be possible to reduce the tax base for it.

A cash receipt does not contain information that allows you to understand which category a specific expense falls into: advertising, entertainment, or other. If an advance report is not attached to the paper, the employee will not be able to confirm the legality of the expenditure. In this case, the money he used for the purchase will be considered by government agencies as additional income above wages, subject to personal income tax.

Additional problems will arise for the company if the document is printed by a cash register that is not registered with the tax authority. An analysis of current judicial practice shows that arbitrators in many cases are inclined to recognize a cash register document as invalid. Only some judges side with the buyer and indicate that he is not obliged to monitor the condition of the seller’s cash register and the legality of its use.

There's a dangerous trap in your gas station receipt.

Over time, the information reflected on a cash receipt may fade or fade completely. Often, after just a few months, cash register checks turn into completely blank pieces of paper, as if nothing had been printed on them at all. This happens if the cash register uses, for example, the thermal printing method. It is almost impossible to recover lost information on your own.

Sellers (individual entrepreneurs, organizations) engaged in retail trade and using PSN or UTII may not use cash register until July 1, 2019. And if such individual entrepreneurs do not have employees, then they may not use CCP until 07/01/2019 (Part 7.1, Article 7 of the Federal Law of 07/03/2016 No. 290-FZ). Instead of a cash receipt, they issue sales receipts to customers (Part 7, Article 7 of the Federal Law of July 3, 2016 No. 290-FZ).

Features of an advance report without a cash receipt

- Related Posts

- What Amount Is Not Taxed When Selling An Apartment?

- How to get regional maternity capital without waiting 3 years

- What kind of family is there based on financial status?

- How to call the hotline for migration issues

But employees, as a rule, do not pay attention to this, and gas station operators usually do not consider it necessary to warn that after refueling you need to go to the cash register again for a normal receipt. Therefore, for safe accounting, it is necessary to warn drivers in advance so that they double-check the documents directly at the gas station and, if necessary, ask the operator for a cash register receipt.

Cash and sales receipts – how to accept them?

Let's imagine a situation where an employee, when preparing an expense report, did not provide cash receipts for one or more services. In this case, it is best for the accounting department to play it safe and accept the maximum number of documents that were issued to the employee after payment at the place of business trip or purchase. An alternative behavior for the administration is to go to the enterprise before a planned business trip and pay bills by means of a payment order. In this case, there is no need to issue accountable funds, say, for accommodation or even travel (for example, you can pay for tickets with a corporate card online).

If, nevertheless, the employee went on a business trip with corporate funds and did not bring fiscal documents, you can request additional completed forms from him, for example, strict reporting.

Such documents have certain filling requirements:

Package of documents

- They must indicate the name, for example, an invoice for a hotel or for additional services, if their payment is provided for in corporate title documents.

- Series and number of the form are strictly reporting.

- Registration number, name of the organization and other details by which you can identify the organization providing services to posted workers.

- Full name of the service, its cost and time of provision (calculation).

- Information about the employee who prepared the document.

Additional requirements for the form include the need to issue it on specialized equipment (printing). The form must include two sections: for the organization dispensing the services, and for delivery to the client.

A sales receipt without a cash receipt is valid in 2020

Sometimes documents confirming payment have the date of a weekend or holiday. This raises questions among tax authorities and auditors. Why did the person make purchases during non-working hours? Was he actually making these purchases for the business and not for personal use? If it is impossible to justify the need for spending on such days, it is better to avoid them.

Since 2020, online cash registers have been introduced throughout the country, which, upon sale, transmit information about the sale to the Federal Tax Service. From July 1, online cash registers will become mandatory for most organizations and individual entrepreneurs. Innovations were introduced by Federal Law No. 290-FZ of July 3, 2016. We reported about this in the article “Online cash registers from 2020: who should use them.”

Having analyzed the details in the cash receipts that employees most often bring, the company can give recommendations not to refuel at certain gas stations. Or the accounting department, anticipating tax claims, may immediately recognize that some of the expenses will not reduce taxable profit. So, let’s assume that the driver of the organization, who was traveling around Moscow, submitted cash receipts for gasoline to the accounting department (see pp. 60 - 61).

The goods were purchased by an accountable person

A particular problem can be caused by cases where a taxpayer purchases material assets through an accountable person.

Although the Ministry of Finance, for example, in letters dated December 5, 2019 No. 03-03-06/2/94579, dated November 26, 2019 No. 03-03-06/1/91715, dated November 18, 2019 No. 03-03-07/88709, so that there is no problem here.

He pointed out that the identification of the buyer (client) as an organization occurs on the basis of the power of attorney he presents to make payments on behalf of the organization. The taxpayer (buyer) issues such a power of attorney to the accountable person, and he presents it to the seller.

Based on this power of attorney, when making payments, the cash receipt reflects information about both the seller and the buyer.

However, in practice, it often happens that an accountable person makes purchases promptly without a power of attorney and, as a result, the cash register check does not contain information about the buyer-organization or individual entrepreneur, that is, the check is issued in the same way as if it had been issued to an individual.

On this basis, local tax authorities sometimes refuse to recognize expenses confirmed by such a check.

Let us note that such actions of officials directly contradict the position of the Federal Tax Service, which explains on the website nalog.ru that a cash receipt (CSR) issued to an individual, including an accountable person, is the primary document on the basis of which an organization (IP) can take into account expenses. Even if it does not contain the details provided for in clause 6.1 of Art. 4.7 of the Law on CCP.

And rightly so. After all, the accountable person attaches a cash receipt to the advance report, according to which expenses are reimbursed to this accountable person. That is, as a result, it is obvious that it is the taxpayer who bears the costs corresponding to the amount indicated on the check.

However, it is possible that the taxpayer will have to justify this position in court, and he must be aware of this risk.

Details of a cash receipt for fuels and lubricants, inaccuracies in which lead to tax disputes

In the case under consideration, the accountable person confirmed the fact of payment (attached a cash register receipt to the advance report), but he did not confirm the fact of purchasing gasoline (there are no documents from which it follows that it was gasoline and not some other product that was purchased). Therefore, we believe that such an advance report should not be accepted by an accountant.

Clause 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, states that upon returning from a business trip, a company employee must submit an advance report to the employer and attach to it documents confirming the rental of housing, travel expenses and other items.

Is a cash register receipt a special document?

There is a general rule (clause 1 of Article 252 of the Tax Code of the Russian Federation): the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory these expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

At the same time, in order to generate tax accounting data, it is necessary to have properly executed supporting documents confirming the expenses incurred.

So is a cash register receipt a supporting document for expenses? Obviously yes, since it should be recognized as the primary accounting document.

In accordance with Parts 1 and 5 of Art. 9 of the Law on Accounting[1], each fact of economic life is subject to registration with a primary accounting document. Such a document is drawn up on paper and (or) in the form of an electronic document signed with an electronic signature.

If the current legislation of the Russian Federation establishes mandatory forms of documents for registration of specific transactions, then the forms of documents established by the current legislation must be used.

According to Art. 1.1 of the Law on Cash Register [2] cash register receipt is a primary accounting document generated in electronic form and (or) printed using a cash register at the time of settlement between the user and the buyer (client), containing information about the settlement, confirming the fact of its implementation and meeting the requirements of the law Russian Federation on the use of CCP.

Thus, the cash register receipt confirms the fact of the payment and contains information about it. But is this information enough so that expenses can be specified and correlated with the actual activities of the taxpayer?