Before a product reaches the buyer, it goes through a long life cycle, starting with the extraction of raw materials and their preparation for production, preparation of the product and its processing. Once the product is processed and ready for consumption or use, it is packaged or formed into a form convenient for transportation. After passing these stages, it is sent to the storage warehouse. All of the above stages of life cycle are accompanied by its changes, both qualitative and quantitative. During the process of creating a product and after its manufacture, enterprises inevitably suffer commodity losses.

What it is?

The loss of goods in quantitative or qualitative terms is commodity losses. They arise during any production and sales of a product. The consequence of commodity losses are material losses, which are expressed in monetary terms in kind. Depending on the stage at which the actions occurred that resulted in a reduction in the cost of the batch, the amount of losses varies, since at different stages of the life cycle the cost of the product is different. At the stage of production and preparation of the presentation, losses will be less than if the goods had already been transported and stored in storage areas. As you can see, such losses in material terms completely depend on the cost of the goods at the time of their occurrence.

The relationship between the amount of losses and their cost is very close and affects the economic condition of the enterprise and the price of the consignment. Often the cause of losses is the human factor. In this case, the company does not include them in the cost price.

Accounting for write-off of commodity losses

Loss of goods, depending on the identified cause, is recorded using the following main entries:

- Dt 94 Kt 41, 10, etc. – loss of goods according to the act was revealed.

- Dt 73 Kt 94

- Dt 70, 50 Kt 73 - the shortfall is attributed to the guilty person, the shortfall is repaid from wages (in cash).

- Dt 44, 20, 23, etc. Kt 94 - losses within the limits of natural loss are written off as expenses.

- Dt 91/2 Kt 94 – losses exceed natural loss, but the guilty party has not been identified.

- Dt 99 Kt 94 – loss from a natural disaster.

The last entry given does not apply if the fact of theft is established as the cause of the loss of goods. Then the court determines the culprit, and depending on its decision, the commodity loss is presented to the guilty person for repayment or written off, reducing the company’s profit.

It is especially worth paying attention to the write-off of goods losses associated with transportation: Dt 94 Kt 60 – losses were identified at the stage of acceptance of goods from the carrier.

Write-off options:

- Dt 44, etc. Kt 94 – write-off for the recipient’s expenses within the normal values of natural loss.

- Dt 60 Kt 94 – a claim was made to the carrier for an amount exceeding the norms for natural loss of goods (sanctions may be added here according to the contract).

VAT on commodity losses is reflected by posting D91/2 Kt 19. It is not accepted for deduction. Writing off losses of goods within the limits of natural norms allows you to include the amount in costs in accordance with the Tax Code of the Russian Federation (Article 254-7).

The procedure for establishing norms of natural loss has been approved by the Government. This is document No. 814 dated 11/12/02, containing general principles for establishing standards. Standards are developed by various Ministries in accordance with their competence. They cover certain groups of goods. An accountant, as a rule, uses a specific document (documents) related to a particular product line.

Thus, the storage of grocery goods in retail trade involves the use of natural loss norms enshrined in Order of the Ministry of Industry and Trade No. 252 of 01/03/13; sausages and smoked products are mentioned in the same document and additionally in Order of the Ministry of Agriculture of the Russian Federation No. 395 of 16/08 /07; the natural loss of dishes is regulated by Order of the USSR Ministry of Trade No. 2 dated 04/01/88, etc.

Order of the RF Committee on Trade (Roskomtorg) No. 1-794/32-5 dated 10/07/96 established the rule: losses of goods within the normal limits are written off in the month when they are discovered. Usually this is the month of the inventory count (clause 9.24).

If there are no standards for a certain type of product, it cannot be written off as expenses (letter of the Ministry of Finance No. 03-03-РЗ/24762 dated 05/23/14).

Important! It is advisable to include a provision on the norms of natural loss into the accounting policy or formalize it as a separate LNA if there is a wide range of goods in the organization.

Briefly

- It is possible to write off commodity losses as expenses only within the limits of natural loss norms. If the officially approved documents containing the norms of natural loss do not contain the name of the product, it is not written off as an expense.

- A commission is created to determine the culprit when loss norms are exceeded. Its conclusions are approved by the head of the company. The person at fault can compensate for the damage from wages or cash. If the culprit is not determined, the amount is included in other expenses. In case of losses due to natural disasters, they are immediately charged to the profit and loss account.

- If losses are incurred during transportation, they can be attributed to the recipient's expenses without exceeding the loss norms. Excessive shortages are filed as a claim to the carrier and then collected.

- The losses of goods are recorded according to Dt 94, in correspondence with the account on which the goods were registered, and then, according to Kt 94, they reflect the write-off of commodity losses according to one of the named options.

Types of commodity losses

The main losses of goods can be divided into:

- quality;

- quantitative.

It is important to note that the quality of a product is its main characteristic. It is based on this that the demand for the product is formed. Consumers choose a product that is suitable for them, relying primarily on its properties. If the proper level of quality indicators is lost, the product automatically becomes illiquid. Unit costs also play a big role in shaping consumer demand.

Quantitative commodity losses cause no less damage to trade enterprises serving the sphere and production facilities. The rate of physical reduction of goods in a batch depends on many factors that can be minimized.

Any company engaged in the production and sale of goods seeks to reduce both types of costs. Only in the case of an established process of the enterprise’s activities, technical support and well-coordinated work of personnel can large product losses be avoided.

(The explanation “On the development of standards for commodity losses”, developed taking into account the opinion of MART, is posted on the website of the Ministry of Taxes and Taxes.)

In connection with issues that arise when developing norms for losses of goods and inventories in the absence of such norms established by law, the Ministry of Taxes explains:

- pp. 1.3 clause 1 art. 171 of the Tax Code establishes that standard costs include losses from shortages and (or) damage during storage, transportation and (or) sale of goods, stocks within the limits of natural loss norms, as well as loss (breakage) norms established by law, and in their absence - within the limits established by the manager in agreement with the owner, the general meeting of participants, members of the consumer society, authorized persons or a person authorized by them.

• Natural loss is the loss of a product (a decrease in its weight while maintaining quality within the requirements of regulatory documents), which is a consequence of the physical and chemical properties of the product, the impact of meteorological factors and the imperfection of the currently used means of protecting products from losses during transportation, storage and sale.

• Damage to goods is understood as deterioration of all or individual qualities (properties) of a product, as a result of which this product cannot be used for sales purposes and (or) in the production of products (performance of work, provision of services).

To normalized in accordance with clause 1.3 of Art. 171 Tax Code losses include, in particular: • natural loss of goods and inventories; • destruction, scrap of goods, stocks due to their fragility; • damage to goods, stocks or damage to the consumer packaging in which they are packaged, which in turn causes loss of consumer properties of goods and stocks; • broken empty glassware, etc.

The Tax Code does not contain special rules governing the procedure for calculating standardized losses.

Organizations are given the right to independently develop an algorithm for calculating losses of goods and inventories, depending on the specifics of the enterprise’s activities, seasonality, terms and conditions of storage of goods, inventories and other objective reasons affecting the amount of losses.

Payers do not have the right to include losses of goods and inventories in the normalized costs on the basis of the standards established by Order of the Ministry of Trade of the Republic of Belarus dated 04/02/1997 No. 42 “On the norms of commodity losses, calculation methods and the procedure for recording” (hereinafter referred to as Order No. 42), since it does not have the characteristics of a normative legal act and is not part of the legislation defined by paragraph 2 of Article 3 of the Law of the Republic of Belarus dated July 17, 2018 No. 130-Z “On normative legal acts”.

At the same time, according to MART, in order to develop their norms for losses of goods and inventories, organizations have the right to be guided by the norms and calculation methods approved by Order No. 42, or to use a methodology independently developed taking into account the specifics of their activities.

Taking into account the above, for the purposes of calculating income tax, losses from shortages and (or) damage during storage, transportation and (or) sale of goods and inventories must be included in the standard costs within the limits of separately developed norms of natural loss, losses (breakage) established by the organization independently, regardless of the methods used in their development.

This procedure for writing off commodity losses applies, inter alia, to retail trade organizations that sell goods using the self-service method, in which damage to goods is an inevitable consequence of the peculiarities of this trading method, which involves self-inspection, selection and delivery of selected goods by customers to the cash register, during which the product is subjected to additional physical impact.

2. Losses of goods and inventories that arise naturally as a result of technological processes during production, as well as during the preparation of goods for sale (supply to the packaging workshop, packing, unpacking, loading into a bunker, etc.), during loading and unloading operations and in other circumstances not directly related to the storage, transportation and sale of goods, stocks, in the absence of guilty persons, for the purposes of calculating income tax are included in the costs of production and sale of goods (work, services), property rights in accordance with paragraph 1 tbsp. 170 NK.

At the same time, losses under the same circumstances, but arising as a result of the guilty actions of specific persons, can be taken into account when calculating income tax only in the manner established by paragraphs. 3.14 clause 3 art. 175 NK.

3. Article 442 of the Civil Code establishes that the shelf life is the period after which the product is unsuitable for its intended use.

When taxing profits, the cost of spoiled products due to expiration dates cannot be included in the standard costs.

Source: https://nalog.gov.by/ru/razjasnenija_ru/view/r-pismo-ministerstva-po-nalogam-i-sboram-ot-07042020-2-2-10-00775-o-razrabotke-norm- tovarnyx-poterr-36138/

Best regards, Consulting

20.04.2020

Quantitative

Loss in the quantity of goods is called natural. They are associated with a decrease in the length, volume, and weight of an object. These include all quantity indicators that can characterize a specific product. The main causes of such losses are shrinkage, breakage, spillage, spraying, volatilization, respiration and absorption. Waste is separated separately.

All these processes are inevitable, they arise at different stages and are written off when accounting for inventory balances. Reducing such losses is impossible. Therefore, there are standards for calculating commodity losses. There is a loss associated with preparation for sale (cutting clips on sausages), and natural (shrinkage of moisture-containing products).

What are the types of lost working time – types and features

When considering the types of lost working time, it should be remembered that not in every case they are caused directly by problems in the organization of work activities, and not by other factors that do not depend on the actions of the employer or employees. In this case, the loss of working time can be divided according to different criteria. From the point of view of their acceptability, types of lost working time are divided into:

Normalized or planned.

Many employers provide additional breaks for their employees - this could be a smoking break, visiting the toilet, rest rooms, or communicating with other employees. They also include the time when the employee does not actually perform tasks that bring profit to the enterprise, but are necessary. These include preparing the workplace for work, end-of-work procedures, routine maintenance and repair of equipment. If such intervals are provided, then these losses of working time are considered normalized and their presence is not a sign of problems.- Unregulated or unplanned. In this case, the loss of working time is not initially planned, which means it poses a threat to the effective operation of the organization and is a consequence of the presence of certain problems caused by various circumstances. It is the non-standardized losses of working time that should be reduced first.

By duration, types of lost working time can be divided as follows:

- In-shift. These losses include those that occur directly during a work shift and take away a specific part of it, but at the same time, during the shift itself, the employee still devotes some time to the direct performance of his work function and the fulfillment of the organization’s goals. Such losses are quite difficult to calculate, but they are the most regular.

- All day long. In some situations, an organization may experience whole-day losses of working time, for example, in the event of downtime, the occurrence of certain unforeseen circumstances, or absenteeism of workers. Such losses can often be critical and must be eliminated first, however, the frequency of their occurrence in general and the impact on overall loss indicators in most cases is an order of magnitude lower than with intra-shift losses.

In addition, loss of working time can be divided into types based on the criteria for their occurrence:

- Loss of working time due to the production of defective products. In this case, the employee can actually perform his job function during the entire working time. However, due to circumstances - low-quality raw materials, equipment failure, or one’s own incompetence or negligence, the products produced or services provided are not a source of profit for the enterprise and allow the expenditure of working time on their production or provision to be classified as losses.

- Lost working time caused by unforeseen circumstances . In some cases, losses may be due to the impact of various unfavorable circumstances that were impossible to foresee. For example, forced downtime of an enterprise due to untimely delivery of raw materials. Also, significant losses may occur as a result of various disasters or natural disasters, structural economic and political crises, changes in legislation regulating the activities of the organization.

- Loss of working time due to violation of labor discipline. Employees do not always spend all their working time on work. Excessively frequent visits to the kitchen and rest room, restrooms, conversations in the workplace, negligent attitude to work duties - all this can lead to a significant decrease in the efficiency of work activity in comparison with the planned one. It is these losses that the employer should monitor first and foremost and use various tools to eliminate them.

Natural quantitative losses

Unavoidable losses include:

- Shrinkage - takes up from 40 to 100% of the total volume of losses. This is the process of evaporation of moisture as a result of exposure of the product to the environment. Typical for food products.

- Spraying is characteristic of products that are finely ground (for example, flour, cereals, table salt, cement, sand). Loss occurs due to shaking or spraying of part of the product.

- Liquid absorption - the fatty or water fraction seeps and is absorbed into the packaging (oil, pickled vegetables, fish, halva, etc.).

- Volatilization - occurs due to the content of flavored and volatile substances in the product.

- Bottling - product residues on the walls of the container.

- Breathing is typical for vegetables and fruits, cereals and flour.

Reducing natural commodity losses is almost impossible. They can be minimized, but by insignificant amounts.

Standardized and non-standardized commodity losses and measures to reduce them.

⇐ PreviousPage 21 of 22Next ⇒Loss of goods within the limits of natural loss during transportation, storage and sale. These losses include:

- loss of goods within the limits of natural loss during transportation, storage and sale, which was formed due to shrinkage and weathering, shrinkage and spraying, coloring, leakage (melting and seepage), spillage during pumping and sale of liquids, weight loss during fruit respiration and vegetables;

— loss of goods from damage during transportation, storage and sale of glass and porcelain tableware with food products and empty (within normal limits);

- losses from combat during the transportation, storage and sale of porcelain, earthenware, glass and ceramic products, Christmas tree decorations, gramophone records, perfumes and cosmetics, household and haberdashery products made from plastics, household chemicals in small packaging and others (within limits );

— loss of goods in self-service stores (departments, sections) (within established standards).

Trade enterprises from among the new “commercial structures” operating on the principle of self-service need to pay special attention to the last position in this list, since they often do not use it in full or at all, and shortages due to the fault of customers become a burden for the employees of the enterprise itself.

In retail trade, as in wholesale, commodity losses are divided into standardized (for which there are established write-off norms) and non-standardized (for which there are no written-off norms). Standardized losses include natural loss and waste of goods within established standards, waste during the preparation of goods for sale, as well as losses in self-service stores provided for by current standards.

Non-standardized losses consist of shortages, loss of goods in excess of norms or for goods for which norms of natural loss have not been established. Among the normalized losses in retail trade, the largest share is occupied by natural losses on goods sold, which are set as a percentage of retail turnover. Goods received in packaged form and piece goods are not accepted for calculation.

When calculating the natural loss for goods according to the norms, the norm for the loss at the beginning of the inter-inventory period and for the goods received is summed up, then the loss for the documented expense and for the balance of goods at the end of the month is subtracted. In retail trade, losses due to natural loss of goods are also written off as distribution costs based on inventory results in the event of an actual shortage of goods.

The norms of natural loss do not include:

- regulated waste that is generated during the preparation for sale of sausages, smoked meats and fish, which are sold after pre-processing;

— stripping butter;

- any kind of loss as a result of damage to goods, damage to containers and the difference between the actual weight of the container and the weight of the container according to the stencil;

- actual additional losses associated with self-service, within the established standards.

For goods packaged in a store, the same standards apply as for non-packaged goods. When calculating the amount of natural loss within the established norms, retail turnover does not include goods sold to other stores and organizations (with separate accounting), sold in small wholesale, returned to suppliers and handed over for processing, written off according to acts as a result of scrap, crumbling, spoilage and damage to containers.

In trading enterprises, depending on the number of goods received in glass containers, special norms for losses from broken glass containers have been established. After determining the shortage during inventory, the waste is written off no more than the maximum norms for the waste of dishes. Empty dishes are written off at deposit prices. Losses of goods due to damage, damage and other reasons resulting from the negligence of workers, poor storage or transportation conditions are not standardized and are attributed to the perpetrators. These losses are formalized by an act of the commission, the decision on which is made by the head of the enterprise.

⇐ Previous21Next ⇒

Pre-realization losses with subsequent use

Liquid losses are characterized by compensation of their value from recyclable materials. For example, trimmings from fish (head, tail, fins), bones after trimming smoked meats.

All trimmings and parts of food waste can subsequently be sold to a retail buyer or part of their value can be returned when returned for recycling or secondary use. You can recycle containers for sour cream, cottage cheese or other products. Non-food products can also be recouped if, for example, you sell cardboard boxes in which shipments are delivered.

Losses to be written off

Often, when packaging and selling a product, there is a small percentage of weight loss. These inevitable costs are typical for food products.

Unliquidated losses are parts of a product or its packaging that cannot be resold. This could be packaging cheese, loops and clips of sausages, cutting off weathered and damaged parts of the product.

Quality

The loss associated with a decrease in the quality of the product is caused by biological, chemical and microbiological processes. This is primarily damage to the goods due to depressurization of the packaging or expired sales period.

Rodents and insects have a biological impact. A chemical change in the composition of the product is a consequence of non-compliance with storage conditions. This may separate fat or age the product. Confectionery products are susceptible to this. As a result, the product acquires a specific smell and taste.

Product losses. Types and varieties of commodity losses

1 Product losses. Types and varieties of commodity losses.

At various stages of the technological cycle of commodity circulation, various losses of raw materials, semi-finished products, energy resources, finished products, and then goods are observed. These losses can be measured in kind and monetary terms, depending on which they are divided into two groups - commodity and material.

Commodity losses are losses caused by partial or complete loss of the quantitative or qualitative characteristics of a product in kind.

Material losses are losses caused by partial or complete loss of value characteristics in monetary terms.

These two groups of losses are interrelated, but commodity losses are primary, and material losses are secondary, a consequence of commodity losses.

Product losses are divided according to the type of lost characteristics of the goods into two subgroups - quantitative and qualitative.

Quantitative losses – reduction in weight, volume, length and other quantitative characteristics of goods.

Losses of this subgroup are caused by natural processes characteristic of a particular product that occur during storage and commodity processing. Therefore, in a number of regulatory documents they are also called natural, and according to the order of write-off - normalized.

Quantitative, or natural, losses are considered inevitable. They can be reduced or the place of their occurrence changed by targeted regulation of factors in the external or internal environment of the product, but they cannot be completely eliminated. This explains the establishment of norms for natural losses.

Quantitative losses, depending on the reasons for their occurrence, are divided into two types - natural loss and pre-realization losses.

Natural loss is quantitative losses caused by processes that are characteristic of goods and occur during their transportation and storage.

The causes of natural loss are the following processes: evaporation of water or shrinkage; spray (dusting, spraying); spill (smearing); volatilization of substances; absorption of the liquid fraction of the food product into the packaging; breathing (only for goods that are living objects); breaking glass or crushing polymer containers.

Pre-sale commodity losses, or waste, are the processes (operations) associated with the preparation of goods for sale. These losses can be liquid or illiquid. Waste includes:

removal of low-value parts of goods that can be sold at a lower price or sent for processing;

separation of components of a product that do not have its functional purpose or have lost it;

crumbling of goods when dividing into parts or during transportation, storage, weighing;

separation from the bulk of the product of its constituent components - water, fats and others.

Unlike quantitative losses, qualitative losses are written off not according to standards, but according to acts, which is why they are also called activated.

Qualitative losses are losses caused by microbiological, biological, biochemical, chemical, physical and physicochemical processes. The list of these groups of processes is ranked in descending order according to their importance.

Microbiological processes cause damage to goods, significantly reduce their quality, make it impossible to use them for their intended purpose, or reduce reliability. Food spoilage occurs due to various types of fermentation, rotting, sliming, molding, and the development of toxic bacteriosis. Non-food products (fabrics, leather, furs and products made from them) are characterized only by mold.

Microbiological processes are one of the causes of biodamage.

Biological processes – damage caused by insects: moths, beetles, caterpillars, larvae.

Significant damage to consumer goods during storage is caused by mouse-like rodents, which eat and contaminate not only food products, but also damage furs, leather, fabrics and products made from them.

Biochemical processes are characteristic mainly of food products, as well as non-food products that are biological objects (for example, fresh flowers and animals). They occur with the participation of various enzymes.

Disruption of the natural course of these processes can cause various physiological disorders, which ultimately can lead to the death of biological objects. As a result, their further use for their intended purpose becomes impossible.

Chemical processes lead to damage to goods due to changes in substances.

Physical and physico-chemical processes are caused by mechanical destruction or deformation of goods.

Shrinkage is also a physical process. The drying of some goods provokes physical and chemical processes, as a result of which the goods become of poor quality.

2 Measures to prevent and reduce losses

Measures to prevent and reduce losses are divided into organizational, technological and informational.

Organizational measures are aimed at identifying the causes of losses in order to prevent or reduce them. They can be preventive or ongoing.

Preventive measures are associated with acceptance quality control, which already at the first stage of storing goods makes it possible to predict their shelf life and possible shelf life, regardless of whether there are expiration dates for specific goods or not.

Organizational current measures include measures to ensure timely delivery of goods on time, moral and material incentives for workers to reduce losses, as well as the current procedure for their accounting and write-off, forms of responsibility for the preservation of goods.

Technological measures are measures to take into account internal environmental factors and regulate external environmental factors, allowing to prevent or reduce commodity losses.

Internal factors are determined by the chemical composition and structure (structure) of consumer goods. All substances of chemical composition can be divided into two groups according to their effect on losses:

Substances that increase losses. Of the first group of substances, water and volatile substances have the greatest influence on quality losses. When they evaporate or volatilize, the mass of the product is lost. In addition, the quality of the product deteriorates, up to the loss of good quality or functionality.

To prevent loss of water and aromatic substances, sealed packaging is used. To slow down the drying of goods in non-airtight packaging, storage at low temperatures and high relative humidity is recommended. Increased humidity is achieved when storing goods in polymer packages that limit air exchange. In this case, the evaporating moisture partially remains in the packaging, thereby creating a microclimate with high humidity.

Not all goods can be stored in plastic packaging. Since high humidity can provoke microbiological spoilage due to mold and infection.

Substances that reduce losses. This group is represented by substances that reduce losses. These include substances that have water-holding capacity or bactericidal properties. The latter prevent microbiological spoilage of goods and reduce losses in their quality.

Product structure. The structure (structure) of consumer goods is also important for the size of losses. Thus, many processes that cause natural loss are determined precisely by the structure of the product.

Pre-sales losses are entirely determined by the structure of the product. Since the value of its individual parts is unequal, parts of the product that are of little value or unsuitable for their intended use are removed.

The structure of goods and their mechanical properties significantly influence the crumbling of goods during cutting, chopping and other operations related to dividing a whole into parts.

External factors are a set of influences from the external environment, as well as means of protection against it, affecting the amount of losses. These are conditions, storage (or transportation) periods, packaging and pre-sale commodity processing operations.

Information measures - measures to provide working personnel with the necessary information about the rules, norms and requirements established by regulatory and technological documents, which help prevent or reduce product losses.

Technological documents are presented with instructions for storing goods of certain product groups, as well as instructions for the procedure for writing off norms of natural loss.

An important role in providing information to working personnel is played by professional training, retraining and advanced training.

Measures to prevent or reduce losses must be comprehensive, due to the complexity and importance of the problem of commodity losses, which is of current national economic importance.

The national economic significance of the problem of preventing and reducing losses is due to a number of reasons.

1 The solution to this problem, even partial, is interconnected with another global problem - the rational use of natural resources. Land, energy, labor and other resources are used to produce goods that may then be lost for consumption in accordance with their intended purpose. Reducing commodity losses by 10–20% allows you to save up to 40–60% of natural resources.

2 Losses of goods, regardless of their place of origin (manufacturer, seller or consumer), cause great economic damage not only to legal entities or individuals through whose fault the losses occurred, but also to society as a whole.

To maintain consumption at the proper level, it is necessary to increase the production of goods to replace those lost. If for some reason it is impossible to increase production, then consumption decreases, increased demand arises and prices rise.

3 Commodity losses are part of production or distribution costs, so they can affect price increases. In turn, an increase in price reduces the competitiveness of goods, even if other criteria of competitiveness remain at the same level. A decrease in the competitiveness of goods inevitably entails a decrease in demand and a slowdown in sales. If a company attributes losses to profits rather than distribution costs, then the profitability of the enterprise decreases.

In the process of storing goods in a warehouse, preparing them for release and performing other warehouse operations, commodity losses occur. It is necessary to distinguish between acceptable commodity losses, for which norms of natural loss are established, and unacceptable ones, which relate to activated losses.

At the stage of receipt of goods, losses may arise due to the transfer of goods in defective containers, as well as defective goods, spillage of goods and damage to containers during loading and transportation of goods. It is possible to prevent these losses by refusing to accept goods of inadequate quality, or goods in damaged containers, or by strict contractual regulation of the acceptance of such goods, regulation of the technological process of loading and transporting goods.

At the storage stage, losses may occur due to improper storage of goods. Laying, grouping, sanitary conditions, packaging, etc. Losses can be avoided by following technological standards indicating the correct placement of goods and observing storage conditions. Constantly maintaining an appropriate room climate and observing temperature conditions. Correctly maintaining records of goods and building a system for regulating and managing the functions of warehouse workers.

In warehouses where operations for the acceptance, storage and release of goods are carried out rationally, their losses are reduced to a minimum.

Causes of commodity losses

The main costs due to a decrease in the quality and quantity of the product are incurred by enterprises during the transportation of goods and their storage.

Manufacturers always indicate the storage conditions for products.

Strict adherence to these recommendations will reduce product losses to the minimum amount. How to do it? Causes of commodity losses

| Factors | Changing Properties | Type of changes | Minimization methods |

| Temperature | Freezing of liquids, fragility of packaging at low temperatures. Melting, decomposition, drying out and evaporation at high temperatures | Broken, cracks, peeling of labels, drying out, separation of the product into components (for example, milk), spoilage of products, broken containers, violation of packaging integrity Polymer aging, deformation, oxidation, product aging | Store products without loading them. Maintaining the temperature recommended by the manufacturer. Transportation in refrigerators |

| Sun exposure | Products decompose | Changes in color, taste and smell of the product Appearance of spots Damage and burnout of packaging Drying | Packaging must be made of materials resistant to solar radiation |

| Biological factors | Insects, rodents, mold and mildew | Rotting, decomposition, deterioration of product and packaging | High-quality packaging that prevents the penetration of bacteria. Sanitation of storage areas against pests |

| The atmosphere around | Presence of hydrogen sulfide, sulfur dioxide or chloride gas | The appearance of electrolytes | Coating with lubricants and anti-oxidation agents |

| Chemical exposure | Deformation of packaging, damage to product | Swelling, corrosion, product leakage | Packaging must be chemical resistant |

| Humidity | Swelling, deterioration of the product and packaging, hydrolysis, change in product properties | Loss of packaging color, deterioration of materials that are not resistant to moisture. Swelling of products | Sealing of packaging. Ventilation and heating in winter |

| Exposure to air | Product changes that cannot be corrected | Oxidation of fats, staling of bakery goods and confectionery products, weathering, drying out | Protective packaging |

| Loss of properties | Loss of natural odor of the product Presence of foreign odors | Liquid volatilization and absorption | Vacuum sealing of goods and hermetic packaging |

All changes that occur to a product during its storage reduce its value. The organization suffers losses, or they fall on the buyer. And this, in turn, reduces demand. For companies with inventories, it is important to take care of the safety of goods and provide them with storage conditions.

Each group of technical requirements (inventory) has its own reasons for the occurrence of commodity losses. For example, the non-food group is less exposed to air or biological factors. Food products, on the other hand, are susceptible to almost every one of the above factors. It is worth noting that the storage time for all products is different.

Accounting in trade 1997'4

| Home | Search | Editions | Contacts | k-press.ru | |

Accounting for commodity losses

Before a product reaches the final consumer, it goes through many stages, at each of which losses may occur for both objective and other reasons. Therefore, it is important for an accountant of a commercial enterprise to know how to identify, register and account for such losses.

Let us recall that losses of goods that occur at commercial enterprises can be divided into groups depending on the stage of movement of goods at which they occurred: during transportation, storage in warehouses, in preparation for sale and at the time of sale itself.

In addition, a distinction is made between normalized and non-standardized losses. While the latter, as a rule, are a consequence of mismanagement (damage to goods, shortages, theft, etc.), standardized losses are usually associated with changes in the physical and chemical properties of goods and are objective in nature.

The procedure for registration and reflection on accounting accounts of commodity losses arising at all stages of the movement of goods is regulated by the Methodological Recommendations for the accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1 –794/32–5 (hereinafter referred to as Methodological Recommendations).

Rationing of commodity losses arising during transportation and storage in warehouses of trading enterprises

The following groups of losses can be distinguished for which standards have been established.

1. Natural loss of goods - losses caused by changes in physical and chemical properties that occur during transportation and storage of goods.

Natural loss rates are established for standard goods as a percentage of cost (weight) for both food and individual non-food products. The list of current standards is given in the letter of the Ministry of Trade of the USSR dated May 21, 1987 M'085 “On the norms of natural loss of food products in trade”, as well as in the appendix to the order of the Ministry of Trade of the RSFSR dated February 22, 1988 No. 45 “On approval of the norms of natural loss fresh potatoes, vegetables and fruits in urban and rural retail chains and instructions for their use.”

Natural loss of goods that occurs during transportation includes: shrinkage, attrition, weathering, spraying, crumbling, leakage, breakage, etc.

The norms of natural loss established for food products depend on:

- type (group) of goods;

- type of transport;

- transportation distances;

- period of the year (warm or cold).

In this case, the period from May 1 to September 30 is considered warm for areas located north of 50 degrees N, or from April 1 to September 31 for areas located south of 50 degrees N.

Norms of natural loss when storing food products in warehouses, bases, retail trade enterprises and public catering establishments are established depending on:

- type (group) of goods;

- climatic zone (first or second zone). The second zone includes Dagestan, Kalmykia, Astrakhan and Volgograd regions, all other territories of the Russian Federation - the first zone;

- store groups (determined depending on the annual turnover and sales area and is established annually by order of the trading enterprise);

- season;

- shelf life of goods;

- storage conditions.

2. Losses from broken goods in glass containers and fragile goods (glass, crystal, etc.).

Product losses in this group can also occur at all stages of the movement of goods. The norms for these losses are established as a percentage of the amount of goods received and sold and are different for domestic and imported goods.

These losses are written off upon the actual presence of a battle within the established norms for distribution costs.

3. Actual additional losses associated with the sale of goods using the self-service method. Norms are set as a percentage of actual turnover, depending on the specialization of the store and the area of the sales floor. If there is a shortage of goods within the approved standard, these losses are written off as distribution costs. In stores selling a universal range of goods, the amount of write-offs from the sale of goods using the self-service method should not exceed 0.3% of turnover.

4. Losses resulting from damage to goods, damage to containers, as well as the curtain of containers are also included in the normalized category. If these losses are detected within the established standards, you can reduce the amount of goods received at the expense of the supplier or at the expense of the enterprise itself.

5. Commodity losses arising in the process of preparing goods for sale are not included in the norms of natural loss, but are also included in the normalized ones:

- waste generated during the preparation for sale of sausages, smoked meats and fish sold after preliminary cutting;

- butter stripping;

- crumbs formed during the sale of granulated caramel and refined sugar.

The procedure for identifying and recording commodity losses arising during transportation

Losses from shortages, damage, damage to goods that occurred during transportation are identified upon acceptance of goods. At the same time, in accordance with clause 2.1.7 of the Methodological Recommendations, each case of detected losses is documented in a special act (OKUD code 0903001).

Situation one

The retail trade organization purchased in July:

- boiled sausage - 1225 kg at a price of 22,000 rubles. for 1 kg in the amount of 26,950,000 rubles. (including VAT - 10%);

- cheese in paraffin coating - 1150 kg at a price of 11,000 rubles. for 1 kg in the amount of 12,650,000 rubles. (including VAT - 10%);

- mayonnaise in glass jars - 3000 jars at a price of 2000 rubles. for a jar in the amount of 6,000,000 rubles. (including VAT - 10%).

The goods were delivered by road.

The transportation distance was 35 km.

Upon acceptance of the goods, the following losses of goods were discovered: a shortage of 5 kg of boiled sausage (worth 10,000 rubles), damage to 0.3 kg of cheese (worth 3,300 rubles), broken 20 cans of mayonnaise (worth 40,000 rubles).

Since losses were identified upon acceptance of the goods, it is necessary to determine whether they can be entirely attributed to natural loss and to what extent the losses are excessive.

When transporting these goods by road over a distance of 35 km in the warm season, the following norms for natural loss and losses from breakage of goods in glass containers are established (see letter of the USSR Ministry of Trade dated May 21, 1987 M'085):

- boiled sausage 0.09%;

- paraffin-coated cheese 0.04%;

- mayonnaise in glass jars 0.05%

The accounting department of the enterprise must calculate the amount of natural loss for each product using the following formula (clause 9.19 of the Methodological Recommendations):

Eu = (Hx T) /100,

Where

- Ey - the amount (size) of natural loss in monetary terms (or in quantitative terms);

- N - rate of natural loss, %;

- T is the cost (weight) of the product.

Thus, the size of the natural loss of boiled sausage is:

- in kind:

- 1225 kg - 0.09%: 100% = 1.1 kg;

- in monetary terms:

- 22,000 rub. — 1.1 kg = 24,200 rub.

The amount of natural loss of cheese:

- in kind:

- 1150 kg - 0.04%: 100% = 0.46 kg;

- in monetary terms:

- 11,000 rub. — 0.46 kg = 5060 rub.

Limit amount of losses from broken glass containers with mayonnaise:

- in kind:

- 3000 ban. — 0.05%: 100% = 1.5 bans;

- in monetary terms:

- 2,000 rub. — 2 ban. = 4,000 rub.

Please note: if losses from broken glass containers with goods according to established standards are less than one can (bottle), then when calculating standards, shares of up to 0.5 units of product are discarded, and 0.5 and above are rounded up to one. For example, in this example, the maximum amount of losses from fighting when transporting mayonnaise is rounded up to 2 cans.

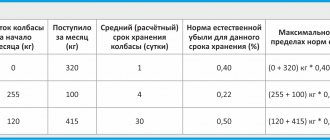

For clarity, we summarize the results of the calculations in Table 1.

Table No. 1

| Name of product | Weight/quantity according to invoice | Natural loss in kind | Actual loss in kind | Cost of goods according to invoice | Natural loss in monetary terms | Actual loss in monetary terms |

| Sausage | 1225 | 1,1 | 5 | 26 950 000 | 24 200 | 110 000 |

| Cheese | 1150 | 0,46 | 0,3 | 12 650 000 | 5060 | 3300 |

| Mayonnaise | 3000 | 2 | 20 | 6 000 000 | 4 000 | 40 000 |

In the accounting accounts, the receipt and posting of goods by a retail trade enterprise will be reflected as follows (in the case under consideration, under the terms of the contract, the delivery of goods to the buyer’s warehouse was carried out by the supplier):

1. Reception of boiled sausage

Dt sch. 60 Set count. 51 - 26,950,000 rubles - transferred to the supplier as payment for the goods

Dt sch. 41 Set count. 60 - 26,840,000 rubles - actually accepted goods are capitalized (26,950,000 - 110,000)

Dt sch. 84 Set count. 60 - 24,200 rubles - the shortage of goods is reflected within the limits of natural loss during transportation

Dt sch. 63 Set count. 60 - 85,800 rubles - a claim was made to the supplier for a shortage of goods in excess of the norms of natural loss (110,000 rubles - 24,200 rubles)

Dt sch. 44 Set count. 84 - 24,200 rubles - the shortage of goods within the limits of natural loss during transportation is written off as distribution costs (at purchase prices)

Dt sch. 51 Set count. 63 - 85,800 rubles - the amount of the claim was received from the supplier for losses of goods that occurred in excess of the norms.

In the event that the supplier does not accept claims for the loss of goods and the arbitration office refuses to satisfy the claim in this regard, the resulting excess losses are charged to account 84 “Shortages and losses from damage to valuables” from the buyer:

Dt sch. 84 Set count. 63 - 85,800 rubles - the identified excess amount of losses is reflected.

The total amount of identified losses is listed on account 84 until a decision is made on the procedure for writing them off.

Dt sch. 80 Set count. 84 - 85,800 rubles - the amount of excess losses, the recovery of which was refused by the court (as losses from theft, the perpetrators of which were not identified by a court decision based on clause 15 of the Regulations on the composition of costs for the production and sale of products (works) is written off as losses of the enterprise , services) included in the cost of products (works, services), and on the procedure for generating financial results taken into account when taxing profits, approved by Decree of the Government of the Russian Federation of August 5, 1992 No. 552, taking into account subsequent changes and additions).

2. Eating cheese

Dt sch. 60 Set count. 52 - 12,650,000 rubles - transferred to the supplier as payment for the goods.

Dt sch. 41 Set count. 60 - 12,646,700 rubles - the goods actually received were capitalized (12,650,000 - 3,300).

Dt sch. 84 Set count. 60 - 3,300 rubles - the shortage of goods is reflected within the limits of natural loss during transportation.

Dt sch. 44 Set count. 84 - 3,300 rubles - written off as distribution costs: shortage of goods within the limits of natural loss during transportation.

We draw your attention to the fact that according to the norms of natural loss, only actually identified losses are written off, and not the entire amount of permissible natural loss, i.e., writing off 5,060 rubles is unacceptable. instead of the actual 3300 rubles.

3. Taking mayonnaise

Dt sch. 60 Set count. 51 - 6,000,000 rubles - transferred to the supplier as payment for the goods.

Dt sch. 41 Set count. 60 - 5,960,000 rubles - the goods actually received were capitalized (60).

Dt sch. 84 Set count. 60 - 4,000 rubles - the shortage of goods is reflected within the limits of natural loss during transportation.

Dt sch. 63 Set count. 60 - 36,000 rubles - a claim was made for excess breakage of glass containers with mayonnaise (shortage of goods).

Dt sch. 44 Set count. 84 - 4,000 rubles - written off as distribution costs: shortage of goods within the limits of natural loss.

Dt sch. 51 Set count. 63 - 36,000 rubles - the amount of the claim was received from the supplier for losses of goods that occurred in excess of the norms.

A claim for shortage, damage or damage to goods can be brought against both the supplier and the transport organization, depending on who is responsible for the losses in a particular case. In the accounting accounts, in both cases, the amount of the claim is reflected in the debit of account 63 (the corresponding subaccounts for accounting for settlements with a supplier or transport organization) in correspondence with the credit of account 60 (for the subaccount for accounting for settlements with a supplier).

If the goods were transported by the purchasing company’s transport, then all the goods, according to the invoice, are credited to the debit of account 41 in correspondence with the credit of account 60, and then the amount of shortages identified upon acceptance of the goods to the warehouse is written off from the credit of account 41 to the debit of account 84. When In this case, as in the above example, the amount of the shortage within the established norms of natural loss is written off as distribution costs (D-t account 44 K-t account 84), and in excess of the norms of natural loss - to the guilty persons or, if recovery is impossible the amount of losses from the guilty parties (which must be established by a court decision) - on the financial results of the organization’s activities (i.e., included in non-operating expenses).

Please note that in the example under consideration, the money for the goods has already been transferred to the supplier.

In the event that money is transferred to the supplier after receipt of the goods, but the terms of the contract do not provide for the buyer’s refusal to pay for missing or damaged goods, an act is also drawn up for the identified losses and a letter of claim is sent to the supplier. The procedure for recording operations for receiving goods and writing off losses at the expense of the supplier in the accounting accounts is similar to the above.

If money is not transferred to the supplier for the goods received from him and the contract provides for the attribution of losses to his account, then no entry is made on account 63. When paying for goods, the buyer simply reduces the payment amount by the cost of the lost (damaged) goods (clause 3.1 of the Methodological Recommendations).

The procedure for identifying and writing off losses that occurred during the period of storage of goods in the warehouse

The presence and condition of inventory in retail warehouses is determined during the inventory. In this case, one should be guided by the procedure established by the Methodological Guidelines for Inventorying Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and the Regulations on Accounting and Reporting, approved by Order of the Ministry of Finance of the Russian Federation dated December 26, 1994 No. 170.

The frequency of inventories during the reporting year in accordance with the Regulations on Accounting and Reporting in the Russian Federation is established by the head of the enterprise. In this case, an inventory is required in the following cases:

- when transferring the property of enterprises for rent, during redemption, sale, as well as during the transformation of a state or municipal enterprise into a joint-stock company or partnership;

- before drawing up financial statements (if the last inventory of property was carried out earlier than October 1 of the reporting year). Enterprises located in the Far North and equivalent areas can carry out inventory of goods during the period of their smallest balances;

- when changing the financially responsible person (on the day of acceptance and transfer of funds);

- when establishing facts of theft or damage to valuables;

- in case of fire or natural disasters;

- during the liquidation of an enterprise before drawing up a liquidation balance sheet and a number of other cases provided for by law.

Losses from damage, scrap and broken goods identified during the inventory are reflected in the Act on damage, broken, scrap (OKUD code 0903008). The act must indicate the name, article, grade, price, quantity and value of the goods, the cause and culprits of the loss, the possibility of further use of the goods (sale at reduced prices, delivery for processing, scrap, feeding enterprises, etc.) or destruction .

The act of damage, damage, or scrap is transferred to the accounting department. After the accounting department checks the correctness of the act, it is approved by the head of the enterprise. At the same time, the question is being resolved at whose expense the losses should be written off.

Calculation of the amount of natural loss, within which the shortage of goods identified during the inventory can be written off as distribution costs, is made only for goods actually sold during the inter-inventory period. Natural loss that may arise from the balance of goods at the end of the inter-inventory period is not included in distribution costs. At the same time, within the limits of natural loss norms, only actually identified losses can be written off, i.e., writing off an amount exceeding the actual shortfall is unacceptable.

Since in retail trade, as a rule, there is no analytical accounting of goods sold by type, to determine the turnover for the sale of a particular type of product, it is proposed to use the commodity balance formula (clause 9.22 of the Methodological Recommendations):

P = He + P - V - Ok,

Where

- P is the cost of goods sold during the inter-inventory period,

- It is the balance of goods at the beginning of the period between inventories,

- P - receipt of goods during the inter-inventory period,

- B - documented disposal of goods (return, internal transfer, except sales) during the inter-inventory period,

- Ok - the balance of goods at the end of the period between inventories.

For goods whose damage or shortage was identified as a result of inventory, the accounting department calculates the amount of natural loss using the above formula Ey (0 - T) / 100.

The amount of natural loss is determined for each specific product. The calculated amounts for each product (product group) are added up, ultimately forming the sum of natural loss for all products.

Losses from damage, breakage, or scrap of goods that exceed established standards are considered as non-standardized, i.e., arising as a result of mismanagement, and are attributed to the guilty parties. In cases where it is impossible to identify the guilty persons, or their innocence is proven in court, the amount of excess losses is written off as non-operating expenses of the organization.

Situation two

The store is located in climate zone 1 and belongs to group II. The inventory was taken on July 31, 1997.

The balance of frozen meat as of July 1, 1997 (based on the results of the previous inventory) is 40 kg.

Received during the period from July 1, 1997 to July 31, 1997—10,000 kg of frozen meat.

Sold during the period from July 1, 1997 to July 31, 1997—9950 kg of frozen meat.

The balance of frozen meat as of July 31, 1997 is 70 kg.

According to calculations based on documents, the remaining meat should be 90 kg (40 kg + 10,000 kg - 9,950 kg).

Thus, during the inventory, a shortage of 20 kg of frozen meat was discovered (the accounting price is 15 thousand rubles per 1 kg). The actual shortage in value terms is:

15,000 rub. — 20 kg — 300,000 rub.

The amount of natural loss for meat sold during the inter-inventory period is:

9950 kg - 0.04%: 100% 3.98 kg;

or in value terms:

(15,000 rub. - 9950 kg) - 0.04%: 100% 59,700 rub.

Thus, the loss is 16.02 kg (20 kg - 3.98 kg) in the amount of 240,300 rubles. (300,000 rubles - 59,700 rubles) occurred in excess of the norms of natural loss.

The following entries will be made in the accounting accounts:

Dt sch. 84 Set count. 41 - 300,000 rubles - the cost of the actual shortage identified during the inventory is written off.

Dt sch. 44 Set count. 84 - 59,700 rubles - the cost of the shortage is written off within the limits of natural loss norms.

Dt sch. 73 K-t count. 84 - 240,300 rubles - the cost of the shortage in excess of the norms of natural loss is written off to the guilty parties.

If the shortage, which occurred in excess of the norms of natural loss, is a consequence of theft, and the perpetrators are not identified by a court decision, then its cost is written off as losses of the enterprise:

Dt sch. 80 Set count. 84 - 240,300 rub.

If the structure of the store’s turnover is stable, then, with the consent of the financially responsible person, to write off losses within the limits of natural loss norms, the average rate of loss from the total turnover of the store during the inter-inventory period can be established.

The average loss rate is a calculated value obtained by dividing the amount of commodity losses within the limits of natural loss rates identified for the previous reporting period (for example, a year) by retail turnover for the same period. The average rate of natural loss is approved by the head of the enterprise.

The write-off of the actual shortage of goods identified as a result of the inventory, within the established norms, is written off from the financially responsible person at the prices at which the goods were posted.

Please note that commodity losses are written off at purchase prices as distribution costs.

Losses of goods that occurred during storage of goods in a warehouse and discovered as a result of inventory are written off in the month of the inventory (clause 9.24 of the Methodological Recommendations). But since the natural loss of goods occurs throughout the entire inter-inventory period, losses should be distributed evenly over all months of this period. For this purpose, the enterprise can create a reserve for writing off losses from natural loss (i.e., the planned amount of losses from natural loss is written off monthly as distribution costs).

Dt sch. 44 Set count. 89 - a reserve is accrued for writing off losses from natural loss (monthly).

Dt sch. 89 Set count. 84 - losses of goods (at purchase prices) are written off from the reserve.

If at the end of the reporting period (during an inventory) the amount of the accrued reserve turned out to be less than the actual shortage of goods that occurred as a result of natural loss, then the reserve is adjusted: an entry is made for its additional accrual for the amount of the specified difference (D-t. 44 K-t. 89). In the event that the reserve exceeds the actual losses, the excess accrued amount is reversed (clause 9.24 of the Methodological Recommendations).

When releasing goods from retail warehouses, the amount of natural loss is calculated for each product depending on the established and actual periods of its storage. In this case, the norms of natural loss at the time of goods release are determined based on daily norms.

Example. The norms for the natural loss of ice cream meat when stored in retail and public catering warehouses located in the first climatic zone are set at:

0.08% when stored for three days;

with a storage period of 3 to 10 days, the norms of natural loss increase by 0.01% for each subsequent day of storage;

with a storage period of 10 to 30 days, the norms of natural loss increase by 0.005% for each subsequent day.

This product was stored in the warehouse for 14 days.

In this case, the rate of natural loss for meat released from the warehouse will be:

for the first three days - 0.08%;

for a period from 4 to 10 days (7 days in total): 0.01% - 7 days. = 0.07%;

for the period from 11 to 14 days (4 days in total): 0.005% - 4 days. = 0.02%;

the general rate of natural loss for 14 days: 0.08% + 0.07% + 0.02% = 0.17%.

The procedure for identifying and accounting for commodity losses from packaging containers

A shortage of goods may also be a consequence of the container in which the goods are delivered being closed. The tare weight is the difference between the actual tare weight and its marked weight.

Received goods are by net weight. In this case, the net mass is determined by subtracting from the gross mass the mass of the container in accordance with its labeling. After the sale of the goods, the container from under it may be hung up and turn out to be larger than it was taken into account (for example, due to the weight of the container incorrectly indicated in the shipping documents or due to the absorption of part of the liquid goods into it).

The rules for registration and accounting of containers were approved by letter of Roskomtorg dated July 10, 1996 no. 1–794/32–5.

The amount of containers must be written off from the financially responsible person, since the quantity of goods sold turns out to be less than what was capitalized. Therefore, all goods for which there may be a curtain of containers must be registered in the “Registration Book of Goods, Materials Requiring a curtain of containers” (OKUD code 0903006) (clause 9.8 of the Methodological Recommendations).

Entries in the Book are made on the basis of receiving commodity documents. The curtain of containers is drawn up in the “Act on the curtain of containers” (OKUD code 0903005), which is drawn up in two copies. The first one is attached to the product report; the second is sent along with the complaint to the supplier (if he incorrectly indicated the tare weight) to compensate for losses at his expense.

In this case, the following accounting entries are made: Dt account. 84 Set count. 41 - commodity losses from containers are reflected (at purchase prices).

Dt sch. 63 Set count. 84 - losses from containers are written off (at purchase prices) at the expense of the supplier.

Dt sch. 51 Set count. 63 - funds were received from the supplier to compensate for losses from the curtain of containers.

We draw your attention to the fact that the certificate for the curtain of containers must be drawn up within the time limits established by the contract for the supply of goods, but no later than 10 days after the container is emptied (clause 9.11 of the Methodological Recommendations). If the specified container contained a liquid product, then it must be sealed immediately after its release. In this case, a mark must be made on the container indicating the date of its completion and the certificate number in order to avoid repeated write-off of the same container (and. 9.11 of the Methodological Recommendations).

If the arbitration court refused to file a claim for these commodity losses to the supplier (for example, due to the fact that the certificate for the curtain of containers was drawn up in violation of the requirements for it or at a later date), then the losses should be attributed to the perpetrators - employees trading enterprise that committed these violations.

Dt sch. 84 Set count. 41 - commodity losses from containers are reflected (at purchase prices).

Dt sch. 73 Set count. 84 - the amount of commodity losses is attributed to the perpetrators.

Repayment of the accrued amount by guilty persons can be made by deduction from wages: D-t. 70 Set count. 73 or by the guilty person depositing sums of money to repay the shortfall to the enterprise’s cash desk:

Dt sch. 50 Set count. 73.

An act is not drawn up for hanging containers of fish and fish products (except caviar) (clause 9.13 of the Methodological Recommendations). Suppliers usually provide an additional discount for these products. When goods are received, this discount is credited to account 42 “Trade margin” to the analytical account “Discount on containers”. In this case, the amount of containers is written off only when an excess shortage of goods is identified as a result of inventory. First, the amount of the discount received is debited from the specified account (D-t account 42 K-t account 84), and then the natural loss of goods is written off in the prescribed manner (clause 9.16 of the Methodological Recommendations).

We draw your attention to the fact that current legislation does not provide for the possibility of writing off commodity losses from containers as distribution costs. Therefore, in exceptional cases, when the supplier’s claim is rejected by arbitration and the perpetrators are not identified, losses from the curtain of containers are written off to the account. 81 “Use of profits”.

Losses when selling goods using self-service

The norms for losses arising from the sale of goods by self-service and with open display are established depending on the specialization of retail enterprises and the area of the sales floor. The planned level of commodity losses is set as a percentage of turnover. The maximum amount of write-offs from sales is 0.3% of turnover for stores with a universal assortment.

Such losses are written off, if they are actually identified, in a manner similar to the write-off of losses as a result of natural loss: at the expense of the accrued reserve.

The amount of monthly contributions to the reserve is determined by the formula (clause 9.26 of the Methodological Recommendations):

P = Tf - Upl: 100,

Where:

- P is the amount of contributions to the reserve,

- Tf - actual turnover for self-service and open display,

- Upl is the planned level of commodity losses.

Accrued reserves for losses when selling goods by self-service and with open display may be included in distribution costs.

We draw your attention to the inadmissibility of including this group of losses in the cost of goods.

Accounting for losses incurred during the preparation of goods for sale

The current rules for the sale of food products provide that certain products require preliminary preparation for sale. For example, sausages and a number of meat products must be freed from containers, paper packaging, metal and rope clips and ties, etc. It is mandatory to clean and cut off contaminated and weathered surfaces in preparation for the sale of butter, cheeses, and fats.

Drawing up an act for writing off losses and waste arising during the preparation of food products for sale is not required. The calculation of waste sizes is carried out in accordance with established standards directly on the supplier’s sales documents. In accordance with the terms of the supply agreement, when these products are capitalized, the amount of the trade discount is reduced by the cost of the waste (i.e., the waste is written off at the expense of the supplier) or charged to the account of the trading enterprise.

In particular, the procedure for accounting for waste generated during the preparation for sale of a number of meat and sausage products is established in accordance with the Instructions for the application of waste standards for sausages and pork products during preparation for sale in retail trade and public catering establishments, approved by order of the USSR Ministry of Trade dated 31 March 1989 No. 37.

According to the specified Instructions, when conducting an inventory in the statements, the balances of the goods listed in it are reflected as follows:

- if the goods are prepared for sale, then in the “name of goods” column the entry “cleaned” is made, and in the “net” column the weight of the remainder is indicated;

- if the goods are not prepared for sale (together with waste), then in the “name of goods” column the entry “uncleaned” is made, and in the “net” column the net weight of the residues is indicated, defined as the difference between the weight of the residues (gross weight) and discounts for waste , calculated according to approved standards.

Situation three

The inventory revealed the presence in the warehouse of 50 kg of smoked cervelat sausage produced in Finland, not prepared for sale. The waste rate for this type of sausage is set at 0.25%.

In the inventory sheet, in the “net” column, the weight of this balance will be indicated - 49.875 kg, calculated as follows:

- The weight of waste is determined according to the standards - 50 kg - 0.25: 100 - 0.125 kg;

- net weight of the remainder - 50 kg - 0.125 kg - 49.875 kg.

The procedure for writing off losses when preparing goods for sale is determined by clause 2.13 of the Methodological Recommendations for Accounting of Costs Included in Distribution and Production Costs, and Financial Results at Trade and Public Catering Enterprises, approved by the letter of the RF Committee on Trade dated April 20, 1995 M' 1–550/32–2.

Losses arising in the process of preparing goods for sale are assessed from the point of view of the possibility of covering them. For example, part of the waste generated during the preparation for sale of these products can be sold to the trading enterprises themselves at lower prices (ham bones, heads, tails and fins of fish). Stripping animal butter and margarine, sugar crumbs (when selling sugar and sprinkled caramel), stale bakery products, sour dairy products can be recycled and written off on the basis of invoices at the prices at which this waste was delivered.

Situation four

The organization sells butter at a price of 20,000 rubles. per kg. The purchase price of oil is 16,000 rubles. for 1 kg. Trade allowance - 4,000 rubles. for 1 kg.

Butter strips in the amount of 10 kg are handed over for processing at a negotiated price of 10,000 rubles. for 1 kg.

In the accounting accounts, the specified operation will be reflected as follows (accounting is carried out at sales prices):

Dt sch. 41 Set count. 60 - goods were capitalized at the purchase price, including 160,000 rubles - the cost of oil stripping (16,000 rubles - 10 kg).

Dt sch. 41 Set count. 42 - the trade allowance is reflected, including 40,000 rubles - the trade allowance for stripping (4,000 rubles - 10 kg).

Dt sch. 84 Set count. 41 - 200,000 rubles - reflects the cost of stripping at the discount price (20,000 rubles - 10 kg).

D-t. sch. 42 Set count. 83–5 - 40,000 rubles - reflects the trade markup for stripping.

Dt sch. 62 Set count. 84 - 100,000 rubles - the cost of stripping is written off at the sales price (10,000 rubles - 10 kg) Dt inc. 83–5 Set count. 84 - 40,000 rubles - the difference between the accounting and purchase prices related to strippings is written off [(20,000 rubles - 16,000 rubles) - 10 kg].

Dt sch. 44 Set count. 84 - 60,000 rubles - the difference between the purchase and sale prices of strippings is written off [(16,000 rubles - 10,000 rubles) - 10 kg].

Grimalsky V.L. President of the auditing firm “Alyagr-M”

Copyright © 1994-2016 K-Press LLC

Norms

The losses of different groups of goods have their own values. Rationing of losses is typical only for natural commodity losses. Shrinkage, spray per ton of product, or spillage can be quantified. Based on the normative data that was generated during observation and research, there are indicators of natural loss. Determination of the weight of cereals lost during storage is calculated using the formula:

X = AB / 90, where

X is the required indicator;

A - loss rate up to 90 days;

B - average number of days of storage.

If the period exceeds three months, then the indicator is adjusted by the difference between the highest norm and the average (up to three months), taking into account the full shelf life.

Topic 17. Types of commodity losses, measures to reduce them, write-off procedure

For various reasons, the movement of goods from production sites to consumers is accompanied by commodity losses. In stores, product losses occur in the process of storing goods, preparing them for sale and sale.

Commodity losses are divided into standardized and non-standardized. Types of losses are presented in Fig. 1.

Rice. 1. Types of commodity losses

Natural loss is the loss of a product (a decrease in its weight while maintaining quality within the requirements of regulatory documents), which is a consequence of the physical and chemical properties of the product, the impact of meteorological factors and the imperfection of the currently used means of protecting products from losses during transportation, storage and sale.

Natural decline is a consequence of:

¨ drying, weathering, spraying;

¨ leaks (melting, seepage);

¨ bottling when pumping and dispensing liquid goods.

These reasons lead to the following:

1.Norms of natural loss are not established for products:

¨ accounting of the quantity is carried out in units different from mass;

¨ transported or stored in sealed containers;

¨ easily absorbs moisture (when transported by sea and river transport).

2.Norms of natural loss do not apply to goods that are accepted and released by the organization in the container or packaging of the first seller without weighing (by count or by stencil).

3.Natural loss norms do not apply to goods that have manufacturing defects specified in the relevant regulatory and technical documentation (GOSTs, OSTs, TUs).

4.Natural loss does not include losses caused by violation of standards, technical conditions, cargo transportation rules, as well as losses due to damage to containers and changes in product quality. These losses are classified as activated and are written off in accordance with the established procedure.

5.Natural loss rates are differentiated by type (group) of product and its packaging; they depend on the type of transport and the distance of transportation; standards vary depending on the climatic zone, time of year, conditions and shelf life of the goods.

Commodity losses from breakage, scrap, damage to goods and damage to consumer packaging, to a certain extent, are also the result of a number of objective (for trade organizations) reasons:

¨ introduction of economical but fragile transport packaging (cardboard boxes, paper and mesh bags, polymer film, etc.);

¨ insufficiently high level of mechanization of loading and unloading operations;

¨ condition of roads, etc.

Standardized technological waste and trade losses are:

¨ waste generated during the preparation for retail sale of sausages and smoked meat products in pure mass;

¨ waste and loss of meat, meat products, and other goods during machine cutting in stores;

¨ loss of dry ice and carbon dioxide consumption due to the technology for selling certain types of goods, and other losses.

The norms for commodity losses are divided into norms:

¨ commodity losses during transportation;

¨ commodity losses during storage;

¨ commodity losses in the retail trade network;

¨ technological waste and losses.

Product losses from breakage, scrap, damage to goods or damage to consumer packaging