Parties details

Since we are talking about an individual employer, the standard sample employment contract between an individual entrepreneur and an employee must include his full data:

- FULL NAME.;

- information about the identity document;

- TIN;

- information about registration as an individual entrepreneur (from the entry sheet of the Unified State Register of Individual Entrepreneurs from 2020);

- location address.

If the contract is not concluded by the entrepreneur himself, but by an employee hired for this purpose or an otherwise authorized person, his data is also indicated in the document.

Employment contract between an employee and an individual entrepreneur

Employment contract between an employee and an individual entrepreneur

___________________________ "__" ________ 200_

(place of conclusion of the contract)

Individual entrepreneur_____________________________________,

hereinafter referred to as the “Employer”, acting on the basis of

Certificate of state registration of an individual as

individual entrepreneur without forming a legal entity

N ________, issued by "__" _________________ ___ year, on the one hand,

and citizen of the Russian Federation _________________________________________________,

hereinafter referred to as “Employee”, on the other hand, together

referred to as the “Parties”, have entered into this agreement as follows:

1. Subject of the employment contract

1.1. The employee is hired ________________________________

________________________________________________________________________

(labor function is indicated: work according to the position in accordance with

staffing schedule, profession, specialty indicating qualifications;

specific type of work assigned to the employee).

1.2 The Employee’s place of work is ______________________________.

1.3. The employee is obliged to start work with “___” ___________ 200_g.

1.4. This employment contract comes into force from the moment it is

signed by both Parties.

1.5. Work for the Employer is for the Employee __________________

__________________________________________________________ place of work.

(indicated as main or part-time)

1.6. The employment contract is concluded for an indefinite period.

1.7. In accordance with Article 70 of the Labor Code, the Employee

accepted for work with the condition of a test in order to check it

compliance with the assigned work. Duration of probationary period

is ___ month(s) from the date of conclusion of this agreement.

The criterion for passing the probationary period is the exact and

high-quality (complete, timely, etc.) performance of official duties

responsibilities.

2. Rights and obligations of the employee

2.1. The employee reports directly to the Employer.

2.2. The employee is required to perform the following job duties:

2.2.1. _____________________________________________________________

(brief description of job responsibilities)

_______________________________________________________________________;

2.2.2. conscientiously perform their job duties,

assigned to him by the employment contract;

2.2.3. comply with internal labor regulations and labor

discipline;

2.2.4. comply with occupational health, safety and

industrial sanitation;

2.2.5. take care of the property of the Employer, third parties, and

other employees;

2.2.6. immediately inform the Employer or direct

to the manager about the occurrence of a situation that poses a threat to life and

health of people, safety of the Employer’s property.

2.3. The employee has the right to:

Get full text

Tutors

Unified State Exam

Diploma

2.3.1. providing him with work stipulated by the employment contract;

2.3.2. a workplace that meets labor protection requirements;

2.3.3. timely and full payment of wages;

2.3.4. the right to rest in accordance with the terms of this

employment contract and legal requirements;

2.3.5. protection of their labor rights, freedoms and legitimate interests by all

in ways not prohibited by law;

2.3.6. compensation for damage caused to him in connection with the execution

labor duties, and compensation for moral damage in order,

established by the Labor Code and other federal laws;

2.3.7. other rights granted to employees by the Labor Code of the Russian Federation.

3. Rights and obligations of the employer

3.1. The employer is obliged:

3.1.1. provide the Employee with work in accordance with the conditions

this employment contract. The employer has no right to demand from

An employee performing duties (works) not specified herein

employment contract, except for cases provided for

labor legislation of the Russian Federation;

3.1.2. ensure safe working conditions in accordance with

requirements of the Safety Regulations and labor legislation of the Russian Federation;

3.1.3. provide the Employee with everything necessary to perform

labor responsibilities;

3.1.4. pay the Employee on time and in full

wages;

3.1.5. pay insurance premiums and other obligatory payments in

in the manner and amount determined by federal laws;

3.1.6. compensate for damage caused to the Employee in connection with the execution

their labor duties in accordance with current legislation;

3.1.7. perform other duties provided for by labor

legislation and local regulations.

3.2. The employer has the right:

3.2.1. require the Employee to perform his labor duties,

stipulated by this agreement;

3.2.2. encourage the Employee in the manner and amount provided for

this employment contract, as well as the conditions of the legislation of the Russian Federation;

3.2.3. involve the Employee in disciplinary and material

liability in cases provided for by the legislation of the Russian Federation;

3.2.4. exercise other rights granted to him by Trudov

Code of the Russian Federation.

4. Working time and rest time

4.1. The employee is assigned a __________ day work week.

Work start time ____ hour, end ____ hour, break ____ hour.

Weekend ______________________________________________________.

4.2. The employee is granted annual paid leave

lasting 28 calendar days. Annual paid vacation

provided in accordance with current labor laws.

4.3. An employee may be granted leave without pay

wages in accordance with current labor legislation.

5. Terms of payment

5.1. The Employee's salary consists of the official salary in

in the amount of ____ rubles per month and an additional monthly bonus

rewards.

5.2. Salary is paid twice a month: advance

(in proportion to the time worked) - no later than __ day of the month, and

the remaining part no later than the ___ day of the month.

5.3. When the Employee conscientiously performs his duties

he is paid an additional monthly bonus

in the amount determined by the Employer at its discretion, taking into account

results of the latter’s financial and economic activities.

5.4. When performing work of various qualifications, combining

professions, work outside the normal working hours

time, at night, on weekends and non-working holidays, etc.

the employee receives appropriate additional payments.

5.5. Work on weekends and non-working holidays is paid in

double size.

5.6. For the period of validity of this employment contract for the Employee

all guarantees and compensations provided for by the current

labor legislation of the Russian Federation.

6. Responsibility of the parties

6.1. In case of non-fulfillment or improper fulfillment by the Employee

their duties specified in this agreement, violation of labor

legislation of the Russian Federation, as well as causing material damage to the Employer

damage, he bears disciplinary, material and other liability,

in accordance with the current legislation of the Russian Federation.

6.2. The employer bears financial and other liability in accordance with

current legislation of the Russian Federation.

7. Termination of the employment contract

Get full text

7.1. This employment contract may be terminated on the grounds

provided for by current labor legislation.

7.2. In accordance with Article 307 of the Labor Code of the Russian Federation, this

an employment contract can be terminated on the following grounds:

_______________________________________________________________________.

8. Final provisions

8.1. The terms of this employment contract are binding

legal force for the Parties. All changes and additions to this

employment contract are formalized by a bilateral written agreement.

8.2. In accordance with Article 306 of the Labor Code of the Russian Federation

The employer has the right to change the conditions determined by the Parties

employment contract only in the case where these conditions cannot be

retained for reasons related to changes in organizational or

technological working conditions. On changes determined by the Parties

terms of the employment contract, the Employer warns the Employee of

in writing at least 14 calendar days in advance.

8.3. Disputes between the parties arising during the performance of labor

contracts are considered in the manner established by Article 308 of the Labor Code

Code of the Russian Federation.

8.4. In all other respects that are not provided for in this labor

agreement, the Parties are guided by the legislation of the Russian Federation governing

labor Relations.

8.5. The employment contract is concluded in writing, drawn up in two

copies, each of which has equal legal force.

9. Addresses and signatures of the parties

Employer:

FULL NAME. ______________________________________________________________

passport: series _______________________, No. _______________________,

issued _________________________________ “___” ___________ 200 __,

department code ___________________________________________________

registered at: ________________________________________

Taxpayer Identification Number _______________

______________________________

(signature)

Worker:

FULL NAME. ______________________________________________________________

passport: series _______________________, No. _______________________,

issued _________________________________ “___” ___________ 200 __,

department code ___________________________________________________

registered at: ________________________________________

I have received a copy of the employment contract.

______________________________

(signature)

Place and working conditions

The form of the employment contract between the individual entrepreneur and the employee must contain a section describing the place of work and the requirements for its implementation. Lawyers recommend that all job responsibilities of an employee be spelled out in detail. But we can limit ourselves to the phrase that before signing the contract, the employee was familiarized with the job descriptions, additionally reflecting this fact in the agreement itself.

As for the section on the place of employment, the following wording is allowed:

Place of work: IP Ivanova A.A., registered at Moscow, st. Puteyskaya, 3.

Or you can register the specific address of the production or store where the person will work. The fact is that labor legislation separates the concepts of “place of work” and “workplace” (Article 209 of the Labor Code of the Russian Federation). The first is a mandatory condition of the agreement, and the second is an additional one that can be dispensed with. At the same time, we must remember that if you indicate a specific address of a production or store, and later it changes, additional agreements will have to be concluded for all contracts.

How to compose

To properly formalize an employment agreement between individual entrepreneurs and citizens, it is necessary to comply with the general requirements provided for by Chapter 11 of the Labor Code of the Russian Federation. They include:

- Requirements for the form of the document;

- Requirements for the composition of documents that must be provided by the citizen being hired;

- Requirements for the preparation of employment documents.

A prerequisite for proper execution of documents is a written form of the employment agreement. The legislation does not approve a standard form of an employment contract between individual entrepreneurs and employees, therefore the parties have the right to develop it independently, taking into account the requirements of regulatory legal acts.

Since an entrepreneur is not a legal entity, he may not have a staff structure, including a personnel service. The Labor Code of the Russian Federation does not prohibit individual entrepreneurs from personally completing all documents necessary for the employment of citizens, including making an entry in the work book.

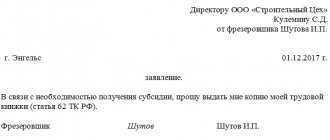

Article 66 of the Labor Code of the Russian Federation

The work book is the main document confirming the work activity of citizens throughout their lives. The obligation to fill out books also applies to individual entrepreneurs; in this case, it is necessary to take into account the peculiarities of the norms of Art. 66 Labor Code of the Russian Federation:

- An individual entrepreneur, like another employer, has the right not to fill out an employee’s work book if his work period does not exceed five days;

- Throughout the entire period of the employment relationship with the employee, responsibility for maintaining and storing the work book rests with the entrepreneur;

- All entries in the book must correspond to actual information about hiring, termination of employment, transfers, and awards.

When filling out the text of the agreement, special attention should be paid to compliance with the guarantees of labor rights of citizens, which are regulated by the Labor Code of the Russian Federation.

Contract duration

Art. 59 of the Labor Code of the Russian Federation allows, by agreement of the parties, to conclude a fixed-term employment contract with an individual entrepreneur in 2020, even if the employment is not temporary or fixed-term. This condition applies to private businessmen who employ no more than 35 people (no more than 20 if trade is carried out or personal services are provided). If an employee requires an indefinite relationship, a refusal to hire may be regarded as a violation of the law (Article 64 of the Labor Code of the Russian Federation).

Hiring for an individual entrepreneur

The generally accepted procedure for registering employees of all organizations, including individual entrepreneurs, is established by Art. 68 Labor Code of the Russian Federation:

- first, the employee and the employer enter into an employment contract (hereinafter referred to as the TD);

- then, on its basis and in accordance with the conditions stipulated there, an order for employment is issued;

- the order (instruction) must be announced to the hired employee against signature within 3 days;

- Before signing the TD, the employee must be familiarized with the collective agreement adopted by the organization and local regulations in the field of labor relations (the current regulations on wages and bonuses, PVTR, shift schedules, etc.).

Other rules regulate the remaining mandatory stages of employment for specific cases (passing a medical examination, concluding an agreement on full financial responsibility, etc.), which are mandatory for all organizations and for individual entrepreneurs with employees.

Chapter 48 of the Labor Code of the Russian Federation, dedicated to the work of employees for individuals, does not establish any exceptions for individual entrepreneurs from the general hiring procedure.

In Art. 303 of the Labor Code of the Russian Federation specifically stipulates that:

- the conclusion of a written employment contract between the individual entrepreneur and the employee is mandatory;

- this TD must include all conditions essential to its parties;

- The individual employer is obliged to pay personal income tax, insurance premiums and mandatory payments for the employee, and issue SNILS for first-time employees.

Art. 309 of the Labor Code of the Russian Federation obliges the employer, who is an individual entrepreneur, to maintain work books of employees in the manner prescribed by law.

For individual entrepreneurs (if the staff number is no more than 35 people (in retail and consumer services - 20 people)) there are features in establishing the term of the TD: if the parties reach an agreement, then a fixed-term contract can be concluded (Part 2 of Article 59 of the Labor Code of the Russian Federation ).

Grounds for dismissal

According to Art. 307 of the Labor Code of the Russian Federation, at your own discretion, you can enter any grounds for termination of the agreement into the sample employment contract for individual entrepreneurs. The main thing is that they are not discriminatory. For example, a store owner may fire a seller for failure to issue a receipt or evasion of using a cash register, since this is his direct responsibility. But the law prohibits laying off an employee if his qualities change that do not affect the quality of performance of job functions.

To avoid future litigation, the employer cannot fire the offending employee immediately. He is obliged to follow the entire procedure for applying disciplinary sanctions - first issue a warning, then a reprimand, and only then termination of the contract.

Registration of employment contracts for individual entrepreneurs

Registration of labor relations with citizens obliges individual entrepreneurs to pay mandatory taxes and insurance contributions. To do this, each agreement must be registered with the territorial division of the Pension Fund and social insurance authorities. Based on the results of registration of contracts, the individual entrepreneur receives a notification that he is recognized as an insurer, obligated to pay contributions in relation to the insured persons.

The entrepreneur has one month to register as an insurer, and violation of this period will be grounds for prosecution in the form of a fine. In relation to registered contracts, a desk audit will be carried out regarding the correctness and timeliness of the calculation and payment of insurance premiums for employees.

Employer obligations

Drawing up an employment contract between an employee and an individual entrepreneur is the main obligation of the employer. Current legislation does not allow work without official registration.

In addition, the entrepreneur, who is the employer, is obliged to pay insurance coverage in favor of hired specialists. Moreover, insurance premiums will have to be calculated and paid in full, according to the established tariffs. It is unacceptable to apply the rules on insurance premiums for individual entrepreneurs in this case.

Also, the commercial employer is obliged to act as a tax agent, that is, to calculate and withhold personal income tax, and then transfer it to the state budget.

In addition, the private owner will have to prepare “salary” reports to regulatory authorities. These include:

- calculation of insurance premiums;

- calculation of 6-NDFL;

- 2-NDFL certificates;

- SZV-M;

- SZV-STAGE;

- 4-FSS;

- report on the average headcount.

Work records of hired employees will also have to be maintained. Such norms are enshrined in Article 309 of the Labor Code of the Russian Federation. Note that filling out labor. a book is not needed if the individual entrepreneur hires workers under a contract.

Registration of an employee in funds

After signing the contract, draw up and sign an order for hiring an employee and collect a package of papers for registration with the Pension Fund and the Social Insurance Fund in order to register as an insured employer. As soon as you become an employer, the countdown begins for 10 days for mandatory registration with the Social Insurance Fund and 30 days with the Pension Fund .

Any employer, including individual entrepreneurs, must pay contributions for each of its employees. The list of payments includes the following payments:

- for pension insurance;

- for health insurance;

- For social insurance.

Plus, a businessman who earns money through entrepreneurial activities and hires staff is a tax agent and must pay personal income tax. The amount of tax for employees is calculated from the total amount of all contributions in their favor. This includes wages, allowances, bonuses, and some types of financial assistance.

Income tax is paid for all individual entrepreneurs. In the general taxation regime, it is mandatory and amounts to 13% of deductions in favor of an individual, but in the simplified taxation system, PSN and UTII it is not necessary to pay it.

https://youtu.be/EUEMcamll8k

General provisions

If an entrepreneur decides to hire employees, then he must comply with all legal requirements. Officials provided the following algorithm (Article 68 of the Labor Code of the Russian Federation):

- An agreement is concluded between the merchant and the hired specialist.

- Based on the signed agreement, the employer issues an appropriate order.

- The newly hired employee must be familiarized with the order and signed no later than 3 days from the date of its approval.

Please note that before concluding an agreement, the employee must be familiarized with the current local documents establishing the specifics of remuneration against his signature. For example, with the current regulations on remuneration, regulations on bonuses, with a collective agreement and internal regulations.

It is important to know: What documents are required to conclude an employment contract