Trade organizations regularly face the need to write off goods that have become unusable. First of all, these are shops and retail outlets selling perishable goods and products. However, write-off of unusable goods periodically has to be done in other areas of trade. It always starts with the inventory process. The documents drawn up based on its results are the basis for the formation of transactions and the inclusion in costs of the amounts of overdue goods in accounting and tax accounting.

Legislative regulation and write-off features

During the inventory, goods that are subject to spoilage and expired are identified, as well as those on which an expiration date should be indicated, but in fact it is not. All these goods are classified as unusable and withdrawn from trade.

Write-off of goods that have become unusable is carried out on the basis of:

- Civil Code of the Russian Federation, art. 469, 470, 472;

- Federal Law-2300-1 dated 07/02/92

According to the norms of the Civil Code, the seller is obliged to offer the buyer only high-quality, usable goods. The sale of goods with an expired expiration date is prohibited, and this period must be set in such a way that the consumer can use the product before its expiration.

The Federal Law “On the Protection of Consumer Rights” requires the transfer to the buyer of goods that meet the mandatory requirements for it (Article 4), and also names goods on which the manufacturer must indicate an expiration date: medicines, household chemicals, cosmetics, perfumes, products (Article . 5).

Goods that are expired or do not have an expiration date indicated on the packaging are returned by the trading establishment to the supplier, destroyed or disposed of.

Federal Law No. 446 dated November 28, 2018 introduced a ban on the return of perishable goods of good quality (with a shelf life of less than a month). Requests for refunds or replacements for items subject to perishable deterioration have also been prohibited since the end of last year.

If the unusable product is not returned to the supplier, it is destroyed or disposed of. Without the participation of third parties, this can be done in relation to spoiled products or goods whose exact origin is unknown. In other cases, an expert assessment from a supervisory government agency (veterinary, merchandising, etc., depending on the type of product) is required.

Write-off of expired goods

General provisions

Best before date

– the period after which the product (result of work) is considered unsuitable for its intended use.

According to Art. 13 of the Law of 09.01.2001 No. 90-Z “On the protection of consumer rights” for food products, perfumery and cosmetic products, medicines and other similar goods (results of work), the consumer properties of which may deteriorate over time, the manufacturer (performer) is obliged to establish expiration date and (or) shelf life.

The seller (manufacturer, performer) is obliged to transfer goods (results of work) for which an expiration date and (or) shelf life have been established to the consumer in such a way that they can be used for their intended purpose before the expiration date and (or) shelf life.

Sale of goods (result of work) after the expiration of the established shelf life and (or) shelf life, service life, as well as goods (result of work) for which a service life, shelf life and (or) shelf life should be established, but they are not established , is prohibited. The sale of certain non-food products whose service life and (or) shelf life has expired (except for medicines) may be permitted in the manner established by the Government of the Republic of Belarus, based on the results of an appropriate examination of these goods. A permit for the further sale of goods whose service life and (or) shelf life has expired must contain an indication of the period during which the goods can be used.

To write off expired goods, it is necessary to draw up a report on damage to goods, which is approved by the manager. According to clause 64 of the Sanitary Norms and Rules “Requirements for Food Raw Materials and Food Products”, approved by Resolution of the Ministry of Health dated June 21, 2013 No. 52, food products that do not meet the safety requirements established by these Sanitary Norms and Rules, hygienic standards establishing safety requirements and the safety of food products, can be disposed of, used for animal feed or destroyed in the manner prescribed by law.

Accounting

Account 94 “Shortages and losses from damage to property” is intended to summarize information on the movement of amounts for shortages and losses from damage to materials, goods, other stocks, fixed assets and other property identified in the process of its procurement, storage and sale, except for losses of property in as a result of natural disasters.

The actual cost (in organizations engaged in trade, trade and production activities - the cost at retail prices when maintaining accounting records of goods at these prices) of missing or completely damaged materials, goods, and other inventories is reflected in the debit of the account. 94 “Shortages and losses from damage to property” and credit account. 10 “Materials”, 41 “Goods” and other accounts for the relevant inventories.

When identifying the guilty persons, the amounts of shortages and losses from damage to property in excess of the norms of natural loss are reflected in the debit of the account. 73 “Settlements with personnel for other operations” (subaccount 73-2 “Settlements for compensation of damage”) and credit account. 94 “Shortages and losses from damage to property.”

In the absence of the guilty persons, as well as when a court ruling is made to refuse to satisfy demands for the recovery of monetary amounts from the guilty persons, the amounts of shortages and losses from damage to property in excess of the norms of natural loss are reflected in the debit of the account. 90 “Income and expenses from current activities”, 91 “Other income and expenses” and credit account. 94 “Shortages and losses from damage to property”, 73 “Settlements with personnel for other operations” (subaccount 73-2 “Settlements for compensation of damage”).

The difference between the amount to be recovered from the guilty parties and the value of the missing property recorded on the account. 94 “Shortages and losses from damage to property”, reflected in the debit of the account. 73 “Settlements with personnel for other operations” (subaccount 73-2 “Settlements for compensation of damage”) and credit account. 90 “Income and expenses from current activities”, 91 “Other income and expenses”.

Taxation

Disposal of goods as a result of their damage is not subject to VAT. At the same time, according to sub. 19.15 clause 19 art. 107 of the Tax Code are not subject to deduction of VAT on goods in the event of their damage or loss (with the exception of damage or loss of goods due to emergency circumstances: fire, accident, natural disaster, traffic accident).

Under damage to goods

refers to the deterioration of all or individual qualities (properties) of a product, as a result of which this product cannot be used for sales purposes and (or) in the production of products (performance of work, provision of services).

Loss of

goods

refers to an event that results in the destruction or loss of goods. Loss of goods incurred by the payer within the limits established by law is not considered a loss.

Tax deductions of the payer are subject to reduction by the amounts of VAT previously accepted by him for deduction on the goods specified in part one of subparagraph. 19.15 clause 19 art. 107 NK. If it is impossible to determine the amount of VAT previously accepted for deduction or to establish the fact of the transactions specified in part four of subparagraph. 19.15 clause 19 art. 107 of the Tax Code, the payer’s tax deductions are subject to reduction by tax deductions equal to 20% of the cost specified in part one of subparagraph. 19.15 clause 19 art. 107 NK goods. Tax deductions are reduced in the reporting period in which the damage or loss of such goods occurred. The date of damage or loss of goods is defined as the date of drawing up a document confirming damage or loss of goods.

The payer's tax deductions are not subject to reduction in the following cases:

- attribution of VAT amounts presented upon acquisition or paid upon import specified in part one of subparagraph. 19.15 clause 19 art. 107 Tax Code of goods, to increase their value or at the expense of the sources specified in subparagraph. 19.3 clause 19 art. 107 NK;

- inclusion of VAT amounts as specified in part one of subparagraph. 19.15 clause 19 art. 107 Tax Code for goods into the payer’s costs for the production and sale of goods (work, services), property rights, taken into account for taxation;

— acquisition (creation) specified in part one of subparagraph. 19.15 clause 19 art. 107 of the Tax Code of goods, in which the VAT amounts were not presented to the payer by sellers of goods (works, services), property rights or were not paid by the payer when importing goods.

Let us note that the Tax Code does not provide for the creation of an ESCF in cases of restoration of deductions for shortages and damage to goods.

Taxation does not take into account amounts of shortages, losses and (or) damage to property that occurred in excess of the norms of natural loss approved in the manner established by law, if the court refused to collect these amounts for reasons depending on the organization (subclause 1.9, clause 1, article 131 NK).

According to sub. 3.7 clause 3 art. 128 of the Tax Code, non-operating income includes income from compensation for damage in kind, losses (including lost profits), with the exception of income specified in subparagraph. 3.6 clause 3 art. 128 NK. Such income is reflected on the date of its receipt, regardless of the method of compensation for damage in kind, losses (including payment of debt to third parties, offset of counterclaims and other methods).

Amounts of shortages, losses and (or) damage to property, as well as losses incurred, compensation for which is included in non-operating income in accordance with subparagraph. 3.6 and sub. 3.7 clause 3 art. 128 of the Tax Code, within the amount of such compensation are included in non-operating expenses. Such expenses are reflected on the date of receipt of compensation for the specified expenses (losses), but not earlier than their actual implementation (subclause 3.26-17, clause 3, article 129 of the Tax Code).

Example 1

In the warehouse of an organization engaged in the wholesale trade of food products, expired goods worth 75 rubles were identified. The warehouse manager was found guilty. The VAT rate on goods is 10%. The cost of goods, as well as the amount of the restored VAT deduction, is withheld from the wages of the guilty person.

In accounting, these transactions are reflected as follows.

| Contents of a business transaction | Debit | Credit | Amount, rub. |

| The cost of goods with expired expiration dates is reflected | 94 | 41 | 75 |

| The shortage of goods is attributed to the guilty party | 73-2 | 94 | 75 |

| Restored "red reversal" method VAT deduction attributable to shortage of goods (75 × 10 / 100) | 68-2 | 18 | 7,50 |

| The amount of the restored VAT deduction was attributed to the guilty person | 73-2 | 18 | 7,50 |

| The amount of damage was withheld from the wages of the guilty person (75 + 7.50) | 70 | 73-2 | 82,50 |

Example 2

Expired products worth 120 rubles were found at the catering organization's warehouse.

Products are accounted for at sales prices. The estimated VAT rate is 17.8504%, the average percentage of trade markups (margins) is 53.4217%. The amount of VAT on products previously accepted for deduction cannot be determined. The perpetrators have not been identified.

In accounting, these transactions are reflected as follows.

| Contents of a business transaction | Debit | Credit | Amount, rub. |

| There is a shortage of products at sales prices | 94 | 41 | 120 |

| “red reversal” method reflects the amount of VAT included in the sales price of products (120 × 17.8504 / 100) | 94 | 42 | 21,42 |

| Using the “red reversal” method reflects the trade markup (margin) included in the selling price of the products (120 × 53,4217 / 100) | 94 | 42 | 64,11 |

| The cost of products was included in other expenses for current activities (120 – 21.42 – 64.11) | 90-10 | 94 | 34,47 |

| Using the “red reversal” method the VAT deduction attributable to the shortage of goods has been restored (34.47 × 20 / 100) | 68-2 | 18 | 6,89 |

| The amount of the restored VAT deduction was allocated to other expenses for current activities | 90-10 | 18 | 6,89 |

Example 3

In a retail trade organization, expired goods worth 185 rubles were identified.

Goods are accounted for at retail prices and were purchased from an organization that applies the simplified tax system without paying VAT. VAT rate – 20%, trade markup – 24%. The perpetrators have not been identified.

The goods were donated to an agricultural organization for use as animal feed. In accounting, these transactions are reflected as follows.

| Contents of a business transaction | Debit | Credit | Amount, rub. |

| The cost of goods with expired expiration dates is reflected | 94 | 41 | 185 |

| “red reversal” method reflects the amount of VAT included in the retail price of missing goods (185 × 20 / 120) | 94 | 42 | 30,83 |

| “red reversal” method reflects the trade markup included in the retail price of missing goods ((185 – 30.83) × 24 / 124) | 94 | 42 | 29,84 |

| The cost of goods transferred free of charge has been written off (185 – 30,83 – 29,84) | 90-10 | 94 | 124,33 |

Sale or offer for sale of expired goods, storage or sale entails a fine on an individual entrepreneur or legal entity in the amount of 30 to 500 basic units

(Clause 2 of Article 12.17 of the Code of Administrative Offenses).

Sergey KOZYREV,

Candidate of Economic Sciences

Write-off procedure

Inventory is carried out according to rules No. 49 of 06/13/95. Damaged goods are not included in the inventory, but are entered in the write-off act according to f. TORG-16 (15) or using an independently developed form reflected in the LNA. When using unified forms, it is recommended to fill out both acts. TORG-15 documents the fact of damage, the TORG-16 act records the withdrawal from trade circulation and further actions in relation to the goods: recycling, destruction.

On a note! When disposed of, the product can still be processed and used; if destroyed, further processing is not possible.

The destruction of goods, in addition to the act signed by the commission and the conclusion, is formalized by a separate order. If damage or impossibility of further use of the goods is detected, explanations are taken from financially responsible persons. These actions allow us to identify the reason why the product has become unusable, for example:

- expiration date missed;

- damage due to the negligence of responsible persons;

- force majeure situation.

Depending on it, transactions are reflected in tax and accounting.

“Overdue” goods and the costs of their disposal can be taken into account without any problems in the NU, when reducing the tax base. This is stated in letters of the Ministry of Finance No. 03-03-06/1/53901 dated 08/23/17, No. 03-03-06/1/30409 dated 05/26/16 and a number of others. Likewise - spoilage within the limits of loss norms. The unsuitability of the goods, as a result of the negligence of the guilty persons, is compensated by these guilty persons in accordance with Chapter. 39 Labor Code of the Russian Federation. Losses of goods are first reflected in non-operating expenses (Tax Code of the Russian Federation, Art. 265), and then as non-operating income (Tax Code of the Russian Federation, Art. 250).

The situation of damage during a natural disaster makes it possible to include the cost of damaged goods in expenses (Article 265-2-6), as well as the fact of failure to identify those responsible for the damage to goods (ibid., paragraph 5). This fact must be confirmed by a certificate of termination of the criminal case (letter 16 -15/065190 dated June 25, 2009, Federal Tax Service in Moscow).

When writing off unusable goods, account 94 is used, reflecting shortages and losses of inventory items.

Tax accounting: calculation of income tax

To calculate income tax, the procedure for writing off goods depends, again, on the situation in which the product was damaged. If the goods have expired, then their price is fully taken into account in other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated December 24, 2014 No. 03-03-06/1/66948, dated December 20 2012 No. 03-03-06/1/711). If the goods are damaged due to the fault of the employee, then their cost is included in non-operating expenses (subclause 8, clause 7, Article 272 of the Tax Code of the Russian Federation): or on the date when the employee acknowledged the amount of damage (for example, on the date of concluding an agreement on voluntary compensation for damage), or on the date when the court decision to recover the amount of damage from the employee came into force. At the same time, the income must take into account the amount of damage found guilty or awarded by the court (subparagraph 4, paragraph 4, article 271 of the Tax Code of the Russian Federation).

If goods are damaged due to an emergency, then their cost is included in non-operating expenses on the date of drawing up a document from the competent authority confirming that the damage was caused by an emergency (natural disaster, fire, accident). For example, in the event of a fire, such papers will be a certificate from the Ministry of Emergency Situations, a report on the fire and a protocol for examining the scene of the incident (Letters of the Ministry of Finance dated December 29, 2020 No. 03-03-06/1/77005, Federal Tax Service for Moscow dated June 25, 2009. No. 16-15/065190). If the goods were damaged due to natural reasons, then their cost is taken into account in material costs within the limits of natural loss rates (Letters of the Ministry of Finance dated July 6, 2020 No. 03-03-06/1/38849, dated May 23, 2014 No. 03 -03-РЗ/24762).

VAT previously accepted for deduction on damaged property does not need to be restored, since such a basis for restoring the tax is absent in paragraph 3 of Article 170 of the Tax Code of the Russian Federation. A similar opinion is expressed by regulatory authorities. In their explanations, they refer to court decisions that have always supported taxpayers who did not restore VAT (Letters of the Federal Tax Service dated June 17, 2020 No. GD-4-3 / [email protected] , dated May 21, 2020 No. GD-4-3 / [email protected] ).

Read also “VAT Restoration”

EXAMPLE.

DISPOSAL OF DAMAGED GOODS IN THE ABSENCE OF GUILTY PERSONS The store transfers a unit of goods to the sales area for display display.

The product was purchased at a price of RUB 3,540. (including VAT 540 rub.). After some time, the goods are considered completely damaged and written off. There are no employees at fault. In the company's accounting, transactions should be reflected as follows. When purchasing goods: Debit 41 Credit 60

- 3000 rub.

– goods have been received (3540 – 540) (supplier’s shipping documents, goods acceptance certificate); Debit 19 Credit 60

- 540 rub.

– reflects the amount of VAT presented (invoice); Debit 68/VAT Credit 19

- 540 rub.

– the submitted VAT (invoice) has been accepted for deduction; Debit 60 Credit 51

- 3540 rub.

– payment has been made to the supplier (bank account statement). If damaged goods are identified: Debit 94 Credit 41

- 3000 rub.

– the cost of damaged goods is written off (act of damage, damage, scrap goods and materials); Debit 44 Credit 94

- 3000 rub. – the amount of determined losses is included in the cost of sales (accounting statement).

Postings

Standard transactions for damage to goods will be as follows:

- 94/41 – damaged goods written off;

- 41/42 reversal – the trade margin is reversed;

- 96, 44/94 – allocation of costs due to the created reserve for product losses or to increase sales costs (within the limits of loss norms);

- 91-2, 73/94 - attribution of costs to the perpetrators or to other expenses if the culprit is not identified;

- 73/98 – if there is a difference between the price recorded for the goods and the amount collected from the culprit;

- 98/91-1 – attribution of this difference to other income.

If the volume of damaged goods exceeds natural loss, VAT is restored: 94/68.

Unusable goods with expired expiration dates are reflected in the following entries:

- 91, 90/41 – if the product is disposed of;

- 94/41 – if the goods are destroyed.

Costs for writing off damaged goods under the simplified tax system

Organizations selling food products, be it catering or retail enterprises, quite often face the fact of food spoilage. The legislation of the Russian Federation prohibits the sale of spoiled food products, which means they must be disposed of.

In the practical activities of trade organizations, questions often arise related to the procedure for accounting for the costs of writing off damaged goods. Indeed, inventories may lose their consumer qualities in whole or in part during storage; in addition, the goods may become unusable due to damage or breakage. Quite often, organizations that sell food products are faced with the fact of product spoilage, because these products have a certain, often short, shelf life, and also require special storage conditions, which are not always possible to comply with.

It is also known that, in accordance with the norms of accounting legislation, every fact of the economic life of any organization is subject to registration as a primary accounting document.

In addition, Federal Law No. 402-FZ dated December 6, 2011 (as amended on May 23, 2016) “On Accounting” allows all commercial organizations to use both standard forms of primary documents and independently developed ones to document the facts of economic activity. It is important that the forms of the primary documents used contain all the necessary and mandatory details named in clause 2 of Art. 9 of Law No. 402-FZ.

Let us note that the accounting department is engaged in developing forms of primary documents and submits them to the head of the organization for approval.

However, developing your own “primary” forms is quite labor-intensive, so organizations often use unified forms of primary accounting documents. Thus, for the accounting of trade operations, unified forms of primary accounting documentation are applicable, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. For documentary confirmation of commodity losses, the above-mentioned resolution provides for the following forms of primary documents:

- form No. TORG-15 is used in the case of drawing up a report on damage, damage, scrap of inventory items if there is the possibility of their further sale, for example, at a reduced price;

- Form No. TORG-16 is used when drawing up an act on the write-off of goods in the event that the goods are subject only to recycling or destruction.

GOOD TO KNOW

The reason for preparing reports of forms TORG-15 and TORG-16 is the corresponding defective statement.

As a rule, a special commission authorized by the head of the organization is involved in drawing up acts for writing off damaged goods in a trade organization. The commission usually includes a representative of the company administration and a financially responsible person, and if necessary, a representative of the sanitary supervision is also included in the commission.

Acts are drawn up in triplicate. The acts signed by the members of the commission are approved by the head of the trade organization, and he also decides at the expense of which source the damaged goods will be written off. We also note that the indicated acts must indicate all information about the product and the reason for its write-off.

One copy of the act is transferred to the accounting department of the organization, since it is the basis for writing off commodity losses from the financially responsible person, the second is transferred to the division of the organization where commodity losses were identified, and the third is transferred to the financially responsible person. If a product is subject to liquidation, then in order to avoid its repeated write-off, this product is destroyed in the presence of members of the commission.

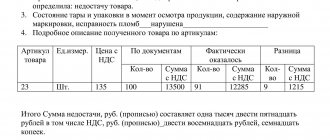

To the above, we only add that the procedure for writing off goods does not end with the preparation of the TORG-15 and TORG-16 acts corresponding in each individual case. The organization writing off damaged goods must also conduct an inventory of them. The results of the inventory of goods are separately reflected for each name and article in the matching sheet. This must be done in order to identify deviations in the actual availability of goods from the data shown in accounting.

ORIGINAL SOURCE

When conducting an inventory and recording its results, organizations need to be guided by the Methodological Guidelines for Inventorying Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49.

— Clause 1 of Art. 30 of Law No. 402-FZ.

Reflection of damaged goods in the organization’s accounting records

The procedure for reflecting damaged goods subject to liquidation directly depends on the reasons as a result of which it was damaged. Let us say right away that in any case, such a product must be reflected in the accounting records as a debit to account 94 “Shortages and losses from damage to valuables” in accordance with the Instructions for the use of the Chart of Accounts.

So, if the commission found that when storing goods in an organization, the storage conditions were violated, then the damage to the goods should be attributed to the person at fault. In such a situation, the amount of the shortfall in the part reimbursed by the employee is written off to account 73 “Calculations for compensation for material damage.” Documentary evidence of the situation that has arisen can be a comparison sheet, an explanatory note from an employee, and other documents.

If a product turns out to be unsuitable for sale as a result of its expiration date, then its cost can be written off as expenses, in the debit of account 91 “Other expenses”. And if the goods turned out to be damaged due to an unforeseen situation (fire, flood, accident, etc.), then the goods can be written off through non-operating expenses based on paragraphs. 6 paragraph 2 art. 265 Tax Code of the Russian Federation. At the same time, the recognition of these expenses as non-operating, reducing the received income of the “simplified” person, must be documented by such additional documents as, for example, a certificate from the State Fire Service of the Ministry of Emergency Situations, a protocol for examining the scene of the incident and a report on the fire that occurred. These documents also establish the cause of the fire and the absence of those responsible.

POSITION OF THE MINISTRY OF FINANCE

In the Tax Code of the Russian Federation, costs in the form of the cost of damaged goods are not indicated, and, therefore, the costs of its acquisition are not included in the single tax base.

— Letter dated May 12, 2014 No. 03-11-06/2/22114.

Example

Goods worth 6,000 rubles were transferred to the sales floor as a visual sample, incl. VAT 20%. A month later, the commission declared the goods damaged and decided to write them off. The act reflects the cost excluding VAT. No persons responsible for the damage have been identified; the goods deteriorated due to natural causes.

Postings:

- Dt 94 Kt 41 - 5000 rub.;

- Dt 44 Kt 94 - 5000 rub.

Let's use the conditions of the previous example, but determine that the goods were stored in a warehouse, and as a result of the negligence of the guilty party, they became unfit for use. The guilty person, who entered into a liability agreement with the organization, confirmed in an explanatory note his agreement to compensate for the damage in full.

Postings:

- Dt 94 Kt 41 - 5000 rub.;

- Dt 73 Kt 94 - 5000 rub.;

- Dt 50 Kt 73 - 5000 rub.

Here, the cost of the goods is attributed to the guilty parties, and then the debt is repaid by depositing cash into the cash register.

What are the rules for writing off spoiled food?

Spoiled food products may appear in retail establishments, public catering establishments, or storage warehouses for a number of reasons:

- storage and sales conditions were violated,

- transportation conditions were violated or products were loaded of inadequate quality,

- the sell-by date (expiration date) has expired,

If products located in a warehouse or on the sales floor have deteriorated as a result of improper storage before the expiration date, then such damage requires confirmation through an inventory. As you know, inventory can be planned in accordance with accounting policies, or unplanned as a result of the occurrence of reasons affecting the quantitative indicators of inventory items.

The procedure for conducting an inventory is described in the Guidelines for the inventory of property and financial obligations, which are approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49. During the inventory process, the actual availability of property is checked by mandatory recalculation, reweighing or re-measuring inventory items. The data obtained is entered into the inventory list (form No. INV-3). Next, based on the accounting data and inventory list, a matching statement is compiled (form No. INV-19), which reflects the discrepancies between the indicators according to the accounting data and the inventory list data. At the same time, a report on spoilage (form No. TORG-15) and an act on write-off of goods (form No. TORG-16) are drawn up for the cost of spoiled food products/goods. The same applies if products have expired.

If food products have spoiled during transportation, then in this case, in accordance with the order of the manager, a commission is also created, which draws up a report of spoilage f. No. TORG-2 (for imported goods form No. TORG-3). The act indicates information about the supplier, the dates of dispatch and receipt of the cargo, the date of sending a fax or other document about damage to the products to the supplier, discrepancies in quantity and quality compared to the accompanying documents, a description of the condition of the product, and the signatures of the commission members. This act will be the basis for filing claims against the supplier or transport company, depending on the cause of the damage.

A situation is possible when a product has partially lost its original quality, but which can still be sold. For example, in boxes of cherries, about 20% of the berries show signs of spoilage. In this situation, it is also necessary to draw up an act either according to f. No. TORG-15 or in the form developed by the organization. This document will confirm that the organization has revalued the product taking into account the loss of quality and is selling the product discounted due to damage. Such revaluation is carried out by order/order of the head of the organization.

Example 1 . Maska LLC, located on the simplified tax system with the “income minus expenses” tax system, July 7, 2013. For retail sale, I purchased 200 kg of strawberries; the actual cost per unit was 45 rubles. for 1 kg. The selling price of 1 kg is 65 rubles. As a result of improper storage in the heat, the marketability of the berries decreased: spoiled berries appeared, and therefore their market price fell. Organization July 17, 2013 I marked them down for the entire amount of the trade margin (200 kg x 20 rubles = 4000 rubles). The perpetrators have not been identified. All products after the price reduction were sold at retail until July 20, 2013.

Based on the markdown, an act of revaluation of goods was drawn up in form No. TORG-15.

In accounting, on the basis of receipt documents and the act of revaluation of goods, the following entries were made:

July 7, 2013:

— the actual cost of strawberries is reflected:

Debit of account 41 “Goods” Credit of account 60 “Settlements with suppliers and contractors” - 9,000 rubles;

— the amount of the trade margin is reflected:

Debit account 41 Credit account 42 “Trade margin” - 4000 rubles;

July 17, 2013:

-the trade margin attributable to damaged goods was reversed:

Debit account 41 Credit account 42 4000 rub.;

July 20, 2013:

-revenue from retail sales of strawberries is recognized:

Debit of account 62 “Settlements with buyers and customers” Credit of account 90 “Sales”, subaccount 1 “Revenue” - 9000 rubles;

— the sales value of sold strawberries is written off:

Debit account 90, subaccount 2 “Cost of sales” Credit account 41 - 9000 rubles;

The organization did not receive any profit from this sale. the taxable base for the tax paid in connection with the application of the simplified taxation system for this sale for the organization would be 1% of turnover, i.e. 90 rub.

In accordance with paragraph 5 of Article 346.16 and paragraphs. 2 clause 7 of article 254 of the Tax Code of the Russian Federation for tax purposes, you can take into account only the amount of loss from spoilage during storage and transportation of food products within the limits of natural loss norms. These standards were approved by Decree of the Government of the Russian Federation of November 12, 2002 N 814. According to the above-mentioned Decree, they are developed in accordance with the technological conditions of storage and transportation of goods, climatic and seasonal factors affecting their natural loss. The standards are reviewed as necessary, but at least once every 5 years. The standards are developed by ministries in accordance with clause 2 of this resolution and approved in agreement with the Ministry of Economic Development of the Russian Federation.

The norms of natural loss of food products in the field of trade and public catering are approved by Order of the Ministry of Economic Development of Russia dated September 7, 2007 N 304, and the norms of natural loss applied during transportation by all types of transport (except pipelines) are approved jointly with the Ministry of Transport of the Russian Federation.

It must be borne in mind that the norms of natural loss of products/goods during storage differ from the norms of loss for the same goods/products, but during their transportation, and also depend on the type of transport by which they are transported. Therefore, for each case it is necessary to look for the appropriate regulatory document.

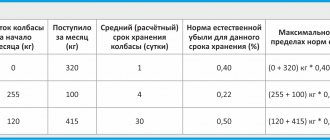

To determine the amount of product losses due to natural loss, you can use the following formula.

The amount of natural loss is determined as the quotient of the product of the mass of goods sold by the rate of natural loss divided by 100. To determine this value in value terms, the resulting quantity of the product is multiplied by the accounting value of its unit (kg, g, etc.).

Example 2. A batch of frozen strawberries in wooden boxes with a net weight of 500 kg arrived at the warehouse on July 9 and was sold in October in parts: November 14 - 200 kg, November 26 - 294.81 kg. The shelf life of strawberries was 4 full months and 5 days of the 5th month for the first part and 4 full months and 12 days of the 5th month for the second part of the batch.

With the loss rate for 4 months of storage being 0.98% and for 5 months being 1.18%, the natural loss within the norm is:

(0.98 + 5 x (1.18 - 0.98) / 30)) x 200 / 100 + (0.98 + 12 x (1.18 - 0.98) / 30) x (300 - 2, 03) / 100 = 3.16+2.03 = 5.19 kg.

Actual losses - 5.19 kg (500 - 200 - 294.81). The financially responsible person is charged with a shortage of frozen strawberries in the amount of 5.19 kg, i.e. in the amount of the actual shortage.

Example 3. Berezka LLC is engaged in retail trade in dairy products. The store with a sales area of 200 sq.m is located in Voronezh. On July 25, 2013, an inventory was carried out, as a result of which it was revealed that 20 kg of cottage cheese by weight were spoiled. The purchase price of the cottage cheese was 60 rubles. for 1 kg. Since the last inventory, 70 kg of cottage cheese have been sold. The store is not a supermarket or self-service store. The norms for the natural loss of dairy or fat products in retail chains are approved by Order of the Ministry of Economic Development of Russia dated September 7, 2007 N 304 (Appendix N 29). Voronezh is located in the second climatic zone, the store belongs to the second group, so the loss rate for these conditions is 0.47% of the sales volume.

Let's calculate the cost of cottage cheese losses resulting from natural loss:

60 rub. x 70kg x 0.47% = 19.74 rub.

The store's actual losses due to product damage are:

60 rub. x 20kg = 1200 rub.

Thus, a store can include 19.74 rubles in material costs, and 1180.26 rubles. will be attributed to other expenses that do not reduce the taxable base for the tax paid in connection with the application of the simplified tax system.

To calculate the cost of the value of natural loss during the transportation of goods, you can use the formula The cost of the value of natural loss during transportation is determined as the quotient of dividing by 100 the product of the total cost of the brought goods for which damage was detected by the rate of natural loss.

Example 4. Berezka LLC is engaged in retail trade. August 2, 2013 a batch of semi-smoked sausage was purchased and paid for with a total cost of 120,000 rubles. On the same day the goods were delivered, and it turned out that part of the shipment worth 20,000 rubles. turned out to be spoiled. This product was transported by refrigerated truck over a distance of 300 km.

The norms for the natural loss of meat and meat products during transportation by road are approved by Order of the Ministry of Agriculture of Russia and the Ministry of Transport of Russia dated November 21, 2006 N 425/138 (Appendix No. 2). For transportation of semi-smoked sausage under these conditions, the norm is 0.09% for transportation from 51 to 100 km plus 0.05% for each next 100 km.

The amount of expenses within the limits of natural loss norms will be equal to:

(120,000 rub. - 20,000 rub.) x (0.09 + 0.09 x (0.05 + 0.05) % = 99 rub.

Depending on whether the guilty person is identified or not, losses from spoilage are recorded in excess of the norms of natural loss.

If the culprit is not identified, then losses from damage as economically unjustified expenses are taken into account as expenses that do not reduce the taxable base for the tax paid under the simplified tax system (clause 49 of article 270 of the Tax Code of the Russian Federation).

If the guilty person is identified, then the amount of compensation for damage, in accordance with clause 3 of Article 250 of the Tax Code of the Russian Federation, is reflected in non-operating income. Losses from damage to products/goods identified during their storage and sale are reflected in account 94 “Shortages and losses from damage to valuables”. The amount of damage to goods within the limits of natural loss norms is attributed to production or distribution costs, and the amount in excess of the norms is attributed to the guilty parties.

Example 5. Cafe “Lastochka” (located on the simplified tax system - “income minus expenses”) purchased on July 1 30 kg of imported sweet pepper. On July 31, 2013, damage to the pepper was discovered due to a violation of the temperature regime for storing vegetables by storekeeper M.P. Osina, who is the financially responsible person. The commission found that 5 kg of pepper was completely spoiled and subject to write-off, about which a report was drawn up in the TORG-16 form. Retail price is 140 rubles. for 1 kg. In accordance with the norms of natural loss of fresh vegetables and fruits during storage and release in pantries of public catering establishments (Order of the Ministry of Economic Development of Russia dated 09/07/2007 N 304), the norm of natural loss of pepper in summer is 0.9%.

The following entries were made in the cafe's accounting records:

The cost of spoiled pepper is reflected:

Debit 94 “Shortages and losses from damage to valuables” Credit 10 “Raw materials and supplies” - 700 rubles. (140 rub. x 5 kg)

Let's calculate the cost of losses due to natural loss:

140 rub. x 5 kg x 0.9% = 63 rub.

That. 63 rubles will be allocated to reduce the tax base for taxes paid in connection with the application of the simplified tax system.

Debit 91.02 “Non-operating expenses” Credit 94 “Shortages and losses from damage to valuables” - 63 rubles.

The remaining 637 rubles. will be attributed to the person responsible.

Debit 73 “Settlements with personnel for other operations” Credit 94 “Shortages and losses from damage to valuables” - 637 rubles.

The guilty person can compensate for the damage in 2 ways - either by making a one-time payment to the enterprise’s cash desk for the cost of the damage caused, or in accordance with Art. 138 of the Labor Code of the Russian Federation, the entire amount of damage to goods must be reimbursed from wages by decision of the head of the organization.

If, upon detection of damage to products/goods, there are no norms of natural loss for them, then the amount of the loss, if there is a guilty person, is completely written off to him, and otherwise to a non-operating expense that does not reduce the tax base, according to the tax paid in connection with the application of the simplified tax system.

Briefly for the lazy

- Unusable goods are written off on the basis of a write-off commission act as a result of the inventory of goods. The legislator equates missing the product's expiration date to the impossibility of using a product.

- Unusable commodity mass is taken into account in account 94 or in account 91/2, if its disposal is possible. In tax accounting, expired goods can be included in expenses, as well as damage within the limits of loss norms.

- If the cost of damaged goods is attributed to the perpetrators who compensated for the damage, the amount is reflected in other income and expenses. In the event of natural disasters or if the court has not determined the person at fault, damaged goods may be reflected in other expenses.

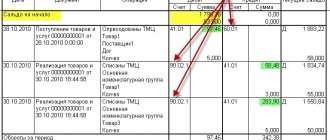

How to write off damage to goods in 1C 8.3: instructions

Below we will consider the procedure for writing off goods whose damage is determined based on the results of the inventory. During the procedure, the accountant generates an inventory sheet, which reflects the accounting balances of the goods. Responsible employees (usually storekeepers) compare accounting data with actual balances in the warehouse and, upon detection of damage, draw up a corresponding report and submit it to the accountant. Based on the act, the accountant reflects the write-off of goods in 1C.

Step #1 – Inventory

At the first stage, the accountant creates an inventory sheet (menu “Warehouse” → “Inventory of goods”). At the top of the document, the accountant fills in the following data:

- Name of company;

- Document Number;

- MOL (responsible person);

- Inventory date.

Product balances on the reporting date are filled in automatically by clicking the “Fill” button and selecting the “Fill according to warehouse balances” item from the drop-down list.

As a result, the screen displays the remaining goods, which, in accordance with accounting data, are listed in the warehouse as of the reporting date. By default, the inventory sheet is generated without discrepancies - the data in the “Accounting Quantity” column is equal to the indicators in the “Actual Quantity” column.

Next, the accountant prints out the statement and passes it to the persons responsible for the availability of goods in the warehouse. MOLs compare actual balances with accounting balances and, if damage is detected, draw up a corresponding report.

Based on the act, the accountant adjusts the inventory sheet by inserting the actual quantity of goods (minus the shortage) in the “Actual quantity” column, and then clicks the “Write” button.

How to take into account the write-off of illiquid inventory items in accounting

The chart of accounts for the accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), for accounting for the decrease in the value of inventory and materials as a result of their damage, as well as for writing off the entire cost of valuables when they are destroyed, account 94 is intended “Shortages and losses from damage to material assets.” This account is used for interim accounting of the cost of inventory items subject to write-off.

Depending on the circumstances surrounding such a write-off, the cost of inventory items can be attributed (Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia N 94n)):

- for production expenses or sales expenses when writing off the cost within the limits of natural loss norms during the production, storage or sale of inventories (clause 58 of the Methodological Instructions, paragraph 3 of the Methodological Recommendations for the development of natural loss norms, approved by Order of the Ministry of Economic Development of Russia dated March 31, 2003 N 95 );

- on account of other settlements with personnel in cases where the amount of damage is attributed to the guilty persons from among the organization’s employees;

- against other expenses, if the perpetrators are not identified.

If damage to material assets is recognized as an insured event, the organization separately takes into account the amount of insurance compensation as other income (clause 7, 10.2 of section III of the Accounting Regulations “Income of the Organization” PBU 9/99 (approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 32n)). If the organization provides for the creation of a reserve for the depreciation of inventory items, their value is written off at the expense of this reserve. It should be noted that the formation of a reserve for a decrease in the cost of inventory and materials is a mandatory requirement for all organizations, except those that are granted the right to use simplified methods of accounting (paragraph 2 of clause 25 of the Accounting Regulations “Accounting for inventories” PBU 5/ 01 (approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n));

- directly to the profit and loss account in case of losses arising from natural disasters, if such are not subject to compensation.