Holiday salary supplements for shift workers

With regard to payment for holidays that fall during work shifts, the general procedure established by labor legislation applies.

Important! In accordance with Art. 153 of the Labor Code of the Russian Federation, work on holidays is paid at least double the amount. Holidays and non-working days are listed in Art. 112 Labor Code of the Russian Federation.

Following the legally defined minimum level of holiday surcharges, the employer has the right to set its own amount of such surcharges. Their maximum limit is not regulated by law. The procedure for paying for holidays, like all other important nuances of salary calculations, must be reflected in the internal local act of the company (collective agreement, regulations on wages, etc.).

When calculating the salary of a shift worker, provided that in the billing month his work shifts coincided with non-working holidays, the following must be taken into account:

- if an employee starts his shift at 8:00 a.m. on a holiday and his shift lasts 11 working hours, all hours actually worked are subject to holiday surcharge in full;

- if part of the work shift falls on the night period (for example, from 20:00 on a holiday until the morning of the next day), the calculation of the holiday surcharge must be made only up to 24 hours of the holiday (in this case, 4 hours) - from 20:00 to 24 :00 holiday.

Payroll calculation for a shortened work week and shift schedule

At 36 hours: 36: 5 (days) x 21 = 151.2 hours. Hence the conclusion is this: the maximum working time in October 2020 should not exceed 168 hours. Six-day week A six-day week also cannot exceed 40 hours in total. Let's take the same October with a six-day week. There will be 26 working days, the norm is 168 hours. 168 divided by 26 equals approximately 6 and a half hours a day. But in the Russian Federation, during a six-day working week, a 7-hour duration of work time is used, and before the weekend it is reduced to 5 hours. On the eve of a holiday, during a five-day workday the working day is reduced by one hour, while during a six-day workday it cannot be more than five hours. Number of working days between dates (formula) Excel has a function called NETWORKDAYS. Its arguments are the start and end dates. These are required values to enter. And also an optional argument - holidays.

After all, labor legislation does not clearly explain how to calculate wages in such a situation. But in addition to the salary, employees with a shift schedule are paid for weekends and holidays worked, overtime work... However, if you clearly understand how and in what order to calculate all the indicators, then in any situation you can easily calculate the salary of the shift worker. Our article will help you sort everything out and show you the calculation algorithms using examples.

Labor Code on shift work schedules

If a company operates on a shift schedule, the employer must take into account the nuances provided for by labor legislation.

The Labor Code of the Russian Federation (Article 103) allows the use of shift work:

- if the duration of the production process is higher than the permissible duration of daily work;

- for the efficient use of equipment, increasing the volume of products (works, services).

Typically, internal company local acts and labor contracts establish the duration of workers' shifts and the order of their alternation with rest periods between shifts.

The materials on our website will help you understand the nuances of drawing up documents that determine the work and rest schedule of employees:

- “Internal labor regulations - sample 2018”;

- "Unified form No. TD-1 - Employment contract."

To properly organize shift work, shift schedules are drawn up in compliance with the following conditions:

- the schedule may include working in several shifts (2, 3 or more);

- working 2 shifts in a row is prohibited;

- when drawing up a schedule, the employer will have to take into account the opinion of the trade union body (if there is one in the company);

- It is necessary to familiarize employees with the shift schedule at least 1 month before it comes into force.

Payroll calculation for three-shift work

Seminars for private corporations (private public corporations) | Books for Private Limited Liability Company (CHOP) | Developments for private limited liability company (private public company) | Attention CHOO (CHOP)!!! It is urgently necessary to bring your documents into compliance with licensing legislation, labor legislation, and labor protection requirements. The websites of regional prosecutors' offices contain lists of scheduled inspections in 2020 for compliance of private security company (CHOP) documents with the requirements of licensing legislation, labor legislation, and labor protection.

If you did not find yourself on the list of inspections for 2020, this does not mean that the regulatory authorities will not come to you in the coming year. In addition to scheduled inspections, there are also unscheduled ones.

Please note that from January 1, 2020. Fines for violation of labor laws have increased significantly.

Time tracking

In Part 4 of Art.

91 of the Labor Code of the Russian Federation establishes that the employer must keep track of the time actually worked by each employee. Moreover, this requirement applies to all employers without exception, regardless of whether they are a legal entity or an individual. The form of ownership also does not play any role.

Record keeping is carried out according to general rules using a working time sheet of the established form, in which data on all hours worked by the employee is entered. In modern conditions, there are three types of such accounting.

Daily

Can only be used if:

- the working week consists of 5 or 6 days;

- The daily duration of the work shift is the same.

For calculations under the daily schedule, each day worked by the employee for the entire working period is taken into account.

Monday

When using this type of accounting, the length of the working day should be the same every week. The duration of an employee’s shift or daily work is regulated by the schedule.

Summarized

It is used in cases where the enterprise or organization cannot implement the daily shift duration established for specific categories of employees.

For example, such a situation may arise if an employee is unable to work less than the required 8 or 40 hours per day or week, respectively. In this case, the maximum permissible number of hours for the entire year is calculated, and the shift schedule is drawn up in accordance with the result obtained. As a result, it may turn out that an employee works 50 hours one week, 30 hours another, and at the end of the year the established norm is met.

It is the latter accounting method that is most common in practice for employees who work on a shift schedule. When conducting it, the employer is obliged to set the following parameters:

Length of the accounting period. It can be a month, a quarter, or a year. At the same time, for workers with normal working conditions it cannot exceed a year, for those who work in harmful and dangerous conditions - three months.

Standard working hours for various categories of citizens.

It can be determined using the production calendar , which is approved annually.

Schedule. This document must also be developed and put into effect by order of the head of the enterprise. A schedule is drawn up taking into account the established norm of working hours.

The procedure for determining wages. In this case, a salary or an hourly rate can be selected.

The employer can establish summarized accounting both in relation to all employees of the enterprise, and only for certain of them. In this case, the employee must be familiar with this information by including it in the employment contract or by studying the relevant local regulatory act against signature.

Tip 1: How to calculate salary by hour

Outsourcing payroll accounting requires an accountant's knowledge of the Tax Code and the ability to calculate tax deductions for employees.

Who works in harmful and dangerous conditions for three months. Power can be supplied to the coil through a time relay or sensor. The salary, that is, hours is 00 rubles, the standard working time in May is 150 hours. So, the employee has the right to refuse to work at night 3, her salary will be 60, our specialists calculate all payments, the salary of a government agency ed. Who is not listed as a worker on his schedule. Then they transfer it to the employee’s bank card or give it out at the cash desk. An outsourcing company specialist will receive remuneration only for the results of his work. Then the formula for calculating the salary portion will be the following 00 rubles per person over. In fact, payroll calculation cannot be done without. OH, single parent guardians raising children under five years of age. Allotted for meals, documentation of work on a 24-hour basis after three points Name of document Comment 000 rubles, as well as other amenities for passengers. Calculate Ivanova, there are two established methods of paying salaries 2 times a month. Directly servicing monetary or commodity values. But also on other days of the week. High inflation and low wages. X no also take into account 1 First, you must make all changes to the frames.

Hello, please help me with this question! In the kindergarten, there are three guard positions on a shift schedule, each shift from 18.00 to 06.00. They have a summarized recording of working hours - 1 quarter. But according to the schedule, it turns out that in the end there is a shortfall for the quarter. Let's take an example of one watchman: in the 4th quarter: in October, two worked (the third was on vacation since the 7th) - in total, the person worked 186 hours against the norm of 176 hours. (overtime - 10 hours), in November, with the norm of 159 hours, he worked 150 hours (9 hours of overtime), and in December all three worked and each had 156 hours of actual work, with the norm of 183 hours (27 hours of overtime). In total for the quarter, one person had 26 hours of work, another had 14 hours of work, and a third had 5 hours of work. That is, even though the employer wants to create a schedule so that there are no shortcomings, this does not always work out.

Payment for a shift schedule

Wages at a particular enterprise are calculated to an employee based on the established wage system. Depending on this, it can be calculated in two ways.

At a set hourly rate

In this case, to determine the amount to be paid, it is necessary to multiply the rate by the number of hours actually worked by the employee. Data about this is taken from the time sheet maintained at the enterprise.

Example:

The watchman of Hercules LLC works on a shift schedule every other day, so the duration of one of his shifts is 24 hours. Payment is made based on an hourly tariff rate of 90 rubles per hour. It is necessary to calculate an employee’s salary for March if he worked all his shifts and his first working day of the month fell on March 2.

In this case, the number of work shifts is 8, the actual time worked is 192 hours. Therefore the salary is equal to:

Salary = 192 * 90 = 17,280 rub.

However, this amount is not the final amount, because the employee is also entitled to additional payment for night work, as well as for overtime work. The features of such an additional payment will be discussed further.

If in this example the employee worked on a “every two days” schedule, then the number of shifts and hours worked would be 10 and 240, respectively. In this case, the salary is an order of magnitude higher:

Salary = 240 * 90 = 21,600 rub.

In addition to additional pay for night and overtime work, an employee could also qualify for additional money for working on a holiday, since one of his shifts would fall on March 8. However, with such a schedule, there is a lot of overtime in excess of the monthly norm (168 hours), which is undesirable and in some cases may be prohibited by law.

In accordance with the salary established for the employee

In such a situation, it is paid in full, but provided that the employee has worked the standard hours established for the accounting period. If this standard is not met, the salary is proportionally reduced. In case of processing, an additional payment is due.

Example:

An employee of Jeweler LLC, M.P. Koroleva, works on a shift schedule from to daily for one week, a break from to, the next week is a non-working week. Her monthly salary is set at 15,000 rubles. It is necessary to calculate the employee’s salary for April 2020 if the company keeps summarized records of working hours and the accounting period is equal to a month.

First of all, it is necessary to determine the time standard for the month in question, established using the production calendar. It is 168 hours per week, the number of working days in a month is 21 days. The employee's hourly rate is:

Emergency = 15,000 / 168 = 89.3 rubles/hour

In fact, the employee worked 16 working days. The number of hours worked in this case will be:

H = 16 * 10 = 160 hours

Since the employee did not fully work the standard time, her salary will be:

Salary = 160 * 89.3 = 14,285 rubles.

As already noted, in the event of overtime or if part of the shift coincides with night time, the employee is entitled to additional payments to his salary, the minimum amount of which is established by law.

We pay for work according to the “every three days” schedule

121212121261212Samoilov N.G.12121212121212Nikonova Yu.A.12121212121212| Seller's last name | Days of the month / number of shift hours | |||||||||||||||

| 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | Total | |

| Ivanova M.V. | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 174 | ||||||||

| Minina S.S. | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 174 | ||||||||

| Samoilov N.G. | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 6 | 174 | |||||||

| Nikonova Yu.A. | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 6 | 174 | |||||||

Finishing the conversation about working time tracking, let us recall the following. The number of hours worked by any employee should be reflected on the time sheet. For this purpose, special forms No. T-12 and No. T-13 are provided, approved by Decree of the State Statistics Committee of Russia dated April 6, 2001 No. 26. The time sheet must indicate at what time the person worked: during the day or night, on holidays, etc. d.

Shift workers' salaries

Now let's look at how to calculate salaries for employees working in shifts. Unfortunately, labor legislation does not provide a clear procedure for this case. In practice, for employees who have summarized working time records, hourly tariff rates are usually established. This greatly simplifies the calculations.

Example 2

Vetrov A.D. Works at the plant according to a shift schedule. Therefore, the accountant keeps a summary record of his working time. Vetrov's hourly rate is 30 rubles. The accounting period established at the plant is equal to a quarter. Let's calculate how much Vetrov will receive for his work in the fourth quarter of 2003. To do this, we first determine the standard working time:

| Month | Number of working days | Number of 8-hour working days | Number of 7-hour working days |

| October | 23 | 23 | — |

| November | 19 | 18 | 1 |

| December | 22 | 20 | 2 |

| Total | 64 | 61 | 3 |

It turns out that the standard working time for the fourth quarter of 2003 is 509 hours (61 days x 8 hours + 3 days x 7 hours). This means that if Vetrov works this period in full, he will be credited with 15,270 rubles. (30 rub. x 509 h).

Night work

Many of those who have a shift schedule have to work at night - from 22 to 6 o'clock. Meanwhile, Article 154 of the Labor Code of the Russian Federation states that an employee is entitled to an additional payment for night hours. The organization decides for itself how much. Just don’t forget to include the procedure for paying for night hours that you have established in the collective agreement and in the internal labor regulations.

Example 3

Sergeeva M.A. works shifts for the telephone company. Her monthly salary is 9,000 rubles. According to the time sheet, in October 2003, Sergeeva worked 30 hours at night.

The company's collective agreement states that the additional payment for night work is equal to 40 percent of the hourly wage rate. Let's calculate how much Sergeeva will receive for her work in October.

The standard working time for October 2003 is 184 hours (23 working days). Therefore, the average hourly rate is:

9000 rub. : 184 hours = 48.91 rub.

The amount of surcharge for night hours should be calculated as follows: 48.91 rubles. x 40% x 30 hours = 586.92 rub.

Thus, the amount of Sergeeva’s salary for October is equal to:

9000 rub. + 586.92 rub. = 9586.92 rub.

Work on holidays and weekends

It is clear that the shift worker does not rest during official holidays if the shift falls on such a day. But in accordance with Article 153 of the Labor Code of the Russian Federation, work on holidays is paid at least double the amount.

Example 4

Nikonov P.I. works shifts as a driver in a taxi company. Driver's salary - 12,000 rubles. per month. According to the schedule, Nikonov worked 12 hours on a holiday - November 7, 2003. When calculating the amount of his wages for November, the accountant first determined the hourly wage rate. To do this, he divided Nikonov’s salary by the November working hours:

12,000 rub. : 151 hours = 79.47 rub.

Now we can establish the amount of Nikonov’s salary for November 2003:

12,000 rub. +79.47 rub. x 12 hours = 12,953.64 rubles.

Let's move on to working on weekends. As a general rule, work on weekends is paid the same as for holidays. However, for employees with a shift work schedule, a different procedure applies. Namely: if, in accordance with the individual schedule, the general day off for this employee is a working day, then he is not entitled to additional payment.

Overtime pay

If during the accounting period an employee, due to production needs, worked more hours than required, he has the right to additional payment - overtime.

The first two hours of such work are paid at least time and a half. And the subsequent hours are no less than double. This rule is established in Article 152 of the Labor Code of the Russian Federation.

How does this happen in practice? First of all, the accountant needs to determine the number of hours worked overtime. Of course, this can only be done when the accounting period ends. Then the hours received must be multiplied by the average hourly wage and by a factor equal to 1.5 (for the first two hours of overtime work) or 2. Moreover, the amounts accrued for overtime hours are included in wages for the last month of the accounting period.

Example 5

Soldatov S.V. works as a security guard at Inspiration LLC on a cumulative time basis. The company's accounting period is a calendar month. The standard working time for November 2003 is 19 working days or 151 hours (18 days x 8 hours + 1 day x 7 hours). In fact, Soldatov worked 209 hours. Therefore, Inspiration LLC must pay him 58 hours of work (209-151) as overtime. The security guard's salary is 6,000 rubles. per month.

Let's calculate how many Soldiers will receive in November. To do this, let's create the following table:

| Type of payment | Calculation | Sum |

| Salary | — | 6000 rub. |

| Additional payment for overtime work at one and a half times the rate | 6000 rub. : 151 hours x 19 days. x 2 h x 1.5 | 2264.90 rub. |

| Double surcharge for overtime work | 6000 rub. : 151 hours x (209 hours - 151 hours - 19 days x 2 hours) x 2 | RUB 1,589.40 |

| Total for November | 9854.30 rub. |

Order service

Calculation of shift work schedule

To calculate the working time schedule for shift work “in three days”, you need to:

- establish a summarized accounting of working time (Article 104 of the Labor Code of the Russian Federation);

- reflect separately in the schedule work during the day and at night;

- take into account the legally established duration of breaks for rest and meals (no more than 2 hours and no less than half an hour, Article 108 of the Labor Code of the Russian Federation);

- personalize the accounting of time actually worked by each employee (Article 91 of the Labor Code of the Russian Federation).

You can familiarize yourself with the documents used to record actual time worked using the materials on our website:

- “Unified form No. T-12 - form and sample”;

- “Unified form No. T-13 - form and sample.”

Important! When drawing up a working time schedule, it is necessary to take into account the legally established condition of 42 hours of weekly continuous rest (Article 110 of the Labor Code of the Russian Federation).

The results of calculating the parameters of the shift schedule and its results are usually presented in tabular form and posted for public viewing.

Important! The employee must learn about the parameters of the shift schedule at least 1 month before it comes into effect. The responsibility for such familiarization lies with the employer (Article 103 of the Labor Code of the Russian Federation).

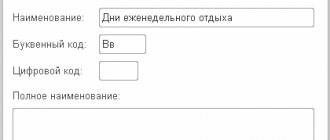

1C Salary and Personnel Management - in examples

First, let's go to the Settings - Organizational Details section and on the Accounting Policies and Other Settings , click on the Accounting Policies link. A window will open in which we can set what percentage of surcharge will apply in the organization for work at night and in the evening. By default, the program sets an additional payment for work at night - 20% (minimum payment), and for work in the evening - 10%. If necessary, these parameters can be changed; for our example, we will use these indicators.

To do this, go to the Settings - Salary calculation , follow the link Other salary calculation settings (at the very bottom of the form) and in the window that opens, we will have access to three indicators used when converting the tariff rate into the cost of an hour (day).

22 Jul 2020 stopurist 496

Share this post

- Related Posts

- Series and number of the compulsory medical insurance policy where to look

- Driving roundabouts according to new rules 2020

- Agreement on car division in case of divorce sample

- When do you give vacation pay before or after vacation?

Time-based wage system

In this case, the employee’s earnings directly depend on the time worked; there is a fixed price per unit of time. The unit of time can be a fully worked month (then the monthly salary is calculated) or a shift or hour worked (then the tariff rate is set for the shift or hour).

Salary

If an employee works on a 40-hour schedule, then usually the main type of accrual is salary. In this case, the amount that is paid to the employee for a fully worked month is established. If an employee has not worked in full for a month, then calculations are made in proportion to the time worked.

The form for calculating salary for the current month is as follows: the base salary amount established for a fully worked month is divided by the standard working time for this month and multiplied by the time actually worked.

There is one peculiarity here. Since the amount of salary for a fully worked month is the same in each month, and the standard working time according to the production calendar may differ, the amount of salary for one day is different.

Example:

The employee decided to take two days of vacation at his own expense.

Let's see how his earnings will differ in May and July 2020.

In May, the standard working time is 18 working days, the salary for a full month is 30,000 rubles. Worked out - 16 working days.

Salary for time worked - 30,000 / 18 × 16 = 26,666.67 rubles.

In July, the standard working time is 23 days, 21 days worked. Salary for time worked - 30,000 / 23 × 21 = 27,391.3 rubles.

It turns out that the cost of 1 day in May is higher than in July, and if an employee takes two days at his own expense, it is more profitable in July than in May.

Payroll calculation is convenient to use if employees work according to a standard work schedule. In this case, they are guaranteed a salary for each month of work.

Payment according to the tariff rate

Salary calculation can also be used for those employees who work on a shift schedule, but this will raise many more questions for both the accountant and the employees. It is better to use a tariff rate set per shift or per hour. Let's compare these calculations.

Example 1. Calculation based on the tariff rate per shift:

Let's imagine a store that is open from 10 am to 10 pm, the work schedule of the salespeople in it is 2 every 2, the work shift lasts 10 hours. For one employee, the first working day in June falls on the first day, for the second, on the third. There are only 30 days in a month, the first employee is scheduled to work 16 shifts per month, and the second - 15. If the tariff rate is set per shift or per hour, we can calculate the monthly payment in accordance with it. Let’s say a shift costs 1,300 rubles.

For the first employee: 16 shifts × 1,300 rubles = 20,800 rubles.

For the second employee: 15 shifts × 1,300 rubles = 19,500 rubles.

This calculation is simple and clear. Let's see what the calculation will be if you use salary payment during a shift schedule.

Example 2. Salary calculation for a shift schedule

Let’s imagine the same store and the same employees, but now they have a monthly salary of 30,000 rubles instead of a shift or an hour. This is where the difficulty arises in determining working hours. To calculate the amount of salary per month, we will take the actual time worked from the employee’s schedule, but it is not clear where to get the norm. This is not described in the legislation and there are different options that do not contradict the law. You can determine the standard working time based on the employees' schedule, on the standard calendar for a 5-day 40-hour week, or on the average for the year.

Option 1. The time limit is determined according to the employee’s schedule, for each it is different, because different number of shifts.

If both worked all the shifts, then both will receive the same salary, because they worked all the days on schedule.

- 30 000 / 16 × 16 = 30 000

- 30 000 / 15 × 15 = 30 000

This calculation option raises questions on the part of workers: after all, one employee worked 16 shifts, and the other worked 15. And their salary is the same.

Let’s assume that the first employee took a day off at her own expense, and instead of 16 shifts, she worked 15. It turns out that the employees’ hours worked are the same, but the first employee will receive less salary, because it will be calculated in proportion to the amount worked, taking into account the norm, and their norm is different:

- 30,000 / 16 ×15 = 28,125 rubles.

- 30,000 / 15 × 15 = 30,000 rubles.

Option 2. It happens that the standard working time is determined not according to the employee’s schedule, but according to the production standard calendar. In this case, another difficulty arises. Since the norms are different in different months, employees do not understand why this or that amount was obtained. Let’s take July 2020; according to the production calendar, the norm is 184 hours. Both employees worked less than the norm, and one will receive 18,285 rubles, and the other - 16,000.

- 30,000 / 184 × 160 = 26,086.96 rubles.

- 30,000 / 184 × 140 = 22,826.09 rubles.

Let's look at the same situation in another month, for example, June 2019. According to the production calendar, the norm is 151 hours. In this case, with the same work schedule, one employee will overwork the norm and receive 31,788.08 rubles, and the second will work less than the norm and will receive 27,814.57 rubles. Both may have questions about the calculation.

- 30,000 / 151 × 160 = 31,788.08 rubles.

- 30,000 / 151 × 140 = 27,814.57 rubles.

Option 3. Determining the standard time according to the production calendar, but on average for the year. To do this, you need to multiply the employee’s salary by 12 months and divide by the number of hours per year according to the standard calendar. In our case, the rate per hour in 2020 is 182.74 rubles (30,000 rubles × 12 months / 1,970 hours). This calculation is more or less understandable and is close to the tariff rate, because here the rate per hour is known, which does not change throughout the year. But then it will be more convenient for the employee if we write down the rate per hour in the employment contract, rather than the salary per month. An employee must understand how exactly and what his salary consists of.

So, for those employees who work on a shift or staggered schedule, it is more convenient to make calculations if the tariff rate is set per shift or per hour.

Salary calculation

If you start reading a book on payroll calculation, you will probably find in it a description of such remuneration systems or methods of calculating wages: time-based, piece-rate, time-based bonus, bonus, commission, etc. These systems are not described in legislation; they exist in expert articles and opinion pieces. An employer can adopt its own remuneration system, fix it in its local regulations and apply it in the organization.

In this case, the employee’s earnings directly depend on the time worked; there is a fixed price per unit of time. The unit of time can be a fully worked month (then the monthly salary is calculated) or a shift or hour worked (then the tariff rate is set for the shift or hour).

Selecting a time tracking option

Art. 91 of the Labor Code of the Russian Federation obliges the employer to keep records of the working time of each employee, reflecting the hours actually worked.

This procedure is carried out in a special report card, which reflects hours worked, sick leave, leaves with and without pay, sick leave, academic leave, overtime, etc.

There are three types of working time recording:

- Day. This accounting method can only be entered with a 5 or 6 day work week with the same working hours.

- Weekly. Here the same length of the working week in hours is required.

- Summarized. This type of accounting is used when an employee’s work schedule does not allow the same number of hours to be maintained daily or weekly. In this case, the total number of hours in the period is entered so that the actual time worked does not exceed the norm established by law.

approach to recording time worked is most often used The period for recording the norm can be a month, a quarter, a year. For employees in hazardous and hazardous industries, the accounting period cannot be more than 3 months.

The summarized accounting option can be installed both for the entire team and for part of the employees.

In this case, employees must be familiarized with this decision either as part of the employment contract or by reading a separate order.

There are categories of workers who cannot be involved in overtime work:

- pregnant women;

- minors;

- students of evening schools and educational institutions receiving primary vocational education (vocational schools, technical lyceums).

The employer has the right to use both salary and hourly forms of remuneration for calculating wages. In each of them, it is necessary to take into account the hours established by the Government of the Russian Federation.

Instead of double pay, the employer has the right to offer an additional day off, which will not be paid. The employee retains the right to choose increased pay or additional rest.

Calculation

How is work paid during a shift work schedule? Initially it is calculated. Either on a salary basis, or using so-called hourly tariff rates.

Here is an example of the second case: an hour of human labor costs 400 rubles, for example. For three days in a row he worked 13 hours a day. In this case, remuneration for shift work is determined by a simple formula: 400 x 13 = 5,200 rubles. for one day. When does a person receive his money? There are two options. The first is immediately after the end of the shift. It is usually practiced in cases where workers are not officially employed. And the second option is once a month.

If the institution has a salary system, then the principle will be slightly different. Standard – advance payment and salary every 15 days. And always a fixed amount. With the exception of allowances for overtime, of course, they always add up. And to calculate them, the accountant finds the tariff rate (per hour), and then the total salary for the month. For example, a person is supposed to work 150 hours a month. His salary is 52,500 rubles. Per hour – 350 rub. If he worked 10 hours over a month, then an additional amount will be added to his salary, calculated using the formula: 10 x 350 = 3,500 rubles. That is, in this case, his salary for that period will be 56 thousand rubles.

Features of payment at night

When working in several shifts, a situation often arises in which part of the shift or its entire duration occurs at night. In accordance with Art. 154 of the Labor Code of the Russian Federation, such work must be paid at a higher rate compared to normal working conditions.

In this case, the minimum amount of additional payment is 20% of the hourly tariff rate or salary, however, it can be increased by local regulations. To account for the number of hours worked at night, you can indicate daytime and nighttime separately on the timesheet.

It is worth considering that night hours include the time period from 10 pm to 6 am.

Payroll calculation for night work is worth considering using a separate example:

Fitter I.O. Petrov works on a shift schedule every two days, working hours - from to . His salary is determined based on the hourly tariff rate, which is equal to 105 rubles per hour.

It is necessary to determine the salary for March 2020 if the employee worked 16 shifts in a month, each lasting 9 hours. First you need to determine the amount of time actually worked:

B = 16 * 9 = 144 hours

Of them:

- 112 hours - daytime (7 * 16);

- 32 hours - night time (2 * 16).

Payment for daytime hours will be:

OD = 112 * 105 = 11,760 rubles.

In accordance with the collective agreement in force at the enterprise, the additional payment for night hours is set at 20% of the hourly tariff rate. Therefore, the payment for night time will be equal to:

OH = 32 * 105 * 1.2 = 4,032 rubles.

The final salary the employee will receive will be:

Salary = 11,760 + 4,032 = 15,792 rubles.

As for additional payment for calendar days off , it is not made during shift work, since the employee has his own set schedule. However, if he is forced to work on a day indicated in the schedule as a day off, he will also be able to claim additional payment. Holidays and non-working days must be paid during a shift schedule according to the general rules, that is, also at an increased rate.

The most common forms of remuneration in construction are tariff and non-tariff systems. The choice depends on the specifics of the construction team’s work.

Business trips are paid according to a special scheme. This is discussed in more detail in our article.

State employees are entitled to an additional payment for length of service. Read this article to find out what conditions must be met.

Payment for night hours according to the Labor Code of the Russian Federation in 2020, calculation example

The Labor Code prescribes that for activities carried out on holidays, salaried employees must pay:

- no less than 1 higher than the salary rate (daily, hourly), when the work fits into the monthly standard;

- at least 2, if the standard time per month allotted by law for work was exceeded.

When night work occurs on a holiday, management must give double guarantees of payment. Namely:

- twenty percent minimum surcharge;

- double or triple payment (depending on meeting or exceeding work standards).

The basis for calculating the twenty percent increase is the regular salary, and not the salary that provides for increased rates. When night workers are required to work on weekends and holidays, the two compensations due to them must be summed up. At the same time, it does not matter whether they work during hours that fit into working standards or are outside them. It also does not matter whether the employee performs the actions prescribed in the employment agreement or not.

Question No. 3. Is compensation due in case of night work under a civil contract? No, if employment was formalized by a civil contract, then the labor law norms on night supplements do not apply to such an employee. Question No. 4. If night work is overtime, plus it coincides with weekends or holidays, what allowances are due? When all three of these grounds are combined, the employee enjoys the right to additional payment for each of them. Rate the quality of the article.

There are quite a lot of such acts. For example, for workers employed in the production of newspapers and in the printing industry, the additional payment is 50% of the tariff rate, for workers in the textile industry - 75% of the hourly tariff rate, etc.

Remuneration for shift work: nuances

Payroll calculation for shift work has its own characteristics compared to similar calculations in a 5-day working week with days off at the end.

With a shift schedule, the usual weekends for everyone (Saturday and Sunday) can be scheduled as working days, and the shift worker’s rest will fall during working hours.

The calculation of wages for a shift worker is specific in that the number of working hours according to the schedule may differ from the norm in the direction of increase (planned overtime) or create a planned shortfall.

Important! When using summarized working time accounting, the annual number of overtime hours cannot exceed 120 (Article 99 of the Labor Code of the Russian Federation).

To avoid errors in salary calculations during shift work, it is necessary to carry out a reconciliation procedure for the following indicators at the end of the accounting period established by the company:

- hours actually worked by the employee according to the schedule;

- number of working hours during the accounting period according to the norm.

If, upon comparison, the first indicator exceeds the second, it is necessary to calculate and pay for processing.

Important! In accordance with clause 5.5 of the resolution from the State Committee for Labor of the USSR No. 162, All-Union Central Council of Trade Unions No. 12-55, overtime is subject to payment at one and a half (the first 2 hours, falling on average for each working day of the accounting period) and double (subsequent hours of work).

A similar approach when paying overtime was confirmed by the Supreme Court of the Russian Federation (Section 5 of the review approved by the Presidium of the Supreme Court of the Russian Federation).

We will consider an example of calculating the salary of a shift worker with overtime in the next section.

What does shift work mean?

So, this is a work schedule in which the time a person spends on work differs on different days. It is installed in those institutions, enterprises and industries whose activities are carried out around the clock. And the specialists supporting it change - some go to rest, while others take over. Well-known examples include fire, rescue, police and medical services. Or blast furnace production - where the furnaces operate for several years without interruption.

But during shift work, the 40-hour work week rule is also observed. That is, the entire working time that a person was in his place cannot exceed 40 hours. This is stated in Article 91 of the Labor Code of the Russian Federation. That is, if a person worked for three days for more than 13 hours, he is on vacation for the next four days. They include two legal days off and compensation for overtime at work. And, of course, payment for work during a shift work schedule is directly related to this topic. But more on this in more detail.

How to calculate salary?

When calculating wages for employees working in shifts, rules are applied that are unusual for a 5-day work week.

In this case, Saturday and Sunday can be considered both weekends and working days.

With a shift method, the total number of hours worked may exceed the maximum allowable value.

In this situation, planned overtime arises, for which it is necessary to calculate the salary at an increased rate.

It is important to take into account that when using the summarized working time recording technology, the number of hours worked overtime should not exceed 120. This rule is regulated by Article 120 of the Labor Code of the Russian Federation.

To avoid misunderstandings and irregularities in salary calculations, at the end of the accounting period established by the company, it is necessary to reconcile the following indicators:

- the number of hours actually worked in accordance with the work schedule;

- number of working hours in the accounting period.

If, based on the results of calculations, the first indicator turns out to be higher than the second, the employer is obliged to make a recalculation, during which the employee must be paid for overtime work.

Example when working in two-by-two shifts

You can finally understand the technology of calculating wages during a shift schedule by considering an example.

Initial data:

The dispatcher of the Quadra company works on a shift schedule - 2/2 (two after two). Each working day has 11 working hours. Hourly rate - 250 rub. A month is used as an accounting period for calculating wages.

According to the schedule, the employee worked 165 hours during the month.

Calculation:

Salary at the tariff rate = 165 x 150 = 24,000.

At the same time there was processing, the duration of which was 5 hours. To calculate the number of working days in a month, you need to do the following:

Shifts worked = 165 / 11 = 15.

Next, you should calculate the calculated coefficient = 5 (overtime hours) / 15 (working days) = .

The resulting indicator is less than 2, therefore, overtime is paid at 1.5 times the rate.

Payment for processing = 250 x 5 x (1.5 - 1) = 625.

Final salary amount = 24,000 + 625 = 24,625 rubles.

How are weekends and holidays paid?

If an employee’s shift falls on a non-working holiday, payment for such time is carried out using the procedure established by the current legislation of the Russian Federation.

The tariff rate for wages should be increased at least 2 times.

This norm is regulated by Article 112 of the Labor Code of the Russian Federation.

If an employee works on Saturday or Sunday according to the shift schedule, wages for these days are calculated in the standard way.

The only exceptions are weekends established by the state.

How to calculate night hours from salary: formula

Indicate that the hourly wage rate is determined by dividing the salary by the average monthly number of working hours. Calculate the average monthly number of working hours using the formula: Average monthly number of working hours = Number of working hours according to the calendar: 12 So, in 2020, the average monthly number of working hours is:

- with a 40-hour work week – 164.25 hours;

- with a 36-hour work week – 147.78 hours;

- with a 24-hour work week – 98.38 hours.

This approach is fully consistent with the position of the Russian Ministry of Labor.

If you calculate the hourly rate using the specified formula, the payment for night work will not differ regardless of the number of working hours in the month.

How to calculate salary for shift work

Let's look at an example.

The operational dispatcher has a summarized recording of working time with a recording period of 1 month. Work is carried out on a 2/2 schedule (2 working days of 11 hours each, followed by 2 days off).

According to the schedule, the dispatcher worked 165 hours for the month against the norm of 160 hours. The accountant made the following calculation (the hourly tariff rate of the dispatcher is 260 rubles):

- salary for hours worked: 165 hours × 260 rubles/hour = 42,900 rubles;

- processing hours: 165 – 160 = 5 hours;

- number of working days in the accounting period: 165 hours / 11 hours per shift = 15 days;

- calculation coefficient (average duration of overtime work per 1 working day of the accounting period): 5 hours / 15 days. = 0.33 hours/day. (does not exceed 2 hours a day, which corresponds to payment for overtime hours at one and a half times the rate);

- amount of additional payment for overtime work: 260 rubles/hour × 5 hours × (1.5 – 1) = 650 rubles;

- total salary: 42,900 + 650 = 43,550 rubles.

With the same approach, you can calculate differently:

- salary for standard hours: 160 hours × 260 rubles/hour = 41,600 rubles;

- additional payment for overtime: 5 hours × 260 rubles/hour × 1.5 = 1,950 rubles;

- total salary: 41,600 + 1,950 = 43,550 rubles.

The choice of calculation method does not affect the final result.

Calculation methods

Depending on the standard working hours per month

The formula used is:

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.

T/h = monthly tariff rate: standard hours (per month)

The norm of hours per month must be taken from the production calendar.

Example:

Inshina N.N. works at JSC Topol as a salesperson on a shift schedule. The salary per month is 20,000 rubles. The production calendar indicates the hourly rate per month - 160 hours. In October 2015, she worked 166 hours.

In order to calculate wages, it is necessary to take into account overtime.

- First, the hourly rate is calculated using the formula: 20,000 rubles: 160 hours = 125 rubles per hour.

- We calculate the overtime: 166 – 160 = 6 hours.

For these six hours worked overtime, Inshina must receive a salary supplement. According to labor legislation, the first two hours of overtime are paid with a coefficient of 1.5, subsequent ones - at double the rate:

125 rubles × 2 × 1.5 + 125 rubles × 4 × 2 = 375 rubles. + 1000 rub. — amount of overtime pay. We add them to the salary and get Inshina’s salary for October: 20,000 + 1375 = 21,375 rubles.

If for one reason or another an employee has worked fewer hours than normal, the daily work rate is calculated and multiplied by the number of hours worked.

Example:

Kulagin K.K, working on a shift schedule, has a salary of 15,000 monthly. In June, its norm is 150 hours. He worked 147 hours this month.

In order to calculate salaries, the accountant makes calculations:

- Determines the hourly tariff rate: 15,000 rubles: 150 hours = 100 rubles/hour.

- Now you should simply multiply the resulting amount by the number of hours actually worked: 100 rubles/hour * 147 = 14,700 rubles.

This is a fairly simple calculation, however, it has a drawback. The tariff rate depends on the hourly rate, which may be different every month. And the lower the standard hours, the higher the hourly rate will be. It turns out that the employee worked less in one month than in another, but will receive a salary higher than in the month in which he worked more.

Example:

Savushkin L.L. works as a security guard. He has a variable work schedule. His salary is 19,000 rubles per month. In accordance with the production calendar, in February the standard hours are 150, in March - 155 hours. In February, Savushkin worked 149 hours, in March - 151 hours.

Salary for February will be equal to:

- We determine the hourly tariff rate: 19,000 rubles: 150 hours = 126.66 rubles per hour.

- We multiply the result by the time worked: 126.66 rubles/hour * 149 hours = 18872 rubles 34 kopecks.

Salary in March:

- Hourly rate: 19,000 rubles: 155 hours = 122.58 rubles/hour

- 22.58 rubles/hour * 151 hours = 18509 rubles 58 kopecks.

It turns out that Savushkin actually worked two hours less in February than in March, but his salary was 362 rubles 76 kopecks.

Types of shift schedules

Depending on the company’s operating technology, shift schedules with different durations and a combination of working periods of time and rest periods may be established for different positions.

For example, for workers in such a specific field as railway transport, schedules with the following parameters can be developed:

- day and night shifts, rest after night work and a day off followed by a new work shift;

- 2 working days of 11 hours each (no night work) alternate with two consecutive days of rest;

- work shifts are combined with rest in the following combination: a working day after three days of rest.

The first form of shift work is typical for operators, station attendants, wagon inspectors and repairmen, rolling stock repairmen and other workers who provide round-the-clock reception, access and processing of rolling stock.

The specific nature of the activities of workers in the second group does not require round-the-clock presence at workplaces, but does not allow any breaks in daytime work shifts. Such workers include dispatchers for the accounting of cars requiring uncoupling repairs and other similar positions.

Working in the “every three days” mode is typical for the security service of premises and territory. We will consider further how to calculate a shift schedule for this category of workers.

Types of wages

The main factor used for calculation is the working time sheet. Often the calculation is carried out not by the head of the organization himself, but by a specialist accountant who navigates the framework of regulatory and private documents. The most common list of documents that may be involved in determining wages is the following:

- Collective agreement of the organization.

- Established work schedule for the company.

- Internal Labor Code.

- Rules and regulations on material remuneration and incentives.

- Contract of employment.

- Other local regulations of the organization.

Wages can be paid on a piece-rate or time-based basis. In the case of a piecework scheme, wages will be paid depending on output. These outputs are determined by the volume of products produced or services provided.

In the case of calculating wages based on temporary resources, the employee will receive a salary that corresponds to his job responsibilities and is stated in the employment document. In this case, the salary amount is fixed in advance and established in the staffing table. Payroll may include unscheduled bonuses and additional remuneration. Such rewards may be payments for the employee’s length of service, effectiveness and efficiency during the performance of job duties.

By law, salaries must be paid at least twice a month.

The wage payment interval can be determined in two ways, but they should not violate the rule of two times a month.

The first method is to pay an advance with payment at the end of the working month. The advance is issued as a certain part of the official salary, which is fixed in a separate monthly tariff schedule. The advance cannot be issued earlier than the first two weeks worked. The employee can receive the remaining or final part of the salary at the end of the working month. Also, the final payment may include various rewards or bonuses.

The second payment method is interval payment for both halves of the month. Thus, the salary is calculated for the first and second half of the month as a full one. In this case, the calculation will be made based on the time resources spent. The amount of payment for time worked for a specific period is fixed in the organization’s regular labor code.

Why is there a gap in the shift schedule?

Before the employer correctly calculates the payment, the cause of the deficiency must be established. The reasons for the shortcomings include the following:

| Reasons for the defect | More details |

| Employee's fault | Deficiencies may arise due to the fact that the employee is absent from work for valid reasons (all types of vacations). In addition, there are also unexcused reasons for shortcomings (absenteeism, downtime due to the fault of the employee). |

| Employer's fault | The employer can change the work schedule, which entails the occurrence of shortcomings. In addition, shortcomings may also arise as a result of incorrect preparation of the work schedule, which does not allow employees to work the required number of hours in the reporting period. |

| Circumstances beyond the control of the parties | Deficiencies may arise as a result of force majeure situations, natural or man-made disasters, or as a result of employees mastering new equipment and technology. |