Home / Labor Law / Dismissal and layoffs / Dismissal

Back

Published: 01/12/2018

Reading time: 8 min

0

3023

Failure to pay the funds required by law upon termination of an employment contract is a violation of labor legislation. Often, the employer promises the dismissed employee to pay the money later or avoids payments altogether.

There is only one way out in such a situation - filing a complaint with the relevant government authorities.

- Terms of payment of settlement funds

- What to do if the money is not issued?

- Ways out of the situation For those officially employed

- For unofficial employees

- To the labor inspectorate

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

What payments can a resigning employee claim?

Labor law directly obliges the employer to pay all wages due to the employee on the date of dismissal. The list of eligible amounts includes:

- Payment for work actually performed for the period from the beginning of the month until the date of dismissal;

- Payment of premiums, bonuses, allowances and additional payments to which the employee has the right in accordance with the local regulations of the company;

- Amounts of vacation pay for unused days;

- Severance pay and compensation payments in accordance with the law and local documents of the employer;

- Various payments according to company policy that are not included in the remuneration system, but are due to the departing employee.

Important! In some cases, legislation limits the maximum amount of certain termination payments. In particular, severance pay is prohibited for dismissal on culpable grounds (theft, absenteeism) in accordance with Art. 181.1 Labor Code of the Russian Federation. The total amount of all additional payments upon dismissal (in addition to salaries and vacation compensation) of managers, deputy directors and chief accountants should not exceed their 3 average monthly earnings (Part 4 of Article 349.3 of the Labor Code of the Russian Federation).

If an employee has the right to paid time off, they must also be compensated, with the exception of rest days for donating blood.

Filing a claim in court

Labor inspection bodies and prosecutors can conduct unscheduled inspections, issue a report on violations of labor legislation and eliminate the consequences, i.e. oblige the employer to pay the employee a settlement. But administrative authorities cannot take actual actions that would help transfer the earned funds to the employee, i.e. their decisions do not have the force of an executive document and are not directly executed by bailiffs. To receive legal amounts, you will need a statement of claim to the court at the location of the employing company or at the place of work of the applicant, the location of the branch, representative office of the debtor organization, where the plaintiff worked at the time of dismissal.

The claim is filed according to the rules of the Code of Civil Procedure of the Russian Federation - Art. 131-132. The document indicates the names of the parties, the amount of the claim, which may be equal to the amount of the unpaid settlement or supplemented by a claim for other compensation payments. The descriptive part provides detailed information about the content of the employment contract, the date and place of its conclusion. It is also necessary to indicate data on the application on the basis of which the employee terminated his employment relationship with the organization or individual entrepreneur.

Evidence should be attached to the application - copies of the employment contract, order (if the applicant has them at the time of filing the claim), other documents. State duty on labor disputes is not paid. The statute of limitations for payments from the employer is one year from the date of violation of the employee’s right to receive payment.

When resolving labor disputes, timely legal support is desirable.

When should full payments be made?

According to the norms of Part 3, 4 Art. 84.1, Art. 140 of the Labor Code of the Russian Federation, the employer must pay the employee in full on the day of his dismissal. In addition to this, the legislation identifies certain cases when deviation from the specified period is possible. List of similar situations:

- If an employee receives a salary in cash and was absent from work on the day of dismissal, the due funds must be given to him the next day after he submits the corresponding request;

- When on vacation with subsequent dismissal, payment for the vacation is made 3 days before its start, and all other amounts are transferred on the day preceding the start of the vacation period;

- If the termination of the employment relationship is associated with the death of an employee, all payments due to him are received by his closest relative within a week after he presents a document certifying the fact of relationship.

In a situation where the employee is not paid upon dismissal within the above deadlines, the employer violates the requirements of the law and may be held liable.

Prerequisites for the offense

Late payment of the settlement may be due to the fact that on the last day of dismissal the employee could not be present at the workplace for objective reasons. On the day of dismissal, the employee may be unable to work - open a sick leave certificate. An employee may be on scheduled leave or absent on shift. It is possible that payment may not be received due to other valid circumstances. If an employee works on a shift schedule, then he may have a day off and, accordingly, he is not always able to report to the employer. In any case, the employer is obliged to pay the amounts due to the employee.

Expert commentary

Gorchakov Vladimir

Lawyer

There are situations when a company is in bankruptcy and cannot pay its employees in a timely manner. When carrying out financial rehabilitation procedures, the management of the enterprise, including the interim manager, may make a radical decision and dismiss some of the staff. Then, in addition to settlement, employees will need to be paid severance pay and, if necessary, compensation amounts. They must be listed in a timely manner, regardless of the actual volume of labor functions performed at the time of termination of employment agreements.

Important! An employer may deliberately not pay an employee the required amount, citing the difficult financial situation at the enterprise. The employee is not responsible for the company's debts. He must receive payment on time.

Responsibility of the employer for late or incomplete payment

If the employer does not pay the dismissed employee on time, he may be brought to financial, administrative or criminal liability. If it is established that the employee's accruals were not transferred in full, after the established period, or a refusal to pay the amounts due, the employer faces:

- Material punishment according to Art. 236 of the Labor Code of the Russian Federation in the form of interest charged for each day of delay on the debt amount;

- Administrative fines in accordance with Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, in this case, both the organization as a whole and a specific official guilty of a violation can be punished;

- Criminal liability in case of complete non-payment of wages for more than 2 months in a row or partial non-payment for more than 3 months (Article 145.1 of the Criminal Code of the Russian Federation). In this case, it is important that there is intention on the part of the employer and the financial ability to make the payment on time;

- Additional liability may arise by court decision if the employee demands compensation for moral damages and the arbitrators grant his claim.

Important! Financial liability arises regardless of whether the employer is at fault for delaying wages (part 3 of article 2.1 of the Code of Administrative Offenses of the Russian Federation, paragraph 1 of paragraph 15 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2005 No. 5).

Employers' liability

Quite often a problem arises when a person quits his job and is not given a paycheck. The trade union committee or an experienced lawyer can tell you where to go in this case and where to get a sample for the application. But before filing a complaint about non-payment of benefits to higher authorities, you can submit a claim directly to the administration of the enterprise. The owner can avoid unwanted litigation and subsequent fines.

If the conflict cannot be resolved peacefully, the employer will have to bear responsibility to the fullest extent of the law. Non-payment or unreasonable delay in payments may result in:

- material liability - in accordance with Article 236 of the Labor Code, management is obliged to provide not only what is detained, but also moral compensation, the amount of which is determined by the current rate of the Central Bank;

- administrative liability - according to the Code of Administrative Offences, the amount of a fine for officials can reach up to 20 thousand rubles, and a legal entity will have to pay up to 50 thousand, in addition, the manager can be removed from high positions;

- criminal liability - Article 145 of the Criminal Code of the Russian Federation prohibits delaying the payment of money for more than 3 months, otherwise you will have to pay a fine of 500 thousand rubles and incur additional punishment in the form of forced labor or imprisonment.

In order for the termination of the employment relationship to be easy and painless for both parties, it is necessary to comply with the requirements of the law for both the employer and the staff. In each case, it is important to remember not only your rights, but also your obligations.

https://youtu.be/uI25kK_lHhM

What should a fired person do if he is not paid?

If a citizen is not paid upon dismissal, he has the right to defend his violated rights by all means available to him. For these purposes he can:

- Contact your former employer with a written demand for repayment of the debt;

- Seek help from the labor inspectorate;

- Complain to the prosecutor's office;

- File a claim in court.

As a rule, a direct demand to the former employer for repayment of the debt is unsuccessful. In this regard, it is more advisable to immediately resort to subsequent options.

How to complain to the State Tax Inspectorate or the prosecutor's office?

A citizen whose labor rights have been violated can submit a written complaint to the labor inspectorate. It can be delivered in person, sent by mail with a notification, or sent by email. Each application is considered within 30 days from the date of its receipt; in exceptional, particularly difficult cases, this period can be extended by another 30 days.

During the specified period, the State Tax Inspectorate will verify the fact of the violation. If non-payment of wages upon dismissal is confirmed, the inspectorate takes the following actions:

- Issues an order to repay the debt within a certain period (Part 1 of Article 357 of the Labor Code of the Russian Federation, Article 12 of Law No. 59-FZ);

- If the employer does not fulfill it within the period specified in the document, then no later than a month from its end, the procedure for forced collection of the salary debt begins;

- A decision on forced collection that has not been appealed and not fulfilled on time is sent to bailiffs for execution.

In general, the procedure for contacting the prosecutor’s office is similar to filing a complaint with the State Tax Inspectorate and is considered within the same time frame. The prosecutor conducts an inspection and, if a fact of non-payment of wages is discovered, issues an order to eliminate the violation, which is mandatory for the employer.

- Sample application to the prosecutor's office,

- Sample application to the labor inspectorate,

Competent authorities

If an unscrupulous employer tries to evade payment within the period established by law, there is only one option left - to seek help from the court. Labor legislation firmly protects the rights of workers, and any violations by enterprise owners are punishable by significant fines and even criminal liability.

To apply to the judicial authorities, you must collect the following documents:

- a copy of the pages of the work book with an entry made about the termination of the employment relationship;

- certificate of salary received;

- a document confirming the employee’s request to make a payment (copy of the application);

- other documents that may prove the illegality of management’s actions.

The court must also provide the amount of compensation and all benefits that should be paid to the employee according to its preliminary calculations. The Labor Code also provides other options for where to go and what to do if the employer does not pay upon dismissal. For example, you can complain to the Labor Inspectorate or the prosecutor's office, they will conduct an inspection at the enterprise and identify violations.

In addition, if the employee does not intend to resign, but the employer delays payment for more than 15 days, a complete cessation of any production activity is allowed. The management must first be notified in writing of such intentions of the personnel. Such actions are considered unlawful in the Armed Forces of the Russian Federation, the Ministry of Emergency Situations, as well as gas and heat supply, electricity and water supply services.

The court will not satisfy or partially satisfy the employee’s claim if, for justified reasons, he was not paid a settlement upon dismissal . The Labor Code explains what to do in this case. If during the verification process a shortage of money or other material assets for which a specific person is responsible was discovered, then the damage will have to be compensated. Direct actual damage is discussed in Article 239 of the Labor Code of the Russian Federation. The employee must immediately compensate for all losses caused to the enterprise in order to receive all due payments in a timely manner.

In addition, in enterprises where personnel are provided with workwear, it is subject to return or compensation, which is deducted from the calculated payments.

Cases of payment of settlement to an employee

Based on the norms of existing labor legislation, the resigning employee’s salary is paid either on the date of his dismissal from the company, or on the day (but not later than the next day) when he demanded that his manager pay such a salary.

An employee can demand payment on a day other than the day of his dismissal if he was absent from his place of work on the date of his official dismissal.

In turn, absence from the workplace on the last working day must be valid, for example, due to vacation, sick leave or a day off in accordance with the schedule.

If there is disagreement

There are situations when the employee and the employer do not come to a common opinion regarding the amount of payments due to the employee and the situation can develop into a conflict.

The legislation prudently stipulates such cases, and if they arise, the employee can apply for restoration of violated rights to the appropriate authorities.

At the very beginning of the difficult path of resolving a controversial situation, the least painful and more rational thing would be to appeal to the conscience and common sense of the employer.

In fact, in most cases, disagreements over employee benefits can be resolved this way.

If the employee and the manager fail to come to an understanding, then it makes sense to file a complaint with the trade union organization, labor inspectorate, prosecutorial authorities, or the court.

Communicating with the employer

Simple verbal communication with the boss when resolving disagreements may not end in anything, for the reason that it is just communication.

After all, words that are not recorded on any storage medium remain just words.

In order for the agreement with the manager to be official, the employee must contact his boss in writing with the obligatory registration of his appeal.

In this case, the employer will be forced to give the same written response, which, in case of a negative result, will need to be attached to complaints to subsequent authorities.

Contact the labor inspectorate

The Labor Inspectorate is perhaps the most effective government body in resolving problematic situations involving non-payment of wages.

A written complaint is submitted to the inspectorate from an employee whose rights have been violated.

The complaint must indicate the full name of the organization, full name of the head, the essence of the appeal, the amount of the settlement to be paid, the period of non-payment, the date and signature of the person who applied.

You can also send a complaint to the inspectorate by mail or via the Internet on the official website of the inspectorate. The employee's complaint will be considered within a month.

Based on the results of its consideration, if a violation of labor legislation is revealed, the inspectorate will issue an appropriate order to the head of the enterprise with a requirement to repay the settlement debt and the deadline within which this must be done.

In addition, such a manager will be subject to administrative punishment in the form of a fine.

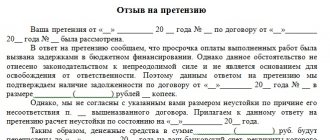

We complain to the prosecutor's office

Contacting the prosecutor's office is carried out in the same written manner, either by mail with a return receipt requested, or by email on the website of a law enforcement agency.

The requirements for the complaint in this case are similar, so there is no need to write anything else here.

The complaint must be accompanied by a written response from the employer, if the employee has previously contacted him in writing. Prosecutor's response measures will be similar.

That is, when it is established that the organization is in debt, a prosecutorial response will be issued to the employee, with a requirement to pay the amount due with interest for the delay. After which, the manager will also have to pay a fine to the state.

Complaint to the judiciary

Any employee can file a complaint about unpaid severance pay in court. This can be either a district court located on the territory of the employing organization, or a magistrate’s court serving the given area.

When filing a claim in court, it is important to know that a dismissed employee has the right to go to court no later than three months after his dismissal.

The employee can contact the judicial authorities and write a statement asking for a court order to be issued to him. Based on the court order, a writ of execution is prepared, which he then presents to his organization and receives payments.

The employee can also file a lawsuit for payment of the settlement. Judicial practice shows that filing a claim is more effective.

An employee can contact all of the above authorities either step by step or simultaneously; there are no legal prohibitions in this procedure.

What to do if you were not paid an unpaid salary upon dismissal?

In case of conflicts and disagreements with the employer, employees who receive their salary “in an envelope” are least protected. If the employee was officially registered and received part of the income “in white,” he has the right to receive a payment within the limits of this salary. In the absence of documentary evidence of the fact of an employment relationship, the employer formally has no obligations to the employee and it is extremely difficult to force him to pay in court or with the help of supervisory authorities.

An effective measure could be to contact the employer with an official letter of demand, in which the ex-employee:

- cites the norms of the Labor Code and states the violations committed;

- requires payment of settlements within a certain period;

- informs of its intention to contact the labor inspectorate and the prosecutor's office regarding the company's violation of employment standards, wages and other provisions of the law, and also to transfer all available information to the tax service.

The letter should be accompanied by copies of documents that can confirm the fact of an employment relationship with the company and previous payments - work documents, screenshots of official correspondence, etc. The more complete the set of evidence, the more likely it is that the company will enter into a dialogue with the fired person in order to avoid the attention of government authorities.

Criminal liability for non-payment of payment

Art. 145.1 of the Criminal Code of the Russian Federation established non-payment of wages as a criminal offense. The integral elements of such a crime are:

- the fault of the head (other official) of the employing organization for the delay;

- personal or selfish interest. According to paragraph 16 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated October 16, 2009 No. 19, personal interest includes the desire of an official to obtain non-property benefits, the motivation for which is, for example: the desire to hide incompetence;

- careerism;

- desire to receive a return favor;

- nepotism;

- desire to receive support on a specific issue.

Selfish interest is defined as the desire to obtain a property benefit for oneself or another person by committing an unlawful act.

Only individuals are held criminally liable. According to Art. 145.1 of the Criminal Code of the Russian Federation may be punished:

- employer - an individual (for example, a notary, individual entrepreneur, etc.);

- head of an organization or its structural unit;

- chief accountant (in collaboration with the manager).

Consequences of refusing to pay an employee

Refusing to pay a former employee is quite dangerous for the organization. Such actions entail various negative consequences:

- material costs of litigation;

- the need to pay compensation to the employee for delay in payment;

- administrative responsibility.

The law provides for a fine for unscrupulous employers. At the same time, money is paid not only by the organization, but also by officials who are obliged to pay the employee on time. For officials, the fine ranges from 5 to 50 minimum wages, and for an organization – from 300 minimum wages.

The rules described above protect the rights of workers from unscrupulous employers. Financial and administrative responsibility serves as a good deterrent. The main thing is to go to court on time! The maximum period for application is one month . This government body will help protect the rights of the employee and punish the unfair employer.

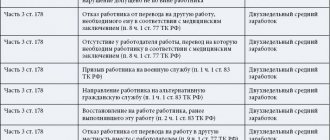

The procedure for calculating an employee upon termination of an employment contract

Upon dismissal, the employee receives:

- the remainder of the salary;

- compensation for unused vacation days (if you were fired without such compensation, this is a violation of the law);

- other compensation (for downsizing, liquidation of an organization, etc.).

The employee receives the first two amounts in hand on the last working day (or on the day specified in the Dismissal Order as the day of termination of the employment contract), but there are exceptions:

- other compensation, for example, severance pay, will be received by the dismissed person for a certain period (no more than 2-3 months, in accordance with Article 178 of the Labor Code of the Russian Federation);

- when on vacation followed by dismissal, all payments are paid on the day before leaving for vacation.

Data on the amounts paid are entered by the accounting department into the calculation note (form T-61, Resolution of the State Statistics Committee No. 1).

Important! The remaining salary and compensation for unused vacation days are subject to both insurance contributions (since information is submitted to the Funds for the previous month) and personal income tax.

Thus, if an employee was fired but not paid, then this is a sufficient basis for using mechanisms to protect their labor rights.

Contact Rostrud

If contacting the employer does not bring a positive result, the employee has the right to contact the State Labor Inspectorate in his region. At the legislative level, the deadlines for contacting the Labor Inspectorate are not established, but it is advisable for the employee to write a statement about the violation of his rights as soon as possible.

You can contact the Labor Inspectorate by sending a complaint by mail, giving it to the labor inspector at a personal meeting, or sending it by email.

The complaint to the Labor Inspectorate should indicate:

- name of the territorial division of Rostrud;

- full name of the organization in which the employee worked, full name and position of its head;

- Full name and position of the dismissed person;

- the period of his work at the enterprise;

- grounds for work (employment contract);

- date of termination of the employment relationship;

- information about the violation committed - non-payment of wages upon termination of the employment contract;

- an indication of violated labor legislation.

The powers of the Labor Inspectorate in accordance with Article 356 of the Labor Code of the Russian Federation include consideration of complaints and appeals from citizens about violations of labor legislation. In pursuance of these powers, labor inspectors have the right to check the facts stated in the appeal, if violations are confirmed:

- issue mandatory orders to employers to eliminate identified violations;

- bring employers to administrative responsibility in connection with violations of labor legislation (Article 357 of the Labor Code of the Russian Federation).