What is an advance

The portion of compensation that employees receive during a pay month is usually called an advance.

If we turn to the laws in the field of labor relations (Labor Code of the Russian Federation), then this point is not clearly stipulated at the legislative level. However, regulations regulate the procedure for paying wages. Law 07/03/2016 No. 272-FZ made significant changes to Art. 136. The new version of this article establishes that employees must receive remuneration at least once every two weeks and no later than 15 calendar days from the end of the pay period.

You may be interested in: Technology for installing foundation piles: features, instructions

Russian regulations oblige all employers in the country to pay staff salaries twice a month, therefore the practice of collecting partial (advance) and final payments is commonplace in modern enterprises.

The accrual of salary advances is calculated based on the data on hours worked during the current month. Money is paid in the middle of the month or on another date determined by the company.

It is clear that it is more difficult to fully calculate a month’s salary than to collect an advance. Therefore, in practice, the organization first determines the salary payment date. In accordance with Art. 136 of the Labor Code of the Russian Federation, it must be installed between the 1st and 15th of the next month. Which specific day to choose in a given period depends on the organization of accounting in the company. The better the exchange of information, the sooner employees will be able to receive wages.

After determining the salary payment date for the company, you need to add 14 days (15 days). This sets the date for the advance payment in accordance with the requirements of the Labor Code of the Russian Federation.

For example, if the deadline for salary payment is the 4th, then the advance should be issued no later than the 19th, if it is 8th, then no later than the 23rd, etc.

What happens if an advance is issued earlier than 15 days? For example, on the 19th day from the date of payment of salaries on the 5th? In this case, the limit of 15 days established by the Labor Code of the Russian Federation will be exceeded, which is a violation of the law. The organization may be at fault for violating the payment procedure.

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

Calculation procedure

Let's look at how the advance is calculated in accordance with current rules.

The Ministry of Labor indicates in its letters that the amount of the advance payment should be determined jointly with the company management and the trade union when drawing up a collective contract.

You may be interested in: Accounting is a system... Definition, types, objectives and principles

The Ministry of Labor notes that the small amount of advance payments must correspond to the costs at the tariff rate, which is applied to the actual hours worked.

You can calculate the amount of the advance payment for wages using different methods, for example, as a percentage of the wage fund, as a fixed amount, or for hours worked.

The last option is more reasonable and comfortable for both parties, since it takes into account how each employee actually worked during the period. There is no overpayment if the employee was not at work for a certain period.

Source - SPS Garant

BRIEFLY: — The new instruction does not regulate cash payments between individuals . They can be settled in any cash amount.

— The maximum amount of settlements under one contract per day as part of the fulfillment of civil obligations between participants in settlements (and this is only legal entities and entrepreneurs) is left at 100 thousand rubles.

— The maximum size of settlements between participants in settlements (legal entities, entrepreneurs) and individuals has not been established. They can be settled in any cash amount.

— As a general rule, in order to pay in cash, payment participants (legal entities, entrepreneurs) must withdraw funds from their bank account and credit the cash to the cash desk for further cash payments

-The new instruction duplicates the cases of the old instruction, when in certain limited cases cash settlements between settlement participants and individuals (without restrictions on amounts) can be made without first withdrawing funds from a bank account due to the receipt of funds in the cash desk from professional activities , for example, through funds from goods sold by them, work performed by them and (or) services provided by them.

In particular, an individual entrepreneur who has received funds from an individual at the cash desk (without restrictions on the amount) has the right to issue cash to himself (without restrictions on the amount) for the personal (consumer) needs of the individual entrepreneur not related to his business activities. Here the Entrepreneur acts in 2 statuses.

Below is an overview of the changes

(review of changes made to the procedure for making cash payments by Directive of the Bank of Russia dated December 9, 2020 N 5348-U “On the rules of cash payments”)

April 24, 2020

On April 27, 2020, Directive of the Bank of Russia dated December 9, 2020 N 5348-U “On the rules of cash payments” (hereinafter referred to as Directive N 5348-U) comes into force. It will replace Directive of the Bank of Russia dated October 7, 2013 N 3073-U “On cash payments” (hereinafter referred to as Directive N 3073-U), which has been in force since 2014. Let us dwell on the most important differences between the new legal regulation and the old order.

Cash payment limit

First of all, we note that the maximum amount of cash payments between legal entities and individual entrepreneurs (which, as in Directive N 3073-U, are called participants in cash payments) has remained unchanged. It still amounts to 100 thousand rubles (or an equivalent amount in foreign currency) under one agreement (clause 4 of Directive N 5348-U).

clause 4 of Directive N 5348-U 4. Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments within the framework of one agreement concluded between these persons can be made in an amount not exceeding 100 thousand rubles or an amount in foreign currency equivalent 100 thousand rubles at the official exchange rate of foreign currency against the ruble established by the Bank of Russia in accordance with paragraph 15 of Article 4 of the Federal Law “On the Central Bank of the Russian Federation (Bank of Russia)” (Collected Legislation of the Russian Federation, 2002, No. 28, Art. 2790 ; 2020, N 29, Art. 3857), on the date of cash payments (hereinafter referred to as the maximum amount of cash payments).

Restrictions on cash spending

The main changes introduced by the new directive to the procedure for cash payments concern restrictions on spending cash received at the organization's cash desk. However, for the majority of business entities nothing will change - the innovations are related to the peculiarities of the work of microfinance organizations, pawnshops, and consumer credit cooperatives, including agricultural ones.

Firstly, the range of cash receipts that are subject to restrictions has expanded. If, in accordance with Directive N 3073-U, restrictions on cash spending applied only to the revenue of organizations (cash received at the organization’s cash desk for goods sold, work performed and (or) services provided), then Directive N 5348-U also applies to money , received by the named entities under a loan agreement (under an agreement for the transfer of personal savings), received as a return of the principal amount of the debt, interest and (or) a penalty (fine, penalty) under the loan agreement. For credit consumer cooperatives and agricultural credit consumer cooperatives, restrictions also apply to money received as share contributions (clause 1 of Directive N 5348-U).

Secondly, for these organizations the list of acceptable purposes for spending cash received at the cash desk has been expanded. Pawnshops and microfinance organizations will be able to spend it on issuing loans, returning borrowed loans, paying interest and (or) penalties (fines, penalties) on borrowed loans. Such expenses should not exceed 50 thousand rubles under one loan agreement, and not amount to more than 1 million rubles in one day per microfinance organization (its separate division), pawnshop (its separate division).

Credit consumer cooperatives (including agricultural ones) have the right to spend proceeds on issuing loans, returning borrowed loans, returning funds under agreements for the transfer of personal savings, fees for the use of funds under agreements for transferring personal savings, paying interest, penalties (fines, penalties) on attracted loans, under agreements for the transfer of personal savings, as well as for the payment of amounts of share savings (shares). Such expenses should not exceed 100 thousand rubles for each of the listed agreements, for each share accumulation (share), and should not amount to more than 2 million rubles per day per cooperative (its separate division) (clause 1 of Directive No. 5348 -U).

Other innovations

In addition, in the text of Directive N 5348-U, in comparison with Directive N 3073-U, a number of wordings are clarified. Thus, according to paragraph 1 of Directive N 5348-U, all settlements between participants in cash payments and individuals, except for the exceptions listed in this paragraph, are carried out at the expense of cash received at the cash desk of the participant in cash payments from his bank account (previously this requirement applied only for settlements on transactions with securities, under real estate lease agreements, on the issuance (repayment) of loans (interest on loans), on the activities of organizing and conducting gambling - clause 4 of Directive N 3073-U).

The norm contained in paragraph 5 of Directive N 3073-U has disappeared, stating that cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments and individuals are carried out without limiting the amount. However, it duplicated the norm of paragraph 1 of Art. 861 of the Civil Code of the Russian Federation and for this reason had no practical significance.

Clause 1 art. 861 of the Civil Code of the Russian Federation: 1. Settlements with the participation of citizens not related to their business activities can be made in cash (Article 140) without limiting the amount or by bank transfer.

The norm of paragraph 6 of Directive N 3073-U on making payments to employees, issuing cash on account and spending money on personal needs of an individual entrepreneur without observing the maximum amount of cash payments has also been excluded. This norm also had no independent significance, since the maximum amount of cash payments does not apply to these payments. At the same time, its cancellation, it seems, may cause a certain misunderstanding, both on the part of business entities and regulatory authorities, which will require the issuance of additional clarifications.

At the same time, in pp. 1, Directive N 5348-U mentions the need to comply with currency legislation when carrying out transactions with foreign currency. Considering the mandatory compliance with federal laws by all participants in legal relations, the presence of such a clause also seems unnecessary.

Calculation method: required indicators

How is the advance calculated? The calculation methodology used will be discussed below.

When calculating advance payments, the accountant does not have final information about the work of the company and each employee for the initial part of the month due to the fact that this information can only be prepared based on the results of the month worked.

As a result, the calculation may turn out to be erroneous and must be corrected during the final payroll calculation.

An accountant can use the following documents and data for calculations:

- the amount of salary for previous months, if the employee has been working in the organization for a long time;

- tariff schedule with increases and allowances;

- staffing schedule;

- orders for leave, reception and transfer of employees.

When calculating the advance payment, the total number of days of work during the calculation period and those days that were practically worked at the time of accrual are taken into account.

Sports betting strategy and system

Using the system as a betting strategy is beneficial. Among the main advantages of this version of the game are:

- Increased security. Unlike express bets, there is an opportunity to make a mistake.

- Minimal risks in the process.

- Great for selecting outcomes with high odds. When a player feels that the express may not go through, in order to maintain the overall odds, choosing a system is justified.

- If the selected options become passable, the amount of winnings in the system is significantly higher than in the express bet.

- The system shows high efficiency indicators when the selected outcomes have odds of at least 1.50. There are cases when the winnings from the system are greater than from the ordinary one.

Sports betting system: calculation

You can find a lot of information and special forums on how the system is calculated in sports betting on the Internet. To make it easier to understand the features of the system, it is better to show it with an example. The better chose four matches. In his opinion, in each match the victory will be celebrated by the first team, for which a conditional coefficient of 1.5 is given. A system of size 3 out of 4 is selected, which means the formation of express trains of three matches. It turns out that the following options exist:

- 1-2-3;

- 1-2-4;

- 1-3-4;

- 2-3-4.

The player plans to bet 200 rubles. In each express bet, the odds are 3.375 with a bet amount of 50 rubles.

If one express bet passes, the player wins, respectively, 168.75 rubles. In general, the situation is considered a losing one, but allows the player to save more than 75% of the bet amount. If it were a regular express bet, the bet would simply be burned. This is one of those sides that shows how the system works in sports betting.

The situation is even more rosy when all outcomes pass. Then the player wins 675 rubles. If you had passed such a bet with an express bet, you could have won 1012 rubles. But the risk of complete loss would be much higher.

The odds of events and, as a result, the probable amount of winnings may change, but the essence of the system remains constant. Now you can independently calculate the system bet in sports.

New calculation rules in 2017-2018.

The new rules for calculating advance payments in 2020, which were provided for in the Labor Code of the Russian Federation, mainly affected only the dates. And when determining the amount of the advance payment, you should proceed from the time that was practically worked in half the month.

In addition, officials advise that when calculating the advance payment, only those components of the salary that are specifically tied to working hours (wages, combination costs, etc.) are taken into account. Regarding payments, the amount of which can only be determined at the end of the month (for example, bonuses for implementing a plan), they, according to the Ministry of Labor, should not be used when calculating the advance payment.

You might be interested in:AP Companies: reviews from clients and employees, review of services

Example 1. The number of working days is 20, the salary of engineer I. I. Anisimov is 25,000 rubles. In the first half, I.I. Anisimov worked for 9 days. How the advance is calculated is presented below:

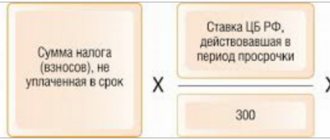

A = 25,000 rub. / 20 days × 9 days = 11,250 rubles.

To calculate the advance payment amount, the new advance payment formula takes into account the actual time spent on labor from the first to the fifteenth day of the current month.

This calculation method is extremely labor-intensive. In practice, it increases the work of accounting services that are associated with the calculation of payments. Therefore, in practice, when determining how a salary advance is calculated, a certain percentage of the salary amount is usually set.

The Ministry of Health and Social Development, in its letter No. 22-2-709 dated February 25, 2009, advises issuing salaries and advance payments in comparable amounts. Since personal income tax is usually not withheld on advance payments, to ensure comparability of payments, the best solution would be to set an advance payment of 40-45% of the salary.

Example 2. How to calculate an advance to an employee? I. I. Anisimov’s salary is 25,000 rubles. The company has set the advance payment amount at 40%. Personal income tax is not used for Anisimov I.I. Advance calculation:

A = 25,000 rub. × 40% = 10,000 rubles.

And the salary is:

H = 25,000 rub. — 25,000 rub. × 13% - 10,000 rubles. = 11,750 rub.

Of course, an employee may miss part of the payroll month at work (due to illness, vacation, etc.). In this case, it is better to determine the advance based on the time of work.

Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U

Based on Articles 4, 82.3 of the Federal Law of July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)” (Collected Legislation of the Russian Federation, 2002, No. 28, Art. 2790; 2003, No. 2, Art. 157; No. 52, Art. 5032; 2004, No. 27, Art. 2711; No. 31, Art. 3233; 2005, No. 25, Art. 2426; No. 30, Art. 3101; 2006, No. 19, Art. 2061; No. 25, Article 2648; 2007, No. 1, Article 9, Article 10; No. 10, Article 1151; No. 18, Article 2117; 2008, No. 42, Article 4696, Article 4699; No. 44, Article 4982; No. 52, Article 6229, Article 6231; 2009, No. 1, Article 25; No. 29, Article 3629; No. 48, Article 5731; 2010, No. 45, Article 5756; 2011, No. 7, Art. 907; No. 27, Art. 3873; No. 43, Art. 5973; No. 48, Art. 6728; 2012, No. 50, Art. 6954; No. 53, Art. 7591, Art. 7607; 2013, No. 11, Art. 1076; No. 14, Art. 1649; No. 19, Art. 2329; No. 27, Art. 3438, Art. 3476, Art. 3477; No. 30, Art. 4084; No. 52, Art. 6975) present The Directive establishes the rules for making cash payments in the Russian Federation in the currency of the Russian Federation, as well as in foreign currency, in compliance with the requirements of the currency legislation of the Russian Federation.

1. This Directive does not apply to cash payments with the participation of the Bank of Russia, as well as to:

cash payments in the currency of the Russian Federation and in foreign currency between individuals who are not individual entrepreneurs;

banking operations carried out in accordance with the legislation of the Russian Federation, including regulations of the Bank of Russia;

making payments in accordance with the customs legislation of the Russian Federation and the legislation of the Russian Federation on taxes and fees.

2. Individual entrepreneurs and legal entities (hereinafter referred to as participants in cash payments) do not have the right to spend cash received in their cash registers in the currency of the Russian Federation for goods sold by them, work performed by them and (or) services provided by them, as well as received as insurance premiums , except for the following purposes:

payments to employees included in the wage fund and social payments;

payments of insurance compensation (insurance amounts) under insurance contracts to individuals who previously paid insurance premiums in cash;

issuing cash for personal (consumer) needs of an individual entrepreneur not related to his business activities;

payment for goods (except for securities), works, services;

issuing cash to employees on account;

refund for previously paid in cash and returned goods, uncompleted work, unrendered services;

issuing cash when carrying out operations by a bank payment agent (subagent) in accordance with the requirements of Article 14 of Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System” (Collected Legislation of the Russian Federation, 2011, No. 27, Art. 3872; 2012, No. 53, Art. 7592; 2013, No. 27, Art. 3477; No. 30, Art. 4084).

Credit organizations have the right to spend cash received at their cash desks in the currency of the Russian Federation without limiting the purposes of spending.

3. Bank payment agents (subagents) do not have the right to spend cash in the currency of the Russian Federation, accepted when carrying out transactions in accordance with Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System”.

Payment agents (subagents) do not have the right to spend cash in the currency of the Russian Federation, accepted when carrying out transactions in accordance with Federal Law of June 3, 2009 No. 103-FZ “On the activities of accepting payments from individuals carried out by payment agents” (Collection of Legislation of the Russian Federation) Federation, 2009, No. 23, Article 2758; No. 48, Article 5739; 2010, No. 19, Article 2291; 2011, No. 27, Article 3873).

4. Cash payments in the currency of the Russian Federation between participants in cash payments (subject to the maximum amount of cash payments established by paragraph 6 of this Instruction), between participants in cash payments and individuals for transactions with securities, under real estate lease agreements, for the issuance (return) ) loans (interest on loans), for the activities of organizing and conducting gambling are carried out at the expense of cash received at the cash desk of the participant in cash payments from his bank account.

5. Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments and individuals are carried out without limiting the amount.

6. Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments within the framework of one agreement concluded between these persons can be made in an amount not exceeding 100 thousand rubles or an amount in foreign currency equivalent to 100 thousand rubles at the official exchange rate of the Bank of Russia on the date of cash payments (hereinafter referred to as the maximum amount of cash payments).

Cash payments are made in an amount not exceeding the maximum amount of cash payments in the fulfillment of civil obligations provided for in an agreement concluded between participants in cash payments and (or) arising from it and executed both during the validity period of the agreement and after its expiration. actions.

Cash payments are made in an amount not exceeding the maximum amount of cash payments when a credit institution issues cash upon request for the return of the balance of funds transferred to a special account with the Bank of Russia, the procedure for opening and maintaining which is determined by the Directive of the Bank of Russia dated July 15, 2013 No. 3026-U “On a special account in the Bank of Russia”, registered by the Ministry of Justice of the Russian Federation on August 16, 2013 No. 29423 “Bulletin of the Bank of Russia” dated August 28, 2013 No. 47).

Without taking into account the maximum amount of cash payments, cash in the currency of the Russian Federation received at the cash desks of participants in cash payments is spent in accordance with paragraph 2 of this Directive for the following purposes:

payments to employees included in the wage fund and social payments;

for personal (consumer) needs of an individual entrepreneur not related to his business activities;

issuance to employees for reporting.

7. This Directive comes into force 10 days after the day of its official publication in the Bulletin of the Bank of Russia. Chairman of the Central Bank

of the Russian Federation E. S. Nabiullina

Minimum size

In practice, most companies pay amounts in the form of half the monthly salary, taking into account salaries (tariff scale), monthly benefits.

When calculating the advance payment, bonuses, sickness benefits, allowances and other amounts are not taken into account. When calculating the minimum value, the monthly amounts are initially reduced by the number of tax payments withheld, and forty percent is taken from the remaining amount.

Nuances

The main aspect that must be taken into account when calculating the advance payment is that in legislative documents it is designated as wages for the first half of the month, in other words, when calculating it, you must follow the same rules as when calculating wages.

The differences between prepayment and basic salary are as follows:

- when calculating the advance payment, they do not take into account the amount of bonuses, allowances, and social benefits;

- no deduction of income tax from the employee and other types of deductions from salary;

- Amounts of payment for vacation, illness, daily allowance, etc. are not included.

As a result, the calculation of the advance payment must be approached as carefully as in the case of salary calculation.

Do I need to pay personal income tax?

When paying wages, the employer is a tax agent, withholding income tax from the employee's income. Wages become income based on taxation requirements on the last day of the current month (clause 2 of Article 223 of the Tax Code of the Russian Federation). However, at the time of payment of the advance, the employee’s income for this time has not yet been received and, at the same time, there are no grounds for paying income tax from employees.

But if the date of receipt of the advance payment is set on the final day of the month, the tax authorities may recognize this payment as income for the past period. In this case, the company will have to calculate personal income tax twice a month.

In what situations is the minimum size used?

The minimum size usually applies in a few main cases. All of them are described in detail in the law under number 255, but the main ones will be the following.

- The man did not work at the company for long. Typically this period is less than 6 months.

- There is no earnings for the billing period or the amount is less than the established one.

- Incapacity for work occurred as a result of intoxication.

- The person was on sick leave, but did not comply with the prescribed regimen.

In this case, the formula for average daily earnings will be as follows:

SDZ = minimum wage × 24 / 730.

Important! It must be remembered that from the beginning of this year the minimum wage for calculating sick leave is 11,280 rubles. In addition, you need to apply coefficients for calculation.

Excerpt from Article 7 of Federal Law No. 255

If the time is not fully worked out

It is not uncommon for employees to work not the whole month, but only part of it.

The prerequisites for this are extremely diverse, for example:

- exit not from the very beginning of the month;

- dismissal;

- certificate of incapacity for work;

- leave (regular, educational, without pay);

- partial or incomplete work.

To understand how to correctly calculate an advance, you need to refer to the legislation. The requirements of the Ministry of Labor are that the employer must pay a salary advance for actual hours worked, so it is collected even if the first half of the month has 1 working day.

To calculate wages for part-time work for employees, you need to know the number of working days.

Calculation example. An employee with a salary of 45,000 rubles. worked for 5 days and went on sick leave, which by the time the advance was calculated had not yet been transferred to the accounting department.

To calculate, you need to know the total number of working days per month, of which only 3 days are taken into account.

An example of how a salary advance is calculated:

- 45000 / 20 = 2250 rubles - average daily salary;

- 2250 x 5 = 11250 rubles - salary for hours worked;

- 11250 x 13%= 1463 - income tax on accrued wages;

- 11250 - 1463 = 9787 rubles - wages minus income tax.

Rules for determining the amount of travel allowances

All issues related to business trips are regulated by modern legislation and articles of the modern labor code. We are talking about chapter 24, articles:

- 166 – concept and definition.

- 167 – guarantees provided.

- 168 – reimbursement of expenses incurred.

If a question arises regarding the correct calculation of travel allowances, you need to refer to the regulations listed above.

Calculation of average wages

Today, the exact amount is calculated based on the average earnings received. It is calculated according to the following scheme:

The total wages for the reporting period are divided by days worked.

The same exact formula is used to calculate the average required to pay for a business trip. Payment is due for the entire day that the person worked on a business trip, the time spent on the road and the period of probable forced delay or stop.

Accordingly, the average payment for days spent on a business trip is determined by the formula of dividing all allocated funds by the time worked in days. When summing up your salary, all taxable payments are included in the calculation:

- Premium transfers.

- Incentives.

- Rewards.

Social benefits and various types of one-time transfers are not taken into account when making calculations.

At some enterprises, not daily wages, but hourly wages are used to pay for work. The work schedule may not be clear, but flexible. Hours spent on business travel will be paid at a salary or at established hourly and tariff rates.

If the salary was increased, an increase was accepted or an additional payment was made for the time a person was on a trip, the average salary should be indexed.

Charges for weekends and holidays

If an employee on a business trip on standard weekends or holidays is forced to work, he will be charged double pay. In some cases, he is provided with days of rest at the rate of one day off per day of work, everything depends on the internal rules of the organization.

Work on a business trip on holidays and regular weekends will be paid only if a corresponding order has been received from the manager.

Other mandatory payments

Along with the average salary per working day, the organization is obliged to provide employees with funds to pay for expenses such as:

- Transport services;

- Meals during a business trip;

- Renting a home or staying in a hotel.

The business traveler must submit information about expenses incurred three days after arrival. This should be a kind of report with tickets attached to it, receipts from public catering establishments, and hotel bills. If an employee has funds left after counting, he must return them to the cashier.

What about vacation?

How to correctly calculate an advance payment in case of vacation? Let's consider this issue in more detail.

There are rules for calculating an advance payment in cases where an employee works for an incomplete reporting period. The most important prerequisite for absence is leave, regardless of its type (paid or at your own expense).

You may be interested in: Why SMS are not sent to number 900: description of problems, possible solutions

An example of how an advance payment is calculated after a vacation. So, if the weekend ended on the 12th, and the employee started work on the 13th, the administration must pay him wages within 3 working days (13, 14 and 15).

If the vacation ends on the 15th, and the employee comes to work on the 16th, then the accounting department has the right not to give him an advance, since there was practically no time in the first half of the month. In this case, the employee cannot appeal the administration’s decision.

Features for business trips

How is a salary advance calculated during a business trip? Let's look at the answer below.

From time to time, an inexperienced accountant finds it difficult to issue an advance to people on a business trip. In this case, the employee performs his official duties while being in another territory, and therefore there should be no issues with the calculation of the advance payment.

If the accountant does not have information that the employee does not go to work for some reason (for example, he is sick), then all days are considered working days, but his wages are not charged at the tariff rate, but based on the average income for 12 months with receiving bonuses, sick leave and vacation pay.

In this case, the advance is written off entirely for the first part of the billing period when calculating the number of working days, but is taken into account not according to wages, but according to average earnings.

It often happens that in this case the employee loses his salary. The administration may issue an order to compensate for losses, and when calculating the final salary for the employee, the amounts will be recalculated.

New procedure for cash payments from June 1, 2014

1. In connection with this, the procedure for making cash payments has changed.

2. What has changed in the procedure for cash payments and what points to pay special attention to.

3. What legislative and regulatory acts regulate the procedure for cash payments (with the opportunity to familiarize yourself with these documents).

Since June 1, 2014, a new procedure for cash payments has been in effect, approved by the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U “On cash payments.” With the adoption of this document, the previously applied Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash settlements and the expenditure of cash received at the cash desk of a legal entity or the cash desk of an individual entrepreneur.” So, let's look at what changes have occurred in the rules for cash payments by legal entities and individual entrepreneurs since June 2014.

In order to understand what innovations have occurred in the procedure for cash payments since June 1, 2014, I propose to compare the provisions of the Instruction of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U, which entered into force, with the provisions of the previously effective Instruction of the Bank of Russia dated June 20. 2007 No. 1843-U.

| Provisions that have changed | New procedure, effective from 06/01/2014 (Instruction No. 3073-U) | The procedure is valid until 06/01/2014. (Instruction No. 1843-U) |

| 1. The purposes for which individual entrepreneurs and legal entities have the right to spend cash received in their cash registers for goods (work, services) sold, as well as received as insurance premiums |

(Clause 2 of the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U) |

(Clause 2 of Bank of Russia Directive No. 1843-U dated June 20, 2007) |

| 2. The maximum amount of cash payments between participants in cash payments (legal entities, individual entrepreneurs) | Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments within the framework of one agreement concluded between these persons can be made in an amount not exceeding 100 thousand rubles or an amount in foreign currency equivalent to 100 thousand rubles at the official exchange rate of the Bank of Russia on the date carrying out cash payments. Cash payments are made in an amount not exceeding the maximum amount of cash payments in the fulfillment of civil obligations provided for in an agreement concluded between participants in cash payments and (or) arising from it and performed both during the period of validity of the agreement and after the expiration of its validity period. (clause 6 of the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U) | Cash settlements in the Russian Federation between legal entities, as well as between a legal entity and a citizen carrying out entrepreneurial activities without forming a legal entity, between individual entrepreneurs related to the implementation of their entrepreneurial activities, within the framework of one agreement concluded between these persons, can be made in in an amount not exceeding 100 thousand rubles. (Clause 1 of Bank of Russia Directive No. 1843-U dated June 20, 2007) |

| 3. Restrictions on payments from the cash register of legal entities and individual entrepreneurs when making payments for certain transactions | Cash payments in the currency of the Russian Federation between participants in cash payments (subject to the maximum amount of cash payments), between participants in cash payments and individuals for transactions with securities, under real estate lease agreements, for the issuance (repayment) of loans (interest on loans), activities related to the organization and conduct of gambling are carried out at the expense of cash received at the cash desk of the participant in cash payments from his bank account. (clause 4 of the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U) | Not installed |

Now let’s look in more detail at each change in the procedure for cash payments from June 1, 2014.

1. Purposes for which it is permitted to issue cash from the cash register

The issuance of cash for the personal needs of an individual entrepreneur is officially enshrined in the new Directive of the Central Bank of the Russian Federation No. 3073-U as one of the permissible purposes for spending cash received at the cash desk for goods, works, and services sold.

Let me remind you that the previously effective Directive No. 1843-U did not contain direct permission for the payment of funds from the cash register for the personal needs of an individual entrepreneur, however, a ban on such payments was also not established. In this regard, doubts arose about the legality of issuing cash for the personal needs of an individual entrepreneur. The new Directive of the Central Bank of the Russian Federation “On cash payments”, effective from 06/01/2014, eliminates these doubts and clearly allows individual entrepreneurs to issue cash for personal needs not related to business activities.

In addition, the new procedure for cash payments specifies payments from the cash register to employees: payments included in the wage fund and social payments, as well as the issuance of cash on account. Previously, in addition to wages, stipends and travel allowances, “other payments to employees” were indicated, which caused discrepancies.

2. Limit amount for cash payments

The maximum amount of cash payments between participants in cash payments (legal entities and individual entrepreneurs) has not changed and remains equal to 100 thousand rubles within the framework of one agreement. However, the Directive of the Central Bank of the Russian Federation, in force since June 1, 2014, clarifies that this restriction applies both during the validity period of the contract and at the end of the contract. For example, if the contract establishes a validity period, and at the end of the validity period the buyer (customer) has outstanding accounts payable, then the payment of this debt will also be subject to a limitation on the amount of cash payments.

! Please note: Both the recipient and the payer of funds must comply with the established limit for cash payments. In this case, the limit applies to all payments within the framework of one agreement and does not matter:

- Type of contract. That is, the maximum limit for cash payments must be observed both in relation to payments under the loan agreement and in relation to payments under the contract for the supply of goods.

- The term of the contract and the payment procedure for it. For example, when making cash payments under a lease agreement, the amount of all lease payments should not exceed 100 thousand rubles, even if each payment individually is less than this amount. At the same time, it is allowed to make payments under different contracts within one day, each of which is less than 100 thousand rubles, even if the total amount of such payments exceeds the maximum amount for cash payments.

- Type of obligation: provided for by the contract, an additional agreement thereto, or arising from the contract. For example, it is impossible to pay a penalty under a contract in cash if, together with the principal amount of the contract paid in cash, it exceeds 100 thousand rubles.

- Payment method: through the cash register or through an accountable person.

! The limitation on the maximum amount of cash settlements is established in relation to settlements between participants in cash settlements who are legal entities and individual entrepreneurs. At the same time, in accordance with clause 5. Directive of the Central Bank of the Russian Federation No. 3073-U, cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments and individuals are carried out without limiting the amount.

That is, if an organization or individual entrepreneur has entered into an agreement with an individual, for example, for the rental of property, then the limitation on the maximum amount of cash payments (100 thousand rubles) will not apply to payments under such an agreement.

3. Requirements for the procedure for payments from the cash desk for individual transactions.

Directive of the Central Bank of the Russian Federation No. 3073-U, which came into force on June 1, 2014, introduces a restriction on cash payments from the cash register. Certain types of settlements can be carried out exclusively at the expense of money received at the cash desk from the current account:

- on transactions with securities,

- under real estate lease agreements,

- on issuance (repayment) of loans (interest on loans),

- on the activities of organizing and conducting gambling.

This restriction applies to settlements carried out both by legal entities and individual entrepreneurs, and with the participation of individuals. For example, under a real estate lease agreement with an individual, the tenant, who is an organization or individual entrepreneur, can pay rent in cash only if they are withdrawn from the current account.

According to Art. 15.1 of the Code of Administrative Offenses of the Russian Federation “violation of the procedure for working with cash and the procedure for conducting cash transactions, expressed in the implementation of cash settlements with other organizations in excess of the established amounts...” entails the imposition of an administrative fine:

for officials in the amount of 4,000 to 5,000 rubles;

for legal entities - from 40,000 to 50,000 rubles.

! Please note: from June 1, 2014, the procedure for conducting cash transactions by organizations and individual entrepreneurs has also changed. Read more in the article New procedure for conducting cash transactions.

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any comments or questions, write to us and we’ll discuss them!

Legislative and regulatory acts

1. Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U “On cash payments”

2. Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash payments and the expenditure of cash received at the cash desk of a legal entity or the cash desk of an individual entrepreneur”

3. Code of Administrative Offenses of the Russian Federation

Find out how to read the official texts of these documents in the Useful sites section

Payment order

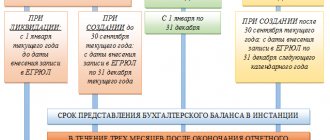

In accordance with the amendments to Article 136 of the Labor Code of the Russian Federation, 2 terms for payment of wages are provided:

- from the 1st to the 15th day, when payment is made for the second half of the month spent;

- from the 15th to the 31st day - days of receiving wages for the first part of the month, which implies an advance.

A specific payment date is indicated in one of the main documents that regulate the relationship between employees and the employer:

- inner order rules;

- labor or collective agreement.

The definition of “advance payment” is not used in the rules; both payments are called earnings.