The current rise in inflation has raised many citizens with the question of how much their income will be when they retire. Today it is very difficult to live on the pension payment provided by the state. To achieve a comfortable existence in old age, it is better to take care of it in advance and look for ways to increase your own financial condition when a person acquires pensioner status. Currently, the government is increasingly supporting and helping the population of the Russian state with pension benefits. How do you accumulate points and what will your future pension be? At the moment, the answers to these questions are becoming more and more accessible to every person.

What is the value of the individual pension coefficient?

Of similar importance is the direct impact on insurance financial coverage associated with the total length of service. Along with other indicators, the individual pension has its own smallest and largest value . The maximum value that the accumulative part can be will be different for those who decide to use or refuse it.

Annual individual pension coefficient

The reform on pension payments involves a small amendment - a citizen applying for these benefits must first score a minimum number of points. If a person is underemployed, that is, there is an insufficient number of accrued points, when retirement age approaches, he may be left without benefits or increases to them.

Women retire at 55, men at 60.

When calculating the individual pension coefficient, the entire period of employment is taken into account; it must be at least thirty years.

The value of the individual pension coefficient

The minimum value of the coefficient, adopted two years ago, is 6.6 percent , and strictly, every year, it increases by two and a half percent.

Who installs? Distribution of funds

Labor legislation does not regulate clear positions regarding the calculation of earnings according to the labor participation rate (KTU). The calculation is made in a convenient way, the main thing is that there are no contradictions with laws and other regulatory documents.

It is important to know that no matter how earnings are distributed, the amount that each member of the work team receives cannot be less than what is due according to the tariff for similar work performed in a specific period of time.

Depending on the form of payment, the coefficient is applied in:

- Tariff-free system. The amount to be paid is divided by the number of employees, and then the average coefficient, equal to one, must be adjusted based on the KTU.

- Distribution in excess of the tariff. Each employee receives a fixed amount of money according to the tariffs, and the rest of the money must be divided taking into account the coefficient.

What size can an IPC be?

The value of the individual pension coefficient is determined by the state and changes it annually. Reform carried out in 2020. changed its size to sixty-four rubles. Exactly a year later, when inflation increased, this figure was increased by ten rubles. After another year, its cost increased by four rubles, and began to amount to 78 rubles and a few kopecks.

The amount of the individual pension coefficient

The coefficient that allows you to correctly calculate the amount of pension accruals is associated with many circumstances. People often have difficulty calculating their pension points; not everyone understands how this system works. This is due to the following reasons:

- The government allows changing the size of the accumulated pension portion until 2020 , the period when the individual coefficient reform was carried out.

- The corresponding points can be accrued during a citizen’s absence from employment on good grounds. These include:

- completing compulsory military service;

- caring for children under one and a half years of age;

- official content of a person incapable of work, even without family ties.

Calculation of individual pension coefficient

According to the new system, all points accumulated by a citizen until he retires are taken into account. Their total amount is calculated using a formula in which points relative to the reform carried out are added to the points accrued before the innovations created in 2020, and their amount is multiplied by the planned increase in the pension coefficient.

The formula is relevant when calculating benefits after the designated period.

Coefficient mв

Table 7

| Operating conditions (according to table 1) | 1A and 1 | 2 | 3 | 4 |

| Coefficient mв | 1 | 0,9 | 0,85 | 0,75 |

Classes of operating conditions for wooden structures.

Table 1

| Operating environment classes | Operating moisture content of wood, % | Maximum air humidity at a temperature of 20 °C, % |

| 1A | up to 8 | 40 |

| 1 | 8 — 12 | 65 |

| 2 | up to 15 | 75 |

| 3 | up to 20 | 85 |

| 4 | more than 20 | more than 85 |

| Notes 1 It is allowed to take the “equilibrium” moisture content of wood as “operational” (Figure D.1). 2 A short-term excess of maximum humidity is allowed for 2 - 3 weeks a year. | ||

Procedure for calculating the IPC

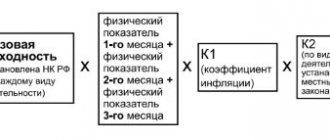

Any potential pensioner can calculate his own coefficient using the formula expressed by dividing the insurance pension deduction corresponding to the tariffs of the final year of the previous year by the price expression of a single point in relation to the initial stage of the coming year. The formula looks like this:

IPK = SP/SB

In this case, only insurance payments are taken into account, excluding state established benefits. The result can be rounded to two or three digits following the decimal point. They are added upward if the value is more than five tenths.

Formulas for calculating basic personnel coefficients

To calculate these coefficients, special formulas are used, which can be presented in the following form:

| Coefficient | Calculation formula |

| Personnel stability coefficient | Chp / Chsr where: Chn – the number of employees who worked fully in the analyzed reporting period; Chsr – average number of employees |

| Staff turnover rate | Chu/Chsr where: Chu – the number of dismissed employees for the analyzed period; Chsr – average number of employees for the analyzed period |

| Acceptance rate | Chp / Chsr where: Chn – number of hired employees; Chsr – average number of employees for the analyzed period |

| Attrition rate | (Chv + Chu) / Chn where: Chv – the number of employees who retired or joined the army; Chu – the number of employees dismissed from the organization for various reasons; Chn – number of employees at the beginning of the analyzed period |

| Key workers ratio | (1-Chvs) / Chsr where: Chvs – number of support staff; Chsr – average number of employees for the analyzed period |

How much does an individual pension figure cost?

One pension point has a certain price indicator, which is taken into account when assigning pension accruals. Every year this coefficient is adjusted, along with the amount of insurance pension benefits for the population.

The price of the individual pension coefficient from 2020 is 78.58 rubles. Its growth depends on the level of inflation. A preliminary analysis is carried out on the growth of consumer prices over one year. The results of this assessment of the economic situation in all regions of the country are included in the Government Resolution. The federal law approves the tariff of the individual pension coefficient , together with the adoption of the annual budget of the Social Insurance Fund.

Cost of pension ball in 2020

On February 1st, the cost of IPC increases annually. Last year it rose by 1.04, when both price indicators of real inflation increased much more. This deviation from legislative norms occurred due to a shortage of financial resources available to the federal budget.

This year, pension benefits were indexed, along with the value of the coefficient, according to the accepted principle. The size of insurance pensions changed by 5.8 percent. This year, in April, the value of the pension indicator was increased by the same figure.

The procedure for calculating increasing coefficients in accordance with paragraph 16 of the regulations on average earnings

| When calculating vacation pay, you need to adjust the average earnings only if the salaries of all employees of the structural unit have been increased. In this case, salaries and all payments established as a percentage or multiple of the salary, taken into account when calculating average earnings, are adjusted. Let's say an employee goes on vacation in October 2007 for 28 calendar days. In May of this year, the structural unit increased salaries for all employees. Data on accrued wages for the billing period are given in the table. The billing period has been fully worked out.

Let's calculate the average employee's earnings to pay for vacation. Official salaries accrued for October 2006 - April 2007 must be adjusted by increase factors. These coefficients are calculated according to the rules of paragraph 2 of clause 16 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as the Regulations on Average Earnings). It is necessary to divide the official salary established in October 2007 (the month of occurrence of the event that is associated with the preservation of average earnings) by the official salaries established in this period. Since the same salary was accrued in each month for the period from October 2006 to April 2007, the increase factors are also the same for all months. The coefficient is calculated as follows: 15,000 rub. : 5,000 rub. = 3. Official salaries accrued for May - September 2007 are not adjusted and are added according to the actual accrued amounts. Therefore, the salary taken into account for calculating vacation pay will be: (5,000 rubles x 3 x 7 months) + (15,000 rubles x 5 months) = 105,000 rubles. + 75,000 rub. = 180,000 rub. Additional wages calculated using the standard calculation system are taken into account for the entire billing period based on the amounts actually accrued without adjustment. The fact is that although this coefficient is set in the range of multiples of the salary, it is not guaranteed. It is determined every month taking into account the employee’s performance and qualifications. The amount of additional salary included in the calculation of average earnings is: 40,000 rub. + 35,000 rub. + 40,000 rub. + 50,000 rub. + 50,000 rub. + 45,000 rub. + 20,000 rub. + 45,000 rub. + 45,000 rub. + 30,000 rub. + 45,000 rub. + 45,000 rub. = 490,000 rub. So, the total amount of payments that should be included in the calculation of vacation pay is equal to: 180,000 rub. + 490,000 rub. = 670,000 rub. In accordance with paragraph 10 of the Regulations on Average Earnings, to pay for vacation, you need to calculate the average daily earnings. To do this, the salary accrued for the billing period should be divided by 12 and 29.4. Average daily earnings are: 670,000 rub. : 12 : 29.4 = 1,899.09 rub. Average earnings for vacation pay are determined by multiplying the average daily earnings by the number of vacation days. This follows from paragraph 9 of the Regulations on Average Earnings. The amount of vacation pay is: RUB 1,899.09 x 28 days = 53,174.52 rub. |

Example for calculating the coefficient

Sergeeva N.P. I wanted to independently calculate her accumulated points for her total work experience, how many of them would be required for the pension benefit to be twenty-five thousand rubles. The constant amount of insurance payments is 4559 rubles. In addition, citizen Sergeeva N.P. Payments of 18,300 rubles are made monthly from the pension fund.

An example of calculating an insurance pension in 2020

The fixed insurance portion is subtracted from this amount. This means that the amount of her pension will be equal to 13,741 rubles. To calculate the individual pension coefficient, you need to divide the result by the cost of the IPC , that is, by 74.58. This will be approximately 184 points. This means that Sergeeva N.P. accumulated exactly that many points. Reverse calculations will help determine the missing amount so that every month she receives a pension benefit equal to twenty-five thousand rubles. The result will be ninety points, which the citizen still needs to accumulate in order for the desired pension payments to be transferred to her.

Calculation of pension and IPK, video

The individual pension indicator is considered the most important value that affects the insurance pension accruals due to an individual due to age. No one has the opportunity to change the fixed payment to the highest value; it is approved and indexed by the state. But potential retirees can calculate their own accumulated points using a formula or using a calculator.

Today, any person has the opportunity to find out how long he still needs to work, and what kind of payment for work he should receive for a decent future pension.

Coefficient mb

e) for bent, eccentrically compressed, compressed-bent and compressed glued elements of rectangular cross-section with a height of more than 50 cm, the values of the calculated resistance to bending and compression along the fibers - by the coefficient mb indicated in Table 9;

Table 9

| Section height, cm | 50 or less | 60 | 70 | 80 | 100 | 120 or more |

| Coefficient mb | 1 | 0,96 | 0,93 | 0,90 | 0,85 | 0,8 |

Individual pension coefficient in questions and answers

Question: How can you determine the number of points for a pension benefit earned by a citizen?

Answer: You can find out how much the individual pension indicator will be using the website of the Pension Fund of the Russian Federation. The insured person needs to go to the personal account section on the website www.pfrf.ru. To gain access to it, you must register on the government services portal. He then types in his own email or mobile phone number, along with his password.

Calculation of pension points

After entering this site, you must select the section on the formation of pension rights. It is there, online, that personal account data becomes available, and the necessary statement is also requested. The second option for obtaining the required certificate is via the specified email address.

When entering his personal account, the insured can see information on his total length of service, periods of employment, all pension points, including other information. The listed data contained in this section is transmitted by the employer.

If it is necessary to carry out a preliminary calculation of points, use the calculator located in one of the tabs of the Russian Pension Fund website. You must enter the amount of wages into the calculator, then the automatic program will calculate the points accrued according to the results of the current year.

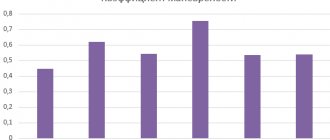

What do the standard values of the coefficients show?

The following are considered the standard values of the considered coefficients:

- For absolute liquidity - in the range of 0.2–0.5, which indicates the ability to very quickly repay from 20 to 50% of short-term debts.

- For urgent liquidity - in the range of 0.7–1, i.e. when you can quickly close from 70 to 100% of short-term debts.

- For overall liquidity, it is equal to or greater (but not much) 1, i.e. current assets must cover the amount of short-term liabilities. A coefficient value significantly exceeding 1 indicates ineffective use of working capital.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

List of laws

The individual pension coefficient is supported by regulations prescribed in certain regulatory documents at the federal level. These include the following federal laws:

- No. 400, adopted on December 28, 2013, in articles: 9, 15, 35, as well as in the fourth appendix;

- No. 404, formed on December 28, 2013;

- No. 173, approved on December 17, 2001.

The main benefit of the pension coefficient is the future welfare of the country's population. It has a direct impact on pension payments and dependence on the total employment, the procedure for these accruals, official earnings, and his state economic situation. It is important for citizens of the Russian Federation to remember that in order to receive the highest individual pension coefficient when they reach the appropriate age, they should look for a job with an official salary. In addition, the wages should be high.

What is the labor participation rate

In general, there are no explanations on this matter in the Labor Code of the Russian Federation. In practice, the decoding of KTU literally means the coefficient of labor participation. The abbreviation implies the quantitative value of the contribution of the efforts of each employee to the common cause to achieve the final goal. This parameter is considered relative, since it characterizes the share of labor applied by any team member.

Few people know what KTU is in wages, and yet it is used to calculate the amount of remuneration. That is why it is considered one of the important statistical indicators in the company, sometimes even within a small auxiliary unit (department, workshop). The areas of its application are quite diverse, but an indispensable condition for use is considered to be work activity, the nature of which consists in the performance of identical actions by each employee. A good example is a team that maintains a level of productivity that takes into account the quality of each member's work and the cohesive work of the entire group.

How funds are distributed

Since the procedure for calculating the labor participation coefficient is not established in the provisions of the Labor Code, the head of the company or organization has the right to determine its indicator. He has the right to use one of two main options for using KTU.

- Using the salary or piecework method of calculation. Earnings are strictly tied to the number of hours worked, the volume of products produced, the qualifications and level of training of the employee. The amount of payments is distributed equally among all team members.

- Tariff-free wages. Here, employees are given money at a fixed rate. The remainder of the finances is divided among all participants, taking into account the KTU. The amount of remuneration is affected by the following indicators:

- number of employees in the company;

- qualification level of employees;

- KTU itself;

- the size of the salary fund;

- actual time worked.

Types and scope of application

Since the Labor Code of the Russian Federation does not contain an explanation regarding the labor force participation rate, each company determines the procedure for applying the labor participation coefficient and calculation rules for itself. In practice, there are several types of system:

Collective. The amount of the cash fund is directly proportional to the labor success of the team, and the amount of remuneration for each participant is calculated taking into account the amount of time worked and the KTU. Successfully used in enterprises with a limited number of personnel.

Commission. Each employee's earnings depend on his personal productivity. It is used in network marketing, insurance stores, sales, as well as home work.

With floating odds. This takes into account the conditional size of the salary fund and personal KTU. It is used when it is necessary to distribute monthly profits between team members and to pay the manager.