What is commercial real estate?

Let's start with the most important definition. Commercial real estate is considered to be various structures, land plots, buildings that are used by their owners and employers to carry out business activities. The goal of the latter is to obtain constant profit, periodic capital gains, and rental income. This is one of the investment options.

Here are the most common objects that can be called commercial real estate:

- Agricultural enterprises.

- Industrial facilities.

- Hotels, inns, hostels.

- Warehouses, garages.

- Office structures.

- Shopping centers and shops.

How to open your own commercial real estate agency

Your own business opens up many opportunities, and its main advantage is independence. For many, working in an office, a store, or an enterprise becomes unbearable, primarily due to the incorrect attitude of management towards subordinates and the lack of a career ladder. Working with commercial real estate allows you to build your business, gain complete financial freedom, and get acquainted with most areas of small, medium and large businesses in your region. Having established yourself as the head of a large company made from scratch or as a successful independent agent, you will have sufficient information and start-up capital for your further path to the heights of success.

However, if your income is sufficient to buy an expensive car, a nice apartment and a house outside the city, an annual vacation anywhere in the world is the limit of your dreams, and the work in real estate itself is to your liking, there is nothing stopping you from stopping there.

In this article, we will look at each step step by step and provide a number of useful tips, such as working with objections from owners and clients, and the correct answer to an incoming call from a potential buyer.

What we need to start: a cell phone with the ability to spend about 2,000 rubles a month, good shoes and a desire to work and earn money.

The essence of the work: one person (or organization) owns a premises that he wants to either sell or rent out; the second person (organization) intends to engage in production, warehousing, wholesale or retail trade, or involves office work (for example, a psychologist’s office or programmers) - for these purposes he will need premises.

If there is not enough money to purchase, the person (organization) will look for premises to rent. Of course, the owner of the property will be interested in the highest price possible, and the buyer in the lowest possible price. Here we will need to focus on the average market price and lead both parties to a compromise.

The first thing we’ll start with is to go online to the most popular real estate sites in the region (top sites in search engines for the query “commercial real estate”, of which the most interesting are 3-4 sites with the maximum number of advertisements).

Without yet having the premises on which we will work, there is no need to waste time. We need to find premises from the owners on the websites - this is very simple to do: the owner indicates the exact address of the premises, but the agency does not do this (pay attention to this, you will also do this - if the address is indicated and it is written that you are an agent or you are If you say this over the phone, the potential acquirer of the right to the object will consider it stupid to pay you and will go there himself to look for the owner).

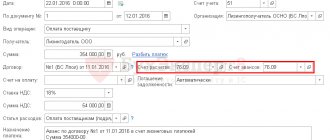

As for the agent's commission, proceed from the market situation in the region (study the operating conditions of agencies in the market based on their advertising and their websites). We will consider an option in which a rental commission is accepted from both sides.

Please note, write it down separately, because this will become an argument when talking with the owner and tenant:

- We help the owner find a tenant as quickly as possible and make a profit from the property being rented out as quickly as possible, you can pay attention to the fact that the premises have been empty for a long time (if this is really the case and you are reliably aware of this);

- We help the tenant quickly find premises for the development of his business, the premises most suitable for him (always try to look for truly suitable premises, first according to the customer’s requirements, and then based on our own many years of experience in this area, because you will have experience working with clients in those places The ones you found for them are most often successful, but not always.

Over the years, many even enjoy helping newcomers to a particular business in finding the most profitable places for them. And never cram in junk for immediate gain - word of mouth works both positively and negatively).

During the first week, we monitor all sites and record premises from them into groups (ideally, keep a log for each): production facilities up to 200 sq.m. and from 200 sq.m., warehouses up to 200 sq.m. and from 200 sq.m., offices up to 30 sq.m., 30-100 sq.m. and from 100 sq.m., shops up to 40 sq.m., 40 – 100 sq.m. and more than 100 sq.m., free-use (usually premises on the ground floors with separate entrance suitable for a store, office, services) up to 40 sq.m, 40 – 100 sq.m and from 100 sq.m.

The premises can be 1000 or 10,000 sq.m., but as a rule, after 100-200 sq.m. there are not as many premises as smaller ones and the demand for them is lower.

Every day we submit at least 10-20 advertisements (trying to eventually reach 200 or more advertisements on each site from the top 3 regions).

In the advertisement we indicate “for rent/sale” the premises, then the characteristics of the actual premises (price and area are required), but in no case verbatim, like the owner, and slightly change the area, usually rounding (for example, not 122, but 120 sq.m. ) and indicate the approximate area (with an accuracy of no more than 2 stops); if you need to indicate the number of storeys of the house, please note that there are houses with the same number of storeys nearby or write the number of storeys of most neighboring buildings.

In your advertisements, be sure to indicate that you are a real estate agent and take a commission (at the first stage, you can dump on the cost of services, taking not a 50% commission, but 20-25%). Many realtors will say that this should not be done under any circumstances, you need to respect your work... Don’t listen - they don’t benefit from competition, but on your part everything is extremely honest - you don’t have so little experience, there will be many offers that are not suitable, there will be a lot of nonsense and therefore take a full commission is not entirely fair.

When the first potential buyer or tenant calls and asks about the premises, clarify what he is interested in and refer to the fact that it is extremely inconvenient to talk (for example, you are at a meeting) and call back as soon as possible.

Urgently call the owner (urgently, does not mean in a hurry and excitement - always keep calm and composure in your voice), introduce yourself as a real estate agent, say that you have a client who would be suitable for this premises, that you take a commission of 50 for your services in finding a tenant % (at the first stage I suggest, as with the client, it will be limited to 20-25%).

If the owner agrees, find out a time convenient for the showing and call the client. If the owner refuses, make a choice: limit yourself to the commission on the one hand, or call back and say that, alas, the premises have already been rented out and you are ready to find another one in the near future in the desired area according to the client’s parameters.

When showing the premises, ALWAYS arrive in advance to avoid the parties meeting before you and exchanging contacts (always say that while sending by mail, calling through you is part of your work, since you must be in the know and help resolve all issues that arise. Always try in advance visit the place, see what you will offer and walk around everything within the radius of the nearest stop.

The agent is also responsible for preparing contracts between the parties. Templates for agreements can be found on the Internet, but all of them will have to be finalized individually and, before sending them to the parties for review, you will need to include everything that will be agreed upon at the first meeting, so listen carefully and write it down in a notebook.

Having gained your first experience in conducting transactions and earning your first money, get ready to move on to the next stage - registration as an individual entrepreneur or organization.

Here you will be charged with constant tax, pension, and insurance expenses, but the work will become official and it will be possible to conclude real contracts from an individual entrepreneur or LLC with owners and clients, and not sign an essentially fake 1-page agreement between them and you as an individual. person to provide services for finding premises, a tenant, a buyer.

At the very beginning, nothing prevents you from working from home, but the more often you come across people trying not to pay for work, the more often you will have to think about concluding contracts. It is not appropriate to conclude an agreement at home or in a cafe, so you will need an office, at first the smallest one, to put a desk with a laptop and a small cabinet for documents. A prerequisite is to be extremely accessible to clients and have parking.

After at least a year of experience, if you have finances, you can move on to expansion and hiring employees, but this is a topic for another discussion.

What else is commercial real estate?

The following can also be called commercial real estate:

- Land and other natural areas.

- Certain areas of underground subsoil.

- Demarcated water bodies.

- Forest areas.

- Perennial plantings.

- Other types of property attached to the land or firmly connected with it. As a rule, these are various buildings and structures.

We must not forget that real estate also includes rights to it. It can also include space objects, watercraft and aircraft that are subject to state registration.

Real estate is considered commercial only if it is intended to be used commercially. One in which it becomes a source of constant profit.

Formation of the cost of commercial real estate

It is important that when renting out an object or selling it to an interested party, the price per square footage may exceed the cost of an equal square footage in the housing stock, which is located next to a commercial property. This is due to the fact that in addition to the main price for the value of the property, it includes the most important point - making a profit from this property. But also, the price can be affected by location, appearance, interior decoration and transit traffic. Additional inclusions in the price may be the condition of the entrance to the building, since this point will be important for the tenant or buyer if his main task is to attract and serve potential buyers of goods or services.

What you need to pay attention to when buying or renting a real estate structure:

- Location of the object . This factor is the key to the profitability of the enterprise.

- Pedestrian and vehicle traffic , which may include the number of access roads, the quality of adjacent roads, and bus stops.

- Entourage of the building and premises. The appearance of real estate influences the attraction of the required audience of buyers of goods or services.

- It is important to choose the right layout required for the quality provision of services or the implementation of the main functional tasks of the enterprise.

You can find out how to sell commercial real estate quickly and very profitably here

Categories

Now - the gradation of commercial real estate:

- Buildings for free use. Sports and fitness centers, hotels, hotels, restaurants, cafes.

- Retail premises. Shops and shopping and entertainment centers.

- Office real estate. From business centers to private offices and office spaces.

- Industrial buildings. Production premises, structures of industrial enterprises, warehouse complexes.

- Social rooms. Medical centers, entertainment complexes (bowling alleys, swimming pools, disco halls, etc.), commercial airports, etc.

- Commercial housing. So-called apartments in apartment buildings, premises for short-term rental for the purpose of living.

However, only the first four categories are still considered truly commercial real estate. The last two occupy a more borderline position - between social and commercial, between residential and commercial types. They will bring profit to their owners and tenants only when used for certain purposes.

Objects that will be in demand:

Small office premises with an area of 15 - 35 sq.m. in the format of business centers.

The structure of most areas of business is changing. Trade is moving to the Internet. Spaces in shopping centers and street retail are replacing online sales channels. Companies rent cheaper, compared to retail, warehouse space in industrial zones and small office space in the city center in new prestigious business centers for sales departments and back offices.

In addition, the demand for such space is generated by IT industry companies. IT companies do not need large premises to create product and value. At the same time, they pay more attention to the space for employees to work than other areas of business.

Also, the demand for small office space will be created by companies in the beauty industry, which is currently in a growth stage. Beauty salons, cosmetology salons and hairdressers. For them, the key requirement is the availability of water and sewerage in the premises - pay attention to this when choosing a premises.

Commercial real estate in new buildings.

Premises in new buildings have a number of characteristics that are important to business, and which will acquire additional importance and value over time:

- Stained glass glazing of facades;

- Ceiling height;

- Open plans;

- Ventilation ducts separate from the general house ones;

- Entrance to the premises from ground level.

When comparing two properties in the same location - in a new building and in a building where commercial premises have appeared through transfer from apartments, a potential tenant will always choose a new building.

Premises for cafes in street retail format up to 100 sq.m.

The catering industry is gaining popularity and demand every year. When choosing premises for this business, take into account the characteristics necessary for cafes and restaurants: increased permissible electricity load, the presence of an additional entrance group for unloading and loading, a ventilation duct separate from the general one.

Premises for grocery stores from 100 to 180 sq.m.

Federal grocery chains, as well as other areas of business, are moving along the path of optimization. Large federal players are pushing regional companies out of the market. Unprofitable retail outlets are closing.

In general, in the grocery store market, Russia repeats the experience of Western countries where large hypermarkets and small stores with an area of 100 - 200 sq.m. do well. The world's most popular chain of small grocery stores of this format is Seven-Eleven. Founded in 1927, it now has more than 36 thousand stores.

Large Russian federal chains such as Magnit have already begun to master the format of small grocery stores, replacing with them the usual format of stores with an area of 350 - 500 sq.m. And small regional players, such as the Trafic chain of stores in the Republic of Tatarstan, show record levels of profitability and return on investment in grocery stores with an area of 100 -150 sq.m.

I see great potential in retail spaces of this format. In addition, the area is from 100 to 200 sq.m. also consider other areas of business: catering, hardware and other non-food stores, which gives them high liquidity.

Example of commercial housing

The most common example of such housing is a typical multi-story, apartment building. But each apartment in it acts as a private living space. In fact, the construction of apartment buildings is an investment project in the field of commercial real estate. After all, the design, architectural planning and further construction of a building is an investment, the purpose of which is quite clear - to make a profit.

But at the same time, every apartment in such a building is residential real estate. Once the apartments in such a building are sold, it ceases to be a commercial project. From now on it will apply only to residential private property.

Commercial housing. What is this in Belarus? This is exactly the example that is meant. But besides this, you need to know about commercial housing in the Moscow Region and other large cities of Russia, which is better known to the public under the name “apartments.”

Commercial and residential: what's the difference?

Many people ask: what is more profitable - commercial or residential real estate? It all depends on your goals. If you want to buy housing for your family, of course, it is more profitable to spend money on a regular apartment. Investors need apartments. In general, the question of profit usually arises when it comes to commercial real estate, because using it to systematically make a profit is a normal practice. Moreover, this is one of the properties of such objects. They are bought to conduct business.

Other points that distinguish commercial properties from residential ones:

- They are usually rented out or resold - this is the most profitable option for ownership. Renting gives the manufacturer, product seller or service provider mobility, and the building owner the opportunity to earn money easily.

- They often have high utility bills. This is due to the fact that square meters are purchased for profit, which means that more can be asked of the owner.

- Real estate taxes are calculated depending on the owner - an individual or a legal entity, etc. By the way, there are also mortgages for commercial real estate, but the interest rates are most often very high.

Is it profitable to rent out commercial real estate? Definitely yes. But a lot depends on the object. It is important where the future store is located, whether it is conveniently located, and whether there are nearby places that could negatively affect the business.

Don't forget that COVID-19 has greatly changed the way we do business. Many types of commercial real estate are simply no longer needed. For example, more and more people are moving from offices to their own apartments. And employers benefit from this scheme, because they can free up empty premises and not spend money on rent. Therefore, before choosing an object, think about exactly who you will rent it to and for what purposes.

If you have significant capital that you want to invest for a long time, then it is more profitable to buy commercial real estate rather than an apartment for rent. There are various subtleties in its purchase and maintenance, but a favorable agreement with the tenant will justify all the difficulties. The main thing is to choose the right object.

Prevalence of the phenomenon

Statistics show that more than a quarter of real estate on the primary housing market in Moscow are apartments. Why are they so common? It's all about the low price, which is a huge plus for selling housing in the capital region of the Russian Federation.

But buyers do not pay attention to the big drawback - the legal status of such premises is not yet clearly stated. Formally, these apartments are non-residential real estate. Despite the fact that they are completely suitable for human habitation, they are actively included in the plans and projects of administrative centers and hotel complexes.

Apartments in Moscow, for example, account for about 26-28% of all housing offers for sale. The largest distributors here are such large companies as “Symbol”, “ZilArt” and others.

How much does commercial housing cost? If we compare apartments with new buildings in typical residential high-rise buildings, they will be 20-25% lower in cost. Moreover, the characteristics of the premises will be similar.

What to do after?

The completion of construction is marked by the search for tenants. Why launch an advertising company:

- announcements are published;

- Photos are posted on virtual bulletin boards, forums, social networks and communities.

Search for tenants

The tenants are:

- network companies;

- banks;

- communication shops;

- pharmacies;

- small shops;

- other commercial structures.

Despite the fact that network companies are considered to be seemingly profitable partners, in fact, rental practice says the opposite. Very often they demand a discount on rent, and this reduces the profit margin. They offer only their template as an agreement, depriving the landlord of leverage.

Beginning entrepreneurs are considered unreliable partners. They have no experience in running a business, so such counterparties can disappear at any time without paying the rent. Experienced entrepreneurs, as opposed to the first ones, are considered the most organized and successful businessmen.

When looking for a tenant, you should pay attention to sales agents . They, as a rule, occupy the premises for one day, but organize an advertising campaign in such a way that numerous buyers are drawn to the new construction project.

It is difficult to deal with organizations that sell products with a specific smell, or a pet store. Amber spreads very quickly and is difficult to get rid of. If a grocery store also organizes a cafe or bakery within its walls, then the commercial property will inevitably suffer internal destruction.

We talked more about the features of commercial real estate transactions in a separate article.

Control

Property management consists of maintaining and improving the condition of the building in good quality. Besides:

- rental housing fees are charged;

- development analysis is carried out;

- conflicts are resolved with all parties;

- options are being considered to reduce the cost of maintaining the facility and increase profits from use.

Property management is carried out either by the owner himself or by a hired employee. The latter is considered both an individual and a legal entity. A contract for property management is concluded with the hired citizen (company). Read more about the pros, cons and other aspects of trust management of commercial real estate here.

The cost of commercial real estate pays off over time. For successful business development, we recommend reading our other articles:

- How to evaluate an object and draw up a final report?

- What is the procedure for calculating tax, terms of transfer and consequences of non-payment?

- What are the rules and consequences of converting residential property to commercial property?

- What is redevelopment and how to make a separate entrance?

Construction of commercial real estate is a profitable and promising commercial enterprise. In order for it to generate income, you need to correctly place emphasis and priorities.

Who is the offer intended for?

How to buy commercial housing? You just need to contact the sales department of the developer you are interested in. There are no problems with buying apartments in Russia today.

Initially, this type of construction began to develop in the capital of the Russian Federation due to a shortage of sites for the construction of traditional housing. Apartments were included in business centers. Further more. Former factories are now being converted into apartment complexes.

Who are they intended for? Initially, the apartments were premises for temporary comfortable residence of successful businessmen. A business person could buy such housing in a city where he often appears on business trips, for the purpose of meetings, negotiations, so as not to stay at a hotel or inn.

Then another category of citizens began to purchase apartments. Not for living, but for investing your money in real estate.

Taxation

Property tax

It replaced the property tax in 2015 and significantly increased the tax burden of taxpayers.

What is the reason? Previously, the rate was calculated based on the book value (inventory) of the property, determined by the BTI based on construction costs and the degree of natural wear and tear of the building or premises. Now the cadastral value is taken as the basis for the calculation, i.e. the market value, which is taken into account when selling property. In this case, the location of the property, its attractiveness for business or residence, the infrastructure of the area and other factors matter. The assessment is carried out by various expert companies, as well as the Cadastral Chamber. If a taxpayer believes that the price of his real estate is too high, then he can write an application for review. However, the independent assessment is carried out at his own expense.

The reform to change the type of property valuation was carried out gradually, covering more and more new areas every year. By 2021, it is planned to transfer all real estate (commercial and residential) of individuals (with the exception of some preferential categories) and organizations to cadastral valuation. The list of types of real estate subject to valuation according to the new rules is established by Art. 378.2 of the Tax Code of the Russian Federation. It is logical that the tax amount will increase significantly primarily for owners of business buildings: shopping centers, offices, cafes and restaurants, since they have the highest market value. Initially, the cadastral rate was 1.2%, in 2018 it reached 2%. (although regions could set it to a smaller size, at their discretion)

Who is interested in apartments today?

Today, apartments are also of interest to citizens who are far from big business and investment. Those who just want to purchase comfortable housing at an affordable price for permanent residence.

But you shouldn’t rush into such a purchase. Attracted by the lower cost, new residents at first do not pay attention to the many pitfalls, which then turn into big problems for them.

First of all, the terms “commercial housing” and “apartments” are not enshrined at the legislative level at all - neither at the regional nor at the federal level. In essence, apartments are residential real estate. But they are regulated by law as a commercial one. Taxes are paid according to this principle.

As for public housing commercial housing, it's not even a related concept. This refers to housing rented out under commercial lease agreements, not apartments.

Features of commercial land plots

Commercial land quickly pays for itself, because office, retail or warehouse premises are built on them, which are then rented out or sold. Such land plots are also often used for agricultural purposes or for residential development. In any case, the investments made in the purchase of land are quickly returned, and the profit received exceeds the costs several times. The buyer of industrial land can be either a private person or an investment, development, construction or any other organization.

Commercial land located near the capital is becoming more and more expensive every year, so it is better not to delay its acquisition. Well-localized commercial land plots are always in high demand, because the profitability of an object largely depends on its location. The location of the commercial site is selected depending on the intended purpose. It is better to choose agricultural land and plots for housing construction in environmentally friendly areas, near rivers, lakes and forests. Industrial land for development of office centers, shops, car services, warehouses, etc. are selected depending on transport accessibility, and preferably close to federal highways. In any of the options, a commercial land plot must already have all the necessary communications or at least be in close proximity to them. The price of 1 hectare of land depends on the location of the land plot and the availability of communications. The cleaner the zone, the closer the rivers and lakes, forests and roads, the more expensive the land. But you shouldn’t save on purchasing land, because the more favorable the location of the land plot, the shorter the payback period and the higher the profitability of the future commercial facility.

An important factor in the acquisition of commercial land is careful preparation for the transaction. First of all, you need to choose a reliable selling company with a good reputation, because the sale of commercial land is far from a transparent business, and you can easily run into scammers. It is best to contact a company that owns the proposed land plots, and not to intermediaries: buying land through intermediaries will be more expensive, and its registration will take longer. Secondly, after selecting a specific piece of commercial land, you need to check its history; this is necessary so that after the completion of the transaction, the so-called “pitfalls” do not surface and spoil the plans for using the site, because commercial land may be encumbered by the ownership rights of third parties, the owner’s obligations for debts, loans or enforcement proceedings. After checking the commercial land, all necessary documents are collected, contracts are drawn up and registration actions are carried out. To formalize a transaction for the purchase and sale of commercial land, it is better to involve a qualified lawyer who knows all the necessary nuances and can find any shortcomings in the documents.

The acquired commercial land must fully correspond to its intended purpose; this purpose is indicated in the title documents. It is forbidden to use a commercial site in circumvention of the established type of permitted use. However, legally there is a way out of this situation - this is to change the category of the commercial site. Converting a commercial industrial site to agricultural use or for the construction of residential buildings is quite simple. But there may be difficulties with converting the site to industrial use. In any case, all issues related to changing the category of commercial plots are regulated by Federal Law No. 172 of December 21, 2004, which it is recommended to familiarize yourself with before starting such events.

Registration question

Commercial housing for military personnel does not include apartments. These are apartments provided under commercial lease agreements.

The second significant disadvantage of apartments is that, by law, they are not intended for permanent residence. Consequently, even being their owner and living there all the time, it is impossible to register in such a premises. There is only one exception: registration in apartments is possible if they are components of a hotel complex.

What types are there

Residential

The first group is regulated by the Housing and Civil Codes (LC - https://www.consultant.ru/document/cons_doc_LAW_51057/ and the Civil Code, respectively - https://www.consultant.ru/document/cons_doc_LAW_5142/), the second - by the Civil Code. Such premises are intended for permanent residence of citizens. In this regard, the Housing Code of the Russian Federation and by-laws establish fairly strict standards, according to which the premises are recognized as belonging to this category. (for example, compliance with living space standards per person, sanitary and hygienic rules, the presence of certain utilities, infrastructure, etc.). One of the most important legal consequences of this status is that the owner cannot be deprived of his only habitable home under any circumstances. “Inside” this norm there are a lot of nuances, but they are not the subject of this article.

a commercial

The above rule does not apply to it (for example, apartments). In addition, building categories can transform into one another, i.e. change places. For example, an apartment building during construction is a commercial facility. However, after the sale of apartments, each of them becomes a residential property, and entrances, basements and attics become common areas for residents. The opposite situation is when, for example, the owner of a “one-room apartment” (most common), located on the ground floor, decides to use this area for a store, warehouse or office. Cases when it is possible to transfer real estate from one category to another are regulated by housing legislation. The transfer itself is carried out by local governments and is a rather complex procedure.

Where can I register?

According to the law, registration in non-residential premises is possible when they fall under the jurisdiction of specialized institutions - hotels, hotels, hospitals, rest homes. The responsibility for registering residents living here is assigned to the administration of such an organization.

If the apartments are part of a business center or a former factory, it is impossible to make them a place of registration. But even in the resolved case, not everything is smooth. Even here, apartment owners receive non-permanent registration. They are required to renew their registration every 5 years. But it will give them the same rights as those registered in standard apartments. That is, they will be assigned to a local clinic and can apply for a place for a child in a kindergarten or school with registration. Therefore, apartments often become the choice of family buyers.

Features of taxation

Not everything is going smoothly with the tax payment for commercial housing either. Since apartments do not actually belong to the housing stock, it is impossible to obtain a 13% tax deduction.

But at the same time, property taxes themselves are levied at high rates, because by law it is commercial. Therefore, the owner of an apartment, in comparison with the owner of a regular apartment, overpays 20-25% in taxes. Moreover, every year.

When determining the tax base (based on the cadastral value), the minimum rate for apartments is 0.5%, the maximum is 2% (clause 2, clause 2, article 406 of the Tax Code of the Russian Federation). As for standard residential real estate, a rate of 0.1% applies to it (clause 1, clause 2, article 406 of the Tax Code of the Russian Federation).

The most disadvantageous apartments from a tax point of view are those located in an office, shopping complex, or in a building intended for catering establishments. The rate here is 1-2%. The most economical ones are hotel apartments. The maximum rate is 0.5%.

Is it possible to privatize commercial housing? There are also some “troubles” here. Sometimes new residents are offered contracts where they are the owners not of the apartment, but of some share in the common property.

Price

A square meter of KN is higher than a square meter of residential buildings, even if they are located in the same area. As stated, this is related to future income. In this case, the cost is determined based on various parameters:

- squares;

- location;

- condition of the premises;

- surrounding infrastructure.

These are the main parameters, but others are also possible, for example, the entrance to the room. So, if an office center is located in a central area, but the entrance to the building is not on a busy street, but in the courtyard, its cost will be lower than a similar center whose entrance is located on a central street or roadway.

When determining the price at which the premises will be sold or rented, potential income also plays an important role. For example, if warehouse premises are being considered, the price will be determined not only based on the area and location, but also the convenience of access roads leading to the warehouse, and the proximity of highways (roads, railways).

Each type of commercial facility, in addition to the classical parameters, has individual criteria that will affect the cost.

Rates

As for utility tariffs, there are again difficulties with apartments. They will not be subject to housing code requirements that are mandatory for the residential sector in relation to the management of common property.

Thus, apartment owners cannot influence the amount of tariffs set by the management company for the operation of the building, local area, and infrastructure in general. Therefore, utility bills here are definitely higher when compared with ordinary apartments. On average, by 15%.

Where to look and how to choose premises?

The main search methods are:

- real estate agencies;

- bargaining;

- specialized sites;

- private advertisements.

When choosing an object, you should pay attention to such factors as:

- location of the room - it is important to remember the purpose of the object;

- infrastructure;

- availability of parking, access roads, proximity to public transport;

- availability of repairs.

Is their assessment necessary and how is it carried out?

The appraisal helps determine the real value of the property or revise the tax amount. Establishing the value will help in procedures with loans, transfer of property into shared ownership, disputes with inheritance, and leasing.

The expert determines the real cost of the object upon receipt of the technical specifications and after concluding a contract for the provision of services. After the assessment, all information is entered into a report, which is sent to the owner.

Unregulated infrastructure

Another alarming disadvantage that you need to pay attention to before purchasing an apartment. The developer is not obliged to improve the area adjacent to commercial real estate. That is, a green area, lawns, playgrounds, places for temporary parking of cars and pedestrian paths may never appear near your house.

Pay attention to your neighbors too. If the apartments are located in a business center, then your house will have a wide variety of visitors and couriers. Under the windows there can be a smoking area or car parking for office workers.

Investments in closed-end mutual funds (UIFs)

This is the least risky instrument for investing in commercial real estate: stable profitability, a minimum entry threshold and the opportunity to invest in almost any (including large) objects - shopping centers, offices, mixed-use complexes, etc. Investors buy units - conditional shares of the mutual fund's property, and portfolio managers select an asset for investment, assess risks, invest funds and manage the object.

For the investor, this scheme saves time, effort and money (payment of taxes and operating costs). Most investors can afford to buy shares in a mutual fund: the investment amount in most funds starts from 1-2 million rubles. The profitability of such projects can reach 10-13% per annum.

Risks. There are no guarantees of profit in mutual funds: a shareholder may not only not make money, but also lose money. It all depends on the experience of those who manage capital, their knowledge of the market and economic situation, seasonality, macroeconomic factors (crises, exchange rates, oil prices, etc.).

SanPiN standards

In conclusion, we add that commercial housing is not subject to sanitary standards, which must be strictly observed by construction companies constructing standard housing. According to the level of illumination, noise insulation, insolation.

This is especially alarming for apartments located in old industrial complexes that have undergone reconstruction. That is, former factories, factories, warehouses. Many people are attracted to so-called lofts, but how safe will you be there?

If the enterprise that was previously located there was, in one way or another, connected with the chemical industry or hazardous waste, then living in such a premises is simply dangerous. Since the decay period of such substances is tens, or even hundreds of years.

Commercial housing is what apartments are called. Previously, they attracted only businessmen and investors. Today - ordinary citizens interested in affordable personal housing. But in fact, the lower cost of apartments results in a number of disadvantages that cannot even justify it.

How to rent out commercial real estate?

- First of all, you should study the supply market in order to be able to determine the price of the property. Once you have decided on this issue, you can create an ad that will allow you to attract the attention of potential clients;

- You can rent out yourself, or you can give priority to these opportunities to real estate agents. In this case, the search for optimal offers will be quick, but you will have to pay for the services provided;

- There is also a trusted management option. You can sign an agreement with a company that will carry out the process of managing your property, taking into account your wishes. In this case, the owner does not carry out any actions, he simply receives a profit. Trust management involves paying a percentage of the profits received to the manager;

- Before renting out a property, it is imperative to carry out a process of analyzing its condition. Light repairs and modifications are an opportunity to make a property more attractive and interesting to potential buyers. Thus, you will be able to invest in your real estate, and the return on such an investment will be very quick;

- Keep in mind that it is best to rent out such real estate under an agreement, within the framework of which all the nuances and important points will be spelled out, through which the basic price will be determined, and the main features of payments will also be established, etc. An oral agreement in this case is not possible due to for the reason that you will not be able to further protect your rights in court proceedings.

In fact, there will be no difficulties with renting commercial real estate; however, you must initially outline your plan of action in order to select the best offers with maximum cost parameters.