Payment of maternity benefits to the Social Insurance Fund in 2020

- payment for sick leave and parental leave are not included in the calculations;

- The time when the employee received money from the company, but did not carry out work activities, is excluded.

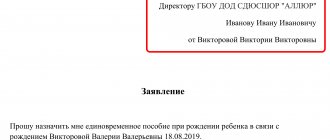

In it, the employee must indicate the person to whom the document is intended.

Sample application for payment of sick leave, description of the application

There is no exact form for filling out the application; it is arbitrary, and sometimes you will need to fill out a ready-made template.

In addition, it is important to know that the application can be filled out by a friend or relative of the patient, but the signature must be his personal one.

Recommendations for filling out an application for payment of sick leave - form and sample for downloading for 2020

The basis for calculating benefits will be a certificate of incapacity for work. If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits.

For example, payslips for the last two years.

Such a statement in accordance with Art.

62 Labor Codes are reviewed within three working days. If you receive a refusal or do not receive a response at all, there is the possibility of challenging it in court or appealing to other authorities. The basis for payment of temporary disability benefits is sick leave.

Application for FSS sick leave: form and sample

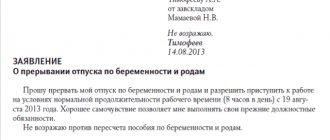

It can be initiated by both the employee and the employer. A statement is written when an employee needs recalculation.

Attention As a rule, this happens in cases where the amount of the benefit does not correspond to the length of service and the average salary. The procedure for drawing up such an application remains unchanged, with the following exceptions:

- The body of the text indicates on what basis recalculation is required.

For example, if the length of service is incorrectly calculated or the calculation period needs to be changed when calculating sick leave benefits.

- There is no need to indicate the method of receiving benefits and details, because the employer must initially agree on the recalculation.

- The applications must indicate the availability of a certificate and the amount of wages for a period of no more than 3 years.

- the amount of the policyholder's debt to the Social Insurance Fund of the Russian Federation for insurance premiums at the beginning and end of the billing period;

- the amount of insurance premiums accrued for payment, incl. for the last 3 months;

- the amount of insurance premiums additionally accrued to the policyholder;

- the amount of expenses that were not accepted for offset;

- the amount of funds received from the Federal Insurance Service of the Russian Federation to reimburse expenses incurred;

- the amount of insurance premiums that were returned or offset against overpaid or collected premiums;

- the amount of funds spent by the policyholder for the purposes of compulsory social insurance, incl. for the last 3 months;

- the amount of insurance premiums paid, incl. for the last 3 months;

- the amount of the insured's debt written off.

For payment An application for payment of sick leave can be written both after returning to work and during the period of sick leave, if it lasts for a long period (several months). In this case, the employee is entitled to receive interim benefit payments.

For recalculation If for some reason an employee was paid a benefit that does not correspond in size to that which is due to him based on the amount of insurance coverage and average salary, then he has the right to write an application addressed to the head of the company with a request to recalculate this payment.

The document must contain information about the reasons for the need to perform these actions, for example, the length of service was incorrectly calculated.

How to apply for sick leave?

GET A FREE LEGAL CONSULTATION BY PHONE: MOSCOW AND MOSCOW REGION: ST. PETERSBURG AND LENIGRADS REGION: REGIONS, FEDERAL NUMBER: In order to receive the insurance payment required by law, the employee must fill out an application for payment of a temporary disability certificate.

will depend on the reason for drawing up the sheet; the principle of drawing up the document is the same for all cases. How to write an application correctly? You can view a sample application for payment of sick leave in 2020 on a specialized website.

There is no officially approved application form, but in some cases the employer requires the use of a ready-made template. Therefore, if the company where you currently work is registering sick leave for the first time, it would be better to clarify this information.

Written statement from the policyholder

In his application, the policyholder must indicate the name and address of the legal entity or full name. and passport information indicating the address of permanent residence, if the policyholder is an individual. The application also indicates the registration number of the policyholder and the amount of funds required to pay the insurance coverage.

Application for reimbursement of expenses for temporary disability benefits (FORM).pdf

Help-calculation

For periods before January 1 of last year, the above documents must be accompanied by a calculation in Form 4-FSS.

Attention! In 2020, instead of the 4-FSS calculation, a new calculation certificate is submitted.

The calculation certificate contains the following indicators:

https://youtu.be/MmK6wRvu_zI

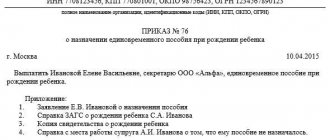

Example of a benefit application.

Application for payment (recalculation) of benefits (vacation pay)

General requirements for filling out an application for sick leave from the Social Insurance Fund. TOE the author of the question 0 points. The Foundation has a sample form for each case.

Calculation of average earnings. Despite the fact that from 2020 the tax authorities will control the payment of insurance premiums and check the costs of paying benefits. View the sample form for filling out the Application for Payment of Vacation Benefits and download it. So, the employee must write down an application for payment of sick leave benefits.

To receive an insurance payment, you need to write an application for payment of sick leave, a sample of it. In 2012, a special application form for reimbursement of expenses for payment of benefits was developed.

Application for payment (recalculation) of benefits (vacation pay)

occurrence of an insured event.

AS DVO from 08.04. , there are no restrictions on benefit payments or the possibility of recalculating its amount depending on. on the collection of benefits, compensation for moral damage, costs of paying for services for drawing up a statement of claim. to terminate the accrual and payment of child care benefits, the organization: offered to fill out an application for.

. We just received an application from the employee requesting leave with subsequent dismissal.

all payments have been made.

Sample applications (forms)

- Sample of filling out an application for reimbursement of expenses for the payment of social benefits for burial (Appendix No. 6 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Application form for reimbursement of expenses for paying four additional days off to one of the parents (guardian, trustee) for caring for disabled children (Appendix No. 7 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

- Sample of filling out an application for reimbursement of expenses for paying four additional days off to one of the parents (guardian, trustee) to care for disabled children (Appendix No. 7 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

This is important to know: Pension points for maternity leave

Form of a certificate calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to the place of treatment and back (Appendix No. 10 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

- Sample of filling out a certificate calculating the amount of vacation pay (in addition to annual paid leave)

https://youtu.be/hHZl8ZIgsso

Form 23 FSS

Contents Appendix No. 6 to Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 4, 2013 No. 712n 1 Filled out by an organization that has opened a personal account with the Federal Treasury. 2 To be filled in by the head of the organization (separate division).

3 To be completed if there is a chief accountant. 1 In the “TIN” field and in the “KPP” field, the policyholder’s TIN and KPP are shown, respectively. There are currently no clarifications on the procedure for filling out these details. We believe that this information is necessary for the purposes of issuing an order to transfer funds to the policyholder.

In a payment order for the transfer of funds, field 61 “TIN” and field 103 “KPP” refer to information about the recipient (see Appendices 1 and 3 to the Regulations on the rules for transferring funds, approved by the Bank of Russia on June 19, 2012 N 383-P) .

We recommend reading: Rospotrebnadzor appeal by mail

Considering the above, when filling out form 23-FSS of the Russian Federation in the specified fields, in our opinion, you should provide the data of the policyholder, and not the bank (see, in particular, the form of the Notification of offset of overpaid (collected) amounts of taxes and fees, other income, penalties, fines on them, given in Appendix No. 2 to the Procedure for accounting by the Federal Treasury of revenues to the budget system of the Russian Federation and their distribution between the budgets of the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated December 18, 2013 No. 125n).

APPLICATION FOR REIMBURSEMENT OF COSTS FOR PAYMENT OF SOCIAL BENEFIT FOR FUNERAL (Appendix No. 6 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2020 No. 578)

This form came into force 10 days after the official publication of the Order of the Social Insurance Fund of the Russian Federation Appendix No. 6 to the order of the Social Insurance Fund of the Russian Federation dated November 24, 2020 N 578 Form B (name of the territorial body of the Social Insurance Fund of the Russian Federation) From (full name of the organization (separate division) or Full name of the policyholder - an individual) I ask, in accordance with the Regulations on the specifics of the appointment and payment in 2012 - 2020, to insured persons of insurance coverage for compulsory social insurance in case of temporary

Application for payment of sick leave

Currently, the following constituent entities of the Russian Federation are participating in the Pilot Project, which includes direct payments of benefits to employees: Type of constituent entity of the Russian Federation Name Republic of Adygea, Altai, Buryatia, Kabardino-Balkarian, Kalmykia, Karachay-Cherkess, Karelia, Crimea, Mordovia, North Ossetia - Alania, Tatarstan, Tyva Region Altai, Primorsky, Khabarovsk Region Amur, Astrakhan, Belgorod, Bryansk, Vologda, Jewish Autonomous, Kaliningrad, Kaluga, Kostroma, Kurgan, Kursk, Lipetsk, Magadan, Nizhny Novgorod, Novgorod, Novosibirsk, Omsk, Oryol, Rostov, Samara, Tambov, Tomsk, Ulyanovsk Federal city of Sevastopol The application for payment of benefits is drawn up in the form approved by the Order of the Social Insurance Fund of November 24, 2017 No. 578, and given in the Order. The application must be filled out in Russian in block letters and in black ink.

Recommendations for filling out an application for payment of sick leave - form and sample for downloading for 2020

If the applicant is in doubt as to what type of insured event he is in, this can be clarified on the temporary disability certificate. In the “method of payment” column, put a tick next to either “by postal order” or “by transfer to a credit institution.” If you have chosen the method of receiving the sick leave amount benefits “through a credit institution”, then the bank details and passport data fields are filled in. If the applicant wishes to receive disability benefits by postal order, only personal data and address should be filled in the application. The transfer will be sent to the post office to which this address belongs. You will need to appear in person to receive the transfer after receiving the appropriate notice. After the form is filled out, it must be taken to the employer along with the original temporary disability certificate. Below you can download the current form

Appendix No. 1.

Application for payment (recalculation) of benefits (vacation pay)

Download an application for payment of leave benefits.

Application for payment (recalculation) of benefits (vacation pay)

General requirements for filling out an application for sick leave from the Social Insurance Fund. TOE the author of the question 0 points. The Foundation has a sample form for each case.

By submitting an application, the employee receives written confirmation that the documents for the assignment of benefits are available. Hello, does anyone have samples of forms for calculating sick leave. Despite the fact that compensation for the costs of paying benefits from 2020 is carried out by the tax authorities, for payments for sick leave.

Calculation of average earnings. Despite the fact that from 2020 the tax authorities will control the payment of insurance premiums and check the costs of paying benefits.

Application for payment recalculation of vacation pay benefits images

— — Most often, the HR department is provided with a sick leave certificate along with an application for payment of material resources, but there may also be a case when sick leave is submitted immediately upon illness. According to the law, an employee can bring sick leave within six months after its closure, at the same time an application for payment of money must be written. As for HR workers, they have only five days during which they send documents to the social security fund. In this case, the employee must bring a sheet and a completed application.

If the application is not completed, you can fill it out using the sample in the HR department, or print it and then simply sign it. When drawing up an application for payment of funds for sick leave, the employee must indicate the last name, first name, patronymic, year of birth, full passport details, and company details.

There are situations when a special application for sick pay is sent directly to the Social Insurance Fund.

Example of a benefit application. Application for payment (recalculation) of benefits (vacation pay)

The procedure for filling out an application for payment of a lump sum benefit.

Sick leave form for pregnancy and childbirth sample to fill out. Explanations for filling out sample applications for child benefits and the commission's protocol. Sample application for assignment and payment of benefits.

With sample filling. A FALSE SICK FOLLOWING RESULTS IN CRIMINAL LIABILITY.

Insured employees of companies located in pilot regions receive

This is important to know: Preferential maternity leave

Drawing up an application to the FSS and its sample

In rare cases, the application must be submitted not to the personnel department, but directly to the Social Insurance Fund (SIF). For example, this situation may arise when a company goes into liquidation. Also, self-employed people (individual entrepreneurs, lawyers, attorneys, etc.) submit an application to the Social Insurance Fund, but only on the condition that they pay insurance premiums.

Important: The attached form is for advisory purposes only, so you should contact your territorial office to find out about the current form.

The application form has three pages, which are drawn up in compliance with the following rules:

- You need to fill out the form with a black pen (gel, ballpoint, etc.).

- The fields must be filled in block letters.

- Corrections and blots are unacceptable, so letters cannot be crossed out or covered up.

- The text should not go beyond the established columns and fields.

It is worth noting that you can fill out the form on a computer, print it, sign it and take it to the Social Insurance Fund.

The application form itself is filled out in the following order:

- In the upper right corner, in the empty cells, enter the name of the territorial Social Insurance Fund where the application will be submitted, and the full name. applicant.

- From the proposed options, it is proposed to choose according to which insured event the application for the assignment and payment of benefits is submitted. For example, a suitable option is “Temporary disability benefit”.

- Select payment method:

- By transfer to a bank account. In this case, an additional tab is filled in where you need to indicate the bank details of the credit institution where the citizen holds an account.

- By postal transfer. In this case, the 6th block is filled in, where the address at which the applicant wishes to receive benefits is entered.

- Indicate information about the recipient - full name, date of birth, information about the identity document.

- The details of the documents are included, which are attached to the application and submitted to the employer.

- The applicant's signature and the date of the application are affixed.

The completed form to the FSS is offered here.

Appendix No. 1.

Application for payment (recalculation) of benefits (vacation pay)

Recommendations for filling out an application for payment of sick leave - form and sample for downloading for 2020

» » » 12/14/2018The period allows the employee to receive insurance compensation in the form of. However, this is only possible if the necessary documentation is submitted to the employer in a timely manner. Everyone knows about the need to provide a sick leave certificate prescribed by a doctor, but is it necessary to also write a statement? The article describes typical situations.

To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free! [uptolike]If the employee receives it in the traditional way (at the place of work), then there is no need to write an application. The basis for accrual of sick leave, the amount of which will be reflected in a certain column of the pay sheet, is. With the launch of the pilot project “Direct Payments”, the number of workers who want to receive “sick leave”, “maternity” and other amounts directly from social insurance authorities is growing.

In this case, the application is written

Application for sick leave from the Social Insurance Fund (form and sample)

→ → Update: March 1, 2020

The Social Insurance Fund of the Russian Federation is a guarantor of respect for the rights of citizens in the event of their illness, birth of a child, injury, resulting in a temporary loss of a person’s ability to work and earn income. However, it should be remembered that in order to exercise the rights of citizens to receive money when the described cases occur, it is necessary to prepare and submit to the Fund a whole list of documents, including an application form for sick leave from the Social Insurance Fund.

A sample and form are presented below.

The current legislation of the Russian Federation guarantees each employee timely and full payment of his sick leaves.

This obligation of the Social Insurance Fund or the employer in the case of indirect payment for ballots arises immediately after presentation of the certificate of temporary incapacity for work.

Application for payment (recalculation) of benefits (vacation pay)

02/02/2018 The new form “” was officially approved by the document Appendix No. 1 to the order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

N 578. (zip archive 170.9 kb) The form was uploaded to the website: 02/02/2018 You can also download others More details about using the form:

- . 2020. The procedure for indexing and recalculating state benefits for citizens with children is prescribed. ;294. The amount of some benefits also depends on the minimum wage.

- . in particular, this order approved: an application for payment (recalculation) of benefits (vacation pay); a list of applications and documents required for appointment. and payment of temporary disability benefits; application for reimbursement of expenses for payment of social benefits for funeral; statement about . reimbursement of expenses for additional payments.

Funeral benefit FSS

Documents required to assign temporary disability benefits

- Application of the insured person (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Certificate of incapacity for work.

If temporary disability occurs as a result of an accident at work and (or) an occupational disease, an additional report on the accident at work or a report on the case of occupational disease (or copies of the investigation materials - if the investigation continues).

When a branch of the regional branch of the Fund receives documents or information confirming the existence of grounds for refusal to grant temporary disability benefits, the branch of the regional branch of the Fund makes a reasoned decision on such refusal.

The decision to refuse to grant temporary disability benefits is sent (delivered) to the insured person within 2 working days from the date of adoption of this decision.

Documents required for the assignment of maternity benefits, one-time benefits for women registered in the early stages of pregnancy

- Application of the insured person (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Certificate of incapacity for work.

- Certificate of registration in the early stages of pregnancy.

Documents required to assign a lump sum benefit at the birth of a child

- Application of the insured person (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Certificate of birth of a child issued by the civil registry office (form 24).

- A certificate from the place of work (service, social protection body at the child’s place of residence) of the other parent stating that the benefit was not assigned - if both parents work (serve), as well as if one of the child’s parents does not work (does not serve) or is studying full-time in educational institutions of primary vocational, secondary vocational education and higher vocational education and institutions of postgraduate vocational education, and the other parent of the child works (serves).

- For persons replacing parents: a copy of the decision to establish guardianship over the child (a copy of the court decision on adoption that has entered into legal force, a copy of the agreement on the transfer of the child to a foster family).

Documents required to assign a monthly childcare benefit for a child up to 1.5 years old

- Application of the insured person for the assignment of benefits (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Documents established by clause

54 of the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n.

Documents required to pay for leave to a person who has suffered health damage as a result of an industrial accident and (or) occupational disease (in addition to the annual paid leave established by the legislation of the Russian Federation)

1. Application of the insured person for vacation pay (Appendix No. 1 to Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

2. Order of the policyholder to provide the insured person with leave.

3. Certificate of calculation of the amount of vacation pay (Appendix No. 10 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

Documents are submitted to the branch of the regional office of the Fund by the policyholder no later than 2 weeks before the start of the vacation.

Documents required to reimburse the policyholder for 4 additional days off to care for a disabled child

1. Application from the policyholder for reimbursement of expenses for paying 4 additional days off to one of the parents (guardian, trustee) to care for disabled children (Appendix No. 7 to Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

2. A certified copy of the order to provide additional days off to one of the parents (guardian, trustee) to care for disabled children.

Within 10 working days from the date of receipt of the documents, the branch of the regional branch of the Fund makes a decision on reimbursement of expenses to the policyholder for paying 4 additional days off to one of the parents (guardian, trustee) for caring for disabled children and for paying social benefits for funeral and within 2 working days from the date of adoption of this decision, transfers funds to the policyholder’s current account.

Documents required for reimbursement of expenses for temporary disability, carried out at the expense of interbudgetary transfers from the federal budget

- Application by the policyholder for reimbursement of expenses for payment of temporary disability benefits (Appendix No. 3 to Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Documents confirming the employee's insurance experience.

Documents required for reimbursement of expenses for payment of preventive measures to reduce industrial injuries and occupational diseases of workers

- Application by the insured for reimbursement of expenses incurred to pay for preventive measures to reduce industrial injuries and occupational diseases of workers within the amount agreed with the branch of the regional branch of the Fund for these purposes (no later than December 15 of the corresponding year) (Appendix to the Order of the Ministry of Health and Social Development of the Russian Federation dated July 11, 2011 No. 709n);

- Documents confirming expenses incurred.

Within 5 working days from the date of receipt of documents for payment of preventive measures, the branch of the regional branch of the Fund makes a decision on reimbursement of expenses from the Fund’s budget and transfers funds to the policyholder’s current account.

Documents required to reimburse the policyholder's expenses for the payment of social benefits for funerals

- The policyholder's application for reimbursement of expenses for the payment of social benefits for burial (Appendix No. 6 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Certificate of death of the insured person (or minor family member), issued by the civil registry office (original).

Documents required for reimbursement of the cost of a guaranteed list of funeral services to a specialized funeral service

- Application for reimbursement of the cost of funeral services indicating the bank account to which the amount of reimbursement is transferred (Appendix No. 8 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578).

- Certificate of death of the insured person issued by the civil registry office (original).

- Account of the cost of services provided according to the guaranteed list of funeral services.

The policyholder, within 2 working days from the date of receipt of the documents, sends them to the branch of the regional branch of the Fund at the place of its registration.

The branch of the regional branch of the Fund, within 5 working days from the date of receipt of the specified documents, makes a decision on reimbursement of the cost of funeral services and, within 2 working days after that, transfers funds to the bank account of the specialized service in an amount not exceeding the amount of social benefits for burial.

Note.

- The employer of the deceased pays the relatives who have taken on the responsibility for burial a social benefit for burial (Article 10 of the Federal Law of January 12, 1996 No. 8-FZ “On Burial and Funeral Business”). The paid social benefit for funeral is reimbursed to the employer by the Social Insurance Fund of the Russian Federation.

- In the absence of a spouse or close relatives, burial is carried out by a specialized funeral service. In this case, the Social Insurance Fund of the Russian Federation reimburses the cost of the guaranteed list of burial services to the specialized service (Article 12 of the Federal Law of January 12, 1996 No. 8-FZ “On burial and funeral business”).

Note!

If the insured person has missed the deadlines for applying for benefits for temporary disability, pregnancy and childbirth, monthly child care benefits, established by Article 12 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity" (6 months from the date of termination of the insured event), and there are no documents confirming the validity of the reason for missing these deadlines, the application and documents necessary for the assignment of the appropriate type of benefit, or the register of information by the policyholder are not sent to the branch of the regional branch of the Fund.

If the insured person has missed the deadline for applying for a one-time benefit for women registered in medical institutions in the early stages of pregnancy, for a one-time benefit at the birth of a child, established by Article 17.2 of the Federal Law of May 19, 1995 No. 81-FZ “On State Benefits for Citizens with Children "(6 months from the date of birth of the child), the application and documents necessary for the assignment of the appropriate type of benefit, or the register of information by the policyholder are not sent to the branch of the regional office of the Fund.

If the recipient of a funeral benefit has missed the deadline for applying to the policyholder for payment of a social benefit for a funeral, established by Article 10 of the Federal Law of January 12, 1996 No. 8-FZ “On Burial and Funeral Business” (6 months from the date of death), the documents of the policyholder to the branch of the regional Fund branches are not sent.

If a specialized service for funeral matters has missed the deadline for applying for reimbursement of the cost of services provided in accordance with the guaranteed list of funeral services, provided for in Article 9 of the Federal Law of January 12, 1996 No. 8-FZ “On burial and funeral business” (6 months from the date of burial) , documents are not sent by the policyholder to the territorial body of the Fund.

Application for payment of sick leave

Having received a certificate of incapacity for work from a medical organization, the employee passes it on to his employer. And the employer is obliged to accrue this benefit within 10 calendar days from the date of the employee’s application for benefits and pay it on the day closest to the date of payment of wages after the award of the benefit ().

At the same time, the employee does not have to submit an application to the employer for sick leave.

Temporary disability benefits can be assigned if the application for it follows no later than 6 months from the date of restoration of working capacity (). This is the general procedure for assigning and paying sick leave.

Application form for payment of benefits (vacation pay) and samples of filling out the application

Application form for payment of benefits (vacation pay)

Download (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017

FSS RF official website application forms to the tax office

How is child support distributed between children from different marriages?

Where to go to assign an address to a site

Is it possible to take maternity leave after 3 years without saving?

Job description of a seamstress

When is the next trading on the currency exchange

I bought a faulty computer from Eldorado and they refuse to replace it.

Date of publication: 06/06/2012

How social insurance protects children

The country celebrates two wonderful holidays - Family Day and Children's Day - two weeks apart. Both dates are united by one goal - to draw attention to the problems of family and children, to strengthen the status of family values. A conversation with the manager of the State Institution - the regional branch of the Social Insurance Fund of the Russian Federation in the Republic of Tatarstan, Ramil Gaizatullin, about how the state takes care of a young family.

— Ramil Rinatovich, the Social Insurance Fund is charged with caring for the family from the beginning of its inception...

“This is true and very important, since it is in the first years, with the birth of a child, that a young family undergoes a test of strength and especially needs help, both material and psychological.

Sample applications (forms)

ATTENTION. From December 29, 2017, the forms approved by the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578 FOR THE EMPLOYEE are in effect: Application form for payment of benefits (vacation pay) (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017.

- Samples of filling out an application for payment of benefits (vacation pay) (Appendix No. 1 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

TO THE EMPLOYER: Sample letter to the Social Insurance Fund from the policyholder with an incorrectly completed electronic register. Form of inventory of applications and documents necessary for the appointment and payment of the relevant types of benefits to insured persons (Appendix No. 2 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017.

Sample application for payment of sick leave, description of the application

When getting a job, every employee thinks that there will be cases when he will not be able to go to work. At such moments, employees should ask questions to their superiors regarding sick leave. After all, every person gets sick, and no one is immune from this, so a sick leave certificate will be needed.

This is important to know: Is it possible to immediately take vacation after sick leave (or take sick leave immediately after vacation)

This document is filled out only by registered employees, and only officially registered employees can also receive sick pay, so you need to find out about it immediately during the interview. In order to receive monetary compensation for sickness, an employee must fill out an application for sick pay; usually this application has the same format, and its content will depend on the cause of the illness.

There is no exact form for filling out the application; it is arbitrary, and sometimes you will need to fill out a ready-made template. In addition, it is important to know that the application can be filled out by a friend or relative of the patient, but the signature must be his personal one.

Filling out an application at the company's HR department

A completed application for payment of sick leave money is provided to the HR department, regardless of the cause of the illness. This could be a common cold, treatment by a gynecologist, illness in children, or an injury resulting in a disability category followed by leave.

An important fact remains the possibility of filing an application even after dismissal, if the former employee fell ill within a month after the official dismissal from the position. Most often, the HR department is provided with a sick leave along with an application for payment of material resources, but there may be a case when sick leave is submitted immediately upon illness.

According to the law, an employee can bring sick leave within six months after its closure, at the same time an application for payment of money must be written.

As for HR workers, they have only five days during which they send documents to the social security fund. In this case, the employee must bring a sheet and a completed application. If the application is not completed, you can fill it out using the sample in the HR department, or print it and then simply sign it.

When drawing up an application for payment of funds for sick leave, the employee must indicate the last name, first name, patronymic, year of birth, full passport details, and company details.

Pilot region: rules for filling out an application

Payment for sick leave in pilot regions has a number of differences.

The method of payment for sick leave in pilot regions differs from regular payment. In this case, employees are paid money to a bank card, or they receive it by mail, without taking into account the day of wages. Regarding the submission of the application, there are no changes, since it is also submitted directly to the personnel department, in some cases (described above) to the fund.

The completed application must be ready for scanning; no free form is provided; there is an exact template. You can get an electronic form of the template, or print it out from the HR department; if you have difficulties filling it out, employees should help. If the application is not filled out according to the rules, it will have to be redone and sent back to the HR department.

The good news for workers is that in the coming years the system for receiving payment for sick leave will be improved; you may not even need to fill out an application for payment, but they will be processed automatically. But at this stage it is better to adhere to established standards, and if there is a template, take it as an example.

If a company requires a correctly completed application, but does not provide a template, you can download it from a specialized website and find out all the details of filling it out in the HR department. Otherwise, as always, the application has an arbitrary form. Also on the website you can learn about filling out sick leave, and also download a template, and there are explanations on how to write an application for recalculation of sick pay.

Social Security Fund: Applying Directly

There are situations when a special application for sick pay is sent directly to the Social Insurance Fund. Thus, employees of a liquidated enterprise, or independent workers (individual entrepreneurs, notaries) submit an application exclusively to the social insurance authority.

In this case, individual entrepreneurs can submit an application, subject to payment of insurance premiums. Typically, the application for such workers has three sheets, and is intended for processing by machine. The template can be seen directly in the fund, and there are samples for each case. The usual procedure for filling out an application is to provide the following information:

- Exact details of your personal passport (date and year of issue must be indicated);

- Indicate your bank account and sick leave number;

- Describe the attached documents (certificates, certificates of no payments, and data of the person being cared for).

FSS RF official website application forms free download

Info

Current legislation provides for the conduct of appropriate desk and on-site inspections. The first to cover 100 percent of policyholders reporting to the Fund. At the same time, monitoring is also carried out to ensure compliance with the deadlines for submitting reports.

About 2 thousand policyholders were held accountable for their violation in 2011; the amount of penalties applied amounted to 1.1 million rubles. On-site control of the correctness of calculation and completeness of payment by policyholders of contributions for compulsory social insurance in case of temporary disability and in connection with maternity is carried out by our employees together with representatives of the Pension Fund branch of the Republic of Tatarstan. Last year, 1.5 thousand such checks were carried out, as a result of which more than 13 million rubles were added to insurance premiums.

— Ramil Rinatovich, let's focus on temporary disability.