In 2020, a program to increase working age was approved. Together with her, the government began to raise questions about providing the opportunity for people with extensive experience to retire prematurely.

Initially, the law provided for 40 years of development for women and 45 years for men . Then V.V. Putin amended the law, reducing these indicators. These benefits were introduced to smooth out the consequences of increasing the working period.

What length of service is required for early retirement?

Those who have worked for most of their lives without neglecting labor laws, and have made insurance contributions for them, will be able to retire in advance for a well-deserved rest. For these citizens, the Government has developed a new benefit - to stop working 2 years earlier.

In addition to length of service, other requirements will also apply. Early retirees must be at least 55, and pensioners - 60. Let us remind you that our country is currently undergoing a pension restructuring, according to which the age for retirement is increasing. By 2028, men and women can count on a contributory pension at ages 65 and 60 respectively.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Taking into account this smooth transition and the minimum age requirements (55/60 years - women/men), early retirement will also be carried out gradually. We look at this in more detail in the early retirement table.

For women

For representatives of the fairer sex, the value of 37 years of work experience is established. With this amount, a woman aged at least 55 can retire earlier than usual.

For men

Men over the age of 60 with 43 years of service can also count on early old-age payments.

Having the required length of service does not give you the right to retire as soon as you are exhausted. The working life in this case is reduced by 2 years.

Specific filters apply to work experience. It is not calculated like regular insurance.

A little about early retirement

A citizen is entitled to a preferential pension until the general age for retirement established by law. This measure of support for certain categories of Russians was provided for before the start of the pension “reform”, but in its light it was somewhat expanded.

The legislator retained previously established benefits, and the law was supplemented with new opportunities for early receipt of state benefits.

Exit conditions

Important! In addition, in some cases, the number of accumulated pension points is taken into account. The minimum amount required to assign an insurance pension is established.

Thus, the law establishes the following categories of beneficiaries:

- Persons employed in jobs with hazardous working conditions (such experience must be at least 10 and 7.5 years for men and women, respectively).

- Workers with difficult working conditions, including those employed in underground work.

- Women who have a long history of working on self-propelled, road, and loading equipment.

- Women workers in the textile industry, if their working conditions showed signs of intensity and severity.

- Some railway and transportation workers.

- Persons with work experience in the forestry sector, geological exploration, navy, and civil aviation.

- Drivers of public route transport.

- Teachers, doctors and artists.

- Firefighters and rescuers.

- Employees of the criminal correctional system.

These categories were provided for in legislation earlier. All of them retained their right to early assignment of pension benefits upon reaching the previously established age and meeting other mandatory conditions.

The list has been supplemented with the following as new categories:

- persons with long work experience;

- mothers of many children;

- persons registered as unemployed and unable to find employment.

Is it possible for a woman to receive early retirement after 37 years of service?

One of the newly provided cases of preferential pension is precisely long service. Thus, new changes to pension legislation provide for such a right for women if she has a total length of official work experience and other socially significant periods of activity of at least 37 years. However, the period of experience is not the only prerequisite.

What does the new law say about providing benefits?

The measure in question to support women during the implementation of pension innovations was introduced into the previous law on pensions. Changes to it were made by law dated October 3, 2018 No. 350-FZ as part of changes to the entire pension legislation as part of the so-called reform. This legal act provides for the following conditions when a woman can receive security on preferential terms:

- A woman’s work experience is 37 years or more (we are not talking about work activity, but specifically about insurance experience, which includes not only periods of work, but also time spent performing other socially useful activities).

- The onset of age 55 years.

- Availability of an individual pension coefficient of 30 or more (you can view it in your personal account on the official website of the Pension Fund of the Russian Federation or request information directly from this body).

Important! Even if all the mentioned conditions are met, a woman will be able to go on a well-deserved rest no earlier than 2 years before she could qualify for a pension on a general basis.

https://youtu.be/jHoRKR9KL_c

The right to the support measure in question for women arises if, in total, the following periods amount to at least 37 years:

- carrying out labor activities under an employment contract with an individual or legal entity, individual entrepreneur (subject to official employment);

- the period of carrying out entrepreneurial activities without forming a legal entity (if there is official registration with the tax authority);

- the time of performance of work or provision of services under civil contracts, if the customer, in accordance with the law, transferred insurance premiums to the Pension Fund of the Russian Federation;

- the time when the woman received benefits due to temporary disability;

- being on parental leave for up to 1.5 years. On this basis, only leave in respect of 4 children is taken into account for length of service. The period of care for 1.5-year-old children exceeding 6 years is not taken into account;

- periods when a woman was registered as unemployed at the employment center and received appropriate benefits;

- performing paid public works;

- the time required to move to a new place of work, if it is carried out in the direction of the employment service;

- work as a judge;

- the time of serving a criminal sentence by a person who was unjustifiably convicted and subsequently rehabilitated, as well as the removal of a woman from office for the period of unjustified criminal prosecution;

- work with operational intelligence agencies on a contractual basis;

- living with a diplomat spouse abroad or a military spouse in an area where the woman reasonably did not have the opportunity to officially work;

- care for a disabled child, group 1 disabled person or an elderly person over 80 years old (if officially registered in accordance with regulatory documents).

What will not apply to work experience?

The most obvious period that will not be counted in the calculation for assigning security on a preferential basis is that the woman did not work and was not registered as unemployed. In addition, the following time periods can be identified that cannot constitute an insurance period:

- being on parental leave for up to 1.5 years for 5 and subsequent children (since the maximum such period is 6 years);

- maternity leave for up to 3 years (although by law the woman retains her job for this period and can even receive appropriate benefits at the employer’s discretion);

- care for a 1.5-year-old child if the child’s father was on official leave (which is not prohibited under current legislation).

Reference! The required length of service does not include periods when a woman performed a labor function, but the employer did not transmit the necessary information to the Pension Fund of the Russian Federation and did not pay insurance premiums for it (this usually happens with unofficial employment).

Once the general retirement age for women is set at 60 years, it will not be difficult to calculate the time for a possible preferential pension if you have 37 years of experience. From 2020 to 2028 there is a transition period when this age increases gradually.

At what age will women retire according to the new law? The table shows the years when a woman can exercise the right to early receipt of state support:

| Woman's year of birth | Possible year of retirement (not earlier) |

| 1964 | 2019 |

| 1965 | 2020 |

| 1966 | 2022 |

| 1967 | 2024 |

| 1968 | 2026 |

Women of subsequent birth years can simply subtract 24 months from the generally established date.

Thus, if there is a long period of work or other socially significant activity, a woman has the right to complete it 2 years earlier than the total period.

However, this will require compliance with a number of conditions, such as the size of the pension coefficient and reaching a certain age.

What is included in the preferential period

definitely in this length of service :

- labor activity in Russia, when insurance contributions were paid to the Pension Fund;

- funded holidays;

- sick leave when short-term disability benefits were paid.

The benefit period differs from the insurance period in that it will not always include the following periods of time:

- being registered with the Employment Center;

- emergency service;

- maternity leave up to 1.5 years (but not more than 6 years in a lifetime);

- care for disabled people and elderly people over 80.

These indicators will be taken into account only if before or immediately after this period the person immediately got a job and contributions were made to the Pension Fund.

The grace period will be significantly less due to the lack of long periods. Therefore, early retirement is only possible for those who officially started working at a young age.

How will the amount of pension accruals be calculated?

The accumulated length of service affects not only the end date of employment, but also the amount of future payments. Since when calculating the length of service for early retirement, not all episodes are taken into account, a logical question arises: what exactly will PFR employees take into account when calculating cash payments?

The law says this:

- if training, child care and other “non-insurance” cases occurred before 2002, then they will be taken into account when determining the amount of payments, despite the “preferential” nature of issuing a pension certificate;

- the amount of cash payments will also be affected by the process of completing military or other service (for example, in the police, in drug control agencies, as a firefighter, etc.);

- if parental leave (not only paid - up to 1.5 years, but also unpaid - up to 3 years) fell on dates earlier than 10/06/1992, then it will also be taken into account when calculating payments.

When it comes to tuition, it is important to consider how future payments are calculated.

- If the method is chosen according to clause 4 of Art. 30 of Federal Law No. 173 of December 17, 2001, then all study time is taken into account according to the calendar schedule.

- If, for the calculation, clause 3 of Art. 30 of the same federal law, the calculation is based on Soviet standards. That is, a citizen had to first serve in the army or get a job, and only then go to study and improve his skills. Only then is study time counted for calculating a pension.

To independently calculate the amount of pension payments, you can use the calculator on the Pension Fund website. However, it is worth remembering that the exact amount due to you by law can only be found out after completing and submitting the application. Pension Fund specialists will take into account all points, coefficients, possible benefits, after which information on the amount of monthly payments will become available in your personal account.

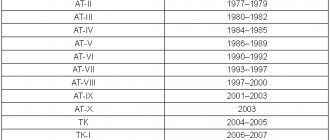

Table of early retirement by length of service by year of birth

This table presents gradual early retirement taking into account the minimum age for this.

| Year of birth | Pension age according to insurance period | Decrease in indicator | Pension age according to preferential length of service |

| Women | |||

| 1964 | 55,5 | 0,5 | 55 |

| 1965 | 56,5 | 1,5 | |

| 1966 | 58 | 2 | 56 |

| 1967 | 59 | 57 | |

| 1968 | 60 | 58 | |

| Men | |||

| 1959 | 60,5 | 0,5 | 60 |

| 1960 | 61,5 | 1,5 | |

| 1961 | 63 | 2 | 61 |

| 1962 | 64 | 62 | |

| 1963 | 65 | 63 | |

To summarize, for women born 1964-1965. and men born 1959-1960 There is no provision for retirement 2 years earlier, because they will be less than 55/60.

Early pension for 42 years and 37 years of service in 2020: new conditions and adjustments for this year

In order to mitigate the consequences of the pension reform, in addition to the general increase in the retirement age by 5 years, the new law will provide additional benefits for early retirement for certain categories of citizens. One of these benefits is the provision of early pension based on length of service. If it is at least 37 years for women and 42 for men, then it will be possible to apply for an old-age insurance pension 2 years earlier than the new prescribed retirement age, which has begun to gradually increase since 2019 and will reach 60 years for women and 65 years for men (by 2028).

- The main limitation is that it will be possible to become a pensioner early due to long-term work activity no earlier than upon reaching the age of 55 or 60 years (for women and men, respectively). That is, it will not be possible to reduce the general retirement age valid until the end of 2020 in this way.

- In the first 2 years of the new reform (in 2020 and 2020), it will not be possible to take full - i.e. It will still be impossible to reduce the retirement period by 2 years, since in any case it cannot be less than now - 55/60 years (see table of retirement by length of service).

When determining the right to a benefit, all periods included in the insurance period will be taken into account (i.e., both periods of work and other taken into account “non-work” periods determined by law - for example, caring for each child until the age of 1.5 years).

It is also necessary to understand that the benefit provided for by the new law for a long insurance period of 37 years for women and 42 years for men will not in any way affect the general requirements for length of service! Those conditions, the fulfillment of which is already provided for in order to receive an old-age insurance pension on a general basis, do not change during the reform and will remain the same .

Experience giving the right to early retirement (for women and men)

The Law on Raising the Retirement Age, which entered into force on January 1, 2020 , provides an additional basis for early retirement - the presence of a long insurance period , which allows you to become a pensioner 2 years earlier than the period provided for by the new law (taking into account the provisions of the transition period) .

The new law also contains a restriction according to which it is impossible to take advantage of such a benefit before the age of 55/60 . was reduced by 3 years for women and men during the discussion of the bill in comparison with the original version.

Let us recall that the government draft law initially established standards allowing for early retirement status at 40 years for women and 45 for men . It was with this content that the draft was adopted by deputies in the first reading in July.

During a televised address to the population of the country, Vladimir Putin announced the need to reduce the proposed parameters so that such a benefit would become more accessible. Corresponding amendments to the draft law were introduced by the President in September. In them, the length of service requirements were relaxed to 37 and 42 years (that is, 3 years).

Table with explanation of the Pension Fund of Russia

As of August 1, 2020, pensions were assigned to 198 residents of the region (41 men and 157 women) for long-term insurance coverage 6 months earlier than the established age.

Men:

| Year of birth | Retirement age giving the right to an old-age pension | Right to an insurance pension | Retirement age with 42 years of service | Year of retirement with 42 years of service |

| 1959 | 60 years 6 months | II half of 2019 I half of 2020 | 60 | 2019 |

| 1960 | 61 years 6 months | II half of 2021 I half of 2022 | 60 | 2020 |

| 1961 | 63 | 2024 | 61 | 2022 |

| 1962 | 64 | 2026 | 62 | 2024 |

| 1963 onwards | 65 | 2028, etc. | 63 | 2026, etc. |

Women:

| Year of birth | Retirement age giving the right to an old-age pension | Right to an insurance pension | Retirement age with 37 years of service | Year of retirement with 37 years of service |

| 1964 | 55 years 6 months | II half of 2019 I half of 2020 | 55 | 2019 |

| 1965 | 56 years 6 months | II half of 2021 I half of 2022 | 55 | 2020 |

| 1966 | 58 | 2024 | 56 | 2022 |

| 1967 | 59 | 2026 | 57 | 2024 |

| 1968 onwards | 60 | 2028, etc. | 58 | 2026, etc. |

What insurance periods count towards early retirement?

The length of service for early retirement is calculated in calendar order. When calculating, only the insurance period will be taken into account, including:

- Periods of work or other activities on the territory of the Russian Federation, during which insurance premiums were paid to the Pension Fund.

- Other periods during which contributions to the Pension Fund were not deducted, but in accordance with clause 1 of Art. 12 of Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”, they are counted towards the insurance period (pension points can also be awarded for them).

In particular, countable “other periods” include those during which the Russian:

- looked after each child until he was 1.5 years old, but no more than 6 years in total;

- cared for a disabled person of the 1st group, a disabled child or a citizen who has reached 80 years of age;

- served in the military or other equivalent service;

- received social benefits insurance during temporary disability;

- received unemployment benefits;

- upon the direction of the employment service, moved to another area for further employment;

- participated in paid community work;

- was in custody as a person unjustifiably brought to criminal liability, etc. periods.

According to paragraph 2 of Art. 12 of Law No. 400-FZ, the above periods will be counted towards the insurance period if before or immediately after them there were periods of work or other activity during which insurance contributions were paid to the Pension Fund.

Early retirement based on length of service in 2020

Having accumulated the required number of years of service (37 for women, 42 for men), a citizen will be able to apply for an old-age insurance pension early - two years earlier than the retirement age provided at that time. However, due to the fact that this age standard will increase gradually from 2020, not all citizens who have worked the required number of years will be able to become pensioners 2 years earlier .

In fact, in the first years of the reform this decrease will be for fewer years:

- In 2020, the retirement age in Russia on a general basis will be 55.5 and 60.5 years. Citizens who have worked the required number of years for early retirement will be able to reduce their retirement age by only 6 months - that is, they will be able to become pensioners at 55 and 60 years old (according to the standards of the old law). This change will apply to women born in 1964 and men born in 1959 .

- In 2020, the decrease will already be 1.5 years , since the retirement age standard this year will be 56.5 and 61.5 years. , women born in 1965 and men born in 1960 will be able to become early pensioners based on length of service at the ages of 55 and 60 years.

Early retirement by year of birth in the presence of long insurance (work) experience can be presented in the following table:

Note: GR - year of birth; PV - retirement age.

After the final retirement ages for Russians are established - 60 and 65 years old, the age for early retirement will also be finally fixed at 58 and 63 years old . According to these standards, women born in 1968 and men born in 1963

Thus, in 2020, such a benefit (that is, having 37 or 42 years of experience) will allow you to retire early:

- women born in 1964-1965;

- men born 1959-1960.

For their younger fellow citizens, such a benefit is not provided in 2020, since the reduction is made by 2 years relative to the retirement age, established depending on the date of birth (see table).

For example, for women born in 1966. The retirement age is 58 years. That is, the benefit allows her to reduce this standard only to 56 years old and retire only in 2022 (the very fact of working out the length of service is not enough).

What length of service is required to receive a pension under the new law in 2020?

With the implementation of the pension reform from 2020, no additional conditions for receiving an old-age insurance pension are introduced, however, the requirements for the minimum required length of service began to increase even earlier - from 2020.

Every year the minimum required value of this standard increases by 1 year :

- for 2020 the standard is set at 10 years;

- in 2020 it will take 11 years;

- in 2024 the final value will be established - 15 years .

But it is worth recalling that in addition to long-term work activity, there are 2 more conditions , the fulfillment of which is required for registration of old-age insurance payments, these are:

- reaching the prescribed retirement age (will gradually increase from 01/01/2019 to 60/65 years for women/men );

- availability of the minimum required number of pension points - IPC (standards are increased annually by 2.4 points to reach the standard of 30 points).

Therefore, for retirement:

- In 2020, you had to reach the age of 55.5/60.5 years , have at least 10 years of experience and 16.2 IPC .

- In 2020, these standards will be changed to 56.5/61.5 years, 11 years of work activity and 18.6 points .

All planned changes to retirement conditions by year are presented in the table below:

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| PV | women | 55 | 55,5 | 56,5 | 58 | 59 | 60 | ||

| men | 60 | 60,5 | 61,5 | 63 | 64 | 65 | |||

| Required experience (years) | 9 | 10 | 11 | 12 | 13 | 14 | 15 | ||

| Minimum IPC (points) | 13,8 | 16,2 | 18,6 | 21 | 23,4 | 25,8 | 28,2 | 30 | |

Note: PE - retirement age

Procedure for assigning early pension

Having extensive work experience is not a prerequisite for retirement. Those who have not completed that many years of service will retire according to standard requirements.

To apply for a pension, you should contact the Pension Fund to find out what documents are required. The day the pension is assigned is considered the day the application is submitted with a set of papers. You can submit the application only when you already have the right to a pension, not earlier. To find out what documents are needed, you should apply six months in advance.

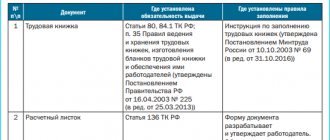

As a rule, the standard package of documents will be considered to be the provision of:

- passports;

- work book;

- military ID, if any;

- certificates of average earnings for 60 consecutive months before 2002;

- SZV-STAZH or certificates of insurance premiums;

- other certificates, depending on the category of citizens.

Let's take a closer look at what SZV-STAZH is. This is an annual reporting form for employers, which displays the same insurance payments. The report must be submitted by March 1 of the current year for the previous calendar year. If an employee decides to apply for pension payments, then he writes a free-form application at work about submitting a SZV-STAZH report for him. The employer is obliged to submit it within three days.

In this form, the employer indicates the type of information “Pension assignment”, the current year, fills in the employee’s data, periods of work, vacation, sick leave, etc. The last period line is filled in with the applicant’s date of birth, if he submits documents in advance, or with the planned date of submission of documents. Afterwards, the employer submits a report to the Pension Fund. If more than 25 people are employed, the reports are submitted electronically, if less, they can be submitted in paper form.

An application for payments can be submitted in person to the Pension Fund or sent by letter. The date shown on the postmark will be considered the date of acceptance.

If any documents are missing, the citizen is given 3 months to submit the missing papers. Then the date of receipt of the application is equal to the date of application. If you do not meet these deadlines, you will have to resubmit your documents.

Within ten days, the Pension Fund considers the application, checks all documents and issues a decision on the appointment. If the documents are not in order or the length of service is not enough, then within five days the Pension Fund sends a refusal with explanations.

Early retirement: nuances of accounting for work experience

At the beginning of 2020, the long-announced pension reform began in Russia. The age for old-age retirement increases annually, in “steps,” for men and women for a total of 5 years. These provisions were put into effect by Federal Law No. 350-FZ dated October 3, 2018.

One of the positive aspects of this reform, the Pension Fund announced the possibility of retiring 2 years earlier than expected (24 months). To do this, you must have a work experience of at least 42 years for men, and at least 37 years for women.

Another condition is that early retirement can be taken advantage of upon reaching a certain age: for men it is 60 years old, for women it is 55 years old. However, the initiators of the reform “remained silent” about other nuances reflected in the law.

This law significantly reduced the periods of service that will be included when determining the right to early retirement pension.

Periods of service not taken into account when exercising the right to early retirement

- To assign an early pension, periods of childcare and maternity leave for women and military service for men are no longer included in the insurance period, and in some cases, the length of service now does not include time spent studying in higher educational institutions.

- When taking into account the length of service required to use the early retirement benefit, only periods of working activity for which the employer calculated and paid insurance premiums, and periods of temporary disability with payments for compulsory social insurance (“sick leave”) are taken into account.

Let’s make a simple calculation: a woman now needs 37 years of service to retire early. For example, a girl entered college or university at age 17 and graduated at age 22. Then she gives birth to a child and goes on maternity leave, as well as parental leave - that’s another 3 years. All these periods are not taken into account for preferential retirement.

The following is simple arithmetic: 25 + 37 = 62 years, i.e., at least she should be eligible for early retirement at 62 years old. But the general retirement age for women is already set at 60 years. For men, too, everything is similar: college and the army “do not qualify for seniority.”

Who will receive?

As you can see, with the introduction of new requirements, it is now extremely difficult to obtain a pension thanks to early retirement.

This means that practically no one will be able to take advantage of this right, because in such circumstances the employee must start working at the age of 18 (or better yet at 16), study part-time, combine work with study, or not study anywhere, and not have children. In such situations, the chance of early retirement will probably be one in 1,000.

A couple of nuances

But that's not all, there are two more tricks to early retirement. Preferential exit can be issued if several conditions are met. In order to retire early, an employee must be dismissed for reasons due to a reduction in position, staffing or liquidation of an organization.

And lastly: a person can work all his life, but if the employer does not pay insurance premiums, then this length of service is not considered insurance and is not taken into account when calculating the length of service required for retirement.

This applies not only to preferential retirement, but also to retirement in general. It is no secret that territorial branches of the Pension Fund often refuse to confirm the length of employment insurance.

Moreover, this year the Pension Fund of Russia has especially zealously begun to remind employees of the need for employees to check the status of their personal account on the Pension Fund of Russia website. As they say, saving drowning people is the work of the drowning people themselves.

There is also a nuance here: the employer must not only pay insurance premiums, but also submit an annual report to the Pension Fund (the so-called confirmation of insurance experience). For example, if the employer paid the insurance premiums, but did not submit the report or submitted it with errors, these insurance premiums do not go to the employee’s personal account, and the periods are not included in the insurance period.

And all these subtleties are often not explained to people. When an elderly worker comes to the Pension Fund to apply for a preferential pension, it comes as a shock to him: it seems that he has done everything that was required, but he does not and cannot have the right to a benefit.

Source: https://www.9111.ru/questions/7777777777667951/

Calculation of pension payments

The size of the pension is calculated in the same way as the old-age pension, with the exception of taking into account the increasing coefficient.

So, the amount of early payments based on length of service will be equal to the product of the individual pension coefficient and the value of the pension point at the time of registration; the amount of the fixed payment of the insurance pension is added to this value.

Calculation formula

Amount of early payment = IPC*SPK+FV.

In [2019], SPK = 93.00, PV = 5,686.25 rubles.

The fixed payment indicator changes annually depending on variations in prices for meeting basic needs. Simultaneous payments for length of service are also provided if the citizen meets this criterion.

Service until retirement, giving the right to retire early (for women and men)

The new federal law dated October 3, 2018 No. 350-FZ provides benefits for all women starting from 2019. Article 7 provides that if a woman has 37 years of insurance experience, she can retire 2 years earlier!

Please note: we are not talking about harmful or dangerous work experience, but about the most common one.

However, the new law also contains a restriction according to which women cannot take advantage of this benefit before the age of 55.

This, in fact, means that in the first years of the reform, when the retirement age will be gradually increased in increments of 1 year (in 2019 - 0.5 years), with a long period of service it will be possible to retire not 2 years earlier, but less number of years (in 2019-2020).

| Women | When will they retire early? | ||

| Year of birth | General retirement age | Preferential retirement age (with 37 years of experience) | |

| 1964 | 55,5 | 55 | 2019 |

| 1965 | 56,5 | 55 | 2020 |

| 1966 | 58 | 56 | 2022 |

| 1967 | 59 | 57 | 2024 |

| 1968 | 60 | 58 | 2026, etc. |

The law on raising the retirement age, adopted by the State Duma on September 27, provides an additional basis for early retirement - the presence of a long insurance period, which allows you to become a pensioner 2 years earlier than the period provided for by the new law (taking into account the provisions of the transition period).

The new law also contains a restriction according to which it is impossible to take advantage of such a benefit before the age of 55/60. However, the very length of the period giving the right to early retirement based on length of service, during the discussion of the bill for women and men, was reduced by 3 years in comparison with the original version.

Let us recall that the government draft law initially established standards allowing for early retirement status at 40 years for women and 45 for men. It was with this content that the draft was adopted by deputies in the first reading in July.

During a televised address to the country's population, the president announced the need to reduce the proposed parameters so that such a benefit would become more accessible. Corresponding amendments to the draft law were introduced by the President in September. In them, the length of service requirements were relaxed to 37 and 42 years (that is, 3 years).

The length of service for early retirement is calculated in calendar order. But it is worth noting that the procedure for calculating length of service for early retirement will differ from the standard calculation of length of service. According to paragraph 4 of Art. 8 of Law No. 350-FZ of October 3, 2018, the length of service for early retirement will only include:

- Periods of labor activity during which insurance contributions were paid to the Pension Fund (Part 1 of Article 11 of Law No. 400-FZ of December 28, 2013);

- Periods of temporary incapacity for work, during which compulsory social benefits are paid. insurance (Clause 2, Part 1, Article 12 of Law No. 400-FZ).

Thus, only periods of official work and time spent on sick leave will be counted towards the preferential length of service - all other periods (for example, being on parental leave for up to 1.5 years) will not be included here.

In general, the insurance period includes:

- Periods of work or other activities on the territory of the Russian Federation, during which insurance premiums were paid to the Pension Fund.

- Other periods during which contributions to the Pension Fund were not deducted, but in accordance with clause 1 of Art. 12 of Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”, they are counted towards the insurance period (pension points can also be awarded for them).

In particular, countable “other periods” include those during which the Russian:

According to paragraph 2 of Art. 12 of Law No. 400-FZ, the above periods will be counted into the insurance period if before or immediately after them there were periods of work or other activity during which insurance contributions were paid to the Pension Fund.

The government reminds that the requirements for 37 years and 42 years of experience are not basic for a person to have the right to receive early age pension payments. For example, mothers with many children can retire early, but this also has its own nuances:

- if there are 3 children, the pension is issued 3 years earlier than the established retirement age;

- 4 children in a family - 4 years earlier;

- 5 children or more give you a chance to get an old-age pension at 50 years old.

It is also worth noting citizens who worked in the Far North or regions equivalent to it. In this case, the pension is also assigned at 50 years of age. But there is a condition here that the mother must also have at least 2 children.

For the rest of the Northern workers, the retirement age will be 55 years for women and 60 years for men.

Law on preferential retirement age for men with 42 years of service

On January 1, 2020, Federal Law No. 350-FZ of October 3, 2018 came into force, amending Law No. 400-FZ, which guides the authorities of the Pension Fund of Russia when assigning old-age insurance pensions.

In Part 1 of Art. 8 of this law sets the retirement age for men at 65 years, taking into account the transitional provisions for the gradual introduction of such a norm. Article 8 has been supplemented with clause 1.2, which states that a man has the right to apply for an old-age pension 24 months earlier than the specified age under the following conditions:

- having 42 years of insurance experience at the time of application;

- reaching 60 years of age.

Thus, starting from this year, a man who turns 60 and has the necessary length of service has the right to receive a well-deserved pension. But during the transition period (the first years of reform) it will not be 24 months earlier, but for fewer years.

“Military” issues in the new pension law

Thursday, 10/18/2018, 11:46:40

We answer questions related to military service

The new Pension Law provides for “long” service for men of 42 years (for early retirement); does military service or just work count towards these 42 years?

According to the new Law, persons with at least 42 and 37 years of insurance experience (men and women, respectively) can be assigned an old-age insurance pension 2 years before reaching the new retirement age - but not earlier than reaching the age of 60 (men) and 55 years (women). ).

This is important to know: Preferential calculation of a serviceman's length of service

periods of work and other activities that were carried out on the territory of Russia, provided that during these periods contributions to the Pension Fund were accrued and paid, as well as the period of receiving compulsory social insurance benefits during the period of temporary disability.

No other non-insurance periods, including military service, are counted towards this length of service.

According to the law in force since January 1, 2020, one year of conscription military service entitles you to 1.8 points.

In 2020, points—their correct name is “individual pension coefficient”—participate in the formula by which the insurance pension is calculated. ]

Will a military pensioner be able to receive a “civilian” pension early from 2020 with 42 years of service, and will the period of service in the authorities be taken into account when calculating this length of service?

Military pensioners are one of the few categories of citizens who are awarded two pensions: “military” and “civilian”.

They receive one pension from the security forces.

Another - if you have developed a certain length of service working in civilian institutions, reached the required retirement age and accumulated a certain number of pension points.

It is called an “insurable old-age pension without a fixed benefit”.

According to the new Law, from January 1, 2020, citizens with at least 42 years of insurance experience (for men) can be assigned an old-age insurance pension 2 years before reaching the new increased retirement age, but not earlier than reaching the age of 60 for men.

When calculating this insurance period, it includes periods of work and other activities, as well as the period of receiving compulsory social insurance benefits during a period of temporary disability, provided that the work was on the territory of the Russian Federation and insurance contributions were paid to the Pension Fund.

Considering that you are a recipient of a long-service pension through the Ministry of Defense, part of your 42 years of service is taken into account when assigning a departmental pension.

In addition, periods of military service are not included in the calculation of the insurance period, which gives the right to receive an insurance pension ahead of schedule.

OPFR in the Novosibirsk region - for the “New Pensioner”

Ill. "New pensioner"

Subscribe to our newsletter to be the first to receive the most interesting news from the pension system in Russia, articles on legislation and legal issues, information about charitable and social programs, an overview of cultural, sports, foreign and other news.