Often the working hours of employees and management do not coincide. For this reason, a person’s last working day may fall on a weekend. It also happens that according to a person’s schedule, a day of rest falls at the time of termination of the agreement. Dismissal under a fixed-term employment contract on a day off is not permitted by the legislator. Therefore, to answer the question regarding when to fire an employee, you need to turn to the Labor Code of the Russian Federation.

Procedure

The process of terminating employment relations is being implemented in a simplified format. This provides that the management of the enterprise issues an act regarding the termination of the agreement. Some difficulties may also arise. They are associated with the fact that the initiative to terminate the contract is taken by the employee, employers, or there is an agreement between the parties.

On the day the contract expires, an order is issued indicating the end of the person’s labor activity. Each party has the right to express its desire to terminate the agreement earlier than the deadline. The employer also has the authority to send notice of the expiration of the document. The dismissal procedure is carried out in accordance with labor legislation.

Registration of 6-NDFL, if the last day of the month is a day off

In such a situation, in the second section of document 6-NDFL (that is, in lines 100-140), you will need to indicate information about the listed taxes separately for each available period. Tax agents must transfer the amounts of tax calculated and withheld from wages by the last day of the month, including those cases when vacation pay is transferred to employees.

In the process of filling out reports on Form 6-NDFL, the most important thing you need to pay attention to is whether the organization’s employees have different types of income, if they receive actual payments on the same day, but there are different deadlines for tax remittance.

At the request of the employee

The Labor Code indicates the possibility of terminating an agreement at the employee’s will, and the type of employment agreement does not matter. When the agreement was concluded for the purpose of performing seasonal work or the validity period is less than two months, the employee must notify the company of his desire to resign.

Notification is sent in writing. The deadline is set by the legislator - three days before the termination of the relationship occurs. The grounds for termination of employment may be the lack of opportunity to continue working. For example, this happens when enrolling in university, retirement, etc. In the listed situations, the contract is terminated within the period reflected by the person in the application.

Read on topic: Early termination of a fixed-term employment contract

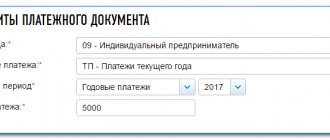

How to pay property taxes in 2020

The first way is to pay taxes according to the issued tax notice. The tax authorities sent out such notices at the end of September. Those Russians who are registered on the State Services or the Federal Tax Service website nalog.ru received a notification in electronic form.

If you pay taxes in the taxpayer’s personal account, you can do this using a bank card (you will first have to give the Federal Tax Service consent to process personal data) and through online banking.

You can also generate a paper receipt directly on the website, according to which taxes can be paid at a regular bank branch.

On a weekend

When the day of dismissal falls on a weekend, there is usually no serious problem associated with this. When terminating an employment relationship under a fixed-term agreement, it is required to notify the employer three days in advance. Therefore, it is possible to calculate in advance what day of the week the dismissal falls on.

It is important to know! If none of the parties expresses a desire to terminate the relationship, then the contract expires automatically. Therefore, a situation may arise that the day of termination of the agreement period falls on a weekend.

The question is resolved this way:

- the day of dismissal is considered to be the day preceding the onset of the day off;

- the day following the weekend.

In practice, controversial situations may arise related to the termination of relations with certain categories of workers. For example, a pregnant woman is considered such. If an employer violates her rights, she can go to court to protect them.

Commentary on Article 193 of the Civil Code of the Russian Federation

1. The commented rule applies only when the last day of the term is non-working. On the contrary, non-working days falling at the beginning and period of the period are not excluded from the calculation.

2. Weekends are considered non-working days, i.e. Saturday and Sunday with a five-day work week or only Sunday with a six-day work week, and holidays (January 1 and 2, January 7, February 23, March 8, May 1, May 9, June 12, November 4). If a holiday coincides with a weekend, the latter is postponed to the next day after the holiday. The Government of the Russian Federation exercises the right to transfer weekends to other days, which in this case are also considered non-working days.

3. The commented article does not contain any restrictions on the scope of its application, due to which it applies to all terms (i.e., both terms determined by a calendar date and terms determined by a period of time) and legal relations with any subject composition. This means that public days off and public holidays, in all cases when they fall on the last day of the term, automatically lead to its increase. The fact that a specific organization (for example, a store) was working on the relevant day has no legal significance.

4. On the other hand, the rules of this article are also applicable when other days that do not coincide with general days off or holidays are declared non-working for a specific organization in which certain actions must be performed. It is not at all necessary that the day be declared a holiday. Closing an organization for re-registration, sanitization, quarantine, etc. is of similar importance.

Recording in labor

Read on the topic: Grounds and conditions for terminating a fixed-term employment contract

Similar to an ordinary employment agreement, when terminating a fixed-term one, an entry must be made in the work book. After the contract period expires, a corresponding entry must be made in the specified document. It should be noted that when applying for employment, it is not necessary to indicate the temporary nature of the duties.

If the contract is terminated, the employer is obliged to indicate that the basis was the expiration of the validity period of the act. The exception is the presence of other grounds for dismissal. In a situation where the validity period has expired, but the person continues to work, the agreement takes on the character of an unlimited term. After this, the provisions of labor legislation apply to him.

Sample entry in the work book about termination of a fixed-term contract

Advance and salary payment deadlines for 2020 new employees

It is impossible to give a new employee the first part of the salary after the end of the first month of work if the employee was hired before the 15th. For example, if an employee gets a job on the 1st, then for the first month he will receive money only once - on the 30th. And this is a violation, because salaries must be paid every six months. Therefore, the company can be fined 50 thousand rubles (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). The judges consider the fine to be legal (decision of the Ulyanovsk Regional Court dated June 23, 2016 No. 7-202/2016).

You can avoid a fine. To do this, write down in the labor regulations that you pay newcomers three salaries for the first month of work.

- On the day when you issue salaries to other employees for the previous month. Since the newcomer did not work last month, calculate his payment from the number of days worked in the current month.

- On the day of payment to all employees of the first part of the salary (advance) for the current month. When calculating the advance, do not take into account the days that have already been paid to the newcomer.

- On the day of payment of the second part of the salary for the current month.

Next, the newcomer will receive a salary like other employees.

An example of issuing salaries according to the new rules 2019

The company hired an employee on July 3. Paydays in the company: 25th and 10th. The employee's salary is 46 thousand rubles. In July - 23 working days. Salary for one day - 2000 rubles. (RUB 46,000: 23 days).

July 10. From the 3rd to the 10th – 6 working days. Pay - 12,000 rubles. (2000 rubles × 6 days).

July 25. From July 11 to July 25 – 11 working days. Pay - 22,000 rubles. (2000 rubles × 11 days).

10th of August. Withhold personal income tax and previously issued amounts from your income. Pay - 6020 rub. (46,000 rubles - 46,000 rubles × 13% - 12,000 rubles - 22,000 rubles).

The monthly bonus can be issued at any time, the Ministry of Labor believes. The period, which is written in Article 136 of the Labor Code of the Russian Federation, applies to payments every half month. At the same time, in letter dated August 23, 2016 No. 14-1/B-800, the Ministry of Labor gave other clarifications. The bonus must also be issued no later than 15 calendar days after the month in which it was awarded. Therefore, it is safer to stick to these deadlines.

Notification

An important component of the procedure for terminating an employment relationship is the preparation of a notice. This is reflected in labor legislation. If such provisions are not met, there is an opportunity to appeal. The notification includes information regarding the employee’s details and the position he occupies; each notification has its own number and date.

Sample notice of termination of a fixed-term employment contract

Also included are information regarding the agreement that was concluded with the employee, the day on which it expired and the person was fired. The employer signs the document and sets the date of preparation.

Experts do not recommend neglecting this act, since in the event of a conflict it will be possible to prove that the dismissal process was implemented in accordance with the provisions of the laws.

At the end of the agreement, a certain sequence of actions is established. Initially, the employee must be notified that the fixed-term contract is expiring. It does not matter that such a deadline falls on a weekend. Then an order is issued reflecting the termination of the employment relationship.

Sample order for termination of a fixed-term contract

The employee reads the order and signs. Otherwise, it is considered that the person is not familiar with the document. If the day of dismissal falls on a weekend, the employer must pay the employee the day before or immediately after the weekend. Also, on the day of payment, a person is given a work book.

How working days became non-working days and what to do now with fulfilling obligations. Lawyer's comments

2020 has made changes to all areas of our lives, shaking even such established categories of contractual relations as deadlines. No, we are not talking about the fact that the obligation has become impossible to fulfill. The question arose much earlier: has the deadline for fulfilling contractual obligations, the last day of which fell at the end of March or April 2020, arrived? Should payment or performance of work (provision of services, delivery of goods) be considered overdue? Is it already possible to submit a claim or is it too early? And if it’s early, then when? Elena Stafievskaya, the leading lawyer of Siberian Law Company LLC, dealt with these and other issues.

Any contract includes a term clause: they can be calculated over a period of time or be tied to a specific date or event. By determining the execution time in working, calendar or banking days, both parties to the contract, although with a small error in the calculations, knew when to expect execution from the other party.

The clear passage of time and the alternation of days changed dramatically by Decrees of the President of the Russian Federation, by which the periods from March 30 to April 3 and from April 4 to April 30, 2020 were established as non-working days. The Decrees of the President of the Russian Federation do not apply to certain categories of organizations, as well as to those organizations that will be determined by decisions of the highest executive body of state power of the constituent entities of the Russian Federation. In the Novosibirsk region, the corresponding Resolutions of the Government of the NSO were also adopted.

What has changed with the introduction of new non-working days?

As it was before: if the parties to the contract used calendar days to calculate the period, then the last day of the period was usually indicated on the basis that it was a working day. When determining the final date for fulfilling the obligation, the parties were guided by the rule of the Civil Code of the Russian Federation: if the last day of the period falls on a non-working day, then it is postponed to the next working day. The same rule applied when specifying a period in weeks, months or years.

What now? Let's say the parties entered into an agreement according to which the seller agreed to deliver goods (not related to essential goods) by April 5, 2020. When concluding the deal, the parties were sure that this was an ordinary working day. But under the current conditions, all days of April 2020 have been officially declared non-working days. The question arises: what to do with the execution of the contract? Until what date can the goods not be delivered? Or, starting from April 6, 2020, is a penalty already accrued?

On the one hand, if we are guided by Art. 193 of the Civil Code of the Russian Federation and the new “quality” of April 5, 2020 (non-working day), the last day of the deadline should be postponed to the nearest working day, and this is May 6, 2020 (taking into account the weekends postponed by Government Decree No. 875 of July 10, 2019 ). It turns out that the seller received additional days to fulfill the contract, and the buyer found himself in a disadvantageous position.

Let's look at another example. The parties agreed that the customer would pay for the work performed within 20 working days after the parties signed the work completion certificate. By signing the work completion certificate in March 2020, the contractor was confident that he would receive payment no later than April 3, 2020. According to declared non-working days, the last 5 days of the term falling on March 30, 31 and April 1, 2, 3 are excluded from the calculation of the payment deadline. Moreover, given that the period is calculated in working days, the period will resume only from May 6, 2020 (and provided that the period of non-working days is not extended). It turns out that for the customer the deadline for fulfilling the obligation is suspended, and the contractor must simply wait for the end of the non-working days? If we take a literal approach to interpreting the terms of the contract in conjunction with new realities, this is exactly what happens.

You can complicate the problem: what if one of the parties belongs to the category of organizations to which the Decrees of the President of the Russian Federation on non-working days do not apply? Let’s say that for the supplier and contractor in the examples given, the period from March 30 to April 30, 2020 remains working days, and for the buyer and customer – non-working days. In this case, can the obligation be considered to have expired? Or maybe it is necessary to differentiate the parties according to the principle: whoever works on “presidential non-working” days fulfills the contract, and who does not work does not fulfill the contract until the first working day? Not simple questions.

We will not be able to arrive at a correct balanced solution by any interpretation of the current regulations; clarifications from the relevant government bodies or amendments to the current legislation are necessary.

The problem of calculating deadlines with “presidential non-working” days has emerged not only in relation to contractual relations, but also in all areas where calculating deadlines is important. Now, as problems are discovered or realized, appropriate decisions are made, but for the most part this applies to those areas in which the deadlines are established by law.

Thus, the Tax Code of the Russian Federation previously provided that a working day was considered a day that was not recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday. Federal Law No. 102-FZ of April 1, 2020 amended the article: now a working day is considered a day that, in accordance with the legislation of the Russian Federation or an act of the President of the Russian Federation, is not recognized as a weekend, a non-working holiday and (or) a non-working day.

According to the Decree of the Government of the Russian Federation dated 04/03/2020 N 443, the terms provided for by the Federal Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” and the regulatory legal acts adopted in accordance with it, calculated in working days, are now are subject to calculation in calendar days. In this case, Saturday and Sunday are not taken into account when calculating deadlines. And if the last day of the period calculated in accordance with the specified federal law falls on a non-working day, then the end day of the period is considered such a non-working day (except for the case if the last day of the period falls on Saturday or Sunday, in which case the end day of the period is considered the next day after them Monday).

The Bank of Russia in its clarifications divided the periods from March 30 to April 3 and from April 4 to April 30, 2020 and indicated a different approach. Thus, in the Information Letter dated March 27, 2020 N IN-03-31/32, they were recommended to follow Art. 193 of the Civil Code of the Russian Federation: to postpone the last day of the deadline for fulfillment by clients of credit institutions and non-credit financial institutions, provided that it fell during the period from March 30 to April 3, to the next working day. Later, in the Information dated 04/03/2020, posted on the Bank of Russia website, it was stated that obligations under financial transactions, the due date of which falls on non-working days, must be fulfilled by debtors within the period stipulated by the agreement. At the same time, creditors, acting in good faith, should take into account the actual capabilities of the debtor to fulfill the relevant obligation, the presence or absence at his disposal of the possibility of remote service, and in the absence of such a possibility, the regime of restrictive measures that are applied in the relevant constituent entity of the Russian Federation and may affect the client’s ability to visit the office of a financial institution to complete transactions in a timely manner.

As we see, in relation to contractual relations, a dilemma has arisen: on the one hand, the principle of the inadmissibility of arbitrary interference by anyone in private affairs applies (Article 1 of the Civil Code of the Russian Federation), on the other hand, in the current situation, such interference is necessary. Fortunately, government agencies already have an understanding of this. Thus, at the beginning of April 2020, the Chairman of the Supreme Court of the Russian Federation sent an appeal to the chairmen of courts at various levels with a request to forward to the Supreme Court of the Russian Federation questions arising in connection with the application of legislative changes and measures to counter the spread of the new coronavirus infection, including the announcement of non-working days. The judicial community is actively working to formulate proposals to resolve these issues, and the Supreme Court of the Russian Federation plans to adopt the corresponding official clarifications. An analysis of the draft of such recommendations leaves hope that non-working days declared as such by Decrees of the President of the Russian Federation of March 25, 2020 No. 206 and April 2, 2020 No. 239, will not be considered as non-working days in the sense given to this concept by the Civil Code of the Russian Federation, under which traditionally refers to weekends and non-working holidays. This will allow the parties to restore the lost “status quo” and gain a clear understanding in further actions.

What should the parties to the contract do?

There can be two options. Option one: refers to the calculation of deadlines as it would be if there were no “presidential non-working” days, taking into account the actual capabilities of the debtor to fulfill the relevant obligation (a position similar to that taken by the Bank of Russia), the presence or absence of remote servicing at its disposal , and in the absence of such a possibility – also a regime of restrictive measures. Option two: consider non-working days introduced by the president as non-working days covered by the Civil Code of the Russian Federation.

It remains to wait for official clarifications that will support the first or second option, or come up with a third. As soon as they appear, we will immediately share them with you.

Leading lawyer of LLC "SIBERIAN LAW COMPANY" Elena Stafievskaya

Share:

Our channel on Yandex.Zen

| If you want ChS-INFO to write about your problem, notify us at or contact us by phone +7 913 464 7039 (Whatsapp and Telegram) and through social networks: Vkontakte, Facebook and Odnoklassniki |

Sick leave

The employer must keep in mind that the validity of the agreement is not dependent on third-party situations. Therefore, when an employee is on sick leave, the company’s management sends him a notice that the contract is coming to an end. It is important to ensure that the employee signs receipt of the document. Otherwise, it will not be possible to prove the fact of delivery. After this, the process starts as usual.

Companies are now increasingly using fixed-term contracts. Due to the fact that the drawing up of such a document and its termination has many nuances, the legislator has made attempts to take into account the interests of both parties to the agreement. Before you start drawing up a contract, you need to understand the intricacies of the procedure for terminating an employment relationship under such a document.

What to consider when setting payroll dates

Before approving salary dates, consider the possible risks and tax consequences. There are a number of slippery points that you should pay attention to:

- The expressions “every half month” and “twice a month” should not be confused. For example, the numbers 3 and 16 fit the definition of “twice a month,” but the rule of not exceeding a gap of 15 days is not followed here, since from the 16th to the 3rd it is more than half a month.

- It is dangerous to choose not clear dates, but a time period - for example, from the 1st to the 5th, as well as deadlines, for example, no later than the 5th and 25th. Firstly, Art. 136 of the Labor Code of the Russian Federation speaks of the need to establish specific dates, and secondly, there is a risk of confusion and exceeding the six-month interval between payments. The illegality of this approach is stated in the letter of the Ministry of Labor of the Russian Federation dated November 28, 2013 No. 14-2-242, the resolution of the Supreme Court of the Russian Federation dated May 15, 2014 No. 3-AD14-1, the ruling of the Trans-Baikal Regional Court dated September 5, 2012 No. 33-2867-2012.

- An insufficiently defined phrase will also be unsafe, for example: “salaries are paid no later than the 5th and 20th of each month.” After all, it is impossible to understand from such a phrase when an advance is given and when the final amount is given.

- When choosing convenient dates, you need to take into account the requirements of the Tax Code of the Russian Federation. Thus, the 15th day for the final payment turns out to be inconvenient, since the advance payment in this case falls on the 30th day, and this is the last day in many months. From the advance paid on the last day of the month, personal income tax will have to be withheld (clause 2 of Article 223 of the Tax Code of the Russian Federation, determination of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804). But in months that have 31 days, this is not necessary. This will create confusion for both the accountant and controllers.

Payment of personal income tax from vacation pay if the last day of the month is a day off

What if the employer pays employees extra for vacations and sick leave? In what time frame do you need to pay personal income tax on such additional payments? The date of actual receipt of income in the form of additional payment to salary in this situation is the date of payment of the specified income.

226 Code; Individual entrepreneurs who are NA and are on UTII or “patent”, transfer personal income tax at the place of their registration in connection with the conduct of such activities on UTII or “patent” (Part 7 of Article 226 of the Code). Vacations are provided in accordance with Chapter 19 of the Labor Code of the Russian Federation (hereinafter referred to as the Law). Based on Art. 114 of the Law, any employee carrying out activities under an employment contract has the right to leave.

How to show vacation pay in 6-NDFL - practical examples

However, many questions arise about how to show January vacation pay in December in 6-NDFL. The problem, in my opinion, is purely psychological – the long New Year holidays. Otherwise, there are no differences from other “transitional” situations between quarters. Therefore, we will also analyze a small example on the topic.

- — warehouse manager Bosonozhkina B.B. from March 5 to 10 days, vacation pay in the amount of 9800 rubles, payment on February 28;

- - Secretary of Tufelkina T.T. from March 19 to 28 kd., vacation pay in the amount of 21,500 rubles, payment on March 15;

- — seller Sapozhkova S.S. from April 2 to the 14th day, vacation pay in the amount of 12,300 rubles, payment on March 29.

How to fill out 6-NDFL if the last day of the month in which vacation pay is issued is a day off

Let us remind you that recently, according to paragraph 2 of paragraph 6 of Article 226 of the Tax Code, when paying income to a taxpayer in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last the date of the month in which such payments were made.

- line 100 “Date of actual receipt of income” is filled in taking into account the provisions of Article 223 of the Tax Code

- line 110 “Tax withholding date” - taking into account the provisions of paragraph 4 of Article 226 and paragraph 7 of Article 226.1 of the Tax Code

- line 120 “Tax payment deadline” - taking into account the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code.