With whom can you sign a full financial liability agreement?

The list of positions and work replaced or performed by employees with whom it is possible to conclude a standard agreement on full individual financial liability for shortages of entrusted property was approved by Resolution of the Ministry of Labor No. 85 dated December 31, 2002. The

list consists of two sections. The first indicates positions with which it is possible to conclude an individual agreement on full individual financial responsibility for 2020. The second lists the types of work, the implementation of which also allows you to conclude a financial liability agreement.

https://www.youtube.com/watch{q}v=Z00pHc86VFQ

The employer does not have the right to enter into written agreements on financial liability if the position or specific work is not provided for in the specified List.

The list of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for shortages of entrusted property was approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85.

The list consists of two sections. The first contains positions that provide for the conclusion of individual agreements on full financial responsibility with the employees replacing them. The second section lists types of work, the performance of which also allows the employer to conclude individual agreements with employees on full financial responsibility.

The employer does not have the right to enter into written agreements on individual financial responsibility if the employee’s position or the specific work assigned to him is not provided for in the specified List.

The form of the agreement on full individual financial responsibility is provided for by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85. Accordingly, the employer does not need to develop it independently. However, he may include additional conditions or individual responsibilities for the employee in the standard agreement on full financial liability, or use his own form. There is no need to issue an organization order.

The purpose of this document is to compensate the employee for probable damage in full. At the same time, concluding an agreement is a right, not an obligation of the employer. However, the absence of such an agreement will not allow the employee to be held fully financially liable.

If a compensation agreement is concluded with a newly hired employee, it is important to ensure the following:

- the list of responsibilities specified in the vacancy announcement contains labor functions provided for in the List, or the name of the position itself is included in the List;

- The employment contract itself reflects the condition for concluding an agreement on full individual financial responsibility.

Why is this necessary{q} In the event that a hired employee decides to refuse to assume liability for damages. According to para. 2 clause 36 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2, if the performance of duties for the maintenance of material assets is the main labor function of the employee, which is agreed upon when hiring, and by virtue of the current legislation, an agreement on full material liability, which the employee knew about, refusal to conclude such an agreement should be considered as a failure to fulfill labor duties with all the ensuing consequences. You can use the sample full liability agreement 2020 we prepared as a basis.

Work and rest schedule

6.1. The employee is obliged to perform labor duties provided for in clause 1.1., section 3 of this agreement, during the time established in accordance with the internal labor regulations, as well as during other periods of time that, in accordance with laws and other regulatory legal acts, relate to working hours.

6.2. The employee is assigned a 40-hour work week with a standardized working day.

6.3. The Employer is obliged to provide the Employee with time to rest in accordance with current legislation, namely:

— breaks during the working day (shift);

— daily (between shifts) leave;

— days off (weekly continuous vacation);

— non-working holidays;

- vacations.

6.4. The Employer is obliged to provide the Employee with annual paid leave of duration:

— basic leave [meaning] calendar days (at least 28 days);

— additional vacation [value] days.

back to contents

Sales representative liability agreement sample

When hiring a new salesperson, the employer must be sure that the actions of the new employee will not cause material harm to his company, and if this happens, the damage incurred will be compensated. For this purpose, a liability agreement is drawn up.

There are three types of liability (ML):

- limited;

- full individual;

- collective.

With limited MO, no agreement is entered into, but the employer has the right to recover damages from the employee in the amount of no more than 20% of each salary payment.

When collecting on several grounds, the amount of withholding increases to 50%, and in some cases the limit is 70% of earnings (when serving correctional labor, collecting alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who suffered damage due to with the death of the breadwinner, and compensation for damage caused by the crime).

The seller is obliged to compensate for damage in the following cases:

- causing damage to property or when a shortage is detected at a retail outlet;

- if the employer suffered losses due to actions or inactions of the seller;

- if the amount of damage is determined.

The situation is completely different with full MO.

Agreement

For both individual and collective full MO, a written agreement is concluded. Full compensation for losses is carried out regardless of the amount of wages. A document of this kind is concluded subject to two mandatory conditions:

- The employee has reached the age of majority.

- The employee performs work related to the storage and use of material assets.

We invite you to read: How to track tax payments from an employer

An agreement can be concluded in certain cases, which are provided for in Art. 243 Labor Code of the Russian Federation:

- when the employee is assigned a financial obligation in full for damage caused to the employer in the performance of his job duties;

- if there is a shortage of valuables entrusted to the employee under the contract or received by him under a one-time document;

- when intentionally causing harm;

- if the employee was drunk or under the influence of drugs;

- if he disclosed a commercial or other secret;

- if he has committed a crime or administrative offense (must be established by a court or government agency).

Be sure to draw up an agreement on individual financial responsibility with certain employees, especially with those who deal with the sale of goods, transfer of money, and handle cash.

Then you will be calm that you will be able to obtain compensation from a dishonest or careless and inattentive employee for the harm voluntarily or unwittingly caused to the organization.

A sample agreement on the seller's liability 2020 will help you in drawing up the document.

How to terminate a contract without dismissal

Termination of an agreement on full financial liability is possible for various reasons at any time, for example, when the employer decides to relieve the employee of the material burden for the safety and condition of valuables. An employee may be transferred to another position for which such a function is not provided (we will not hide, as an option, when transferred from the position of “cashier” to the position of “accountant” without performing the duties of a cashier).

In this case, the employer needs to take a number of actions, in particular, conduct an inventory. Based on its results, an act is drawn up. If there are no shortages when reconciling property and, accordingly, claims, a special agreement must be drawn up.

Step 1. Assign an inventory procedure.

Step 2. Determine the members of the commission, in which it is desirable to include a lawyer.

We suggest you familiarize yourself with: The procedure for opening a will, when and how the last will of the deceased is announced

Step 3. Carry out the procedure for reconciling property.

Step 4. Based on the results of the reconciliation, record the immediate result and draw up an inventory sheet.

Step 5. Draw up and sign in 2 copies an agreement to terminate the contract for financial liability. Leave one with the employer, give the second to the employee.

Step 6. Carry out the actual in-person (not over the phone) transfer of property at the address where it is located (for example, if the organization is located in Moscow, it is there), drawing up a transfer and acceptance act based on the results of a preliminary inventory.

Step 7. Draw up an additional agreement to relieve liability of a material nature for the position held by the employee and do not forget to say “Thank you” to the employee for the duties performed.

The date of announcement of the end of the financial liability agreement specified in the agreement means that from that moment the employee is not responsible for the property that was previously entrusted to him.

How to hold an employee accountable

To bring the employee to full financial responsibility, according to Art. 244 of the Labor Code of the Russian Federation, the following conditions must be present:

- reaching the age of 18 years (part 1 of article 244 of the Labor Code of the Russian Federation);

- performing functions that are associated with servicing monetary and commodity valuables, according to the position provided for in the List;

- conclusion of an agreement on full individual financial responsibility;

- committing guilty and illegal actions when servicing valuables entrusted to him;

- causal relationship.

The loss caused to the employer must be documented, for example, by an inventory act. The employee must be required to provide a written explanation as to what caused the incident. If the employee refuses to provide them, it is necessary to draw up a corresponding report.

The amount of damage is determined by actual losses, which are calculated on the basis of market prices prevailing in the area on the day of occurrence, but not lower than the value of the property according to accounting data, taking into account the degree of depreciation of this property.

Compensation for losses is made regardless of whether the employee is brought to disciplinary, administrative or criminal liability for actions or inactions that caused the damage (Part 6 of Article 248 of the Labor Code of the Russian Federation).

The perpetrator may voluntarily compensate in full or in part, or, with the consent of the employer, may transfer equivalent property to compensate for the damage. By agreement of the parties, compensation is possible in installments according to a written obligation of the employee. In this case, the employer has the right to exempt the employee from compensation.

Lost income (lost profits) are not subject to recovery (Article 238 of the Labor Code of the Russian Federation). This restriction does not apply to heads of organizations (Part 2 of Article 277 of the Labor Code of the Russian Federation, Part 2 of Article 15 of the Civil Code of the Russian Federation).

If the employee refuses to compensate for the loss voluntarily, it can only be recovered in court. The employer has the right to go to court within one year from the date of discovery of the damage caused. The court may reduce the amount of the collected amounts, but does not have the right to completely release the employee from the obligation. The court has no right to reduce the amount if the damage was caused for personal gain.

To attract an employee to compensation for damages in accordance with Art. 244 of the Labor Code of the Russian Federation, the following conditions must be present:

- reaching the age of 18 years (Part 1 of Article 244 of the Labor Code of the Russian Federation);

- performing functions that are associated with servicing monetary and commodity valuables, according to the position provided for in the List;

- conclusion of an agreement on full individual financial liability;

- committing guilty and illegal actions when servicing valuables entrusted to him;

- causal relationship.

Damage caused to the employer must be documented, for example, by an inventory act. The employee must be required to provide written explanations as to what caused the damage. If he refuses to provide them, it is necessary to draw up a corresponding act.

The amount of damage is determined by actual losses, which are calculated based on market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of depreciation of this property.

Compensation for damage is made regardless of whether the employee is brought to disciplinary, administrative or criminal liability for actions or inactions that caused damage to the employer (Part 6

Art. 248 Labor Code of the Russian Federation

).

https://www.youtube.com/watch{q}v=gjztiC70D8M

The employee who caused the damage may voluntarily compensate it in full or in part, and may, with the consent of the employer, transfer equivalent property to compensate for the damage. By agreement of the parties, compensation for damage is possible in installments according to a written obligation of the employee. In this case, the employer has the right to exempt the employee from compensation for damage.

Lost income (lost profits) cannot be recovered from the employee (

Art. 238 Labor Code of the Russian Federation

). This restriction does not apply to the leaders of the organization (Part 2

Art. 277 Labor Code of the Russian Federation

, part 2 art. 15 of the Civil Code of the Russian Federation).

If an employee refuses to compensate for damage voluntarily, it can only be recovered in court. The employer has the right to go to court within one year from the date of discovery of the damage caused. The court may reduce the amount of the collected amounts, but does not have the right to completely release the employee from compensation for damages. The court has no right to reduce the amount of compensation if the damage was caused for personal gain.

| articles: An employment contract with a sales representative can be classified as an employment contract with specialists, therefore an employment contract with a sales representative is subject to all the general rules of such contracts. Employment contract with sales representative. as well as its application, the job description, indicates the knowledge, skills, and qualification requirements that a sales representative must have. He must possess these skills and abilities to ensure the completion of the tasks required to complete the project. The job responsibilities of a sales representative are specified in the employment contract and are determined by the qualification directory of positions for managers, specialists and other employees. Key responsibilities of a sales representativeA sales representative is an intermediary between the supplier company and retail outlets. He can also act as an intermediary between wholesalers and retailers. The job of a sales representative is to promote the company's products in the territory entrusted to him, develop the existing client base and search for new clients, receive and process orders, track payment terms and amounts. An employment contract with a sales representative who is hired and dismissed by order of the director of the enterprise belongs to the category of employment contracts with specialists. Such a position, according to an employment contract with a sales representative, can be occupied by a person who has a higher professional education and work experience of at least 2 years. The main task of the sales representative is to make every effort to ensure that stores (kiosks, supermarkets) take the company’s products for sale. Main functions of a sales representative: establishing relationships with managers of retail outlets, skilfully presenting information about the company and its products, concluding a deal, signing a contract for the supply of products. Employment contract with sales representativeSamples on the topic: Contract. Work SUBJECT OF THE AGREEMENT1.1. The Employer undertakes to provide the Employee with work as a sales representative, to provide working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement (if any), agreements, local regulations and this agreement, in a timely manner and in full. pay the Employee wages, and the Employee undertakes to personally perform the functions of a sales representative and comply with the internal labor regulations in force at the Employer. 1.2. Work under a contract is the main one for the Employee. 1.3. The Employee’s place of work is the Employer’s office located at: _________________________. 1.4. The employee reports directly to _____________________. 1.5. The Employee’s work under the contract is carried out under normal conditions. The Employee’s labor duties do not involve performing heavy work, work with harmful, dangerous or other special working conditions. 1.6. The employee is subject to compulsory social insurance against accidents at work and occupational diseases. 1.7. The Employee undertakes not to disclose legally protected secrets (official, commercial, other) and confidential information owned by the Employer and its counterparties. CONTRACT TIME2.1. The Agreement comes into force on the date of its conclusion by the Employee and the Employer (or from the day the Employee is actually admitted to work with the knowledge or on behalf of the Employer or his representative). 2.2. Start date: "___"_________ ____ 2.3. The contract is concluded for an indefinite period. CONDITIONS OF PAYMENT FOR EMPLOYEES3.1. For the performance of labor duties, the Employee is paid a salary in the amount of _____ (__________) rubles per month. 3.2. The employer sets additional payments, allowances and incentive payments. The amounts and conditions of such additional payments, allowances and incentive payments are determined in the Regulations on bonuses for the Employee (approved by the Employer "___"_________ ____ with which the Employee was familiarized when signing the contract. 3.3. If the Employee, along with his main job, performs additional work in another position or performs the duties of a temporarily absent employee without being released from his main job, the Employee is paid an additional payment in the amount established by an additional agreement of the parties. 3.4. Overtime work is paid for the first two hours of work at time and a half, for subsequent hours - at double rate. Based on the written consent of the Employee, overtime work, instead of increased pay, may be compensated by providing additional rest time, but not less than the time worked overtime. We invite you to familiarize yourself with: Land privatization, land law 3.5. Work on a day off or a non-working holiday is paid in the amount of a single part of the official salary per day or hour of work in excess of the official salary, if work on a day off or a non-working holiday was carried out within the monthly standard working time, and in the amount of a double part of the official salary per day or hour work in excess of the official salary, if the work was performed in excess of the monthly working hours. At the request of an Employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment. 3.6. Downtime caused by the Employer is paid in the amount of two-thirds of the Employee’s average salary. Downtime due to reasons beyond the control of the Employer and Employee is paid in the amount of two-thirds of the official salary, calculated in proportion to downtime. Downtime caused by the Employee is not paid. 3.7. The Employee's wages are paid by transfer to the Employee's bank account every half month on the day established by the Internal Labor Regulations. 3.8. Deductions may be made from the Employee's salary in cases provided for by the legislation of the Russian Federation. WORKING HOURS. HOLIDAYS4.1. The employee is set the following working hours: ____________________ with the provision of _____ day(s) off ____________________. 4.2. Start time: ____________________. Closing time: ____________________. 4.3. During the working day, the Employee is given a break for rest and food from _____ hours to _____ hours, which is not included in working hours. 4.4. The Employee is granted annual basic paid leave of at least 28 calendar days. The right to use vacation for the first year of work arises for the Employee after six months of his continuous work with this Employer. By agreement of the parties, paid leave may be provided to the Employee before the expiration of six months. Leave for the second and subsequent years of work may be granted at any time of the working year in accordance with the order of provision of annual paid leave established by the given Employer. The Employee must be notified by signature of the start time of the vacation no later than two weeks before its start. 4.5. For family reasons and other valid reasons, the Employee, on the basis of his written application, may be granted leave without pay for the duration established by the labor legislation of the Russian Federation and the Internal Labor Regulations of the Employer. |

Employment contract with a cashier salesperson: sample

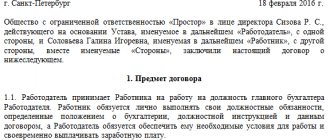

The procedure for concluding an employment contract with a cashier salesperson is general. A unified form of employment contract has not been approved, so each employer develops its own sample document. At the same time, there are general requirements for an employment contract that must be taken into account.

The employment contract is concluded in simple written form in two copies. One of the copies remains in the employee’s hands, the second copy is kept in the HR department of the employer. The employment contract must be signed no later than three days from the date of commencement of work in the company. Indeed, in the event of any conflict with the employer, this document is intended to help resolve and exhaust mutual claims.