Disadvantages of receiving a property deduction through an employer

- Refunds are not made in a single amount for the entire year at once, but monthly, in the form of full wages (without deducting personal income tax in the amount of 13%).

- If a citizen changes jobs during the year, he will not be able to receive a deduction at his new place of work until the next year.

- This method is not suitable for those who, for a number of reasons, do not want to report to their place of work the fact of purchasing residential real estate.

- The deduction is provided only from the month when the citizen submitted to the employer a notification from the tax authority confirming the right to the benefit.

Since the period for checking documents at the tax office is 1 month, a citizen will be able to start receiving the deduction no earlier than February, and therefore for January he will have to receive it at the end of the year at the tax office.

What deductions can an employee receive from an employer?

What deductions can an employee receive from an employer and what is needed for this?

1. Standard tax deduction

2. Social tax deduction

3. Professional tax deduction

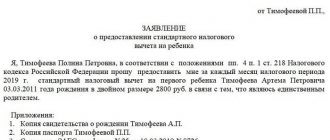

Standard deduction

Typically, this deduction is used by employees with children. The deduction amount is 1,400 rubles for the first child, 1,400 rubles for the second child, 3,000 rubles for the third and each subsequent child, 12,000 rubles for each child if the child under 18 years of age is a disabled child, or full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II. The deduction also applies to the guardian, trustee, foster parent, spouse of the foster parent, who is supporting the child, in the following amounts: 1,400 rubles for the first child, 1,400 rubles for the second child, 3,000 rubles for the third and each subsequent child, 6,000 rubles - for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is disabled Group I or II

Each parent (guardian, trustee) has the right to take advantage of the deduction by submitting an application to the employer and attaching copies of the relevant documents. The deduction is provided for each child under 18 years of age, as well as for each full-time student, graduate student, resident, intern, student, cadet up to 24 years of age.

A double deduction is provided to the only parent (adoptive parent), adoptive parent, guardian, trustee. The provision of the specified tax deduction to the only parent ceases from the month following the month of marriage. The concept of “sole parent” means the absence of a second parent in a child, for example, due to death, recognition of the parent as missing, or declaration of death. The fact that parents are divorced does not mean that the child does not have a second parent. The ex-spouse’s evasion of paying alimony also does not mean that the child does not have a second parent. Also, the deduction is provided in double amount to one of the parents (adoptive parents) of their choice on the basis of an application for refusal of the other parent (adoptive parent) to receive the deduction, but provided that the refused parent has the right to receive a deduction based on income taxed at the rate 13%.

The tax deduction is valid until the month in which the employee’s income (with the exception of income from equity participation in the activities of organizations received in the form of dividends by individuals who are tax residents of the Russian Federation), calculated on an accrual basis at a tax rate of 13%, exceeded 350,000 rubles. If an employee has several jobs, the deduction is provided by one employer of his choice based on an application. The deduction is provided from the month of birth of the child (children), or from the month in which the adoption took place, guardianship (trusteeship) was established, or from the month of entry into force of the agreement on the transfer of the child (children) to be raised in a family. As for the deduction for children studying in educational institutions, it applies to the entire period of study of the child (children), including academic leave. If the taxpayer does not start working from the first month of the year, deductions are provided taking into account the income received from the beginning of the year at another place of work. The amount of income received is confirmed by a certificate of income received by the taxpayer, issued at the previous place of work

There are other standard deductions, but in practice they are used less frequently. This is a deduction in the amount of 3,000 rubles, provided, in particular, to “Chernobyl victims”, persons injured as a result of accidents who participated in nuclear weapons tests; a deduction of 500 rubles for disabled people of groups I and II, disabled people since childhood, and special categories of military personnel. Moreover, if an employee claims both of these deductions, then the maximum of them is provided. To receive a deduction, submit an application and submit supporting documents.

What to do if you had the right to a standard deduction, but for some reason it was not provided at your place of work? For example, you were unable to promptly obtain a certificate from an educational institution if your child is studying in another city, or the right to a deduction appeared at the end of the year, and there was no time to collect all the documents? In this case, the deduction does not disappear, since the employee has the right to apply to the tax authority for it by submitting a declaration in Form 3-NDFL and documents confirming his right to the deduction, as well as an application for a tax refund. The employee decides where to apply for a tax deduction: you don’t have to declare it at your place of work, but immediately contact the tax authority at the end of the year, especially if there are grounds for other deductions, for example, property deductions.

Example: an employee had her first child in December. The employee’s salary is 40,000 rubles, he has no other deductions. If an employee applies to the accounting department to receive a deduction, then the personal income tax on income will be 5,018 rubles. (tax base is 40,000-1,400 = 38,600 rubles, personal income tax 13% of 38,600 rubles will be 5,018 rubles). If the employee does not submit an application, then all income is subject to the personal income tax rate of 13%. The tax will be 5200 rubles. Next, the employee decides for himself whether to apply for a deduction to the tax authority.

Social deduction

The most common types of deduction are tuition and medical deductions. An employee has the right to receive a deduction in the amount of amounts paid both for his own education in organizations engaged in educational activities, and in the amount paid for full-time education of children under 24 years of age in organizations engaged in educational activities. In this case, the child’s educational expenses are taken into account in an amount not exceeding 50,000 rubles for each child in the total amount for both parents (guardians, trustees). Brothers and sisters can also take advantage of this deduction when paying educational expenses for their brothers (sisters). At the same time, the organization carrying out educational activities must have a license, and if training is carried out by an individual entrepreneur, then the unified state register of individual entrepreneurs must contain information about the implementation of educational activities. As for the deduction for treatment, it can be received in the amount paid for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to the employee himself, spouse, parents, children (including adopted children) under 18 years of age, wards under 18 years of age according to the list of medical services, as well as in the amount of the cost of medicines for medical use (according to the list of medicines approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201), prescribed by the attending physician and purchased at their own expense. Another deduction option is the deduction of the amounts of insurance premiums paid under voluntary personal insurance contracts, as well as under voluntary insurance contracts for spouses, parents, children (including adopted children) under 18 years of age, wards under 18 years of age, concluded with insurance organizations licensed and providing payment exclusively for medical services.

The amount of social deduction for all reasons is 120,000 rubles. This amount does not take into account the costs of studying for children, with a limit of 50,000 rubles per child, and the costs of expensive treatment, for which there is no limit. Expenses must be paid by the employee himself, as follows from the payment documents, except in the case where spouses pay each other’s expenses - either of them has the right to take advantage of the deduction. For example, a wife was treated at a medical organization and received the necessary documents, but a tax deduction can be issued to her husband.

To receive a deduction from the employer, they first contact the tax authority for a notification confirming the right to receive a social tax deduction, and then transfer it to the accounting department. The notification is issued within 30 days after the application.

The social deduction is not carried over to subsequent periods, so if expenses exceed the established limits, the remainder of the deduction is lost.

Other types of social deductions are deductions for life insurance costs and voluntary medical insurance costs, which are also received from the employer.

The procedure for providing a social deduction is as follows. After the employee submits an application and notification from the tax authority, the employer, from the month of receipt, reduces income taxed at a rate of 13% until the deduction is used. If the deduction amount exceeds taxable income, then the balance is not transferred anywhere.

To apply for a social tax deduction for treatment, you will need the following documents:

- a copy of the contract for medical services;

- a copy of the license of a medical organization (individual entrepreneur);

- a certificate of payment for medical services for submission to the tax authorities, where, if necessary, a code for expensive treatment is entered;

- copies of the VHI agreement, as well as the license of the insurance company, if this information is not specified in the agreement;

- payment documents confirming the contribution (transfer) of funds to pay for treatment, payment of insurance premiums under VHI agreements (cash receipts, receipts for cash receipt orders, bank statements about non-cash transfers of money);

- a copy of a document confirming relationship (guardianship, trusteeship), marriage with the person to whom the services were provided (for example, marriage certificates, birth certificates)

To apply for a tax deduction when purchasing medicines, obtain the original prescription form with the stamp “For the tax authorities of the Russian Federation, Taxpayer INN” and collect payment documents. In this case, a deduction can be provided in the amount of expenses incurred even for drugs not directly included in the List, but which contain a drug named in the List (Letter of the Ministry of Finance of November 10, 2020 N 03-04-05/7402). How to apply for a tax deduction when purchasing medicines if they were purchased for expensive treatment, but are not included in the List? In the Letter of the Federal Tax Service of Russia dated June 10, 2016 N BS-3-11 / [email protected] it is noted that the issue of classifying certain types of services as expensive types of treatment, as well as related medications, is decided by the medical institution that issues a certificate of payment for medical services. And if the amount of expenses includes medications, then a free-form certificate or discharge summary is required confirming the prescription of drugs and their use in the process of expensive treatment.

To apply for a social tax deduction for education, you will need the following documents:

- copy of the agreement;

- copies of the license of the educational organization, if its details are not specified in the contract;

- copies of payment documents confirming payment. For example, cash receipts, receipts for cash receipts, paid bank receipts, etc.

If you are applying for a deduction for the education of children, wards, brothers, sisters, then you will additionally need:

- a copy of a document confirming the relationship and age of the student - if the education of children, brothers, sisters has been paid for. For example, a copy of your birth certificate;

- a document confirming full-time study (if not specified in the contract). For example, a certificate from an educational institution;

- a copy of the document confirming guardianship or trusteeship, if the education of the wards is paid for.

Example

: manager Ivanov A. paid for English language courses for a child in the amount of 55,000 rubles in an organization with a license for educational activities, treatment for his wife in the amount of 15,000 rubles, his expensive treatment at the dentist in the amount of 130,000 rubles, as well as his sister’s studies at a university in the amount of 40,000 rubles . In this case, the social deduction that Ivanov A. has the right to claim will amount to 235,000 rubles: all amounts are accepted for deduction in full, with the exception of expenses for the child’s education. Only 50,000 rubles are taken into account for the cost of a child’s education.

Professional deduction

This deduction is provided to individuals who perform work and provide services under civil contracts and are not registered as individual entrepreneurs or persons engaged in private practice (notaries, lawyers, etc.), in the amount of documented costs based on the application. If there are no documents, no deduction is provided. In this case, the connection between the result of work or services and the costs incurred must be clearly visible.

Individuals also receive a deduction for royalties or remuneration for the creation, performance or other use of works of science, literature, art, for the creation of other results of intellectual activity, remuneration to patent holders of inventions, utility models, industrial designs, in the amount of expenses incurred and documented. If the author does not document the costs, then cost standards are applied as a percentage of the income received, depending on the type of work. The deduction is also issued upon application.

Example

: engineer Sergeev S. entered into a civil contract under which he undertakes to repair the equipment in the amount of 20,000 rubles. The costs associated with the execution of the contract amounted to 3,000 rubles (replacement of parts and assemblies). The tax base for personal income tax will be: 20,000 – 3,000 = 17,000 rubles, personal income tax is 2,210 rubles. The amount to be paid is 17,790 rubles.

Example : the author of the texts, Mikhailov N., entered into an agreement to write a series of articles. The amount under the contract is 30,000 rubles, but since he does not confirm the expenses, according to the application he receives a 20% deduction for the creation of literary works. In this case, the tax base for personal income tax will be: 30,000 – 20% * 30,000 = 24,000 rubles, personal income tax is 3,120 rubles. The amount to be paid is 26,880 rubles.

Conclusion

How to apply for social and standard tax deductions is the taxpayer’s decision: contact the employer or the tax authority. If the second option is chosen, then they draw up a declaration in Form 3-NDFL, valid in the corresponding year, attaching the necessary documents. It’s more convenient and easier to apply for a tax deduction through your personal account, and here’s how it’s done. First, contact the tax authority with your passport to receive a login and password, then generate an electronic digital signature. In your personal account, fill out the declaration and attach scanned images of documents, then sign it and send it and fill out the return application. In this case, the tax authority checks the declaration within three months, and another month is given to refund the overpaid amount of tax. You can submit a declaration within 3 years after the right to deduction arises. You can also apply for a tax deduction through the government services portal if you have a confirmed account or through an MFC branch.

Procedure for claiming benefits at the place of work

1. Collection of necessary documents.

The package of documents submitted to the tax authority is similar to what is submitted when applying for a deduction through the Federal Tax Service, with the exception of the 3-NDFL declaration.

- Application for confirmation of the right to deduction from the employer.

- Documents confirming ownership of the purchased property.

- Payment documents confirming the purchase of housing.

2. Transfer of documents to the tax authority at the place of registration.

Documents to confirm the right to deduction can be submitted to the inspection in the following ways:

- Personally or through a representative (by proxy).

- By registered mail with a list of attachments.

- Through the “Taxpayer Personal Account” on the Federal Tax Service website.

3. Receipt of notification of confirmation of the right to deduction.

After 30 days from the date of receipt of the documents, the tax authority must send the citizen a notification confirming the right to a deduction or denying it.

4. Submission of notification at the place of work.

After the tax office issues a notice to confirm the deduction, it will need to be submitted to the accounting department at the place of work along with an application for this benefit. Starting from the month in which the notice was submitted, the citizen will begin to receive a deduction, namely, personal income tax will no longer be deducted from his salary.

On what basis is a standard personal income tax deduction provided?

To receive a deduction, the employee must submit to the employer (clause 3 of Article 218 of the Tax Code of the Russian Federation):

- application for deduction;

- documents confirming the right to deduction.

Here is a list of documents that an employee must submit, using the example of some standard deductions:

| Type of standard deduction for personal income tax | Documents confirming the right to deduction |

| Children's deduction for parents | A copy of the child’s birth certificate (if an employee has several children, then birth certificates of all children (even adults) are needed to correctly determine the number of children and the order of their birth) Other documents may also be needed depending on the situation (for example, a disability certificate if the child is disabled) |

| Deduction for a disabled employee of group I or II | Copy of certificate confirming disability |

| Deduction for the hero worker of the Russian Federation | Copy of the Hero of the Russian Federation ID |

Obtaining a tax deduction through an employer: documents, application

Dear visitors of our legal portal “SocLgoty.ru”. Today we will present to your attention a tax deduction that is issued directly through the employer. Previously, we focused on returns through the Federal Tax Service. Now let's talk about the advantages, disadvantages and features of receiving the corresponding benefits at the enterprise.

How to get a tax refund faster and easier, this is a deduction at work, a large number of readers are striving. The popularity of this method is due to the absence of the need to fill out a declaration. The package of documents for the employer is smaller than the standard list. Let's understand the intricacies of this procedure.

This is important to know: Settlement when selling and buying an apartment

Promotion. Legal consultation 2500 rubles FREE until November 30

Article 231 of the Tax Code of the Russian Federation stipulates the possibility of returning excess income tax paid.

Concept and methods of filing a deduction

Property tax deduction is a type of relief of state significance, which is provided to bona fide taxpayers. If an employee makes regular personal income tax contributions to the budget, then he can receive a refund when spending on socially significant needs. You can arrange it in two ways:

- at the employer;

- through the Federal Tax Service.

On a note!

The deduction is not assigned automatically, but only upon the application of the applicant.

The bottom line is that the state offers the citizen to receive some kind of compensation for certain types of expenses, including payment for educational and medical operations, as well as the purchase of living space. To receive a refund, you can contact the Federal Tax Service in person, through a legal representative or through your employer.

At the same time

If a citizen works several jobs at once, each organization transfers personal income tax from his income to the budget. As already mentioned, tax legislation allows you to get a deduction even while working part-time.

In this case, upon receipt of a notification to the Federal Tax Service, you must draw up an application, indicating in which workplace and how much amount you need to receive.

Is there a tax deduction for the treatment of a spouse? Information here.

What is the deadline for returning a tax deduction after a desk audit? Details in this article.

Features of receiving a tax refund in the form of a deduction from the employer

One of the main advantages of compensation through the employer is the minimum list of documents. The main thing is that the applicant does not need to submit Form 3-NDFL, which many applicants have difficulty filling out. But you won’t be able to do it without visiting the Federal Tax Service.

Advantages of applying for a refund at the enterprise:

- no need to submit a declaration;

- the ability to issue a refund immediately after spending, without waiting for the end of the reporting period;

- minimum set of documents;

- expedited desk audit;

- earlier return period (accruals begin on the first salary after appointment).

As for the set of documents, this list is indeed minimal for the employer. But the Federal Tax Service will still have to prepare an exhaustive list of papers. On their basis, confirmation of the taxpayer’s right to preference is issued.

Disadvantages of registration at an enterprise:

- impossibility of receiving the entire amount at once;

- the need to contact the Federal Tax Service to confirm deduction rights.

Perhaps one of the biggest disadvantages of this registration method is the inability to receive the entire return limit at once. The applicant’s salary includes monthly accruals that would have to be used to pay off income taxes. This fee is not withdrawn until the entire amount is covered.

For small amounts, NV through the employer is justified. Every month, the employee receives a certain increase, which he can spend now. But if we take a property return, which involves large sums, then the applicant wants to receive the money in one amount in order to manage it correctly.

Indeed, the funds accumulated over the year allow you to achieve more significant goals than minor monthly additional payments. But on the other hand, while these amounts are collected, their value is lost due to inflation. For an employee to immediately receive a certain amount, it opens up the possibility of spending it in a timely manner.

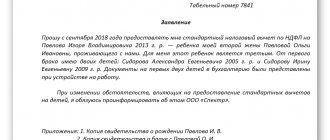

Application for the employer when receiving a deduction

In order not to wait until the end of the current year to contact the tax office to receive funds, collect the necessary documents and take them to your employer. The list of required papers includes:

- a statement drawn up in accordance with the standards established at the state level;

- payment documents;

- certificates confirming the owner’s right to own the property in question.

Application writing sample

Then you need to go to the tax authority to which you belong according to your place of official registration. Submit your documents for verification and wait for a notification from the tax office containing a positive or negative verdict.

Once the response is received, go to your employer and claim your right to receive the funds without waiting until the end of the current tax period. The notification received will be confirmation of this right.

After accepting the papers for processing, the employer will receive grounds to stop withholding personal income tax from your salary, that is, 13% of the amount due.

Note! The employer does not need accompanying documents, that is, copies of papers provided to the tax service. The tax agent’s competence does not include their verification; therefore, compensation is deducted on the basis of the submitted tax notice.

Table 1. Filling out an application for a deduction for an employer

| Step | Description |

| Step 1 | The following information is written in the upper right corner of the sheet:

|

| Step 2 | Below in the middle of the sheet we indicate one word “statement”. It must be capitalized and not followed by a period. |

| Step 3 | Next, write a request for a deduction and indicate the basis for receiving compensation. In the case under consideration, it will be Article 220 of the Tax Code of the Russian Federation, more specifically, its paragraph number 1 and its following subparagraphs:

|

| Step 4 | Since you intend to receive the deduction from your employer, further in the text enter the full name of the organization where you are an employee. If the organization is not a legal entity, but is represented by an individual entrepreneur, it is necessary to indicate the last name, first name and patronymic of the owner of the enterprise. In addition, enter the following information about the tax agent:

|

| Step 4 | After the previously written text, it is necessary to indicate which supporting documents are attached to the requested application, despite the fact that the responsibility for checking them does not lie with the employing company. The transfer is made in the form of a numbered list. |

| Step 5 | At the bottom of the page, you must indicate the date the paper was drawn up, and also endorse the sheet, deciphering the signature. |

An example of filling out on paper is presented at the beginning of this section of the article. You can use it as a sample.

How to return a tax deduction in 2020 with the help of an employer

Please note that no changes are planned regarding the payment of NV. For 2020, the standard process that is relevant in 2018 is maintained. After spending, you must contact the Federal Tax Service to issue a certificate. The second point is the submission of a minimum package of papers to the employer.

We remind you! You can have your situation assessed by a lawyer - it's free! Call!

- Contact the company's accounting department for advice.

- Collection of documentation.

- A trip to the tax office.

- Waiting for an answer.

- Obtaining a certificate (if the answer is positive).

- Submitting a package of papers to the employer.

- Receive the first payment in the next salary.

On a note!

If, at the end of the calendar year, deduction balances have formed (the amount has not been paid in full), then in the next period you will need to re-apply for confirmation from the Federal Tax Service, on the basis of which the employer will continue to make additional accruals.

Required documents (for submission to the Federal Tax Service)

Almost all documents for providing a tax deduction from the employer will initially have to be submitted to the tax authority. So, depending on the type and method of spending, the Federal Tax Service will need to provide:

- If there was a purchase of real estate on the secondary market, then the DCT + an extract from Rosreestr about the new owner.

- If housing in a new building was paid for, then DDU + certificate of acceptance of the object into operation.

- When applying for a mortgage, you need a loan agreement + a certificate of balance + a statement with the amount of interest paid.

- If you are paying for tuition, then you need an agreement with the educational institution + a university license.

- When paying for medical services, a doctor’s report on the need for expensive treatment + an establishment’s license is prepared.

- With construction and renovation, it is necessary to prepare contracts for the provision of services, estimates and other papers.

For each of the above cases, payment documents will be required, including:

- checks;

- payment orders;

- invoices;

- receipts.

Copies of the applicant’s personal documents are also needed, in particular the passport and TIN. If you jointly own an apartment or pay for the education of relatives, you will need marriage and birth certificates to confirm the relationship between the participants.

Based on the reviewed package of papers, the applicant is issued an appropriate confirmation certificate or not. If the basis is confirmed, then the employer must provide:

- application for deduction;

- certificate from the Federal Tax Service.

Attention!

Checking papers at the tax office should not take more than 30 days.

Form 2-NDFL is needed at the Federal Tax Service when applying there for a certificate of the balance of the amount. For example, the applicant’s salary did not allow him to cover the entire amount of the deduction until the end of the year. Therefore, at the end of the period you need to go to the inspector to get a certificate on the results of the recalculation. The determination will be made on the basis of an income certificate.

How to apply for a tax deduction at your place of work

“Personnel issue”, 2011, N 4

HOW TO APPLY FOR A TAX DEDUCTION AT YOUR PLACE OF WORK

Property tax deduction, especially when buying/selling an apartment, is an impressive amount. In fact, by buying an apartment for more than 2 million rubles, you can get 260 thousand rubles. in your arms. This can be done in two ways: at the tax office or at your place of work. Below we will tell you how to apply for a tax deduction at your place of work.

Tax agents - Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation, from which or as a result of relations with which the taxpayer received income, are required to calculate, withhold from the taxpayer and pay the amount of personal income tax (clause 1 of article 226 of the Tax Code of the Russian Federation).

Calculation and payment of personal income tax are made in relation to all income of the taxpayer, the source of which is a tax agent, with the exception of the following income:

1) income from transactions with securities and from transactions with financial instruments of futures transactions (Article 214.1 of the Tax Code of the Russian Federation);

2) for REPO transactions, the object of which are securities (Article 214.3 of the Tax Code of the Russian Federation);

3) for securities lending transactions (Article 214.4 of the Tax Code of the Russian Federation);

4) income of certain categories of individuals (Articles 227, 227.1 of the Tax Code of the Russian Federation);

5) certain types of income (Article 228 of the Tax Code of the Russian Federation).

When determining the tax base, all income received by the taxpayer is taken into account:

- in cash;

- in kind;

- in the form of material benefits (Article 212 of the Tax Code of the Russian Federation).

If any deductions are made from the taxpayer’s income by order, by decision of a court or other authorities, such deductions do not reduce the tax base.

For income in respect of which the tax rate established by clause 1 of Art. 224 of the Tax Code of the Russian Federation - 13%, the tax base is defined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions provided for in Art. Art. 218 - 221 Tax Code of the Russian Federation.

Articles 218 - 221 of the Tax Code of the Russian Federation provide for the following types of tax deductions:

1) standard tax deductions (Article 218 of the Tax Code of the Russian Federation);

2) social tax deductions - for charitable purposes, for training, for treatment, pension contributions under the agreement (agreements) of non-state pension provision, additional insurance contributions for the funded part of the labor pension (Article 219 of the Tax Code of the Russian Federation);

3) property tax deductions (Article 220 of the Tax Code of the Russian Federation);

4) professional tax deductions (Article 221 of the Tax Code of the Russian Federation).

Standard tax deductions

Standard tax deductions are provided to the taxpayer by one of the tax agents at the taxpayer’s choice based on his written application (in any form) and documents confirming the right to such tax deductions.

According to Art. 218 of the Tax Code of the Russian Federation, there are the following types of standard tax deductions:

Taxpayer deductions:

1) in the amount of 3 thousand rubles. for each month of the tax period (clause 1, clause 1, article 218 of the Tax Code of the Russian Federation):

— persons affected by the disaster at the Chernobyl nuclear power plant; persons affected by the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River; persons directly involved in testing of nuclear weapons in the atmosphere and radioactive military substances, exercises with the use of such weapons before January 31, 1963; disabled people of the Great Patriotic War; disabled military personnel who became disabled in groups I, II and III as a result of wounds, contusions or injuries received during the defense of the USSR, the Russian Federation, as well as other categories of disabled people equal in pension provision to these categories of military personnel;

2) in the amount of 500 rubles. for each month of the tax period (clause 2, clause 1, article 218 of the Tax Code of the Russian Federation):

- Heroes of the Soviet Union and Heroes of the Russian Federation, persons awarded the Order of Glory of three degrees; participants in the Great Patriotic War, military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the army, and former partisans; disabled people since childhood, as well as disabled people of groups I and II; and etc.;

3) in the amount of 400 rubles. for each month of the tax period (clause 3, clause 1, article 218 of the Tax Code of the Russian Federation). Provided to taxpayers if they are not listed in paragraphs. 1 and 2 paragraphs 1 art. 218 Tax Code of the Russian Federation. This type of deduction is valid until the month in which the taxpayer’s income, calculated on an accrual basis from the beginning of the tax period (for which a tax rate of 13% is provided) by the tax agent providing this standard tax deduction, exceeded 40 thousand rubles. Thus, starting from the month in which the indicated income exceeded 40 thousand rubles, the tax deduction is 400 rubles. does not apply.

Note. If a taxpayer is entitled to more than one standard tax deduction, the taxpayer will be entitled to the maximum of the applicable deductions.

Deductions for children:

a) in the amount of 1 thousand rubles. for each month of the tax period (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation) applies to:

— each child of taxpayers who support the child and who are parents or the spouse of a parent;

— each child of taxpayers who are guardians or trustees, adoptive parents, or the spouse of an adoptive parent.

This deduction is made for each child under the age of 18, as well as for each full-time student, graduate student, resident, student, cadet under the age of 24, and is valid until the month in which the taxpayer’s income, calculated on an accrual basis from the beginning of the tax period , exceeded 280 thousand rubles. From the month in which the specified income exceeded 280 thousand rubles, the tax deduction is not applied. Tax deduction doubles:

1) if a child under 18 years of age is a disabled child;

2) if a full-time student, graduate student, resident, student under the age of 24 is a disabled person of group I or II;

3) the only parent (adoptive parent), guardian, trustee. If the only parent gets married, then the provision of a tax deduction ceases from the month following the month of his marriage;

4) one of the parents (adoptive parents) of their choice based on an application for refusal of one of the parents (adoptive parents) to receive a tax deduction.

The concept of “sole parent” means the absence of a second parent in a child, in particular due to death, recognition of the parent as missing, or declaration of death. Thus, if one parent is deprived of parental rights, the other parent does not have the right to receive a standard double tax deduction for a child, since he is not the only parent (Letter of the Ministry of Finance of Russia dated May 6, 2011 N 03-04-05/1- 341).

The concept of “sole parent,” according to the Ministry of Finance of Russia (Letter dated May 6, 2011 N 03-04-05/1-337), may include cases where the paternity of a child has not been legally established. In this case, information about the child’s father in the child’s birth certificate in the form approved by Decree of the Government of the Russian Federation of October 31, 1998 N 1274 “On approval of application forms for state registration of acts of civil status, certificates and other documents confirming state registration of acts of civil status states" (Form No. 25), are entered on the basis of the mother’s application.

In such cases, the mother of the child may receive a double tax deduction, the provision of which ceases from the month following the month in which the paternity of the child is established in accordance with the current legislation or the occurrence of other grounds.

The concept of “sole parent” may include cases when, at the request of the child’s mother, information about the child’s father is not included in the child’s birth certificate (Letter of the Ministry of Finance dated September 1, 2010 N 03-04-05/5-516).

Note. The standard child tax credit is available regardless of the standard taxpayer tax credit.

If the taxpayer has been working in an organization not since the first month of the tax period, tax deductions in the amount of 400 rubles. and for children are provided at this place of work, taking into account the income received from the beginning of the tax period at another place of work in which the taxpayer was provided with tax deductions. The amount of income received is confirmed by a certificate of income received by the taxpayer. If during the tax period standard tax deductions were not provided to the taxpayer or were provided in a smaller amount than provided for in Art. 218 of the Tax Code of the Russian Federation, then at the end of the tax period, on the basis of the tax return and documents confirming the right to such deductions, the tax authority recalculates the tax base.

Documents confirming the right to standard tax deductions include:

— documents confirming disability;

- birth certificates of children;

— certificates of full-time study from educational institutions;

— documents confirming guardianship and trusteeship;

— medical certificates certifying that the child has been disabled since childhood;

- and etc.

Social tax deductions

Social tax deductions are provided when submitting a tax return to the tax authority at the end of the tax period (clause 2 of Article 219 of the Tax Code of the Russian Federation). But a tax deduction in the amount of pension contributions paid by the taxpayer in the tax period under non-state pension agreements concluded by the taxpayer with a non-state pension fund, or in the amount of insurance contributions paid by the taxpayer in the tax period under a voluntary pension insurance agreement concluded with an insurance organization, can also be provided employer.

It should be noted that the deduction is provided upon concluding the above agreement in favor of:

- taxpayer;

- spouse (including in favor of a widow, widower);

— parents (including adoptive parents);

— disabled children (including adopted children under guardianship (trusteeship)).

The deduction is provided in the amount of expenses actually incurred, but in total no more than 120 thousand rubles. in the tax period (clause 2 of article 219 of the Tax Code of the Russian Federation).

If in one tax period the taxpayer has expenses for training, medical treatment, expenses under a non-state pension agreement, under a voluntary pension insurance agreement and for the payment of additional insurance contributions for the funded part of the labor pension in accordance with the Federal Law “On Additional Insurance Contributions for the funded part of the labor pension and state support for the formation of pension savings,” the taxpayer independently, including when contacting a tax agent, chooses which types of expenses and in what amounts are taken into account within the maximum amount of the social tax deduction - 120 thousand rubles. (this amount does not take into account: expenses for educating children - in the amount of actual expenses incurred, but not more than 50 thousand rubles; expensive types of treatment - in the amount of actual expenses incurred).

In addition, this social tax deduction is provided by the employer when the taxpayer submits documents confirming his actual expenses for non-state pension provision and (or) voluntary pension insurance, and provided that contributions under the non-state pension provision agreement and (or) voluntary pension insurance were withheld from payments in favor of the taxpayer and transferred to the appropriate funds by the employer.

Thus, an approximate package of documents required to obtain this social tax deduction from an employer should contain:

1) application of the taxpayer;

2) copies of documents on the basis of which the employer deducts insurance premiums from wages under the above agreements;

3) copies of payment documents confirming actual expenses under contracts;

4) copies of the agreement with an insurance organization or with a non-state pension fund;

5) copies of the license of the insurance organization and (or) non-state pension fund.

Property tax deductions

The taxpayer has the right to receive a property deduction in the amount of expenses actually incurred by the taxpayer:

- for new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, land plots provided for individual housing construction, and land plots on which the purchased residential buildings are located, or shares(s) in them ;

- to repay interest on targeted loans (credits) received from Russian organizations or individual entrepreneurs and actually spent on new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share (shares) in them, land plots provided for individual housing construction, and land plots on which the acquired residential buildings are located, or share(s) in them;

— to repay interest on loans received from banks located in the Russian Federation.

The total amount of this property tax deduction cannot exceed 2 million rubles. excluding amounts allocated to repay interest (clause 2, clause 1, article 220 of the Tax Code of the Russian Federation).

Property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, can be provided to the taxpayer before the end of the tax period when he contacts the employer, subject to confirmation of the taxpayer’s right to a property tax deduction by the tax authority in the form approved by Order of the Federal Tax Service of Russia dated December 25, 2009 N MM-7-3/ [email protected] “About the notification form.”

In order to receive this notification, the taxpayer must contact the tax office at his place of residence and submit the following documents:

1) written application of the taxpayer;

2) documents confirming ownership;

3) an agreement on shared participation in construction (co-investment), an act on the transfer of an apartment, share(s) in them to the taxpayer;

4) payment documents drawn up in the prescribed manner and confirming the fact of payment of funds by the taxpayer for expenses incurred (receipts for receipt orders, bank statements on the transfer of funds from the buyer’s account to the seller’s account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents);

5) a copy of the taxpayer’s passport;

6) a copy of the TIN certificate.

The taxpayer’s right to receive a property tax deduction from a tax agent must be confirmed by the tax authority within a period not exceeding 30 calendar days from the date of filing a written application by the taxpayer and documents confirming the right to receive a property tax deduction.

According to the clarifications of the Ministry of Finance of Russia (Letter dated March 21, 2011 N 03-04-06/6-46), if an employer applies for a property tax deduction not from the first month of the tax period, the deduction is provided starting from the month in which the taxpayer applied for by providing it.

A refund of the amount of personal income tax withheld by a tax agent from the taxpayer’s income before he receives the taxpayer’s request for a property tax deduction can be made by the tax authority when the taxpayer submits a tax return based on the results of the tax period.

According to paragraph 4 of Art. 220 of the Tax Code of the Russian Federation, if after the taxpayer submits in the prescribed manner an application to the tax agent to receive a property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, the tax agent unlawfully withheld tax without taking into account this property tax deduction; the amount of tax withheld in excess after receiving the application must be returned to the taxpayer. Thus, when a tax agent provides a property tax deduction, the excess withheld is the tax that is unlawfully withheld after the taxpayer submits an application to the tax agent in the prescribed manner to receive a property tax deduction.

If, at the end of the tax period, the amount of the taxpayer’s income received from the employer was less than the amount of the property tax deduction, the taxpayer has the right to receive a property tax deduction from the employer in subsequent tax periods. In order to obtain new confirmation from the tax authority to receive the balance of the unused property tax deduction from the employer, it is enough to submit to the tax authority, along with the application, a certificate of income in form 2-NDFL, which the employer can issue at the end of the current tax period (Letters of the Ministry of Finance of Russia dated October 28 2010 N 03-04-05/7-647, dated May 11, 2010 N 03-04-06/9-94).

It is unclear from the explanations of the Ministry of Finance whether providing a property deduction from the month in which the taxpayer applied for it is an employer’s right or obligation and what are the consequences of the employer’s actions if the deduction is provided to an employee from the beginning of the year.

In practice, many employers continue to provide a property deduction from January 1, even if a tax notice from the employee is received in the middle of the year, since both the employee and the tax authority benefit from this. The employee does not need to once again submit a package of documents to the tax office to receive personal income tax that has not been reimbursed from the beginning of the year to the beginning of the month in which the employer will not withhold tax from him, and the tax authorities do not need to waste time processing documents and providing a tax deduction directly to the taxpayer. It should be noted that if you do not follow the instructions of the Ministry of Finance, you may have to defend your point of view in court.

Professional tax deductions

The right to receive professional tax deductions is exercised by submitting a written application to the tax agent. In the absence of a tax agent, professional tax deductions are provided to taxpayers when filing a tax return at the end of the tax period (Article 221 of the Tax Code of the Russian Federation).

The following categories of taxpayers have the right to receive professional tax deductions:

individuals carrying out entrepreneurial activities without forming a legal entity, notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice - in the amount of expenses actually incurred by them and documented, directly related to the extraction of income. The composition of these expenses accepted for deduction is determined by the taxpayer independently in a manner similar to the procedure for determining expenses for tax purposes established by the chapter “Organizational Income Tax.” If taxpayers are unable to document their expenses related to activities as individual entrepreneurs, a professional tax deduction is made in the amount of 20% of the total income received by the individual entrepreneur from business activities;

taxpayers receiving income from the performance of work (provision of services) under civil contracts - in the amount of expenses actually incurred by them and documented expenses directly related to the performance of these works (provision of services);

taxpayers receiving royalties or remuneration for the creation, performance or other use of works of science, literature and art, remuneration to the authors of discoveries, inventions and industrial designs in the amount of actually incurred and documented expenses. If these expenses cannot be documented, they are accepted for deduction in the amounts specified in Art. 221 Tax Code of the Russian Federation.

When determining the tax base, expenses confirmed by documents cannot be taken into account simultaneously with expenses within the established standard.

E. Perevozchikova

Journal expert

K. Lieberman

Chief editor of the magazine

Signed for seal

10.06.2011

Deadlines

Readers are interested in what the maximum terms for providing compensation are at their place of work. So, after receiving confirmation from the tax office, you won’t have to wait. The first accruals will go to your next salary.

If, when submitting a declaration, when receiving a deduction in the standard way, you need to wait 90 days, then the application for issuing a certificate is considered in only 30 days. In addition, payment through the company does not require the end of the year: there is a waste, the basis for the return is confirmed and the funds are immediately paid.

When applying for a deduction in the standard way through the Federal Penitentiary Service, you will have to wait 90 days for a desk audit, and then another month for the money to be credited to the account.

Deduction for part-time employment

If an employee works at several enterprises at the same time, then he has the opportunity to receive a refund from each employer. But we are not talking about doubling the amount. You get the opportunity to simply return the assignment faster.

This is important to know: Who pays tax when buying an apartment

On a note!

Until 2014, it was not possible to issue compensation at several enterprises. After the changes are implemented, the taxpayer can claim the right for each official place of work, having previously indicated in what proportions appointments will be made by each employer.

Questions and answers

Question:

My husband works part-time.

Can he be provided with an NV? Answer:

The length of the working period does not affect the possibility of receiving compensation, the main thing is that the place of work is official and there are income tax transfers.

Question:

Does length of service affect the amount of deduction?

Answer:

The length of service indicator itself does not affect the level of accruals. The amount is determined taking into account the amount spent (within the limit). The number of months worked in a year affects the amount of income tax paid for the year, and therefore the level that can be paid to the applicant at the end of the period.

The article is over. Do you have any questions? FREE legal consultation

Without leaving the cash register

The procedure for providing property tax deductions has undergone changes since January 1, 2005, which were introduced by Federal Law dated August 20, 2004 N 112-FZ.

Starting from the new year, a property tax deduction is provided in the amount received by the taxpayer upon the sale of both real estate and other property that was in his ownership for three years or more.

Thus, regardless of the category of property, a single period has been established for it to remain in the taxpayer’s ownership for receiving a tax deduction without limitation by the maximum amount. Until January 1, 2005, in relation to residential houses, apartments, dachas, garden houses and land plots, in order to receive a property tax deduction in the full amount received from their sale, they had to be owned by the taxpayer for at least five years.

Privatized residential premises have been added to the list of real estate for the sale of which a taxpayer has the right to receive a property tax deduction. Individual taxpayers who sold a share(s) of real estate will also be able to take advantage of the deduction.

If the property was owned by the taxpayer for less than three years, then the amount of the tax deduction is still limited to the maximum amount. When selling residential houses, apartments, dachas, garden houses, land plots and shares in the said property, the tax deduction cannot exceed 1,000,000 rubles. When selling other property that was owned by the taxpayer for less than three years, the maximum deduction amount is 125,000 rubles.

Instead of using the right to receive a property tax deduction, the taxpayer has the right to reduce the amount of taxable income by the expenses actually incurred by him and documented in connection with the receipt of this income, with the exception of the sale by the taxpayer of securities owned by him.

A taxpayer can still exercise his right to receive a property tax deduction when selling property only at the end of the tax period by submitting a written application and tax return to the tax authority.

The legislator has made the most significant changes to the procedure for providing property tax deductions for the purchase or new construction of housing.

The taxpayer has the right to receive this property tax deduction in the amount spent on new construction or acquisition on the territory of the Russian Federation of a residential building, apartment or share(s) in them, in the amount of expenses actually incurred, but not more than 1,000,000 rubles. But from the new year, in excess of the established limit, a tax deduction is also provided in relation to amounts aimed at repaying interest on targeted loans (credits) received from credit and other organizations of the Russian Federation and actually spent by them on new construction or the acquisition of a residential building on the territory of the Russian Federation, apartments or share(s) in them. It should be recalled that until January 1, 2005, tax deductions were provided only for the amount of interest paid on mortgage loans.

New edition of subclause 2 of clause 1 of Art. 220 of the Tax Code of the Russian Federation specifies the taxpayer’s expenses incurred when purchasing housing, which are taken into account when providing a property tax deduction. In particular, such expenses during the construction or acquisition of a residential building include the costs of developing design estimates, connecting to electricity, water, gas and sewerage networks, etc.

A characteristic feature of the present time is the sale of apartments without finishing, that is, not ready for living. Therefore, the list of expenses for purchasing an apartment taken into account when providing a tax deduction includes expenses for the purchase of finishing materials, as well as for work related to finishing the apartment.

In this case, a mandatory condition for deducting expenses for the completion and finishing of the purchased house or apartment is the presence in the contract of an indication of the acquisition of an unfinished residential building or apartment (rights to the apartment) without finishing. Otherwise, a property deduction will be provided only for expenses associated only with the acquisition or new construction of housing.

Before the latest changes were made, the taxpayer could only exercise the right to receive a property tax deduction if he had documents confirming ownership of the purchased (built) residential building or apartment. Of course, such a legislative requirement created a large time lag between the moment the taxpayer invested funds and received a property tax deduction. Now the basis for granting a deduction can be an agreement on the acquisition of rights to an apartment in a building under construction with the attachment of payment documents confirming the fact of payment of funds.

The main change in the procedure for providing a property tax deduction for the purchase of housing is that, starting from January 1, 2005, the deduction can be provided both at the end of the tax period when filing a tax return with the tax authority (as in previous years), and before the end of the tax period when contacting the employer. This choice can only be made by taxpayers working under an employment contract.

If a taxpayer has several places of employment, then he has the right to receive a property tax deduction from one of the tax agents of his choice.

To receive a property tax deduction at the place of work, a taxpayer must first contact the tax authority with a written application. Documents confirming the right to deduction must be attached to the application. Such documents include documents confirming the purchase or new construction of a residential building, apartment, as well as payment documents (receipts for receipt orders, bank statements about the transfer of funds, sales and cash receipts, etc.).

Within a period not exceeding 30 calendar days from the date of submission of the written application and the specified documents, the tax authority is obliged to issue a notice confirming the taxpayer’s right to a property tax deduction. The notification form was approved by order of the Federal Tax Service dated December 7, 2004 N SAE-3-04/ [email protected] This document is then provided by the individual to the employer and is the basis for receiving a property tax deduction.

Thus, responsibility for the validity of the calculations and their correctness remains with the tax authority. The employer’s responsibility is to correctly calculate the personal income tax payable to the budget, taking into account the amounts of the property deduction provided.

At the same time, receiving a property tax deduction from one of the employers does not exclude the taxpayer’s right to apply to the tax authority after the expiration of the tax period to receive an additional deduction amount, but within the general established limit of 1,000,000 rubles.

With the introduction of a new procedure for providing property tax deductions, the question arises: does the employer have the right to provide, starting from January 1, 2005, a property tax deduction for apartment purchase transactions executed before 2005?

Explanations on this issue are given in the letter of the Ministry of Finance of Russia dated November 18, 2004 N 03-05-01-04/83 “On the calculation of the tax base for personal income tax.” In particular, the Russian Ministry of Finance indicated that Article 220 of the Tax Code of the Russian Federation does not limit the possibility of providing a property tax deduction from an employer to the year in which the taxpayer became entitled to receive this deduction. Thus, the employer is obliged to provide a property deduction in 2005 upon receipt from the taxpayer of confirmation of the right to a property deduction issued by the tax authority, if this right arose both in 2004 and in 2005.

Also, the employer may receive the remainder of the property tax deduction if such a deduction was previously received from the tax authority and was not used in full.

What can you get a property deduction for?

The essence of the deduction itself is the return of tax paid by a citizen for a certain period. If property is sold, the amount of income subject to taxation is reduced. Accordingly, the benefit applies exclusively to people who are taxpayers.

You can take advantage of the opportunity to receive a property deduction in certain circumstances:

- When purchasing real estate;

- During the construction of housing;

- When applying for a mortgage for the specified purposes;

- When purchasing a plot of land with housing or intended for its construction.

There are conditions under which a citizen is deprived of the right to deduction if certain actions are performed:

- This applies to the purchase of living space from persons who are classified as interdependent. We are talking about spouses, brothers and sisters, parents, i.e. close relatives.

- The state does not provide benefits if the property was not purchased with one’s own money: with the help of the employer’s funds or at the expense of maternity capital.

- People who have exhausted the deduction amount also cannot count on a refund.

The following expenses are allowed to be included in the list of expenses for subsequent reimbursement:

- To purchase land for housing construction;

- Purchase of materials for construction or finishing;

- Payment for finishing and construction works;

- Development of projects and estimates;

- Connection to utilities.

You cannot take advantage of the benefit when remodeling or rebuilding a finished structure, reconstruction in the form of adding a floor or creating an extension, installing gas or plumbing equipment, or erecting additional structures (bathhouse, garage, shed, fence).

The issue of purchasing property not with your own funds, but with borrowed funds, has some peculiarities. Thus, buying out a home with a mortgage makes it possible to receive a deduction, both for the principal amount paid and for the interest on the loan. The second nuance is the purchase of housing partly with the tenant’s money with their own investments. In such circumstances, the citizen retains the right to receive a refund in proportion to personal expenses.

Documents for deduction

To receive any of the property deductions, you must submit the following documents to the employer:

- a free-form application requesting a deduction;

- notification from the tax office.

The notification form was approved by order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/3. To receive it, you need to contact the tax office at your place of residence, where to submit:

- application for notification in any form;

- documents confirming the right to deduction. Their composition coincides with the composition of the documents that must be submitted when receiving a deduction from the tax office. The exception is the declaration in form 3-NDFL. In this case, there is no need to present it.

Such a list of documents is established in subparagraphs 6 and 7 of paragraph 3, paragraph 8 of Article 220 of the Tax Code of the Russian Federation.

If a person wants to receive deductions from several employers, then the application must indicate the specific deduction amount for each of them. Then the inspectorate will issue the citizen several notifications, that is, for each employer. This was stated in the letter of the Federal Tax Service of Russia dated July 28, 2014 No. BS-3-11/2497.

After the necessary documents have been submitted, inspectors must issue a notification to receive a property deduction within 30 days (paragraph 4, paragraph 8, article 220 of the Tax Code of the Russian Federation).

Over the course of one year, a person may receive several notifications from the tax office confirming his right to receive a property tax deduction. Even to the same employer. Article 220 of the Tax Code of the Russian Federation does not contain restrictions on the number of such notifications. For example, after receiving a notice to deduct expenses related to the purchase of housing, a citizen may receive a notice to deduct the amount of interest paid to repay the mortgage loan. Or, within one year, receive notification first in relation to one object, and then in relation to another. Similar clarifications are provided in letters of the Ministry of Finance of Russia dated February 16, 2015 No. 03-04-07/6813 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated May 18, 2020 No. BS-4-11/8256), dated September 18, 2009 No. 03-04-05-01/698.

If a person has underused the property deduction in the current year, then in order to receive the balance of the deduction next year, he needs to re-apply to the tax office to receive a new notification (paragraph 5, clause 8, article 220 of the Tax Code of the Russian Federation).

Situation: is it necessary to receive a new notification for property deduction after a citizen has been transferred to work from the head office to a separate one? Now this notification is issued to the parent organization.

No no need.

When purchasing (constructing) housing or land, a citizen has the right to receive a property tax deduction from the organization of which he is an employee. To do this, he must submit:

- a free-form application requesting a deduction;

- notification from the tax office in the form approved by order of the Federal Tax Service of Russia dated January 14, 2020 No. ММВ-7-11/3.

This procedure is provided for in paragraph 8 of Article 220 of the Tax Code of the Russian Federation.

In the notification, the tax inspectorate indicates the name and details of the organization (tax agent) from which the citizen plans to receive the deduction (Order of the Federal Tax Service of Russia dated January 14, 2020 No. ММВ-7-11/3).

Separate divisions are neither employers nor tax agents. The corresponding functions are assigned to the parent organization specified in the notification (Article 20 of the Labor Code of the Russian Federation, paragraph 1 of Article 226 of the Tax Code of the Russian Federation).

Therefore, a notification for a property deduction can be used throughout the entire tax period, regardless of where exactly the citizen works (at the head office or in any of the separate divisions).

Such clarifications are given in letters of the Ministry of Finance of Russia dated September 7, 2011 No. 03-04-06/4-209, Federal Tax Service of Russia dated July 12, 2011 No. ED-3-3/2342.

Situation: can a citizen not be given a notice for a property deduction because his employer has not transferred personal income tax to the budget for him?

No, they can't.

The tax office checks a citizen's right to receive a deduction. It does not depend on whether the employer has personal income tax debt. Paragraph 8 of Article 220 of the Tax Code of the Russian Federation does not contain such a restriction.

In addition, a citizen’s obligation to pay personal income tax is considered fulfilled from the moment the tax is withheld by the employer (subclause 5, clause 3, article 45 of the Tax Code of the Russian Federation).

Thus, if an employer withheld personal income tax but did not transfer it to the budget, a citizen cannot for this reason be denied a notification for a property tax deduction.

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated June 15, 2012 No. ED-3-3/2090.

Situation: can a citizen not be given a notice for a property deduction because he has arrears in paying taxes and fees?

No, they can't.

The tax office checks a citizen's right to receive a deduction. It does not depend on whether he has debts on taxes and fees. Paragraph 8 of Article 220 of the Tax Code of the Russian Federation does not contain such a restriction.

This position is also confirmed by the courts (see, for example, the resolution of the Federal Antimonopoly Service of the Volga District dated February 9, 2006 No. A55-18246/05-6).

Rules for obtaining a property deduction

The amount of personal income tax refund through the employer, as well as through the tax authorities, is determined by several factors:

- In total, you can return tax in the amount of 13% of the purchase price, but not more than 2 million rubles;

- The maximum amount that can actually be obtained in this way is 260 thousand rubles;

- If the property was purchased before 2008, the deduction is calculated from a maximum of 1 million rubles;

- During the year, you can return funds not exceeding the amount of the transferred payroll tax;

- Receiving compensation is allowed for several years, as long as the balance of the deduction remains;

- For housing purchased before 2014, the state is ready to provide compensation only once, even if part of the funds remains unclaimed;

- In other situations, you can return the tax more than once, but within the established limit.

There are different rules for reimbursing mortgage interest. You can take advantage of the property tax deduction through your employer or tax authority without restrictions if the housing was purchased with a loan before 2014. In other cases, the interest amount is limited to 3 million rubles, i.e. the maximum return will be 390 thousand rubles.

Who and how can receive a property tax deduction?

Tax deductions

– a number of measures provided for by law in order to reduce the tax burden on taxpayers.

Property tax deduction is an opportunity for citizens of the Russian Federation to compensate for part of their costs associated with the purchase of housing by returning the personal income tax (NDFL) they paid.

The procedure for providing a property tax deduction for expenses on the purchase of real estate is established by Article 220 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation).

Very often citizens have a question: “How many times can you get a property tax deduction?”

Current legislation stipulates that such compensation is provided once within established limits.

Moreover, when receiving compensation for training, treatment, etc. such limits are established within one calendar year. At the end of the year, this limit is “reset to zero” and you can get it again.

A distinctive feature of the property tax deduction for housing is the presence of more stringent restrictions: the law limits the maximum amount and the number of times you can receive a refund during your life.

Until 2014, there were restrictions according to which a tax deduction on housing and interest on a loan for its purchase could be obtained only once in a lifetime and only for one piece of real estate.

The changes that made it possible to receive this compensation until the maximum limit amount was reached came into force only in 2014 and only in relation to new transactions.

Read more…

Receiving a property tax deduction is not the responsibility of the taxpayer, but his right, which he declares by submitting the appropriate application and documents to the tax authority.

A deduction for the purchase of property is provided for expenses:

- for new construction or acquisition of residential real estate on the territory of the Russian Federation - an apartment, a residential building, a room (shares in them), land plots for them;

- to repay interest on targeted loans (credits) actually spent on new construction or the acquisition of housing (share(s) in it), a land plot for it, on the territory of the Russian Federation;

- to repay interest on loans received from Russian banks, for refinancing (on-lending) loans (credits) for the construction or acquisition of housing (share(s) in it), a land plot for it, on the territory of the Russian Federation.

The following can receive a tax deduction for housing:

- property owner;

- spouse of the owner (if the spouse did not previously use the deduction and the property was acquired during marriage);

- parent of a minor homeowner (if the parent has not previously received a deduction).

To exercise this right, you must:

- have tax resident status (tax residents of the Russian Federation are individuals or legal entities registered on its territory);

- receive income that is subject to personal income tax at a rate of 13% (except for income from equity participation in an organization, and from 01/01/2018 also winnings in gambling and lotteries);

- buy real estate in Russia or draw up a transfer and acceptance certificate for an apartment (for a new building);

- pay for housing with your own money or by taking out a mortgage (clause 2 of article 207, clause 3 of article 210, clause 1 of article 224 of the Tax Code of the Russian Federation; clause 1 of article 1, article 2 of the Law of November 27, 2017 No. 354- Federal Law).

Features of receiving a deduction through an employer

There are two ways to exercise your right to receive a refund. The first involves contacting the tax authorities, the second involves obtaining a tax deduction from the employer. These options have a number of differences.

Advantages of returning deductions through an employer

The benefits of returning a property tax deduction through an employer include:

- The opportunity to use the allocated funds earlier than at the tax office;

- It is easier to collect documents for obtaining a tax deduction from an employer; their package is smaller;

- There is no need to fill out a tax return.

Let's look at the advantages of income tax refund through an employer in more detail.

When applying for a tax deduction at the place of work, a citizen receives compensation already in the current year. In practice, this is expressed in the absence of deductions of 13% tax from salaries. The payer has the opportunity to insure against inflation losses, since he receives funds immediately.

If you try to receive a tax deduction through your employer not in the first month of the year, but in the subsequent month, the amount will be calculated for the entire period, starting in January. From the difference between the amount of tax calculated before the start of the benefit and the amount of tax payments due in the month of filing the application, the excess transferred amount of tax is obtained. It is subject to return by the tax agent.

Disadvantages of receiving a deduction through an employer

Receiving a property deduction at work also has its disadvantages. This requires confirmation of the right to preference, and for this you will still have to visit the Federal Tax Service. Moreover, the tax deduction notice for the employer is valid for one year. If the benefit for this period is not fully taken out, in order to receive it next year you need to draw up a new paper.

The inspectorate is given up to 30 days from the date of filing the application to issue such a notification. Another nuance is the difficulty of providing benefits by a structure that is not an official employer. This applies to work under civil contracts. In such circumstances, the deduction can only be obtained from the tax authorities.

This is important to know: Tax deduction for the purchase of an apartment in 2020 for individuals: who is eligible, size, how to get it

Compensation from multiple employers

Receiving a deduction when purchasing an apartment or other living space is also possible from several tenants. This option is suitable for citizens who are simultaneously in employment relationships with several structures or change their place of work during the tax period.

In such situations, employing organizations can provide the benefit in two ways: simultaneously or sequentially throughout the calendar year. In the first case, tax authorities will issue certificates for the employer for a tax deduction based on the number of organizations involved. The documentation must be submitted to the accounting department of each structure, as well as applications for tax deductions must be written.

With the sequential option - in the event of dismissal - the remaining amount of payments at the time of termination of the working relationship is taken into account. The employer does not return the original certificate. The remaining deduction can be provided by the new employer.