Today, Russian citizens who have the right to receive subsidies by paying property taxes can fill out a corresponding application. It is necessary to enter information into the form according to KND 1150063, an example of which can be filled out in this article, without a single mistake. This should be done, for example, if you receive a disability status that gives you the right to benefits, or if you own several taxable objects.

The KND form consists of several sheets, each of which is dedicated to a specific piece of property owned by an individual and subject to taxes. When submitting an application to the Federal Tax Service, filling out all pages of the form is not required. The taxpayer should enter data only on the sheets he needs.

Submitting a form that confirms the right to receive tax benefits is a right, not an obligation, of an individual.

A citizen is not required to provide supporting documents to the tax service, since, if necessary, INFS inspectors will independently request information about them from the relevant authorities, and then inform the taxpayer about the decision made.

An individual can submit the KND form through the personal account of the Federal Tax Service or in person.

forms according to KND 1150063

General procedure for filling out the form according to KND 1150063

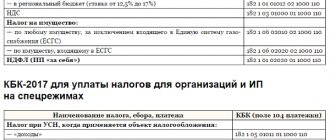

Currently, there are certain features of drawing up an application, on the basis of which citizens receive the right to apply for benefits on property, transport and land taxes.

The procedure for filling out the form according to KND 1150063 is regulated by current tax legislation. However, in order to learn how to fill out the form correctly, you should familiarize yourself with its ready-made example.

An example of filling out a form to receive benefits

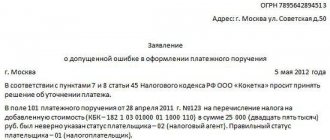

The first page indicates the data of the tax authority (code), TIN and full name of the taxpayer, his date and place of birth, passport and contact information, as well as the method of informing about the results of the review, date and signature. In the lower left corner of the form, the information of the authorized person is written down if his representative submits the document for the taxpayer.

On the second page of the form, fill in the abbreviated full name of the person on whose behalf the application is being submitted. A code is selected in the tax benefit column. The details of the make and license plate number of the vehicle, as well as the period for granting the benefit, are detailed below. The following indicates the basis for obtaining the right to a subsidy. In the example above, this document is a certificate of disability. But in your case another document may be involved. In the next column, information is entered about the authority that issued the document, its date of receipt and validity period, as well as the series and number.

On the third page of the application, the abbreviated full name of the taxpayer is again entered. The next column indicates the cadastral number of the land plot, the validity period of the benefit, as well as the details of the document on the basis of which it is issued. The information is filled in similarly to the information on the second sheet.

On the fourth page, the abbreviated full name of the person receiving the property tax benefit is written down. Just below, select the type and indicate the number of the property. The deadline for granting the benefit must be entered, and the details of the document on the basis of which the taxpayer receives it are entered.

Who should fill out the KND form?

The form for granting tax benefits must, according to tax legislation, be filled out by the person who personally owns the property. Data in the application form can also be entered by his representative, if he has a power of attorney. However, in this case, the authorized person will have to fill out the application on his own behalf.

Composition of the form according to KND

The application for tax benefits includes:

- title page;

- tax benefit reminder;

- benefit form.

Each page of the form must be numbered on both sides at the top in a special field.

Grounds for refusal to provide land tax benefits

Information about the cadastral value and the tax rate in a particular region is provided when contacting the Federal Tax Service. For example, in Moscow and St. Petersburg the land tax rate is 0.3-1.5%. In Russia, the rate also cannot be higher than 1.5%.

Cadastral value of a land plot x size of shared ownership x tax rate (specific region) x land ownership coefficient (if the land is not used for a full year).

There are several good reasons for refusing to provide tax breaks:

- Not all documentation on the list has been collected.

- There were inaccuracies in the application for land tax benefits for pensioners.

- There are no tax breaks in a specific region.

If a refusal is received, a person has the right to file a petition (complaint) with the territorial Federal Tax Service.

The document should indicate the essence of the claim and justify it. A higher authority will consider complaints within 30 days, after which a final decision will be made. [Total votes: 0 Average: 0/5]

Rules for preparing the form for KND

The application for a tax benefit must be filled out by hand or on a computer. If data is entered manually, then it must be entered into the document with a black helium pen.

The form is drawn up in 1 copy without any blots. It is strictly prohibited to use proofreaders and other means to correct errors. If incorrect information is entered, the application must be rewritten.

For each type of data, the form has special fields with cells in which the corresponding numbers, letters and symbols must be entered.

Filling out the title page

The title page contains information in all fields, except for those about. The data is entered by the taxpayer personally or by his authorized representative.

The TIN column indicates the code assigned by the tax authority to a citizen who is registered as an individual entrepreneur. If a person is an ordinary individual, then in the TIN line he must indicate the number of his personal document.

Point No. 1 specifies the Federal Tax Service code, which was selected by the taxpayer when filling out the form. The tax office is assigned based on the registration or location of the property.

Point No. 2 indicates the taxpayer’s personal data without abbreviations, his information from his passport and information about the authority that issued the document.

Read more: Where to look at an organization’s taxation system

Next, contact information is filled in on the title page. When specifying a phone number, spaces cannot be inserted, and all remaining cells must contain even dashes.

In paragraph No. 3, in the column with the phrase “The application was drawn up on...” you should indicate the number of completed pages of the document. In the next line you need to enter the total number of pages to be copied. These sheets prove the right of an individual to receive tax benefits legally due to him.

Point No. 4 clarifies the accuracy of all information filled out above. To do this, the person filling out the document must put the current date and signature. Below in the column with details, you should write down the data from your passport if the application is drawn up by a representative of the payer.

There is no signature or date on the title page if the document is filled out electronically and sent through the taxpayer’s personal account.

Design rules

It is possible to fill out forms either manually or using software. Each method has its own requirements and features. The form is filled out in a single copy. The printed form must be double-sided. To fill out each column, a corresponding field consisting of empty cells is allocated. The necessary letters and numbers are entered into them. You can download the application form on the official website of the Federal Tax Service of the Russian Federation. Although there are other sources that offer this option, using them is strongly discouraged. Often, third-party sites may contain malware, the unknowing installation of which can harm your computer.

Features of handwriting

- The form is filled out with a black gel pen.

- No corrections to what is written are allowed, including corrections with a correction pen.

- Each character must be written strictly within the dimensions of the cell, without going beyond its boundaries.

- All letters must be capitalized.

- The letter must imitate printed font; variations in handwriting and calligraphy are not allowed.

- All fields are filled in from top to bottom, from left to right.

- If nothing will fit into the selected field, it is indicated by a longitudinal dash running from the beginning to the end of the entire column.

Features of design using a PC

- The required font is Courier New.

- The text size should be in the range from 16 to 18.

- It is prohibited to change the number of columns or cells of which they consist.

- The dash in the computer version of the form is not indicated in a special way. Instead, unclaimed fields should be left blank.

Read more Mark the boundaries of your region of residence

How to correctly enter information into the sheets with an application for a tax benefit?

Sheets with data on tax benefits must be filled out according to information about the property and the type of tax that implies preferential tax conditions.

If you, as a taxpayer, are entitled to receive several types of benefits, then a separate form must be drawn up for each property.

At the top of the application, the surname and initials of the payer, as well as his TIN, are entered. The next paragraph indicates information about the property using a code and full name. Then the validity period of the benefit and the details of the document that is the basis for receiving it are specified. At the end of the page there is a date and signature.

Application for benefits

- The form provides for receiving benefits for only one property. If there are 2 or more, a separate form is completed for each of them.

- At the top of the application, the TIN and surname of the applicant are indicated. Column 4 indicates the duration of the benefits. Column 5 contains data from the document confirming the right to receive them.

- Paragraph 5 contains data on land plots, including cadastral number. In the remaining columns you need to enter the data from the title deed.

- Point 6 reflects real estate data. Namely, indicating the property number and documents allowing you to receive tax benefits.

Deadlines for submitting the KND form

Individuals and individual entrepreneurs who are legally entitled to receive tax benefits must submit an application under KND 1150063. The form and deadlines for its submission are approved by the Government of the Russian Federation and regulated by current tax legislation.

According to the orders of the Federal Tax Service of the Russian Federation, the time frame for drawing up and submitting an application for benefits is not limited. In this regard, the tax authorities do not have the right to refuse to accept it.

The timing of the provision of benefits, on the contrary, is limited. Having received your documents, inspectors of the Federal Tax Service are required to review them and approve them within 24 hours.

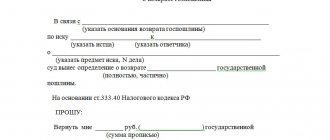

How to draw up and submit an application to offset tax overpayments

Taxpayers should be aware that only in the absence of arrears on other taxes and fees can an offset of overpayments on taxes be granted.

Tax overpayments can be disposed of no later than three years from the date of its formation, in accordance with Article 78 of the Tax Code of the Russian Federation. There are three ways for taxpayers to submit an application for a credit for the amount of overpaid tax: The head of an organization, an individual entrepreneur or an individual, or their legal representatives (based on a power of attorney) can contact the territorial office of the tax office in person.

Send the completed document by mail.

In this case, send by registered mail with return notification and a list of enclosed documents. Arrange for sending electronically through secure communication channels that are used to send reports.

By sending an email

Responsibility for failure to provide documents

The taxpayer needs to apply for tax benefits personally, so filling out and submitting the form under KND 1150063 is his direct interest. The legislation does not provide for the imposition of penalties for the late transfer of documents to the Federal Tax Service, and therefore documents can be submitted at any time.

Thus, an individual and an individual entrepreneur have the right to apply with a completed form to receive a tax benefit for transport, land or real estate to the Federal Tax Service or through the taxpayer’s personal account. He can obtain information about benefits on the website of the Russian Tax Service or through a service containing reference information on rates and benefits for property taxes.

Citizens who are eligible to receive benefits due to property taxes need to fill out an application. It is mandatory to complete this form if you are receiving a disability degree that entitles you to preferential treatment, or if you have two or more taxable items. Benefits are provided for one object. If the individual entrepreneur owns a truck, then in order to pay for Platon you will need to fill out this document.

Application for transport tax relief

The presented material will be useful primarily to individuals. Of course, organizations also pay transport tax, but a legal entity, even if there is a benefit, is required to annually file a declaration indicating the reasons why payments have not been made. And for private owners, it is enough to enter the data once into the sample application for a tax benefit if they have rights to the privilege.

Of course, not all subjects of the Russian Federation have introduced such benefits, and in some, if they have been introduced, they are differentiated depending on certain factors. For example, it is useless to write an application for tax benefits for pensioners in Moscow - the capital does not provide tax privileges for personal transport of this category of the population. And in St. Petersburg, the benefit will only apply to pensioners who own a domestic car with a capacity of up to 150 hp. With.

KND 1150063

Download PDF (*.pdf) Download DOCX (*.docx) Download EXCEL* (*.xls)

* - Unfortunately, the form cannot be provided in excel (xls) format ** - All documents were checked for viruses by Avast antivirus

Filled out by whom?

An application for property tax relief must be completed by the person who owns the property. The application form can be filled out by a representative, but then it must be completed on his own behalf.

Composition of the form according to KND

- Title page;

- Page with a reminder about the tax benefit;

- A six-part application for tax relief.

Each page must be numbered. You need to start from the first sheet - at the top of the page there are fields with three free cells. It's called "Page". On the first page write “0 0 1”. On the reverse side write “0 0 2”, so fill in the numbers on all pages.

Application to the tax office for property tax relief for pensioners

Attention! You can also list multiple real estate properties. The form has sections for two objects. If there are more of them, then you can simply take an additional sheet, indicating its number.

Sheet 1 (title)

Pensioners have the right to receive a property tax benefit. Property that is owned, not used as commercial, and whose value does not exceed 300 million rubles is exempt from payment. In addition, if there are several real estate objects (for example, 2 apartments, 2 garages or 2 houses), then one from each category is exempt from payment. To receive the benefit, you must submit a corresponding application and package of documents to the tax office. We will tell you in the article how to fill out the form correctly.

Confirmation of a taxpayer's right to a tax benefit is carried out in a manner similar to the procedure provided for in paragraph 3 of Article 361.1 of the Tax Code of the Russian Federation. The form of an application for a tax benefit and the procedure for filling it out, the format for submitting such an application in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.”

How to apply?

Fill out the tax benefit form by hand with a black gel pen. You can use software that allows you to print files. Use double-sided printing via Excel.

The tax application must be completed only in a single copy. It is prohibited to correct errors using a bar-corrector or similar means.

For each indicator there is a single field, which consists of limited cells to fill. Numbers and symbols are entered into them, depending on the field.

Each page must be numbered. You need to start from the first sheet - at the top of the page there are fields with three free cells. It's called "Page". On the first page write “0 0 1”. On the reverse side write “0 0 2”, so fill in the numbers on all pages.

Handwritten method

- To fill in fields for text, numbers, codes, start from the leftmost cell to the right side;

- Fill in the fields with text so that there is one character in one cell, without going beyond the outline of the cell. Letters must be capitalized, in block handwriting;

- In cells in which there is nothing to write, put a dash. Also in empty cells that remain after filling.

A dash is a continuous line that is drawn in the middle of the cell from the left to the right edge.

Using software

When filling out an application on a computer, you do not have to insert dashes into unfilled cells in the application form. You can download it on websites that help you overcome life’s difficulties. You can also download the file on the official tax website. It is recommended that you familiarize yourself with the sample first. The file is saved in Excel format and is available for recognition in Word. Do not allow downloads from dubious sources. You cannot change the position, number of cells, or dimensions of the graph. Filling is allowed in Excel or Word in Courier New font size 16, 17 or 18. Save in a standard format.

Read more: Dembel leave upon dismissal from military service

Title page

All fields, except those with o, must be filled in by the person who pays taxes.

In line TIN 1, indicate the digital code assigned by the Federal Tax Service of Russia for each citizen. If a person has not registered an individual entrepreneurship, then he may not indicate his TIN if he further indicates his passport details in paragraph 2.

In paragraph 1, indicate the code of the tax authority chosen by the payer filling out the form. The body is selected depending on the place of residence or the location of real estate and transport in case of relocation.

In the second, you need to indicate personal information, namely: last name, first name and patronymic in full; abbreviations are prohibited. Also the date of birth, hometown of the payer, which is indicated in the passport. It is necessary to write down your passport data, indicating the document type code as “1”. Enter the series and number of the passport, the date of issue of the passport and the authority that issued it. All information is carefully copied from the passport, tax officials check each document on tax benefits.

If the person filling out indicated an identification number, then only the full name can be filled in.

Next, you need to indicate the payer’s mobile number, without omitting the country code. You cannot insert spaces or dashes into mobile numbers, only in the remaining empty cells. Do not skip cells; it is most convenient to use Excel.

In the third paragraph there is the line “The application was drawn up on -”. In the empty left cell, enter the number of pages that are completed. In the next field, if necessary, you need to write the number of sheets to copy. They confirm the ability of an individual to receive tax benefits that are entitled to him by law.

The next paragraph clarifies the reliability of the information. If you are a taxpayer, then enter code “1”. If you are a representative of the payer, enter “2” and write your full name in three lines. To prove authenticity, the representative must affix the date and his signature. Below, on the line “Name and details”, he must indicate the type and details of his identity passport.

When filling out by hand, please enter the date of completion and your signature in the appropriate fields. When filling out an application in your personal account electronically, there is no need to write a date and sign.

Benefit application sheet

The pages containing information about tax benefits must be completed according to the property and type of tax that provides preferential tax conditions.

If a taxpayer has the opportunity to receive tax breaks on two or more properties, then the form must be filled out for each property separately.

At the top of the application, write down your tax identification number and last name.

In paragraph 4, first indicate the type of transport using a code. Each type of transport has a corresponding code, they are written down in the application for tax benefits. Example: if you own a passenger car, enter the number “0 1”. The make and model of the car is entered, and below is the state registration number of this car, which is subject to tax benefits.

In the fourth line, you must declare the duration of the tax benefit. If it is limited, then indicate two dates - start and end.

The fifth field is required for information about the document that confirms the payer’s right to receive benefits for this object.

Completely fill out the information in clause 4.5:

- The first line indicates the full name of the certificate, pension certificate, or other document that provides tax benefits;

- The second line is the name of the organization that issued the document;

- The third line is the date the document was received;

- The fourth line is the periods of validity of the tax benefit: indefinite or for a limited period, indicating the start and end date;

- The fifth line is for the document number.

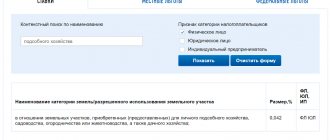

The fifth paragraph contains information about land plots. In the first field you need to write down the cadastral number of the plot of land that is being applied for preferential tax treatment.

The remaining fields must be filled in similarly to the fields in the previous paragraph: you need the name of the document, organization, date of its execution, duration of validity and number confirming the fact of filing the application.

The sixth paragraph contains information on the provision of tax benefits for the property of an individual:

The first line is needed to indicate the type of property using the appropriate code. If the property is a residential building, enter code “1”. For each type of property that involves tax levies, there is a code that is indicated on the form.

The second line contains the number of the property that offers a tax benefit. Write down the corresponding code, they are written to the right. Choose one example and write it down.

The remaining fields of the sixth paragraph are necessary to indicate the document itself, which provides preferential tax conditions. Filling them is carried out similarly to the above procedures. Tax benefits are provided for all types of property.

Form 1150063 in Excel

– KND 1151090. Tax return on excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products – KND 1151074.

Tax return on excise taxes on tobacco products Water tax - KND 1151072. Tax return on water tax Unified (simplified) tax return - Unified (simplified) tax return UTII - Application on form No. UTII-4 for deregistration of individual entrepreneurs. – Application in form No. UTII-3 for deregistration of the organization.

– Application on form No. UTII-2 for registration of individual entrepreneurs – Application on form No. UTII-1 for registration of an Unified Agricultural Tax organization – Form No. 26.1-7. Notification of termination of business activities under the Unified Agricultural Tax – Form No. 26.1-3.

Notification of refusal to use the unified agricultural tax – Form No. 26.1-2. Notification of loss of use of unified agricultural tax – Form No. 26.1-1. Notification of the transition to Unified Agricultural Tax for agricultural producers Land tax - KND 1150063.

Statement

Forms and samples of transport tax forms

Announcements August 8, 2020 You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

No. ММВ-7-21/ [email protected] Application for tax benefits for transport tax, land tax, property tax for individuals (KND form 1150063) Order of the Federal Tax Service of Russia dated November 14, 2020 No. ММВ-7-21/ [email protected] © NPP GARANT-SERVICE LLC, 2020. The GARANT system has been produced since 1990.

https://youtu.be/5up3HsrMA1Q

and its partners are members of the Russian Association of Legal Information GARANT. All rights to the materials on the GARANT.RU website belong to NPP GARANT-SERVICE LLC. Full or partial reproduction of materials is possible only with the written permission of the copyright holder.

The GARANT.RU portal is registered as an online publication by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor), El No. FS77-58365 dated June 18, 2014. LLC "NPP "GARANT-SERVICE", 119234,

Moscow, st. Leninskie Gory, 1, p. 77, . 8-800-200-88-88 (free long-distance call) Editorial office (ext.

3145), Advertising Department (ext. 3161), . Advertising on the portal. If you notice a typo in the text, highlight it and press Ctrl+Enter

KND form 1150063 to fill out

If the property is a residential building, enter code “1”.

For each type of property that involves tax levies, there is a code that is indicated on the form. The second line contains the number of the property that offers a tax benefit.

Write down the corresponding code, they are written to the right.

In the fourth line, you must declare the duration of the tax benefit. If it is limited, then indicate two dates - start and end. The fifth field is required for information about the document that confirms the payer’s right to receive benefits for this object. Completely fill out the information in paragraph 4.

5: First line - indicate the full name of the certificate, pension certificate, or other document that provides tax benefits; The second line is the name of the organization that issued the document; The third line is the date the document was received; The fourth line is the periods of validity of the tax benefit: indefinite or for a limited period, indicating the start and end date;

Download the form according to KND 1150063 to fill out electronically

In the second, you need to indicate personal information, namely: last name, first name and patronymic in full; abbreviations are prohibited.

Attention Also the date of birth, hometown of the payer, which is indicated in the passport.

It is necessary to write down your passport data, indicating the document type code as “1”.

Important Enter the series and number of the passport, the date of issue of the passport and the authority that issued it.

All information is carefully copied from the passport, tax officials check each document on tax benefits.

If the person filling out indicated an identification number, then only the full name can be filled in.

Next, you need to indicate the payer’s mobile number, without omitting the country code. You cannot insert spaces or dashes into mobile numbers, only in the remaining empty cells. Do not skip cells; it is most convenient to use Excel.

The form and procedure for filling out the application can be found here.

Who must submit documents and when?

Taxpayers - individuals who have the opportunity to receive tax benefits - must submit documents under KND 1150063. They are established by the government and documented by law. Orders of the Federal Tax Service of the Russian Federation MMV-7-21/897 do not limit the time limit for filling out an application; tax authorities do not have the right not to accept it. The terms for providing benefits are minimal; the inspection and other services are required to review your documents. They will be approved as soon as possible, notification will arrive within 24 hours.

Fines for late documents

The person who pays taxes personally needs the benefit, so it is in his interest to fill out and submit the paperwork. The law does not provide for fines or sanctions from the inspectorate due to the late submission of a form for a tax benefit for transport or other tax.

The KND form 1153006, an example of filling it out in this article, has the full title “Notification on the availability of real estate and (or) vehicles recognized as objects of taxation for the corresponding taxes paid by individuals.”

There is nothing unusual about filling out this form. But when you are dealing with bureaucratic bodies, it is better to do everything “to the point” so as not to be nervous about incorrectly presented evidence.

Form according to KND 1153006 example of filling

The articles “Property Tax for Individuals in 2020” and “Transport Tax for Individuals” described what to do if you did not receive a notice of payment of property taxes for last year by November 1st. But you need to contact the Federal Tax Service yourself with a message that you have property on which you must pay taxes.

Read more: Heirs of the first stage according to law without a will

Otherwise, a fine of 20% of the tax amount is possible.

This request must be made before December 31st.

Who should submit a Message using the KND form 1153006

It is not always necessary to submit such an application. There is no need to provide information to the Federal Tax Service if you have paid taxes before and you have not acquired any new property. This means that all the data on your taxable objects is in the tax database and there is no need to duplicate it.

Failure to receive payment notice in this case has another reason.

For example, the amount of tax payable for each group of objects was less than 100 rubles. This is possible if benefits are available. In this case, the amount of tax for last year will be added to the tax for the current one, and receipts next year will be for 2 years at once.

Form for notification of availability of taxable objects

The Message form consists of three pages:

Form according to KND 1153006 example of filling

- title page

- Section 1. Information about real estate objects

- Section 2. Information about vehicles.

You only need to fill out pages if they contain data. These are: the title page (always) and the section on which there is something to report.

General rules for filling out documents at the Federal Tax Service

Documents to the Federal Tax Service can be filled out on a computer or manually.

When filling out manually, the rules are as follows:

- fill in with a black or blue pen

- Each cell of the information field contains one sign

- letters - capitals and font - printed

- each page has the taxpayer’s signature and the date the document was compiled

- numbering of sheets is continuous, starting from the title page

- in lines where there is no information, dashes are placed

How to fill out the title page of the KND form 1153006

The title pages of all declarations are very similar to each other.

The peculiarity of this title is in the field “as of”, coming after “Submitted to the tax authority.”

So, in the “as of” field, the last date of the year of appearance or termination of ownership of the object is indicated.

How to fill out section 1 “Information on real estate objects”

Information is filled in about each object separately.

- TIN - repeated from the title page

- Page = +1 to the previous number

- Surname I.O - surname is written in full, initials - first letters

- “Type of real estate property” - select a number corresponding to one of 7 options

- “Real estate object number” - also select one of three options corresponding to the one that is in the document confirming your rights to the object. Below, write down this number with all digital and non-digital characters - one in each cell.

The Federal Tax Service Instructions for filling out this form talk about the address of the object, but the form itself only asks for its code. Therefore, you don’t have to write the address. It will be taken from the attached copy of the document.

- “Type of title document” - select the number corresponding to the document with which you will confirm your right to the object. If the number “5” = Other is selected, then below you need to write the name of the document.

- “Authority that issued the title document” - filled in in accordance with what is indicated in the document

- “Date of registration of the right” and “Date of termination of the right” are also indicated in the document itself. However, the date of termination of the right may not yet occur. Then these cells remain empty

- The bottom half of the sheet is the same, but for the next property.

If there are more than two objects unaccounted for by the Federal Tax Service, then filling continues on a new sheet of the same type in Section 1.

How to fill out section 2 “Information about vehicles”

Very similar to filling out section 1, but for a vehicle.

Form according to KND 1153006 example of filling

- The header is filled in similarly to the section

- The vehicle type code is selected from the proposed ones. And, if you select “16” = Other, write below what exactly, in letters and numbers

- Further from clause 2.2 to clause 2.8 data from registration documents and PTS

- The bottom half of the sheet is exactly the same - for another vehicle unit, if there is one.

Copies of documents confirming the Information

When the Information is completed, you need to make copies of all documents that were referenced. Count how many sheets of copies you got and write them down on the title page.

Methods for submitting a document to the Federal Tax Service

You can choose the method of submitting Information to the Federal Tax Service from the following:

- in person: come to the Federal Tax Service and submit the document along with copies of supporting documents to the inspector. In this case, it is necessary to have original documents so that the inspector has the opportunity to verify copies

- by mail: send Information and copies of supporting documents to the Federal Tax Service. It is important to remember here that you must send something to the Federal Tax Service with an DESCRIPTION. This is necessary to be able to confirm the timely delivery of these particular documents by such and such a person, on so and so many sheets

- via Internet channels with a qualified electronic signature.