Unified State Register of Individual Entrepreneurs, OGRN and OGRNIP - what is the difference

There is a difference between these concepts. If you decipher the abbreviation USRIP, you can understand that we are talking about a state register, into which information about individual entrepreneurs of the Russian Federation is entered.

The document is stored in paper and electronic format and includes the following statements:

- individual data of a private entrepreneur;

- information about the gender, date of birth, citizenship, place of residence of the manager;

- passport data, information sheets on individual entrepreneur registration;

- codes of the type of activity of the entrepreneur, information on the registration of a private entrepreneur with state registration.

The Unified State Register of Individual Entrepreneurs is a register where all data on the activities of an individual entrepreneur and manager are recorded. OGRN is also reg. state number, but it is assigned when registering a new legal entity, and not when an entire enterprise is entered into the register. OGRNIP is actually the same as OGRN, but it contains the specified number not 13, but 15 digits.

OGRN - meaning in the government apparatus

When there were not as many enterprises in Russia as there are now, and the accounting system did not require such comprehensive control, there simply was not so much evidence.

Thus, it was quite enough for regulatory organizations that joint-stock companies and limited liability companies had an individual taxpayer number (TIN).

However, later other forms of business organization appeared, and legal developments in this area led to the fact that the TIN certificate was no longer sufficient. After all, the information contained in it only indicated which tax office the enterprise was assigned to and under what number it was registered.

That is why in 2001 a new federal law was introduced that regulated the state registration of legal entities. This law introduced the concept of the main state registration number (OGRN) for all organizations.

Unlike the TIN, this is not just a numerator, but also a set of data about the form of ownership, the date of creation, the region where the enterprise is located, and the tax office to which it is assigned.

What does it mean?

Unlike the TIN, which is simply a serial number, the OGRN, the decoding of which is done according to a certain method, stores the data within itself. As an example, consider any number at random. For example, this one: 1-13-77-46-40873-3.

As you can see, it consists of 13 digits in the format S-YY-KK-NN-XXXXXX-CH. Let's start decoding:

The number 1 at the very beginning is a sign of attribution. If the number 1 is indicated, then this is a legal entity. If the number is 2, then this is a government organization. If the number is 3, then we are talking about an individual entrepreneur (in this case, we have before us not OGRN, but OGRNIP, but more on that later).

The next two digits (13) indicate that the company was created in 2013.

Two more numbers (77) indicate that this legal entity is registered in Moscow. It is number 77 that is assigned to Moscow in accordance with Article 65 of the Constitution of the Russian Federation. Each subject of the federation has its own number, and in the article you can find a complete list.

All together, numbers 4 to 7 (7746) already indicate a specific Federal Tax Service Inspectorate in a specific region. In this case we are talking about the 46th interdistrict inspection for Moscow.

The next five digits are the number of the decision according to which this enterprise was established. New decisions about decisions are entered into the tax register throughout the year, and this number is also unique. In this case, he indicates that the enterprise was created in accordance with decision number 40873.

Finally, the OGRN check is done thanks to the last, 13th digit. All the first 12 digits make up a single number, and this number is divided by 11. The remainder of the division is written to the 13th position in the OGRN. In this case, it is 3. If the remainder is 10, then the last digit is zero.

As is easy to see from the description of the OGRN, there cannot be two such identical numbers. The year already determines that the numbers will be able to repeat themselves in at least a hundred years (if the existing accounting procedure is maintained).

At the same time, the combination of the region number and the Federal Tax Service with the decision number is unique, so there cannot be a single repetition. By deciphering the OGRN, you can get quite enough information about the enterprise - much more than is available through the TIN.

How to get OGRNIP IP

In order for an individual entrepreneur to obtain a OGRNIP permit, he must complete the following steps:

- officially register an individual entrepreneur;

- go to the tax service, create a request for a certificate;

- wait for the query results.

What OGRNIP looks like:

To obtain a number, an entrepreneur can create a request electronically by sending it to the tax office. When the application is processed in the standard mode, an extract is issued free of charge; if you need to find out the number urgently, then the price of the issue depends on how quickly the result should be known.

Where is the registration number of the Pension Fund of Russia according to the TIN of the legal entity?

After registering a business entity in the all-Russian Unified State Register of Legal Entities, it is automatically registered in the accounting database of the Pension Fund, of which the Fund notifies the policyholder by notification. In a notification drawn up in a unified form, the Pension Fund of Russia indicates in a separate line the registration number under which the legal entity is registered in a given territorial division of the Pension Fund of Russia.

Read also: TIN statistics codes for legal entities

Decoding OGRNIP

The abbreviation stands for “ main state registration number of an individual entrepreneur

“. Now let's talk about how to “read” or decipher a number.

The number consists of 15 characters. These numeric values are deciphered as follows:

Sample certificate for individual entrepreneur

- the first digits are 3 or 4 - a three indicates that the record was assigned to the main registration number, a four determines the relationship of the record to another state. reg. number;

- the second and third numbers indicate the year of registration of the individual enterprise;

- the numbers that are in 4th and 5th place are the number that was assigned to a specific subject of the Russian Federation;

- the sixth and seventh characters are the designation of the department code of the Federal Tax Service;

- signs from 8 to 14 - the serial number of the individual entrepreneur, which is indicated in the state register;

- sign 15 is a check number created to check the correctness of the document.

You can decipher this number for a specific individual entrepreneur using a special online calculator.

What is OGRN?

When opening their own business, businessmen are faced with a huge number of identification and classification numbers that are assigned to their young enterprise.

A business owner should know how all these identifiers differ from each other. Now we will tell you about OGRN.

OGRN: what is it for?

Until recently, there were much fewer identifiers in Russia. This is understandable: after all, there weren’t many enterprises, and it was easier for the authorized bodies to classify them and keep statistics. Thus, JSC and LLC were assigned an INN (individual taxpayer number), and this suited everyone.

Over the years, new business structures have emerged, which entailed changes in the field of legal relations. Now the regulatory authorities could no longer be content with the TIN certificate.

In 2001, a law regulating the procedure for registering legal entities came into force. This law for the first time recorded such a concept as: OGRN - main state registration number.

Decoding the OGRN number

Many people know that a TIN is just a serial number. Another thing is OGRN. It is decrypted according to certain rules and contains more information than the TIN.

Let's look at one of the codes (1-14-77-46-30576-2) and decipher it.

The code is formed by 13 digits in the format S-YY-KK-NN-ХХХХХ-Ч.

The code begins with the number 1, which is a sign of assignment and indicates that the number is assigned to a legal entity. 2 – attribute of a government agency. The number 3 at the beginning of the number means that it belongs to the individual entrepreneur (in this case, the number is called not OGRN, but OGRNIP).

This is followed by two numbers (14), thanks to which we find out in what year the enterprise was founded (in this case, 2014).

Then follow two numbers indicating the place of registration of the legal entity. Each subject of the federation has its own number, fixed by law. 77 is the code for Moscow. It is not difficult to draw conclusions.

Numbers four through seven (in our example, 7746) are an indication of the tax office in the region. Specification is provided by the sixth and seventh digits. In this example, we mean the 46th Interdistrict Inspectorate of Moscow.

What is meant by the next five numbers (30576)? – Number of the decision due to which this organization arose. Throughout the year, the Tax Service enters fresh data on decisions into the register, but in this case we are talking only about serial numbers.

The final digit is a control digit and serves to verify the authenticity of the OGRN code. To find out whether a certain combination of numbers is a OGRN code, you can use an online OGRN calculator or a special formula.

Of course, there are no two completely identical OGRN codes. With the current accounting procedure, numbers can be repeated no earlier than in a century (two digits indicating the date of foundation are responsible for this).

In addition, the region number in combination with the Federal Tax Service department number forms a unique combination, so repetitions are excluded. A person who knows how to decipher the OGRN has the opportunity to extract much more useful information from this code than from the TIN.

What does an extract from OGRNIP look like?

A special document that solely indicates the document number is not issued in the register. Find this state reg. number is available in the following documents:

1. official certificate of individual entrepreneur.

2. Extract from the Unified State Register of Individual Entrepreneurs.

The document is presented to a legal entity after its enterprise is entered into the official register. An extract from the Unified State Register of Individual Entrepreneurs, where the OGRNIP number is located, can be obtained in electronic format by sending a request or in paper form. If the consumer wishes to receive a statement in paper form, the waiting period for the document will be up to 7 working days.

How to check the authenticity of the presented OGRNIP

Often, when concluding an agreement, an individual entrepreneur is presented with a OGRNIP number, but is it possible to independently check its authenticity? To establish the authenticity of a combination of numbers, you can use a service with a special calculator.

You need to enter 15 digits, after which a message will be displayed indicating whether the entered digital value is correct or incorrect. There are many such services, you can simply enter a query in a search engine.

You can do the same yourself using a simple calculator: enter the first 14 digits of the number and divide by 13, the resulting remainder must correspond to the last, 15th digit.

How to find an individual entrepreneur by registration number

Not every entrepreneur dares to build business relationships with unknown people, and before concluding an agreement for a large amount, it is best to check your counterparty using the OGRNIP number.

This can be done via the Internet on the official website of the Federal Tax Service by selecting the block: “individual entrepreneur”, then opening the “State Registration” function and typing the individual entrepreneur’s registration number in the request line.

In the window that opens, enter the number, and data about the entrepreneur will appear in front of you, but if you were presented with a fake number, then nothing will be found.

What is OGRN and why do you need a OGRN certificate?

OGRN (for individual entrepreneurs - OGRNIP) is the main state registration number of a legal entity, which is assigned upon its creation and after recording it in the Unified State Register of Legal Entities (or Unified State Register of Individual Entrepreneurs for individual entrepreneurs). The OGRN is indicated in the certificate, which is officially issued by the tax service and indicates tax registration.

The OGRN number was introduced in Russia in 2002 and all organizations that were created earlier also received it. However, the year of such companies in the OGRN does not indicate the basis, but the receipt of the registry. numbers.

OGRN number of the organization - LLC, CJSC, OJSC (and from September 1, 2014, a non-public or public JSC may be needed for various purposes, and is indicated in the information about the company, in details, etc. along with the TIN, legal address, checkpoint and etc.

Using OGRN, you can check both information about your company at the tax office and find out information about another organization (or individual entrepreneur according to OGRNIP). A OGRN certificate may also be needed, for example, when changing the company name.

What information does the OGRN contain?

The OGRN of a legal entity contains important information (region, year of creation, etc.), which is recorded using numbers and has its own structure and decoding, just like the TIN or KPP.

There are a total of 13 characters in the OGRN, each of which has its own characteristic (in OGRNIP there are 15 digits):

- OGRN template: S G G K K N N X X X X X H

- Example OGRN: 1 1 4 7 7 4 6 0 1 8 9 2 6

- OGRN structure:

- C – corresponds to the criterion of state classification. registration number of the record, where the numbers are:

- 1, 5 – sign of OGRN;

- 2 – sign of another state. registration registration number (RRN).

- YY – corresponds to the year the entry was made in the Unified State Register of Legal Entities (only the last 2 digits).

- CC - correspond to the serial number of the subject of Russia (Article 65 of the Constitution of the Russian Federation).

- NN - correspond to the code of the interdistrict Federal Tax Service, which issued the OGRN.

- XXXXX – entry number in the Unified State Register of Legal Entities made during the year.

- H – check number (the least significant digit of the remainder from dividing the previous 12-digit number by 11).

How to check OGRN

Both the company itself and another individual or legal entity can find out or check the OGRN number.

This may be needed in such cases as:

- to confirm the existence of the organization;

- to find out the company's TIN;

- to find out the accuracy of the documentation that comes from the counterparty;

- to clarify the address of the organization’s location;

- to obtain information about the name of the director of the company;

- to find out if the Federal Tax Service is located;

- to understand whether the director of the Federal Tax Service is present.

OGRN for individual entrepreneurs, why?

So, the OGRN number for an individual entrepreneur is OGRNIP, which stands for similarly - the main state registration number of an individual entrepreneur. A certificate with a number is issued to the entrepreneur when it is created and entered into the state register. register – Unified State Register of Individual Entrepreneurs.

OGRNIP for individual entrepreneurs is written down and carries a similar semantic load as OGRN for legal entities. persons:

- OGRNIP template: S G G K K X X X X X X X X X

- Example OGRNIP: 3 0 6 7 8 4 7 2 3 0 0 0 2 2 0

- OGRNIP structure:

- C – corresponds to the criterion of state classification. registration number of the record, where the numbers are:

- 3 – sign of OGRNIP;

- 4 – sign of another state. registration record (GRN).

- YY – year of entry into the Unified State Register of Individual Entrepreneurs (only the last 2 digits).

- KK – code of a subject of Russia in accordance with (Article 65 of the Constitution of the Russian Federation).

- ХХХХХХХХХ – number of the entry in the Unified State Register of Individual Entrepreneurs made during the year.

- H – check number (the least significant digit of the remainder from dividing the previous 14-digit number by 13).

The main difference between the OGRN of a legal entity and the OGRNIP is the number of digits corresponding to the registration number in the state. register, as well as the procedure for calculating the control number.

How to find OGRNIP by TIN or last name

Using the TIN you can find out information about a specific individual entrepreneur, his registration number of an individual entrepreneur. Knowing the last name of the entrepreneur and his TIN, you can find the numerical value of OGRNIP using the following search options:

- send a request to receive an extract from the Unified State Register of Individual Entrepreneurs (the tax service will process the request within 7 days, if necessary earlier, you will have to pay extra);

- open an electronic database on the Internet, enter your TIN or last name, send a request;

- attract third parties who have access to detailed government information without data and pay the appropriate fee for the service.

If you open the electronic database, you can get only a minimum of information about the individual entrepreneur, and to find out the registry. IP number and other details, you will have to pay a little.

Good to know: Distribution or distribution – what is the correct spelling?

Which type of leasing is more profitable for individual entrepreneurs: we’ll tell you in our review.

How to find out the OGRN by the TIN of an organization, find the address of an individual entrepreneur, check the payment of taxes: https://bsnss.net/organizatsiya-biznesa/nalogooblozhenie/kak-uznat-ogrn-po-inn.html

Checking the counterparty according to OGRN

The reliability of the counterparty is the key to successful cooperation. Therefore, before concluding a transaction, you need to make sure at least that the organization (IP) with which you are going to deal really exists.

The easiest way in this situation is to go to the Federal Tax Service website and open the section containing information about entrepreneurs and legal entities. If you know the OGRN of your prospective partner, you can easily find the organization itself, or make sure that such a number is not registered.

There is also a more complex (but more reliable!) method - submitting a request to the tax service. Based on the results, you will receive a statement confirming information about the counterparty.

As for cooperation with an individual entrepreneur, if you know the name of the intended partner, you will be able to find out his OGRNIP.

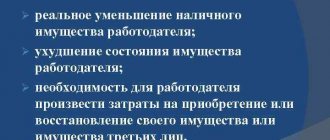

Why do you need to study information about the counterparty so carefully?

- Firstly, to be sure that the legal entity is really registered.

- Secondly, to ensure the reliability of the documents provided by the counterparty.

- Thirdly, to check the TIN, clarify the authority of management and legal address.

- Fourthly, to know for sure that the counterparty is not blacklisted by the Federal Tax Service.

Sometimes you may notice that the OGRN and TIN contain different tax inspection codes. There is nothing reprehensible in this, because the TIN is issued by the local tax office, and the OGRN is provided by the interdistrict.

OGRN is one of the most informative identifiers. It gives the entrepreneur the opportunity to verify the reliability of the counterparty.

Knowing what OGRN is allows you to avoid many problems in modern business. After all, as you know, any modern enterprise is always equipped with many identifiers and numbers, and abbreviations such as OGRN and OGRNIP may initially cause confusion among business owners. Let's look at the basic concepts associated with these two identifiers.

OGRNIP certificate was not issued: what to do?

The individual entrepreneur's registration number is written in the individual entrepreneur's certificate. This document is issued after the registration of an enterprise, confirming its existence. If the document has not been received, then you need to do the following:

- contact the tax service at the place of registration of the individual entrepreneur;

- provide documents confirming the identity of the entrepreneur, registration of individual entrepreneurs;

- submit a request aimed at clarifying the reasons that became an obstacle to the issuance of a document;

- fix existing problems with registration, documents, get a certificate.

The OGRNIP number is indicated in the Individual Entrepreneur Certificate, is assigned once, and cannot be corrected or replaced.

https://youtu.be/FVAR_GiR4F4

How to obtain a duplicate of the OGRN or OGRNIP certificate

OGRN and OGRINP refer to the registration documents of an organization or individual entrepreneur, as well as an extract from the state. register or TIN, which is issued by the tax service when it is created.

However, for various reasons, both depending on legal entities or individuals, and beyond the control of the main state reg. the number may be lost, like other company documents, constituent or registration. Therefore, there is a procedure for restoring the main number.

To obtain a duplicate of the OGRN certificate, the head of the company with a passport or another authorized person acting under a power of attorney must personally apply to the tax service (for Moscow - MIFNS No. 46).

The application must indicate:

- company name;

- date of entry in the Unified State Register of Legal Entities;

- OGRN (GRN), INN, KPP of the company;

- reasons for obtaining a duplicate OGRN.

Also, in addition to the application, you must pay the state fee and submit a receipt confirming this to the tax office. The state fee for a duplicate of the OGRN certificate is 20% of the amount of payment for registration of a legal entity (for example, 20% of 4 thousand rubles - 800 rubles).

Similarly, an individual who is an individual entrepreneur can apply for a duplicate OGRNIP to the tax service with a passport and an application in free form, indicating information about the company, as well as a receipt for payment of the state duty (20% of 2 thousand rubles - 400 rubles .).

As you can see, the OGRN and OGRNIP certificate is an important document for a company or individual entrepreneur, as well as a number that contains useful information. And every organization or entrepreneur should have such a main registry. number, the application and purpose of which is multifunctional

Since July 1, 2002, the main state registration number (OGRN) is assigned to an organization upon its creation, or more precisely, when making an entry about its state registration in the Unified State Register of Legal Entities (USRLE). OGRN is used as the registration file number of a legal entity.

Information about which OGRN is assigned to an organization is contained in the certificate of state registration of a legal entity, which is issued by the tax authority at the place of registration of the company.

The OGRN entered into the Unified State Register of Legal Entities consists of 13 characters and has the following decoding:

- the first character is a sign of assignment of the state registration number of the entry: 1, 5 – to the OGRN; 2, 6, 7, 8, 9 – to another state registration number. In other words, the first digit indicates the nature of the entry in the Unified State Register of Legal Entities and means initial registration or simply a change in data;

- 2nd, 3rd characters – the last two digits of the year the entry was made in the Unified State Register of Legal Entities;

- 4th, 5th – code designation of the subject of the Russian Federation in which the organization is registered;

- from the 6th to the 12th character - the number of the entry entered into the state register during the year;

- The 13th character is the check number, the least significant digit of the remainder of the division of the previous 12-digit number by 11.

OGRN is indicated:

- in all records in the state register related to this legal entity;

- in documents confirming the entry of relevant entries into the state register;

- in all documents of this organization along with its name;

- in information on state registration published by registration authorities;

- in acts of the government and federal executive authorities when mentioning legal entities registered on the territory of the Russian Federation (with the exception of state authorities and local governments).

Using the OGRN, you can check the existence of a legal entity, the accuracy of the documentation received from the counterparty, find out the full name of the director of the company, its tax identification number and legal address.

You can also find out whether the organization, including its leader, is on the so-called black list of tax authorities, which includes shell companies and persons who have ever held management positions in them.

Sources:

1) https://www.temabiz.com/terminy/chto-takoe-ogrn.html

2) https://dezhur.com/db/dict/chto-takoe-ogrn-i-ogrnip-prostaya-rasshifrovka-slozhnyh-nomerov.html

3) https://www.reghelp.ru/ogrnsvidet.shtml

4) https://www.banki.ru/wikibank/osnovnoy_gosudarstvennyiy_registratsionnyiy_nomer/

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 407-26-30 (St. Petersburg) It's fast and free!

How is a registration number assigned?

In Russia, a certain algorithm for assigning registration numbers is provided. First, a company or individual entrepreneur is registered with the territorial tax authorities. After registration is completed, the tax office transfers data about the new entity to the Pension Fund. Here they are required to process documents within 5 working days and assign an individual registration number to the subject.

Next, the Pension Fund sends this data back to the territorial tax authorities. Within another 5 working days, the tax office prepares the documentation, verifies the data, and registers the payer with mandatory registration. Such a system is provided for when registering all business entities and individuals.

After assigning a number and registering documents with the tax service, you can make contributions to the Pension Fund

From this moment on, the company, entrepreneur or private practitioner becomes a full-fledged payer of contributions to the pension fund. Payment of fees is made directly to the registration number. Without this information, the payment cannot be identified. Therefore, it is highly not recommended to forget it. The individual number of the taxpayer organization is assigned randomly. This set of numbers means nothing.