Although, of course, you have to try to meet high requirements,” advises Anna Solovyova from Cornerstone. Average salaries of chief accountants at the beginning of April 2012, rub.

Source:

HeadHunter.ru

Which specialists are in demand?

According to Valeria Chernetsova from the Superjob.ru portal, the most in demand are accountants who are able to manage several areas of accounting at once - they account for 26.9 percent of vacancies (see below). In second place are chief accountants (14.8% of vacancies). Well, the least demand is for inventory accountants (3.8%), cashier accountants (3.6%) and accountant assistants (3.4%).

Positions in greatest demand (as a percentage of total finance vacancies)

Source:

Superjob.ru

What requirements do employers have?

A candidate for the position of chief accountant must have a higher education (financial or economic) and at least three years of work experience. He should also understand accounting programs and legal reference systems, have a good understanding of the legislation and know all areas of accounting. Olga Kornienko clarifies: if the chief accountant expects to find employment in a large foreign company, then he will be required to have knowledge of English, a DipIFR certificate, as well as skills in working in an ERP system (a corporate information system designed to automate accounting and management).

Employers have set an equally high bar for ordinary accountants. According to Anna Solovyova from Cornerstone, a specialist needs to have additional education, for example, obtain a certificate of completion of courses as a tax consultant or internal auditor. Foreign companies may be asked to provide DipIFR or ACCA certificates. Knowledge of modern ERP systems will also be a big plus.

It is also possible to replace the fine with an administrative suspension of activities for up to 3 months. Repeated violation of the law by an official who was previously subject to administrative punishment for a similar offense entails disqualification for a period of 1 to 3 years. There is also a high probability of reputational risks. For example, in the absence of job descriptions, it may be difficult to dismiss an employee due to his failure to fulfill his job duties. And in the absence of personnel documents justifying certain payments to employees, as well as due to incorrect calculation of average earnings, labor disputes and conflicts that often escalate into litigation.

Review of salary statistics for the profession accountant personnel officer in Russia

Rules);

- copies of documents and extracts from them;

- certificates from the place of work (see, for example, Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n regarding the preparation of a certificate of the amount of wages, etc.);

- power of attorney (in many cases it may be necessary: see

Article 185.1 of the Civil Code of the Russian Federation and the explanations given in the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 2 (2015), approved by the Presidium of the Supreme Court of the Russian Federation on June 26, 2015); - archival references.

Some documents must be affixed with the main seal (usually located in the accounting department), while others can be affixed with the seal of the HR department (that is, the seal of the organization with an additional note about its use by the HR department; located in the HR service). According to the circumstances established by the court, seals and stamps that have become unusable and have lost their meaning must be returned to the place of issue, where they are centrally destroyed according to an act with a corresponding mark in the journal (clause 8.3.9 of the Employer’s Temporary Instructions).

Who is valued more: personnel or accounting?

As a result, the company not only loses real money, but also risks running into claims from the tax authorities, which usually scrutinize the validity of bonus payments.

Example 2

A foreign mission requests an accountant to register an employee for remote work. For example, a foreign employee will work remotely while abroad, but at the same time his salary will be calculated in Russia.

What does an accountant do most often? Enters such an employee into the database and makes a note that he works remotely. If a personnel officer sees something like this, he will immediately say that there is a violation, since remote work for foreigners is prohibited in Russia.

Info

The accountant may not have known about this, and the company’s top person will be responsible for the violation. Example 3

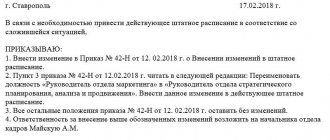

From the head office of a foreign company, the accountant receives an order to hire such a citizen for such and such a position.

However, the position is not included in the staffing table. In such situations, the accountant most often does not think twice and enters the employee into the salary calculation database as he was asked. This is because for an accountant, staffing is often a simple formality. The personnel officer will first say: “Let’s take a look at the staff, perhaps we can hire an employee for one of the positions provided for there, just by changing the name a little.” “Inflating” the staffing table during a crisis can lead to unnecessary questions from the employment service, which will have to be answered adequately.

Target software

The Personnel System program was created to conduct automated staff office work at various enterprises (for example, the Federal Penitentiary Service).

Since 2013, this software has become freely distributed. Using the KSS program in the “Personnel System” format allows you to more effectively manage workforce (monitoring, automation of control, etc.) and has noticeable advantages:

- minimizes the cost of maintaining a large staff. It is enough for the enterprise to have a chief accountant;

- work autonomy;

- simplification of control.

"Personnel System" is used for the following purposes:

- maintaining personal cards, as well as staffing tables;

- travel arrangements;

- preparation of time sheets for working hours;

- vacation registration and much more.

To date, this program has successfully proven itself in office work in various departmental structures (Ministry of Internal Affairs, Federal Penitentiary Service, etc.). This is due to the fact that when it was created, algorithms were used to simplify the systematization of information management. The system is easy to configure. Therefore, learning to work with it will take a minimum of time.

An accountant formally refers to personnel records

Not realizing the importance and value of personnel records, accountants treat the preparation of “personnel papers” formally. This leads to the fact that personnel documentation is maintained incorrectly, with a lot of shortcomings and errors.

Don’t be too lazy to look at this paper in order to minimize clashes between departments.

And if any functions remain controversial, try to find time and discuss this issue either as a manager with a manager (chief accountant and head of the personnel department), or with the involvement of higher “arbiters” from the company’s management. One of the experts friendly to the “Calculation” formulated golden rule: “A personnel officer works in “human numbers,” and an accountant works in “money numbers.” Senior accountant 350 61 600 0 0 Junior accountant 200 35 200 0 0 Operator, courier 100 17 600 0 0 Total real salary of the chief accountant 100 167 200 “So, just like that, the general director will just raise my salary?” - you ask. It will, no doubt about it. The more often he sees his chief accountant busy with real and important business matters, the more he will listen to him.

Important

It just so happens that some papers are expensive to both. Of course, there are electronic systems, both accounting and for “personnel specialists”, which should consolidate all information and help in finding documents for the next audit or when generating reports.

But, unfortunately, representatives of the two “camps” cannot figure out who should enter what data: some do not enter information about vacations or salary changes on time, and the second do not want to accept travel expenses, since there is no advance report and official assignment. As it should be... The more distant the HR and accounting departments are from each other, the more noticeable the inconsistency in their actions.

Attention

Even if you do not take into account simple human dissatisfaction, which seriously spoils the climate in the team, things can lead to the loss of important documents or errors in reporting.

About the friendship between the personnel officer and the accountant

The employee's salary is established by the employment contract in accordance with the employer's current remuneration systems (Part 1 of Article 135 of the Labor Code of the Russian Federation).

At the same time, remuneration systems are introduced by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law standards (Part 2 of Article 135 of the Labor Code of the Russian Federation). Thus, the legislation does not provide for mandatory requirements for the methodology and method for determining employee salaries. At the same time, labor legislation contains certain requirements for the level of employee wages. So, in accordance with Part 3 of Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage.

I work as a technology salesman. In times of crisis they are thinking of laying us off, I will be laid off 100% because... I've been working recently. I have the opportunity to go to study. Which job do you think is more interesting and more prestigious - HR or a career in accounting? I don’t really like to tinker with papers and numbers, so I want to go to the specialty “Human Resources Management”, but my parents and husband dissuade me, they say that this is all nonsense and not serious. But it seems to me that good personnel management in a large enterprise is one of the components of success. In addition, I am a creative person, I am interested in everything related to people. In the end, there may be development here - conducting trainings, being a trainer, a consultant. But to be honest, I don’t know the specifics of accounting work from the inside at all.

Accountants believe that since these are not reports and cannot be submitted anywhere, then “this will do.”

What can a violation of labor laws lead to? In accordance with Art. 5.27 of the Administrative Code, violation of labor legislation entails the imposition of an administrative fine on the general director of up to 5 thousand rubles, and on the company up to 50 thousand rubles. It is also possible to replace the fine with an administrative suspension of activities for up to 3 months.

Repeated violation of the law by an official who was previously subject to administrative punishment for a similar offense entails disqualification for a period of 1 to 3 years. There is also a high probability of reputational risks. For example, in the absence of job descriptions, it may be difficult to dismiss an employee due to his failure to fulfill his job duties. And in the absence of personnel documents justifying certain payments to employees, as well as due to incorrect calculation of average earnings, labor disputes and conflicts are possible, which often develop into legal proceedings.

What is the peculiarity of the work specifics?

The central task in any organization is the correct accounting of labor costs and their payment.

The economy is created by labor, which also serves as a commodity, since employees sell their activities, creating material values. From these interactions, added value has appeared for the products produced by the enterprise; the labor intensity involved contributes to the rise in price. Financiers are faced with the task of evaluating and paying for work in any of its forms, and including costs in the cost of the marketable product. Payroll clerks, when performing operations, refer to regulatory documentation every day. A good economist, who works flawlessly and does not cause any complaints from fiscal authorities, must understand the issues of accrual:

- salaries;

- bonuses;

- various payments and compensations;

- benefits and allowances;

- sick leave;

- social security.

Any accrual of remuneration for hours worked or the need to withhold a certain amount will require familiarization with the provisions set out in various sources and the use of labor legislation.

There is a lot of work, especially for small institutions, where the chief accountant often performs the duties of a material accounting specialist, calculates and issues salaries, and performs the functions of a personnel officer. A computer program created specifically for small companies facilitates the activities of accountants; with its help, competently completed documentation is created and reports are sent.

An accountant's internal dissatisfaction can develop into open conflict

Personnel accounting is usually given to accountants as part of their main work. Obviously, the accountant is unhappy with this, especially if the additional function does not affect his income.

Our personnel officers do much more. They set up work schedules and all holidays. There can be a lot of schedules, especially if there are shifts.

They include vacation, sick leave, and absences. but they are made unconducted. This is carried out by the accountant after receiving the document. thus, a timesheet is automatically generated. Periodic constants of the Manager type are changed if the manager is absent and someone replaces him, then everything in the documents is formed correctly.

It is worth noting that this is all their direct work; it’s another matter that they are now doing everything on paper for you. I’m not even talking about purely personnel data such as date of birth, T2 cards.

Practical advice.

Purely personnel data (which the accountant does not need) personnel officers will quickly learn to introduce and agree to do.

With the rest, where the interests of the personnel officer and the accountant intersect (sick leave, vacation pay,...) problems will begin (monitored in the example of many of my implementations). The only solution (based on my experience) is literally at the very initial stage of implementation to issue an order for the enterprise signed by the manager with the agreement of the chief accountant and the head of the personnel department about who enters what and who carries out what.

Deadlines are required. This order can be modified in the process, but it needs to start from something. After this, everyone’s passion for what I will do or what I will not do diminishes.

And then HR officers themselves will understand all the delights of working in 1C.

However, S., who is personally responsible for the storage and use of seals and stamps, having information about the presence of an official seal in the department’s accounting department, during the centralized delivery of seals and stamps, did not inform the branch that not all the seals were handed over to him and on what grounds, but also, upon returning from vacation, the employee to whom this seal was transferred for use did not take measures to confiscate it and subsequently transfer it to the branch, thereby allowing a violation of his official duties.

Appointment of those responsible for maintaining certain areas of personnel

HR records management is a complex and multifunctional process, which is regulated by the legislation of the Russian Federation and requires proper documentation. Therefore, it is very important that this process is handled by a full-time HR specialist who has the relevant experience.

However, there are cases when an organization does not have a full-time personnel officer and accountants, secretaries, and office managers are involved in preparing personnel documents.

In a small organization, the functions of preparing personnel documents can be performed by the manager himself - in this case, additional documentation is not required, since in accordance with the organization’s charter, the manager is responsible for any aspect of the organization’s activities.

We appoint someone responsible for maintaining work records

If an organization has a human resources department or a separate specialist, he is responsible for a large number of important organizational and administrative documents. However, an important point is often overlooked - the responsibility of the personnel officer.

The GIT inspector will immediately identify such deficiencies in the design by requesting the appropriate mandatory orders. Based on this, the employer has a direct obligation to appoint a responsible person to further avoid fines.

Based on clause 45 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers[1], one of the mandatory orders is to appoint someone responsible for maintaining, storing, recording and issuing work books (example 1).

For violations in this area, the inspector has the right to impose an administrative penalty[2]. Not only the organization or the manager, but also the responsible employee of the HR department who maintains work records is at risk of receiving a fine.

We appoint someone responsible for maintaining military records

An employer may be held administratively liable for the absence of an order to appoint someone responsible for maintaining military records. The specified order can establish the person responsible for performing mandatory military registration operations (example 2).

If the organization does not have a person responsible for maintaining military records of citizens, including the reservation of citizens in reserve and storage of strict reporting forms, the maximum fine can be 50 thousand rubles[3]. In this case, it is not the official who is fined, but the organization itself.

We appoint a person responsible for the processing of personal data

In accordance with Art. 88 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), only specially authorized persons can have access to personal information of employees of an organization.

In addition, Federal Law of July 27.

2006 No. 152-FZ “On Personal Data” (hereinafter referred to as Federal Law No. 152-FZ) requires that a business entity appoint a specialist who will be responsible for working with personal data (example 3).

The absence of such an order is equivalent to a violation of Federal Law No. 152-FZ. Sanctions Art. 13.11 of the Code of Administrative Offenses of the Russian Federation for violation of the legislation of the Russian Federation in the field of personal data provides for a warning or the imposition of an administrative fine:

- for officials - from 500 to 1 thousand rubles;

- for legal entities - from 5 thousand to 10 thousand rubles.

We appoint someone responsible for maintaining time sheets

The employer is obliged to keep records of the time actually worked by each employee, regardless of the form of remuneration used[4].

Responsibilities for maintaining time sheets may be provided for in an employment contract or, more correctly, in a job description. If these functions are not recorded in documents, it is necessary to draw up an order appointing a responsible person (example 4).

For violations in recording the time actually worked by employees, administrative penalties are possible on the basis of Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- for officials of the employer - a warning or a fine from 1 thousand to 5 thousand rubles;

- for an individual entrepreneur - a fine from 1 thousand to 5 thousand rubles;

- for an employer-organization - a fine of 30 thousand to 50 thousand rubles.

Authorized persons must be familiarized with all of the above orders against signature.

Accounting and HR department. divide and conquer?

This means that in personnel matters, the accountant “cuts out” for his department only that which concerns accounting and tax accounting of amounts defined as wages, compensation and other payments to employees. It is these numbers that the accountant should work with, and reliable information on them should be required from the human resources department. Next, the tax base for the unified social tax is calculated, personal income tax is withheld as tax agents and insurance premiums and taxes are paid to the relevant structures.

The reporting associated with this office work should also be within the competence of the accounting service, since declarations are filled out by the hands of its employees, and all documents during tax audits pass through the same department.

What competencies should a HR specialist have?

An employee who works in the HR department must have the following knowledge and skills:

- know the regulations, as well as legislative documents that relate to working with personnel;

- know materials that are methodological in nature;

- know the legislation that relates to labor;

- know the staff of the organization and its structure;

- be able to draw up documents;

- be able to keep work records;

- be able to manage personal affairs of workers;

- know the procedure for setting the names of professions;

- be able to draw up pensions;

- be able to process preferential and compensation payments;

- know how to keep personnel records;

- be able to conduct office work;

- know the rules that relate to labor protection;

- be able to work with a personal computer.

Why an accountant cannot and should not conduct personnel records

Code of Administrative Offences, violation of labor legislation entails the imposition of an administrative fine on the general director of up to 5 thousand rubles, and on the company up to 50 thousand rubles.

It may all end with the accountant either demanding a salary increase or deciding to quit (well, if there is no conflict and accompanying labor disputes).

So if you want:

- so that relations with your company’s employees are formalized in full compliance with Russian labor legislation;

- employees understood that they would not be able to manipulate you due to gaps and shortcomings in personnel work;

- feel protected if a labor dispute with employees does end up in court;

- avoid punishment for violation of labor laws and incorrect maintenance of personnel records in the event of a labor audit,

then it makes sense to transfer HR administration to a reliable outsourcing company.

At the same time, the issue of choosing such a company must be approached very carefully. The fact is that in a number of outsourcing companies there is very often no clear division between those who calculate salaries and conduct personnel records. Such a combination of functional responsibilities, as we have already shown above, leads to unfavorable consequences.

We, in turn, are well aware that the competencies and qualifications of an accountant do not cover the entire area of responsibility in terms of personnel records management.

Where accountants are needed

Important detail

The greatest demand for accounting employees is in Moscow - the capital accounts for more than 40 percent of vacancies.

Representatives of companies involved in personnel search are unanimous in the opinion that accounting positions are among the most in demand on the labor market. “Good accountants are always needed,” says Anna Solovyova, a consultant in the Finance and Audit department of headhunting, adds Olga Kornienko, head of the personnel selection department at Kelly Financial Resources. This is because supply significantly exceeds demand. For example, in February of this year there were 9.3 resumes per vacancy.

The largest number of accounting employees is required in Moscow—the capital accounts for 42.2 percent of vacancies (see below). Companies from St. Petersburg need 3 times fewer accountants - 13.2 percent, and in Samara and Irkutsk there are just over 1 percent of accounting vacancies.

How is the demand for accountants distributed between regions (as a percentage of the total number of accounting vacancies)

Source:

Superjob.ru

According to Valeria Chernetsova, head of the analytics department of the Superjob.ru portal, the most difficult thing to find work for accountants and financiers is in Ufa, where 27.6 people apply for one vacancy, and in Volgograd, where the competition is 22.5 people per place.

Perhaps it’s time for some specialists to think about moving: many employers from the cities that have posted the largest number of vacancies are waiting not only for local residents, but also for out-of-towners. But you can envy Yekaterinburg accountants: getting the desired position with a competition of 4.7 people per place is much easier.

As for Moscow, competition for jobs here is approximately equal to the all-Russian level (8.8 resumes per vacancy). Personnel management is not the responsibility of an accountant. An accountant formally refers to personnel records. During the reporting period, the accountant does not have time for personnel issues. The accountant’s internal dissatisfaction can develop into an open conflict.

In business practice, personnel records management is very often left to the accounting department. We encounter such situations almost every day when clients contact us.

Moreover, this is typical not only for staff accounting. A similar combination of functionality is found in some outsourcing companies.

The lack of delineation of functional responsibilities entails very large risks for users of “combined” accounting, especially in the context of Russian labor legislation, which is more often on the side of the employee than the employer.

Today I want to talk about why an accountant cannot and should not conduct personnel records.

Who manages personnel if there is no personnel officer on staff?

share on: To document all personnel transactions in an organization, certain knowledge and skills are required.

Office work at the enterprise is regulated by instructions independently developed and approved by the director. It is an internal regulatory act and is mandatory for compliance by all employees of the business entity. The HR department develops and monitors its implementation.

The law requires the preparation of many documents that document all aspects of the employee’s employment relationship with the employer.

Management is responsible for the documentary fund of the enterprise.

Why an accountant cannot and should not conduct personnel records

Personnel management is not the responsibility of an accountant. An accountant formally refers to personnel records. During the reporting period, an accountant does not have time for personnel issues. The internal dissatisfaction of an accountant can develop into an open conflict. In business practice, personnel records management is very often left to the accounting department.

We encounter such situations almost every day when clients contact us. Moreover, this is typical not only for staff accounting. A similar combination of functionality is found in some outsourcing companies.

The lack of delineation of functional responsibilities entails very large risks for users of “combined” accounting, especially in the context of Russian labor legislation, which is more often on the side of the employee than the employer. Today I want to talk about why an accountant cannot and should not conduct personnel records.

Labor inspection is on the doorstep - let’s put things in order in personnel records

Important On the topic Read all materials (221) on the topic.

There is an update (+209), including: July 03, 2008 16:56 Brosalina E.Yu. Filipev D.Yu.

LLC "" The methodological manual was published by LLC "Aktsiya-Inform-Plus" and posted in the Altai edition of our partner legal reference system "Garant". Part 1. Dear leaders! It would be great if all companies initially carried out personnel work competently and complied with labor laws.

And it happens that a message about an upcoming inspection by the labor inspectorate takes the company by surprise. In small firms and entrepreneurs, as a rule, there are no HR specialists on staff; the employer either carries out HR work himself or entrusts it to an accountant or office manager.

In such cases, both the manager and the accountant, who usually do not have sufficient knowledge in the field of labor law, worry about “is everything done correctly.”

Conducting personnel records

The main value of any enterprise is its personnel.

No matter how the owner himself thinks through the ways of developing his business, no matter how profitable and successful it may seem to him, without a team of experienced professionals who will be able to bring all the boss’s plans to life, nothing will work out.

Often, a manager who decides to take on the responsibilities of recruiting personnel, and at the same time, postponing until later the maintenance of all necessary personnel documentation, leads to serious neglect in the documents.

And this, naturally, leads to serious penalties from regulatory authorities.

Therefore, competent organization of personnel records management is a very important component of the work of any company. This process is quite labor-intensive and requires certain experience and knowledge of current legislation.

And who is the personnel officer?!

If you have already come across personnel documents, then you know that many of them have a place for the signature of a personnel employee (for example: “Staffing table”, “Time sheet”, etc.

) It must be borne in mind that many supervisory organizations (labor inspectorate, judicial authorities, tax inspectorates) when conducting inspections or when requesting documents, require an order to appoint a personnel employee or an order to assign responsibilities for maintaining personnel records to someone of the employees. If there is a personnel employee on staff, then no problems arise with providing the above document. But if the organization is small and the costs of hiring and paying an individual employee to conduct personnel records are not economically profitable and not justified? In this case, the manager will have to accept decision to assign the duties of a personnel officer to an already

HR records management

Find out how personnel records are maintained in the organization and what you can be fined for. Download the HR records manual or organize your own records.

Download a useful document In detail and taking into account the requirements of GOST Any company that uses hired labor is required to maintain personnel records. Working with personnel is accompanied by the preparation of many documents, from staffing schedules to personnel orders.

Starting HR records management from scratch, prepare the mandatory HR documents, without which full-fledged work with personnel is simply impossible.

What should a HR manager know first or 20 regulations that a HR specialist must know?

Any personnel officer, getting a job in a new organization, will inevitably be faced with the need to quickly establish personnel records. It’s good if the previous specialist leaves behind his documents in order. But there are also cases when personnel work has to start practically from scratch.

What documents regulate the main issues of personnel work?

How to check whether there are enough local regulations in the company? Why is it better to take samples for drawing up personnel decisions from the resolution of the State Statistics Committee of Russia dated January 5, 2004.

No. 1? What regulations should a personnel officer know? In most organizations, the work of a personnel department employee is not limited to the need to conduct personnel records (registration of admission, transfer, dismissal, vacations, business trips, etc.).

d.). Often, personnel officers have to take a direct part in the development of local regulations governing labor relations between employee and employer.

Are there regulations that oblige a company to include a HR specialist position in its staffing table?

Currently, the Labor Code of the Russian Federation does not regulate the criteria under which an organization must create a personnel service.

The employer himself has the right, at his own discretion, to approve the staffing table and form structural divisions (departments), this applies to commercial organizations; for organizations financed from the state and federal budget, the staffing table is “derived” from a higher organization. When calculating the number of staffing units, one should proceed from the volume of work performed.

Source: https://lawyerms.ru/kto-vedet-kadry-esli-v-shtate-net-kadrovika-18204/

HR management is not the responsibility of an accountant

Let's start with the fact that accounting relies on the Tax Code in its work, and personnel records management requires deep knowledge of the Labor Code. Labor legislation is no less complex and dynamic than tax legislation. Due to this, personnel records management requires deep system knowledge. But, unfortunately, it is a rare accountant who can boast of this.

Example 1

The accountant receives an order to pay an employee a bonus. Let's say, “for beautiful eyes.” Instead of looking into local regulations (Regulations on bonuses, employment contracts, etc.) and finding out whether there are grounds for such a payment or whether the reason for the bonus needs to be reformulated, the accountant simply makes a calculation. As a result, this amount cannot be legally accepted as company expenses, and this, in turn, increases the tax base for income tax.

Representatives of small and large businesses are more active in searching for accountants and financiers. According to Superjob.ru, they posted 39 and 36 percent of vacancies, respectively.

Medium-sized businesses account for fewer requests—25 percent.

How much do accountants earn?

It is clear that in one case, companies can be flexible and focus on the expectations of successful candidates, and in another, they can have a clear budget for the vacancy. And yet, data from the recruiting company HeadHunter is optimistic: if in the spring of last year the Moscow chief accountant could count on an average of 63,900 rubles, then this year - already 68,500 rubles.

Well, the maximum salary of a chief accountant in Moscow reaches 300,000 rubles.

The statistics for Russia are also encouraging. In March last year, employers were willing to pay the chief accountant an average of 53,100 rubles, and in April of this year the proposed salary increased to 56,600 rubles.

But ordinary accountants receive one and a half times less (see below). Perhaps it's time to improve your skills!

How do the salaries of metropolitan accountants differ from the average accounting salaries in Russia, rubles.

Source:

HeadHunter.ru

If we compare wages in different regions, then, of course, Moscow will be in the lead.

In St. Petersburg they pay 25 percent less - 51,100 rubles, but the salary of Kazan chief accountants is three times less than in the capital - 25,900 rubles. (see below). However, regional accountants need not be discouraged.

“Pay attention to large Western companies operating in the region. To attract candidates, they offer competitive salaries.