Constitutional law guarantees every citizen the right to paid work. Labor legislation establishes requirements for the employer regarding the minimum wage (hereinafter referred to as wages), the procedure for its assignment, registration and payment.

Such wages are popularly called white wages and belong to the category of official wages recognized by the state. It cannot be lower than the size determined by the state.

Taxes are paid on white wages, and they are taken into account when calculating pensions. However, in addition to white wages, there are “gray” and “black” wages. Our article will be devoted to these negative phenomena.

Black gray and white wages

A gray salary is a semi-official monetary remuneration of a hired worker for his work. The amount of this remuneration is negotiated in advance (before hiring) by the employer without formalizing such an agreement in writing.

Typically, the gray salary consists of two parts.

The first part consists of officially paid funds - white wages, accrued and issued to the employee in compliance with all the requirements of labor legislation.

Such as:

- Conclusion of an employment contract.

- Issuing an employment order.

- Entry into the work book about hiring.

- Payment of taxes and contributions to the Pension Fund and Social Insurance Fund.

The second part is the salary in an envelope, which is an unofficial or shadow payment called black salary or shadow salary.

There is an unaccounted salary - this is money paid to an employee in an envelope without his official registration for work.

The concept of black wages has no legal definition. This expression was first used by the Kommersant-Daily newspaper on October 2, 1996, in a publication entitled “The government has taken up arms against cocktail lovers,” dedicated to government plans to increase income taxes.

The term black salary comes from the expression black cash and the word “wages” and is currently a stable expression as an antonym to the phraseological unit white salary.

Let's look at black wages and its consequences in more detail.

What is black wages and how to influence employers

Black wages are payments in envelopes, hidden first of all from the state, and secondly from the employee himself.

After all, an employee working for a black salary is not officially hired by law and works without official registration (an employment contract has not been concluded, there is no hiring order, no entry has been made in the work book, etc.).

In a word, an employee with a black salary is a mythical employee, in reality he does the work, but formally he does not exist, since he is not listed anywhere in the company. Therefore, such an employee has absolutely no rights. The employer can at any time, without any explanation or justification, reduce the unpaid wages.

The black scheme for paying salaries is made from unaccounted profits, formed by the formal underestimation by the business organizer of the actual income received.

Such shadow schemes are often used:

- in the trading business (the seller can be hired for menial wages);

- in the transportation business (drivers can receive black wages;

- in the real estate business (a real estate agent may have a black salary in the form of a percentage of the transactions completed by him);

- in the tourism business (the agent is not officially registered, but receives money in an envelope in the form of a percentage of the number of tours sold).

Therefore, when applying for a job in such organizations, be prepared for the fact that your rights will be violated.

How to get a black salary upon dismissal?

If you want to get your unofficial earnings or gray salary after you have been fired, then you should seek help from various government services. You can submit your appeal to:

- Labor inspection;

- Prosecutor's Office;

- Court.

However, the first thing to do is to contact the employer and demand to pay all the black wages and the required compensation. You can directly state that you know the legislation of the Russian Federation and you are aware that you have the opportunity to write an appeal to the tax office and point out a violation of the law. Usually such a statement is sufficient, since losses from tax audits and subsequent fines and sanctions will cost management much more than paying black wages or the remainder of gray wages. So if you want to get your money, then first of all try to do it peacefully. But if the leadership does not cooperate with you, then you will have to turn to government services.

Labour Inspectorate

If you want to receive the payment due upon dismissal, which was withheld by the employer, then you should immediately contact the labor inspectorate. The Labor Inspectorate is a state supervisory service whose main task is to monitor compliance with the Labor Code of the Russian Federation by employers and workers.

Thus, even if you were not officially employed or had a gray salary, you can still turn to this service for help. The first thing you need to do is write a statement. In it, you will need not only to prove that the employer committed a violation, but also to confirm in any available way the fact that you actually worked and received a black salary or a gray salary. This can be done in different ways, but the most effective are the testimony of witnesses or any receipts for transfers from the employer (for example, bank statements).

Once you can prove that your claims to the Labor Inspectorate are justified, you will need to submit an application. This can be done on the official website or at the nearest branch. What can you demand? Firstly, payment of that part of the unskilled salary that you earned before your dismissal and which you did not receive. Determining its exact size is very difficult, and this will be done by specialists. The second thing you can demand is compensation. This could be compensation for vacations, overtime, or for illegal dismissal. You have no right to demand anything more, since no employment contract was actually concluded. The only exception is the gray salary. If you had official earnings and an employment contract, then you can demand compliance with absolutely all of your labor rights.

Prosecutor's office

Contacting the prosecutor's office is a much more serious step. You should not start receiving your black salary by contacting this service, since it does not deal with the intricacies of compliance with the Labor Code. Its main task is to monitor compliance with civil rights, and therefore you should only contact it if you have received an official response from the labor inspectorate, but the employer himself has ignored them.

The task of the prosecutor's office when returning your legal earnings or gray wages is only to force the unscrupulous employee to comply with the order. In this case, some unpleasant consequences and difficulties for the employee himself are possible, which are discussed below.

Court

The court is the most difficult, but at the same time the most effective way to return gray wages or other unofficial income. This is due to the fact that by filing a claim, you will be able to initiate a more thorough audit, with the help of which you can prove that you actually received the amounts that you indicated. In addition, you will be able to receive larger payouts because you will be able to make your own compensation claims, as long as they are reasonable and legal.

There are several disadvantages to the judicial process. First, you will need a lawyer. Cases involving black wages are usually very complex, confusing, have a lot of gaps and require the involvement of specialists. The second difficulty is that your constant participation in the process will be required. In this case, you personally will have to constantly participate in inspections and testimonies. And lastly, it is very difficult to sue a legal entity, so you are not guaranteed success.

Who benefits from black wages?

Of course, paying wages in an envelope is beneficial to the employer for the following reasons:

- The salary can be paid in the minimum amount for the employer (after all, there is officially no employee).

- There is no need to pay the required taxes and payments to the pension fund, social fund, etc.

- There is no need to pay the employee for sick leave and vacation days.

In other words, the unaccounted salary in the envelope for the employer is expressed by its real financial profit brought by the employee.

What does a black salary in an envelope give to an employee?

An employee, receiving payment for his work unofficially, has vague realities, very illusory prospects for the future and many disadvantages.

The disadvantages include:

- Inability to earn a labor pension (you didn’t officially work, which means you can only count on a minimum social pension).

- Unpaid leave.

- You can only get sick without receiving sick pay (you can only get better at your own expense).

- Officially accumulated work experience is not taken into account, which creates difficulties when applying for an official job (there is no entry in the work book that you worked).

- It is impossible to receive monetary compensation if a company is downsizing or liquidating.

- There is a real possibility of not receiving a salary upon dismissal.

- Inability to receive a tax deduction (you didn’t pay taxes).

- You cannot take out a loan from a bank (there is no official income).

The presence of a large number of disadvantages for shadow work means that people agree to it only in desperate life situations. For this reason, it is very difficult for an employee to assert his legal rights.

If we also take into account that many citizens who receive salaries in an envelope are often afraid of losing their only income, then there are only a few who want to report employer violations.

However, it is important for everyone to know that, according to current legislation, liability for the payment of black wages faces, first of all, the employer.

What is a salary “in an envelope”?

| Type of salary | Description |

| “White” wages | Official income. The full amount of the salary is subject to accounting when calculating the amount of contributions to the tax service and extra-budgetary funds (PFR, Social Insurance Fund, Compulsory Medical Insurance). |

| “Black” wages | Income that the employer gives to subordinates in cash without an officially issued statement. No deductions are made from earnings to the Federal Tax Service and extra-budgetary funds, and therefore the employer hides the money paid to employees from supervisory authorities. |

| “Gray” wages | The employer verbally agrees with the employees that a small part of the salary will be paid officially, with the deduction of personal income tax and insurance contributions, and the majority of the salary will be paid in cash without entering amounts into the statements. Thus, the employer partially shows the employees’ earnings to supervisory authorities, and partially hides them. At the same time, the employment contract specifies the amount of the “white” (small) salary recorded in the accounting department, and the remaining amounts remain unknown to the tax service. |

Let us consider what relates to such a salary in more detail.

There are several concepts of salary by “color”:

- When an employee enters into an employment contract with his employer and the entire amount of the salary that is reflected in this agreement is paid to him, and the employer charges and pays insurance premiums and taxes in full from it, then we are talking about an official salary. It is also commonly called “white”.

- A situation may arise when an entity attracts employees without drawing up employment agreements with them. He pays his salary in cash and, as a rule, “in an envelope.” Remuneration for individuals is unofficial, it is not recorded anywhere, and the company does not pay contributions from these amounts. Therefore, such a salary is also called “black”.

- In addition, there is the so-called “gray” salary, which assumes that the employer officially pays its employee a small part of the salary within the minimum established by law, and the rest is transferred to the employee unofficially in cash.

Important! From the first part, the employer will make all the contributions required by the rules (including for pensions to the Pension Fund), and for the second, no contributions will be paid.

It is important to understand that due to the fact that such a salary is unofficial, only the employer and the person receiving it know about its existence.

Since the employer does not pay contributions to funds from this remuneration, this period is not included in the employee’s length of service.

He will not be able to count on paid sick leave, unless, of course, the employer makes payments to him at his own expense. Which happens very rarely. The same situation arises with the accrual and payment of vacation pay. Many employers will not be able to arrange leave.

Attention! In most cases, it becomes impossible for an employee to obtain loans from banks, since the administration of the enterprise will never issue him a certificate with his real income.

Paying unofficial wages to employees can also have negative consequences for the employer. This event is a serious offense; if the competent authorities find out about it, the company cannot avoid serious sanctions.

Any transaction contains both positive and negative sides. Labor relations that are not formally documented (agreement) represent the same transaction, but they are reflected differently.

Party – employee

It should be noted that on the one hand, both parties have a financial advantage - such as the absence of payments for insurance premiums and taxes. An employee, for example, may thus not pay alimony or reduce payments for other obligations.

But at the same time, the employee must know and realize that if he wants to go on vacation, and also if he gets sick, these days will not be paid for by the organization. The same applies to maternity and other benefits. While the white type of remuneration provides for these payments.

Significant disadvantages include:

- The minimum paid in the Russian Pension Fund means that upon retirement, a person will receive a living wage, no more.

- If an employee decides to quit, it is unlikely that they will be able to get their paychecks back.

- If the fact of concealment of income is established, such an employee will bear full responsibility under the Criminal Code of the Russian Federation.

- Lack of guarantees in social benefits.

- You cannot take out loans, because... There is nothing to officially confirm the income.

An organization, be it an LLC or an individual entrepreneur, is responsible to many government services: tax inspectorate, Pension Fund of Russia, insurance organization, etc. One of the most important obligations in labor relations is the payment of wages and related contributions.

Thus, the lower the final salary amount, the less the organization will pay in mandatory contributions. In view of this, many companies negotiate with employees on the payment of black wages. Naturally, this is due to profit.

Also, such an agreement allows the employer not to fulfill the conditions prescribed in the Labor Code of the Russian Federation - compensation for vacation, sick leave payments, maternity leave, etc.

And various fines and criminal liability for concealing income are not scary, because... Few employees will write a complaint to the Labor Inspectorate about violations of their rights. That is why employers should not be afraid, because... They believe that the employee is simply afraid of losing even the small money that he is paid.

The employer's responsibility for wages in an envelope or what the threat is for black wages

For the payment of shadow wages, administrative, civil and criminal liability measures may be applied to the employer; we will briefly talk about them.

Administrative responsibility

For failure to pay taxes on black wages issued, the employer, in accordance with Articles 122 and 123 of the Tax Code of the Russian Federation, faces administrative liability in the form of a fine. Its size is 20% of the amount of unpaid taxes.

However, if intentional understatement of the tax base is proven, a fine of 40% of the amount of unfulfilled tax payments will be collected.

For failure to deduct insurance contributions to the pension fund (Article 27 of the Federal Law “On Compulsory Pension Insurance”), the employer may be subject to a fine in the amount of 5 thousand to 10 thousand rubles.

Civil liability

Such liability of the employer is possible in the event of untimely payment of wages to an employee.

In this situation, the employee has the right to apply to the court with a request to judicially record the fact of the employment relationship and recover unpaid wages from the employer.

In court, the employee is obliged to present conclusive evidence confirming the performance of work duties for the defendant.

Such evidence may include:

- Witness's testimonies.

- Audio and video recordings of the employer.

- Transfers to a bank card on behalf of the employer's responsible persons.

- Transport invoices and other documents of the organization in which the employee’s name appears.

If everything is done correctly, the court will satisfy the stated requirements.

Criminal liability of the head of the organization

The employer's criminal liability is determined by Article 199 of the Criminal Code and occurs in case of failure to pay large amounts of taxes and fees.

However, the hired worker is also responsible for receiving the black salary in an envelope.

Responsibility of the parties

Each party to the labor relationship bears its own responsibility. Both parties are responsible for the fact that black wages are paid and received, which are not recorded anywhere.

Since the individual is the primary taxpayer, he is responsible for the fact that no taxes are deducted from his earnings. Although, as you know, it is the employer who transfers taxes to the appropriate funds.

Contributions to the state budget must be paid by a person who receives money for his work. If an employee received a large amount of money over a certain period of time but did not pay taxes, he may be convicted.

In the case of black wages, it is possible to hold an employee accountable for non-payment of taxes only if it is proven that this type of remuneration was acceptable to both parties to the employment agreement.

If the employee knew nothing about the ongoing lawlessness and violation of labor rights, he will not be responsible for the employer’s machinations.

Important! In accordance with Article 123 of the Tax Code of the Russian Federation, with Federal Law No. 212 of July 24, 2009 and clause 27 of Art. 5 of the Code of Administrative Offenses of the Russian Federation, a fine of 20 to 40% of the amount of unpaid taxes is imposed on the employer.

Such punishment threatens managers who hide the real number of their employees and the existence of black wages.

Until 2020, punishment for dishonest employers for such violations was negligible. Previously, the fine ranged from 1 to 5 thousand rubles. Such amounts did not frighten anyone.

Since this year, fines have increased, and the punishment of negligent managers has become more severe. Currently, for such an offense you can pay a fine of up to 300 thousand rubles. Sometimes you won't be able to settle for a fine.

If the amount of unpaid contributions is too large, the employer faces punishment in the form of arrest for up to six months, forced labor for up to 2 years, or imprisonment (from one to three years).

Watch the video. Is it possible to prove black wages:

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7-495-899-01-60

Moscow, Moscow region

+7-812-389-26-12

St. Petersburg, Leningrad region

8-800-511-83-47

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

Salary in an envelope: is the employee responsible?

It is important to remember that an employee who receives unpaid wages for his work can be held accountable only if the following two conditions are met.

Condition No. 1. The employee knows about non-payment of taxes from his shadow salary

In practice, the employee’s income tax in the form of personal income tax is required to be withheld and paid by the employer from his salary. An employee, receiving money in hand, is deprived of the opportunity to verify the facts of deduction and payment of personal income tax for him.

That is, when receiving a shadow salary in cash, he has the right to assume that the employer has made all the required deductions. In this situation, the employee does not violate the law, so he cannot be held accountable.

Condition No. 2. The fact of a preliminary agreement between the hired worker and the employer regarding non-payment of taxes and fees has been established

According to tax legislation, when receiving income without paying tax, an honest citizen is obliged to submit a declaration and pay personal income tax by April 30 of the following year.

Otherwise, he faces the penalty of personal income tax and corresponding penalties for violating tax laws.

Advantages and disadvantages of “gray” wages for the employee and the employer

It would seem that a “gray” salary involves contributions to extra-budgetary funds and the tax service, however, only fully official earnings guarantee the employee:

- receipt of all required social benefits (including compensation for injury during work, insurance payment to the family in case of death at work);

- calculation of the full amount of a well-deserved old-age pension;

- payment of sick leave;

- payment for vacations (main annual, additional, maternity, child care);

- lack of grounds for holding people accountable for concealing their income from supervisory services.

| Advantages and disadvantages | For the employer | For employee |

| Advantages | Significantly lower costs for paying mandatory contributions for employees. Obtaining the opportunity not to pay benefits, sick leave, and vacation pay, as required by the Labor Code of the Russian Federation. Reducing the amount of personal income tax paid on employee income. | A smaller part of the income goes towards paying personal income tax (personal income tax), that is, more money is paid out into hand. From a small official salary, a smaller amount of alimony and penalties under writs of execution are withheld. |

| Flaws | Possibility of being subject to sanctions and criminal liability. | Sick leave and vacation payments are calculated based on the official “white” (small) salary and become completely insignificant. The bank will not issue a loan because the income indicated in the documents is too low. There are no guarantees that social benefits will be paid. For concealing income, the employee will be held criminally liable. If the company liquidates or goes bankrupt, the severance pay will be too small. The future pension will be quite insignificant, the insurance period may not be taken into account at all. |

Not only the employer will bear responsibility for concealing the income of its employees if supervisory authorities reveal the fact of paying “black” or “gray” wages. The employee also faces punishment, but of a different kind.

| Employer's liability | Employee Responsibility |

| Fine (from 1 to 5 thousand rubles) to an official of the company; fine (from 1 to 5 thousand rubles) for an individual entrepreneur without forming a legal entity; fine (from 30 to 50 thousand rubles) to a legal entity. | Fine for the amount of hidden personal income tax; criminal liability (if large earnings are hidden); lack of work experience; lack of old age pension; absence (or small amount, if the salary is “gray”) of maternity benefits; lack of sick leave benefits; no vacation pay. |

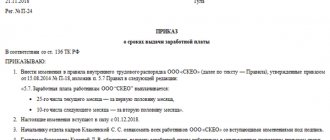

Gray is a salary on which taxes are paid only partially. It consists of an official white part, from which contributions go to the state, and an unofficial part, from which taxes are not paid.

The scheme works like this: the employer enters into a contract with you and assigns you a tiny official salary. From this tiny salary he pays small taxes and contributions for you. He somehow cashes out the rest of his salary and gives it to you in an envelope, bypassing taxes, thereby saving money.

According to the documents, it looks like the employer has low-paid employees. It's not illegal, although it is suspicious. But in essence, this is a tax evasion scheme - at your expense.

No one knows where the employer takes gray money from: from his own pocket or from money purchased from cashers. It may well be that the money in the envelope is money from an underground brothel or drug den.

Your employer can stop paying you at any time. It will be difficult to get money in this situation. That is why you should know about all the negative consequences of a salary in an envelope.

Responsibility of the employee for receiving salary in an envelope

An employee who received a shadow salary in an envelope may be subject to administrative punishment in the form of a fine for failure to submit a declaration of income.

The amount of the fine is 5% of the amount of tax that should have been paid for each month from the beginning of receiving the black salary.

If there is indisputable evidence that an employee has failed to pay taxes to the state on a large scale (the debt for three years must be at least 600 thousand rubles), criminal liability measures may be applied to him in accordance with Article 198 of the Criminal Code of the Russian Federation.

Depending on the conditions and severity of the crime committed, such measures include:

- Fine from 100 thousand to 300 thousand rubles.

- Forced labor for up to 12 months.

- Arrest up to six months.

- Imprisonment for up to a year.

It should be emphasized that in practice, imprisonment for tax crimes is used extremely rarely by the courts (a suspended sentence is often used). The main measure used is administrative punishment in the form of fines.

Thus, by receiving a black salary, an employee not only loses the money he earned and state guarantees, but also exposes himself to the constant risk of being subjected to various types of punishment (from administrative to criminal liability).

However, in some cases, the employee does not know that he is receiving wages in violation of the law. And only after receiving a letter from the Pension Fund with zero transfers of pension contributions, he begins to understand: he is working under the table.

How to deal with this, where can you turn to protect yourself?

What to do if you are paid a black salary?

If an employee is not satisfied with the black or gray wages that he receives for his work, and he wants to legalize his income, then he should contact the competent authorities.

Where to complain?

The first supervisory body over the activities of employers in paying wages is the Federal Service for Labor and Employment (Rostrud).

You can also call for free within Russia to a multi-line phone number 8-800-707-88-41. Or write an email to their address

You can also complain to the following authorities:

- to the tax office;

- to the prosecutor's office;

- to the police.

You can refer to the fact that the employer violates Article 98 of the Criminal Code of the Russian Federation. If he is found to have violated small amounts of payments, then for such actions he will be punished with imprisonment for up to a year, but if the amounts are impressive, then he faces imprisonment for up to three years.

You can write a complaint to the prosecutor's office using the following format:

Application to the prosecutor's office about black wages

Sample application to the tax office:

Application to the tax office

Where can I report anonymously?

An anonymous appeal can be sent by mail to the address of all of the above authorities that exercise control over employers in tax matters.

The tax office premises have publicly accessible boxes for receiving applications from citizens. You can send them a complaint describing the employer’s unlawful actions.

Understanding the complexity of the situation, tax inspectors will most likely analyze the information sent to them for attention and take action.

To court

If a conflict situation arises, an employee can try to prove through the courts the true amount of his salary, including what he received in an envelope. But to do this in court, he will need to prove all the circumstances specified in the statement of claim.

Facts confirming the employer’s unlawful actions may be as follows:

- audio or video recordings;

- payrolls;

- recordings of telephone conversations;

- advertisements;

- information from statistical authorities;

- confirming information from other employees about the amount of wages.

A worker can specifically write to his director in advance an application for the transfer of unpaid wages to his bank account or card.

If the employer agrees, then you can safely use this evidence in court.

You need to keep in mind that you can also file a class action lawsuit on behalf of all employees who do not agree with the concealment of their income. The court will consider it much faster and more readily than an individual one.

A sample statement of claim can be clarified in court; they have standard forms. Or take as a basis a sample claim in court for non-payment of wages and in it set out all the circumstances of the case and references to the articles of law given in this article.

Standard application form:

Claim to establish the fact of labor relations

How to prove the fact of black income in court?

Usually, complaints begin from the moment the employee does not receive wages for his work. The most difficult question in this situation is how to prove non-payment of earnings?

It’s good if you still have copies or originals of statements about the issuance of money that were previously used in the payment of bonuses or others. You can provide voice recordings saved during negotiations with accounting, the director or other employees.

You can use a complaint to provoke an extraordinary inspection to establish the fact of illegal payment of wages.

For example, when monitoring the activities of an organization by the tax service or the state labor inspectorate.

Working payment disclosure schemes

The basis for conducting a visiting group for tax audits of organizations that use the “envelope” scheme in their activities are:

- receipt of a complaint from an individual against the management of the enterprise regarding the incomplete reflection in the accounting documents of money issued for labor or the concealment of such payments;

- leakage of information from other sources; the fact was discovered during an inspection of the organization or when considering complaints in trade union bodies, etc.

If your employer delays or does not pay you money

In this case, workers need to collectively complain against their employer.

The fraudster must be punished. After all, if he does not pay wages to one person, then, most likely, he profits in this way from the rest of the workers.

If a collective complaint is filed, then not a single competent authority to which it was sent will be able to respond to it.

How to punish a manager and force him to pay?

Even an individual consideration of a case of non-payment of wages will certainly lead to punishment by the employer.

Fraud will cost him either a large fine or criminal punishment, everything will depend on the amount of damage caused to the workers.

If you cannot get your earned money by directly contacting the head of the organization, then there is only one way out - to write complaints to all authorities.

You can do this at the same time, this will give you more opportunities to achieve a successful result. The last thing you need to do is file a claim in court.

How to return unofficial income after dismissal?

This is a rather difficult question, because... Most often, the employee does not have evidence that he received illegal wages in an envelope.

But in this case, even an envelope, on which, as a rule, the surname, name of the employee and the amount are written, can also be included in the case as evidence. Here you will need to do a handwriting examination.

Most often, in such cases, the only way to get your hard-earned money back is in court.

How is a deduction from wages made at the request of an employee? Find out from our article. What is the basis of piecework wages? The answer is here.

They pay salaries in envelopes: where to complain and what evidence is needed

If there are reliable facts about a hired employee who is paid for work under the table, and about the employer’s non-payment of taxes and contributions for him, you can contact the authorities exercising state control and supervision.

These include:

- Prosecutor's office.

- State Labor Inspectorate.

- Tax Inspectorate.

However, before contacting the supervisory authorities, it should be taken into account that you need to have a base of evidence regarding the employer. In this case, we must assume that the employer will fiercely defend itself and accuse the hired employee of distorting the facts.

Evidence of receiving black wages should include::

- Pay slips.

- Pay slips (if available).

- Envelopes from shadow wages.

- Service notes or sheets are orders for performing certain types of work.

- Certificates of salary.

- Testimony of witnesses.

- Audio and video recordings.

Now let's take a closer look at each type of evidence.

Payslips

Payslips are a formal document indicating the amount of accrued wages. As a rule, it can be of any form indicating the composition of the funds paid.

There is no company seal on the payslips, but sometimes there may be signatures of senior employees, for example, an accountant. Most often they are an ordinary printout on a computer.

All payslips should be kept and used as proof of receipt of black wages.

Payrolls

It can be very difficult to get them. Therefore, if possible, you should at least make a photocopy of the payroll sheet on which your last name is indicated.

Envelopes

The envelope in which the black salary is issued is usually signed with the surname and initials of the employee receiving the money.

If possible, you can add to your envelope the envelopes of your work colleagues who received the same salary. Such data can serve as conclusive evidence of the payment of shadow wages.

Service notes or sheets - orders

Service notes or sheets - orders according to which the work was carried out, or copies of them should also be kept. They may indicate that the employer is conducting “black” accounting.

Certificates of salary

It can be issued at the request of the employee and only if there are no prerequisites for a conflict to arise between the employer and the employee.

Witness testimony

You should ask your work colleagues if they can confirm your presence in the company as an employee and the facts of receiving your salary in envelopes. And if they agree, you can safely indicate them as witnesses in the application.

Audio and video recordings of conversations with the director

Audio and video recordings of the employer can only be used in the absence of sufficient written and witness evidence.

The main thing in their preparation is compliance with the requirements of current legislation to protect the private personal lives of other citizens.

For example, without installing eavesdropping and spying “bugs” and other spy technologies.

Collection of evidence

These disputes are not resolved by the labor inspectorate or the prosecutor's office, so the employee has a direct route to court. First, he needs to independently collect the necessary evidence. It is better to take care of this in advance, since the very fact of unofficial employment sooner or later threatens a number of problems. The ideal option is documentary evidence of the salary amount. It is unlikely that you will be able to obtain an employment contract, payslips, etc.

You can record the moment of discussion on a voice recorder. Just keep in mind that this will have to be done secretly. Almost all smartphones have audio recording capabilities. Another possible option is witness testimony. They can be given by any person who saw the moment of transfer of money and its quantity.

In some cases, proof may be a job advertisement.

The amount of wages is often written in the text. If it was posted on the website, then it is allowed to take a screenshot, which it is advisable to have certified by a notary. Many companies have double-entry bookkeeping. In this case, the collection of evidence is simplified. Any documents that indicate the amount of wages may be presented in court. In some places, employees are issued income certificates, which also serve as proof. They are given for obtaining a mortgage, loan, etc.

The easiest way to receive a black salary upon dismissal is if it was transferred to a bank card. In this case, it is enough to receive an account statement, which will indicate all receipts during a certain period of time.

Black wages: application to the prosecutor's office

So, you have collected evidence and are ready to contact the prosecutor's office. How to do it right?

An application to the prosecutor's office is prepared in the form of a complaint, stated in any form.

It must indicate the fact of payment of black wages in an envelope with the obligatory attachment of copies of all documents that, in the opinion of the applicant, are evidence.

If there are witnesses, indicate the names and addresses where they can be found and interviewed.

Complaint to the prosecutor's office about the payment of a black patch

Where to complain

When it comes to non-payment of unpaid wages, people rarely complain to higher authorities. It is known that in cases where there are no official documents, it will be difficult to prove the fact of withholding earnings that were not indicated anywhere.

Although you shouldn’t give up your intentions, because the employer can be held accountable only for the fact that there are black wages in the organization at all.

Which authorities should you contact:

- to the labor inspectorate;

- to tax services;

- to the prosecutor's office.

Application to the state labor inspectorate about black wages

You can prepare an application in one of the following ways:

- Arrive at the nearest territorial inspection office with supporting documents and write a statement.

- Prepare an application at home and send it to the inspectorate by mail (preferably by registered mail).

- Use the Internet, fill out an application on the official website of the inspection, or simply send pre-prepared documents via the Internet.

The application is drawn up in any form. But it is important to remember that the inspection does not accept or consider anonymous applications.

In addition, if the complaint against the employer concerns violations that are not within the authority of the inspectorate, then within a week your application will be forwarded to the authority authorized to resolve the problem (for example, the tax inspectorate). The applicant is notified of this in writing.

Complaint to the State Labor Inspectorate about black wages

Black wages: contacting the tax office

The application must be submitted to the tax office at the employer's location.

The application must indicate the violations committed by the employer against you, as well as the employer’s data, the name of the company, the address where it is actually located, the applicant’s full name and contact telephone number.

Attached to the complaint are copies of the applicant’s documents indicating a violation of his rights. For example, I ask you to conduct a tax audit and protect my rights and then describe in detail the essence of the violations.

Application to the tax office for payment of black wages

Salary in an envelope: where you can complain anonymously

Often in practice the question arises: Is it possible to file an anonymous complaint about receiving black wages? Let's give a brief explanation.

You can anonymously complain about an employer to the tax office in two ways: by telephone (orally) or by letter without indicating your personal data.

You can file a complaint orally by calling the tax office hotline, which is registered with the employer company.

You can also prepare an anonymous letter about the payment of black wages and send it by mail to the tax authority.

You should be aware that in order to respond to an anonymous application, the regulatory authority will need time to verify the accuracy of the information received.

Only after this the tax authorities will begin to audit the company. And if the applicant’s personal data is available, the verification will begin in a shorter period of time.