Application for registration of CCP form according to KND 1110061: sample filling

» » The use of cash register is possible only after registering it with the tax authority. To do this, you will need to fill out an application in the prescribed form, on the basis of which the cash register will be assigned a registration number. Depending on the method of submitting the application, the procedure and principle for filling it out differs. It can be completed electronically in the taxpayer’s account on the official website of the Federal Tax Service. You can find out more with step-by-step instructions on how to register a cash register with the tax office. If we talk about filling it out in paper form, then you should adhere to the formalized document approved by Order of the Federal Tax Service dated May 29, 2017 No. The application form has its own digital designation – 1110061. When filling out a paper form, the following features should be taken into account: Dear readers!

Our articles talk about typical ways to solve legal issues, but each case is unique. If you want to find out how to solve your particular problem, call Moscow and Moscow.

Change of director, founder - what form should I fill out?

Surprisingly, it seems that the tax service should know everything about the activities of the organization: it is even interested in the change of director. And for this event there is a special application form - P14001.

The application is filled out for both the predecessor and the successor: it is necessary to enter information on the title page, as well as in appendices “K” and “P”.

As a rule, the newly appointed manager acts as the applicant: his responsibilities will now include the process of interaction with the tax authority. Of course, it is possible to delegate this mission to the chief accountant, but in case of violations, both will suffer, so control over communication between the department and the organization is necessary.

How to draw up and submit an application to offset tax overpayments

January 17, 2020 at 1:37 pm Overpayment of taxes and fees can be returned to the current account of an organization or individual or offset against future payments.

In 2020, the Federal Tax Service approved new application forms for offset of overpayments. Let's figure out how to fill out the document correctly.

Related articles Table of contents If you find an error in the text, please let us know by highlighting it and pressing Ctrl+Enter The new application form for tax offset was approved by Letter of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / The regulatory act canceled the old Order dated 03.03 .2015 No. ММВ-7-8/, in which unified forms of outdated appeals were presented. The need for changes was determined by the reform in terms of insurance coverage, namely the transfer of administrative rights for insurance premiums to the Federal Tax Service. You can use the resulting overpayment in the following areas:

KND form 1150063 (download)

To receive property tax benefits, individuals submit a special application to the tax office.

This is the form for KND 1150063 and a sample application, and we will tell you how to fill it out. The application consists of four sheets and six sections.

But not everything needs to be filled out. KND forms 1150063 and completed samples can be found using the links below.

We recommend reading: Alimony for a child’s bank account

And we will tell you how to fill out the application correctly. download download download download download KND form 1150063 is filled out by individuals in order to receive benefits on three property taxes:

- For the property of individuals.

- Transport,

- Land,

In one form you can declare your right to a benefit for one, two or all three taxes.

Tax form 39-1: sample

Form 39 1 is issued to business entities in cases where they need to confirm the calculation of accrued and paid taxes. The negative one shows the debt to the state, the positive one shows the overpayment.

- What is it for?

- What does Form 39-1 contain?

- How to read?

Form 39-1 is attached to the package of documents when they are collected for the following purposes:

- take part in tenders;

- when applying for a license;

- when submitting documents for lending from a bank;

- documents for receiving grants and subsidies;

- when applying for a visa.

Please note that this is not a complete list of cases when it is necessary to provide Form 39-1. The document is issued by the Federal Tax Service and is an extract that clearly demonstrates the stages and dates of debt formation. You can obtain it at the local branch of the Federal Tax Service freely upon request.

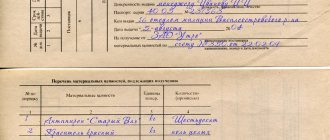

What does Form 39-1 contain?

The document form is a specially approved form. When filling out, follow the template. The complete list of information on the page has the following structure:

- in the upper right corner the name of the body authorized to issue this certificate is indicated;

- title and number of the document;

- date of generation of the information reflected in the certificate marked “as of _____”;

- subject's TIN;

- checkpoint;

- address.

The standard sample of Form 39-1 reflects the status of current accounts item by item. This is the following:

- type of budget fee/tax/contribution;

- KBK;

- OKATO code;

- the amount of overpaid taxes (including after deduction) or arrears, if any, is indicated in rubles;

- the next item indicates the amount of deferred taxes (including during the restructuring process). The exact amount and deferment date are entered in the field;

- overpayments or arrears of penalties. The amount is indicated in rubles;

- deferments and installment payments for penalties. Indicate the total amount and the date by which the penalty must be paid;

- tax debts or overpayments for sanctions and fines in rubles;

- debt or overpayment of funds allocated from the budget.

Form 39-1 (tax), as well as its sample filling, can be downloaded from the link below:

form form 39-1

Sample of filling out form 39-1 (tax)

How to read?

The first column contains information about the tax for which the reconciliation occurs. Their positive or negative value is reflected in cells 4, 6 and 8. If the totals show 0, then there are no overpayments or debts.

It should be borne in mind that if an overpayment is detected, this does not always reflect the real picture. An acceptable situation is when an accountant requests a certificate within a year before submitting the annual declaration.

Before filing the return, advances for each quarter are also shown as overpayments. After the tax office calculates the tax, this amount will disappear. Often the amount of the overpayment is the same as the amount of advances under the simplified tax system for the reporting year.

In order not to run to the tax office for a refund and not get into trouble, you should get an extract and compare the data.

The extract shows the picture for a specific date, and tax reporting is prepared for the period. This must be taken into account. It also consists of 6 blocks.

If the balance is negative, then the final figure will be negative; if it is positive, then this is the amount of overpayment. Penalties and fines are collected in one group, which contains the articles for their accrual.

The picture of mutual settlements with tax authorities is displayed under the “Paid” and “Accrued” items. Charges increase after submitting the declaration.

If a debt is detected that was formed by mistake, you should check the “Paid” item. If there are no previously made payments, then you should take payment documents and contact the tax office for reconciliation. If the error is proven, the document is corrected. If a mistake is made by the company, then you will have to pay off the debts.

Form 39 1 is issued to business entities in cases where they need to confirm the calculation of accrued and paid taxes. The negative one shows the debt to the state, the positive one shows the overpayment.

- What is it for?

- What does Form 39-1 contain?

- How to read?

Form 39-1 is attached to the package of documents when they are collected for the following purposes:

- take part in tenders;

- when applying for a license;

- when submitting documents for lending from a bank;

- documents for receiving grants and subsidies;

- when applying for a visa.

Please note that this is not a complete list of cases when it is necessary to provide Form 39-1. The document is issued by the Federal Tax Service and is an extract that clearly demonstrates the stages and dates of debt formation. You can obtain it at the local branch of the Federal Tax Service freely upon request.

How to fill out a tax return KND 1152017 for organizations and individual entrepreneurs using the simplified tax system

Zakharova Marina Valerievna Author PPT.RU January 31, 2020 A tax return for taxpayers using the simplified taxation system is a document that they are required to provide for each calendar year.

download The Tax Code does not establish deadlines for applying for tax benefits. The taxpayer can apply at any time.

Let's consider options for filling it out for various conditions of using the simplified tax system. ConsultantPlus TRY FOR FREE Form KND 1152017 (form 2020) must be submitted to the tax authority by organizations by March 31 of the year following the reporting year (in 2020 - by 04/01/2019), individual entrepreneurs - by April 30. Is there a new KND form 1152017 for 2020?

No, this form applies from 2020 and consists of a title page and six sections: 1.1, 1.2, 2.1.1, 2.1.2, 2.2 and 3.

The general rules for filling out are as follows: cost indicators are filled in in full rubles, taking into account that a value of less than 50 kopecks is not taken into account, and more than 50 kopecks is rounded to the nearest ruble;

Form KND 1112020 (recommended) “Notification of a reduction in the amount of tax paid in connection with the use of the patent tax system by the amount of expenses for the purchase of cash register equipment”

Currency: Rub. Russian language

- Banking documents Accounting documents State supervision Medical documents Migration documents Taxes and fees Industry documents Postal forms Registration Statistical reporting Customs documents Transport documents Outdated forms Home/ All_forms/ Outdated forms/ Taxes and fees/ By type of taxes, contributions and fees/ Patent taxation system

Has the deadline for submitting the TS-1 form and paying the TC in Moscow been extended?

In connection with measures taken to combat coronavirus, the Moscow Government issued Resolution No. 212-PP dated March 24, 2020. In accordance with it, the deadline for paying the trade fee for the 1st quarter of 2020 has been extended until 12/31/2020 inclusive. It is expected that payment deadlines for vehicle payments will be extended for the 2nd quarter of 2020.

The general procedure for registering a vehicle as a payer has not been changed. Thus, forms TS-1 and TS-2 should be submitted in the order described in the article.

Please note that deregistration as a vehicle payer in April-May 2020 does not make practical sense. Since TC is paid even if an organization or individual entrepreneur worked as a TC payer for at least 1 day in a quarter (Article 412, Article 414 of the Tax Code of the Russian Federation).

KND 1112020: fillings

We will introduce you to the KND form 1112020. With its help, individual entrepreneurs with a patent will be able to reduce the tax on the costs of installing a cash register.

However, the reduction amounts are limited. All the details, as well as the bank and sample filling, are waiting for you in the article. The law on mandatory maintenance of online cash registers also affected entrepreneurs with a patent.

For some of them, installing a CCP is quite expensive.

Therefore, the legislation met halfway and provided them with the opportunity to cover these expenses through the mandatory tax they pay under the PSN. Naturally, the Federal Tax Service should be informed about this economic transaction. To do this, fill out KND form 1112020. But before doing this, take into account all the limits and rules that you will read about later.

In 2020, businessmen with a patent have the right to deduct from tax the amount they spent on installing and purchasing a cash register.

We recommend reading: Which side should you park on at 7 pm on the 6th?

Form according to KND 1110055 (form and sample filling)

→ → Current as of: February 21, 2020

Foreign citizens temporarily staying in the Russian Federation and not required to obtain a visa can work in the Russian Federation when they reach the age of 18 on the basis of a patent ().

They must pay fixed advance payments for personal income tax for the period of validity of the patent (,). Organizations and individual entrepreneurs that employ such migrants act in relation to them as tax agents for personal income tax.

That is, they must calculate, withhold and transfer personal income tax on income paid to these foreign citizens. In this case, the amount of tax should be reduced by the amount of advance payments for personal income tax paid by the migrant himself in the corresponding tax period (, ), which is certainly beneficial for the latter. To do this, a foreign citizen must write a statement in any form stating that he asks to reduce the tax withheld from his income by the amount of advance payments.

Form for KND 1151111 (form for calculating insurance premiums)

Source/official document: Order of the Federal Tax Service No. 44141 of October 10, 2020 Where to submit: Federal Tax Service Penalty for late submission: for late submission a fine of five percent of the amount of contributions that must be paid or additionally paid on the basis of calculation Document name: Calculation for insurance contributions (form for KND 1151111) Format: .xls Size: 552 kb Download Print Preview Bookmark Save: Submit the form for KND 1151111 correctly and online Calculation form for insurance premiums for KND 1151111 is a report that is required to be submitted to the tax office inspection.

The report was approved in the Order of the Russian Tax Service under number 44141 dated October 10, 2020.

The order discusses in detail how to correctly fill out the form; tables are attached along with codes to enter them into the calculation fields.

You can download the free form for KND 1151111 below. The order came into force throughout the country on January 1, 2020.

Form and example of filling out the form according to KND 1150063

Citizens who are eligible to receive benefits due to property taxes need to fill out an application. It is mandatory to complete this form if you are receiving a disability degree that entitles you to preferential treatment, or if you have two or more taxable items.

Benefits are provided for one object. If the individual entrepreneur owns a truck, then in order to pay for Platon you will need to fill out this document. There is a certain procedure for filling out an application providing preferential conditions for transport, land taxes, as well as for the tax on property for individuals.

The Tax Code of the Russian Federation describes the procedure for filling out a form to receive a property tax benefit.

It's safer to look at an example.