This material will describe in detail how a citizen can prove black wages by appealing to a higher court. Cases when a company employee receives a black salary are not uncommon.

In this situation, the employer has several courses of action: draw up an employment contract, where there will be no salary, in the second case, not conclude a contract at all, i.e. do not support the employment relationship with official documents. For the management of the enterprise, the second option is the most profitable, because the obligation to pay taxes for the employee is removed; in fact, the employee does not exist (according to the documents).

Why does an employer give employees unpaid wages?

As mentioned above, for an employer, a black salary is a beneficial solution; below are several examples of such benefits:

- the employer does not need to pay taxes to the pension fund and tax office. In the case of a commercial enterprise, this significantly reduces costs and allows you to make more profits;

- The second important aspect is that black wages represent a kind of leverage, with its help the company’s management can completely manipulate the staff. An example would be the following situation: the employer, by order, wants to leave employees at the workplace after the end of the working day to perform some tasks, but the employees refuse. In this case, the manager may well deprive employees of wages, which are not officially stated anywhere.

The above situation is a common example of when there is a malicious violation of the rights of an employee as prescribed in the Labor Code of the Russian Federation. In order to prove this fact of violation, it is necessary to thoroughly prepare and provide exceptional evidence to the court.

Tax office

The Tax Inspectorate is authorized to conduct audits of organizations regarding their payment of taxes, including personal income tax. The reason for the inspection may be a complaint from an employee of the organization. Based on the results of such an inspection, a decision may be made to bring the employer to administrative liability with the imposition of a significant fine. Before filing a complaint with the tax authority, you should collect all possible evidence confirming the fact that the employer committed violations.

You should contact the tax authority at the location of the organization. You can file a complaint against your employer either in writing or orally. To complain verbally, you can call the special phone number listed on the Federal Tax Service website and provide information regarding the illegal payment of wages. This method is convenient because you can complain about an employer anonymously. The written application must contain the name of the authority to which it is addressed, the name of the employer and his address, the details of the complainant, his signature and date.

Responsibility of an employee receiving menial wages

Responsibility for workers who work without an employment contract and receive unofficial wages:

- in this situation there is a significant risk that the employee will not be able to receive wages for the working period;

- in most cases, there are often situations when the employer does not pay employees wages or vacation pay, which is contrary to the legislation of the Russian Federation;

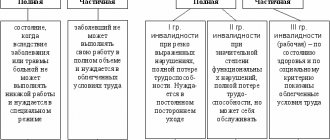

- a small benefit that is paid during an employee’s illness. This compensation will be paid based on officially documented income. It should be noted that if a citizen leaves this workplace, this type of benefit will be paid for two years, in the amount that was established by the previous employer;

- For women who are planning to go on maternity leave, working at such an enterprise is extremely unprofitable. Maternity benefits will be accrued at the minimum rate;

- if a person has worked unofficially all his life, provided that the employer has not made any contributions at all, then the size of his future pension will be set at the minimum rate and will not exceed several thousand rubles.

Homemade fines

According to the acting chief state labor inspector of the Oryol region, Sergei Avdeev, many resort to tricks when hiring and firing. Employment contracts drawn up in violation of the law are becoming increasingly common. And employees are not always aware of the violation of their rights. For example, contracts do not include clauses on bonuses and other conditions of payment for vacation and labor. They are often made indefinite - they do not indicate an expiration date. Taking advantage of this, the director begins to intimidate the employee - they say, I will terminate the contract at any time. In addition, the conditions include illegal clauses on sanctions - fines for disclosing trade secrets and more. Only the state has the right to levy fines, but this does not bother employers. Internal financial sanctions for non-compliance with orders and instructions, non-compliance with labor discipline and work rules have become commonplace. They are also fined for early termination of a contract on the initiative of an employee who decides to leave for another company. All this violates the norms of the Labor Code.

“Only in the fourth quarter of 2021, according to our requirements, changes were made to approximately 200 employment contracts,” said Sergei Avdeev. — The practice of concluding contract agreements with employees and using agency labor has also developed. This can be regarded as evasion of formalizing labor relations.

Employers include illegal sanctions clauses in contracts, for example for disclosing trade secrets

The employee signs a civil contract, thereby freeing the director’s hands. It’s as if he doesn’t hire the employee, and therefore doesn’t provide a social package. The subordinate does not go on vacation, cannot issue sick leave, is deprived of bonuses, etc. And he can be “fired” for a formal reason. And the state inspectorate does not have enough powers to protect such people.

“The labor inspector does not have the right to qualify the nature of the legal relationship between the parties,” explained Sergei Avdeev. — Therefore, employees go to court with claims to establish the fact of labor relations and force the employer to formalize them in accordance with the law.

Over the past year, 551 violations were identified in the Oryol region in the field of payment and labor regulation, and 250 in the registration of labor relations. We also found enterprises that paid wages below the minimum wage. In some places, no special assessment of working conditions was carried out, which is why workers did not receive the “harmful” bonuses required by law.

Our lawyers know the answer to your question

Free legal advice by phone: in Moscow and the Moscow region, in St. Petersburg, as well as throughout Russia.

But there is a category of citizens for whom informal employment is a “saving” measure - these are debtors for alimony, loans and utilities. When issuing a collection order, bailiffs send requests to banking organizations to seize the debtor's accounts. In most cases, unofficial income is issued in person, and all payments are made within the organization, without involving a bank. It is quite difficult to prove the fact of concealment of income in court for alimony; in this case, it is best to contact a competent lawyer.

ATTENTION !!! Today, official employment and salary are mandatory requirements for many transactions related to real estate, finance, etc. For example, a person who earns unpaid wages will not be able to get a loan, because... he does not have documents confirming his income. Therefore, in some situations it is necessary to prove the fact of black payments. This procedure will be discussed in detail below.

Judgment

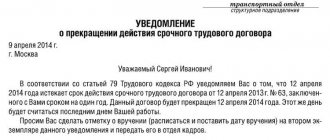

General rules for the consideration of civil cases by the court are carried out within two months from the date of filing the application. The period for making a decision on the commencement of legal proceedings takes five days. But, if we are talking about collecting wages, then such a case relates to the labor sphere, which means there is a shortened period for making decisions. It is often easier for an employee to report a violation to IT Russia than to send a complaint to the judicial authorities.

Many people turn to the specialists of our portal for advice - what to do if they receive their salary in envelopes, how to prove it? Let us note that Russian legislation does not provide for a mandatory list of evidence on the basis of which the court will issue a decision to punish the employer. In the article we have already indicated what factors can have a beneficial effect on the outcome of the case, i.e. The more evidence is provided, the higher the likelihood of winning the case.

In view of this, it is recommended to initially send complaints to both the tax and labor inspectorates.

This will allow regulatory authorities to begin an unscheduled inspection of the organization and identify all violations. And the decisions they make will be irrefutable evidence in favor of the plaintiff.

By the way, if you complain about receiving a “gray salary”, which involves concluding an employment contract with a minimum salary, the likelihood of a positive court decision is very high. If the work involves only menial payments, then proving anything is quite problematic.

If you are faced with such a situation, it is recommended to get a free consultation from the specialists of our portal. Lawyers, having delved into the nuances of the case, will be able to provide more detailed information on what needs to be done and how to force management to pay the money owed to you.

How can I collect

First of all, you need to find out where to go to recover wages from your employer. To begin with, a citizen needs to go to court, where most labor disputes are resolved. When contacting the labor inspectorate or the prosecutor's office, the person will be asked to go to court, since such issues are beyond the competence of these departments.

In court, the employer must prove the following facts:

- he made full payments of wages to the employee;

- confirmation of the fact that the money was in the hands of the employee.

In turn, the employee must prove to the court and justify why he is claiming the amount of payment presented. In case of official employment, when the contract is concluded, but the full amount of wages is not specified in it, it is necessary to have confirmation of this fact in advance.

IMPORTANT !!! Judicial practice regarding labor disputes in Russia is ambiguous. Even if the employee can prove the fact of deception on the part of management, this will not become a fact of satisfaction of the filed claim.

What is called “black” salary or “salary in an envelope”

To understand the difference between wages paid according to the law and income received in an “envelope”, you need to compare all options for paying employees:

| Type of salary | Description |

| “White” wages | Official income. The full amount of the salary is subject to accounting when calculating the amount of contributions to the tax service and extra-budgetary funds (PFR, Social Insurance Fund, Compulsory Medical Insurance). |

| “Black” wages | Income that the employer gives to subordinates in cash without an officially issued statement. No deductions are made from earnings to the Federal Tax Service and extra-budgetary funds, and therefore the employer hides the money paid to employees from supervisory authorities. |

| “Gray” wages | The employer verbally agrees with the employees that a small part of the salary will be paid officially, with the deduction of personal income tax and insurance contributions, and the majority of the salary will be paid in cash without entering amounts into the statements. Thus, the employer partially shows the employees’ earnings to supervisory authorities, and partially hides them. At the same time, the employment contract specifies the amount of the “white” (small) salary recorded in the accounting department, and the remaining amounts remain unknown to the tax service. |

Filing a claim and required documents

When filing an application with the court, the employee must clearly state his requirements and attach the necessary evidence. The best way is to hire an experienced lawyer who will help you correctly draw up an application and collect all the necessary documents.

Today the court can consider the following claims:

- the employer did not pay wages upon dismissal of the employee from the workplace;

- the employer does not pay wages on time, and the last payment was more than 2 months ago.

How to extract money from an employer without going to court?

Many people who are not officially employed and receive income “in an envelope” are interested in what to do if they did not pay a gray salary upon dismissal.

It is worth noting that the current legislation establishes a fairly short period during which an employee can go to court to protect his own rights. It is only three months. At the same time, not everyone wants to bring the case to court and are looking for ways to influence a dishonest employer.

In such a situation, you should write a written statement to the employer, in which you need to set out in detail when and what position you held. It is recommended to describe in detail how wages were calculated and indicate the amount of debt. You need to make it clear to the employer that your rights have been violated.

It is required to write that for late payment of wages upon dismissal, the head of a particular organization may be prosecuted under Article 145.1 of the Criminal Code of the Russian Federation. It is important to establish a requirement to immediately pay due wages. It must be returned within three days.

If the request is ignored, indicate that otherwise you will be forced to go to court to protect your rights. In addition, a corresponding application will be drawn up to law enforcement authorities to bring the head of the company to criminal liability for non-payment of wages or incomplete payment of taxes. As a rule, this method really works, since company managers do not want to get involved with the tax office.

Other ways to apply

A citizen can also apply for an inspection at the labor inspectorate. The citizen’s documents will be accepted and a check will be scheduled regarding this fact with the involvement of other authorized bodies. As a rule, the inspection is on-site and will be carried out directly in the management’s office. Computer equipment will be inspected and working documentation will be seized; in addition, information about the enterprise’s income will be transferred to the tax office to establish the fact of non-payment of taxes.

In another situation, if it is necessary to collect alimony from the ex-husband, and there is a fact of black wages, then the court in this case will issue a writ of execution to seize movable and immovable property. It is through this that debts on alimony payments will be repaid. In this case, it is difficult to collect money from unofficial wages, since its amount can be deliberately reduced by the employer by agreement with the debtor and at the same time it is impossible to document the income.

Prosecutor's office

The prosecutor's office exercises general supervision over the observance of citizens' rights, and labor rights are no exception. You can complain about the payment of black wages by writing a written appeal or going to an appointment with the prosecutor or his assistant. You must contact the prosecutor's office of the district where the organization is located. The content of the complaint must be the same as the complaint to the labor inspectorate. Documents confirming the presence of violations should be attached to the application to the prosecutor's office.

The most effective will be a collective complaint that contains the signatures of several employees of the employing organization. Based on the results of the submitted application, an audit will be carried out. If the facts set out in it are established, an order will be issued to the employer to eliminate violations of the law.