Cashier-operator's change fund: how to properly register

From this article you will learn:

- What document accompanies the issuance of cash to the cashier for exchange?

- What threatens an organization that does not formalize this operation.

- How is the issue and return of the change fund reflected in accounting?

In order to give change to the buyer, the cashier-operator needs small money. And where can the cashier get them, for example, in the first hours of work, when there is no income yet or there is, but not much? That's right, he must receive cash for the change fund from the central cash desk of the organization or entrepreneur. Let's talk about how to arrange everything correctly so as not to have problems with the tax authorities.

Service Temporarily Unavailable

S.I.Ozhegov, N.Yu.Shvedova.

- Guide to the works of Sam IzdatFor those interested in works of art SI links

Complete list of references with annotations

List of the best:

- My personal

Top of the Samizdat magazine

Section statistics

Contact the site programmer.

Website – “Artists” .. || ..

A ledger of accepted and issued cash is kept only in cases where there are several cashiers/operators.

Let's discuss the existing order

“Simplified” (with some exceptions) conduct cash payments with customers using cash registers. Therefore, when issuing a change fund, it is necessary to be guided by the Standard Rules for the operation of cash registers when making cash settlements with the population, approved by the Ministry of Finance of Russia dated August 30, 1993 N 104 (hereinafter referred to as the Rules). In clauses 3.8 and 3.8.1 of the Rules it is stated that before starting work, the cashier must receive from an official of the organization everything necessary for the work, in particular, small change coins and banknotes in the amount necessary for settlements.

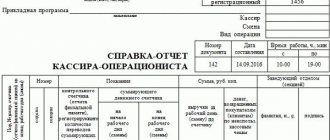

According to clause 3.8 of the Rules, the cashier must receive the change fund against signature. But this does not mean that he will write any kind of receipt, since the issuance of cash from the organization’s cash desk is regulated by the Procedure for conducting cash transactions in the Russian Federation, approved by Resolution of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 N 40. So, when issuing a change fund to the cashier You need to issue a cash receipt order . At the end of the working day, the cashier must draw up a certificate-report of the cashier-operator (Form N KM-6) and hand over the proceeds received to the main cash desk of the organization. And along with the proceeds, he hands over the amount of the change fund received in the morning. When depositing funds, a cash receipt order is drawn up.

Based on these documents, entries are made in the cash book. Note: it is better to draw up separate cash receipt orders for the delivery of proceeds and change funds. This will confirm that the amount handed over is not proceeds from the sale, and thereby protect against unnecessary questions. We also recommend issuing an order in which the manager will establish the amount of the change fund issued to the cashier-operator <1>.

<1> Read about filling out form N KM-6 on p. 74.

Editorial advice. Register the delivery of the proceeds and the change fund with different PKOs, then you will not have to explain to the tax inspector why part of the donated amount is not included in the tax base.

Let's discuss some of the nuances. When trading using cash registers, the cashier is required to maintain a cashier-operator book in Form N KM-4. And only revenue needs to be recorded in it; exchange amounts are not reflected in this book (in fact, in the unified form there is no special column for them). There is one more document that will have to be maintained, but only if the organization has several cashiers-operators. We are talking about a book of accounting for funds accepted and issued by the cashier (Form N KO-5). It reflects the issuance of money for exchange by the senior cashier to other cashiers.

Memo. Unified forms of cash documents (N KO-...) are approved by Resolution of the State Statistics Committee of Russia dated 08/18/1998 N 88, documents for working with cash registers (N KM-...) - by Resolution of the State Statistics Committee of Russia dated 12/25/1998 N 132.

There are nuances. A ledger of accepted and issued cash is kept only in cases where there are several cashiers/operators.

If retail outlets and accounting departments are far from each other

In order not to run back and forth every day to register “change” cash settlements and cash settlements, you can, at the request of the cashier, give him money on account, for example, for a month. This is not prohibited by the procedure for conducting cash transactions. It only obliges the accountant to report on the money spent no later than 3 days from the end of the period for which the money was received. 4.4 Regulations No. 373-P.

In this case, it is necessary to issue an order from the manager to establish the amount of the exchange fund for a certain period. Money is given to the cashier using consumables. After the expiration of the period for which the money was issued, the cashier will have to return the money and draw up an advance report, indicating the “change fund” in the “Advance advance purpose” column. You won’t have to write almost anything in the advance report: you received so much, spent 0.00 rubles, returned so much according to such and such a receipt order.

Cashiers, as a rule, leave the change money issued for reporting in the cash register box, believing that there will be no fine for failure to post it. After all, this is the money of the accountable person. But auditors do not advise doing this.

EXPERIENCE EXCHANGE

EFREMOVA Anna Alekseevna General Director of the Audit Office

“The money received by the cashier on account ceases to be the funds of the enterprise and becomes the cashier’s debt, that is, they are temporarily, as it were, his funds intended to be spent on established purposes. Therefore, if the cashier puts them in the cash register drawer, then, firstly, he will violate the regulations (in particular, clause 4.7 of the Standard Rules for the Operation of Cash Register Machines), and secondly, in the event of an audit of the cash register, this money will be considered as unaccounted revenue.

That is why such funds should be located outside the cash register box, for example, in the cashier’s personal bag. But here he himself faces the risk that in the event of the loss of the bag, he will bear full financial responsibility for the damage caused to the organization in the amount of the unreturned balance of unspent accountable funds. Therefore, it is still better to officially issue change funds to the cashier at the beginning of the shift, especially since increasing the cash balance limit in the cash register by the amount of the change fund is not so difficult.”

***

Despite the fact that lately tax authorities rarely pick up on incorrect execution of the issuance of exchange, it is still not worth the risk.

Other articles from the magazine "MAIN BOOK" on the topic "Cash register / cash desk / paying agents":

2020

- We issue an “interest” check on cash register, No. 2

You may be fined for an incorrectly executed exchange fund.

Are you asking why you need to fill out additional cash receipts and expenditure orders, since money for the exchange fund is transferred only temporarily and is returned in the same amount? Why unnecessary documents and entries in the cash book?

Both documents and relevant records are needed, and here's why. The fact is that in the operating cash desk during the day you can store funds in the amount of revenue received using the cash register. During an audit, the tax authorities may consider the rest as unaccounted cash. In this case, the organization faces fines in the amount of 40,000 to 50,000 rubles, and officials - from 4,000 to 5,000 rubles.

About fines. The amounts of fines are indicated in Art. 15.1 Code of Administrative Offenses of the Russian Federation. Individual entrepreneurs within the framework of the Code of Administrative Offenses of the Russian Federation bear the same administrative responsibility as officials of organizations, that is, they face a fine of 4,000 to 5,000 rubles. (Article 2.4 of the Code of Administrative Offenses of the Russian Federation).

And so that the exchange fund is not considered unaccounted cash, it should be formalized as described earlier. Now let's look at some situations encountered in practice.

Accounting for tea and coffee in the organization

Products that a company purchases for its employees and customers must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost. To find out, you need to refer to the contract with the supplier. The figure indicated there will appear in other company documents. As in the case of water, VAT is not taken into account.

Features of accounting for tea and coffee depend on the presence of the corresponding clause in the collective agreement.

So, if the document contains a provision according to which the organization is obliged to provide its employees with drinks and sweets, expenses for the purchase of products are classified as expenses for ordinary activities. If the products are transferred to the person who is responsible for replenishing them, the actual cost of tea and coffee is written off from account 10 to the debit of account 26. The basis for the manipulation is the corresponding primary document.

The retail outlet starts working before the accounting department

Quite a common situation. The accounting office is open from 9.00 or 10.00, and the store is open from 8.00. And there are also 24-hour retail outlets. How then to formalize the issuance of the exchange fund?

In this case, there is nothing left to do but issue the required amounts to cashiers the night before, issuing cash receipts the next day. The return of the proceeds and the change fund is carried out at the main cash desk in the morning of the next day, retroactively. Of course, this is also a violation, but inspectors will not be able to record it, therefore, there will be no penalties.

An important point. As a rule, the tax office's working hours are the same as those of the accounting department.

How to issue and register a change fund for a cashier

The regulatory documents do not contain a clear answer to this question.

Some experts recommend issuing cash to cashiers on account, accordingly drawing up advance reports indicating the purpose of the advance - “change fund”. In this case, an order is issued from the manager, which sets a deadline for the return of funds issued as an advance. It must be said that this approach is possible, but it has some disadvantages. After all, funds are issued for reporting personally to the cashier, therefore, he must keep them at home (for example, in his pocket or wallet), and not in the operating cash register. However, there are no penalties for this violation.

Situation. Moscow tax authorities avoid answering

In the Letter of the Federal Tax Service of Russia for Moscow dated June 18, 2008 N 22-12/057947, taxpayers asked exactly the question that interests us: is it allowed to issue change funds to store cashiers once a year on an expense order?

However, the said Letter does not contain an answer to the question posed. Tax officials remind you of the rules for working at cash register machines, according to which cashiers must be provided with everything they need before starting work. But there is no prohibition or permission to issue a change fund once a year in the Letter.

In addition, the courts, as a rule, side with taxpayers who are fined for incomplete posting of cash due to a violation of the procedure for registering the change fund. According to the judges, untimely delivery of the change fund to the central cash desk is not an administrative violation specified in Art. 15.1 Code of Administrative Offenses of the Russian Federation.

A selection of documents. There are examples of arbitration practice that are positive for taxpayers. See, for example, Resolutions of the Federal Antimonopoly Service of the North-Western District dated March 2, 2010 in case No. A56-24004/2009 and dated June 28, 2010 in case No. A56-58858/2009, as well as Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 10, 2008 N F04-61/2008(443-A70-43).

Cash limit.

The rules say that before starting work, the cashier must obtain from an official of the organization everything necessary for work, in particular, small change and banknotes in the amount necessary for payments.

According to clause 3.8 of the Rules, the cashier must receive the change fund against signature. But this does not mean that he will write any kind of receipt, since the issuance of cash from the organization’s cash desk is regulated by the Procedure for conducting cash transactions in the Russian Federation, approved by Resolution of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 N 40. So, when issuing a change fund to the cashier It is MANDATORY to fill out a cash receipt order.

Attention

At the end of the working day, the cashier must draw up a certificate-report of the cashier-operator (Form N KM-6) and hand over the proceeds received to the main cash desk of the organization. And along with the proceeds, he hands over the amount of the change fund received in the morning. When depositing funds, a cash receipt order MUST be drawn up.

To the question of whether it is possible to issue change funds to cashiers not every day, but once a week, month or even a year, you can answer yes: the procedure for conducting cash transactions does not prohibit this.

Based on the specified documents (receipt and expense orders), corresponding entries are made in the cash book. Note: it is better to draw up separate cash receipt orders for the delivery of proceeds and change funds. This will confirm that the amount handed in is not sales revenue, and will thereby protect you from unnecessary questions from regulatory authorities regarding the amount of income the organization received on the day the cashier handed in the change coin.

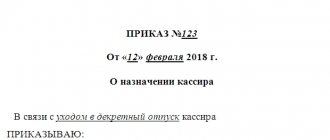

It is also necessary to issue an order in which the manager will establish the amount of the change fund issued to the cashier-operator. Such an order must clearly state what the amount of the exchange fund is, how often it is issued and when it is handed over. We repeat, issuing and returning the change fund does not have to be done every day. You can issue and return money, for example, once a month.

This will confirm that the amount handed in is not sales revenue, and will thereby protect you from unnecessary questions from regulatory authorities regarding the amount of income the organization received on the day the cashier handed in the change coin.

It is also necessary to issue an order in which the manager will establish the amount of the change fund issued to the cashier-operator. Such an order must clearly state what the amount of the exchange fund is, how often it is issued and when it is handed over. We repeat, issuing and returning the change fund does not have to be done every day. You can issue and return money, for example, once a month. Accordingly, the rest of the time they will be in the cash drawer.

We do not recommend giving money to the cashier, although this is not expressly prohibited by law.

Aphorisms of officers of the Soviet army 24k

Rating:

6.00*3

Humor

- Fido Pearls of the Fido network 17k

Rating:

6.00*3

Humor Pearls from the Fido network, for relevant fans (I don’t know where it was stolen from, I had it lying around on my computer, I’m posting it so it doesn’t get lost). - narod Scientific-Student jokes 6k

Humor

Reference information for beginner Internet users and computer scientists

Due to the introduction of information technology into our daily lives. The author of the articles is not a specialist, but an ordinary user, I share what I know...

SI technical issues:

- about 2k

- Inserting links into annotations 4k

Natural Science Comments: 6 (11/30/2014) How to correctly insert links into annotations so that they later work (features of the local engine) link to samizdat (for example) - Inserting pictures into annotations 8k

Comments: 9 (10/18/2016) How to insert a picture into your annotation, and how to make it not stick out on top of the text, but to the left of it. - Inserting pictures into texts and on your SI page 37k

Rating:

3.71*13

Comments: 14 (12/15/2015) Here I will briefly tell you how to insert pictures into your texts, in annotations, how to prepare a file in Microsoft Word format with a large number of pictures so that these pictures are displayed in SI (samizdat).

Illustrations/applications: 10 pcs.

See also:

- Explanatory dictionary of the Russian language.

Reflection of transactions with the exchange fund in accounting

Let us pay attention to organizations that, even under the simplified tax system, keep accounting records in full. We will tell you how the issuance of the exchange fund is reflected in accounting.

For each operating cash desk, a separate sub-account “Operational cash desk 1”, “Operational cash desk 2”, etc. is opened on account 50 “Cash desk”. When issuing the change fund, the following entry is made:

Debit 50, sub-account “Operating cash”, Credit 50, sub-account “Cash of the organization”.

When returning change money, the posting will be reversed:

Debit 50, sub-account “Cash of the organization”, Credit 50, sub-account “Operating cash”.

Example. Horizont LLC applies the simplified tax system and maintains accounting records in full. On June 2, 2011, the store cashier was given a change fund in the amount of 3,800 rubles, and on the same day in the evening the cashier handed over the proceeds received in the amount of 374,500 rubles to the organization’s cash desk. and returned the amount of the change fund. Let us reflect the transactions in accounting provided that subaccount 2 is opened for the operating cash desk on account 50, and subaccount 1 is opened for the central cash desk of the organization (see table).

Table

Accounting entries for Horizont LLC

————————————————————————— N Contents of the transaction Date Debit Credit Amount, Document payable rub. ————————————————————————— 1 2 3 4 5 6 7 —————————————————— ——————— 1 Changes issued 06/02/2011 50-2 50-1 3 800 Expenditure money to the operating cash register order —————————————————————— ——— 2 Reflected trading 02.06.2011 50-2 90-1 374 500 Z-report revenue ——————————————————————————— 3 Reflected delivery 02.06 .2011 50-1 50-2 374 500 Receipt of proceeds to the central cash register order ——————————————————————————— 4 Changes returned 06/02/2011 50- 1 50-2 3 800 Receipt money to the central cash register order —————————————————————————

If, when issuing cash to the cashier for the change fund, an advance report is drawn up, then the following entry is made:

Debit 71 Credit 50.

The return is reflected as follows:

Debit 50 Credit 71.

Nuances that require special attention. When issuing the change fund, an expenditure cash order is issued, otherwise the tax authorities may record the non-receipt of cash, which could result in an administrative fine.

The rules for working with cash registers require the daily issuance and return of change funds, but there are no fines for violating them.

If the retail outlet starts working earlier than the accounting department, then the money for exchange will have to be issued in advance, and its receipt will have to be formalized in the morning of the next day.

P.A. Lisitsyna

Tax consultant

What unified forms can be abandoned?

After the transition to “smart” cash registers, maintaining primary documentation has become much easier. The usual unified forms and accounting logs, previously drawn up on the basis of the requirements of Goskomstat Resolution No. 132 of December 25, 1998 and Federal Law-402 “On Accounting,” after the repeal of Government Resolution No. 470 from July 1, 2020, became optional for use.

The Ministry of Finance came to this conclusion, as reflected in its Letters No. 03-01-15/54413 (September 16, 2020), No. 03-01-15/28914 (May 12, 2017), No. 03-01-15/ 3482 (25 January 2020), No. 03-01-15/19821 (04 April 2020).

However, the opinion of officials is advisory in nature. Therefore, the entrepreneur has the right to use online cash registers and old-style cash documents or can completely abandon the following forms:

- Form KM-1 - an act used when resetting KKM counters;

- Form KM-2 - the act required to take readings when repairing the cash register and returning it to work;

- Form KM-3 - the act that was filled out when returning cash;

- Forms KM-4 - a journal filled out by the cashier;

- Form KM-5 - a special journal designed to record data when using cash registers that operate without a cashier-operator;

- Forms KM-6 – certificate-report for the cashier-operator;

- Forms KM-7 - a document recording CCT readings.

From July 2020, businesses that have switched to online checkouts can legally refuse to fill out such forms.

Note. After switching to a new cash discipline, a business entity has the right to voluntarily maintain the old document flow. In this case, optional documents are filled out in any form.

Change fund for the cash register

Registration of an exchange fund for settlements via cash register

With some minor exceptions, companies using the simplified tax system carry out cash payments to customers using cash registers. Therefore, when issuing a change fund, it is necessary to be guided by the Standard Rules for the operation of cash registers when making cash settlements with the population, approved by the Ministry of Finance of Russia dated August 30, 1993 N 104 (hereinafter referred to as the Rules). In clauses 3.8 and 3.8.1 of the Rules it is stated that before starting work, the cashier must receive from an official of the organization everything necessary for the work, in particular, small change coins and banknotes in the amount necessary for settlements.

According to clause 3.8 of the Rules, the cashier must receive the change fund against signature. But this does not mean that he will write any kind of receipt, since the issuance of cash from the organization’s cash desk is regulated by the Procedure for conducting cash transactions in the Russian Federation, approved by Resolution of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 N 40. So, when issuing a change fund to the cashier It is MANDATORY to fill out a cash receipt order. At the end of the working day, the cashier must draw up a certificate-report of the cashier-operator (Form N KM-6) and hand over the proceeds received to the main cash desk of the organization. And along with the proceeds, he hands over the amount of the change fund received in the morning. When depositing funds, a cash receipt order MUST be drawn up. To the question of whether it is possible to issue change funds to cashiers not every day, but once a week, month or even a year, you can answer yes: the procedure for conducting cash transactions does not prohibit this.

Based on the specified documents (receipt and expense orders), corresponding entries are made in the cash book. Note: it is better to draw up separate cash receipt orders for the delivery of proceeds and change funds. This will confirm that the amount handed in is not sales revenue, and will thereby protect you from unnecessary questions from regulatory authorities regarding the amount of income the organization received on the day the cashier handed in the change coin.

It is also necessary to issue an order in which the manager will establish the amount of the change fund issued to the cashier-operator. Such an order must clearly state what the amount of the exchange fund is, how often it is issued and when it is handed over. We repeat, issuing and returning the change fund does not have to be done every day. You can issue and return money, for example, once a month. Accordingly, the rest of the time they will be in the cash drawer.

We do not recommend giving money to the cashier, although this is not expressly prohibited by law. In any case, no matter which of the indicated procedures for the turnover of the exchange fund you choose, it must be written down in the order on the exchange fund, and you must strictly follow it.

ORDER No. ____ On the creation and accounting of the exchange fund

Moscow "___" ____________ 201_

To ensure compliance with the legal requirements for the procedure for handling cash in the Company, I ORDER: 1. Establish that every day at the beginning of the working day in the cash register of the model “INDICATE MAKE AND MODEL AND SERIAL NUMBER of cash register”, there must be a change fund in the amount of 18,000 rub. small bills and coins. The cashier of the Company issues the change fund to the cashier-operator (cashier-seller) on the 1st day of each month before the start of the work shift according to the cash receipt order. During the month, the change fund is in the cash register drawer of the cash register. The change fund is handed over to the general cash register at the end of the work shift on the last day of the month. The cashier-operator (cashier-seller) is responsible for the safety of the change fund. 2. Put this order into effect starting from the date of signing the order. 3. Familiarize all cashiers and cashiers (cashiers-sellers) with this order against signature. 4. I entrust control over the execution of the order to myself (OR TO OTHER LEADING PERSON OF THE ORGANIZATION).

CEO ______________

The order has been reviewed by: Chief accountant ________________/full name/ cashier_______________________/full name/ cashier-operator __________________/full name/ cashier-operator __________________/full name/ cashier-operator __________________/full name/ cashier-operator __________________/full name/ …

Formation methods

The procedure for creating a change fund is not entirely regulated by law. However, in practice one of these schemes is used:

- Issuance of change coins every day before the start of the shift. In this case, a cash order is issued. Every day the balance of the issued funds is returned to the main cash desk.

- Issuance of change coins for a long period. In this case, an order must be issued. It indicates this information: the period for issuing funds, the amount of exchange, the reason for providing the amount for a long period. The issuance of funds is accompanied by the execution of a cash order.

Change can be provided to the cashier for reporting. But this is not the best option, since funds issued on account may be recognized as the cashier’s personal money. And personal money cannot be kept in the cash register.

Sample order

Yabloko LLC

Moscow

November 7, 2017

Order No. 68

About the formation of the exchange fund

I ORDER:

1. Ensure that the cash register has a change fund in the amount of 1,000 rubles at the beginning of the shift. 2. Give change to the cashier on the 1st before the start of the shift. Do this every month. 3. Hand over change to the central cash desk at the end of the working day on the last day of the month. 4. Appoint cashier R.R. Ivasyuk to be responsible for the safety of exchange. 5. Entrust control over the implementation of the order to the chief accountant Ivanova I.Zh.

General Director (signature) Zaitsev L.L.

The order has been reviewed by: Chief Accountant (signature) Ivanova I.Zh. Cashier (signature) Ivasyuk R.R.

Cash limit. The concept and rules for calculating the cash balance.

The cash register limit is the maximum amount of cash that the company has the right to leave in the cash register at the end of the working day. Funds exceeding the established limit must be transferred to the bank at the end of the day. If previously the cash register limit was determined by one of the banking institutions, today the enterprise is not obliged to notify the bank about the size of the limit, deciding independently how much amount should remain in the cash register during non-working hours. The cash limit is established so that, if necessary, the enterprise has the opportunity to quickly use the required amount for business needs, as change funds (if we are talking about a retail outlet), as an advance for a business trip, etc. The cash limit is calculated taking into account several factors, including the operating mode of the enterprise and the specifics of its activities, distance from the bank, the volume of cash receipts and expenditures. A business entity can determine the cash limit based on the amount of average daily revenue. Even if the established limit exceeds its maximum volume, it is not the inflated amount that will be taken into account, but the average revenue per day.

The cash limit does not need to be agreed upon and approved by the bank!

Bank of Russia Regulation No. 373 dated 10/12/2011

In determining the cash limit, the duration of the bank’s operation plays a role, as well as the agreement existing between the bank and the organization on collection. As for the deadline for depositing funds, this issue is previously discussed with the bank. If the cash register limit is not entered, it should be considered zero. The reasons why a cash balance limit is not set are not taken into account. If after the end of the working day there is money remaining in the cash register that exceeds the limit, it is defined as over-limit. Being an internal matter of the enterprise, the calculation of the cash limit in the cash register, as noted above, should not be agreed upon with the bank. But if during the check there is an amount at the organization’s cash desk, the amount of which differs from the limit, it will be accepted as the limit. Based on this amount, the over-limit will be calculated for the entire period of storage of funds. The fact of exceeding the limit is fraught with the introduction of penalties in relation to the business entity. The cash limit is calculated for the enterprise and for each of its separate divisions separately, approved by internal regulations. During the year, the amount of the limit may change if there are grounds for this (for example, cash turnover may increase). In excess of the approved limit, cash may be kept in the cash desk for the payment of wages, scholarships, pensions and similar payments. If there is no reason to leave the money in the cash register, and the organization does not have time to deposit it in the bank, the excess amount can be given to one or several employees on account (for example, for household needs), returning it to the cash desk on the next working day. If the established deadlines for using cash are exceeded, the company will also face the threat of fines. For an organization just starting its activities, for the first three months of operation the cash limit is set according to forecast calculations, subsequently subject to revision. As a rule, adjustments to the maximum amount left in the cash register occur two weeks after the end of the three-month period. Some businesses have the right to operate without establishing a cash limit. These include banks, religious organizations (monasteries, religious educational institutions, etc.) that do not carry out production or other business activities.

Formulas for calculating the cash limit

1. For enterprises receiving cash for goods sold or services provided:

L = V/ P * Nc,

where: L — cash balance limit in rubles; V is the volume of cash receipts; P —calculation period for which the volume of receipts is taken into account (no more than 92 working days); Nc - the period of time between the days of delivery to the bank (no more than 7 working days).

Example: Mir KKM LLC (retail trade, opening hours from 9-00 to 21-00, closed on Sunday). Revenue for 3 months: March - 1 million rubles, April - 900 thousand.

How to document expenses

All operations related to the company’s business activities must be accompanied by primary documentation (Law No. 402-FZ). Such papers can be accepted for accounting only if they were compiled according to the form that is present in the albums of primary documentation forms. If an accountant needs to draw up a document for which a special form is not established, it is necessary to include the details specified in the law.

The papers required to record sweets and drinks purchased for employees and visitors are presented in the table.

| Type of transaction | Document's name | Form |

| Accounting after purchase | Packing list | No. TORG-12 |

| Receipt order | No. M-4 | |

| Moving products within the company | Request-invoice | No. M-11 |

| Write-off of drinking water | Act on write-off of materials for production | A form that the company specialist developed independently. It must be drawn up taking into account the requirements of Federal Law No. 402-FZ |

To confirm the validity of classifying water as an expense, experts advise drawing up internal organizational and administrative documents. An example could be an order from a manager. The company has the right to develop its own corporate standards in accordance with which workers are provided with drinking water and sweets. The action is carried out with the aim of creating favorable conditions for carrying out work activities.

Organization and accounting of the change fund at the cash desk

rubles, May - 1.2 million rubles. In just 3 months (92 days) - 3.1 million rubles. The proceeds are deposited in the bank the next day at 12 noon. Thus, the cash register limit will be 67,000 rubles. (3,100,000: 92 days x 2 days)

2. For enterprises that do not receive cash for goods sold or services provided:

L = R / P * Nn,

where: L — cash balance limit in rubles; R is the volume of cash disbursements, excluding amounts intended for wage payments; P – billing period for which the volume of issues is taken into account (no more than 92 working days); Nn - the period of time between the days of receiving cash from a bank check (no more than 7 working days).

Example : LLC "World of KKM" (services, opening hours from 10-00 to 18-00, closed on Saturday and Sunday). Cash costs for a week (5 days) - 40,000 rubles. The organization receives money from the bank 2 times a month every 16 days. Thus, the cash register limit will be equal to 56,000 rubles. (40,000: 5 days x 7 days).

Fines

For violation of cash discipline, the Code of Administrative Offenses (Article 15.1 of the Code of Administrative Offenses) establishes a fine:

- for an organization - 40,000–50,000 rubles,

- for management - 4,000–5,000 rubles.

The list of violations includes:

- cash settlements with other organizations in excess of the established amounts;

- non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- accumulation of funds in the cash register in excess of established limits.

Meaning of “Change money” in dictionaries

Change Money—Economic DictionaryTOKEN MONEYUnder the Spectrum Act of 1965 (see U.S. MONEY) and subsequent specie laws, all coins issued in the United States are specie coins, that is, their intrinsic value does not correspond to the face value. . General characteristics of D.r. can be formulated as follows:1. Small denominations predominate. D.B. serve mainly for exchange.2. Made from non-standard denier metal. metal. Change coins are minted from nickel and copper rather than gold or silver, with silver being an additional currency. metal previously officially used to issue standard silver dollars (371.25 grains, troy weight, fine silver) and small silver coins (35.6 grains, troy weight, fine silver for two 50-cent coins, four 25-cent coins and ten dimes, i.e. 10 cent coins).3. Inferior. Net worth D.r. less than the denomination indicated on them. They are more valuable as coins with officially stated purchasing power, rather than as metal. This is done to prevent the coins from being melted down, hoarded or exported and to ensure their continued circulation.4. State minted only. Obviously, if the denomination of coins exceeds the cost of the metal used to mint them, the issuer - the state - receives a profit, or seigniorage, for the right to mint coins. This profit should be intended only for the state, and not for a private individual.5. Minting of a limited number of coins. D.B.

The sequence of measures taken to strengthen monetary circulation is noteworthy.

Initially, a depository office was established, which issued deposit notes backed by silver ruble for ruble. Gold and silver were accepted unlimitedly from the population in exchange for deposit notes. Deposit notes were freely exchanged for metal upon presentation; as a result, in one year, without the state’s expenses for this, the exchange fund amounted to 38 million rubles. Then the banknotes, which were in circulation as a secondary currency, began to be exchanged at the rate of 3 rubles. 50 kopecks for one silver ruble. The monetary reform was completed with the release of state bank notes into circulation and the complete replacement of banknotes, as a result of which the unification of paper banknotes with state notes was ensured, which received widespread circulation along with silver coins and were backed by all the property of the state and exchangeable for a double coin. [p.412] As a result, by the end of 1861, the total amount of banknotes in circulation amounted to 713.6 million rubles, and they were backed by the exchange fund (consisting of gold and silver in coins and bullion) by only 11%. [p.416] EXCHANGE FUNDS—reserves of state treasury notes and small change coins stored in the institutions of the State Bank of the USSR. Created after the transfer of operations with treasury currency to the State Bank of the USSR in November 1929 by the People's Commissariat of Finance of the USSR. At the expense of R. f. Bank institutions exchanged bank notes for treasury notes, issued new ones to replace old treasury notes and defective coins withdrawn from circulation, and accepted and exchanged damaged treasury currency. In 1941 R. f. were combined with the reserve funds of bank notes in the Reserve Funds of notes of the State Bank of the USSR, state treasury notes of the USSR and metal coins. [p.258]

Before the First World War, when gold coins and banknotes redeemable for gold were in circulation, coins served as a reservoir for replenishing metallic goods. circulation during periods of increased circulation needs for money, as well as an exchange fund for banknotes. With the abolition of the gold standard, both of these appointments lost their validity. S. retain their importance as a reserve fund of world money—a universal means of purchasing and payment on the world market. In the era of imperialism and the general crisis of capitalism, coins owned by bourgeois states are used as a military-financial reserve, a means of financing imperialist policies. wars. The accumulation of money takes on especially wide dimensions during periods of inflation, when, as a result of a sharp depreciation of paper money, distrust in it increases. [p.361]

RESERVE FUNDS OF TICKETS OF THE STATE BANK OF THE USSR - funds of bank notes created at large institutions of the State Bank for the purpose of properly organizing money circulation, regulating the cash flow and constant updating of circulating bank notes. In 1941 they were merged with treasury currency exchange funds. Currently [p.429]

When auditing income from cargo operations, following the withdrawal of cash, the amount of revenue that should be in the cash desk at the time of the audit is determined. This amount is determined by the stubs of road manifests for dispatched cargo, by road manifests of issued cargo, and by coupons of receipts for miscellaneous collections. Checking these documents makes it possible to determine the amount of tariff and fees received by the cash desk from the beginning of the reporting day until the start of the audit. In addition, the revenue received from the sale of invoice forms and the exchange fund are taken into account. [p.416]

Cash reports are verified with the data of bank branches on the delivery of revenue and with the operational reports of stations for the transportation of passengers, baggage, cargo and various fees. In addition, the correctness of payments from station revenues is checked (both without special permits and with road management permits) and the compliance of the cash balance in the station cash desk with the established amount of the change fund. [p.584]

State credit banknotes were issued by the State Bank in an amount limited by the needs of monetary circulation, but certainly backed by gold in at least half the amount, until the total volume of the issue reaches 600 million rubles. In addition to this norm, credit notes had to be fully backed by gold - a credit ruble per ruble of gold. By the beginning of 1896, the gold reserves were estimated at 659.5 million rubles, of which 75 million rubles were in the exchange fund. During 1896, the exchange fund was increased to 500 million rubles, which seemed sufficient to launch exchange (for gold) operations. The denomination of credit notes was set at 500, 100, 25, 10 rubles, as well as 5, 3 and 1 ruble. [p.131]

EXPLICIT (MONETARY) COSTS - opportunity costs that take the form of explicit (monetary) payments to suppliers of factors of production and intermediate goods. JAMAICA MONETARY SYSTEM - in 1978, Jamaica ratified an agreement on currency reform by member countries of the International Monetary Fund (IMF). A new currency system was created, called the Jamaican one. The basic principles of Ya. v. With. are the use of national currencies that are not exchangeable for gold as world money and the gradual reduction of international payments in dollars, the abolition of the official price of gold and the exclusion of gold from interstate payments, the gradual introduction of the collective monetary unit of the International Monetary Fund - special drawing rights (SDR) as the main international settlement and reserve means of payment. HAPPY BIRTHDAY). Creation of Ya.v. With. did not bring monetary stability to capitalist countries. The collective monetary unit - SDR - did not receive sufficient circulation. Currency contradictions between the United States, Western European countries and Japan are expressed in the desire to form regional currency blocs (Japanese yen zone, French franc zone). The most institutionalized regional currency bloc is the European Monetary System (EMS), which unites the countries that are members of the European Economic Community (EEC). Currency wars periodically occur between regional currency groups. Imperfection of Ya.v. With. led to the fact that practically the dollar continues to retain its role as the main reserve currency of the capitalist world, which allows the United States to continue to receive great benefits from economic exchanges with other countries. LABEL - a type of trademark, a stamp on [p.240]

A year before the end of the Second World War, in July 1944, at an international conference of 44 allied countries in Bretton Woods, New Hampshire, agreements were adopted that entered into force in December 1945. According to them, a post-war international monetary system was created, including the newly formed International Monetary Fund and the International Bank for Reconstruction and Development. In addition, rules were developed to facilitate international currency exchange and stabilize exchange rates, namely the gold-dollar standard, fixed exchange rate, and currency convertibility. In 1971-1973. The exchange of dollars for gold was suspended and floating rates were introduced. The Bretton Woods system has ceased to exist. — Approx. ed. [p.104]

The Law on the Central Bank of Russia provides for its monopoly right to issue money and issue and cash regulation of the money supply in circulation. Cash circulation is serviced by banknotes and metal coins. The modern mechanism for issuing banknotes is based on lending to commercial banks, the state and increasing gold and foreign exchange reserves. In the first case, the issue is secured by bills and other bank obligations and securities, in the second - by government debt obligations, and when purchasing gold and foreign currency - by gold and foreign currency, respectively. The banknote issue is supported by the assets of the Central Bank of the Russian Federation. Performing this function, he determines the procedure for conducting cash transactions, establishes rules for the transportation, storage and collection of cash, ensures the creation of reserve funds of banknotes and metal coins, determines the signs of solvency of cash reserves, as well as the procedure for replacing or destroying damaged banknotes and coins. [p.52]

During the First World War, the free exchange of A. banknotes was stopped. for gold coins, and in 1931 - for gold bars. In 1939, in connection with the seizure from A. b. gold reserves and its transfer to the Monetary Equalization Fund, the principle of metal backing of banknotes was finally eliminated. In 1946 A. b. shares belonging to private shareholders were nationalized and exchanged for government bonds, while the owners were provided with the same income of an average of 12% per year (every £100 of shares was exchanged for £400 of 3 percent government bonds). [p.71]

The point is that in each branch and agency of the bank there are reserve funds of banknotes created by the Board of the State Bank, which it manages. The placement of reserve funds of paper banknotes and small change at bank institutions ensures the timely supply of turnover with the necessary cash, regulation of the banknote structure of the money supply and its renewal, and also eliminates the counter transportation of banknotes on the scale of each republic, region and country as a whole, which accelerates turnover money and leads to cost savings. [p.246]

At the end of World War II, at a conference held in 1944 in Bretton Woods (USA), international agreements were adopted that formed the basis of a system of monetary relations called the Bretton Woods monetary system. It was based on the gold exchange standard, where gold and US dollars acted as reserves. The countries that signed the agreement fixed the exchange rates of their currencies in dollars or gold. The dollar was linked to gold (1 ounce of gold = $35) and was recognized as the main settlement and reserve currency. Member countries of the International Monetary Fund (IMF), which was created at this conference, pledged to maintain the exchange rates of their currencies at the level of fixed parities, regulating deviations through foreign exchange intervention, that is, the purchase and sale of the dollar. The United States has committed itself to exchanging paper dollars for gold at a fixed rate for the central banks of other countries. [p.288]

Firstly, it helps organize payments between banks. Now there is no need to physically transport money from bank to bank in the form of bags of banknotes and loose change. The transfer of money is carried out only by changing the records of the amounts of reserve funds of a particular bank stored in the central bank of the country. [p.233]

Meanwhile, in the State Council there were heated debates about which metal to use as a basis - gold or silver, or both gold and silver at the same time. The Minister of Finance was adamant - only gold. Bimetallism (both gold and silver), he explained, promises many inconveniences. Firstly, this is double trouble with preserving and increasing the fund. Secondly, when exchanging tickets for two metals, there are more opportunities for speculation. Sergei Yulievich argued that the basis for money circulation should be such a

Professor L. Chodsky significantly expands the boundaries of financial science, including issues of monetary circulation (more precisely, paper money), considering that paper money is a type of loan transaction. The difference between banknotes issued for circulation and the amount of the exchange fund, i.e. the amount of bank notes not actually covered by hard cash represents the instrument of credit 3. He correctly approached the analysis of paper money emission. Paper money can be used by the state as an active financial source in case of significant budget deficits. This process became commonplace in capitalist states with the outbreak of the First World War. However, the use of money as a revenue source of the budget does not give grounds to consider money as a financial category. Money is an independent economic category that has a specific social purpose, independent functions, and its quantitative growth as a result of state policy ultimately affects only purchasing power, i.e. leads to their depreciation. The regulator of the amount of money in circulation is, first of all, the availability of commodity masses. However, in modern conditions the amount of money in circulation depends on a number of other factors, causing [p.31]

During the First World War, in all capitalist countries. In countries other than the United States, the exchange of banknotes for gold was stopped. In England, the old economic system was formally preserved, but in fact it lost its significance, since gold was not used as a change fund, and irredeemable treasury notes began to play the main role in circulation. In Germany, along with the cessation of the exchange of banknotes, the principle of third covering was abolished, and Reichsbank banknotes began to be issued in ever increasing sizes backed by government securities to finance military expenses. [p.629]

In international payment circulation, mottos may be present in the form of banknotes of other countries, as well as foreign securities. Under the gold exchange standard, which was in force in the middle of the 20th century, mottos served as the main security in different countries and as an exchange fund for mutual settlements between different countries. [p.159]

The main reforms in pre-revolutionary Russia were the reform of 1839–1843. and reform 1895-1897 As a result of the first reform, known as the Kankrin reform (named after the Minister of Finance), silver monometallism was established in Russia. The reform was carried out through open devaluation of the assignat ruble. The beginning of the reform was the manifesto of July 1, 1839, which proclaimed the silver ruble with a content of 4 gold as the monetary unit. 21 shares of pure silver. Banknotes were assigned the role of an auxiliary sign of value with a constant exchange rate of 3 rubles. 50 k. for 1 ruble in silver. At the same time, by a special decree, a special depository office was formed at the State Commercial Bank, which accepted silver as deposits and issued in return deposit notes, which were treated equally with silver and could be freely exchanged for it. In 1841, new banknotes were issued - credit notes of 50-ruble denominations, circulated on a par with silver and exchanged for silver coins. During 1842-1843. the amount of issued credit notes amounted to 6 million rubles. The reform ended with a manifesto on June 1, 1843, which ordered the cessation of issuing deposit notes and the exchange of banknotes for credit notes at a ratio of 1 3.5. In fact, the exchange continued until 1852 and instead of 595.8 million rubles. banknotes were issued for 170.2 million rubles. credit tickets. The exchange was ensured by a specially created metallic. fund, the amount of which in 1843 was 28.5 million rubles. silver The reform, carried out in conditions of decaying serfdom, with a deficit of the state budget and foreign trade balance, could not streamline monetary circulation in Russia. Financing of the Crimean War 1853-1856. due to the issue of banknotes, which actually turned into paper money, again caused acute inflation and almost until the end of the 19th century. In Russia there was a disordered paper currency circulation. [p.363]

On the back of banknotes from 1855-1872. excerpts from the Highest Manifesto on banknotes were published with the following content: State banknotes are provided122 with the entire property of the State and non-stop at all times exchange for specie from the designated fund 123. [p.122]

After World War II, only in a few states (Belgium, the Netherlands, Pakistan, South Africa) laws providing for a certain amount of obligations continued to be in force. provision of B. b. gold. The majority are capitalist. countries security standards B. b. gold are not established or have a purely formal meaning. B. b. are provided mainly by foreigners. currency and other mottos, as well as state. securities and insignificantly. parts - commercial bills (for example, in France and Germany - gold along with mottos, bills and securities, in Italy - government securities and mottos, in the Netherlands - gold and mottos). In a number of countries (Mexico, Indonesia, etc.) ensuring the emission of biochemicals. Their assets in the International Monetary Fund also serve. Exchange B. b. for gold does not exist in any country. As for the exchange of national B. b. on the currency of other countries, then this kind of reversibility (convertibility) exists only in Germany, Switzerland and certain other countries, and in most countries there is no bankroll. either they are not convertible or their convertibility is limited. [p.134]

BRETTON WOODS MONETARY SYSTEM (from the English Bretton Woods system) is a world monetary system that took shape at the UN Monetary and Financial Conference in Bretton Woods (USA) in 1944. The Bretton Woods monetary system consisted of agreements on the creation of the International Monetary fund and the International Bank for Reconstruction and Development. The main principle of the Bretton Woods monetary system is based on the provision that the function of world money remains with gold, but the scale of its use in international monetary relations was significantly reduced, and the US dollar was introduced as an international means of payment in international circulation. To mitigate crises of individual currencies, states issued loans to each other through the IMF. The Bretton Woods currency system was a system of interstate gold-dollar standard and placed the US dollar in a privileged position, thanks to which the United States could pay off its debts not with gold, but with dollars. The rapid development of the economies of Western Europe in the 1960s. and other reasons led to an international currency crisis. In 1971, the exchange of dollars for gold was stopped, and all currencies lost any connection with gold. The Bretton Woods currency system was replaced by the Jamaican currency system. [p.67]

SMALL COIN. We format it correctly.

minted in quantities that are practically necessary to service trade. The purpose of this restriction is to protect D.r. from depreciation below par. An act passed by Congress on July 23, 1965 (P.L. 89-81), known as the Specimen Act, repealed the provisions of the law formerly included in Section 43(b)(1) of the May 12, 1933 Act. mutatis mutandis (USC. 462), providing for full and unrestricted rights of legal tender for all coins and currency. United States insignia, including Federal Reserve notes, but with the addition of new statutory provisions identical to those contained in the United States Code (31 U.S.C. 392).

Similar words in dictionaries

links to works will be inserted! ——>

You should know it!:

- For those who only read 1k

Natural History - Password theft 11k

Science - Comrades V. Aphorisms of officers of the Soviet army 24k

Rating:

6.00*3

Humor - Fido Pearls of the Fido network 17k

Rating:

6.00*3

Humor Pearls from the Fido network, for relevant fans (I don’t know where it was stolen from, I had it lying around on my computer, I’m posting it so it doesn’t get lost). - narod Scientific-Student jokes 6k

Humor - about 2k

- Inserting links into annotations 4k

Natural Science Comments: 6 (11/30/2014) How to correctly insert links into annotations so that they later work (features of the local engine) link to samizdat (for example) - Inserting pictures in annotations8k

Comments: 9 (10/18/2016)How to insert a picture into your annotation, and how to make it not stick out on top of the text, but to the left of it. - Inserting pictures into texts and on your S&I page37k

Grade:

3.71*13

Comments: 14 (12/15/2015)Here I will briefly tell you how to insert pictures into your texts, into annotations, and how to prepare a file in Microsoft Word format with a large number of pictures so that these pictures are displayed in SI (samizdat). Illustrations/applications: 10 pcs.

- Explanatory dictionary of the Russian language.

Humor:

Here are some bearded humorous collections and collections, which can also be found on the FIDO network and on other Internet forums.

Reference information for beginner Internet users and computer scientists

In connection with the introduction of information technology into our daily lives.

The author of the articles is not a specialist, but an ordinary user, I am sharing what I know... SI technical issues:

See also:

About registration of the exchange fund for settlements via cash register

A bag with cash is issued to the organization according to the inscriptions on the label for the bag with cash, with the integrity of the bag and seal checked.

5.6. Carrying out transactions in which the client, without depositing cash, presents both an outgoing cash document and an incoming cash document is not allowed.

5.7. The client, without leaving the cash register, in the presence of the cashier who issued the cash, accepts Bank of Russia banknotes in full and incomplete bundles of banknotes according to the inscriptions on the top overlays of the bundles of banknotes, checking the number of spines, the correctness and integrity of the packaging of bundles of banknotes and seals, cliche imprints, availability necessary details on the top overlays of bundles of banknotes, seals, cliche imprints, individual spines, Bank of Russia banknotes - by sheet counting. Bags of coins are accepted according to the inscriptions on the labels of the bags of coins, with verification of the correctness and integrity of the bags of coins and seals, the presence of the necessary details on the seals and labels of the bags of coins, and individual Bank of Russia coins are counted individually. If there is a discrepancy between the amount of cash accepted by the client and the cash expense document, the cash employee draws up a recalculation report in one copy.

The credit organization, VSP are not liable to the client for his claims if the client did not count individually, individually, banknotes and coins of the Bank of Russia under the supervision of the cashier who issued the cash.

The organization accepts bags with pre-prepared cash according to the inscriptions on the labels on the bags with cash, checking the integrity of the bags and seals, and the presence of the necessary details on the seals and labels on the bags with cash.

The client can, in individual booths located at the cash desks where cash is received and issued, or in the room for counting cash by clients, count sheet by piece, piece by piece the cash received, packed in bundles of banknotes, bags with coins, bags with cash. The client delivers cash to the specified premises and counts it in the presence of a supervisory employee. During a sheet-by-sheet, piece-by-piece recalculation of cash by the client, the upper and lower linings from bundles of banknotes, parcels from the stubs, strapping with a seal (plastic packaging) from bundles of banknotes, labels from bags of coins, bags of cash, seal (binding with a seal from bags of coin, bags with cash) are stored until the entire stack of banknotes, bag with coin or bag with cash is counted. For the excess or shortage of cash identified as a result of the client's recounting of bundles of banknotes, bags of coins, the controlling employee draws up in one copy an act on the identification of excess, shortage, dubious banknote 0402145 (hereinafter referred to as act 0402145) (Appendix 14 to this Regulation), from bags with cash - a recalculation act in one copy.

(as amended by the Bank of Russia dated July 30, 2014 N 3353-U)

(see text in previous)

The excess amount of cash is withdrawn from the client, the missing amount of cash is given to the client. Act 0402145, the recalculation act is transferred by the cashier, the controlling employee to the cash register manager.

5.8. The exchange of cash is carried out by the cashier on the basis of an application for the exchange of cash drawn up by the client or the cashier in a free form in one copy. The application for cash exchange shall indicate the name of the organization or surname, initials of the individual, the date of the application, the amount of cash in figures and words, the number and denomination of banknotes, coins of the Bank of Russia to be exchanged, and the client’s signature.

(as amended by the Bank of Russia Directives dated May 13, 2011, and February 16, 2015)

(see text in previous)

When carrying out a cash exchange operation at a credit institution, the VSP cashier, having received cash from the client and checking its solvency, prepares and counts cash in a manner similar to that provided for in paragraph 5.4 of these Regulations, signs an application for cash exchange and issues cash money to the client.

(as amended by the Bank of Russia dated July 30, 2014 N 3353-U)

(see text in previous)

5.9. The amount of cash required to pay wages and other payments to employees of a credit institution, VSP, is determined by the cash manager according to payroll (settlement) statements. The issuance of cash to the cashier is carried out by the cash register manager with the cashier signing in book 0402124, if the payment of wages and other payments to employees of the credit institution, VSP is carried out during the working day, or according to the cash receipt order 0402009, if these payments will be made in period up to three working days inclusive.

Payment of wages and other payments to employees of a credit institution, VSP is carried out according to payroll (settlement and payment) statements or according to cash receipts orders 0402009.

5.10. To carry out cash transactions in the post-operation period, on weekends, and non-working holidays, cash is issued by the cashier to the cashier using cash receipt order 0402009.

(as amended by the Bank of Russia dated July 30, 2014 N 3353-U)

(see text in previous)

links to works will be inserted! ——>

You should know it!:

- For those who only read 1k

Natural History - Password theft 11k

Science - Comrades V. Aphorisms of officers of the Soviet army 24k

Rating:

6.00*3

Humor - Fido Pearls of the Fido network 17k

Rating:

6.00*3

Humor Pearls from the Fido network, for relevant fans (I don’t know where it was stolen from, I had it lying around on my computer, I’m posting it so it doesn’t get lost). - narod Scientific-Student jokes 6k

Humor - about 2k

- Inserting links into annotations 4k

Natural Science Comments: 6 (11/30/2014) How to correctly insert links into annotations so that they later work (features of the local engine) link to samizdat (for example) - Inserting pictures in annotations8k

Comments: 9 (10/18/2016)How to insert a picture into your annotation, and how to make it not stick out on top of the text, but to the left of it. - Inserting pictures into texts and on your S&I page37k

Grade:

3.71*13

Comments: 14 (12/15/2015)Here I will briefly tell you how to insert pictures into your texts, into annotations, and how to prepare a file in Microsoft Word format with a large number of pictures so that these pictures are displayed in SI (samizdat). Illustrations/applications: 10 pcs.

- Explanatory dictionary of the Russian language.

Humor:

Here are some bearded humorous collections and collections, which can also be found on the FIDO network and on other Internet forums.

Reference information for beginner Internet users and computer scientists

In connection with the introduction of information technology into our daily lives.

The author of the articles is not a specialist, but an ordinary user, I am sharing what I know... SI technical issues: