A standard employment contract for microenterprises is a special document developed by the government for small companies and individual entrepreneurs. It allows you to reduce the burden on SMEs - both documentary and administrative. Let's look at a sample of a standard employment contract with an employee (2019) using examples.

From 01/01/2017, the types of employment contracts were supplemented by a new document - a standard form of an employment contract with an employee for micro-enterprises. It was developed by the Ministry of Labor and approved by Government Decree No. 858 dated August 27, 2016. The document is universal and replaces some personnel documents (Federal Law No. 348-FZ dated July 3, 2016).

Who has the right to use a standard form of an employment contract with a micro-enterprise employee

Microenterprise status is granted to organizations and individual entrepreneurs with hired employees that meet the following criteria:

- Staff no more than 15 people.

- Income for last year was no more than 120 million rubles.

Other employers who do not fall under these criteria can also use the sample standard employment contract (2019), but do not have the right to refuse other personnel documentation in this regard.

A standard employment contract with an employee (sample 2019) is convenient because it takes into account the requirements of Article 57 of the Labor Code of the Russian Federation for agreements between employers and their employees, and reduces the risk of receiving a fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation, which provides for administrative liability for:

evasion or improper execution of an employment contract, or the conclusion of a civil contract that actually regulates the labor relationship between the employee and the employer.

Fine:

- for an official - 10,000–20,000 rubles;

- for an organization - 50,000–100,000 rubles;

- for individual entrepreneurs - 5,000–10,000 rubles.

To start using the standard form, it is enough to issue an appropriate order for the organization.

IMPORTANT!

The form is not suitable for conclusions with foreign citizens.

Micro-enterprise criteria, number

The Labor Code has been supplemented with a new chapter 48.1, which establishes the specifics of regulating the labor of persons working for employers - small businesses included in the category of micro-enterprises.

In particular, from January 2020, “micro-babies” will have the right to organize simplified personnel document flow. Note: See simplified accounting for microenterprises.

Individual entrepreneurs and organizations related to micro-enterprises (Article 4 of Law No. 209-FZ) included in the relevant register, the average number of which for the previous calendar year does not exceed 15 people and the total income from all types of business activities for the previous year, determined in the manner established by the legislation of the Russian Federation on taxes and fees, does not exceed 120 million rubles - received the right from 01/01/2017 to simplify their personnel document flow.

You will lose the status of a MICRO enterprise if the amount of income or the average number of employees exceeds the limit values for three calendar years in a row (Part 4 of Article 4 of the Law of July 24, 2007 No. 209-FZ). And even if the upper values are for a Small Enterprise, then the company will be excluded from the register no earlier than July 1 in three years (letter of the Federal Tax Service of Russia dated August 23, 2020 No. SA-4-14/15480).

If a micro-enterprise loses its status, then within four months the employer will have to bring labor relations to the general order.

In particular, the named subjects may not adopt local acts containing labor law norms, such as (Article 309.2 of the Labor Code of the Russian Federation):

- labor regulations of the organization;

- wage regulations;

- bonus regulations;

- shift schedule.

The list is open - the norm also provides for “other documents”. But this “openness” is still conditional, otherwise it is unlikely that some of the relaxations (initially stated in the bill) would have been “lost.” By the way, some of them disappeared after public discussion of the project by the time it was submitted to the State Duma: the first version assumed that the vacation schedule would no longer be mandatory for micro-enterprises (Article 123 of the Labor Code of the Russian Federation), such employers would not have to approve the form of the pay slip (Article 136 of the Labor Code RF).

to menu

https://youtu.be/V2TYYybxY40

What personnel documents can you refuse?

All micro-enterprises that transfer workers to a standard uniform may not have to issue the following personnel documents:

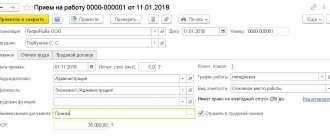

- orders on hiring and dismissal;

- wage regulations;

- bonus regulations;

- inner order rules.

Reason: a sample standard employment contract with an employee (2019), developed for micro-enterprises, already includes all the necessary rules and conditions for the employee’s activities.

What must be included in an open-ended employment contract

The list of mandatory details in employment agreements is listed in Article 57 of the Labor Code of the Russian Federation. The standard agreement for microenterprises is no exception, therefore it stipulates:

- employer details and full name employee;

- employer's TIN and employee's passport details;

- place and date of conclusion;

- employee's place of work;

- the nature of the work to be performed (job title (profession) and job responsibilities);

- deadline for starting work;

- the amount of the salary and the terms of its payment (indicating specific dates, place and method of payment);

- work and rest schedule;

- information about social insurance;

- information about working conditions based on the results of a special assessment;

- additional conditions, if necessary (if working conditions are recognized as harmful or dangerous, appropriate compensation is prescribed; if the nature of the work is specific, this fact is indicated).

There are conditions that an employment contract (completed sample) should not contain. The agreement may not:

- combine main work and part-time work (part-time work itself is not prohibited, but it must be documented in a separate document);

- establish a labor regime that violates the provisions of the Labor Code of the Russian Federation;

- include a condition on payment of wages below the minimum wage;

- set salary payments only once a month.

How to fill out a standard contract

A typical employment contract (form) includes several different work situations. This is a constructor that each employer collects for himself, and the document contains only the information that is necessary for cooperation with a specific employee. The standard form contains correct wording that complies with the norms of the Labor Code of the Russian Federation for all situations, including cooperation with remote and home-based workers, so there is no need to add anything to it.

Employers can simply download a free sample employment contract (2019) at the end of this article. But it is necessary to learn how to fill it out correctly, because working conditions may differ, and you will have to fill out the document differently.

The standard form developed by officials is quite large. It contains 38 points, combined into 11 chapters. But not everything needs to be filled out. We will show you which points to omit using the example of step-by-step filling out an employment contract with an employee hired for the position of sales department manager.

Step 1. The “General Provisions” section must be completed by all employers. It is intended to indicate information about the organization and the employee, so we enter in the form the full name of the employer and his address, as well as the last name, first name, patronymic and position of the future employee. If an employment test is provided for an employee, its duration must be indicated. In the same section you need to write:

- nature of work - main or part-time;

- validity period (if urgent);

- information about when the employee starts work;

- where his workplace will be located.

The employment contract must contain information about the traveling nature of the work. If there are no special features, you can write that “the employee does not have a special nature of work.”

Step 2. In the “Employee Rights and Responsibilities” section, you need to describe all the responsibilities of the new specialist and his rights in accordance with the Labor Code of the Russian Federation and the collective agreement. If desired, the employer can add agreements with a specific employee to the standard text.

Step 3. The section “Rights and Responsibilities of the Employer” informs about the functions of the employer. Here you can add your own conditions to the standard ones.

Step 4. In the “Employee remuneration” section, you need to be careful if the organization has waived the provision on remuneration. It describes in detail the composition of wages. The standard form contains several types of payments; the employer only has to select the ones he needs and indicate the amount:

- official salary;

- compensation payments (for work in hazardous conditions, use of personal transport, etc.);

- incentive payments (bonuses and incentives);

- other payments.

The section indicates the frequency of payments and specific dates, conditions and method of payment - to a bank card, account or cash.

Step 5. In the section “Working time and rest time of the employee” they write about the length of the working day, rest time, weekends and vacations.

Step 6. The “Labor Safety” section is dedicated to the employee’s working conditions. If necessary, we indicate the mandatory requirement and frequency of a medical examination. If the employee is required to wear personal protective equipment, enter which ones.

Step 7. The section “Social insurance and other guarantees” is not needed by everyone. It is filled out if the employer is obliged to pay for the employee’s training, voluntary health insurance policy, or trips to a sanatorium.

Step 8. Completing the section “Other terms of the employment contract” may be required when employing homeworkers, remote workers, or when concluding an agreement with an individual entrepreneur.

Step 9. The section “Changing the terms of the employment contract” contains general information that the terms of the contract can be changed only by agreement of the parties.

Step 10. In the section “Responsibility of the parties to the employment contract” the standard conditions remain.

Step 11. Section 11 “Final Provisions” is intended to indicate the details of the parties, as well as the signature of the employee under all the rules and regulations with which he is familiar. The employer is obliged to familiarize him with:

- with a collective agreement (if there is one);

- job responsibilities;

- various instructions of the organization.

The employee must receive a second copy of the agreement, signed by the head of the employing company.

Remember: a unified labor contract allows you to optimize your work, but does not relieve you from the need to monitor changes in legislation and, if necessary, make the necessary adjustments to the document.

Features of document flow

According to the current general rules and regulations, work with documentation in organizations that have this status does not differ from the general procedure, but has its own characteristics. All documentation must be maintained in strict accordance with the requirements of current legislation.

In practice, documents are drawn up by those specialists who have the necessary specialized knowledge. Structural divisions can maintain accounting forms of documents - books, magazines.

However, in micro-companies things are a little different. The thing is that since the number of workers is small, a large volume of documents will not be required. For this reason, as a rule, an organization can appoint one specialist who will be responsible for the preparation and storage of the necessary documentation. This could be a secretary, assistant manager, or personnel specialist. At the same time, it would be correct to entrust the maintenance of financial documents to an accountant.

Lack of local regulations

The current legislation stipulates that the head of the company is obliged to organize work on the development and approval of internal regulations. These include:

- collective agreement;

- internal safety rules for workers;

- provision for cash payments.

The list is not exhaustive. The manager, at his own discretion, has the opportunity to approve other internal acts.

In such a situation, the head of a micro-enterprise has some advantages.

The whole point is that he can decide on the need for a particular provision. In other words, the manager, at his own discretion, has the right to partially or completely refuse to accept and sign any internal rule.

It should be noted that in case of loss of its status, the company must switch to the implementation of general standards within four actual months, that is, develop and approve the necessary internal rules and regulations.