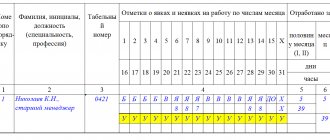

As for part-time workers, you have to assign 2 numbers to them at once, because a standard package of employment documents must be drawn up for them. Working time will be counted separately for both personnel numbers.

- The top lines in columns 5, 7 (form T-12) are filled in with data on the number of days that the employee fully worked. The bottom lines are for workers. time per period (in hours).

- At the end of each month, the personnel employee receives ready-made reports from the employees who kept the timesheets. His task will be to compare the information in the reports with information from the HR department. If necessary, he indicates the reasons why the employee did not come to work. He also checks when the employee was given leave and when he received travel allowances.

Vote:

Employees sent to improve their qualifications while taking time off work to another location are paid for travel expenses in the manner and amount provided for persons sent on business trips (Article 187 of the Labor Code of the Russian Federation). If an employee is trained on the job, that is, is not released from performing his job duties for the duration of the training, then he must be paid the salary established by the employment contract in full.

In the event that an employee is assigned a part-time working regime in connection with training, wages are accrued to him in proportion to the time worked or depending on the amount of work performed (part two of Article 93 of the Labor Code of the Russian Federation). In accordance with Art. 199, art.

Subtleties of paying for the time of employees aimed at improving their qualifications

As far as I know, according to the Labor Code of the Russian Federation, remuneration for workers who are studying outside of work is based on the average monthly salary for the previous period. Our accounting department, referring to some letter of recommendation from the Department of Health. Moscow, calculates my salary for the period of study, based only on the size of the basic salary without duty. Are the actions of the accounting department legal? If so, where can I find this letter of recommendation from the Moscow Department of Health (I couldn’t find it on the Department of Health’s website)?

Can I answer with a quote? Well, really, I’m too lazy to retype a well-written text

“Budgetary healthcare institutions: accounting and taxation”, 2008, N 2

AVERAGE EARNINGS: NEW CALCULATION PROCEDURE

Decree of the Government of the Russian Federation dated December 24, 2007 N 922 approved a new Regulation on the specifics of the procedure for calculating average wages, which takes into account the changes made by Federal Law dated June 30, 2006 N 90-FZ in Art. 139 Labor Code of the Russian Federation. Its application applies to all legal relations arising from 01/06/2008. The previously valid Regulations, approved by Decree of the Government of the Russian Federation of April 11, 2003 N 213, were declared invalid. In this article we will analyze all the changes made and use examples of various situations that arise in practice when calculating average earnings is required.

The new Regulation on the calculation of average earnings No. 922, as well as the previously valid Regulation No. 213, is subject to application in cases provided for by labor legislation. ... - sending an employee for advanced training while taking time away from work (Article 187 of the Labor Code of the Russian Federation); ... To calculate the average earnings in the cases listed above, it is necessary to determine two indicators: the amount of actual payments accrued to the employee and the period involved in the calculation.

Payments to be included in the calculation of average earnings

In accordance with clause 2 of the Regulation on the calculation of average earnings N 922, for calculating the average salary, all types of payments provided for by the remuneration system that are used by the relevant employer are taken into account, regardless of the sources of these payments. Such payments, as before, include: - wages accrued to the employee at tariff rates, salaries (official salaries) for time worked; — payment accrued at piece rates; — allowances and additional payments to tariff rates (official salaries) for professional skills; - for class; — for length of service (work experience); — for an academic degree, academic title, knowledge of a foreign language; — for combining professions (positions), expanding service areas, increasing the volume of work performed; - payment related to working conditions (harmfulness), as well as the amount of accrued regional coefficients; — for work at night, weekends and non-working holidays, overtime work; — bonuses and rewards provided for by the remuneration system; - other payments applicable to this employer. … Expert of the magazine “Budgetary healthcare institutions: accounting and taxation” S. GULIYEVA

I won’t even look for Moscow recommendations - no recommendations can contradict the Government Resolution

18.03.2009, 00:01

Thank you. What do you recommend doing in this situation?

First, find this article (if you don’t find it, publish the email address marked “with the permission of the moderator” - otherwise they will punish you - this is a violation of the RMS) - I will send (and erase the address) You will read the article carefully and contact those who have Your salary is counting. In principle, it answers all questions.

Well, no - the algorithm is known - a written statement addressed to the manager, an appeal to the labor dispute commission (your own, then the territorial one), and then... court, Ministry of Health and Social Development, prosecutor's office...

18.03.2009, 12:18

thanks a lot:)

In principle, it answers all questions.

Well, if suddenly the accounting department is not impressed by the text of the article, here is the resolution itself in question. Will it come in handy?

18.03.2009, 12:26

The address has been copied and deleted. I will send within 5 minutes

20.03.2009, 18:31

Continuation of the epic. I spoke with an accountant. The accountant advised us to read the Labor Code and Article 187, which states that during study the average salary at the main place of work is paid. It is this phrase “main place of work” that has become, it turns out, decisive in the position of the accounting department. Following their interpretation, the main place of work is the one that is paid by my official salary plus bonuses for harmfulness and so on, that is, my day job as the head of the department, but this, it turns out, does not include internal part-time work (my night shifts). To my question, where in The law defines the concept of “principal place of work.” I did not receive an answer either from the accountant or from the code itself. Having studied the provision on calculating average earnings with a commentary, kindly provided by the respected BBC moderator, I then inquired about the calculation of vacation pay, which, as you know, also relates to average earnings for the previous 12 months. I was referred to Article 114 of the Labor Code, which supposedly contains a clause regarding part-time work, which is taken into account when calculating vacation pay. However, Article 114 also talks about the average earnings for the same main place of work. (Almost a copy of Article 187, but only about vacation) It turns out to be an obvious contradiction, but... it is visible only to my eyes. The entire accounting department insists that this is how they were taught in their last years and is not going to back down. Question: where can I finally find a transcript of this notorious main place of work, which is so prone to free formulations? PS By the way, I asked a colleague from another Moscow hospital about this. The accounting department gave him approximately the same answer. They pay for their studies the same way as I do.

Your accountant is reading the wrong articles of the Labor Code... According to Article 65 of the Labor Code (), the main place of work is the place of work - that is, the organization (employer), and not your position - where your work book is. And according to Article 139 of the Labor Code (), the second paragraph - To calculate the average salary, all types of payments provided for by the remuneration system that are used by the relevant employer are taken into account, regardless of the sources of these payments. (as amended by Federal Law No. 90-FZ of June 30, 2006)

21.03.2009, 12:52

I didn’t find anything like that in article 65

Are your night shifts covered by a separate part-time employment contract?

21.03.2009, 20:34

Are your night shifts covered by a separate part-time employment contract? No, there is only one contract.

For some reason I didn’t find anything like that in Article 65. Indeed, the concept of “principal place of work” is not defined by law. However, according to Article 65 of the Labor Code, when concluding an employment contract, a person applying for a job presents to the employer: ... a work book, except in cases where the employment contract is concluded for the first time or the employee enters work on a part-time basis

Thus, a part-time job is a job where your work book is not kept. Therefore, where it is stored is the main one, regardless of the number of payment sources.

Also see Article 282 of the Labor Code (): Part-time work can be performed by an employee both at the place of his main job and with other employers.

On the basis of which we conclude: the concept of “place of work” is identical to the concept of “employer”, which again returns to the provision on calculating average earnings regardless of the number of sources of payments - including part-time work.

Let’s simplify: your employer at your main place of work is some kind of health care facility. It is also an internal part-time employer. There is only one employer - we add up the payments.

And here the conversation takes a new turn. So! There are 2 types of work: Main (where the work book is) and part-time. It is this division that is provided for by the Labor Code of the Russian Federation. Now this is where it gets funny. If there had been an agreement on part-time work, our conversation would have been more difficult. But there is no part-time agreement. And we, as a gift to the chief accountant, open the RESOLUTION OF THE MINISTRY OF LABOR AND SOCIAL DEVELOPMENT OF THE RUSSIAN FEDERATION dated June 30, 2003 N 41 ON THE FEATURES OF WORK ON COMBINATION OF PEDAGOGICAL, MEDICAL, PHARMACEUTICAL WORKERS AND CU WORKERS CULTURES

And we read there

In accordance with Article 282 of the Labor Code of the Russian Federation ... in agreement with the Ministry of Education of the Russian Federation, the Ministry of Health of the Russian Federation and the Ministry of Culture of the Russian Federation decides: .... 2. For the categories of workers specified in paragraph 1 of this Resolution, the following types of work are not considered part-time and do not require the conclusion (registration) of an employment contract: ... g) work without holding a full-time position in the same institution or other organization, including the performance by teaching staff of educational institutions, responsibilities for managing offices, laboratories and departments, teaching work of managers and other employees of educational institutions, leadership of subject and cycle commissions, work on managing industrial training and practice of students and other students, duty of medical workers in excess of the monthly working hours according to the schedule, etc. ; ……

Minister of Labor and Social Development of the Russian Federation A.P. POCHINOK

So, what kind of “part-time work” are we talking about?

Hello! Please tell me how off-the-job training courses are paid for if the employee attended them from April 4, 2011 to April 10, 2011 inclusive. Are only workers paid or all calendar ones?

Answer:

Good afternoon, Yulia.

It should be noted that advanced training of an employee can be carried out both at the initiative of the employer and at the initiative of the employee. At the same time, the guarantees and compensation established by Art. 187 of the Labor Code of the Russian Federation, are subject to application only to cases of advanced training of an employee in the direction of the employer. The need to improve the employee’s qualifications, including off-the-job training, is determined by the employer. The frequency and conditions for training employees, including in the form of advanced training, can be determined by local regulations, a collective agreement, and an employment contract.

Article 187 of the Labor Code of the Russian Federation. Guarantees and compensation for employees sent by the employer for advanced training.

When an employer sends an employee to improve his qualifications outside of work, he retains his place of work (position) and the average salary at his main place of work.

On-the-job training

During vocational training, the employee is completely or partially released from work. 4) The employer should enter into an additional agreement with you on changing the work schedule with the transfer of working hours during classes, on sending you to advanced training while taking time away from work and maintaining average earnings in accordance with Art. 187 of the Labor Code of the Russian Federation for the duration of training. The rest of the time (you work for more than 1 rate, as I assume) can be provided for hourly work with appropriate payment. 5) Involving you in advanced training during non-working hours is engaging you in overtime work, with all the ensuing consequences.

How to correctly draw up an order for referral to training

In any case, when there is a need to train a company employee, first of all an order is drawn up to send the employee for training (you can download a sample below), or an order to send him to advanced training courses.

In addition, there are certain types of activities in which constant improvement of the level of knowledge is mandatory. Such professions include, for example, drivers of all categories, train drivers and other similar occupations.

17 Jul 2020 glavurist 858

Share this post

- Related Posts

- Sample agreement for assignment of right of claim, tripartite sample

- Application for old age pension sample 2020 PFR sample

- Sample application for refund of paid state duty to the tax office

On-the-job training: registration

It contains the name of the specialty or level of qualification received by the employee based on the results of his studies, lists the professional skills planned for development, and indicates the order in which working hours will be paid if classes are supposed to be held on weekdays. What to bring to the tax office To confirm that the student is a full-time employee, you will need to make a copy of his work record book.

The accounting documents upon completion of training will be the program received from the employee reflecting the questions covered, a certificate of services rendered and (in the case of a commercial educational institution) an invoice. If you plan to study in another locality, it would be useful to attach travel documents and a hotel bill to the package of documents.

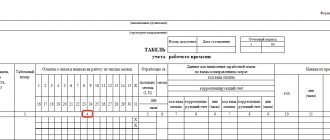

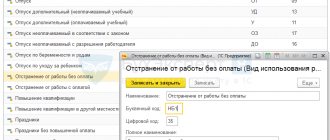

Additional off-the-job training on how to fill out a report card

You can add a topic to your favorites list and subscribe to email notifications. Natalia [email hidden] Russian Federation, Moscow #1[208582] March 21, 2011, 10:25 No ratings Good morning.

The employee took a course. How do you reflect this on your report card? How was the study holiday? I want to draw the moderator's attention to this message because: A notification is being sent... TATYANA [email hidden] Russian Federation, Moscow region #2[208593] March 21, 2011, 10:34 Advanced training with a break from work in the worker's report card time is indicated by the letter code PC or digital code 07.

The Labor Code of the Russian Federation may establish a part-time working regime for an employee studying on the job, that is, he can combine work with training. Part one of Art. 199 of the Labor Code of the Russian Federation establishes mandatory conditions for inclusion in the student agreement.

These include, in particular: an indication of a specific profession, specialty, qualification acquired by the student; the employer’s obligation to provide the employee with the opportunity to study in accordance with the apprenticeship contract; the employee’s obligation to undergo training and, in accordance with the acquired profession, specialty, qualification, to work under an employment contract with the employer for the period established in the apprenticeship contract; duration of apprenticeship; amount of payment during the apprenticeship period. The employer must create the necessary conditions for combining work with training (part five of Art.

196 of the Labor Code of the Russian Federation). On-the-job training: design But let's return to the main topic of our article - on-the-job training. In this case, there are an order of magnitude fewer problems in documenting. Likewise, an annual plan should be drawn up for the number and composition of trainees, with the reasons and objectives of such training. An order for on-the-job training is prepared for each person sent, indicating the reasons for the need for retraining. If an invited specialist or representative of an educational institution will act as a teacher, a contract must be signed with him. When the mentor is one of the company’s employees with a separate payment for teaching activities, it is necessary to draw up an additional agreement with him to the employment contract. When sending employees for on-the-job training, apprenticeship agreements are drawn up.

This is interesting: Free courses at the employment center: list of specialties and training conditions

Training on the report card

https://youtu.be/DVIBdQCcXgM

It should be used when noting all the days the employee is absent from work. This is how training is indicated on the time sheet. In addition to off-the-job training, the option of combining work with study is possible (Articles 173-176, 187 of the Labor Code of the Russian Federation). That is, the employee receives higher, secondary or specialized secondary education while continuing to work in the organization.

In this case, continuous training in the report card is indicated by the letter code “UV” or the digital code “12” (Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1). It is clear that organizations that use independently developed time sheets can introduce their own designations for employee training.

This applies to both the reflection of off-the-job training and on-the-job training in the report card.

Did you like the article? Share the link with your friends: Loading... Comments Read also: 07/12/2019

Advanced training on the job report card

Labor Code of the Russian Federation). Thus: 1) Advanced training is your labor (i.e., performed during working hours) responsibility and must be included in the terms of the employment contract concluded with you; 2) Conditions and procedure for advanced training (what specific frequency, in which cases, for workers of what specializations, advanced training is carried out in one form or another, issues of remuneration, conditions for partial separation from work, etc.) should be established by a local act of the medical institution (collective agreement) but cannot worsen the situation of workers in comparison with current federal legislation.3) Conducting advanced training during non-working hours (rest time) is a gross violation of labor legislation; an employee cannot be required to attend classes during rest, and the employer must organize the educational process during working hours. If an employee undergoes off-the-job training in another city, the letter code “PM” (digital “08”) is entered on the report card. If the training takes place in the city at the place of work, the letter code is “PC” (digital “07”). 2.

How to pay for training days to employees - as working hours, or based on average earnings? In accordance with Article 187 of the Labor Code of the Russian Federation, when an employer sends an employee for advanced training outside of work, he retains his place of work (position) and the average salary at his main place of work. Employees sent to improve their qualifications while taking time off work to another location are paid for travel expenses in the manner and amount provided for persons sent on business trips.

Payment for advanced training courses

The objective need for periodic training courses for employees of an enterprise has long been beyond doubt among employers. Technologies and equipment are changing, requirements for the level of professional knowledge are increasing - there is a need to master new, more modern methods for solving a wide variety of production problems.

Advanced training courses 2014 are one of the types of additional vocational education, the main purpose of which is to update the theoretical base and acquire new practical skills.

Training in advanced training courses is conventionally divided into mandatory training and training at the initiative of the employer.

- Mandatory training, according to Article 196 of the Labor Code of the Russian Federation, must be completed by employees holding certain positions.

- Training at the discretion of the employer, the procedure and conditions of which are established by a collective agreement (agreement), includes training and retraining of personnel for the enterprise’s own needs. The need for training of an employee is determined by the employer.

Training in advanced training courses can be carried out on-the-job, part-time, off-the-job, as well as according to individual training programs.

All advanced training programs are developed by educational institutions independently, but taking into account the wishes of the customer. Curricula are developed in strict accordance with the requirements of state educational standards.

According to Article 187 of the Labor Code of the Russian Federation, an employee undergoing off-the-job training retains the average salary at his main place of work.

If an employee undergoes training in another location, he is paid all expenses provided for business trips, plus average earnings.

If an employee improves his qualifications on the job, he receives a salary for the time actually worked in production.

An employee who combines study and work must not exceed the daily working hours provided for by the Labor Code of the Russian Federation.

They force you to pay for advanced training courses. It is legal?

An employer, when sending employees to advanced training courses, must enter into a service agreement with an educational institution. In addition, the employer must conclude an additional agreement with the employee himself, whom he sends to advanced training courses.

This agreement must clearly state all the employee’s responsibilities that will be assigned to him after completing the training. For example, the contract can stipulate the conditions for working a certain period of time, the procedure for reimbursement of funds spent on his training in the event of interruption of studies, etc.

All costs associated with training employees in advanced training courses are borne by the employer. According to Article 264 of the Tax Code, training costs are included in other costs associated with production and sales.

Where can I take advanced training courses?

Advanced training courses 2014 can be taken at the Solikamsk Institute of Industrial Safety and Labor Protection.

Visit our online store and purchase the necessary training materials

Rules for the technical operation of thermal power plants.

Approved by Order of the Ministry of Energy of the Russian Federation dated March 24, 2003 No. 115

Cost: 150 rub.

Licenses and certificates:

License for the right to conduct educational activities.

The best training centers of the Russian Federation.

Hello! Please tell me how off-the-job training courses are paid for if the employee attended them from April 4, 2011 to April 10, 2011 inclusive. Are only workers paid or all calendar ones?

Answer:

Good afternoon, Yulia.

It should be noted that advanced training of an employee can be carried out both at the initiative of the employer and at the initiative of the employee. At the same time, the guarantees and compensation established by Art.

187 of the Labor Code of the Russian Federation, are subject to application only to cases of advanced training of an employee in the direction of the employer. The need to improve employee qualifications, incl.

his off-the-job training is determined by the employer.

How can a teacher take advanced training courses for free?

The frequency and conditions for training employees, including in the form of advanced training, can be determined by local regulations, a collective agreement, and an employment contract.

Article 187 of the Labor Code of the Russian Federation. Guarantees and compensation for employees sent by the employer for advanced training.

When an employer sends an employee to improve his qualifications outside of work, he retains his place of work (position) and the average salary at his main place of work.

Employees sent to improve their qualifications while taking time off work to another location are paid for travel expenses in the manner and amount provided for persons sent on business trips.

For the calculation, the previous period is taken, equal to the calculated one, and the daily average is considered, i.e. see paragraph 9.

3: “The average daily earnings, except in cases of determining the average earnings for vacation pay and payment of compensation for unused vacations, is calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of this Provisions for the number of days actually worked during this period.”

It should be noted that the guarantees provided for workers who improve their skills outside of work are provided only at their main place of work. Thus, for an employee working on a part-time basis (both internal and external), when sent by his employer for advanced training, the provision of such guarantees is not provided for by law.

In the case of off-the-job training (provided that it is directed by the employer), the following guarantees are provided at the main place of work:

retention of the employee's place of work (position);

maintaining his average earnings for the entire period of study.

Russian legislation does not provide for an employer’s obligation to provide guarantees and compensation to employees undergoing professional retraining and advanced training on their own initiative.

It is necessary to distinguish between advanced training and professional training (retraining) of specialists. By virtue of Art.

21 of the Law on Education, vocational training, being also a type of additional education, has the goal of accelerating the student’s acquisition of the skills necessary to perform a specific job or group of jobs.

This form of training is not accompanied by an increase in the educational level (improvement of qualifications) of the student.

Sincerely,

Larisa Alexandrovna

Improvement of teacher qualifications. Who pays for the courses?

Hello.

Let's start from the end.

Advanced training is both the right and responsibility of a teacher

The employer cannot oblige you to write any statements. Pressure - maybe, force - no. By agreement of the parties to the employment contract, the employee, both upon hiring and subsequently, may be assigned part-time working hours (Article 93 of the Labor Code of the Russian Federation). If teachers have already signed something voluntarily, then it will be difficult to challenge such agreements and this is only possible in court.

The specifics of concluding and terminating an employment contract with employees of organizations carrying out educational activities to implement educational programs of higher education and additional professional programs are determined by Art. 332 of the Labor Code of the Russian Federation, including the duration of the employment contract. Based on the situation you described, there is no violation of this order, at first glance.

As for advanced training, firstly, according to Art. 187 of the Labor Code of the Russian Federation, when an employer sends an employee to vocational training or additional vocational education outside of work, he retains his place of work (position) and the average salary at his main place of work.

Secondly, according to Art. 196 of the Labor Code of the Russian Federation, the need for employee training (vocational education and vocational training) and additional vocational education for its own needs is determined by the employer.

In cases provided for by federal laws and other regulatory legal acts of the Russian Federation, the employer is obliged to provide vocational training or additional vocational education to employees if this is a condition for the employees to perform certain types of activities.

That is, you need to decide whether the advanced training for which you are being sent is mandatory to fulfill your job duties (you cannot work without it) or optional.

In the first case, the employer is obliged to pay for such training and cannot recover these costs upon dismissal of the employee. In the second case, the employee and the employer have the right to enter into an agreement on reimbursement of such costs in the event of dismissal of the employee before the expiration of the period of service after training.

Payment for advanced training courses

Source: https://berkutgun.ru/oplata-kursov-povyshenija-kvalifikacii/

Timesheet for 2018 designation: off-the-job training

As for part-time workers, you have to assign 2 numbers to them at once, because a standard package of employment documents must be drawn up for them. Working time will be counted separately for both personnel numbers.

- The top lines in columns 5, 7 (form T-12) are filled in with data on the number of days that the employee fully worked. The bottom lines are for workers. time per period (in hours).

- At the end of each month, the personnel employee receives ready-made reports from the employees who kept the timesheets. His task will be to compare the information in the reports with information from the HR department. If necessary, he indicates the reasons why the employee did not come to work. He also checks when the employee was given leave and when he received travel allowances.

Time sheet for 2018

Everyday work and life present different situations, so you need to know how to skillfully reflect each regular and not so regular situation in the timesheet. You also need to understand which letter designations to use on the time sheet. Subscribe to the accounting channel in Yandex-Zen! Timesheet keeping Working time is an important component of accounting for any organization.

With its help, it is possible to control the activities of the enterprise and discipline subordinates. To simplify the procedure, a unified form in the form of a time sheet was specially developed. Each enterprise appoints a responsible employee (from the HR department, accounting department, etc.)

d.), who specializes in timesheet keeping. It is compiled based on the specifics of the company’s activities and the number of personnel.

Online magazine for accountants

The procedure for filling out a timesheet. Maintaining a timesheet has its own characteristics:

- To demonstrate the daily expenditure of labor time for a full month per employee, the following is highlighted in the table:

- 2 lines (columns 4, 6) in f. T-12;

- 4 lines (column 4), 2 lines for 2 weeks and the corresponding number of columns (15, 16), in f. T-13.

The number of columns can be increased to accurately enter additional information. In gr. 4 and 6 of both timesheets, in the very top line the labor hour cost codes should be written, and at the bottom the amount of time actually not/worked for a certain day should be written.

- All employees of the organization have a personal personnel number, which is used in papers relating to their work and their payment.

Working time sheet for training with partial separation from the main job

Who should keep track of working hours and who should be responsible for it? If the organization is small, one person can keep time records. If the structure of the enterprise is significant, it is advisable to appoint a responsible person in each division. All responsible persons, regardless of their number, are appointed by orders for the main activities in order to avoid various kinds of misunderstandings. Responsibility for the completeness and correctness of filling out the timesheet lies with the person authorized by the order. The head of the department is responsible for the timely submission of timesheets to the accounting department. The employer is responsible for everyone. 8.

- Themes:

- Time sheet

Question: How can I mark an employee’s work on a time sheet if he goes to advanced training courses during the day and works the rest of the day? How should he pay his salary? Answer If training is carried out with partial separation from the main job, then several lines are filled out in the employee’s report card, one of them indicates the actual time worked by the employee, the other - the training time, you can also indicate both events through a fraction (for example, I / PC). Pay wages for actual hours worked. At the same time, the duration of study and work together should not exceed the daily standard of working time provided for by labor legislation, internal regulations and the terms of the employment contract (Article 91 of the Labor Code of the Russian Federation). How to properly record working hours if the enterprise is small and operates on a five-day basis? There is no single approach to record keeping; you can keep a continuous record (record all facts), or you can only record deviations (temporary disability, absences for unknown reasons, etc.). The main criterion is the correct recording of actually worked time on paper, since this document is the primary one for calculating wages. In everyday work, the first option is more convenient when accounting for working periods in total; the second option is preferable when the duration of working hours is constant, as is the case with a five-day period.

All days on which the employee does not participate in the production process are marked with the code “B (26)” (day off). An employee of the company is on maternity leave. She has the right to work part-time. The table contains the code “OZH(15)” and dashes for working hours.

2 extras must be organized. lines: for code “I(01)” (working hours of full-time employees) and for marking hours of work. This way, statistical information and working hours for salary calculations will be available. Speech by an employee of an enterprise in court Indicated as “other.”

reasons for failure to appear”, evidence of absence due to a summons to a court hearing is a summons certificate. Business trip 1st line: number of working hours, based on the mode at the main place of employment. 2nd line: code “K(06)” (business trip). In the list of the total number of hours (days) worked for the month in gr.

Do I need to pay for training for employees on a day off?

We send employees for training to another city. The organization has a five-day work week, from Monday to Friday. Training is scheduled on weekdays and Saturdays. How to register it? Do I need to pay for school on my days off? If yes, in what size? Olga Tankovich, HR department specialist (Tver)

The legislation does not directly indicate how to register and pay for training on a day off. Therefore, we recommend that these issues be resolved by agreement with the employee (parts two and five of Article 196 of the Labor Code of the Russian Federation). You can send employees to study in another city by arranging a business trip (Articles 166, 187 of the Labor Code of the Russian Federation) or by preparing an order to send employees to study (sample below)

Employees have the right to refuse training on a day off (Article 113 of the Labor Code of the Russian Federation). Therefore, draw up a notice of this right and get a note on it indicating the consent (disagreement) of the employees.

Pay employees travel and accommodation expenses, daily allowances (Article 168 of the Labor Code of the Russian Federation). For the entire period of study, keep their average earnings.

In the work time sheet, training on Saturday is indicated by 1: – with the letter code “PM” or the numeric “08”, if the employee is sent to improve his qualifications while away from work in another area;

– letter code “K” or numeric “06” if the employee is sent on a business trip for training.

Use the same codes to mark the day off when the employee is on training. The issue of payment for days off shall be established by agreement with the employees. You can use one of the following options.

First. Pay for this day at double the rate for work on a day off on a business trip (Article 153 of the Labor Code of the Russian Federation, clause 5 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749). Instead of double pay, an employee can write an application for an additional day of rest.

Second. Pay double for the specific number of hours allocated for training on a weekend (Article 187 of the Labor Code of the Russian Federation). If the number of hours is indicated in the timesheet, then you need to pay for these hours, and if not, for the whole day.

How to stop combining positions?

The employee was assigned to perform additional duties by combining positions.

The additional agreement and order established the combination period from the 1st to the 28th of the month. Is it necessary to issue a cease and desist order? Can an employee refuse a combination earlier? Inna Zubko, leading specialist of the HR department (Ivanovo)

No, it’s not necessary. In your case, the deadline for completing the work is fixed in the additional agreement to the employment contract and order. Therefore, there is no need to issue an order to terminate the combination due to the expiration of the deadline.

However, the employee may refuse to perform additional work earlier. In this case, he must send a written notice three days before the termination of work (part four of Article 60.2 of the Labor Code of the Russian Federation).

Based on the notification, you will need to issue an order to terminate the combination of positions (sample below)

Is it possible to transfer an employee from one temporary job to another?

An employee of our organization was hired under a fixed-term employment contract for the duration of the duties of an absent employee.

He's going back to work soon, but we have a vacant position for someone else who is also temporarily absent. Can we transfer an employee to a vacant position? Svetlana Nosovets, HR manager (Berdsk)

Yes, you can. Complete the transfer of this employee before the employee she replaces returns to work (part one of Article 72.1 of the Labor Code of the Russian Federation). To do this, send her a notice of transfer to another position.

Please note that the fixed-term employment contract indicates the position, as well as the last name, first name and patronymic of the employee whose duties this employee is temporarily performing. Consequently, you have to change the terms of the contract itself.

If the employee gives written consent, then prepare an additional agreement to the employment contract. The transfer is formalized by a transfer order in the form accepted by the organization, or in form No. T-5, approved by Resolution of the State Statistics Committee of Russia No. 1. The order is announced against signature.

Don’t forget to make a note about the transfer in your work book and personnel records.

If your employee does not agree to the transfer, then the employment contract concluded for the duration of the duties of the absent employee is terminated when he returns to work (Article 79 of the Labor Code of the Russian Federation). But you can offer to conclude a new employment contract to replace another employee.

Is it necessary to change the salary and bonuses in the employment contract if the total salary does not change?

In our organization, an employee’s salary consists of two parts - salary and bonus.

We plan to increase the salary and reduce the bonus. However, the total salary will remain the same. Is it necessary to make changes to the employment contract in this case? Oksana Dvorkina, HR manager (Perm)

Yes, it is necessary. The amount of the salary, as well as the size of its component parts, can be changed only with the consent of the employee.

Since the condition on remuneration is necessarily included in the employment contract, you will have to make changes to it or prepare an additional agreement (part two of article 75 of the Labor Code of the Russian Federation).

In addition, you have to clarify the staffing schedule. If the employee does not agree with the changes, then the salary cannot be reduced.

However, if changes in wages are caused by new organizational or technological working conditions, then the terms of the employment contract can be changed at the initiative of the employer (part one of Article 74 of the Labor Code of the Russian Federation).

In this case, it is necessary to send written notice to the employee two months in advance. If the employee does not agree with the changes, then he must be offered another suitable job.

In the absence of work or in case of refusal from it, the employment contract is terminated according to paragraph 7 of part one of Article 77 of the Labor Code.

Is it possible to conclude an agreement on full individual financial responsibility for a certain period?

We conclude an agreement with the employee on full financial responsibility.

Is it possible to include a term clause in the text? If yes, what time period should I indicate? Tamara Vylegzhanina, HR department inspector (Petrozavodsk)

The legislation does not provide a direct answer to your question. The agreement on full financial responsibility with the employee is concluded simultaneously with the labor agreement. It does not contain conditions regarding the period (Article 244 of the Labor Code of the Russian Federation). Such an agreement is concluded for the entire period of work in the position held (clause

5 of the standard form of an agreement on full individual financial liability, approved by Appendix No. 2 to Resolution of the Ministry of Labor of Russia of December 31, 2002 No. 85, hereinafter referred to as the standard form of an agreement on full individual financial responsibility).

Thus, the liability agreement is valid while the employee holds the position.

On the other hand, if the employee’s duties or the work he performs make it possible to establish a day when full financial responsibility can be waived, then this condition can be included in the contract.

Is it necessary to obtain employee consent to change the organization’s operating hours?

We are making changes to the internal labor regulations and changing the working hours.

How and how long in advance do we need to notify employees? Is it necessary to obtain their consent? Tatyana Ivasenko, head of the personnel management department (Anapa)

A change in the organization’s operating hours will affect the working hours of employees, and therefore, the terms of employment contracts will have to be changed (paragraph 6, part two, article 57 of the Labor Code of the Russian Federation). In this case, the consent of the employees is mandatory.

If a change in organizational or technological working conditions is planned, then employees must be given written notice of this two months in advance (part two of Article 74 of the Labor Code of the Russian Federation).

Since your further actions depend on the consent of the employees, provide a line in which they will mark their agreement (disagreement) and the date. It is important to obtain written confirmation of service of the notice.

If employees refuse to receive notice, draw up a report in the presence of two witnesses or send notice by mail.

Employees who do not agree to work in the new mode must be offered in writing another available job that suits them for health reasons.

Offer all available vacancies in the company, and in other areas - if this is provided for by the collective agreement, agreements, employment contract (part three of article 74 of the Labor Code of the Russian Federation).

If there is no suitable work or the employees refuse the offered work, the employment contract is terminated in accordance with paragraph 7 of part one of Article 77 of the Labor Code.

Is it possible to have an employee work on weekends for more than two months in a row?

Can an employee work a day off every Saturday for two consecutive months?

Olga Kryukova, HR manager (Velikiye Luki)

The legislation does not provide for restrictions on the period of employment on weekends. As a general rule, the duration of weekly continuous rest cannot be less than 42 hours (Article 110 of the Labor Code of the Russian Federation).

But for employers whose work suspension on weekends is impossible due to production, technical and organizational conditions, days off are provided on different days of the week in turn to each group of employees in accordance with the internal labor regulations (Article 111 of the Labor Code of the Russian Federation).

The timing of employment on weekends must be related to special circumstances. Work on these days is permitted only to perform unforeseen work and only with the written consent of the employee (part two of Article 113 of the Labor Code of the Russian Federation).

Employment on weekends without the consent of an employee is possible in exceptional cases (part three of Article 113 of the Labor Code of the Russian Federation). However, if an employment contract with an employee is concluded for a period of less than two months, then he can be involved in work on weekends during this entire time, but with his written consent (Article 290 of the Labor Code of the Russian Federation)

Source: https://www.kadrovik-plyus.ru/publ/nuzhno_li_oplachivat_obuchenie_rabotnikov_v_vykhodnoj_den/2-1-0-208

Conditions for providing student days off

A student can count on additional (study) leave only for his main work activity, even if his probationary period has not yet ended. At a part-time job, an employee can take leave at his own expense.

Vacation pay is subject to certain criteria being met.:

- correspondence and part-time forms of study;

- primacy of education;

- state accreditation of the program;

- received a call from the place of study.

Keeping records of working hours

Russian labor legislation outlines the need to keep records of hours worked by an employee. For this purpose, the State Statistics Committee has approved 2 forms of recording time sheets: T-12 and T-13 .

Companies can also develop and put into practice their own form , but the approved form is quite easy to use and is widely used by HR employees.

The time sheet is the primary document for recording the attendance of company employees and is filled out by a specialist in the HR department. Next, it is handed over to the manager for signature, and then to an accounting employee.

The director has the right to appoint any subordinate to enter information into the timesheet. In large companies, each department has a responsible employee who, after a month, passes the completed form to the head of the structural unit, who, after a thorough check, passes it on to the personnel officer. In small companies, a HR specialist fills out the timesheet himself and then passes it on to the accounting department.

Based on the completed timesheet form, the HR service takes into account the number of days worked and monitors compliance with the working time schedule (lateness, absenteeism, no-shows). Based on the document, accounting employees calculate wages in accordance with hours worked and fill out reports to statistical authorities.

How are absences due to study noted?

There are two ways to fill out a time sheet:

- 1. Continuous - marks are placed for each calendar day.

- 2. Selective (with deviations) - only lateness and absenteeism are indicated.

The method of recording deviations is used for the same length of working day for the entire working period. The report card indicates non-standard cases (business trip, vacation, including educational leave, no-show).

This method takes less time to fill than a solid one. It is most popular for personnel officers and accountants with extensive work experience, as well as for small companies with a small number of staff.

Information in the report card on the attendance of employees of the organization is entered in the form of codes , the designations of which are written on the title back of the T-12 form. Codes can be presented in the form of numbers or letters; the use of both options is equivalent.

When designating study leave, it is allowed to use a mixed filling system or a completely different coding if this fact is stated in the company’s internal documentation.

How to mark study weekends on your report card depends on whether earnings are maintained during the vacation or not. For paid time off, the designation is different from personal time off.

How are paid days designated?

Cases when vacations provided for study are paid are discussed in detail in this article.

For student leave with preservation of average earnings, the following designation code is used:

- letter "U";

- number "11".

What code is used for time off without pay?

The specifics of providing unpaid days off can be studied here.

Study leave for which earnings are not saved is indicated differently in the report card:

- letters "UD";

- number "13".

Again, a convenient designation method for the company is determined independently. You can enter both a numeric code and an alphabetic one.

Filling out form T-13

Designations in the report card are entered for each day (calendar) of training . The billing period includes weekends and holidays if they coincide with the study period. Their payment is made in the usual amount. The employee writes a corresponding application addressed to the employer indicating the start and end dates of studies (based on a letter of invitation from the university).

Time sheets are submitted 1 month in advance from the first to the last day. A separate line is issued for each subordinate.

Filling out columns of the T-13 report card when an employee goes on study leave:

- Column 1 records the serial number;

- 2 - employee’s full name and position;

- 3 - personnel number;

- 4 - marks of presence at the workplace for each calendar day of the month. If an employee is on study leave, then the appropriate designation is given: U or 11 for paid days, UD or 13 for unpaid days;

- in column 5 the days and hours worked are recorded for each half of the month;

- in the next column 6 - for a full month;

- in column 7 of the timesheet, cash payments are recorded in the form of a digital code - 2012 (vacation pay);

- Column 9 contains information about hours worked for each type of remuneration. If one type of payment for work activity was used during the month (2000 - salary), columns 7 and 8 are not filled in.

- in columns 10-12 the absence code and the corresponding number of hours are entered.

Sample designation in the report card for paid study leave:

Example of designation for unpaid days:

The employee preparing the time sheet must be very careful and correctly enter the necessary designations. His high competence allows him to correctly calculate remuneration for the employee for the performance of labor functions during each month. If the timesheet is filled out incorrectly, a conflict situation with subordinates may be provoked.

Didn't find the answer to your question in the article?

Get instructions on how to solve your specific problem. Call now:

here - if you live in another region.

How is advanced training paid?

Labor Code of the Russian Federation). The organization must provide and pay for study leave (subject to certain conditions), regardless of whether the employee is working under an employment contract or a fixed-term employment contract.

In addition, the law does not establish restrictions on length of service in an organization that gives the right to study leave. Study leave is given for the number of days that will be indicated in the educational institution’s letter of invitation.

Non-working holidays falling on study leave are paid on a general basis. It should also be remembered that study leave cannot be replaced with monetary compensation. This is due to the fact that monetary compensation can only replace part of the annual paid leave (Art.

126 of the Labor Code of the Russian Federation). Note! According to clause 14 of Regulation No. 922, all calendar days (including non-working holidays) falling during the period of study leave are subject to payment.

How is study leave paid for advanced training?

If problems arise at this stage, you can seek help from lawyers on our website online.

It is important to remember that without a summons certificate, the employer has every reason not to give the employee study leave and count him absenteeism, which is subject to disciplinary punishment.

However, even after certified absenteeism and received a penalty, the employee can apply for study leave.

Algorithm for calculating vacation pay For the entire duration of paid leave for education, the employee will retain his average earnings. Salaries are calculated in the same manner as for other vacations, calculated in calendar days.

The scope of vacation also includes days off that fall on study leave, which the company is obliged to provide after receiving a summons certificate.

Features of payment for study leave

1 tbsp. 177 of the Labor Code of the Russian Federation); - the employee is studying successfully; - the vacation is related to passing exams or defending a diploma; - the educational institution has state accreditation.

If an employee combines work with training simultaneously in two educational institutions, then guarantees and compensation are provided only in connection with training in one of these institutions at the employee’s choice (Part 3 of Article 177 of the Labor Code of the Russian Federation). For your information.

Employee training. payment for student leave (shadrina t.)

Conditions for receiving study leave To apply for study leave, an employee must meet these criteria:

- his performance in the chosen educational institution must correspond to a high level. This criterion is not described in detail in the labor code, but implies the absence of debts and obtaining satisfactory grades;

- the selected educational institution must undergo state accreditation, except in cases where such a condition is stipulated in advance in the employment contract in accordance with Articles 173, 174 of the Labor Code;

- This is the first time you have received education at the selected level.

Study leave

- Vacation goals;

- Vacation dates.

Payment procedure Further registration of vacation occurs according to the following scheme:

- The employer issues an order to grant the employee study leave.

- The average salary of an employee for the period of study will be calculated according to the accounting note-calculation.

- The data is entered into a personal card and time sheet, where working hours are taken into account.

- Upon completion of the training, the employee must provide the manager with the second part of the challenge certificate, this time stating that he systematically attended and completed the required courses. It is given to the employee by the manager himself, and subsequently he must receive it. This part of the certificate must be completed by the educational institution and certified by its seal.

Features of study leave

Provisions N 922, if an increase in official salaries occurred during the billing period, then payments taken into account when determining average earnings and accrued in the billing period for the period preceding the increase are increased by coefficients that are calculated by dividing the tariff rate, salary (official salary), monetary remuneration, established in the month of the last increase in tariff rates, salaries (official salaries), monetary remuneration, on tariff rates, salaries (official salaries), monetary remuneration established in each month of the billing period. Accordingly, the increase factor will be 1.2 (18,000 rubles / 15,000 rubles). The average daily earnings are 612.24 rubles. ((RUB 105,000 x 1.2 + RUB 90,000) / 12 months / 29.4 days). The amount of accrued vacation pay is RUB 12,244.80. (20 days

How is study leave paid at work in 2020?

In a situation where an employee submitted a summons certificate too late (less than 3 days before the required start of the vacation), the accounting department accrues the required amount within 24 hours.

- At the end of the study leave period (usually after the session is closed), the employee must provide as confirmation the second part of the call certificate containing information about the session closure.

A sample application is presented below: Example of a summons certificate: Sample order for the provision of paid leave: In some cases, employers who are new to the legislative framework do not pay vacation pay until the employee submits a certificate of closure of the session. Thus, the employer is breaking the law.

Providing study leave to an employee: 5 rules for an accountant

Info

The Labor Code of the Russian Federation does not apply to employees studying in graduate school (regardless of the form of study), since the content of these norms is limited to the employee receiving higher professional education for the first time. Average earnings to pay for study leave Average earnings to pay for study leave are determined according to general rules.

According to Art. 139 of the Labor Code of the Russian Federation for all cases of determining the amount of average wages provided for by the Labor Code of the Russian Federation, i.e. the average daily earnings to pay for additional educational leaves, is calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (average monthly number of calendar days).